Chromatography Instruments Market Size and Forecast 2025 to 2034

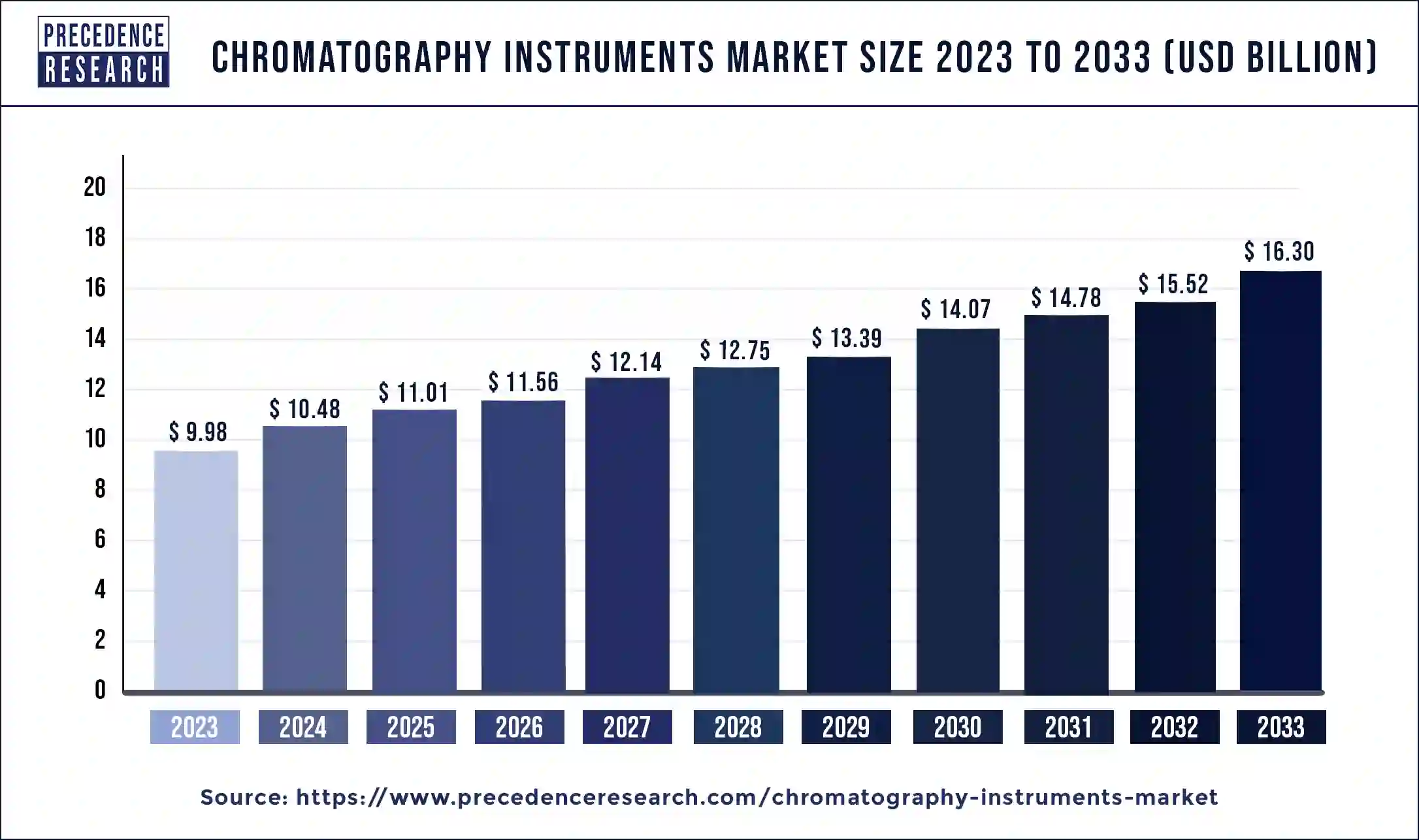

The global chromatography instruments market size was valued at USD 11.01 billion in 2025 and is anticipated to reach around USD 17.08 billion by 2034, growing at a CAGR of 5.01% from 2025 to 2034. Increasing investments in pharmaceutical R&D, growing concerns over pollution and pollutants, and consumers' increasing consciousness of food and food safety are some of the factors anticipated to foster the growth of the chromatography instruments market during the forecast period.

Chromatography Instruments Market Key Takeaways

- The global chromatography instruments market was valued at USD 533.77 billion in 2025.

- It is projected to reach USD 17.08 billion by 2034.

- The market is expected to grow at a CAGR of 5.01% from 2025 to 2034.

- The North America chromatography instruments market size accounted for USD 4.29 billion in 2024 and is expected to attain around USD 7.01 billion by 2034.

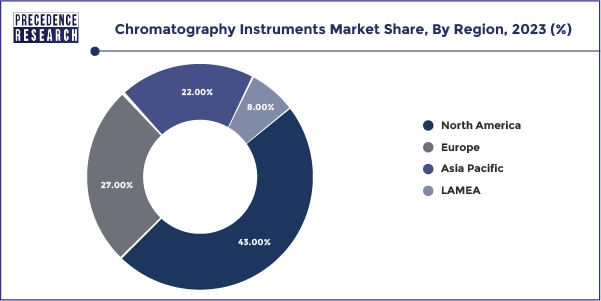

- North America dominated the market with the largest revenue share of 43% in 2024.

- Asia Pacific is expected to grow rapidly during the forecast period.

- By system, the liquid chromatography segment dominated the market in 2024.

- By system, the gas chromatography segment is expected to witness the fastest growth over the forecast period.

- By product, the consumables segment has held the biggest revenue share of 63% in 2024.

- By product, the component segment is expected to grow significantly during the projected period.

- By application, the pharmaceutical & life science firms led the market with the biggest market share of 54% in 2024.

U.S. Chromatography Instruments Market Size in the 2025 to 2034

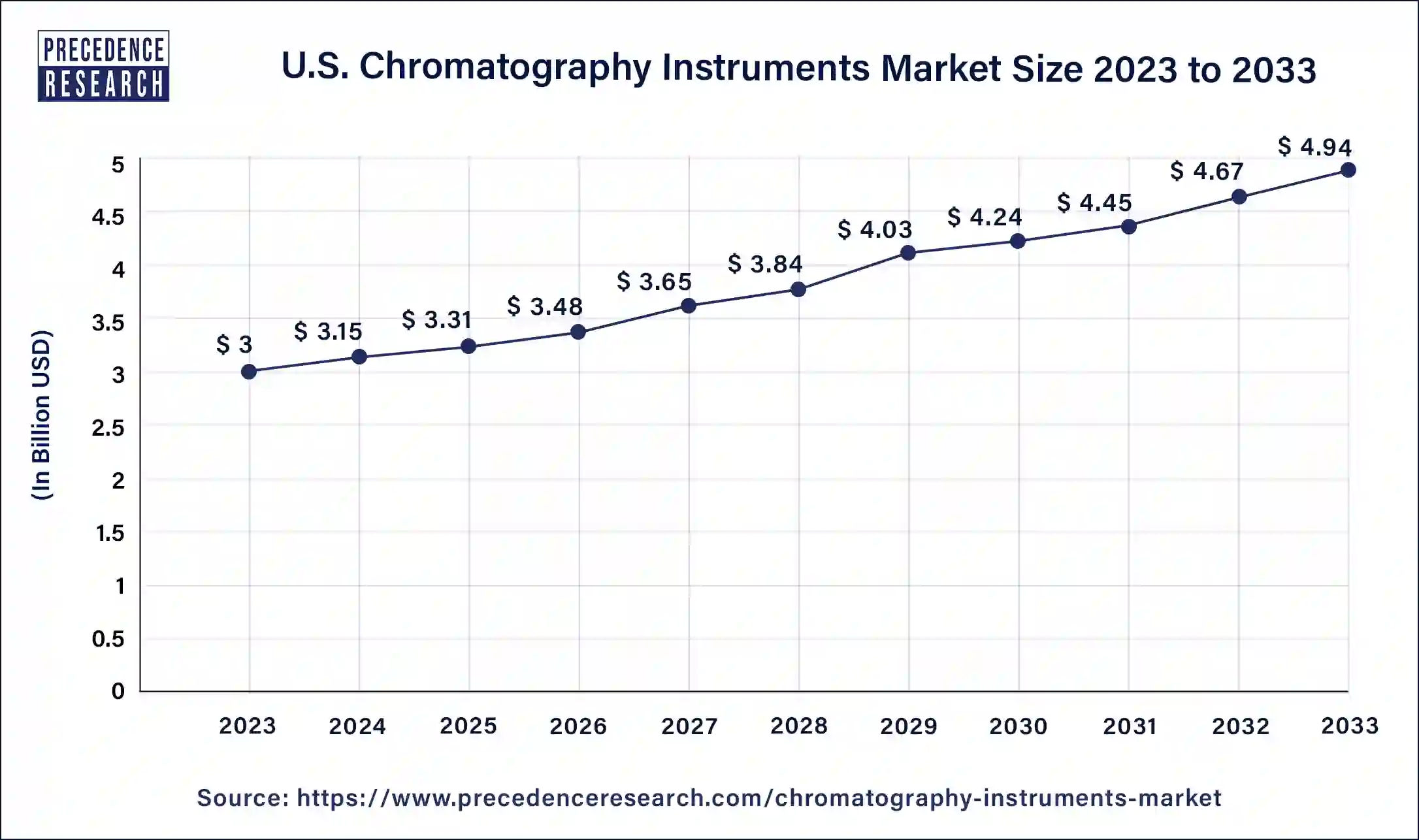

The U.S. chromatography instruments market size was estimated at USD 3.31 billion in 2025 and is predicted to be worth around USD 5.21 billion by 2034, at a CAGR of 4.64% from 2025 to 2034.

North America dominated the chromatography instruments market in 2024. The market in the United States and Canada is poised for growth due to increased government investments in research and development. Moreover, the presence of major industry players and well-established healthcare systems further contributes to this trend. These economies allocate a significant portion of their gross domestic product to research and development by attracting global players and research laboratories to operate within their borders.

- In May 2022, Agilent Technologies signed a collaboration agreement with APC Ltd., in which the companies committed to combining their technologies to provide unique workflows to customers that support automated process analysis via liquid chromatography (LC).

Asia Pacific is expected to grow rapidly in the chromatography instruments market during the forecast period. This growth is attributed to various factors such as environmental protection efforts, expansions by key industry players, and advancements in biomedical and medical research. Additionally, increased awareness about chromatography and government support for the pharmaceutical industry contribute to market growth. The COVID-19 pandemic has also led to a rise in research and development activities, which further boosted the market expansion. Increased investments in drug development are anticipated to drive the growth of the chromatography instruments market in Asia Pacific.

- In March 2024, Everest Instruments, a pioneer in innovative dairy and food testing solutions, announces the launch of the pioneering product, the Gas Chromatography for Milk Fat Fatty Acids and Triglycerides (Everest GC4500), which provides detailed profiling of fatty acids and triglycerides, crucial for understanding milk, milk products, and ghee quality.

Market Overview

Chromatography is an analytical technique used to separate mixtures into individual components for detailed analysis. It finds wide application across various industries. In pharmaceuticals, it helps identify trace chemicals in samples, while in the food industry, it detects contaminants. Furthermore, it's utilized in the chemical industry to test water and air samples. Different types of chromatography methods exist, including gas chromatography, ion-exchange chromatography, liquid chromatography, and affinity chromatography, each requiring specific instruments for effective execution. The demand for chromatography systems and consumables is increasing in the pharmaceutical sector due to their role in qualitative and quantitative analysis of complex samples, large-scale research studies, precision medicine, virus research, and vaccine development.

Chromatography Instruments Market Growth Factors

- Rising investments in pharmaceutical research are one of the major factors driving the growth of the chromatography instruments market.

- The wide use of chromatography technology across various industries is propelling the growth of the chromatography instruments market.

- Rising food safety concerns and utilization of chromatography in novel drug approvals can fuel market growth further.

- Scientific discoveries have also enabled the use of chromatography instruments to test the potency of the drug, which can boost market growth in the future.

- Growing demand for advanced analytical instruments globally can help in the chromatography instruments market expansion.

Market Scope

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 5.01% |

| Chromatography Instruments Market Size in 2025 | USD 11.01 Billion |

| Chromatography Instruments Market Size in 2024 | USD 10.48 Billion |

| Chromatography Instruments Market Size by 2034 | USD 17.08 Billion |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By System, By Product, and By Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Driver

Technological advancements

The demand for high-performance liquid chromatography (HPLC) is driving the growth of the chromatography instruments market. Due to evolving industry-specific needs, advanced features of chromatography techniques, and continuous technological advancements. Various sectors like pharmaceuticals, forensics, and molecular biology rely on chromatography for tasks like purification, separation, and compound analysis. To cater to these demands, chromatography companies are innovating efficient instruments. Moreover, technological progress has introduced new methods, such as silica-based monolith columns with enhanced efficiency and automated systems. Additionally, the market has seen the introduction of advanced pre-packed columns by giving convenience and cost-effectiveness.

- In April 2024, Waters Corporation announced the launch of the Alliance iS Bio HPLC System with new capabilities that address the operational and analytical challenges of biopharma quality control (QC) laboratories. The new HPLC system combines advanced bio-separation technology and built-in instrument intelligence features. It is also designed to help biopharma QC analysts boost efficiency and eliminate up to 40% of common errors, saving time lost by investigating the source of failed runs and out-of-specification results.

Restraint: Limited availability of instruments

The growth of the chromatography instruments market is hampered by factors such as the high cost and limited availability of these instruments, as well as strict regulations governing their use. Utilizing chromatography necessitates a thorough knowledge of the systems and proficiency in operating the instruments. Inadequate expertise and training can result in inaccurate findings, misreading of data, and potential damage to equipment. The notable constraints in the chromatography instrumentation market include the high costs of equipment and the scarcity of skilled personnel for equipment management.

Opportunity: Advancements in gas chromatography

Gas chromatography is widely used in the petroleum industry due to its sensitivity to volatile compounds. Specialized gas chromatography columns are widely employed in petroleum analysis, with constant efforts to develop new columns for improved analytical performance and efficiency. Modern gas chromatographic systems offer advanced technology for detecting both finished products and in-process samples. Ongoing advancements in GC columns aid in enhancing petroleum analysis while reducing instrument downtime and maintenance costs. The development of specialized and sophisticated GC columns is seen as a potential growth opportunity for players in the chromatography instruments market, given the high demand in the petroleum sector.

- In March 2022, Thermo Fisher Scientific launched new gas chromatography (GC) and GC-mass spectrometry (GC-MS) instruments, which offer hardware and software updates. Features of these instruments include unique GC modularity and NeverVent technologies that enable increased instrument uptime by accelerating maintenance operations through user-exchangeable injector and detector modules and the ability to remove MS ion source, filaments, and analytical column without breaking the vacuum.

System Insights

The liquid chromatography segment dominated the chromatography instruments market in 2023. Liquid chromatography (LC) is a technique used to separate ions or molecules in a liquid mobile phase. It's commonly used in preparative scale work to purify and isolate components of mixtures. In modern practice, known as high-performance liquid chromatography (HPLC), very fine packing particles and high pressure are used for analytical separations, detection, and quantification of solutions.

- In July 2022, Agilent launched two new products from its gas/liquid chromatography (GC/LC) mass spectrometry (MS) product lines. These instruments exhibit an amalgamation of the latest technologies, including artificial intelligence and machine learning, with higher accuracy and sensitivity. The innovative design of the equipment will help customers streamline lab analytics and enhance lab productivity with minimal downtime.

The gas chromatography segment is expected to witness the fastest growth over the forecast period. Gas chromatography (GC) is the preferred method for separating smaller volatile and semi-volatile organic molecules, including hydrocarbons, alcohols, fatty acids, hormones, aromatics, pesticides, and steroids. This analytical technique is widely used across various application areas.

Product Insights

The consumables segment dominated the chromatography instruments market in 2023. The growth of this segment is fueled by a rising demand for process development, cost-effective purification methods, and advancements in pre-packed chromatography columns, particularly in the biopharmaceutical industry. There's also an upsurge in the use of pre-packed columns, which are valued for their convenience and affordability in purifying large protein quantities. As biologics become more complex, the need for their purification is expected to increase, with chromatography consumable providers playing a vital role in developing innovative resins and user-friendly formats to meet diverse application needs.

- In August 2023, Trelleborg Healthcare and Medical launched the BioPharmaPro family of innovative products, including fully assembled chromatography equipment with advanced composite columns. To accelerate the advancement of life-changing therapies. Building on its history of innovation, Trelleborg Healthcare & Medical's BioPharmaPro range delivers solutions created from a vast portfolio of materials, including silicones, other elastomers, thermoplastics, and composites.

The component segment is expected to grow significantly in the chromatography instruments market during the projected period. This is attributed to the increase in component demand for gas chromatography. The components like gas supplies and regulators have significantly risen in the last couple of years. These components are important for maintaining the carrier flow.

Application Insights

The pharmaceutical & life science firms dominated the chromatography instruments market in 2023 and is expected to grow substantially over the forecast period. Chromatography methods are widely utilized across drug development stages due to their versatility. Advancements in chromatography instruments have led pharmaceutical companies to embrace them more readily, which aims to enhance productivity and streamline operations.

Recent Developments

- In July 2023, Valmet announced the acquisition of the Process Gas Chromatography business of Siemens. The former company intends to strengthen its automation segment and process automation with the addition of the latter company's process industry gas chromatography system and process analyzer systems to its offering.

- In March 2023, US-based Waters Corporation introduced its next-generation HPLC chromatography system, Alliance™ iS, for its users in the QC laboratories.

- In June 2022, PerkinElmer, Inc. launched the GC 2400 Platform, an advanced, automated gas chromatography (GC), headspace sampler, and GC/mass spectrometry (GC/MS) solution designed to help lab teams simplify lab operations, drive precise results, and perform more flexible monitoring.

- In May 2022, Thermo Fisher Scientific Inc. inaugurated a new manufacturing facility for single-use technology in Utah, U.S. Furthermore, Thermo Fisher launched the Thermo Scientific SureStart portfolio for chromatography and mass spectrometry consumables in February 2022, showcasing its commitment to advancing chromatography solutions.

- In January 2022, RotaChrom announced the launch of its long-term strategic partnership with lea Red Mesa Science & Refining. Their first goal is to create new and profitable operations using RotaChrom's centrifugal chromatography solution.

Chromatography Instruments Market Companies

- Agilent Technologies

- Bio-Rad Laboratories

- Cytiva

- PerkinElmer

- Pall Corporation

- Sartorius

- Shimadzu

- Shodex

- ThermoFisher Scientific

- Waters Corporation

Segments Covered in the Report

By System

- Liquid Chromatography

- Gas Chromatography

- Other Systems

By Product

- Components

- Autosamplers

- Pumps

- Detectors

- Column Accessories

- Fraction Collectors

- Other Components

- Consumables

- Tubes

- Columns

- Vials

- Solvents/Reagents

- Other Consumables

By Application

- Pharmaceutical/Biotechnology Industries

- Academic/Research Institutes

- Other Industries

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content