What is the Liquid Handling Systems Market Size?

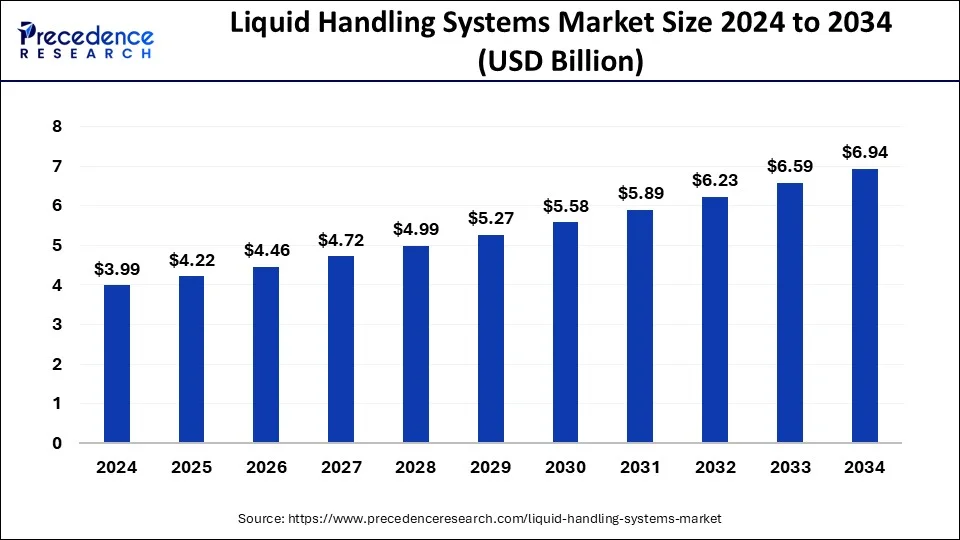

The global liquid handling systems market size was estimated at USD 4.22 billion in 2025 and is predicted to increase from USD 4.46 billion in 2026 to approximately USD 7.30 billion by 2035, expanding at a CAGR of 5.63% from 2026 to 2035. The market is growing because of new technologies that make it easier to handle liquids, like robots, precision dispensing, and software solutions that work with other systems.

Liquid Handling Systems Market Key Takeaways

- The global liquid handling systems market was valued at USD 4.22billion in 2025.

- It is projected to reach USD 7.30billion by 2035.

- The liquid handling systems market is expected to grow at a CAGR of 5.63% from 2026 to 2035.

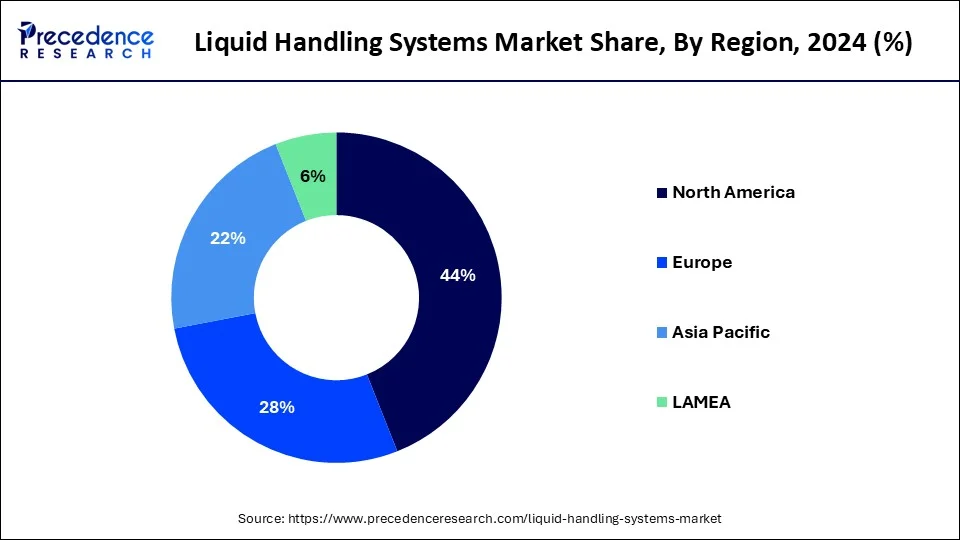

- North America led the liquid market with the largest market share of 44% in 2025.

- Asia Pacific is predicted to grow rapidly over the projected period in the global market.

- By type, the manual liquid handling segment dominated the market in 2025.

- By type, the electronic segment is expected to show the fastest growth over the forecast period.

- By product, in 2023, the automated workstation segment dominated the market and is projected to grow significantly throughout the forecast period.

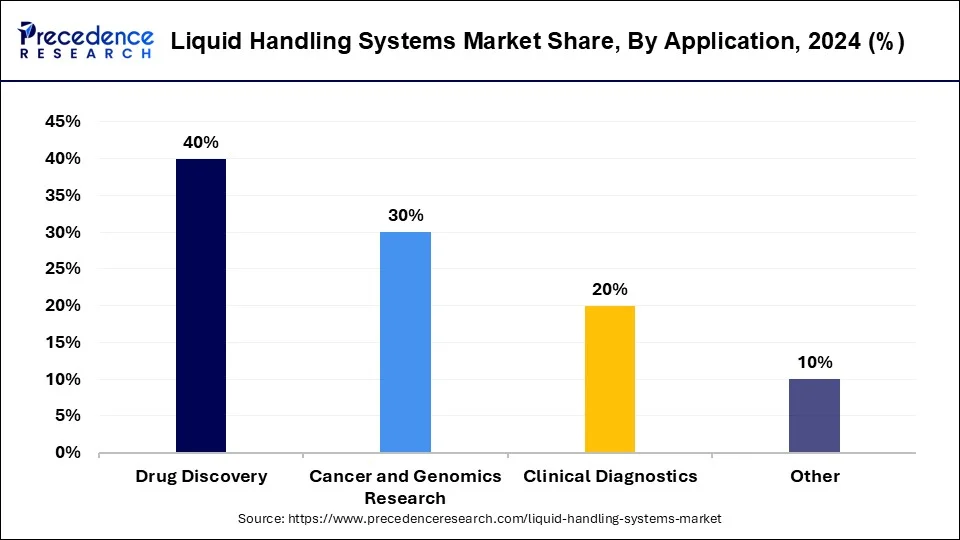

- By application, the drug discovery segment has held the largest market share of 40% in 2025.

- By application, the cancer and genomics research segment is predicted to grow rapidly over the projected period.

What is the Liquid Handling System?

Automated liquid handling systems are becoming increasingly popular in drug discovery, with many major players in the market shifting towards these systems. This trend is fueled by the growing investment in research and drug development. The demand for high-throughput screening is also on the rise and can further drive market growth. Technological advancements in automated liquid handling systems are contributing to this growth as well.

Liquid-handling instruments offer several advantages. They simplify sample preparation with consistently high accuracy, allowing laboratories to handle more samples while maintaining reproducibility. Additionally, they help laboratories address sample preparation needs for various applications, including proteins, metabolites, genomics, and NGS, thereby reducing setup times and protocol development efforts.

How is AI contributing to the Liquid Handling Systems Industry/Process?

AI technology empowers liquid handling systems to perform adaptive control operations that function in real time. Machine learning systems use sensor data analysis to optimize dispensing settings while achieving better precision, upcoming maintenance identification, workflow efficiency, reagent waste reduction, and automated operation and high-volume laboratory testing, which follows standardized procedures in complex scientific research.

Market Trends

- The increasing intricacy of drug discovery methods and the surge in biopharmaceutical studies are fueling the need for advanced liquid handling systems. These systems are essential for activities such as high-content screening, compound management, and bioprocess optimization, aiding progress in biotechnology and personalized medicine.

- A significant trend is evident in the miniaturization and microfluidic technologies within liquid handling systems. These advancements allow for the management of smaller volumes with greater accuracy, lowering reagent expenses and supporting new applications in areas like single-cell analysis and point-of-care testing.

- To enhance the precision of laboratory automation liquid handling, AI is progressively being integrated into liquid handling systems. Algorithms in machine learning can track dispensing in real time and adjust conditions as needed. Due to laboratories' increasing focus on sustainability and cost-effectiveness, there has been a shift towards eco-friendly and economically feasible liquid handling technologies.

- In reply, manufacturers are developing systems that consume less energy, generate less waste, and demand less maintenance. This trend aligns with the broader corporate responsibility initiatives that companies across various industries have implemented.

- The rise of compact and portable systems Compact and portable liquid handling devices are increasingly sought after, especially for field research and point-of-care applications. Techniques that do not require contact, such as acoustic droplet ejection and air pressure, are becoming alternatives to conventional pipette methods. These methods reduce cross-contamination and carryover, providing excellent accuracy and precision.

Liquid Handling Systems Market Growth Factors

- The growing investment in drug discovery and research is anticipated to increase the demand for liquid handling systems.

- Rising demand for high-throughput screening can fuel the market growth further in the near future.

- Technological developments in automated liquid handling systems can boost market growth shortly.

- Advancements in automation and robotics are expected to propel the liquid handling systems market's growth during the forecast period.

- Rising demand from pharmaceutical & biotechnology companies can drive market growth.

Market Outlook

- Growth Industry Analysis: Laboratory automation and high-throughput screening spur the implementation of AI-enabled liquid handling systems.

- Trends in Sustainability: Acoustic dispensing, low-plastic consumables, and energy-saving automation cut down laboratory environmental footprints.

- International Development: The growth of Asia-Pacific is enhanced with North American dominance in biopharma automation infrastructure.

- Key Investors: Thermo Fisher Scientific, Danaher Corporation, Tecan Group, Hamilton Company, Agilent Technologies, Eppendorf SE, and PerkinElmer are investors.

- Startup Ecosystem: Opentrons, SPT Labtech, and Andrew Alliance are making inroads out there with available robotics and open platforms automation.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 4.22Billion |

| Market Size in 2026 | USD 4.46 Billion |

| Market Size by 2035 | USD 7.30Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 5.63% |

| Largest Market | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Type, Product, Application, End-user, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Increasing demand for high-throughput screening

High-throughput screening (HTS) is an automated process used in drug discovery to quickly identify active compounds, antibodies, or genes. It helps researchers find potential treatments for chronic conditions like cancer, HIV, and heart disease by screening large numbers of drug-like compounds. As the prevalence of these diseases increases globally, there is a growing demand for HTS products to aid in drug development. HTS technology enables rapid assessment of the biological or biochemical activity of compounds, facilitating the detection of molecules that interact with specific targets such as receptors, enzymes, or ion channels.

- In December 2023, Piramal Pharma launched a high-throughput screening facility at its drug discovery services site in Ahmedabad, India. It will add to the current in vitro biology capabilities along with the primary and secondary screening capabilities of compound manufacturers at the Indian site.

Restraint

Cross-contamination issues

In high-throughput environments, liquid handling systems are at risk of contamination or cross-contamination between samples or reagents. To mitigate these risks, laboratories must adhere to strict protocols and implement quality control measures. Additionally, there is a need for greater awareness of career opportunities in the medical field, especially in developing countries, where many people may not be aware of the diverse career options available. These factors hinder the growth of the liquid handling systems market.

Opportunity

Integration of robotics with liquid handling systems

The liquid handling systems market has traditionally relied on manual, labor-intensive processes for tasks such as fluid transfer, dispensing, and pipetting. Recent advancements in robotics offer the potential to automate these repetitive tasks by integrating robots with liquid handling equipment. Robotics can enhance precision, accuracy, and output while reducing errors in high-volume dispensing and sample screening. Researchers are developing affordable robots with advanced vision capabilities to seamlessly coordinate with existing liquid handlers, creating a fully automated workflow. This integration also can significantly increase lab productivity and efficiency.

- In June 2023, Becton, Dickinson, and Company, a leading global medical technology company, announced the worldwide commercial launch of a new automated instrument that prepares samples for clinical diagnostics using flow cytometry, enabling a complete "walkaway" workflow solution designed to improve standardization and reproducibility in cellular diagnostics.

Segment Insights

Type Insights

The manual liquid handling segment dominated the liquid handling systems market in 2025. The growth is linked to the low cost and deduction in time required for sample processing offered by manual liquid handling systems in research institutions, biotech firms, etc. Moreover, rising R&D investments have made various pharma companies focus on drug development.

The electronic segment is expected to show the fastest growth over the forecast period. The growth of this segment is mainly fueled by the rising investment in research and development by pharmaceutical and biotech firms. Also, there's a growing demand for dependable liquid handling systems in diagnostic labs. The COVID-19 pandemic has further boosted the need for electronic liquid handling systems. With the necessity for extensive testing and vaccine development, there's been a sharp increase in demand for automated liquid handling instruments. This segment is poised for significant growth in the foreseeable future.

Liquid Handling Systems Market Share, By Type (USD Million)

| Type | 2022 | 2023 | 2024 |

| Manual | 1,071.8 | 1,130.4 | 1,194.7 |

| Automated | 763.2 | 810.7 | 862.9 |

Product Insights

Dispensers segment is seen to grow at a notable rate during the predicted timeframe. Liquid handling systems, such as dispensers, play a vital role in automating laboratory processes, especially in drug discovery and development. These systems facilitate the accurate and effective management of numerous samples, rendering them perfect for high-throughput screening (HTS). Innovations in technology and rising investments in R&D are driving this growth.

The automated workstation segment dominated the liquid handling systems market in 2025 and is projected to grow significantly throughout the forecast period. In labs, automated workstations are becoming more common to improve efficiency and output. By automating tasks that scientists typically perform, like experimental procedures, labs can boost reproducibility and throughput. Robotic control ensures consistent movements, which reduces the variability that can occur with manual techniques. Modular workstations offer flexibility, allowing customization for specific applications such as sample preparation for genomics, proteomics, and cellular analysis.

- In February 2024, Opentrons Labworks, Inc., a leader in lab automation and makers of accessible lab robotics, announced the launch of its new protocol library, offering plug-and-play protocols for all Opentrons robots, including the Opentrons Flex. Opentrons is building a first-of-its-kind ecosystem for simplifying and scaling lab automation, which comprises the protocol library along with generative AI tools for protocol development.

Liquid Handling Systems Market Share, By Product (USD Million)

| Product | 2022 | 2023 | 2024 |

| Pipettes | 211.2 | 224.0 | 238.0 |

| Dispensers | 243.1 | 256.8 | 271.9 |

| Burettes | 159.5 | 168.1 | 177.6 |

| Automated Workstation | 424.5 | 451.4 | 480.9 |

| Consumables | 719.9 | 760.0 | 804.1 |

| Others | 76.9 | 80.8 | 85.0 |

Application Insights

The drug discovery segment dominated the liquid handling systems market in 2025. Liquid handling systems are making a big impact in drug discovery, particularly in the pharmaceutical field. They're essential in the initial phases of drug development, ensuring precise and efficient handling of various substances and samples. These systems are key in high-throughput screening, where researchers can quickly test thousands or even millions of compounds to find potential treatments. Given the growing demand for new drugs to tackle challenging diseases, the drug discovery sector is driving significant demand for liquid handling systems by pushing the market forward.

In the liquid handling systems market, the cancer and genomics research segment is predicted to grow rapidly over the projected period. Genomics research has become increasingly important, providing valuable insights into how genes work and interact, which is crucial for understanding genetic diseases and specific treatments for individuals. With the rapid progress in genomics, especially with next-generation sequencing technologies, the need for liquid handling systems in genomics research is expected to rise significantly.

- In July 2023, UNSW Sydney's Centre for Molecular Oncology partnered with not-for-profit cancer genomics leader Omico to deliver the national precision oncology program PrOSPeCT.

End User Insights

Pharmaceutical and biotechnology industry segment dominated the market. This leadership is fueled by escalating R&D efforts, a greater volume of clinical trials, and an intensified emphasis on developing personalized medicine. Biopharma firms are significantly investing in clinical studies and drug production, with liquid handling systems especially for pipetting and fluid dispensing being crucial for maintaining efficiency and accuracy. The worldwide need for advanced treatments has driven the creation and manufacturing of biologic medications, such as vaccines, monoclonal antibodies, growth factors, cell and gene therapies (CGTs), recombinant hormones, interferons, among others. In these applications, automated liquid handling (ALH) systems are becoming increasingly popular because of their efficient throughput and quick processing.

Contract research organization segment is observed to grow at the fastest rate during the forecast period. Contract research organizations (CROs) represent the most rapidly expanding segment, as they progressively adopt sophisticated liquid handling technologies to enhance the effectiveness and precision of their research services. The rise in clinical trials and the outsourcing of research tasks by pharmaceutical companies have driven growth in CROs. CROs are utilizing liquid handling technologies to boost laboratory capabilities and increase accuracy and efficiency in their research procedures.

Liquid Handling Systems Market Share, By End user (USD Million)

| End user | 2022 | 2023 | 2024 |

| Pharmaceutical & Biotechnology Industry | 811.9 | 857.5 | 907.6 |

| Diagnostic Centers | 251.9 | 268.9 | 287.7 |

| Research Institutes | 339.0 | 358.8 | 380.6 |

| Academic Institutes | 360.0 | 380.7 | 403.3 |

| Others | 72.2 | 75.1 | 78.4 |

Regional Insights

What is the U.S. Liquid Handling Systems Market Size?

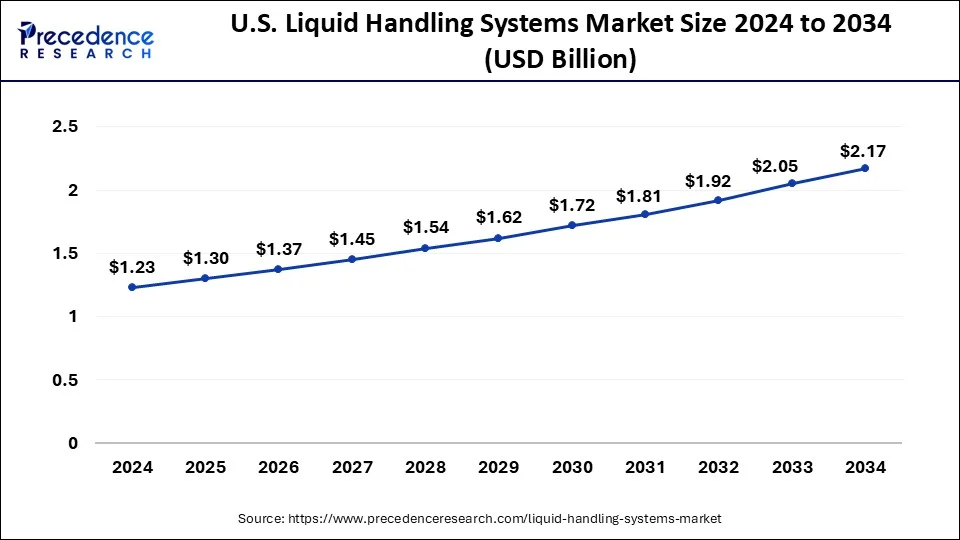

The U.S. liquid handling systems market size was estimated at USD 1.30 billion in 2025 and is predicted to be worth around USD 2.30 billion by 2035 with a CAGR of 5.87% from 2026 to 2035.

North America dominated the liquid handling systems market in 2025. The United States is a key region in research and development spending across life sciences, pharmaceuticals, and analytical chemistry. It's also a major hub for drug manufacturing, using liquid handling systems extensively in the process. Liquid handling systems are vital indrug discovery, cancer research, and clinical diagnostics, and the growth of these industries is expected to have a positive impact on the market. Furthermore, factors like investments from big companies, a rise in infectious and chronic diseases, and an increase in product launches by market players are all contributing to the market's growth.

Asia Pacific is predicted to grow rapidly over the projected period in the global liquid handling systems market. This is because the region is making big strides in improving its healthcare facilities, investing more in research and development, and embracing lab automation technologies. Countries like China, Japan, and India are seeing substantial growth in their biotech and pharmaceutical industries, driven by a growing interest in personalized medicine and genomics-based diagnostics. Hence, there's a rising demand for liquid handling systems in this region.

- As per the news published by PR News in August 2023, the Asia Pacific pharmacy automation industry is poised to undergo a transformative evolution worth $763 million, driven by rapid technological advancements and growing healthcare demands. With an increasing emphasis on efficient medication management and patient safety.

The U.S. represented the highest revenue share of the market within the North America region. The United States possesses a strong and well-developed life sciences and biotechnology industry, featuring various research organizations, pharmaceutical firms, and academic institutions that are actively involved in promoting scientific advancements. Moreover, a supportive regulatory framework and a strong degree of technological innovation help the U.S. sustain its leading role in the adoption and advancement of liquid handling technologies in the North American market.

Since 2019, China's pharmaceutical sector has expanded fueled by substantial biopharma investments and a growing generics market, increasing the need for reliable, affordable liquid handling solutions in both production and research. National biotech parks in cities such as Shanghai and Shenzhen have drawn more than 5,000 startups since 2020, boosting local demand for modular and automated liquid handling systems in preclinical and clinical research.

The liquid handling system market in Europe holds the significant market share, driven by state-of-the-art drug development facilities, government support for the healthcare sector's growth, an aging demographic, and a rising adoption of advanced liquid handling technologies. Moreover, the liquid handling system market in Germany held the largest market share, while the liquid handling system market in the UK was the fastest-growing market in the European Region.

The expansion of the Liquid Handling Technology Market in the Middle East and Africa (MEA) is mainly fueled by the swift development of biotechnology and pharmaceutical research throughout the area. Rising investments in life sciences, government-supported healthcare reforms, and an increasing quantity of diagnostic laboratories are driving the demand for automated and semi-automated liquid handling systems. These technologies are essential for genomic workflows, high-throughput screening, and applications in drug discovery.

Value Chain Analysis of the Liquid Handling Systems Market

- R&D: Preliminary research is the development of new drugs or the advancement of existing formulations by simple research and scientific discovery.

Key Players: Thermo Fisher Scientific, Hamilton Company, Tecan Group, Agilent Technologies - Clinical Trials and Regulatory Approvals: Human trials produce safety, dosage, and efficacy data to conduct regulatory approval.

Key Players: Thermo Fisher Scientific, Hamilton Company, Beckman Coulter (Danaher) - Formulation and Final Dosage Preparation: This is where chemical and biological compounds are converted into forms and forms that are stable and have control over the dosage.

Key Players: Sartorius AG, Hamilton Company, Thermo Fisher Scientific, Corning Inc - Packaging and Serialization: Finished goods are also packed and serialized to verify a trace and avoid counterfeiting.

Key Players: West Pharmaceutical Services, BD (Becton, Dickinson), Gerresheimer AG - Distribution to Hospitals, Pharmacies of Liquid Handling Systems: Logistics provides packaged systems to healthcare organizations and pharmacies economically.

Key Players: Cardinal Health, McKesson Corporation, AmerisourceBergen (Cencora)

Liquid Handling Systems Market Companies

- Qiagen N.V.: Their automated extraction systems, together with magnetic bead technologies, provide clinical laboratories with reliable sample preparation results through their consistent and reproducible extraction process.

- Danaher Corporation: The company provides automated pre-analytical liquid handling systems, which include Biomek workstations as a foundation for laboratory automation that can develop into higher capacities.

- PerkinElmer, Inc.: The company combines real-time monitoring capabilities with remote dispensing system control to enable predictive maintenance and inventory management functions.

Other Major key Players

- Thermo Fisher Scientific, Inc.

- Eppendorf AG

- Sartorius AG

- Merck KGaA

- Agilent Technologies.

- Biosero

- Starlab International

- DISPENDIX

- Tecan Group Ltd

- Hamilton Company

- Agilent Technologies

- Aurora Biomed

- BioTek Instruments

Recent Developments

- In April 2025, Tecan unveiled Veya™, the newest member of its liquid handling lineup, aimed at improving throughput, efficiency, and the general quality of laboratory experiments. Veya's streamlined design and user-friendly functionality make it a perfect option for enhancing workflows, especially in labs incorporating automation for the initial time.

- In June 2025, Sequentify and Bio Molecular Systems (BMS) announced the launch of the InfiniSeq™ Protocol for the Myra liquid handling system, now accessible for download from the BMS Script Library. The partnership combines Sequentify's fast, four-step targeted sequencing method with BMS's accurate automation technology to provide an efficient solution for high-throughput library preparation.

- In July 2024, Becton, Dickinson and Company, a prominent global medical technology firm, announced the commercial release of the first in a series of high-throughput, robotics-compatible reagent kits designed to facilitate automation, ensuring improved consistency and enhanced efficiency in large-scale, single-cell discovery research. The solution features the recently launched BD OMICS-One XT WTA Assay along with the Hamilton Microlab™ NGS STAR automated liquid handling system.

Segments Covered in the Report

By Type

- Manual Liquid Handling

- Electronic Liquid Handling

- Automated Liquid Handling

- Semi-automated Liquid Handling

By Product

- Automated Workstations

- Pipettes

- Dispensers

- Burettes

- Other Products

By Application

- Drug Discovery

- Cancer and Genomics Research

- Clinical Diagnostics

- Other

By End-user

- Diagnostic Centers

- Pharmaceutical and Biotechnology Industry

- Contract Research Organization

- Academic Institutes

- Other

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting