What is the Preparative and Process Chromatography Market Size?

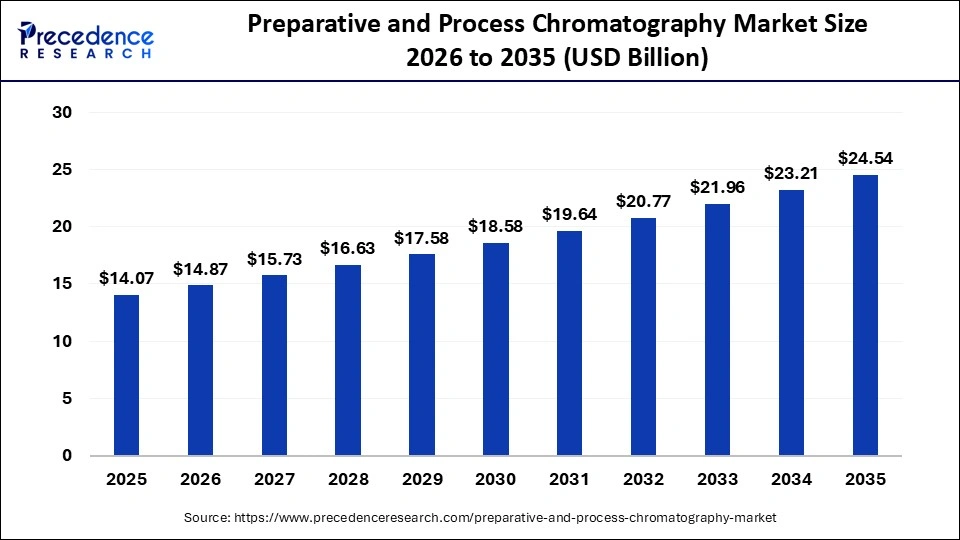

The global preparative and process chromatography market size accounted for USD 14.07 billion in 2025 and is predicted to increase from USD 14.87 billion in 2026 to approximately USD 24.54 billion by 2035, expanding at a CAGR of 5.72% from 2026 to 2035. This market is growing due to increasing demand for high-purity biologics and pharmaceuticals, coupled with advancements in separation technologies.

Market Highlights

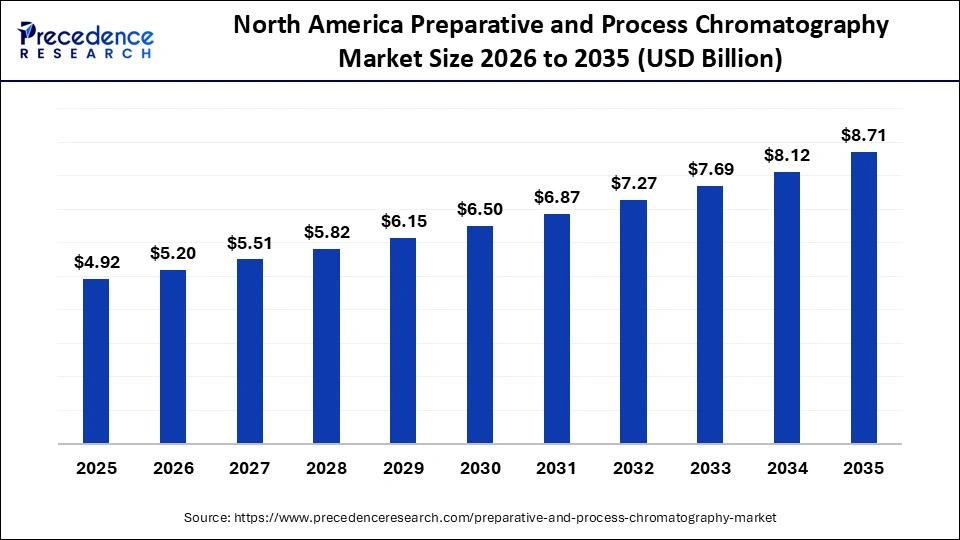

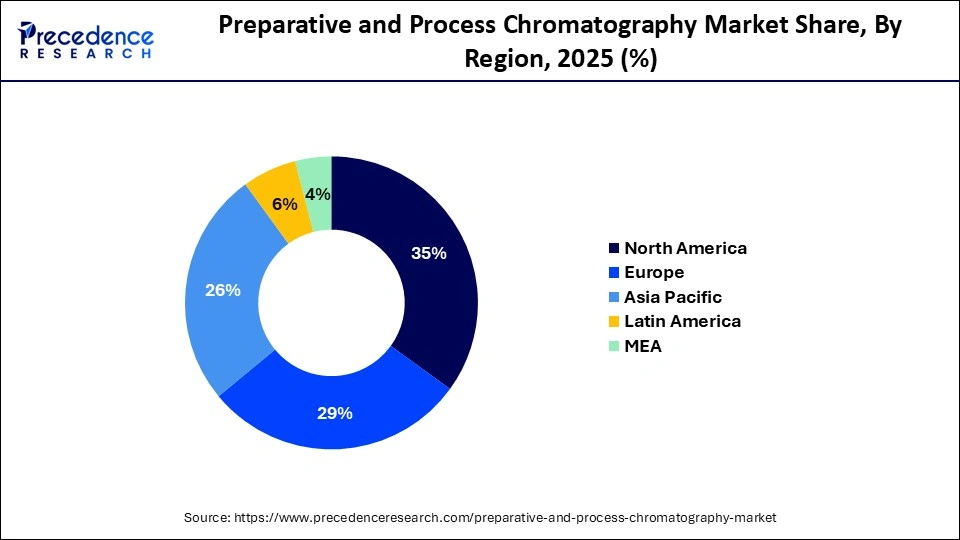

- North America dominated the preparative and process chromatography market, holding the largest market share of 35% in 2025.

- The Asia Pacific is expected to grow at the fastest CAGR of approximately 8.50% between 2026 and 2035.

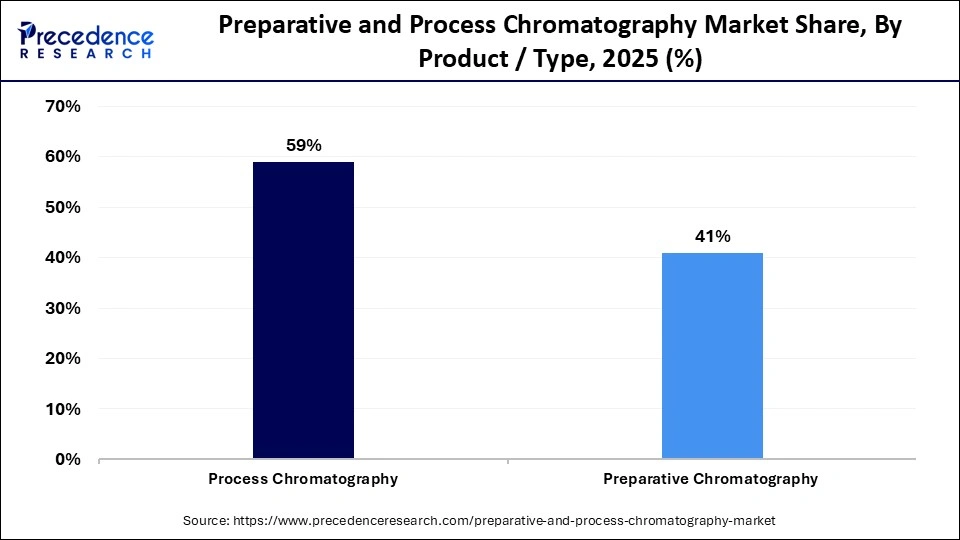

- By product/type, the process chromatography segment held the largest market share of approximately 59% in 2025.

- By product/type, the preparative chromatography segment is growing at a remarkable CAGR of 7.90% between 2026 and 2035.

- By technique/chromatography type, the liquid chromatography segment contributed the biggest market share of 55% in 2025.

- By technique/chromatography type, the supercritical fluid chromatography segment is expected to grow at a strong CAGR of 11.50% between 2026 and 2035.

- By end-use industry, the pharmaceutical & biotechnology industry segment captured the highest market share of 45% in 2025.

- By end-use industry, the food & nutraceutical industries segment is growing at a healthy CAGR of 9.60% CAGR between 2026 and 2035.

- By service/consumable category, the columns & hardware segment held the major market share of 50% in 2025.

- By service/consumable category, the services segment is expected to expand at a solid CAGR of 10.90% CAGR between 2026 and 2035.

Market Overview

Purity Perfected, Progress Accelerated

The preparative and process chromatography market is witnessing robust growth. Demand continues to rise as the biopharmaceutical industry requires high-purity proteins, vaccines, and antibodies for large-scale manufacturing. These products depend on chromatography workflows that can deliver consistent purity, reliable separation, and strong reproducibility. As therapeutic pipelines expand into areas such as monoclonal antibodies, recombinant proteins, and viral vectors, manufacturers rely heavily on chromatography systems to meet regulatory and commercial standards.

Efficiency and scalability are improving through advancements in automated systems and next-generation chromatography resins. Automated platforms help streamline buffer preparation, column handling, and real-time monitoring, reducing manual error and supporting continuous processing. New resin technologies offer higher binding capacities, improved flow rates, and stronger chemical stability, allowing facilities to scale production without compromising purity. These improvements also shorten processing times and lower overall operating costs.

Stricter product quality regulations strengthen this momentum. Biopharmaceutical manufacturers must meet rigorous purity, safety, and consistency requirements, which increases reliance on validated chromatography processes.

Case Study: Cytiva Enhances Purification Efficiency with AI-Driven Continuous Chromatography

In 2025, Cytiva advanced the preparative and process chromatography market with its AI-enabled PureFlow Continuous Purification Suite. The system used digital twins and real-time analytics to optimize column performance, helping manufacturers increase yields by 35% and reduce cycle times by 25%. This smart, automated workflow strengthened Cytivas position as a key enabler of faster, cleaner, and more efficient biologics purification.

Preparative and Process Chromatography Market Outlook

The market for preparative and process chromatography is expanding rapidly due to the growing need for therapeutic proteins, vaccines, and high-purity biologics. The growth of biopharmaceutical R&D is accelerating market adoption, the growing use of single-use systems, and developments in chromatography resins and automated platforms. Investment in preparative and process chromatography solutions is being further driven by regulatory emphasis on product quality and consistency.

The preparative and process chromatography market is focusing on sustainability. Businesses are integrating energy-efficient automated platforms, cutting waste in bioprocessing, and creating reusable, low-solvent systems. Eco-friendly resins and green chemistry concepts are becoming more popular, allowing for production that is both environmentally responsible and upholds strict purification standards.

The chromatography industry benefits from a thriving startup community. New resins, miniaturized purification systems, and AI-driven process optimization are innovations being made by up-and-coming businesses. These startups frequently collaborate with well-established companies to scale technologies, bringing specialized solutions and agility to the market while fostering competition and swift technological advancements.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 14.07 Billion |

| Market Size in 2026 | USD 14.87 Billion |

| Market Size by 2035 | USD 24.54 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 5.72% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Product/Type, Technique/Chromatography Type, End-Use Industry, Service/Consumable Category, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Emerging Opportunities in the Preparative and Process Chromatography Market

| Opportunity Area | Key Insight | Growth Potential |

| Single-use chromatography Systems | Growing adoption for flexibility, reducing contamination risks, and faster bioprocessing turnaround | High in biopharma & vaccine production |

| Continuous Chromatography | Enabled real-time purification, improving efficiency and cutting production costs. | Strong potential in large-scale biologics manufacturing |

| Membrane Chromatography | Rising demand for high-throughput purification and simplified downstream processing | Favored for next-gen biologics and gene therapies |

| Automation & AI Integration | Smart control systems enhance yield prediction and reduce human error | Key driver for precision-based bioprocessing |

| Emerging Biotech Startups | Startups are leveraging innovative purification platforms and microfluidic systems as avenues for investment |

Opens niche R&D collaboration and investment avenues. |

Preparative and Process Chromatography Market Segmental Insights

Product Type Insights

Process Chromatography: The process chromatography segment dominates the market, holding a share of approximately 59%, as it is essential for large-scale purification of vaccines, biologics, and valuable therapeutic compounds. It is the top option for pharmaceutical manufacturers due to its strong ability to maintain purity in commercial batch production and its dependability throughout downstream bioprocessing workflows. Its dominance was further strengthened throughout the year by the ongoing adoption of bioprocessing and the increase in biologics approvals.

Preparative Chromatography: The segment is the fastest-growing in the market, with a CAGR of approximately 7.90%, as industries quickly adopt it to isolate high-purity compounds for specialty chemical applications, clinical manufacturing, and R&D. Because of its high-throughput scalability and flexibility, it can accelerate pilot-scale production and drug discovery. Precision medicine and complex-molecule purification are receiving more attention, driving up demand.

Techniques/Chromatography Type Insights

Liquid Chromatography: The segment dominates the market, holding a share of approximately 55%, owing to its unparalleled ability to separate complex, thermally unstable biomolecules. It is the method of choice across all industries because it is widely used in food analysis, clinical diagnostics, pharmaceutical quality control, and environmental testing. Its capacity to produce accurate, repeatable separations propels ongoing adoption.

Supercritical Fluid Chromatography: Supercritical fluid chromatography is the fastest-growing segment in the market, with a CAGR of approximately 11.50% due to its unparalleled ability to separate complex, thermally unstable biomolecules. It is the method of choice across all industries because it is widely used in food analysis, clinical diagnostics, environmental testing, and pharmaceutical quality control. Continuous adoption is fueled by its capacity to produce accurate, reproducible separations.

Gas Chromatography: The segment is emerging as a notable one in the market due to expanding use in chemical analysis, pollutant testing, flavor & fragrance profiling, and petrochemical applications. Increasing emphasis on environmental monitoring and industrial safety is supporting GCs adoption. Its precision in analyzing volatile compounds is strengthening its relevance.

End Use Industry Insights

Pharmaceutical & Biotechnology Industries: The pharmaceutical & biotechnology industry dominates the market, holding a share of approximately 45%. Biomolecule characterization, quality testing, and purification are in high demand. For biologics vaccines, mAbs, and the development of new drugs, chromatography is still necessary to ensure adherence to international quality standards. Ongoing investments in cutting-edge treatments reinforce this dominance.

Food & Nutraceutical Industries: The segment is the fastest-growing in the preparative and process chromatography market, with a CAGR of approximately 9.60%, driven by the growing need for contaminant analysis, ingredient authentication, and purity testing. Adoption of chromatography in food quality labs is still being driven by growing health consciousness and regulatory compliance requirements. The rise in functional foods and supplements further accelerates demand.

Research Laboratories: This segment is emerging as a notable one in the market because of government-funded R&D programs, private biotech innovations, and growing academic research. The use of chromatography in research settings is growing due to increased interest in molecular analysis, drug discovery, and environmental testing. The growth of incubation facilities and startup labs is adding momentum.

Service/Consumable Category Insights

Columns & Hardware: Columns & hardware dominate the preparative and process chromatography market, holding approximately 50% share because they are essential components for achieving accurate, high-resolution separations. Their continuous replacement cycle, critical role in workflow performance, and wide applicability across analytics and process chromatography ensure stable demand from all end users.

Services: This segment is the fastest-growing in the market, with a CAGR of approximately 10-10.90%, fueled by an increase in outsourcing of system optimization, maintenance method validation, and compliance support. Businesses are increasingly relying on external expertise to ensure seamless chromatography operations and optimize efficiency as they prioritize productivity.

Resins & Media: Resins & media are emerging as a notable segment in the market due to growing adoption of continuous purification, high-capacity bioprocessing, and advanced biomolecule separation. Innovation in affinity, ion-exchange, and size-exclusion media is expanding the capabilities of modern biopharma purification workflows.

Preparative and Process Chromatography Market Regional Insights

The North America preparative and process chromatography market size is estimated at USD 4.92 billion in 2025 and is projected to reach approximately USD 8.71 billion by 2035, with a 5.88% CAGR from 2026 to 2035.

Why Did North America Dominate the Preparative and Processed Chromatography Market in 2025?

North America dominates the preparative and process chromatography market, holding a share of approximately 35%. This leadership stems from the regions robust research infrastructure, which supports advanced purification workflows used across academic laboratories, biotech firms, and large biopharmaceutical manufacturers. Early adoption of innovative chromatography technologies has also strengthened the market, as companies in the region routinely integrate automated purification platforms, high-capacity resins, and digital monitoring systems into production lines. These capabilities allow facilities to handle complex biologics with greater precision and efficiency.

Significant investments in gene therapies, monoclonal antibodies, recombinant proteins, and other high-value biologics further solidify the regions dominant position. These therapies require stringent purification standards and large-scale chromatography systems, which expands demand for preparative and process chromatography equipment. Growth in analytical testing facilities across the United States and Canada also contributes to this trend, as laboratories require chromatography-based methods to verify product purity, stability, and regulatory compliance.

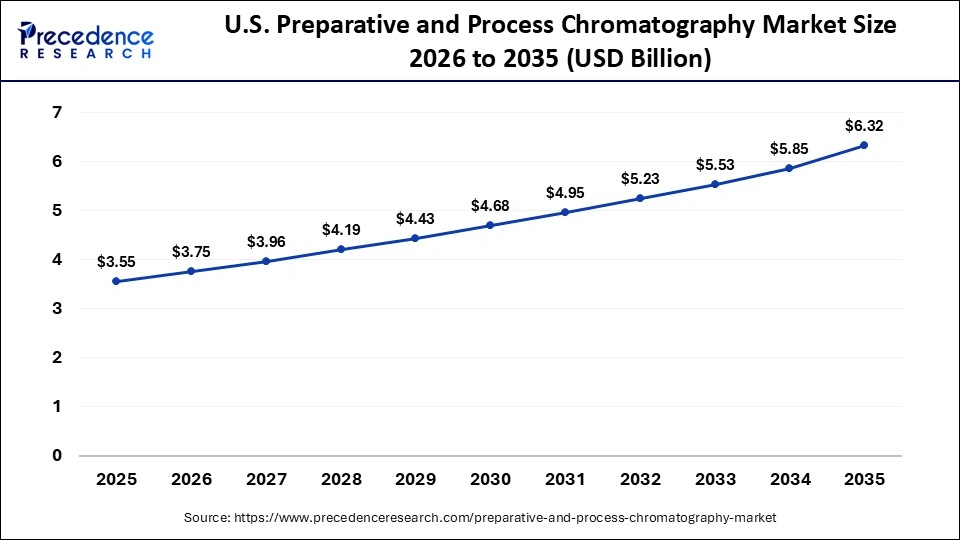

The U.S. preparative and process chromatography market size is calculated at USD 3.55 billion in 2025 and is expected to reach nearly USD 6.32 billion in 2035, accelerating at a strong CAGR of 5.94% between 2026 and 2035.

How is the U.S. Transforming the Preparative and Processed Chromatography Market?

The U.S is leading through automation, ongoing purification processes, stringent FDA regulations, and the quick growth of biologics production. Leading CDMOs and large pharmaceutical companies are adopting digitalized high-throughput purification technologies to improve productivity and product quality.

Asia Pacific is the fastest-growing region in the preparative and process chromatography market, with a CAGR of approximately 8.50%. Growth is driven by the rapid expansion of CDMOs, which provide large-scale manufacturing, purification, and analytical services for global and regional biopharmaceutical companies. These organizations rely heavily on preparative and process chromatography to support the production of biologics, vaccines, and gene therapy materials. As more CDMOs invest in advanced purification platforms, demand for high-performance chromatography systems continues to rise.

The region is also strengthening its position as a biopharma manufacturing hub. Countries such as China, India, South Korea, Singapore, and Japan are expanding their capabilities through new facilities, workforce development, and partnerships with multinational companies. These hubs increase the scale of biologics production, which directly drives the need for efficient and compliant purification technologies.

Regulatory emphasis on quality testing is also growing. National authorities across the Asia Pacific region are updating standards for biologics manufacturing, placing greater emphasis on consistency, purity, and validated analytical workflows.

Indias Preparative and Processed Chromatography Market Trends

India is experiencing strong growth in the preparative and process chromatography market due to the rise of biosimilars, vaccine production, and the expansion of cost-effective CDMO services. The country has become a major centre for biosimilar development, and these products require extensive purification workflows to meet global regulatory standards. As more companies advance biosimilar pipelines in oncology, autoimmune disorders, and metabolic diseases, the demand for high-purity chromatographic separation tools continues to increase. Vaccine production also plays a major role. Indias large-scale manufacturing capacity for traditional and next-generation vaccines requires validated purification processes that support high-volume output with consistent quality.

The expansion of cost-effective CDMOs further strengthens market growth. These service providers offer scalable upstream and downstream processing capabilities, which allow global pharmaceutical companies to outsource purification steps at competitive costs. CDMOs in India continue to upgrade their facilities with automated chromatography systems, digital monitoring tools, and high-capacity resins to support a wider range of biologics.

The Middle East is emerging as a notable regional market, with several nations investing in pharmaceutical production, scientific research, and advanced healthcare capabilities. Countries across the region are strengthening their manufacturing capacity for biologics and vaccines, which requires precise and scalable purification systems. As quality standards rise, laboratories and production facilities are upgrading equipment, expanding analytical suites, and integrating cutting-edge separation technologies to meet regulatory expectations.

Biologics and vaccine development initiatives are gaining momentum. Governments are funding new research centres, supporting technology transfer programmes, and attracting global partners to accelerate the local development of high-value therapeutics. These initiatives increase the need for chromatography tools that can deliver consistent purity and support both early research and large-scale manufacturing.

UAE Preparative and Processed Chromatography Market Analysis

The UAE is emerging as a notable market in preparative and process chromatography due to its rapid expansion of biotechnology infrastructure, strong investment in advanced laboratory facilities, and increasing focus on locally manufactured pharmaceuticals. The country is building world-class R&D centers, adopting high-end analytical technologies, and encouraging global pharma companies to establish regional partnerships and manufacturing bases. Government-driven healthcare modernization, supportive regulatory reforms, and a push toward high-quality diagnostic and therapeutic production are strengthening the UAEs role as a rising hub for chromatography in the Middle East.

Top Companies in the Preparative and Processed Chromatography Market

- Thermo Fisher Scientific

- Merck KGaA

- Danaher Corporation (includes Cytiva)

- Sartorius AG

- Bio-Rad Laboratories

- Agilent Technologies

- Waters Corporation

- Shimadzu Corporation

- PerkinElmer

- Hitachi High-Tech / Hitachi

Recent Developments

- In Jan 2025, Bio Rad Laboratories, Inc. launched Nuvia wPrime 2A Media, a scalable mixed mode weak anion exchange/hydrophobic interaction chromatography resin for both lab- and manufacturing-scale biomolecule purification. This new resin is expected to improve protein yield and purity, helping biopharma companies accelerate downstream processing.(Source: https://www.bio-rad.com)

- In May 2025, DuPont de Nemours, Inc. introduced AmberChrom TQ1 chromatography resin, designed to enhance the purification of oligonucleotides and peptides, complementing its existing resin portfolio. This innovation aims to reduce processing time and increase scalability for next-generation therapeutics.(Source: https://www.prnewswire.com)

- In Jun 2025, Ecolab Inc. (Life Sciences division) unveiled Purolite AP+50 affinity chromatography resin aimed at boosting productivity in antibody manufacturing operations. The resin is designed to support higher throughput in large-scale biologics production while maintaining regulatory compliance.(Source: https://www.businesswire.com)

Preparative and Process Chromatography Market Segments Covered in the Report

By Product/Type

- Process Chromatography (columns, resins, systems, services)

- Preparative Chromatography (smaller scale isolation systems, columns, consumables)

By Technique/Chromatography Type

- Liquid Chromatography

- Gas Chromatography

- Supercritical Fluid Chromatography

- Others (e.g., ion chromatography, affinity-based)

By End-Use Industry

- Pharmaceutical & Biotechnology Industries

- Food & Nutraceutical Industries

- Research Laboratories

- Chemical & Fine Chemical Industries

- Others

By Service/Consumable Category

- Columns & Hardware

- Resins & Media

- Systems & Instruments

- Consumables & Accessories

- Services (installation, validation, maintenance)

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content