U.S. Liquid Biopsy Market Size and Growth 2025 to 2034

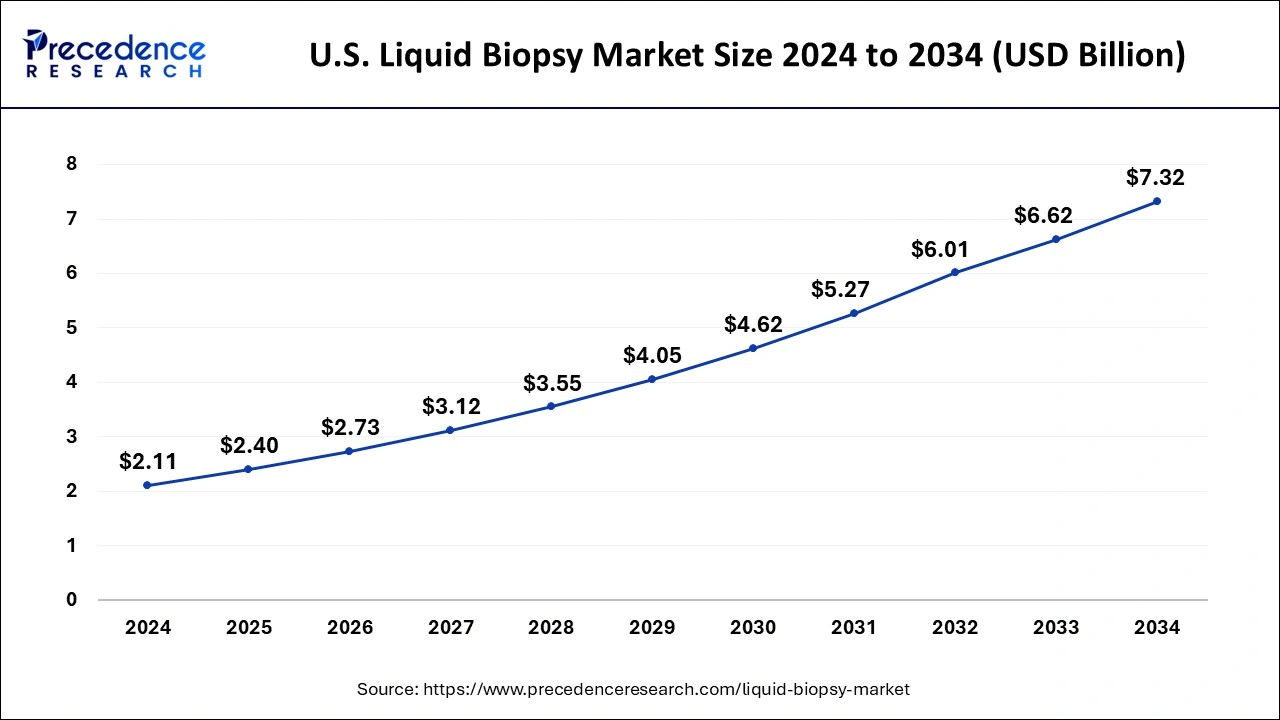

The US liquid biopsy market size was valued at USD 1.85 billion in 2024 and is expected to be worth around USD 6.62 billion by 2034, growing at a CAGR of 13.55% during the forecast period from 2025 to 2034.

U.S. Liquid Biopsy Market Key Takeaways

- On the basis of biomarker types, the circulating tumor cells (CTC) segment is anticipated to dominate the market from 2025 to 2034.

- On the basis of application, the cancer therapeutic application segment had the major market share in 2024.

- On the basis of the sample, the blood sample segment is predicted to expand at the biggest rate from 2025 to 2034.

- On the basis of end-user, the hospitals and laboratories segment had the major market share in 2024.

MarketOverview

A technique that involves diagnosing and tracking diseases like cancer is known as liquid biopsy. This technique involves sampling and analyzing biological tissues in a liquid condition. Liquid biopsies are mainly preferred to eliminate the discomfort associated with operations. For instance, blood and urine are the liquid samples utilized in the method. Both of these samples are obtained painlessly and readily. It is mainly a practical application of two developments in medical science, human genome sequencing and the growing sensitivity of detection measures and assays. Additionally, it provides a risk-free and efficient option for patients who are unable to have a tissue biopsy due to the risks associated, such as those with lung cancer who have tumors that are too close to the heart. Clinical utility challenges, lack of sensitivity, and specificity of liquid biopsy tests are some of the key factors hindering the growth of liquid biopsy.

MarketScope

| Report Coverage | Details |

| Market Size in 2025 | USD 1.85 Billion |

| Market Size by 2034 | USD 6.62 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 13.55% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Biomarker Types, By Application, By Sample, By End User |

Market Dynamics

Drivers

Rise in the prevalence of cancer

On a worldwide basis, the number of cancer patients has grown dramatically. For instance, according to World Health Organization, the leading cause of death is cancer, accounting for nearly 10 million deaths in 2020. Some of the causes of the increased incidence of cancer include environmental factors, cigarette smoking, viral disorders such as Hepatitis B and C, and lifestyle changes. Liquid biopsy provides several advantages over traditional cancer diagnostic procedures, including reduced cost, earlier prognosis, therapy monitoring, tumor heterogeneity discovery, acquired drug resistance, and patient comfort (by eliminating the need for surgery). The liquid biopsy is expected to become the first choice for diagnosis of a wide variety of cancers, such as Central Nervous System (CNS) and pancreatic cancer.

Restraints: Certain liquid biopsies have reduced sensitivity

Detecting ctDNA in liquid biopsies is technically difficult since the quantities of DNA of any particular cancer mutation in a cancer patient's plasma might be very low, especially after therapy or surgery. According to the sampling statistics, there may be less than one detectable copy of the ctDNA with the cancer mutation in each sample of plasma from a patient. As a result, even if ctDNA is present in the plasma at a low level, it may not be found in the patient sample. This results in false-negative results in which ctDNA is not discovered despite its presence, decreasing the predictive value of liquid biopsy testing for cancer.

Opportunities: The increasing influence of companion diagnostics

Companion diagnostics are tests or assays that assist healthcare practitioners to make treatment decisions for patients based on the optimal response to therapy. Co-development of companion diagnostics with therapeutic goods has the potential to significantly transform the drug development process and accelerate the commercialization of drug candidates. This is done by producing safer medications with improved therapeutic efficacy rapidly and cost-effectively. The market for companion diagnostics has considerable growth potential due to the rising need for high-priced specialized therapies and safer medications. The increasing relevance of companion diagnostics is also propelling the liquid biopsy market growth.

Biomarker Type Insights

The RNA (microRNA, mRNA) segment is expected to grow at a CAGR of 9.20% during the forecast period. In the US, the liquid biopsy is elevating the utilization of RNA, especially of miRNAs and microRNAs. The miRNA is convenient due to its stabilization power, which makes it reliable for liquid biopsy analysis. Researchers are adopting mRNA in liquid biopsies largely for prognosis, treatment monitoring, and cancer diagnosis. This segment is steadily attracting researchers and the health sector. Also, it's an advancement in the clinical application.

Technology/ Platform Insights

The next-generation sequencing (NGS) segment held the largest share of 42.10% in the U.S. liquid biopsy market in 2024. The NGS is transforming the liquid biopsy analysis in the US region, specifically in cancer management. NGS provides larger prospective insights into tumor characteristics. It enables remarkable genomic profiling of widespread tumor DNA (ctDNA). The NGS's broader access despite of unavailability and challenges of tissue biopsies led this segment significantly.

The epigenetic analysis segment is expected to grow at a CAGR of 9.50% during the forecast period. The epigenetic analysis is evolving as one of the robust tools in cancer prognosis, treatment monitoring, and detection in the US. It analyzes various other epigenetic modifications and DNA methylation patterns in cell-free DNA. This technology is leading with its development in responsive treatment and addressing minimal residual disease (MRD).

Test Type/ Application Insights

The therapy selection/ companion diagnostics covered the largest share of 27.80% in the U.S. liquid biopsy market in 2024. The liquid biopsy companion diagnostics (CDX) in the US are initiated to address single genetic alterations in patients suffering from cancer. It is guidance for the treatment decisions with complex therapies. The FDA has issued approval to certain drugs, declaring them as companion diagnostics. This segment contributes largely to the severe cancer conditions.

The minimal residual disease (MRD) detection is expected to grow at a CAGR of 10.30% during the forecast period. In the US, liquid biopsy is prominently used for MRD detection, specifically in cancer management. The forecasting of the relapse period and fewer procedures/steps to monitor treatment are attracting healthcare professionals and researchers to invest more in its development in the US healthcare management system.

Cancer Type Insights

The lung cancer (NSCLC, SCLC) segment held the largest share of 28.60% in the U.S. liquid biopsy market in 2024. The prevalence of lung cancer in the US is growing, and eventually the need for precision medicine and treatments is also leading in forefront of the need for patient care. A less invasive method using bodily fluids and or blood to address cancer biomarkers has ensured management and diagnosis of lung cancer in the US. Liquid Biopsy as a tool is promising effectiveness to NSCLC and SCLC in the US region.

The pancreatic cancer segment is expected to grow at a CAGR of 8.70% during the forecast period. Liquiq biopsies have potential value to analyze tumor DNA, exosomes, and widespread tumor cells that provide customized treatment, monitoring, and early detection and diagnosis of pancreatic cancer. The innovative treatment methods are enhancing a broad range of options.

Product and Service Type Insights

The services segment competitively acquired the largest share of 44.90% in the U.S. liquid biopsy market in 2024. The services such as data interpretation, laboratory testing, and sample collection & analysis have predominantly occupied the broader space in the liquid biopsy industry. The services are subject to lengthy testing and implementation processes. The liquid biopsy services in the US are used for treatment planning and monitoring.

The software and bioinformatics tools segment is expected to grow at a CAGR of 9.10% during the forecast period. The tools are emerging as the leading secondary endpoint among the major US liquid biopsy companies. The liquid biopsy clinical application and research highly depend on several bioinformatics and software tools for analyzing data from molecular profiling methods, NGS, and digital PCR (dPCR).

Clinical Setting/ End user Insights

The reference laboratories segment held the largest share of 39.70% in the U.S. liquid biopsy market in 2024. Various significant reference laboratories in the US provide liquid biopsy testing services. These consist of myriad genetics, personal genome diagnostics, Foundation Medicine, and Guardant Health. The collaborations and contracts fuel the rapid growth and profit in reference laboratories.

The biopharmaceutical and biotechnology companies segment is expected to grow at a CAGR of 8.90% during the forecast period. The biotechs are emerging in the clinical setting with their discoveries of new drug development and precision clinical trials. The acquisitions and alliances under these giant leader companies are strengthening the U.S. liquid biopsy industry.

Sample Type Insights

The blood (plasma/serum) segment peaked at the largest share of 81.30% in the US liquid biopsy market in 2024. In liquid biopsy for cancer monitoring and identification in the US, the serum and plasma are mainly used to utilize plasma integration in the seamless extraction and achieve a higher level of sensitivity. The R&Ds mostly focus on assay development and improvement in sampling handling.

The cerebrospinal fluid (CSF) is expected to grow at a CAGR of 9.40% during the forecast period. The cerebrospinal fluid is evolving as a remarkable sample type in the us liquid biopsy, especially for the central nervous system. It has the potential to enable a prominent and direct source for tumor-driven biomarkers. The improvement in monitoring and diagnostics for brain tumors makes the sampling approachable.

Business Model Insights

The centralized testing labs segment covered the largest share of 46.20% in the US liquid biopsy market in 2024. The development of liquid biopsy in the US experienced rapid adoption in centralized testing labs, fueled by its ability to evolve cancer management. These business model labs are rapidly enabling a variety of liquid biopsy services. It elevates advancements in various technologies and NGS.

The direct-to-consumer (DTC) testing model segment is expected to grow at a CAGR of 10.60% during the forecast period. The DTC testing model covered a massive area by providing consumers access to genetic information, discarding physicians' involvement. The transformational shift has unlocked challenges and opportunities in the U.S. liquid biopsy technology and companies.

Recent Developments

- In July 2021, Biocept, Inc. has received a South Korean Patent for the Primer-Switch technology, which uses real-time PCR and related analytical methods to discover rare mutations in circulating tumor DNA (ctDNA).

- In February 2021, Guardant Reveal, the first blood-only liquid biopsy test for detecting residual and recurring illness from a single blood draw, has been made available by Guardant Health, Inc.

U.S. Liquid Biopsy MarketCompanies

- ANGLE plc, Biocept Inc.

- Bio-Rad Laboratories Inc.

- Epigenomics AG

- Exact Sciences Corporation

- F. Hoffmann-La Roche AG

- Guardant Health Inc.

- Illumina Inc.

- MDxHealth SA

- Menarini Silicon Biosystems

- QIAGEN N.V.

- Thermo Fisher Scientific Inc.

Segment covered in the report

By Biomarker Type

- Circulating Tumor Cells (CTCs)

- Circulating Tumor DNA (ctDNA)

- Extracellular Vesicles (Exosomes & Microvesicles)

- Cell-free DNA (cfDNA)

- RNA (microRNA, mRNA)

- Proteins

- Others (e.g., metabolites)

By Technology/Platform

- Next-Generation Sequencing (NGS)

- PCR-based Methods

- Digital PCR (dPCR)

- Real-time PCR (qPCR)

- Microarrays

- Beads, Emulsions, Amplification, and Magnetics (BEAMing)

- Epigenetic Analysis

- Immunoassays (for protein biomarkers)

By Test Type / Application Stage

- Screening / Early Detection

- Diagnosis

- Prognosis

- Therapy Selection / Companion Diagnostics

- Minimal Residual Disease (MRD) Detection

- Recurrence Monitoring / Surveillance

- Treatment Response Monitoring

By Cancer Type (Indication Area)

- Lung Cancer (NSCLC, SCLC)

- Breast Cancer

- Colorectal Cancer

- Prostate Cancer

Pancreatic Cancer - Ovarian Cancer

- Melanoma

- Bladder Cancer

- Liver Cancer

- Others (e.g., hematological malignancies)

By Product & Service Type

- Kits & Reagents

- Instruments/Devices

- Software & Bioinformatics Tools

- Services

- Laboratory Testing Services

- Sample Collection & Analysis

- Data Interpretation Services

By Clinical Setting / End-User

- Hospitals & Clinics

- Reference Laboratories

- Academic & Research Institutes

- Biopharmaceutical & Biotechnology Companies

- Contract Research Organizations (CROs)

- Government & Public Health Agencies

By Sample Type

- Blood (Plasma/Serum)

- Urine

- Saliva

- Cerebrospinal Fluid (CSF)

- Other Biofluids (e.g., pleural effusion, ascites)

By Business Model

- Test Kit Manufacturers

- Centralized Testing Labs (e.g., Guardant Health, Foundation Medicine)

- Decentralized Platforms

- Direct-to-Consumer (DTC) Testing Models

- Partnership-based Companion Diagnostics (CDx)

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting