What is the Legal Services Market Size?

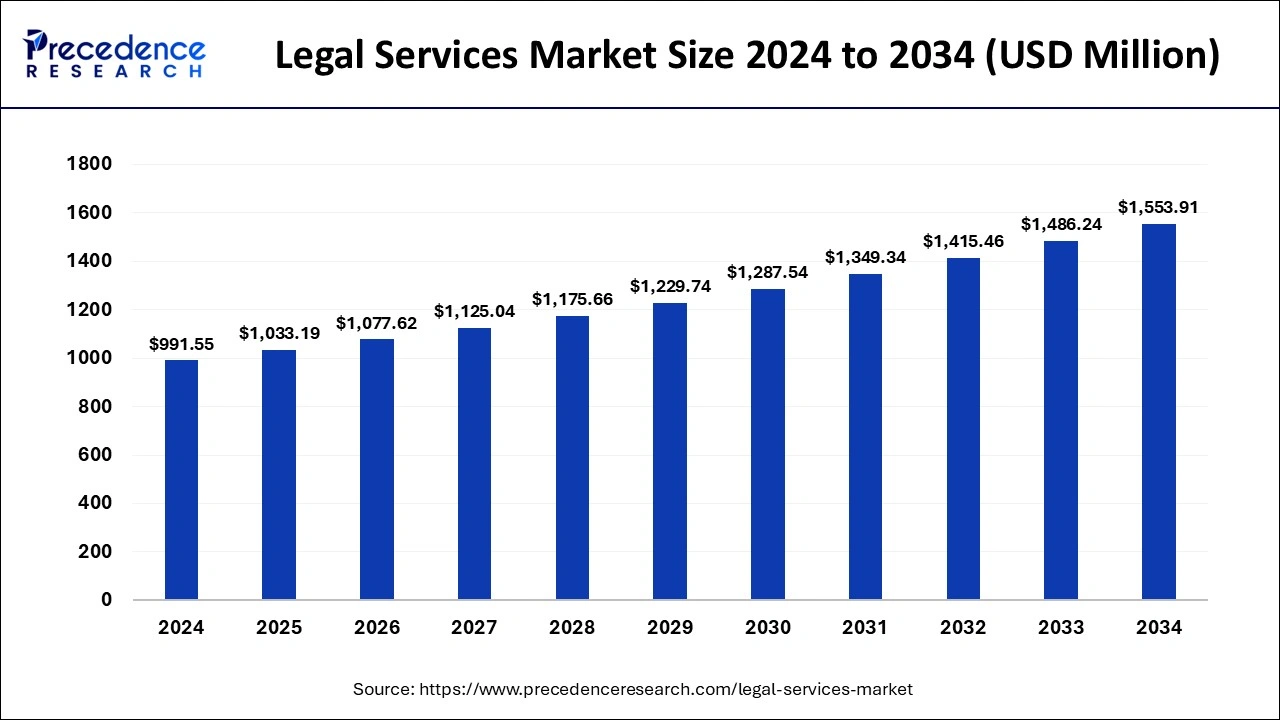

The global legal services market size accounted for USD 1.03 trillion in 2025 and is predicted to increase from USD 1.08 trillion in 2026 to approximately USD 1.62 trillion by 2035, expanding at a CAGR of 4.63% from 2026 to 2035.

Legal Services MarketKey Takeaways

- The global legal services market was valued at USD 1.62trillion in 2025.

- It is projected to reach USD 1.62trillion by 2035.

- The legal services market is expected to grow at a CAGR of 4.62% from 2026 to 2035.

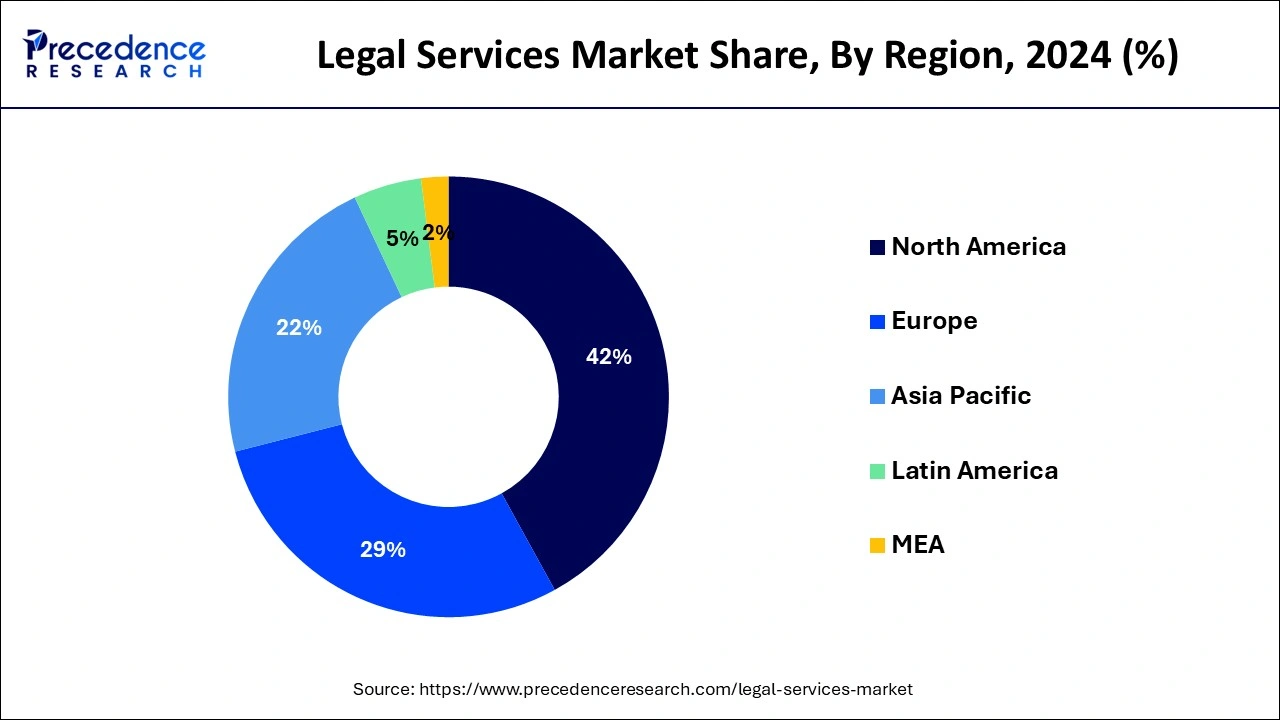

- North America dominated the global market with the largest market share of 42% in 2025.

- Asia-Pacific is estimated to expand at the fastest CAGR between 2026 and 2035.

- By fee type, the contingency fee dominated the legal services market.

- By fee type, the corporate segment is expected to grow at the fastest CAGR during the forecast period.

- By size, the large firms segment held the biggest market share in 2025.

- By size, the small firms segment is observed to grow at the fastest CAGR during the forecast period.

- By practice area, the civil litigation segment captured the major market share in 2025.

- By practice area, the intellectual property segment is observed to grow at the fastest CAGR during the forecast period.

Market Overview

Legal services encompass a range of professional assistance provided by lawyers and legal professionals to individuals, businesses, and organizations. These services aim to navigate and address legal issues, ensuring compliance with laws and regulations. Common legal services include advice on contracts, representation in court, and assistance with legal documents. Lawyers may specialize in various areas such as family law, real estate, or criminal law, offering expertise tailored to specific needs. Legal services play a crucial role in safeguarding rights, resolving disputes, and upholding justice within the framework of the legal system. Access to legal services is fundamental for individuals seeking guidance, protection, and resolution in legal matters, contributing to a fair and orderly society.

Legal Services Market Data and Statistics

- In February 2023, QuisLex, a prominent Alternative Legal Service Provider (ALSP), joined forces with ContractPodAi, a leading provider of AI-powered Contract Lifecycle Management (CLM) products. This collaboration aimed to deliver cutting-edge contract solutions to their clients.

- As of 2022, a survey by the American Bar Association found that 81% of law firms are investing in legal technology to improve efficiency and client services.

- A survey by Deloitte reveals that 89% of organizations consider regulatory compliance a top concern, highlighting the necessity for legal support in navigating complex regulations.

Legal Services Market Growth Factors

- The increasing globalization of business activities and cross-border transactions is driving growth in the legal services market. As businesses expand internationally, the need for legal support in navigating diverse legal frameworks, compliance issues, and international regulations has significantly risen.

- The adoption of technology, including artificial intelligence, automation, and data analytics, is revolutionizing the legal services sector. Technological advancements are enhancing efficiency, reducing costs, and providing innovative solutions such as e-discovery, contract automation, and legal research tools, contributing to market growth.

- The constantly evolving and increasingly complex regulatory environment is a key driver for the demand for legal services. Businesses across various industries require legal expertise to ensure compliance with regulations, manage risks, and navigate the intricate legal landscapes in which they operate.

- The trend toward specialization in legal services is gaining momentum. Clients are seeking expertise in niche areas such as intellectual property, cyber security, and environmental law. Law firms and practitioners specializing in these areas experience higher demand, contributing to overall market growth.

- The emergence of Alternative Legal Service Providers (ALSPs) is reshaping the legal services market. These providers offer cost-effective solutions, including outsourced legal processes, contract management, and legal technology services. The increasing acceptance of ALSPs is influencing market dynamics and expanding service delivery options.

- The growing complexity of business operations and legal requirements has led to an increased demand for in-house legal expertise within corporations. This has spurred growth in legal services as law firms provide specialized support to corporate legal departments, addressing a wide range of complex legal issues.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 1.03 Trillion |

| Market Size in 2026 | USD 1.08 Trillion |

| Market Size by 2035 | USD 1.62 Trillion |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Service, Firm Size, and Provider |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Government initiatives in healthcare

- According to a survey by Altman Weil, 78% of law firms reported increased competition from corporate legal departments, emphasizing the changing dynamics in the legal services landscape.

The surge in corporate legal needs has become a significant driving force behind the growing demand in the legal services market. As businesses expand and operate in an increasingly complex environment, the need for legal expertise within corporations has risen sharply. Companies are grappling with intricate legal challenges, from regulatory compliance to contractual intricacies, prompting a greater reliance on specialized legal services. With a heightened focus on risk management and legal compliance, businesses are increasingly turning to external legal support to navigate these complexities efficiently. This trend not only boosts the demand for legal services but also encourages law firms to tailor their offerings to cater to the specific needs of corporate clients. As a result, the legal services market experiences a notable upswing, driven by the evolving and intricate legal landscape that businesses navigate in today's corporate environment.

Restraint

Resistance to technology adoption

The reluctance to embrace technological advancements acts as a notable restraint on the market demand for legal services. The legal industry, historically characterized by traditional practices, may encounter challenges in fully harnessing the benefits offered by modern technologies. Resistance to technology adoption within legal circles can impede the streamlining of processes, reducing overall efficiency and limiting the potential for cost savings. Law firms and professionals hesitant to integrate innovative solutions such as artificial intelligence and automation may find themselves at a disadvantage in meeting the evolving needs of clients.

This resistance hinders the ability to optimize workflows, automate routine tasks, and deliver legal services more efficiently. Consequently, the legal services market may experience a slower response to changing client expectations and industry trends, impacting its overall growth potential in an era where technology plays a pivotal role in enhancing service delivery and operational effectiveness.

Opportunity

Alternative legal service providers

The rise of Alternative Legal Service Providers (ALSPs) is creating significant opportunities within the legal services market. ALSPs offer innovative and cost-effective solutions, presenting clients with alternatives to traditional law firms. These providers specialize in services such as legal process outsourcing, contract management, and technology-driven legal solutions. Their flexible and often tech-enabled approaches appeal to clients seeking efficiency, cost savings, and specialized expertise. ALSPs are expanding the scope of services available to clients, fostering competition and driving improvements in service delivery.

As businesses increasingly recognize the benefits of outsourcing legal tasks to specialized providers, the legal services market is becoming more dynamic and diverse. ALSPs are not only meeting client demands for cost-effective solutions but also catalyzing a transformation in how legal services are conceptualized and delivered, thereby creating new avenues for growth and innovation in the broader legal services landscape.

Segment Insights

Fee Type Insights

Contingency fee arrangements dominate the legal services market, especially in personal injury, mass tort, and consumer protection lawsuits. This model allows clients to access legal services without upfront payments, empowering underserved populations, and increasing case volumes. The incentive-aligned model also pushes firms to accept only strong cases, enhancing efficiency and client trust. In the U.S., contingency-based work remains a pillar in plaintiff-side firms, particularly in jurisdictions like Texas and California where tort litigation is highly active.

Corporate fee segment is emerging as the fastest growth. Corporate legal departments are using value-based and predictable pricing models such as success-based billing flat rates and capped fees in response to pressure to cut legal expenditures. AFA adoption is being further accelerated by law firms using technology and project management to provide excellent legal work at a reduced cost. The areas where this change is most noticeable are M&A compliance and business contracts.

- In October 2024, Fennemore merged with Lucent Law, creating a technology-forward platform offering automated AFA billing options. As reported by Reuters, the firm integrated AI-powered pricing models to customize fees for corporate clients, particularly in contract review and regulatory advisory work.

Size Insights

Large firms dominate the legal services market, because of their extensive resources and capacity to manage intricate cross-border issues. They serve the government and multinational clientele and are frequently the first to use new billing and legal technology. Their market dominance across practice areas is maintained by their capacity to draw in elite legal talent and provide comprehensive services under one roof.

- In 2024, Thomson Reuters Report, Am Law 100 firms recorded an 8.4% increase in worked rates, outperforming mid-tier firms. Firms like Latham & Watkins and Kirkland & Ellis led this trend, reporting record revenues from their corporate and litigation practice groups.

Small firms' segment is emerging as the fastest growth, due to their agility, cost efficiency, and ability to serve local businesses and individuals with more personalized service. These firms often specialize in niche areas like immigration, IP filings, or local commercial disputes. With the rise of legal tech and virtual practice tools, small firms can now operate with enterprise-level efficiency at a fraction of the cost, making them highly competitive.

Practice Area Insights

Civil litigation segment dominates the legal services market, driven by business disputes; personal injury claims, consumer rights, and contract violations are among the many cases that are filed. For law firms, it is a significant source of income, especially for those that use hourly and contingency billing. This market niche gains from both strong demand during periods of economic stability and booms during downturns. 3. employment disputes and bankruptcies).

Intellectual property segment is emerging as the fastest growth, fueled by the boom in technology, biotech, AI, and digital content. Startups and established enterprises alike seek comprehensive IP services from patent filings to trademark defense and IP licensing. With AI-generated content and inventions on the rise, IP law is evolving rapidly and gaining relevance across sectors.

- 27 January 2025 – Fish & Richardson announced the opening of a new AI & Emerging Tech?focused IP office in Chicago ( Source: https://www.fr.com/ )

Regional Insights

What is the U.S. Legal Services Market Size?

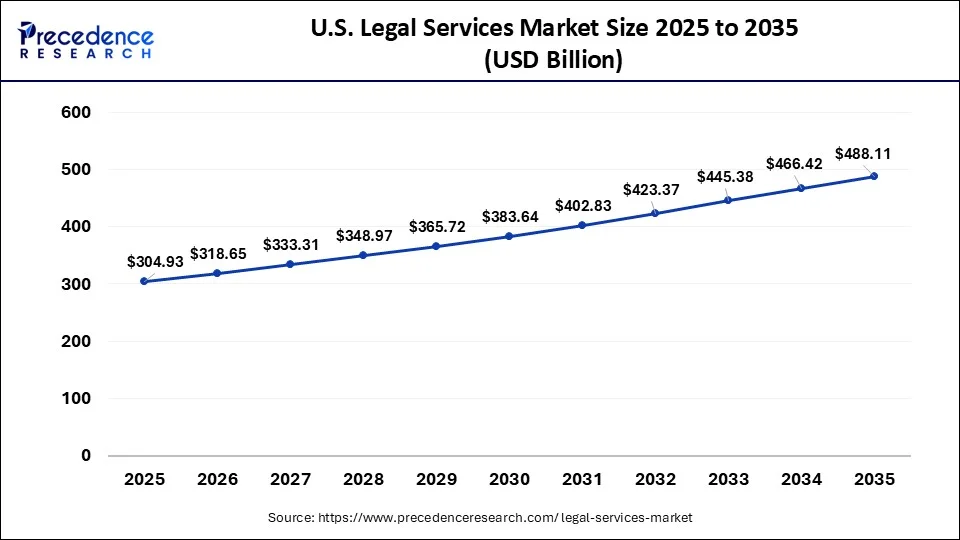

The U.S. legal services market size was exhibited at USD 304.93 billion in 2025 and is projected to be worth around USD 488.11 billion by 2035, growing at a CAGR of 4.82% from 2026 to 2035.

North America held a share of 42% in the legal services market due to its mature legal infrastructure, robust regulatory environment, and the presence of numerous multinational corporations. The region's advanced legal technology adoption, high demand for specialized legal expertise, and the prevalence of complex regulatory frameworks contribute to its major market share. Additionally, the concentration of leading law firms and legal service providers in North America further solidifies its position as a key player in the global legal services landscape.

Asia-Pacific is expected to witness rapid growth in the legal services market due to several factors. The region's robust economic development, increasing cross-border transactions, and a burgeoning middle class are driving the demand for legal expertise. Additionally, evolving regulatory frameworks and the rise of complex business structures contribute to heightened legal complexities. As businesses seek legal support for expansion and compliance, law firms and practitioners in the Asia-Pacific region are experiencing a surge in opportunities, making it a focal point for substantial growth in the legal services sector.

Meanwhile, Europe is experiencing notable growth in the legal services market due to various factors. The region's economic expansion, increasing cross-border transactions, and evolving regulatory landscapes are driving demand for legal expertise. Additionally, the digital transformation within the legal sector, with a growing emphasis on technology adoption, is enhancing efficiency and attracting clients. The demand for specialized legal services, particularly in areas like data protection and environmental law, further contributes to the market's growth as law firms adapt to meet the changing needs of businesses and individuals in the European market.

What are the Advancements in the Legal Services Market in Latin America?

Latin America is expected to witness substantial growth in the market, driven by various factors such as rapid economic expansion, increasing foreign direct investments, and evolving regulatory frameworks across the region. Countries such as Brazil and Mexico are leading players due to the rising number of startups, multinational corporations, and cross-border trade agreements. This has significantly increased the demand for legal services across numerous applications.

Brazil Legal Services Market Trends: Law firms and private attorneys in the country are increasingly leveraging AI-based legal research tools, contract automation software, and online dispute resolution platforms in order to meet the growing demand for effective legal solutions. Growth in sectors such as fintech, energy, healthcare, and international trade is driving demand for cross-border legal services and regulatory advisory expertise.

What are the Key Trends in the Legal Services Market in the Middle East and Africa Region?

The Middle East and Africa are expected to witness steady growth over the forecast years. This growth is driven by increasing foreign investments and the need for businesses to comply with local regulations. Governments in the region are optimizing their legal frameworks, which thus opens up various opportunities for legal service providers to offer compliance solutions. Countries like the UAE and South Africa are leading players in the region.

Saudi Arabia Legal Services Market Trends: The country's market landscape is characterized by a mix of local firms and international players. As businesses recognize the importance of legal compliance, the market is expected to expand even more in the upcoming years.

Legal Services Market Companies

- Baker McKenzie

- DLA Piper

- Clifford Chance

- Skadden, Arps, Slate, Meagher & Flom

- Allen & Overy

- Linklaters

- Freshfields Bruckhaus Deringer

- Latham & Watkins

- Kirkland & Ellis

- Jones Day

- Hogan Lovells

- White & Case

- Sidley Austin

- Mayer Brown

- Norton Rose Fulbright

Recent Developments

- In January 2025, Clifford Chance was recognized for its strategic positioning in anticipation of a resurgence in mergers and acquisitions (M&A) activity. The firm is focusing on leveraging technological advancements, particularly in generative AI, to enhance its services and maintain a competitive edge in the evolving legal landscape.

(Source: https://manda.be) - In February 2023, Latham & Watkins provided legal counsel for Tactile Systems Technology, Inc.'s USD 32.5 million Public Offering of Common Stock. Tactile Systems Technology is a medical technology company dedicated to developing devices for treating patients with underserved chronic diseases at home.

- In October 2022, Kirkland & Ellis offered legal advice to Nordic Capital, a prominent European private equity investor, on the successful closure of the Nordic Capital Fund XI. The fund reached its hard cap, securing EUR 9 billion (USD 9.5 billion) in capital commitments, exceeding the initial target of EUR 8 billion. This fund is strategically focused on buyouts within Nordic Capital's sectors of interest, including healthcare, technology, payments, financial services, and selectively in industrial and business services, reflecting a robust fundraising achievement within a nine-month timeframe.

Segments Covered in the Report

By Fee Type

- Contingency

- Non-Contingency

- Corporate

- Government

By Size

- Solo Practitioners

- Small Firms

- Medium Firms

- Large Firms

- In-house Legal Departments

- Government Agencies

By Practice Area

- Civil Litigation

- Corporate Law

- Employment Law

- Real Estate Law

- Criminal Law

- Intellectual Property

- Tax Law

- immigration Law

- Government Law

- Family Law

- Environmental Law

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting