What is the LED Lighting Market Size?

The global LED lighting market size is calculated at USD 99.47 billion in 2025 and is predicted to increase from USD 110.71 billion in 2026 to approximately USD 285.39 billion by 2035, expanding at a CAGR of 11.12% from 2026 to 2035.

Market Highlights

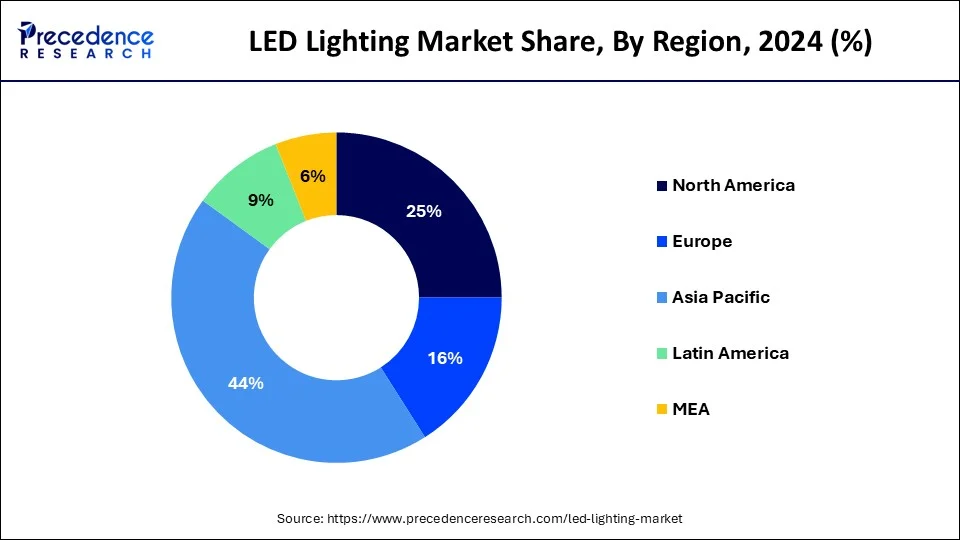

- Asia Pacific held a market share of 44% in 2025.

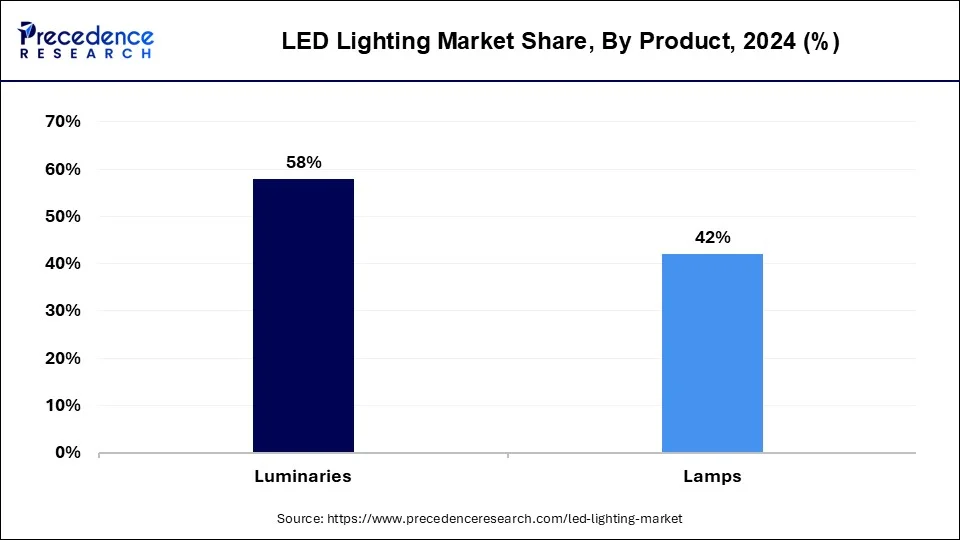

- By product, the luminaries segment registered a maximum market share of 58% in 2025.

- By end use, the commercial segment is expected to capture the biggest revenue share of 52% in 2025.

LED Lighting Market Growth Factors

- The plummeting cost of Light Emitting Diode (LED) along with the transformation in energy policies across the globe drives the market growth for LED lighting. The government of various regions offers rebates and attractive incentives for the application of LED lights over conventional lights, expected to proliferate the growth of LED lights in the coming years. LEDs are highly reliable and efficient, and yield longer life span compared to others. They are cost-effective and deliver nearly 50,000 hours of illumination with less amount of energy consumed. Low cost of LEDs and less amount of heat dissipation make them a preferred choice for customers over the incandescent lights.

- Besides this, a lack of awareness regarding the payback period and installation cost may hamper the growth of the LED lighting market in the coming years. However, rising investment from governments of various countries for smart cities, smart transportation, smart industries, and the application of numerous smart technologies in different applications drive profound growth for the LED lighting market over the analysis period.

LED Lighting Market Trends

Shedding Light on Innovation

- Smart LED integration: There is a notable surge in the adoption of Internet of Things (IoT)-enabled lighting systems, which not only enhance energy efficiency but also facilitate intelligent operations that adapt to user needs and environmental conditions.

- Sustainable solutions: An increasing emphasis on eco-friendly lighting has emerged in response to stringent global environmental regulations and the growing momentum of green building initiatives, highlighting the industry's commitment to sustainability and reduced carbon footprints.

- Cost efficiency: The continuous decline in prices of LED components has made energy-efficient lighting solutions more accessible than ever, benefiting a diverse range of applications in residential, commercial, and industrial sectors, while enabling cost-effective upgrades across the board.

- Urban infrastructure projects: The rapid expansion of smart city initiatives is driving a significant demand for innovative smart street lighting systems and advanced public infrastructure applications, which contribute not only to improved urban aesthetics but also to enhanced safety, energy conservation, and overall quality of life for city residents.

Market Scope

| Report Scope | Details |

| Market Size in 2025 | USD 99.47 Billion |

| Market Size in 2026 | USD 110.71 Billion |

| Market Size in 2035 | USD 285.39 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 11.12% |

| Largest Market | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Product, Application, End User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Long Lifespan

LEDs use very little energy because they turn most of their energy into light instead of heat. When considering traditional lighting solutions, this efficiency translates into lower energy usage and longer lifespans. The adoption of LEDs is being encouraged by numerous governments across the globe through laws and policies that are designed to increase energy efficiency. The switch to LED lighting is being aided by programs that provide standards, rebates, and subsidies for energy-efficient lighting. The functionality of LEDs is being improved by their integration with smart technologies and the Internet of Things (IoT). Their popularity is growing in the home, commercial, and industrial sectors thanks to features including automation, motion detection, dimming, color changing, and remote control.

Restraint

Aesthetic Preferences

LED lights are becoming more and more popular because they look good with contemporary, minimalist interior designs. This comprises subtle fixtures, neat lines, and thin profiles. Tunable white lighting is a feature of advanced LED goods that lets customers change the color temperature based on activities or the time of day. RGB LEDs are designed to satisfy customers who want programmable color options for mood lighting or special occasions. Smart LED lights that are programmable through voice assistants, apps, or home automation systems are in great demand. Functions such as scene-setting, scheduling, and dimming improve practicality and customization. Energy-star-certified products are recommended due to their demonstrated energy efficiency and compatibility with both practical and aesthetic standards.

Opportunity

Urbanization and Infrastructure Development

The development of infrastructure and urbanization are two important drivers propelling the market for LED lighting. The need for energy-efficient lighting options, such as LEDs, rises as cities grow and evolve. Residential illumination is becoming more and more necessary as more people migrate into cities. Because of their extended longevity and energy efficiency, LEDs are now the standard for both new and refurbished homes. The need for LED lighting is increased by the growth of commercial buildings, which include places of business, retail establishments, and lodging facilities. These industries place a high priority on energy efficiency in order to cut expenses. Sustainability is becoming more and more important to governments and municipalities. LEDs are essential for achieving energy-saving goals and lowering carbon emissions.

According to the article published by the Ministry of Housing & Urban Affairs in december 2024, as on 15.11.2024, under the Smart Cities Mission (SCM), work orders have been issued in 8,066 projects amounting to 1,64,669 crore, of which 7,352 projects (i.e. 91% of total projects) amounting to 1,47,366 crore have been completed, as per the data provided by 100 Smart Cities.

Segment Insights

Product Insights

In 2025, LED luminaries occupied a major market value share of around 58% in the global LED lighting market and are expected to exhibit substantial growth over the forecast period. Luminaries are largely used in industrial and commercial applications. It includes lights used in high bays, streetlights, troffers, track lights, downlights, and suspended pendants for various applications. They are costlier than LED lamps and thus contribute a large amount of revenue to the global market. Further, the luminaries are easy to control and provide more light per output power. They also permit designers to use proficient designs that illuminate the same area using less light.

On the other hand, LED lamps exhibit the fastest growth of approximately 14% over the forecast period. LED lamps offer numerous benefits over incandescent lamps such as energy efficiency, robustness, and right temporal stability. In various countries, LED prices are expected to witness a steep decline in the near future, further boosting the demand for LED lamps.

End-use Insights

By end-use, the commercial segment dominated the global LED lighting market and accounted for more than 52% of the market value share. Increasing demand for LED troffers and downlights significantly drives the growth of the segment. Commercial lighting mainly includes museums, galleries, and other exhibition lighting applications that predominantly use projectors, reflectors, and downlights. On the other side, residential segment is expected to witness the fastest growth during the forthcoming years. The growth of the segment is attributed to the rising adoption of LED A-type lamps due to their low price and various subsidy programs initiated by the agencies and governments of different regions. Price contributes as a decisive factor in driving the growth of the residential segment. Furthermore, consumer penetration towards smart home devices that also includes smart lighting accounted as the other prominent factor to propel the residential segment revenue over the predicted period.

According to the article published by the IBEF, as of 6th January 2025, EESL has successfully installed over 1.34 crore LED streetlights across Urban Local Bodies (ULBs) and Gram Panchayats, leading to significant energy savings of over 9,001 million units (MUs) of electricity annually. This achievement has also contributed to a reduction in peak demand by more than 1,500 MW and a decrease in CO? emissions by 6.2 million tonnes per year, highlighting the programme's positive impact on both energy efficiency and environmental sustainability.

Regional Insights

Asia Pacific LED Lighting Market Size and Growth 2026 to 2035

The Asia Pacific LED lighting market size is evaluated at USD 43.77 billion in 2025 and is predicted to be worth around USD 127.00 billion by 2035, at a CAGR of 11.24% from 2026 to 2035.

In 2025, the Asia Pacific captured a major market value share of more than 44% in the global LED lighting market and is projected to continue its dominance during the analysis period. This is mainly attributed to the large consumer base in the region. Most of the developing nations in the region have adopted stringent regulations and attractive offers for the public to escalate the adoption of LED lights in the region. LED lights are helpful in saving energy as they supply more watts per hour in less energy consumption. In addition, rise in the construction sector also positively influences the market growth. There are numerous developing countries present in the region that offer alluring opportunities for the development of medical, education, and infrastructure, thereby promoting the construction of hospitals, schools, buildings, and roads in the region.

Lighting Up Progress with Policy (Top Countries in Asia-Pacific)

- China: The powerhouse of production massive manufacturing capacity, aggressive government subsidies, and widespread infrastructure projects contribute to China's leading position.

- India: Right vision through Policy Push Programmes like UJALA and Street Lighting National Programme (SLNP) have driven mass adoption of LEDs across urban and rural areas.

- Japan: Pioneering energy-efficient innovation Japan's emphasis on sustainability, coupled with smart city frameworks and energy-saving mandates, drives consistent LED demand.

- South Korea – Tech-driven lighting growth integration of LEDs in high-tech applications and government-led green technology investments make South Korea a key contributor.

According to the data published by the Press Information Bureau (PIB) in August 2024, as cited in the latest Economic Survey 2023-24, it is expected that by 2030, more than 40 percent of India's population will live in urban areas. This estimation has been made on the basis of studies and reports of NITI Aayog.

On the other hand, North America and Europe are the other prime contributors to the global LED lighting market growth. Technology advancement and significant initiatives taken by the governments of these regions for reducing energy consumption are some of the major factors responsible for the growth of the regions.

According to the data published by the Press Information Bureau (PIB) in August 2024, as cited in the latest Economic Survey 2023-24, it is expected that by 2030, more than 40 percent of India's population will live in urban areas. This estimation has been made on the basis of studies and reports of NITI Aayog.

North America

Beams of Impact in the LED Landscape

- Government policies: Subsidies, incentive programmes, and infrastructure upgrades stimulate large-scale deployment.

- Commercial sector: Retail, hospitality, and offices adopt LEDs for long-term savings and sustainability.

- Residential demand: Growing consumer awareness and cost benefits drive household adoption.

- Smart city projects: Integration of smart lighting solutions in urban planning supports continuous growth.

- Technological advancements: Innovations in design, efficiency, and connectivity enhance market competitiveness.

How is the Opportunistic Rise of Europe in the LED Lighting Market?

Europe is experiencing an opportunistic rise in the market due to strict energy-efficiency regulations, government incentives, and growing adoption of smart and connected lighting solutions. The region's focus on sustainable building practices, green infrastructure, and reduced carbon emissions drives demand for advanced LED systems. Additionally, continuous technological innovations in high-performance and intelligent lighting products further strengthen market growth across residential, commercial, and industrial sectors.

What Potentiates the Market Within Latin America?

In Latin America, the LED lighting market is growing due to increasing urbanization and environmental awareness. Countries like Brazil and Mexico are increasingly adopting energy-efficient lighting solutions. Government initiatives promoting sustainable development and the reduction of energy consumption have played a crucial role in this transition. Cities are investing in upgrading public lighting systems to LED technology, which not only reduces energy costs but also enhances visibility and safety.

Additionally, the rising penetration of smart lighting systems is set to further drive market growth in the region. With a growing emphasis on green building practices, the demand for LED lighting solutions is expected to continue its upward trajectory.

As the largest economy in Latin America, Brazil has implemented various policies to encourage the use of LED lighting, particularly in urban areas. Incentives for energy-efficient buildings and public lighting upgrades have boosted the adoption of LED technology. Mexico is witnessing a parallel increase in LED lighting adoption, driven by both government initiatives and private sector investments. The country's commitment to enhancing energy efficiency is reflected in its growing number of LED projects, particularly in residential and commercial sectors.

What Opportunities Exist in the Middle East & Africa?

The Middle East & Africa (MEA) presents significant opportunities for the LED lighting market. These opportunities stem from the rapid infrastructure development and urbanization. Countries in the Gulf Cooperation Council (GCC) are heavily investing in LED solutions as part of their commitment to sustainability and energy efficiency. The region's extreme climate further underscores the need for energy-efficient lighting to reduce cooling demands.

In Africa, the market is gaining momentum as governments and NGOs promote electrification projects, particularly in rural areas, using solar-powered LED lighting. This emphasis on energy-efficient lighting solutions aims to improve access to electricity while addressing sustainability goals.

The UAE is at the forefront of the LED lighting market in the region, driven by ambitious sustainability targets and investments in smart city developments. The government's commitment to improving energy efficiency has led to widespread adoption of LED lighting in public and private sectors.

LED Lighting Market Companies

- Cree Inc. (IDEAL INDUSTRIES INC.)

- Acuity Brands Lighting Inc.

- Digital Lumens Inc.

- Dialight

- Hubbell

- GE Current

- LumiGrow

- LSI Industries Inc.

- Siteco GmbH

- Panasonic Corporation

- Semiconductor Co. Ltd. (Seoul Semiconductor)

- Signify Holding

- Zumtobel Group Ag

Recent Developments

- In April 2025, VueReal announced a significant expansion of its Reference Design Kit (RDK) portfolio with new industry-specific bundles. Purpose-built for automotive and consumer electronics, the vertical RDKs are designed to fast-track microLED product development and commercialization with unprecedented speed and integration readiness.

- In February 2025, Cree LED, a Penguin Solutions brand, unveiled the new XLamp XP-L Photo Red S Line LEDs, a groundbreaking advancement in horticulture lighting technology. Designed to deliver exceptional efficiency, durability, and seamless system upgrades, these LEDs are optimized for high-performance applications in greenhouses, vertical farms, and other large-scale growing operations.

- In July 2025, Access Fixtures, a leading manufacturer of high-performance commercial, industrial, and sports LED lighting, launched a new online calculator and comprehensive guide focused on LED light amperage. This user-friendly tool is designed to help electricians, contractors, and project managers accurately calculate the amp draw of LED lights, eliminating guesswork and ensuring project safety.

- In July 2023, Marelli and Ams OSRAM have introduced a revolutionary advancement in front illumination for automobiles. The h-Digi microLED module is currently being produced in series. This digital lighting system is inexpensive and compatible with a larger range of cars. It is based on a new type of intelligent multipixel LED that allows for completely adaptive, dynamic headlamp operation and picture projection.

- In January 2024, Halonix Technologies, one of the fastest-growing electrical firms in India, today unveiled its 'Wall De-Light – Spiritual Series' LED lights as a tribute to the country's rich spiritual tradition. The 'Ram Mandir' project is celebrated in this inventive series that is profoundly based in spiritual symbolism and honors its historical and cultural significance.

Segments Covered in the Report

By Product

- Luminaries

- Troffers

- Downlights

- Streetlights

- Others

- Lamps

- T-Lamps

- A-Lamps

- Others

By Application

- Outdoor

- Indoor

By End-User

- Industrial

- Residential

- Commercial

- Others

By Region

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting