High-performance Liquid Chromatography Market Size and Forecast 2025 to 2034

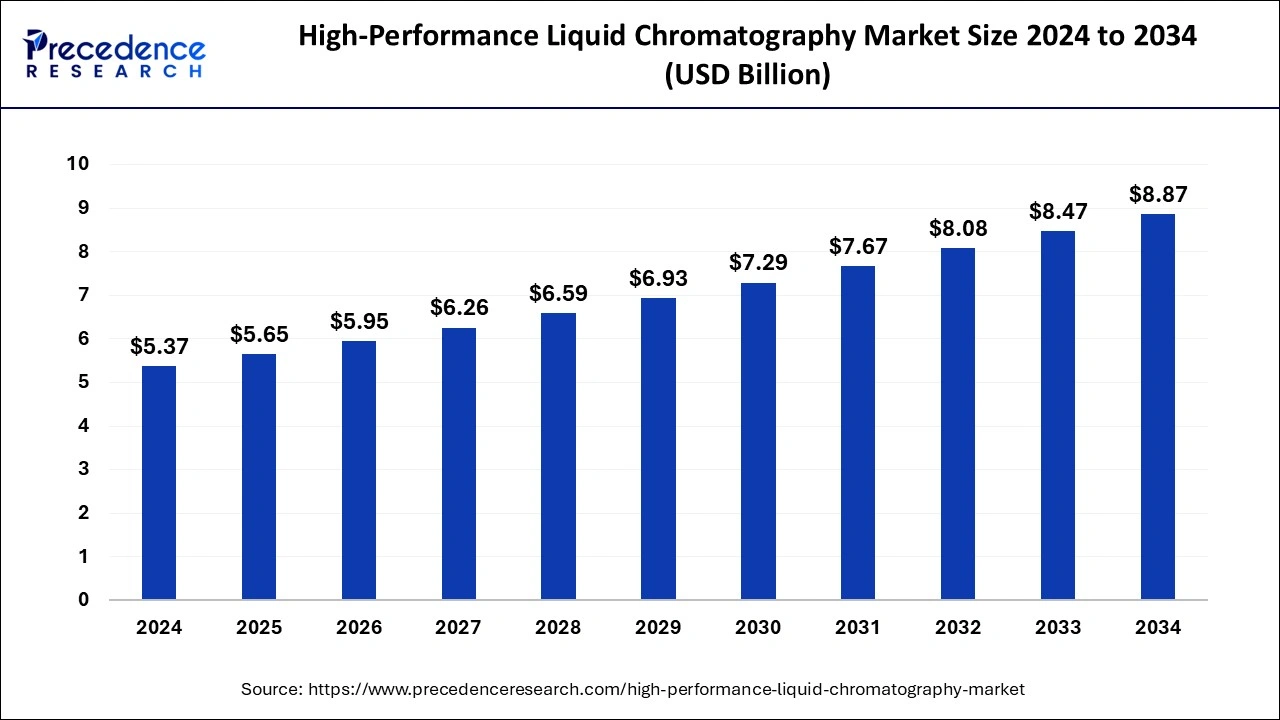

The global high-performance liquid chromatography market size was estimated at USD 5.37 billion in 2024 and is predicted to increase from USD 5.65 billion in 2025 to approximately USD 8.87 billion by 2034, expanding at a CAGR of 5.15% from 2025 to 2034

High-performance Liquid Chromatography Market Key Takeaways

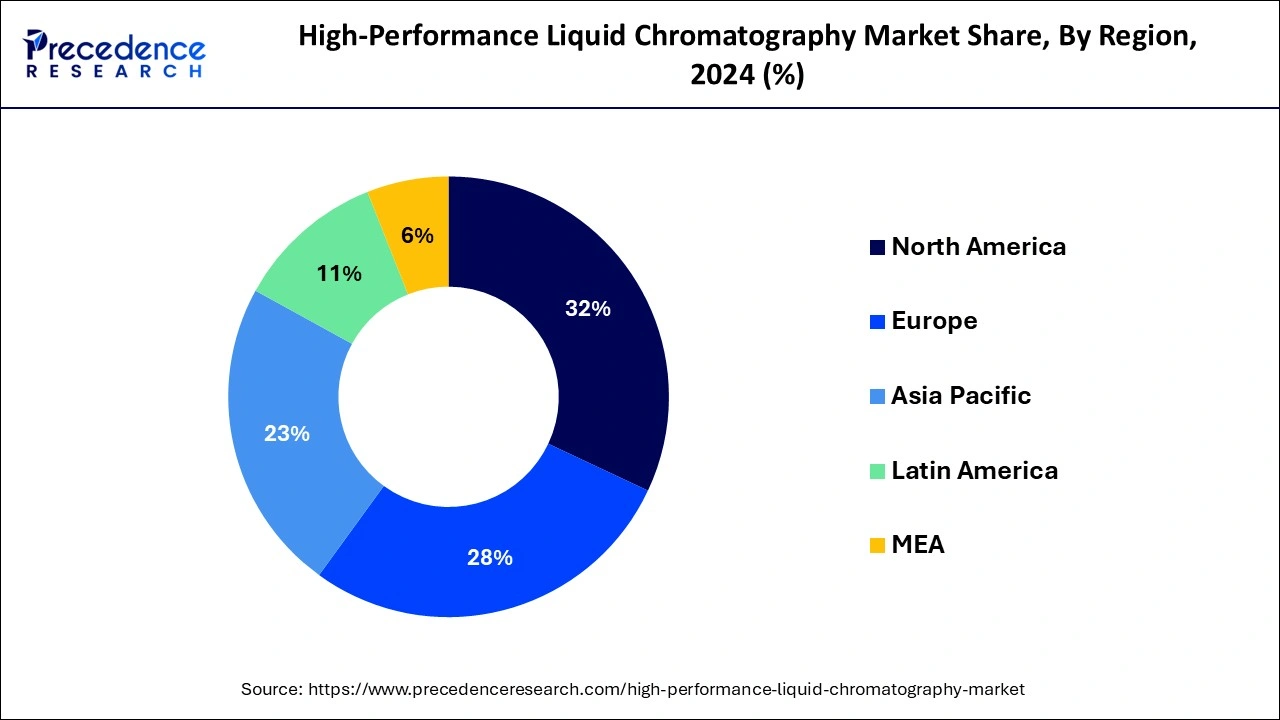

- North America generated more than 32% of revenue share in 2024.

- Asia-Pacific is predicted to grow at a remarkable CAGR between 2025 and 2034.

- By product, the instruments segment captured more than 46% of revenue share in 2024.

- By application, the clinical research segment generated more than 36% of the revenue share in 2024.

- By end-user, the forensic segment is expected to grow at a moderate CAGR between 2025 and 2034.

U.S.High-Performance Liquid Chromatography Market Size and Growth 2025 To 2034

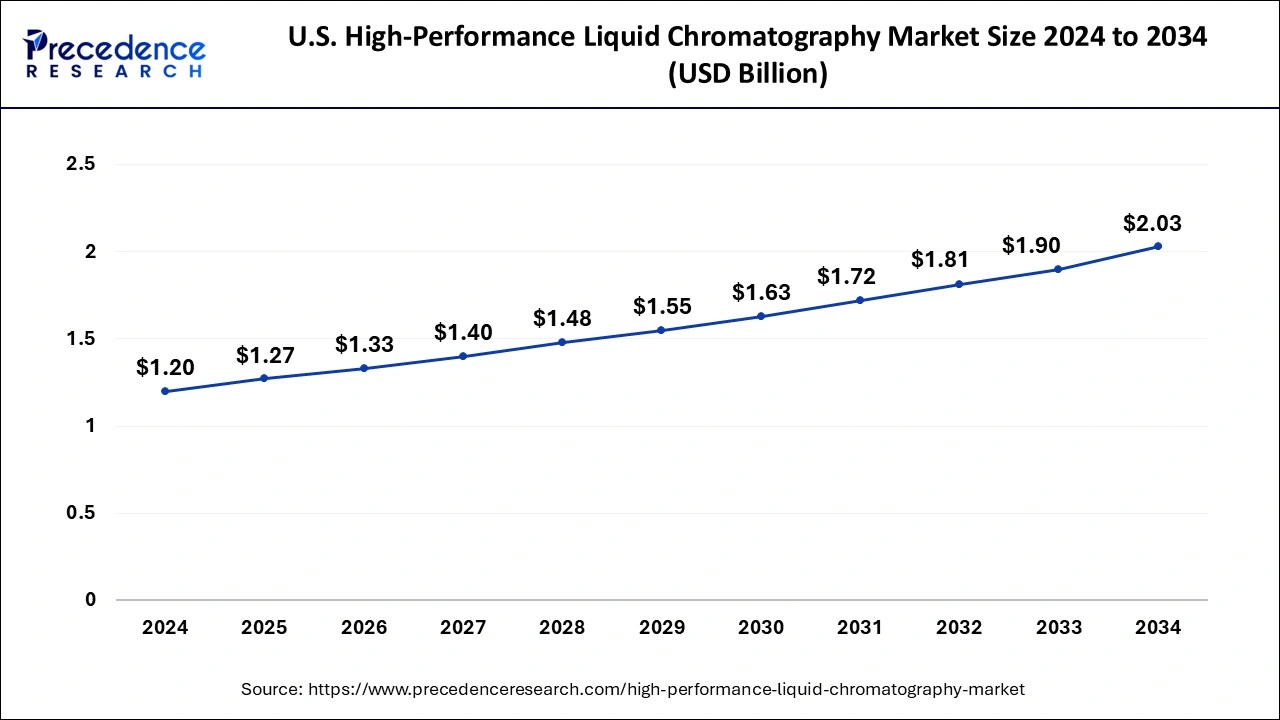

The U.S. high-performance liquid chromatography market size reached USD 1.20 billion in 2024 and is anticipated to be worth around USD 2.03 billion by 2034, poised to grow at a CAGR of 5.40% from 2025 to 2034.

The U.S. high-performance liquid chromatography market is expanding with a significant growth rate due to the presence of several key players, highly established biotech and pharma industries, high-quality analytical techniques to develop various drugs, along with quality checks. Growing governments' support in terms of funding is again a major factor driving the region's growth. Efficient diagnostic tools have been developed by leading players with technical advancements further backed by the market's demand, fueling innovative approaches to resolve healthcare conditions with precise diagnosis. Highly skilled workforce, strong infrastructure, and government initiatives, PKS funding are key drivers of the U.S. high-performance liquid chromatography market.

North America has held the largest revenue share of over 32% in 2024.This is owing to the early adoption of technologies in the region even in the healthcare industry. The market for high-performance liquid chromatography in the United States is anticipated to grow significantly during the forecast period as a result of the growing pharmaceutical industry as well as the increasing occurrence of various disorders. Furthermore, the presence of key companies is also likely to contribute to the regional growth of the high-performance liquid chromatography market within the estimated timeframe.

Asia-Pacific is expected to grow at the fastest CAGR during the forecast period. This is owing to the presence of a large patient pool in the region. The growing manufacturing of generics in economies like India and China is also likely to augment the adoption of HPLC for testing and quality control which is driving the market growth in the region. Further, the growing investment in research and development in the healthcare systems along with the increasing need to advance the healthcare industry is also likely to support the regional growth of the high-performance liquid chromatography market during the forecast period.

The European high-performance liquid chromatography market is significantly expanding owing to technological advancements and improved healthcare facilities in the region. Increased priority for personalized medicine and growing healthcare expenditure are again drivers of the market on a large scale. The region holds a strong biotechnology and pharmaceutical industry, along with a focus on research and development in it, due to the increasing prevalence of chronic diseases and demographic shifts. Leading countries in the Europe region, includes the UK and Germany, are also engaging with significant research and development projects to innovate drugs for severe health concerns, positioning them as a frontier in the Europe high-performance liquid chromatography market.

Market Overview

A form of column chromatography known as high-performance liquid chromatography (HPLC) involves the high-pressure injection of an analyte into a solvent through a column with chromatographic packing material that serves as both the stationary phase and the mobile phase. The sample is transported by a helium or nitrogen-moving carrier gas stream.

Any component in a sample that can dissolve in a liquid can be separated and identified with HPLC at trace quantities as low as parts per trillion. HPLC is utilized in a wide range of scientific and industrial applications due to its versatility, including environmental, pharmaceutical, chemicals, and forensics. This is anticipated to augment the growth of the market during the forecast period.

High-performance Liquid Chromatography MarketGrowth Factors

The technological advancements in high-performance liquid chromatography (HPLC) that has improved the dependability and robustness of liquid chromatography operations are anticipated to drive market growth in the years to come. The latest HPLC systems, for instance, provide multidimensional capabilities, dual-injection systems, and intermediate pressure alternatives that increase the technique's usefulness for a number of research applications.

Furthermore, the pharmaceutical and biotechnology industries are major users of HPLC for drug discovery, development, and quality control. The increasing demand for these products is also likely to augment the growth of the high-performance liquid chromatography market within the estimated timeframe.

Major high-performance liquid chromatography manufacturers who are extending their product lines for niche markets such preparative purification, two-dimensional liquid chromatography, amino acid analysis, method development, and clinical diagnostics are also driving the market growth. For instance, Novasep introduced their Hipersep Process M HPLC system in October 2021 with the goal of purifying oligonucleotides, peptides, insulin, and other pharmaceutically important compounds at a commercial scale.

Additionally, the use of HPLC in the biopharmaceutical industry is anticipated to increase as protein-based treatments such bispecific antibodies and antibody-drug conjugates gain popularity. The increasing adoption of HPLC in emerging markets, such as China, India, and Brazil, is driving the growth of the high-performance liquid chromatography market.

These markets offer significant growth opportunities due to the large and growing pharmaceutical and biotechnology industries, as well as increasing investments in research and development activities.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 5.65 Billion |

| Market Size by 2034 | USD 8.87 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 5.15% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Product, By Application, and By End-User |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Growing pharmaceutical industry

Pharmaceuticals are defined as products like pharmaceuticals and medicines that are used to treat, prevent, or cure diseases and other conditions. Due to this, it goes without saying that the standards in the pharmaceutical sector are extremely high. Simply put, there can be no place for danger when it comes to patient care. The precision and accuracy of high-performance liquid chromatography (HPLC) are recognized. Despite the method's high costs, it is ideally suited for the kind of exact identification and quantification needed for pharmaceuticals.

Pharmaceutical products (drugs and medicine products) are examined using HPLC to determine what components are present. The technique is used to identify, categorize, and quantify the different parts of items as well as how many of each there are.

The quantities of each component, for instance, might alter a product's overall performance and strength, giving developers a greater understanding of a drug's qualities. They can also use it to find and measure any contaminants in medicinal products.

The pharmaceutical industry is growing rapidly. The demand for generic drugs, brand-name pharmaceuticals, and over-the-counter (OTC) medications will rise as the population ages in many developed countries. In particular, the need for medications for chronic diseases will increase in the long run. Also, due to advancements in healthcare systems and rising disposable family incomes, the demand for pharmaceuticals in emerging economies is also expected to rise.

Manufacturers of generic and over-the-counter medications will be the first to gain from this breakthrough. Pharmaceutical and biotech companies typically have easy access to outside funding from banks and investors, which help them, maintain high R&D costs which is further contributing to the growth of the industry. Thus, the growing pharmaceutical industry is expected to increase the demand for high-performance liquid chromatography technology within the estimated timeframe.

Restraints

High costs of HPLC

The price of high-performance liquid chromatography has increased dramatically along with the development of chromatographic methods and materials. A single-column component of today's most advanced chromatography systems can cost as much as $1000 on its own and upwards of $35,000 for the entire system. These systems have substantial equipment, pricey sensors, and intricate internal mechanics.

HPLC analysis requires the use of pricey mobile phase solvents, and consumables like sample, columns, and solvent filters, glassware, vials, etc. have ongoing expenditures. In HPLC analysis, mobile phase solvents represent the biggest expense. As much as possible, analyses of samples needing the same mobile phase and column should be grouped together.

These systems have a base cost, but on top of that, they can be expensive to operate and maintain. The escalating expense of chromatography has, however, been the target of numerous endeavors. Researchers have made progress in developing affordable and efficient chromatography methods.

Opportunities

Increasing developments in the HPLC technology

The traditional HPLC methodology has undergone a number of improvements, and these more recent methods include Ultra-Performance Liquid Chromatography (UPLC), Rapid Resolution Liquid Chromatography (RRLC), Ultra-Fast Liquid Chromatography (UFLC), and Nano Liquid Chromatography (Nano LC). UPLC provides faster and more efficient separations, while automation improves the speed and accuracy of analysis.

Due to its high throughput quantitative analysis, UPLC has applications in the development of new drugs. It supports the study of amino acids, the detection of pesticides, the evaluation of herbal items, and the testing of conventional treatments. The identification of metabolites, bio-analysis/bioequivalence studies, ADME screening, and dissolution tests are all aided by it. Furthermore, it has been discovered that the ultra-fast liquid chromatography (UFLC) approach performs at a speed that is approximately ten times faster than conventional liquid chromatographic procedures, with approximately three times greater separation even at normal pressure levels.

According to reports, the UFLC approach minimizes the technique's departure from the van Demeter theory by optimizing column performance. The method guarantees rapid analysis without compromising analytical accuracy and dependability. These advancements are anticipated to create lucrative growth opportunities for the market in the years to come.

Product Insights

On the basis of product, the instruments segment held the largest revenue share of around 46% in 2024. This is spurred by the popularity of integrated HPLC systems and the accessibility of cutting-edge detectors. The development of systems that can provide greater productivity and application specificity is the main emphasis of manufacturers in this field. In addition, detectors like the Solvere carbon selective detector from Activated Research Corporation, which works with both aqueous and organic solvents, are expanding the range of sample types for which HPLC procedures can be applied. Also, the expansion of the healthcare sector is favorably impacting the growth of the entire market.

Application Insights

Based on the application, the clinical research segment held the largest market share of over 36% in 2024. Clinical laboratories use HPLC to examine intricate biological fluids including plasma, blood, and serum, assisting in the creation of precise, targeted medications. The pharmaceutical industry's increased R&D spending, the rising prevalence of disorders, the focus on rare diseases, and the development of several orphan medications are the main drivers of the growth of the segment. Furthermore, the growing landscape of clinical trial activities is also likely to support the segmental growth of the high-performance liquid chromatography technology within the estimated timeframe.

On the other hand, the forensic segment is likely to grow at the moderate CAGR during the forecast period. HPLC analysis is used by forensic and toxicology labs to screen, quantify, and confirm compounds used in drug tests and criminal investigations. Robust analytical techniques are urgently required for studies on the measurement of drugs of abuse.

In order to manage the constantly changing landscape of new novel psychoactive substances and boost method throughput to meet rising demand, hospital, and screening laboratories are now required to do research into new methods and tools for their screening protocols. This is likely to support the segment growth of the high-performance liquid chromatography market during the forecast period.

High-performance Liquid Chromatography Market Companies

- Thermo Fisher Scientific, Inc.

- Agilent Technologies, Inc.

- Shimadzu Corporation

- Sartorius AG

- Merck KGaA

- Waters

- YOUNGIN Chromass

- Phenomenex, Inc.

- PerkinElmer Inc.

- Tosoh Bioscience

- KNAUER Wissenschaftliche Geräte GmbH

- Sykam GmbH

Recent Developments

- In April 2024, the water corps unveiled the alliance iS Bio high-performance liquid chromatography system, which is designed to resolve operational and analytical challenges encountered by laboratories of biopharma quality control. This system converges highly advanced bio-separation technology along within-built instrument intelligence features to enhance the efficiency of QC analysts working in a biopharma. (Source: https://ir.waters.com)

- In April 2022, Shimadzu unveiled LabSolutions MD software, which aids in the creation of analytical methods for high-performance liquid chromatography (HPLC). The program allows automated column and solvent screening and provides capabilities for established technique scouting.

- In August 2021, an ultra-high performance liquid chromatography (UHPLC) and automated high performance liquid chromatography (HPLC) method development system was introduced by Thermo Fisher Scientific and ChromSword as a result of their collaboration. This system allows chromatographers to deliver robust and validated methods with greater assurance and in less time.

Segments Covered in the Report

By Product

- Instruments

- Consumables& Accessories

- Software

By Application

- Clinical Research

- Environmental

- Forensic

- Others

By End-User

- Pharmaceutical & Biotechnology Companies

- Academic & Research Institutions

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- The Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting