What is Radiation Detection, Monitoring and Safety Market Size?

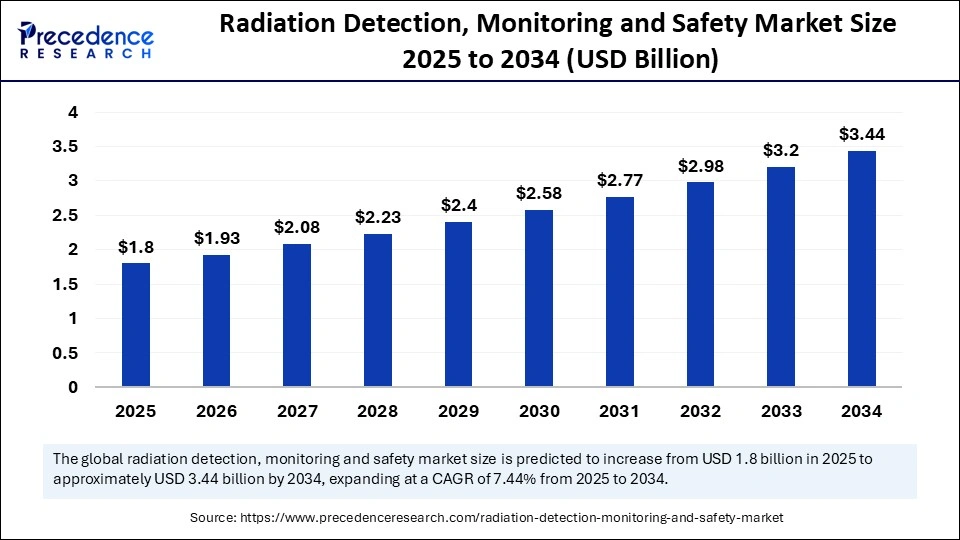

The global radiation detection, monitoring and safety market size accounted for USD 1.8 billion in 2025 and is predicted to increase from USD 1.93 billion in 2026 to approximately USD 3.44 billion by 2034, expanding at a CAGR of 7.44% from 2025 to 2034. The market is expanding rapidly due to the increasing industrialization, the expansion of nuclear power plants, and rising applications in healthcare.

Market Highlights

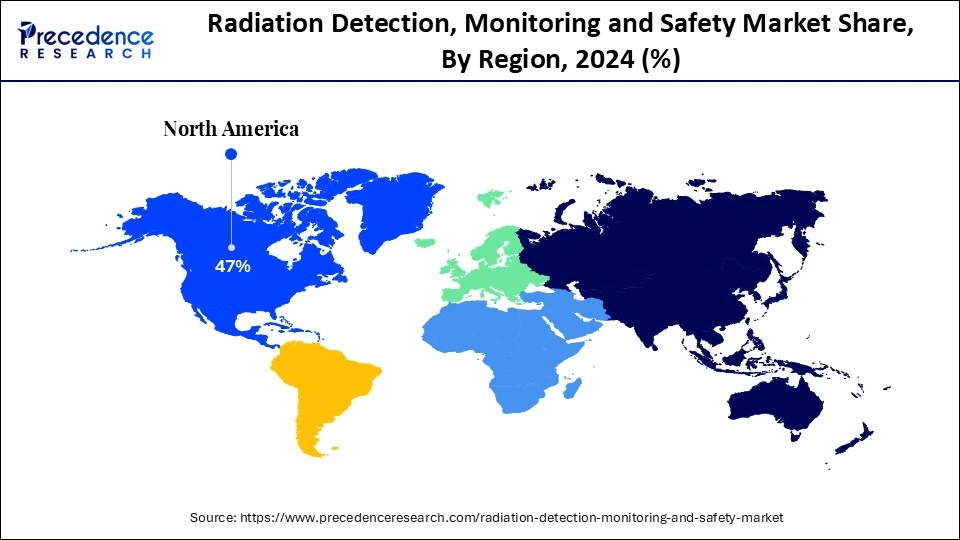

- North America dominated the global market with the largest share of 47% in 2024.

- Asia Pacific is expected to grow at the fastest CAGR from 2025 to 2034.

- By product, the personal dosimeters segment held the major share in 2024.

- By product, the environmental radiation and surface contamination monitors segment is expected to expand at a notable CAGR between 2025 and 2034.

- By detection, the gas-filled detectors segment captured the biggest revenue share in 2024.

- By detection, the solid-state detectors segment is expected to expand at the highest significant CAGR during the forecast period.

- By protection, the full-body protection segment contributed the highest market share in 2024.

- By detection, the face and hand protection segment is expanding at the fastest CAGR during the forecast period.

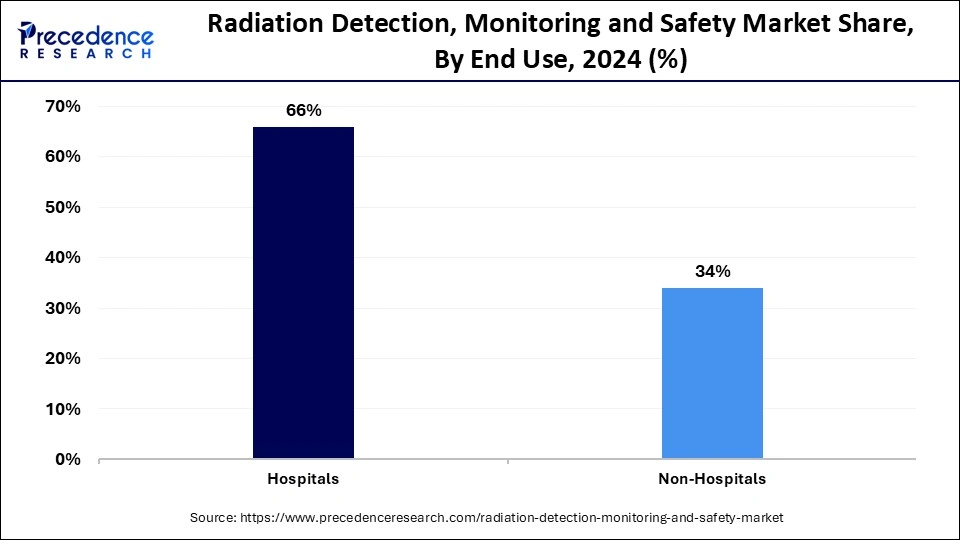

- By end use, the hospitals segment generated the major market share of 66% in 2024.

- By end use, the non-hospital segment is expected to grow at the fastest CAGR over the projected period.

Market Overview

Radiation detection and monitoring solutions are utilized across various industries to ensure worker and public safety, prevent accidents, and comply with regulatory requirements. The radiation detection, monitoring, and safety market deals with solutions for detecting and monitoring radiation, as well as safety measures to guard against harmful radiation exposure. The increasing demand for radiation therapies and the expansion of nuclear power facilities are expected to boost the growth of the market in the coming years. Radiation detection and monitoring solutions also find applications in environmental monitoring. Thus, the rising environmental regulations significantly contribute to market expansion.

How Does AI Impact the Radiation Detection, Monitoring and Safety Market?

Artificial intelligence is transforming radiation detection, monitoring, and safety operations by enabling real-time monitoring, predictive analysis, and automating safety protocols. AI algorithms can analyze vast datasets from radiation detectors to identify anomalies and predict potential hazards, enabling proactive safety measures. AI can also automate tasks such as data analysis and alert systems and adjust safety protocols in response to changing conditions, helping to predict potential safety hazards and equipment failures while optimizing safety protocols. Moreover, AI improves the sensitivity and accuracy of radiation detection, leading to more reliable results.

What are the Key Trends in the Radiation Detection, Monitoring and Safety Market?

- Increased Use of Radiation: The increasing use of radiation in medical imaging, nuclear energy, and other industries contributes to the demand for radiation detection and monitoring.

- Security Concerns: Concerns about nuclear threats and the demand for homeland security measures are driving the adoption of radiation detection and monitoring systems as the market expands into new applications, including industrial radiography, material inspection, and border security.

- AI-Powered Detection and Real-Time Monitoring: The capacity to monitor radiation levels in real-time is becoming increasingly important, particularly in high-risk environments, and machine learning is being employed to analyze radiation data, detect anomalies, and enhance the accuracy of radiation monitoring.

- Remote monitoring and Personal dosimeters: The ability to remotely monitor radiation levels is gaining prominence, especially in remote or hazardous locations. Personal dosimeters are becoming more sophisticated, offering accurate and detailed information about individual radiation exposure.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 1.8 Billion |

| Market Size in 2026 | USD 1.93 Billion |

| Market Size by 2034 | USD 3.44 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 7.44% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Detection Type, Protection Type, End Use, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Growing Reliance on Radiation for Various Applications

The primary driver of the radiation detection, monitoring and safety market is the growing reliance on radiation for various applications, including healthcare and industrial. Radiation is essential in medical imaging, nuclear energy, and other industrial applications. The adoption of radiation detection and monitoring solutions is fueled by heightened public awareness and stringent regulations regarding radiation safety enforced by agencies like the Nuclear Regulatory Commission and the Environmental Protection Agency. The demand for precise radiation detection devices in hospitals, nuclear facilities, and industrial settings is rising due to the increasing concerns about public health and environmental sustainability. These solutions ensure worker and environmental safety in various industries, especially those involving radiation exposure.

Restraint

Higher Cost and Technical Challenges

The main restraint in the radiation detection, monitoring and safety market is the higher cost of radiation detection and monitoring equipment. This high cost factor can hinder smaller organizations, especially in developing countries, from investing in advanced technologies. Devices like dosimeters and Geiger counters require ongoing maintenance, leading to increased operational costs. Moreover, handling these devices requires expertise, limiting their adoption in some industries.

Opportunity

Integration of Advanced Technologies

The key future opportunity in the radiation detection, monitoring and safety market lies in technological advancements. Integrating advanced technologies such as internet of things (IoT) and AI enhances accuracy and enables real-time data analysis. Technological advancements enable the development of portable, wearable radiation detection devices for flexible use across various sectors. These devices can be easily deployed in settings ranging from hospitals to emergency response teams and even for personal use. Moreover, advancements in sensor technology are enabling the development of more accurate and reliable radiation detection equipment, making them suitable for multiple applications like nuclear power plants, hospitals, and emergency response teams.

Segment Insights

Product Insights

Which Product Segment Dominated the Radiation Detection, Monitoring and Safety Market in 2024?

The personal dosimeters segment dominated the market with the highest revenue share in 2024. This is due to their increased adoption in personal radiation exposure monitoring across various industries, particularly healthcare and nuclear power, where compliance with regulations is crucial. The increased availability of advanced, user-friendly, real-time monitoring dosimeters further bolstered the segment. These dosimeters are used in workplaces where the risk of radiation exposure is high, ensuring workers' safety. Increasing investment in research and development to create more sophisticated dosimeters ensures the long-term growth of the market.

The environmental radiation & surface contamination monitors segment is expected to expand at a notable CAGR due to rising concerns over radiation exposure and stringent environmental regulations. Together with advancements in technology, these monitors are becoming increasingly accurate and efficient. Environmental radiation and surface contamination monitors are utilized in various sectors, such as nuclear power, healthcare, and defense, playing an essential role in ensuring safety and regulatory compliance.

Detection Type Insights

Why did the Gas-Filled Detectors Segment Dominate the Market In 2024?

The gas-filled detectors segment dominated the radiation detection, monitoring and safety market with the highest share in 2024. This is mainly due to their wide applications, specifically in ionization chambers, proportional counters, and Geiger-Mueller tubes. They are heavily used in nuclear power plants, medical imaging, and homeland security. Their acceptance is further driven by attributes like cost-effectiveness, portability, durability, and ease of use, making them a preferred choice for various applications. Additionally, ongoing research and development are enhancing their sensitivity, accuracy, and robustness, further increasing their reliability in radiation measurement.

The VF BC-13 Beta Calibrator is designed for calibrating beta radiation detectors, primarily for the safe and convenient calibration of beta radiation detectors and personal dosimeters that measure personal Hp (0.07), Hp (3), and directional Hp'(0.07), Hp'(3) dose equivalents according to the ISO 6980 standard.

The solid-state detectors segment is expected to expand at the highest significant CAGR during the forecast period. This is mainly due to their superior efficiency in detecting ionizing radiation, along with their smaller size and lighter weight. They can convert a significant portion of incident radiation into electrical signals, making them highly sensitive and reliable. Moreover, advancements in solid-state technology are resulting in lower costs and increased flexibility in design, further boosting their adoption through the development of next-generation solid-state detectors with improved performance and capabilities.

Protection Type Insights

What Made Full-Body Protection the Dominant Segment in the Radiation Detection, Monitoring and Safety Market?

The full-body protection segment dominated the market by capturing the largest revenue share in 2024, driven by the increased demand for comprehensive radiation shielding in various applications, especially within healthcare, nuclear facilities, and industrial settings. Nuclear power plants and security applications necessitate full-body protection for personnel working in potentially hazardous environments. Moreover, full-body protection, often involving specialized protective gear such as vests, suits, and shielding materials, ensures individuals are shielded from radiation exposure across their entire body, thereby minimizing the risk of radiation-related health issues. The increased concerns over worker safety further bolstered the segment's growth.

The face & hand protection segment is expanding at the fastest rate during the forecast period. The growth of the segment is primarily attributed to increasing regulatory scrutiny, heightened awareness of radiation hazards, and advancements in protection technology. Developments in personal protective equipment design and materials, including lightweight and comfortable options, along with innovative Bi-Layer technology for enhanced protection, are making face and hand protection more effective and user-friendly, thereby propelling market expansion.

End Use Insights

How Does the Hospitals Segment Dominate the Market In 2024?

The hospitals segment dominated the radiation detection, monitoring and safety market with a major revenue share in 2024. This is mainly due to the widespread use of radiation-based imaging, such as X-rays, CT scans, and PET scans, in the sector. There is a high demand for radiation therapy for cancer treatment, which necessitates careful radiation monitoring. The increased prevalence of cancer and other chronic diseases has led to an increased reliance on radiation therapy and imaging procedures, consequently boosting the demand for radiation safety solutions. Furthermore, the need to protect both patients and healthcare workers from radiation exposure while adhering to regulatory guidelines drives this demand.

The non-hospital segment is expected to grow at the fastest CAGR over the projected period, driven by an upsurge in demand across various industries such as nuclear energy, defense, environmental monitoring, and mining. Radiation detection and monitoring solutions are also used to ensure food safety. Innovations in radiation detection technologies, including advanced sensors, portable devices, and imaging systems, are simplifying and enhancing the efficiency of radiation level monitoring.

Regional Insights

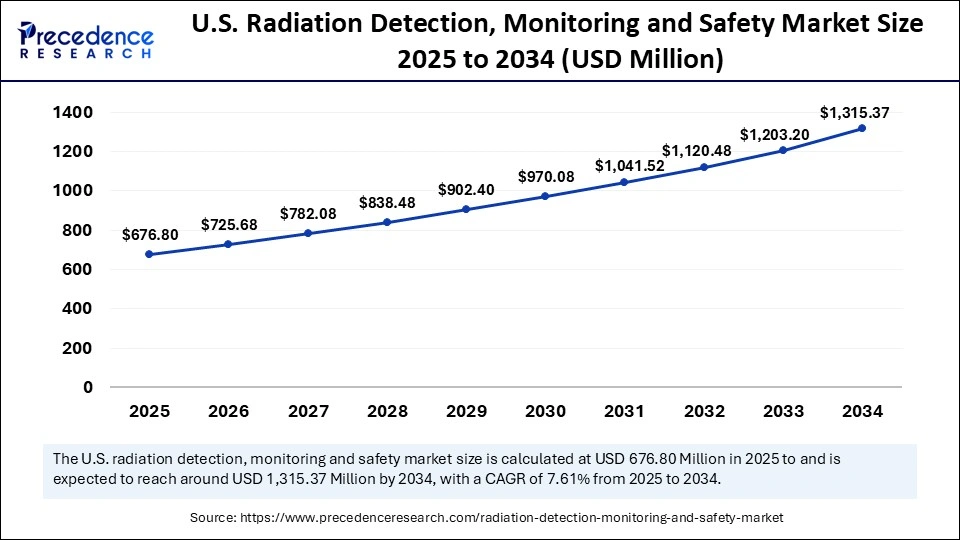

U.S. Radiation Detection, Monitoring and Safety Market Size and Growth 2025 to 2034

The U.S. radiation detection, monitoring and safety market size is exhibited at USD 676.80 million in 2025 and is projected to be worth around USD 1,315.37 million by 2034, growing at a CAGR of 7.61% from 2025 to 2034.

The U.S. Radiation Detection, Monitoring and Safety Market Trends

The U.S. plays a distinctive role in the market. There are stringent regulations regarding public and environmental safety. Thus, several industries in the region are adopting radiation detection and monitoring solutions to manage radiation exposure. The increasing awareness of radiation safety, stringent regulations, and the growing use of radiation in various industries like healthcare and nuclear energy further support market growth. The U.S. Nuclear Regulatory Commission, the Environmental Protection Agency, and the Occupational Safety and Health Administration establish strict regulations for radiation safety in both public and private sectors.

How Does North America Dominate the Radiation Detection, Monitoring and Safety Market in 2024?

North America registered dominance in the market by holding the largest revenue share in 2024. This dominance stems from rigorous environmental regulations, with agencies like the EPA and Environment Canada enforcing stringent standards. This drives demand for compliance testing and monitoring equipment. The industrial sector, particularly in industries such as oil and gas, manufacturing, and mining, also generates significant demand for radiation safety equipment. Additionally, advanced healthcare infrastructure, a strong nuclear power industry, and substantial investments in homeland security and defense applications contribute to this demand for radiation safety equipment and foster innovation in the development of new radiation detection technologies.

What are the Major Factors Contributing to the Radiation Detection, Monitoring and Safety Market Within Asia Pacific?

Asia Pacific is expected to grow at the fastest CAGR in the coming years due to rapid industrialization and expanding nuclear power infrastructure, especially in major economies like China, Japan, and India. Rising healthcare investments and the modernization of healthcare infrastructure are leading to the adoption of advanced radiation therapy equipment, necessitating sophisticated monitoring solutions. The regional market growth is further attributed to government initiatives aimed at boosting border security and preventing unlawful trafficking of radioactive materials, along with an increasing awareness of radiation safety in healthcare settings.

China Radiation Detection, Monitoring and Safety Market Trends

China plays a crucial role in the market due to the rapid expansion of its nuclear power infrastructure. This expansion significantly stimulates the demand for radiation detection and monitoring devices. Moreover, the rising prevalence of cancer and advancements in medical imaging and radiation therapy in China further propel the demand for radiation detection technologies in healthcare facilities. Stringent environmental regulations and concerns regarding industrial radiation exposure compel industries to adopt radiation monitoring solutions.

India Radiation Detection, Monitoring and Safety Market Trends

India also plays a significant role in the market. This is mainly due to rapid industrialization and the expansion of nuclear power infrastructure and radiation therapy centers. There is a high demand for specialized radiation detection instruments, including dose calibrators and gamma cameras. Consequently, the modernization of healthcare facilities and the rising adoption of radiation therapy for cancer treatment boost the demand for radiation detection technologies in hospitals and clinics.

Why is Europe Considered a Notable Region in the Radiation Detection, Monitoring and Safety Market?

Europe is projected to grow at a notable rate in the foreseeable future, primarily due to its strong emphasis on nuclear safety, rigorous regulatory standards, and a robust healthcare sector. Europe has a well-established regulatory framework for nuclear and radiation safety, with stringent environmental regulations fostering the adoption of advanced monitoring systems. Several European countries, such as France, have extensive nuclear power operations, resulting in high demand for nuclear safety equipment and radiation detection technologies.

Germany Radiation Detection, Monitoring and Safety Market Trends

Germany leads the market in Europe. Germany strengthens its emergency preparedness and response with the launch of the 'Radiation Protection Qualification Network.' This initiative aligns with national radiation protection regulations on devices, ensuring compliance with both German requirements and European standards. Germany's robust infrastructure, including the Federal Office for Radiation Protection (BfS) and the Integrated Measurement and Information System for the Monitoring of the Environment (IMIS), supports this effort.

How is the Opportunistic Rise of Latin America in the Market?

Latin America is experiencing an opportunistic rise in the radiation detection, monitoring and safety market, driven by increasing awareness of radiation hazards, particularly in industries like healthcare, nuclear energy, and mining. The ongoing cooperation and support from the International Atomic Energy Agency (IAEA) programs help Latin American countries improve their radiation detection, monitoring, and safety capabilities. Some nations have strengthened their national regulatory infrastructure for radiation safety.

Brazil Radiation Detection, Monitoring and Safety Market Trends

Brazil is a major contributor to the market in Latin America. Brazil's Country Program Framework (CPF) for 2025-2030 focuses on various key areas, including radiation protection and nuclear safety. Technical cooperation resources and the transfer of nuclear technology are likely to play a critical role in supporting the country's national development goals. The country's growing focus on nuclear energy development, industrial applications, and environmental protection also supports the market.

What Opportunities Exist in the Middle East and Africa in the Market?

The Middle East and Africa (MEA) region presents substantial opportunities in the radiation detection, monitoring, and safety market, driven by collaborations with international organizations such as the International Atomic Energy Agency (IAEA). Government efforts focused on infrastructure development, regulatory adherence, and improving occupational safety also bolster market growth. Saudi Arabia leads the regional market, driven by its ambitious Vision 2030 initiative, which includes developing nuclear energy for sustainable power generation and industrial use. The Nuclear and Radiological Regulatory Commission (NRRC) has established a long-standing and evolving regulatory program focused on radiation detection, monitoring, and safety.

Radiation Detection, Monitoring and Safety Market Companies

- LANDAUER

- Mirion Technologies, Inc.

- Ludlum Measurements, Inc

- Thermo Fisher Scientific Inc.

- Radiation Detection Company

- Arrow Tech.

- Centronic Limited

- Amray Group

- ATOMTEX

Recent Developments

- In June 2024, Thermo Fisher Scientific launched the NetDose Pro digital dosimeter. This compact, wearable digital dosimeter is designed to track radiation exposure risk for personnel in a variety of industries, such as healthcare, and help companies adhere to stringent regulatory requirements.(Source:https://www.mlo-online.com)

- In April 2024, Mirion Dosimetry Services announced the commercial availability of its innovative new Instadose VUE wireless dosimeter. This next-generation wearable radiation monitoring device enables users to monitor their radiation exposure more quickly, accurately, and reliably with greater control. Thus, it facilitates more stable and reliable connectivity, faster dose communication and data transmissions, and an increased battery life of up to five years.(Source:https://www.mirion.com)

Segments Covered in the Report

By Product

- Personal Dosimeters

- Environmental Radiation & Surface Contamination Monitors

- Area Process Monitors

- Radioactive Material Monitors

By Detection Type

- Gas-filled Detectors

- Solid-state Detectors

- Scintillators

By Protection Type

- Full-body Protection

- Face & Hand Protection

- Others

By End Use

- Non-Hospitals

- Hospitals

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting