Outdoor LED Lighting Market Size and Forecast 2025 to 2034

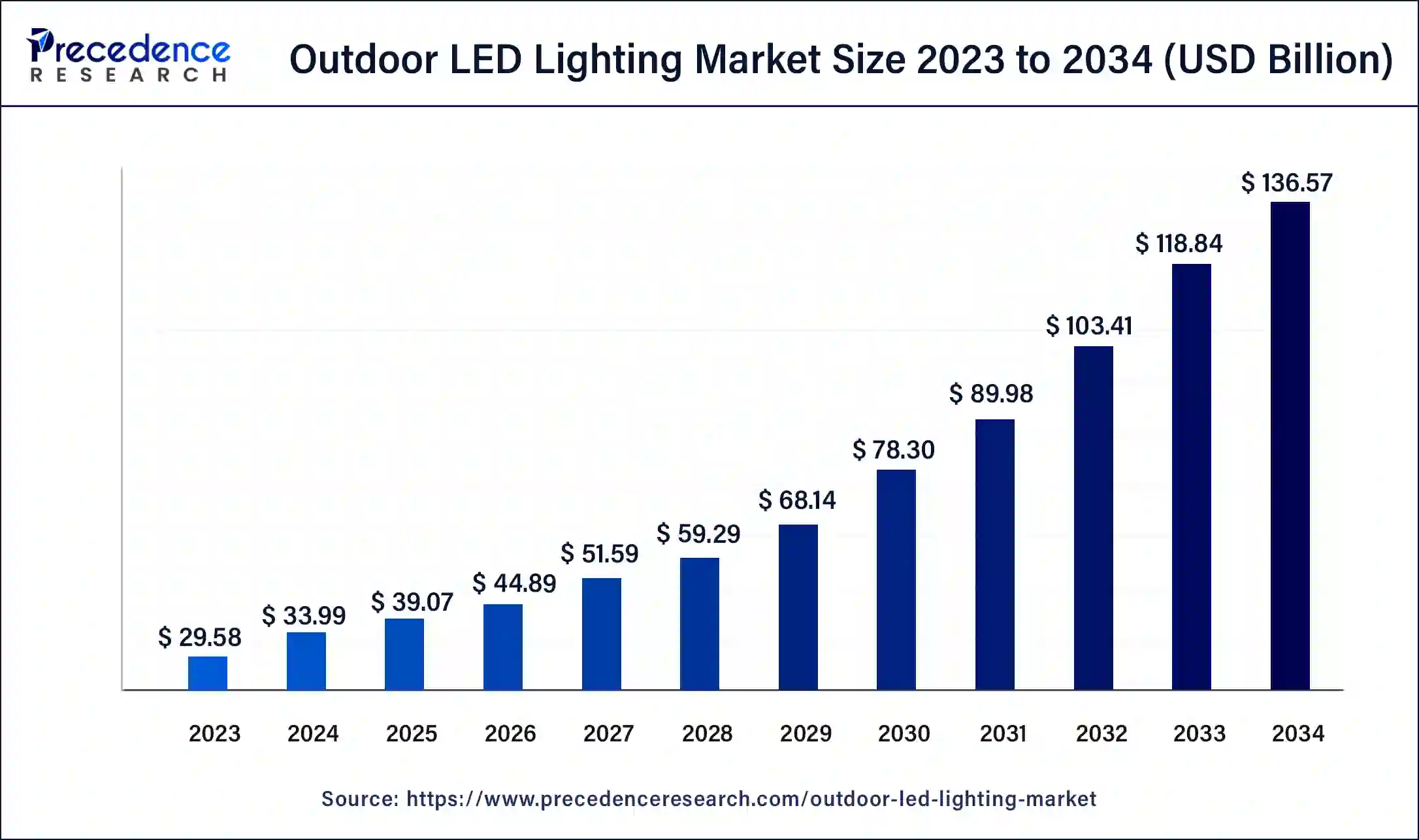

The global outdoor LED lighting market size was valued at USD 33.99 billion in 2024 and is anticipated to reach around USD 136.57 billion by 2034, growing at a CAGR of 14.92% from 2025 to 2034. LED lighting is being widely adopted globally for outdoor lighting purposes due to its energy-efficient, eco-friendly nature, long lifespan, and durability, which makes it ideal for operation under extreme outdoor temperatures.

Outdoor LED Lighting Market Key Takeaways

- In terms of revenue, the LED lighting market is valued at $39.07 billion in 2025.

- It is projected to reach $136.57 billion by 2034.

- The LED lighting market is expected to grow at a CAGR of 14.92% from 2025 to 2034.

- Asia Pacific dominated the outdoor LED lighting market in 2024.

- Europe is expected to grow at the fastest rate in the market during the period studied.

- By installation, the new installations segment dominated the global market for 2024.

- By installation, the retrofit segment is set to see notable growth in the market during the forecast period.

- By offering, the hardware segment accounted for the largest share of the market in 2024.

- By offering, the services segment is expected to grow at the fastest rate in the market over the forecast period between 2024 and 2034.

- By sales channel, the retail/wholesale segment dominated the market in 2024.

- By wattage, the 50-150W segment made up the largest share of the market in 2024.

- By wattage, the above 150W segment is expected to grow at the fastest rate in the market in the forecast period.

- By application, the streets & roads segment dominated the global market in 2024.

- By application, the sports segment is expected to see the fastest growth in the market over the forecast period between 2025 and 2034.

How Artificial Intelligence Is Transforming the Lighting Market?

Artificial intelligence has made an impact on the outdoor LED lighting market with the implementation of the Internet of Things in lighting. This form of connected lighting integrates sensors and smart chips with lighting infrastructure to analyze information such as energy use, temperature, and more. LED lights dim smoothly with minimal flickering or distortion of color. This makes them suitable for various lighting applications where adjustable brightness is desired. This technology will also lead to more personalized light usage; with apps connected to the bulbs, individuals will be able to automate the lights based on their tastes and preferences. Internet of Things technology in lighting has the potential to LED lighting with LiFi capabilities.

- In 2019, pureLiFi announced it had completed a $18M Series B fundraising to provide LiFi technology to mass-market mobile device and lighting manufacturers. The investment allowed pureLiFi to further research and development of Gigabit LiFi components and optimize them for mobile device integration.

Market Overview

A light-emitting diode is a small electronic device that emits light powered by the electricity that passes through it. It consists of a semiconductor that emits photons when electric current passes through. Outdoor LED lighting is exterior lighting that utilizes LED technology to create artificial light sources to illuminate areas. While high-pressure sodium and metal halide technologies continue to improve, LED technology is going through breakthroughs rapidly in terms of continuously optimizing for luminous efficacy, color quality, optical design, thermal management, and cost. Fixtures are also becoming more compact with developments like chip-scale packaging (CSP), LEDs that don't need a package or a casing that encapsulates an LED chip and phosphor. The initial higher cost of LED lights can discourage smaller and medium-level businesses and public sector undertakings from purchasing through outdoor LED lighting market companies.

Outdoor LED Lighting Market Growth Factors

- The eco-friendly, cost-effective, and durable nature of LED lights is driving significant demand in the outdoor LED lighting market.

- Rapid urbanization and infrastructure development in emerging Asian economies and a shift towards smart cities globally are spurring demand in the outdoor LED lighting market.

- New technological innovations in the LED space, including the development of various types of perovskite light-emitting diodes, are helping maintain research and development funding in the space.

- Energy Efficiency Demand- As energy efficiency is highly desirable from governments and businesses alike, LED lighting is being favored since it consumes less energy. This impacts electricity bills and supports global sustainability goals, including decarbonization.

- Smart City Initiatives- The rapid adoption of smart city projects encourages the efficiency of urban infrastructure and the development of intelligent lighting systems enabled by LED technology. Smart city initiatives allow for control, analytics, automation, and monitoring of outdoor lighting in real-time.

- Decreased LED Prices- The cost of LEDs has significantly decreased due to technological improvements and mass production, making them an attractive alternative to traditional lighting for large outdoor applications, such as streets, stadiums, and parking lots.

- Government Regulations & Incentives- Multiple countries have implemented regulations phasing out inefficient lighting and providing subsidies or incentives to switch to LEDs, helping public and private organizations transition towards LED lighting.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 136.57 Billion |

| Market Size in 2025 | USD 39.07 Billion |

| Market Size in 2024 | USD 33.99 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 14.92% |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Installation, Offering, Sales Channel, Wattage, Application, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Driver

Unique features of LED lights compared to alternatives

LED lights have a long lifespan, are energy-efficient, and are compact compared to high-pressure sodium and metal halide alternatives. LED lights do not contain lead, mercury, and other hazardous metals, making them cleaner sources of light. The many advantages of LED technology are driving growth in the outdoor LED lighting market. LEDs are commonly used in lighting fixtures for outdoor spaces such as streetlights, floodlights, garden lights, displays such as digital signage, and others. They are resistant to extreme weather conditions.

Restraint

Prohibitive costs and functional limitations of LED lighting

LED lights are relatively expensive compared to fluorescents and other alternatives, making the cost of acquisition prohibitive for public sectors of emerging economies and small and medium infrastructure organizations. LED lights, while resilient to extreme temperatures, are vulnerable to moisture. The low heat-dissipation in LED lights means moisture does not dry out quickly, compared to traditional, less energy-efficient lighting. Further research and development are necessary to address the restraints in the outdoor LED lighting market posed by limitations of the technology.

Opportunity

Developments in perovskite light-emitting diodes

Research and development efforts taking place in the LED space have led to technological innovations like perovskite light-emitting diodes (PeLEDs), touted as the next-generation of LEDs due to their capacity to emit high color pure light in narrow bandwidths. Green, blue, red, and white perovskite light-emitting diodes have been developed with increased efficiencies. Innovations such as pixel pitches optimize the clarity of LEDs for high-octane uses. The ability to adjust pixel pitches allows businesses to customize their lighting options and find tailored solutions for their needs. Advances in LED technology, such as Perovskite Light-emitting diodes, are making them more efficient, presenting opportunities to scale the new technology for applications in the outdoor LED lighting market.

- In 2021, a team at the South China University of Technology developed white perovskite light-emitting diodes with a high EQE of 12.2% and high luminance of 2,000 cd m−2, both representing the most efficient white sub-type so far. Meanwhile, red perovskite-based LEDs have suppressed biexciton Auger recombination and bright luminescence even at high excitation (600 W/cm2). The red LEDs demonstrate an external quantum efficiency of 18% and maintain high performance at a brightness exceeding 4700 cd/m2.

Installation Insights

The new installations segment dominated the global outdoor LED lighting market for 2024. There has been a surge of demand in the outdoor LED lighting market due to a global push towards sustainable development. LED lights consume less energy compared to their traditional counterparts. In emerging economies where rapid industrialization and urbanization are taking place, large-scale private and public infrastructure projects are currently underway. This has led to several federal public projects globally to adopt outdoor LED lighting.

- In 2024, Planet Lighting, a lighting company from New South Wales, Australia, made an 800-light high-tech and sustainable LED installation for the Paris Olympic Village. Each light has a QR code, and after the Olympics, the medal winners will have their details uploaded so fans can scan the code and be taken to their biography.

The retrofit segment is set to see notable growth in the outdoor LED lighting market during the forecast period as established economies integrate LED lights into older retrofitted infrastructure to preserve cultural heritage. In the United States, efforts to retrofit LED lights started last decade, with big cities like Las Vegas replacing 6,600 lights, leading to approximately 2.2 million fewer kWh consumed. Smaller towns, such as Boulder City, Nevada, have been working toward retrofitting lighting. The city got the go-ahead for the installation of 2,560 light pollution-reducing lighting fixtures and a $1.9 million grant from the U.S. Economic Development Administration for the retrofitting.

Offering Insights

The hardware segment accounted for the largest share of the outdoor LED lighting market in 2024. The rising adoption of LED lights for outdoor infrastructure is generating demand for LED tube lights, lamps, luminaires, and control systems on a massive scale for floodlights, landscape lights, spotlights, and more.

The services segment is expected to grow at the fastest rate in the outdoor LED lighting market over the forecast period between 2024 and 2033. The services segment is expected to grow as public sectors outsource the retrofitting and installation to firms specializing in outdoor LED lighting.

- In 2021, the twin city, Kalyan-Dombivali, India, partnered with Panasonic for smart LED lighting solutions. Panasonic delivered 161 smart LED street lights to upgrade the existing sodium vapor lamps to more efficient and intelligent outdoor LED lighting. The smart lights are monitored and controlled with a device having internet access, allowing the street lights to adapt to situations, monitor individual parameters, control dimming, manage assets, generate actionable reports for various analyses to optimize the system, and more.

Sales Channel Insights

The retail/wholesale segment dominated the outdoor LED lighting market in 2024. The development of robust retail and wholesale distribution channels has streamlined supply chains to the high demand generated by rapid infrastructure development, especially in emerging economies. Meanwhile, the e-commerce segment is gaining traction with a climbing compound annual growth rate. The rise of disposable incomes and changing tastes and preferences in emerging economies are driving demand in the market space.

Wattage Insights

The 50-150W segment made up the largest share of the outdoor LED lighting market in 2024. LED lights ranging from 50-150W are ideal for installation in large outdoor spaces where light has to be dispersed from height and be bright enough to illuminate an area properly. The higher the wattage, the brighter the light output.

The above 150W segment is expected to grow at the fastest rate in the outdoor LED lighting market in the forecast period. LED lights above 150W are the fastest-growing wattage segment with the boom of commercial infrastructure. 150W LED lights can produce up to 20,000 lumens, providing clear and bright lighting for large areas such as warehouses, factories, gyms, or auditoriums.

Application Insights

The streets & roads segment dominated the global outdoor LED lighting market in 2024. Demand for LED lighting is spurred by numerous global smart city projects procuring eco-friendly, cost-effective alternatives. LED alternatives.

- In December 2023, The city of Kochi, India, undertook a ₹40-crore project under Cochin Smart Mission Limited (CSML) to replace 40,400 street lights in Kochi with LED luminaires. The 150-lumen street lights that have been proposed will have a five-star energy rating. Similarly, the city of Dortmund, Germany, replaced its 36.000 street lights with LED versions by March 2024.

The sports segment is expected to see the fastest growth in the outdoor LED lighting market over the forecast period between 2024 and 2033. With the construction of several sports venues for the Olympics and existing venues retrofitting to LED lights, there is a growing demand for outdoor LED lighting in sports.

- In April 2024, Lord's Cricket Ground partnered with Abacus Lighting to become the first UK men's Test Cricket Ground to make the switch to LED floodlights. Lord's aims at reducing energy consumption across and becoming carbon neutral by 2030 and Net Zero by 2040.

Regional Insights

Asia Pacific dominated the outdoor LED lighting market in 2024. The rapid urbanization and infrastructure development in emerging economies of Southeast Asia are driving growth in the space. LED lights are being adopted across public spaces like highways, streets, sports stadiums, commercial spaces, schools, and hospitals in newly developing smart cities across China, India, Japan, and South Korea.

Government incentives to switch to more eco-friendly and cost-effective LED alternatives from traditional lighting have caused a transformation. China's 13th Five-Year Plan had set goals for reducing energy consumption by 15% across the country by 2020, spurring demand for LED lighting solutions. Countries like Japan boast the world's highest penetration rate of LED lighting in developed countries. The Japanese lighting industry is expected to switch to 100% LED products by 2030.

Technological advancements in LED lighting are further boosting Asia Pacific's dominance in the industry. Asia is home to some of the largest LED lighting manufacturers, including Panasonic, Nichia Corporation, and Everlight Electronics. As a result, research and development investment for LED lighting is robust in the region.

Europe is expected to grow at the fastest rate in the outdoor LED lighting market during the period studied. The region is expected to have a steady compound annual growth rate during the forecast period between 2024 and 2033. Major road and highway infrastructure projects currently underway in the continent are expected to drive demand for LED streetlights in the coming years. Several public-private partnerships in the region have raised funds, especially for eco-friendly outdoor solar LED lighting.

Outdoor LED Lighting Market Companies

- Dialight PLC

- General Electric Co. Ltd.

- Osram Licht AG

- Signify N.V.

- Syska Led Lights Pvt. Ltd.

- Zumtobel Group AG

- Acuity Brands Lighting Inc.

- Panasonic Corporation

- Hubbell Inc.

- Eaton Corporation

- Philips Lighting Holding B.V

- Wipro Lighting Ltd.

- Opple Lighting Co. Ltd.

- Bajaj Electricals Limited

- LG Innotek Co. Ltd.

- LIGMAN Lighting Co. Ltd.

- Lumileds Holding B.V.

- MLS Co. Ltd.

- Nichia Corporation

- Samsung Electronics Co. Ltd.

- Schréder Group

- Seoul Semiconductor Co. Ltd.

- L.D. Kichler Co. Inc.

Recent Developments

- In January 2025, Philips Hue launched four Impress smart outdoor lights in the U.S. and Canada. The company describes these products as modern, and they are already on sale in other markets like Europe. There are floor and wall lighting solutions, each offering white and colored lighting as well as app-based controls. Each model offers up to 1,180 lumens of brightness at 4,000K and has a light source said to last for up to 25,000 hours. (source: notebookcheck.net )

- In August 2024, Govee, a leader in the smart home lighting sector, launched the Permanent Outdoor Lights 2 - its second generation of Permanent Outdoor Lights. This new version offers enhanced brightness, improved reliability, and new Matter capability, all at the same price as the original Permanent Outdoor Lights. With Govee Permanent Outdoor Lights 2, users can easily transform their homes into captivating displays of vibrant colors and flowing gradients for unforgettable moments. (Source: prnewswire.com )

- In April 2024, Hama launched its new Neon LED light strip in Europe for indoor and outdoor use. The RGB smart light offers various colors and lighting effects with remote app-based controls or voice commands. The Hama RGB smart light is fully customizable in the Hama Smart Home app. The Hama Neon LED light strip is now on sale in the EU. Designed for indoor or outdoor use (source: notebookcheck.net )

- In May 2024, the 27th edition of the LED Expo took place in Mumbai, India. The expo is set to become a key trade fair for lighting industry professionals, functioning as a platform for the latest innovations, as well as networking opportunities. The expo featured several launches, including Niiv Lites, TINGE indoor and outdoor lights, and new products in the Sancon LED range.

- In April 2024, Hama GmbH & Co KG launched a new Neon LED light strip in Europe for indoor and outdoor use with an IP65 dust and water resistance rating; the LED light strip is 5 meters long. The lights are fully customizable with the Hama Smart Home app.

- In March 2023, researchers from Soochow University and East China Normal University published a study showing control of ion behavior to create a blue perovskite light-emitting diode. The team achieved the results by utilizing a bifunctional passivator, which consisted of Lewis base benzoic acid anions and alkali metal cations.

Segments Covered in the Report

By Installation

- New

- Retrofit

By Offering

- Hardware

- Services

- Software

By Sales Channel

- Retail/Wholesale

- Direct Sales

- E-commerce

By Wattage

- Below 50w

- 50-150w

- Above 150w

By Application

- Streets & Roads

- Architecture

- Sports

- Tunnels

By Geography

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting