What is the LED Driver Market Size?

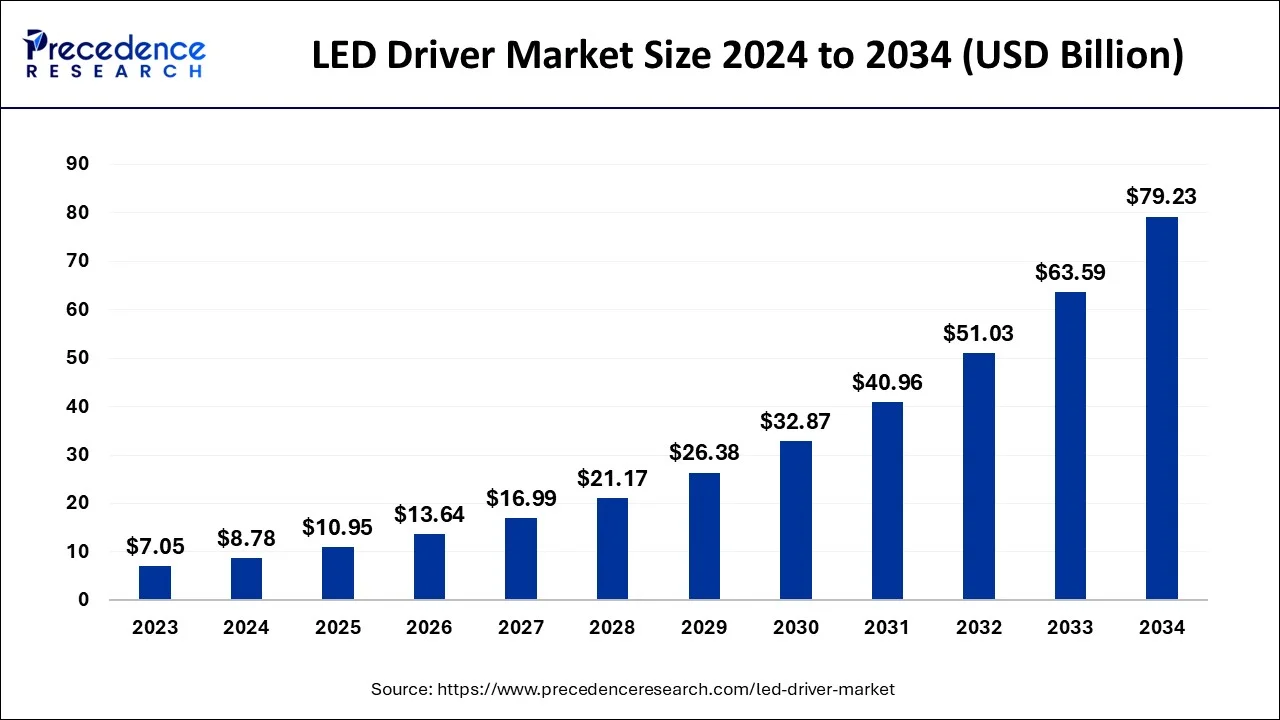

The global LED driver market size is calculated at USD 10.95 billion in 2025 and is predicted to increase from USD 13.64 billion in 2026 to approximately USD 92.82 billion by 2035, expanding at a CAGR of 23.83% from 2026 to 2035.

LED Driver Market Key Takeaway

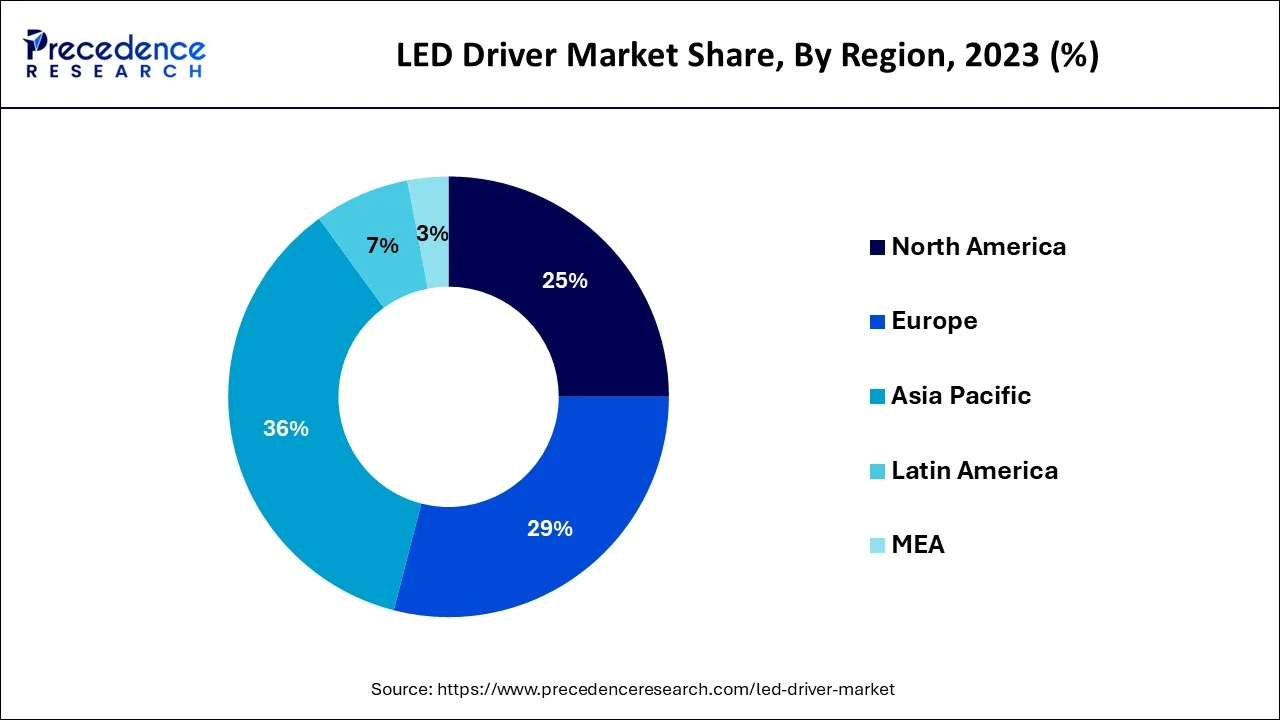

- The Asia Pacific region has held the highest revenue share of around 45% in 2025.

- By product, the constant current segment has accounted for 59.8% of revenue share in 2025.

- By application, the electronic devices segment contributed more than 42% of revenue share in 2025.

- The segment for exterior and general lighting is anticipated to increase at the fastest rate from 2026 to 2035.

- By luminaire type, the type A lamp segment accounted largest revenue share in 2025.

- By component, others segment dominated the market with the highest revenue share in 2025.

Powering LEDs Smartly: How LED Drivers Ensure Performance and Protection

An LED driver is a piece of electrical equipment that helps send electricity to a series of LEDs in some kind of controlled manner. By regulating the thermal runaway, the LED driver is utilized to stop the LEDs from failing too soon. A condition known as "thermal runaway" occurs when an LED's temperature rises and light output falls as the current increases. Numerous aspects are taken into account while building an LED driver, including the need for a constant current or constant voltage driver, the available space, the kind of LED to be used, and the fixture's intended usage. The drivers of LED provide a shield to the LED lights from current and voltage alterations. Regardless of changes in the mains supply, the drivers make sure that perhaps the current & voltage going to the LED lights stay within their operational range. The safeguard prevents supplying excessive current & voltage that would harm LEDs or insufficient current that would lessen light output.

Even though there is a major worldwide movement towards the use of power-efficient lighting options, and predictions indicate that LED & compact fluorescent lamps will eventually replace 90% of the world's indoor lighting, the use and acknowledgment of LED depend on the individual, their decision-making, their awareness, their lifestyle, and associated environmental issues. Due to strict laws, the utilization of LED alternatives is expanding, although consumer knowledge of the advantages of LEDs is still much lower but growing significantly. Consumers should refrain from making purchases of improved lighting solutions purely based on their advantages.

Market Outlook

- Industry Growth Overview: The overall LED Driver Market will continue to grow significantly as smart lighting and digital signage solutions and energy-efficient infrastructure become more prevalent globally.

- Sustainability trends: Manufacturers are now producing LED Drivers using recycled materials, implementing a lower carbon footprint manufacturing process and incorporating smart energy management systems into their products.

- Global Expansion: A large demand for LED Drivers is being driven by the rapid growth of infrastructure development across Asia Pacific, Africa and the Middle East.

- Startup Ecosystem: Many new start-ups are focusing on creating IoT-enabled LED Drivers, ultra-efficient chipsets, and Artificial-Intelligence based Lighting Controls.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 10.95 Billion |

| Market Size in 2026 | USD 13.64 Billion |

| Market Size by 2035 | USD 92.82 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 23.83% |

| Asia Pacific Market Share | 45% in 2025 |

| Constant Current Segment Market Share | 59.8% in 2025 |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Product, Luminaire Type, Component, Control Feature, Application , End User, Region |

Market Dynamics

Market Driver

With technological advancements in LED driver design, small drivers can now be used in a variety of light fittings

The market for LED will grow as demand for energy-efficient lighting technology and programmable LED drivers both soar. Expanding smart systems in developing markets will support the demand for LED drivers. The market for LED drivers will expand in new directions thanks to supportive power-efficient regulations developed by the federal govt and councils that encourage funding of the production of energy-efficient equipment. According to reports, a lot of people are using LED systems in their cellphones, laptops, televisions, and tablets since they enable lower power consumption and have a smaller impact on electricity expenses. This will cause the market for LED drivers to develop significantly.

LED drivers are more favored by end users due to their portability and extended life term, which influences market trends. Thanks to technological advancements in LED driver design, small drivers can now be used in a variety of light fittings and applications. Because more and more compact LEDs are being used in lighting systems, dome lights, welcome lights, car headlights, and fast-acting taillights, there is considerable growth in the demand for LED drivers. Increased efforts to adopt energy-saving alternative options and the integration of stringent government regulations regarding the installation of precautionary measures, such as effective headlights, to protect lights from flashing on drivers in oncoming vehicles and causing accidents, are other factors propelling the growth of the LED driver industry.

Market Restraint

The increase in the nonappearance of standards for the production and installation of these products is expensive

The main factors limiting market growth, among others, are the increase in the nonappearance of standards for the production of these product lines, lack of understanding regarding the advantages and the product's availability in the various emerging economies, and increase in major concerns the high expenses associated with the potential substitute of the commodity in the event of any malfunction or complications in its operations. Additionally, there is a misconception that installing LED drivers is expensive, and as a result, the industry may see certain unfavorable trends. The producers' lack of agreement on standards could make it difficult to develop LED drivers. This is also anticipated to restrain the growth of the worldwide LED driver market.

Market Opportunity

Increasing population and expansion of the industry

A rise in the world's energy demand has also been caused by recent trends in population increase and industrial expansion. The globe is currently experiencing an energy crisis due to dwindling resources and rising power demand. To address the energy crisis, several nations have established laws requiring the use of consumer gadgets with low energy usage. The need for external forces is also anticipated to rise dramatically globally as a result of different smart city programs, which are being undertaken by governments all over the world to cut costs and reduce emissions. This suggests that there will be a rise in the need for exterior LED drivers for outdoor lighting systems like street lights.

The automotive industry has evolved as an important application area for LED drivers as the industry transitions away from conventional HID & halogen lights in favor of enhanced LED. Many countries have laws in place that forbid the use of hazardous HID bulbs. For instance, aftermarket automotive HID lighting systems that emit visible blue light instead of the necessary white-to-yellow range are forbidden in California.

Market Challenges

Absence of manufacturing standards in production lines

- There is a misconception that installing LED drivers is expensive.

- Additionally, the absence of universal standards among manufacturers may make it difficult for the market to expand.

- The high expenses associated with the commodity's replacement should any problems or issues arise.

Segment Insights

By Product Insights

Constant Voltage LED Driver & Constant Current LED Driver are the market segments based on the Driver Method. During the anticipated period, the constant current LED driver segment is anticipated to rule the market. The ability of constant power LED driver segments to avoid exceeding the current rating specified for the LEDs and preventing thermal runaway is credited with their supremacy in the LED driver market.

Further, the market is divided into Attractive Lamps, Integrated LED Module, Reflectors, and Type A-Lamps based on the Luminaire Category. The market leader is the Type A-Lamps category. However, the market for integrated LED modules is expanding quickly because end users prefer completely integrated modules inside of a LED configuration over conventionally manufactured LED systems since they can save money.

By Application Insights

The electronic devices segment accounted more than 40% of revenue share in 2025. The growing use of mobile phones & TVs in underdeveloped nations around the world. In both of these markets, LED is replacing traditional LCD screens because it provides better visual quality, higher color accuracy, and uses less electricity. These parts are also found in the display panels of many different consumer gadgets, including air conditioners, refrigerators, and other devices. Users have been forced to embrace LED lighting due to the rising need for power-efficient lighting across all industries worldwide. As the industry moves away from traditional HID and halogen lights towards elevated led, the automobile sector has emerged as a viable application field for LED drivers.

Many nations have put rules into place to prevent the use of dangerous HID bulbs. In California, for instance, aftermarket car HID light systems that emit blue visible light rather than the required white-to-yellow range are prohibited. Signage, kiosks, video walls, and other familiar application displays are all included in the outdoor display category. Due to an increase in digital marketing and advertising, the need for video walls has expanded primarily in industrialized nations like the U.S., the United Kingdom, and Japan.

By End-User Insights

Residential Lighting, Industrial Lighting, Exterior & Traffic Lighting, Commercial Lighting, and Others are the market segments based on end-user. Over the projected period, the segment for exterior and general lighting is anticipated to increase at the fastest rate. To fully benefit from energy savings, the streets, major thoroughfares, and highways require various control systems, and many projects necessitate several solutions.

Regional Insights

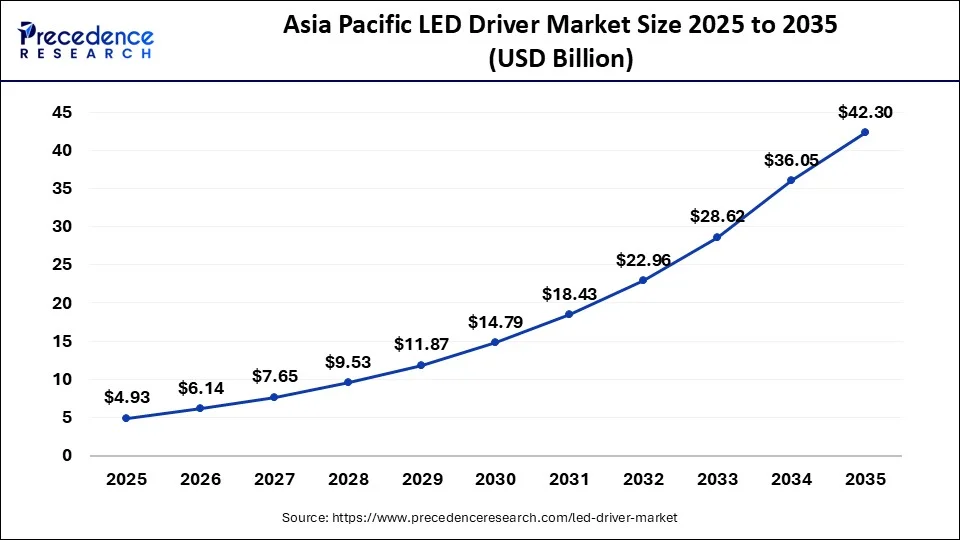

The Asia Pacific LED driver market size is estimated at USD 4.93 billion in 2025 and is expected to be worth around USD 42.30 billion by 2035, rising at a CAGR of 23.98% from 2026 to 2035.

The marketplace for LED drivers was dominated by Asia Pacific and was contributed more than 45% revenue share in 2022. Government subsidies, an increase in the use of LED lighting, and improved production lines in the area are all responsible for the region's rise. In March 2021, the Indian government introduced the GRAM UJALA scheme, which will offer LED lights to rural communities for just Rs. 10 each. Rural consumers can receive 7-watt & 12-watt LED lights with a 3-year warranty if they send in functional incandescent bulbs. Additionally, the Indian government distributed 36.78 cr INR worth of LED lights all around the country. Such initiatives are accelerating market expansion in the area.

China is a significant distributor of LED drivers across the globe as well as a major global hub for the production of industrial and consumer electronics. Over the forecast period, the market for these parts is anticipated to be driven by the growing demands for LEDs across consumers, including smartphones, laptops, T.V.s., and tablets. In addition, the lighting business is in great demand due to technical developments, a drop in the average cost of the drivers, and other factors. With the growing use of LED lighting in high- and low-end automobile segments, Europe & North America are truly to see growth. The use of technologies for exterior applications has expanded in nations like the U.S. and Canada. The European market is seeing increased demand for LED components due to the European Union's prohibition of less effective halogen bulbs as well as lucrative incentive programs for LED.

COVID-19 Impact on the LED Driver Market

Because China, the country where Covid-19 originated and from where a significant portion of LED products are supplied, this pandemic had a significant impact on the market for LED drivers. Price changes, delivery problems, and lower production affected the whole industrial sector. Although these difficulties might motivate regional manufacturers to advance their enterprises and procedures, the scarcity of LED drivers presents a significant barrier. Due to postponed construction projects, the growth rate of the LED driver market revenue has decreased. However, the epidemic increased the demand for LEDs from the medical sector. Market participants also made investments in the study and creation of smart lighting systems. The expansion of LED having a direct impact was impeded by the decline in demand for electronic devices and lighting systems, and the worldwide supply chain was severely damaged by the material shortage. The global economy was also affected by cutbacks in different capital budgets and delays in major projects in many industries.

Europe continues to be the largest market for LED driver technology because of the high degree of energy efficiency demands placed upon LED driver manufacturers by regulatory authorities in the European Union and at the country level with respect to building certification and sustainable practices. Europe also has a large percentage of EU member countries that are using LED technology in automotive applications which continue to grow. In several major European Union member countries including Germany, United Kingdom, France and Italy there is a rapidly increasing demand for high-efficiency LED drivers across a variety of commercial and industrial applications, as well as for the EV (Electric Vehicle) charging system and smart street lighting applications.

In addition to these positive trends there are various forms of government incentives to support carbon-neutral projects and the rapid growth of digital lighting control systems is continuing drive Europe as the leading region for LED Driver technology. Many key industry players are also investing heavily in research and development for new LED driver's products in support of high-tech products such as dimmable LED drivers and Intelligent LED drivers.

The continued development of LED driver technology in many countries in the Latin American region is driven by government interest in creating energy-efficient infrastructure and promoting renewable energy adoption. The governmental upgrades of public lighting systems being performed by many Latin American Governments including Brazil, Mexico, and Chile are fuelling the demand for high quality LED drivers.

The rapid growth in urbanization, industrial growth and investment in Smart City initiatives in Latin America also creates tremendous opportunities within the region. The global suppliers and local manufacturers are competing vigorously by producing low-cost, high-quality LED drivers that are designed for use in different climates, which results in favourable long-term growth opportunities throughout the Latin American region.

The market in Europe is driven by stringent energy-efficiency and environmental regulations that encourage the adoption of LED lighting across residential, commercial, and industrial sectors. Government initiatives promoting smart lighting, smart cities, and carbon-reduction targets are accelerating the replacement of conventional lighting systems with LEDs. Additionally, rising demand for advanced lighting controls, dimmable solutions, and integration with building automation systems is further supporting market growth in the region.

The UK is a major contributor to the European market. The market in the UK is expanding due to stringent energy-efficiency regulations, rising electricity costs, and strong government support for low-carbon technologies. The increasing replacement of traditional lighting with LEDs across the residential, commercial, and industrial sectors is boosting demand. Growing awareness of long-term cost savings, sustainability goals, smart lighting adoption, and infrastructure modernization projects is further accelerating market growth across the UK.

North America is considered a significant market for LED drivers, supported by the strong adoption of energy-efficient lighting, strict energy regulations, and sustainability initiatives. High replacement demand for traditional lighting, increased investments in smart buildings, and rapid adoption of LED and intelligent lighting systems are key drivers. Additionally, the presence of leading manufacturers, technological advancements, government incentives, and rising consumer awareness of energy savings are further supporting steady market growth during the forecast period.

The U.S. is a key player in the North American market, due to strict energy-efficiency regulations, rising electricity prices, and strong government incentives encouraging sustainable lighting. Increasing replacement of traditional lighting with LEDs in residential, commercial, and industrial sectors is boosting demand. Growth is also driven by the adoption of smart lighting, infrastructure upgrades, technological progress, and growing consumer awareness of long-term cost and energy savings.

Value Chain Analysis

- Raw Material Sourcing

This stage involves sourcing essential electronic components, such as capacitors, inductors, MOSFETs, IC controllers, resistors, PCBs, and casing materials, such as aluminum and plastic.

Key players: STMicroelectronics, MEAN WELL, and Inventronics. - Component Fabrication and Machining

This stage involves producing PCBs, assembling them with electronic components, and manufacturing enclosures using methods like CNC machining and sonic welding to ensure durability.

Key players: Texas Instruments and NXP Semiconductors - Testing and Certification

Testing and certifying LED drivers ensure electrical safety, performance (such as efficiency, power factor, and flicker), and compliance with standards such as BIS (India), IEC (International), and FCC (US).

Key players: Texas Instruments, NXP Semiconductors, STMicroelectronics, MEAN WELL, Inventronics.

Top Companies & Their Offerings

- Texas Instruments Incorporated: Designs and manufactures semiconductor solutions, including LED drivers, power management ICs, and analog devices for consumer electronics, automotive, and industrial applications.

- NXP Semiconductors: Provides LED driver ICs, microcontrollers, and power management solutions for automotive, industrial, and consumer electronics, with a focus on energy-efficient lighting and smart devices.

- STMicroelectronics: Offers LED drivers, power ICs, sensors, and microcontrollers for industrial, automotive, and consumer electronics applications, enabling energy-efficient and intelligent lighting solutions.

- Bokedriver: Specializes in manufacturing LED drivers, power supply units, and lighting control solutions for commercial and industrial lighting systems.

- MEAN WELL Enterprises Co.: Produces high-quality LED drivers, power supplies, and industrial power solutions for indoor/outdoor lighting, displays, and electronic applications.

- Inventronics Inc.: Provides advanced LED drivers, power supplies, and control systems for commercial, industrial, and outdoor LED lighting applications worldwide.

LED Driver Market Companies

- ACE LEDS

- Cree LED

- Signify Holding

- Maxim Integrated

- Texas Instruments Incorporated

- NXP Semiconductors

- STMicroelectronics

- Bokedriver

- MEAN WELL Enterprises Co.

- Inventronics Inc.

Recent Developments

To meet energy-saving requirements in March 2022, the lighting design for the Yangtze River International Conference Center incorporated LF-AADxxx series LED drivers that are DALI dimmable. Meanwhile, the Yangtze River International Conference Center has received the highest grade mark from the China Green Building Evaluation & Certification System because of the precise control of lighting energy provided by the DALI lighting control system, as well as its combination with the building's strong curtain walls and environmental protection landscapes.

The PLI scheme was modified in June 2022, by the Department of Telecommunications, to enable LED Manufacturing of telecom components to build India's 5G ecosystem. Market-available LED drivers are acquiring new and more advanced components as well as becoming increasingly efficient at handling power fluctuations. As an illustration, Infineon debuted the BCR431U Constant-Current Linear LED Driver IC in June 2020. The incorporated driver IC drop at the new IC, which offers low-voltage drop capability for controlling LED current, can be as low as 105 mV at 15 mA.

In June 2019, Lumenetix, a maker of customizable color light motors and digital controllers, was bought by ERP Power, a provider of integrated LED drivers for the LED sector. ERP seeks to integrate Lumenetix tunable light with its power control to minimize original equipment manufacturer complexity. A quicker time to market for LED lighting fixtures will result from this.

This SREC development opened up opportunities for the development of LED drivers with integrated thermal protection in December 2018, replacing the thermal protection typically used in downlight luminaires. Together with UL and Intertek, Imply is a well-known security pioneer. They have expanded their cutting-edge safety engineering advancements to include LED class P drivers, led Lighting, and other products.

Programmable output drivers from Mean Well Enterprises Co. Ltd. were released in August 2020 and feature major power conservation and dimmer compatibility. The new PTB Series drivers would be accessible in the Americas in Q3 2020 from Digikey, Mouser, & WPG.

Segments Covered in the Report

By Product

- Constant Voltage

- Constant Current

By Luminaire Type

- Decorative Lamps

- Reflectors

- Type A Lamp

- Others

By Component

- Driver IC

- Discrete Component

- Others

By Control Feature

- Wired

- Wireless

By Application

- General Lighting

- Electronic Devices

- Automotive Lighting

- Lighting Outdoor Display

By End-User

- Residential

- Commercial

- Industrial

By Geography

- North America

- Europe

- Asia Pacific

- Latin America

- MEA

Get a Sample

Get a Sample

Table Of Content

Table Of Content