What is the Gas Chromatography Market Size?

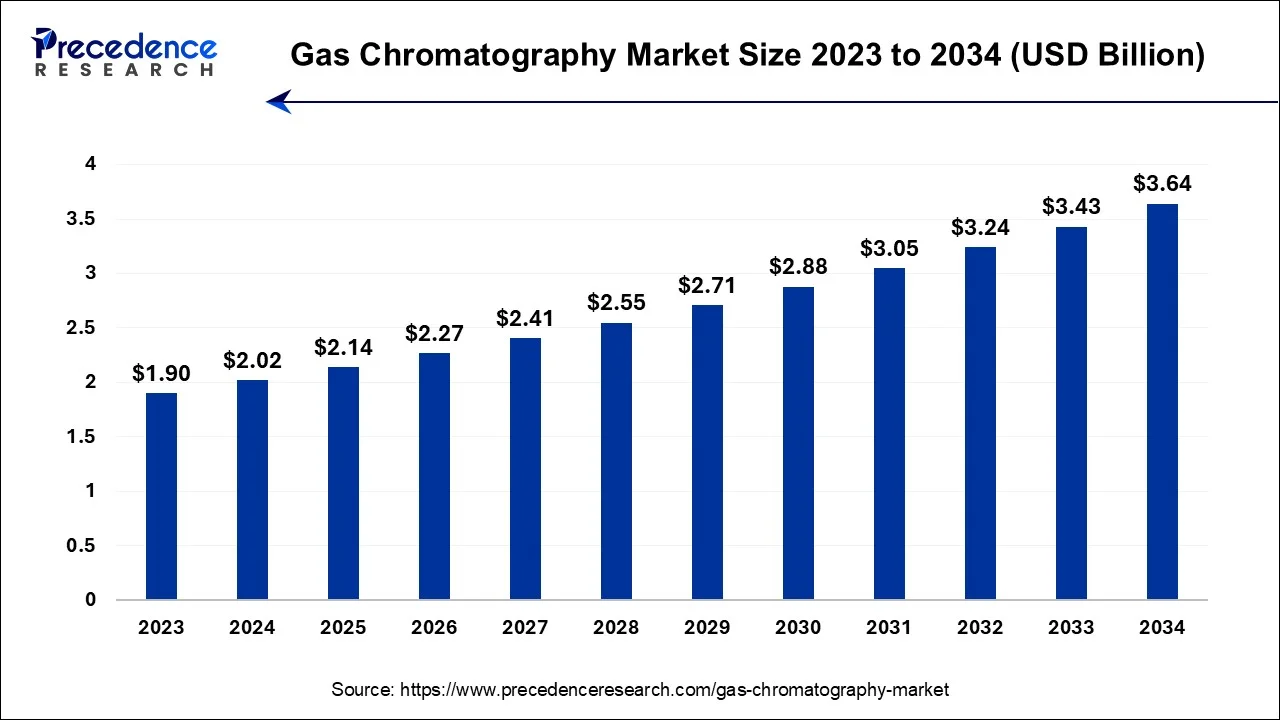

The global gas chromatography market size accounted for USD 2.14 billion in 2025 and is predicted to increase from USD 2.27 billion in 2026 to approximately USD 3.84 billion by 2035, expanding at a CAGR of 6.02% between 2026 to 2035.

Market Highlights

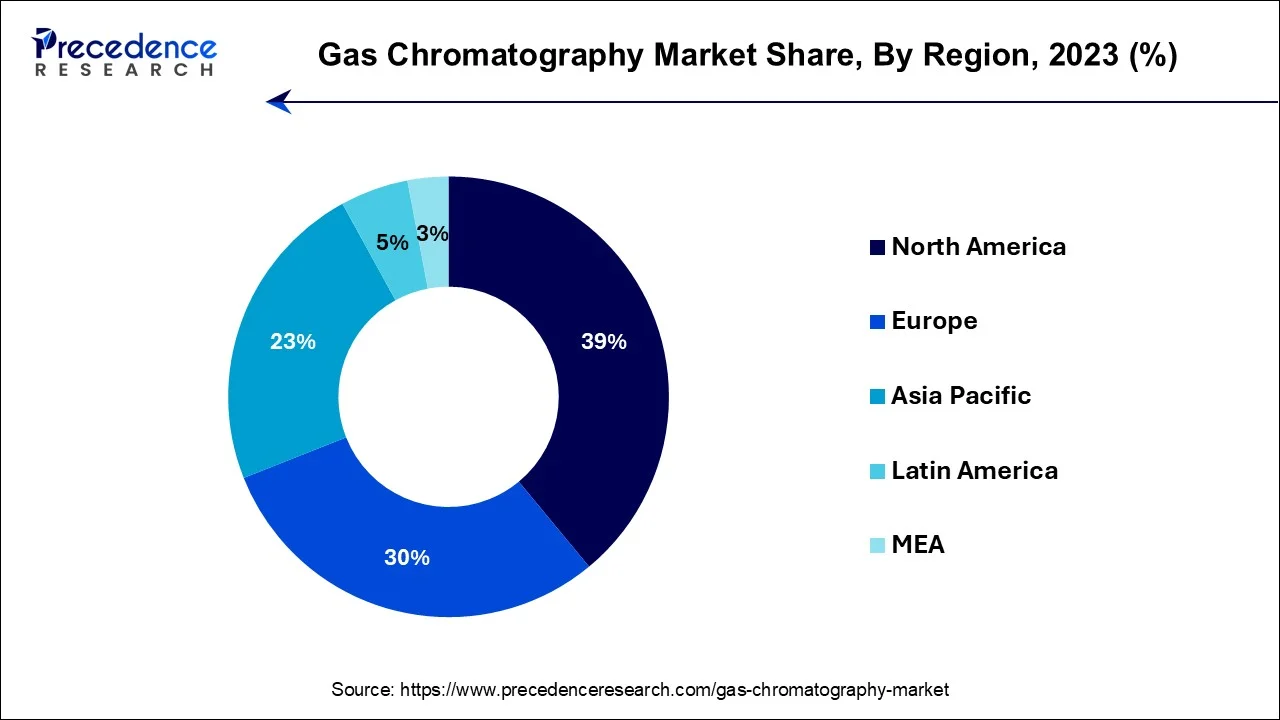

- By region, North America contributed more than 39% of the revenue share in 2025.

- Asia Pacific is estimated to expand the fastest CAGR between 2026 to 2035.

- By Product, the consumables & accessories segment has held the largest market share of 55% in 2025.

- By Product, the instruments segment is anticipated to grow at a remarkable CAGR of 7.6% between 2026 to 2035.

- By End-user, the pharmaceutical & biotechnology company segment had the largest market share of 31% in 2025.

- By End-user, the others segment is expected to expand at the fastest CAGR over the projected period.

Market Size and Forecast

- Market Size in 2025: USD 2.14 Billion

- Market Size in 2026: USD 2.27 Billion

- Forecasted Market Size by 2035: USD 3.84 Billion

- CAGR (2026 to 2035): 6.02%

- Largest Market in 2024: North America

- Fastest Growing Market: Asia Pacific

What is Gas Chromatography?

The gas chromatography (GC) market represents a thriving landscape wherein GC instrumentation is harnessed for the meticulous partitioning and quantification of compounds across diverse domains, including pharmaceuticals, petrochemicals, gastronomy, environmental scrutiny, and scientific exploration. Its enduring ascent can be attributed to its exceptional precision and heightened sensitivity in discerning intricate amalgams and minute constituents, rendering it indispensable for meticulous quality assurance and pioneering research ventures.

Ongoing technological breakthroughs have yielded swifter, more efficient, and user-centric GC systems, thereby amplifying their global market footprint. This is hallmarked by fierce competition and relentless innovation, underscoring its pivotal role in contemporary analytical chemistry.

Gas Chromatography Market Growth Factors

- One of the primary growth drivers is the constant evolution of GC instruments. Manufacturers are consistently introducing cutting-edge technologies that offer improved sensitivity, resolution, and ease of use. These innovations enable scientists to perform more complex analyses with greater efficiency, driving the adoption of GC systems.

- The versatility of GC makes it applicable across various industries, such as pharmaceuticals, petrochemicals, food and beverages, environmental monitoring, and forensics. As new applications are discovered and existing ones expand, the demand for GC instrumentation naturally grows.

- Stringent quality control standards in industries like pharmaceuticals, where precision is paramount, fuel the demand for GC. As regulations become more rigorous, companies rely on GC to ensure compliance and product integrity.

- The global focus on environmental issues, including pollution monitoring and climate change, has elevated the role of GC in tracking and quantifying emissions and pollutants. This heightened environmental awareness drives the need for advanced GC solutions.

- Research institutions and laboratories constantly seek improved analytical methods. GC, with its ability to analyze a wide range of compounds, is a valuable tool for innovation and discovery. As R&D efforts expand, so does the demand for GC equipment.

- Developing economies are witnessing growth in various industries, and they are increasingly adopting GC for quality control and research. This trend opens up new market opportunities for GC instrument manufacturers.

- The integration of GC systems with advanced software and automation solutions streamlines workflows and data analysis, reducing the need for manual intervention. This not only enhances efficiency but also attracts users looking for streamlined processes.

- The competitiveness among GC instrument manufacturers drives innovation and product improvement. This competitive environment encourages companies to develop more advanced, cost-effective, and user-friendly GC solutions, further stimulating market growth.

Market Outlook

- Industry Growth Overview:The gas chromatography market is experiencing significant growth, as increasing its application in the food industry, the pharmaceutical industry, research areas, forensic science, and measuring air pollution.

- Global Expansion:The gas chromatography market expanded globally because its high sensitivity and relatively low operating expenses have made it appealing to major businesses required to identify and measure compounds and molecules within a sample. North America is dominant in the market due to an advanced regulatory framework and a strong R&D ecosystem.

- Major investors:Major investors in the gas chromatography market are large, worldwide analytical instrument manufacturing organizations, venture capital firms, and significant end-user industries such as pharmaceuticals, environmental agencies, and petrochemical companies. It includes Agilent Technologies, Thermo Fisher Scientific, Shimadzu Corporation, PerkinElmer, and many others.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 2.14 Billion |

| Market Size in 2026 | USD 2.27 Billion |

| Market Size by 2035 | USD 3.84 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 6.02% |

| Largest Market | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Product, End User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Quality control requirements

The impetus behind the burgeoning gas chromatography (GC) market lies in the exacting demands of quality control protocols. Industries such as pharmaceuticals, culinary arts, petrochemicals, and environmental stewardship prioritize the meticulous scrutiny of their products and processes. GC, renowned for its ability to meticulously segregate, identify, and quantify intricate compound mixtures, assumes a pivotal role in certifying the integrity of raw materials, intermediates, and final outputs.

The regulatory bodies governing these sectors impose stringent benchmarks to safeguard public well-being and environmental harmony. Conformity to these standards compels organizations to invest in advanced GC instrumentation, ensuring compliance and the detection of minute impurities and contaminants that could undermine product quality. This technology's proficiency in discerning trace-level anomalies proves instrumental in preempting quality discrepancies.

The pharmaceutical sector, specifically, leans on GC for the development and quality assessment of pharmaceuticals. With the continuous introduction of novel drugs and the large-scale manufacturing of established ones, the demand for GC-driven quality control escalates. The rigorous quality control standards, thus, act as a dynamic force propelling the expansion of the GC market, underscoring its indispensable role in certifying the effectiveness and safety of products.

Restraint

Skilled operator requirement

The need for skilled operators in gas chromatography(GC) presents a significant constraint on the growth of the GC market. Efficient operation and maintenance of GC equipment as well as accurate data interpretation, require a high level of technical expertise. This skilled workforce is essential to ensure the precise functioning of the system and the reliability of results. The scarcity of adequately trained personnel can impede the widespread adoption of GC, especially in smaller laboratories and emerging markets. Hiring and retaining skilled technicians can be costly and challenging, which may limit the accessibility of GC technology to a broader range of industries and organizations.

Moreover, as the existing pool of experienced GC operators ages or transitions to other fields, there is a risk of a knowledge gap. This scenario underscores the necessity for comprehensive training programs to bridge the skills deficit and promote the continued growth of the GC market. Overcoming this constraint will require investments in education and training initiatives to cultivate a skilled workforce capable of harnessing the full potential of GC technology.

Opportunity

Diverse applications

The diverse applications of gas chromatography (GC) are a key driver of opportunities within the market. GC's versatility enables its utilization across a broad spectrum of industries, including pharmaceuticals, petrochemicals, food and beverage, environmental monitoring, forensics, and more. This adaptability continually creates new prospects for growth as industries discover novel uses for GC and expand existing applications.

Whether it's analyzing complex mixtures in drug development, ensuring product quality and safety in the food industry, or quantifying environmental pollutants, GC's capacity to provide precise and reliable results makes it an invaluable tool. As these sectors evolve, so does the demand for advanced GC solutions, offering manufacturers the chance to develop tailored systems and services, thereby enhancing their market presence and contributing to the ongoing expansion of the gas chromatography market.

Segments Insights

Product Insights

According to the product, the consumables and accessories segment has held 55% revenue share in 2024. The consumables & accessories segment holds a significant share in the gas chromatography market due to its recurring and essential nature. GC systems require a continuous supply of consumables like columns, detectors, and gases, which need periodic replacement. Moreover, the demand for accessories such as injection systems and detectors for specialized applications remains high. This recurring need for consumables and accessories ensures a steady revenue stream for manufacturers and service providers, making it a substantial and reliable component of the GC market while also offering opportunities for innovation and customization to meet diverse user requirements.

The instruments segment is anticipated to expand at a significantly CAGR of 6.1% during the projected period. The instruments segment holds a major share in the gas chromatography market due to its pivotal role in the analytical process. Gas chromatography relies heavily on sophisticated instruments, including gas chromatographs and associated equipment, to separate and quantify compounds. These instruments are essential for the precise analysis of complex mixtures in various industries such as pharmaceuticals, petrochemicals, and environmental testing. As the demand for accurate and efficient compound analysis continues to grow, so does the significance of the Instruments segment, making it a dominant component of the gas chromatography market.

End User Insights

Based on the end user, pharmaceutical & biotechnology company segment held the largest market share of 31% in 2024. The pharmaceutical and biotechnology company segment commands a substantial share in the gas chromatography market due to its pivotal role in drug development, quality control, and research. Gas chromatography is indispensable for analyzing compounds, quantifying drug formulations, and ensuring compliance with stringent regulatory standards. In pharmaceuticals, GC is used extensively in formulation analysis, impurity profiling, and pharmacokinetics. Additionally, it is vital for biotechnology firms in monitoring bioprocesses and characterizing biomolecules. As these industries continue to expand, the demand for precise, reliable, and high-throughput analytical techniques like GC remains consistently high, cementing its dominant position in this market segment.

On the other hand, the other segment is projected to grow at the fastest rate over the projected period. The others segment holds a significant share in the gas chromatography market primarily due to its diverse and extensive user base encompassing various industries and research fields beyond the more dominant sectors such as pharmaceuticals and petrochemicals.

This category includes smaller niche industries, research institutions, and specialized applications where GC is indispensable, such as food and beverage, environmental monitoring, forensics, and academia. These diverse end users have recognized GC's versatility and reliability, contributing to the substantial share held by the others segment, reflecting its pivotal role in analytical chemistry across a wide spectrum of applications.

Regional Insights

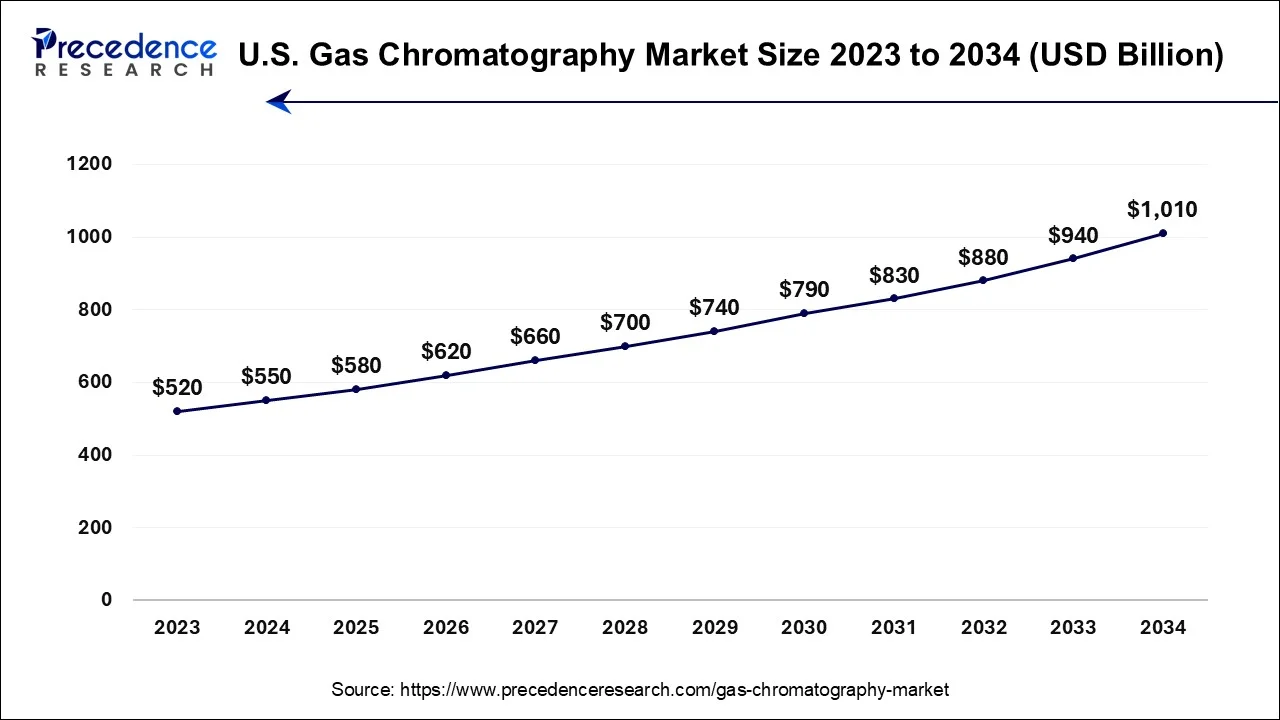

What is the U.S. Gas Chromatography Market Size?

The U.S. gas chromatography market size is estimated at USD 580 million in 2025 and is expected to reach USD 1,073.33 million by 2035, at a CAGR of 6.26% from 2026 to 2035.

North America Commands the Gas Chromatography Market with Advanced Infrastructure and Regulations

North America has held the largest revenue share 39% in 2024. North America commands a significant share in the gas chromatography (GC) market due to several factors. The region boasts a well-established industrial landscape, including pharmaceuticals, petrochemicals, and environmental testing, which rely heavily on GC for quality control and research. Additionally, North America is a hub for cutting-edge research and innovation, driving the demand for advanced GC systems. The presence of numerous key GC manufacturers, well-developed healthcare infrastructure, and stringent regulatory requirements further solidify the region's dominance in the GC market, making it a major contributor to the industry's global market share.

U.S. GC Market Booms with Innovation and Regulatory Support

The growth of the GC market in the US is driven by the continuous expansion of various industries, including pharmaceuticals, food safety, and environmental testing, which significantly contributed to the market's growth in the country. The government is continuously working on the implementation of various environmental regulations to curb pollution, which is significantly contributing to the growth of the market. the GC applications are continuously growing in the food and beverage industry. New technological advancements like hyphenated techniques (GC-MS, GC-FTIR), automation, and portable GC systems have increased the efficiency and accuracy, leading to further growth of the market.

Environmental Monitoring and industry demand Fuel Gas Chromatography in Europe

Agilent Technologies, Thermo Fisher Scientific, and Shimadzu Corporation, are the key players in the market. They continually seek to strengthen their market position through various means, including mergers and acquisitions. The European market is sensitive to the environment-related issues and the use of GC for analyzing pollutants and contaminants in environmental samples is contributing the market growth on a significant level. Academic and research institutions, food and beverage companies, and environmental agencies are the major end users in the UK region contributing to the market growth.

South American Advances in the Gas Chromatography Industry

South America is significantly growing in the market as major R&D centers are significantly focusing on leveraging natural resources and advancing local solutions. Rich biodiversity and natural resources provide unique opportunities for scientific research. Pharmaceutical government compliance confirms that drugs and medical devices meet stringent safety, quality, and efficiency standards, which drives the demand for gas chromatography.

Brazil Gas Chromatography Market Trends

Brazil, a significant global agricultural player, which ranks in the top five agro-food manufacturers and exporters, creates one of the largest consumers of pesticides for this use exact analytical equipment such as GC systems. Brazil is the second-largest worldwide manufacturer of ethanol and the third-largest producer of biodiesel, which increases the demand for gas chromatography.

Asia Pacific Leads Global Expansion in Gas Chromatography

Asia-Pacific is estimated to observe the fastest expansion. Asia-Pacific has emerged as a significant player in the gas chromatography (GC) market due to its rapid industrialization, expanding pharmaceutical and petrochemical sectors, and increasing focus on environmental regulations. The region's economic growth has driven demand for quality control and research, bolstering GC adoption. Furthermore, Asia-Pacific's burgeoning healthcare industry relies on GC for drug development and clinical diagnostics. The presence of both local and international GC manufacturers and a growing emphasis on innovation positions Asia-Pacific as a major contributor to the GC market share, underscoring its pivotal role in the global industry.

Pharmaceutical and Biotech Growth Drive GC Adoption in China

The rise of pharmaceutical, biotechnology, and other research-intensive sectors in China is attracting substantial investments for research and development. Particularly in applications focused on drug discovery, development, and QC, and related things. Various analytical techniques are being widely adopted in areas like pollution monitoring, food safety, and drug manufacturing, as the environmental and product safety regulations have become more stringent. Despite many opportunities, the market is experiencing a few challenges also such as a lack of availability of skilled professionals for handling the GC systems. Pharmaceutical, biotechnology, and other research-intensive sectors are the major players in the Chinese market.

R&D and Technological Integration Fuel India's Gas Chromatography Market

Many industries are showing a significant expansion in the pharmaceutical and biotechnology industries, driven by research and development. The Indian market is rapidly shifting towards the adoption of eco-friendly chromatography techniques due to many environmental concerns. Miniaturization and advanced technology integration lead to enhanced performance and speed of the system. Agilent Technologies, PerkinElmer, Shimadzu, and Thermo Fisher Scientific are the few key players in the Indian gas chromatography market.

Technological Advancements and Compliance Fuel Europe's GC Market Expansion

The Europe market is increasing due to growing demand for high-precision analytical solutions in pharmaceuticals, food safety, environmental monitoring, and petrochemicals. Rising regulatory standards for quality control and compliance, coupled with technological advancements in faster, more sensitive, and automated GC systems, are fueling adoption. Additionally, the expansion of research and development activities, increased government and private sector investments, and the need for accurate detection of complex compounds contribute to the market's steady growth across Europe.

MEA Innovative Approaches for the Gas Chromatography Industry

MEA is significantly growing in the market as the Middle East is set to invest around USD 130 billion in oil and gas supply in 2025, around 15% of the global total. This region has long been related to oil and gas production, standing at the epicenter of the international power field. The increasing prominence of complying with international quality and safety values in different industries increases the acceptance of the GC system.

South Africa Gas Chromatography Market Trends

South Africa's increased spending in science and increased research and experimental development (R&D) activity in the business sector is stimulated by a significant regulator that utilizes advanced analytical techniques such as GC mass spectrometry (GC–MS).

Value Chain Analysis - Gas Chromatography Market

- Raw Material:

The primary raw materials used in gas chromatography are the carrier gas, the sample mixture to be analyzed, and the stationary phase material in the column.

Key Players: Merck and Danaher - Production Processes:

Gas chromatography (GC) production processes include four main stages: sample preparation and injection, separation, detection, and data analysis.

Key Players: Shimadzu and PerkinElmer - Patient Services:

Gas chromatography (GC) is an analytical process applicable in the clinical and healthcare sector to separate, identify, and quantify volatile and semi-volatile compounds in patient samples.

Key Players: Agilent Technologies and Thermo Fisher Scientific

Top Vendors and their Offerings

- Merck KGaA: Supplies GC chemicals, columns, and reagents for pharmaceuticals, food, and environmental analysis.

- DANI Instruments: Provides GC systems and accessories for analytical and research applications.

- SCION Instruments: Offers high-performance GC and GC-MS solutions for laboratories and quality control.

- LECO Corporation: Delivers GC instruments, detectors, and software for precise chemical analysis.

- PerkinElmer: Provides GC systems, columns, and consumables for environmental, food, and pharmaceutical testing.

Gas Chromatography Market Companies

|

Company |

Headquarters |

Key Strengths |

Latest Info (2025) |

|

United States |

Diverse product and service portfolio |

In May 2025, Agilent Technologies Inc. announced the latest enhancements to the Agilent 8850 Gas Chromatograph (GC), including compatibility with single and triple quadrupole mass spectrometry (MS) systems and related tools and technologies to improve laboratory productivity. |

|

|

United States |

Innovation and strong R&D |

A novel portfolio of chromatography and mass spectrometry consumables launched by Thermo Fisher Scientific is intended to meet higher performance needs. |

|

|

Waters Corporation |

United States |

Technology and innovation |

In November 2025, Waters Corporation announced the launch of its Charged Aerosol Detector (CAD), precisely designed for use with Waters Empower Software, the most trusted global chromatography data system (CDS). |

|

Shimadzu Corporation |

Japan |

Advanced analytical technology |

Shimadzu's latest analytical tools support the emerging requirement of modern fuel testing. The Nexis SCD-2030 uses a horizontal-burner intended to lower dead volume, achieve sensitivity down to 4 ppb, and provide equimolar response for straightforward, single-injection calibration. |

|

PerkinElmer |

United States |

Integrated solutions provider |

PerkinElmer leverages digital transformation through tools like its Asset Genius system, which offers real-time data. |

Other Major Key Players

- Bruker Corporation

- Merck KGaA

- Restek Corporation

- LECO Corporation

- SRI Instruments

- Falcon Analytical

- DANI Instruments

- GL Sciences

- Dani Instruments S.p.A.

- SCION Instruments

Leaders' Announcements

- In April 2024, Valmet announced that it had completed the acquisition of the Process Gas Chromatography & Integration business from Siemens AG. The Process Gas Chromatography & Integration business of Siemens AG is a market leader with its MAXUM II Gas Chromatograph platform, Systems Integration, and Customer Services offering to measure the chemical composition in gases and evaporable liquids in all stages of production by supporting its customers in ensuring and improving quality, sustainability, and safety worldwide.

- In July 2025, Edinburgh Instruments announced that Techcomp Instruments acquired Sercon Limited. Sercon designs and manufactures small-Isotope Ratio Mass Spectrometers (IRMS) and their associated sample preparation systems by enabling Techcomp to offer a complete range of innovative IRMS solutions, from sample preparation to analysis results in a powerful, versatile, and user-friendly instrument optimised for demanding applications, including isotopologue measurement.

Recent Developments

- In August 2025, Agilent Technologies announced the launch of the Agilent J&W 5Q GC/MS Columns, marking a significant advancement in GC/MS column technology. These columns feature ultra-inert performance and low-bleed technology, enhancing performance and durability for demanding applications. They offer exceptional peak symmetry, minimal column bleed, and fast conditioning, making them ideal for trace-level analytes and challenging conditions, such as hydrogen carrier gas.

- In January 2025, Shimadzu Corporation introduced seven new Brevis GC-2050 Systems for the Green Transformation (GX) field. These systems integrate the Brevis GC-2050 with various detectors and pretreatment devices, such as an Automatic Gas Analysis System and a Thermal Desorption System. They feature the ECO Idling Function, which reduces gas and power consumption, and visualize cumulative CO2 reduction.

- In June 2025, PEAK Scientific launched the Intura series of hydrogen, nitrogen, and zero air generators for GC instruments at ASMS 2025. Designed for high-purity gas delivery in a compact size, Intura provides labs with flexibility in flow rate and pressure, enhancing productivity and analysis quality by significantly reducing the size and footprint of the generators as well as managing to achieve a much lower power consumption across the series, compared with the product's predecessor.

- In March 2022,Thermo Fisher Scientific announced the launch of updated gas chromatography portfolio to enhance consumer experience.

Segments Covered in the Report

By Product

- Instruments

- Consumables & Accessories

By End User

- Pharmaceutical & Biotechnology Company

- Academic & Research Institutes

- Food & Beverage Company

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting