What is the Lymphedema Diagnostics Market Size?

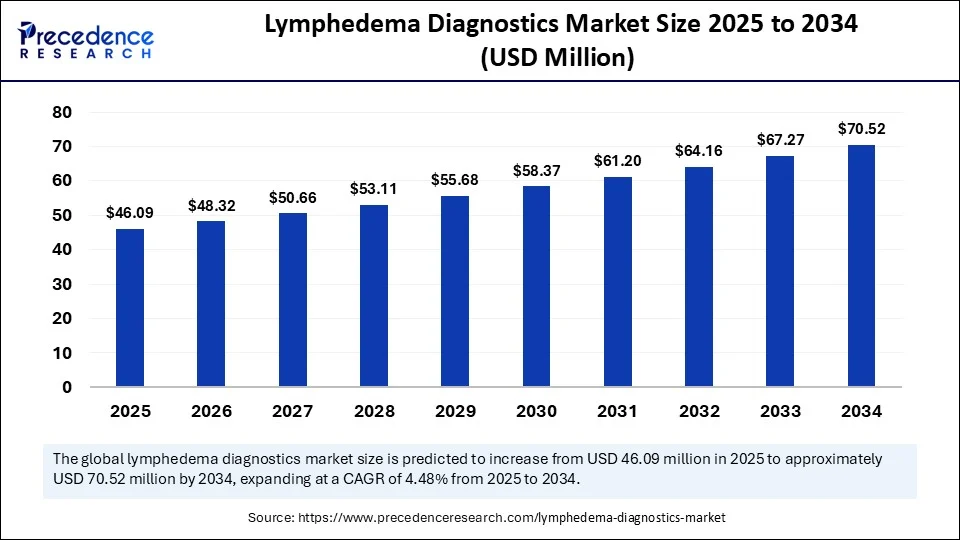

The global lymphedema diagnostics market size is accounted at USD 46.09 million in 2025 and is predicted to increase from USD 48.32 million in 2026 to approximately USD 70.52 million by 2034, expanding at a CAGR of 4.84% from 2025 to 2034. The market growth is attributed to the rising prevalence of cancer-related lymphedema and the increasing emphasis on early diagnosis. Advances in diagnostic technologies further support market growth.

Lymphedema Diagnostics MarketKey Takeaways

- North America dominated the global lymphedema diagnosis market in 2024.

- Asia Pacific is expected to grow at the highest CAGR from 2025 to 2034.

- By diagnostic technology, the lymphoscintigraphy segment held a major market share in 2024.

- By diagnostic technology, the near-infrared fluorescence imaging segment is projected to grow at a significant CAGR between 2025 and 2034.

- By application, the primary lymphedema diagnosis segment contributed the biggest market share in 2024.

- By application, the secondary lymphedema diagnostics segment is expected to expand at the fastest CAGR between 2025 and 2034.

- By end user, the hospitals and clinics segment led the market in 2024.

- By end user, the specialized lymphedema treatment centers segment is expected to grow at a significant CAGR over the projected period.

Strategic Overview of the Global Lymphedema Diagnostics Industry

The lymphedema diagnostics market refers to the global industry involved in the detection, assessment, and monitoring of lymphedema, a chronic condition characterized by abnormal accumulation of lymphatic fluid causing swelling, typically in the limbs. The market involves imaging technologies, bioimpedance spectroscopy, and physical measurement tools that help in early identification, severity grading, and treatment monitoring of lymphedema, particularly secondary lymphedema caused by cancer treatments, infections, or trauma. Accurate diagnosis is critical to prevent progression and improve quality of life.

The rise in cancer survivorship globally is driving high demand for superior lymphedema diagnostics, with early detection of secondary complications like lymphatic dysfunction being a top priority for clinicians. Imaging and measurement technologies used in lymphedema diagnosis, including lymphoscintigraphy, near-infrared fluorescence (NIRF) imaging, ultrasound, and bioimpedance spectroscopy (BIS), are key tools. These tools evaluate excess fluids and stagnation within lymphatic vessels to identify lymphedema symptoms at their earliest stages. Furthermore, the increasing awareness of the utility of these technologies, especially their incorporation into survivorship care plans, is expected to fuel market growth.

Artificial Intelligence: The Next Growth Catalyst in Lymphedema Diagnostics

Artificial Intelligence is revolutionizing lymphedema diagnostics by significantly enhancing the accuracy, speed, and efficiency of clinical assessment. Real-time analysis of complex data using these technologies provides objective results, reducing the chance of misdiagnosis. AI improves image interpretation and detects anatomical changes often missed by traditional methods. AI is crucial for implementing continuous monitoring and early warning systems for high-risk patients. Moreover, integrating AI into diagnostic platforms accelerates research and development of smarter, data-driven technologies. AI algorithms can analyze medical images to detect subtle signs of lymphedema, such as fluid accumulation, lymphatic vessel abnormalities, and tissue changes, often with greater speed and accuracy than human analysis. This can lead to earlier and more precise diagnoses.

Market Outlook

- Market Growth Overview: The lymphedema diagnostics market is expected to grow significantly between 2025 and 2034, driven by the rising cancer prevalence, innovation in diagnostic technologies, including near-infrared fluorescence imaging for real-time visualization and bioimpedance analysis for early detection, and personalized medicine.

- Sustainability Trends: Sustainability trends involve telehealth and remote diagnostics, AI and data analytics, and focus on early detection and preventive care.

- Major Investors: Major investors in the market include GE Healthcare, Siemens Healthineers, and Philips Healthcare.

- Startup Economy:The startup economy is focused on leveraging technologies like smartphone-based imaging, advanced bioimpedance, and AI-powered data analysis to improve early detection and monitoring

Lymphedema Diagnostics MarketGrowth Factors

- Growing Integration into Cancer Survivorship Protocols: Rising clinical emphasis on structured follow-up care is boosting demand for routine lymphedema diagnostic screening post-treatment.

- Advancements in Portable Diagnostic Devices: Technological innovations are driving the development of compact, real-time imaging tools for use in outpatient and home-based settings.

- Rising Inclusion in National Health Guidelines: Formal adoption of lymphedema diagnostic protocols in public health systems is fueling standardized assessments across primary and tertiary care.

- Expanding Role of Artificial Intelligence in Imaging: AI-driven diagnostic platforms enhancing image interpretation speed and accuracy, propelling adoption among multidisciplinary teams.

- Boosting Training Initiatives for Clinical Personnel: Medical institutions are scaling education programs to improve diagnostic competency, strengthening usage across diverse healthcare settings.

- Increased Availability of Reimbursement Frameworks: Health insurers and public payers are growing coverage for diagnostic procedures, driving broader access in high-risk populations.

- Surging Global Health Collaborations: Cross-border partnerships between NGOs, government bodies, and research centers are accelerating innovation and awareness in lymphedema diagnostics worldwide.

Market scope

| Report Coverage | Details |

| Market Size by 2034 | USD 70.52 Million |

| Market Size in 2026 | USD 48.32 Million |

| Market Size in 2025 | USD 46.09 Million |

| Market Growth Rate from 2025 to 2034 | CAGR of 4.84% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Diagnostic Technology, Application, End-User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

How is the Increasing Prevalence of Cancer-Related Lymphedema Driving Demand for Early and Accurate Diagnostics?

The market is projected to be driven by the growing prevalence of cancer-related lymphedema. This increase is likely to boost the expansion of early and precise diagnostics. A rising number of breast, gynecologic, prostate, and head and neck cancers has led to more patients requiring surgical removal of lymph nodes or radiation therapy. Early-stage diagnosis has proven critical, especially in cancer management, to prevent progression to advanced stages.

The National Cancer Institute (NCI) indicates that lymphedema affects around 20-30% of breast cancer survivors in the United States after treatment. The growing need to manage long-term treatment complications in oncology care has increased the demand for scalable and reliable diagnostic tools in the healthcare industry worldwide. Additionally, the drive to minimize the risk of lasting damage to the lymphatic system further fuels the demand for lymphedema diagnostics for early detection. Furthermore, increased awareness among healthcare professionals and the public about lymphedema leads to more frequent screenings and diagnoses.

(Source: https://www.cancer.gov)

Restraint

Limited Awareness and Inadequate Clinical Training Expected to Restrict Diagnostic Adoption

Limited awareness and clinical training are anticipated to hinder the growth of the lymphedema diagnosis market. In many regions, particularly in developing nations, healthcare professionals lack sufficient education in identifying and treating lymphedema. The absence of standardized diagnostic procedures and preliminary screening leads to underdiagnosis or misdiagnosis, especially in non-oncological cases. Even with technological advancements, the effectiveness of these tools is limited if frontline providers fail to integrate them into routine care. This lack of awareness significantly impedes the adoption of specialized diagnostic tools in general practice, thereby further restraining the market. Moreover, Advanced diagnostic technologies can be expensive, limiting their accessibility, particularly in resource-constrained settings.

Opportunity

How Are Surging Investments in Healthcare Infrastructure and Innovation Accelerating Growth in the Lymphedema Diagnostics Market?

Increasing investments in healthcare infrastructure and diagnostic innovation are projected to generate significant opportunities for market players. Both governments and individuals are increasing spending to improve the availability of diagnostic technologies in both rural and urban areas. Research and development in lymphatic imaging and fluid analysis technology has accelerated, leading to the introduction of compact devices incorporating AI. These advancements are experiencing quicker market adoption and broader clinical use across various care applications. Furthermore, the development of more accurate, non-invasive, and cost-effective diagnostic tools, such as advanced imaging techniques and point-of-care devices, is rising, opening up new opportunities in the market.(Source: https://pmc.ncbi.nlm.nih.gov)

Segment Insights

Diagnostic Technology Insights

Why Did the Lymphoscintigraphy Segment Dominate the Market in 2024?

The lymphoscintigraphy segment dominated the lymphedema diagnostics market, accounting for a 40–45% share in 2024. This imaging technique has been increasingly used in clinical practices due to its reliability in visualizing lymphatic drainage patterns and obstructions. Hospitals and cancer centers favor lymphoscintigraphy because it effectively evaluates both primary and secondary lymphedema. The method's suitability for nuclear medicine tools and its functional imaging capabilities enhance its applicability in post-cancer treatment scenarios. In 2024, a CDC-funded clinical trial demonstrated the procedure's efficacy in monitoring changes in breast cancer patients' lymphatic conditions over time. Moreover, the importance of lymphoscintigraphy in early diagnosis further boosts the demand for this diagnostic technology.

(Source: https://pubmed.ncbi.nlm.nih.gov)

The near-infrared fluorescence imaging (NIRF) segment is expected to grow at the fastest rate in the coming years. NIRF imaging offers real-time, in vivo visualization of superficial lymphatic structures using indocyanine green dye. This allows clinicians to monitor lymphatic flow without radiation exposure. Its minimal invasiveness and quick results make it suitable for both hospitals and outpatient settings.

Technological advances have led to portability and increased resolution, expanding its use globally. A 2024 FDA-supported pilot study highlighted NIRF imaging's utility in early detection, particularly in post-operative lymphedema cases. Furthermore, NIRF imaging's ability to improve treatment planning accuracy in complex lymphatic dysfunctions is expected to drive segment growth in the coming years.

(Source:https://pmc.ncbi.nlm.nih.gov)

Application Insights

What Made Primary Lymphedema Diagnosis the Dominant Segment in 2024?

The primary lymphedema diagnosis segment dominated the lymphedema diagnostics market with a 55-60% revenue share in 2024 because it is a condition present from birth or develops early in life, often requiring lifelong management. Early and accurate diagnosis is crucial for effective treatment and preventing complications. Diagnostic assessments of patients with unexplained limb edema and lymphatic formation irregularities are crucial. Experts have utilized innovative imaging and fluid evaluation methods to differentiate between primary lymphedema and other forms of chronic edema.

Clinical campaigns and studies have increased awareness of the hereditary nature of lymphatic disorders, leading to more early diagnoses. A 2024 study, funded by the National Institutes of Health and published in The New England Journal of Medicine, emphasized the use of genetic screening and lymphoscintigraphy in the diagnosis of early-onset primary lymphedema. Additionally, the focus on non-acquired lymphedema in adult, pediatric, and adolescent populations further supports this segment.

(Source:https://my.clevelandclinic.org)

(Source: https://www.ncbi.nlm.nih.gov)

The secondary lymphedema diagnosis segment is expected to grow at the fastest rate in the coming years due to rising cancer survivorship rates, leading to more cases following radiation therapy or lymph node dissection. Oncologists and rehabilitation specialists are increasingly incorporating diagnostic evaluations into post-treatment follow-up protocols. Additionally, increased federal funding for post-cancer rehabilitation programs, including routine lymphatic diagnostics, further supports the growth of this segment.

End User Insights

How Does the Hospitals Segment Dominate the Market in 2024?

The hospitals segment dominated the lymphedema diagnostics market, accounting for a 60% share in 2024, as these settings offer major lymphedema diagnostic procedures to cater to a broader patient base. Hospitals are the primary point of contact. The availability of advanced diagnostic tools in these settings attracts a large patient population. Doctors in hospitals regularly check patients for lymphatic complications, both in recovering cancer patients and those with chronic illnesses. Centralized care focuses on early detection and post-surgery care, supporting the use of diagnostic imaging techniques such as lymphoscintigraphy, ultrasound, and bioimpedance spectroscopy.

Clinical trials and collaborative research studies were also undertaken by the public and private hospitals, making them the center of primary diagnostics. The large patient inflow and investments in hospitals and clinics enable them to acquire and maintain modern diagnostic platforms, making them the most powerful end-user group globally. Hospitals are also crucial in providing access to lymphatic imaging, especially in low- and middle-income countries implementing cancer control measures, which further supports this segment.

The specialized lymphedema treatment centers segment is expected to grow at the fastest rate in the coming years. Specialized centers focus solely on lymphatic disorders, offering a comprehensive solution that includes diagnostics, therapy, and long-term follow-up. Technological advancements and the increased recognition of early-stage detection's importance drive improved referrals to these specialized facilities.

In 2024, the National Institutes of Health (NIH) supported initiatives to enhance special lymphedema treatment centers in high-cancer-incidence areas. Clinical guidelines from The Lancet Oncology in 2024 recommended referring patients to specialized facilities for advanced imaging, such as near-infrared fluorescence (NIRF) and tissue dielectric constant (TDC) analysis. Furthermore, countries testing regional lymphedema centers observed improved outcomes in both urban and peri-urban populations, confirming their relevance in national health policies.

(Source:https://pmc.ncbi.nlm.nih.gov)

(Source: https://www.ouhealth.com)

Regional Insights

What Made North America the Dominant Region in the Market?

North America dominated the lymphedema diagnostics market, capturing the largest revenue share in 2024. This is due to advanced healthcare infrastructure, strong oncology care networks, and the use of imaging technologies. The use of diagnostic tools in post-cancer treatment has propagated a steady demand from hospitals and clinics. The U.S. and Canada have incorporated procedures like lymphoscintigraphy, ultrasound, and bioimpedance spectroscopy into treatment models. There is high usage of telemedicine for remote monitoring and diagnosis, improving access to care, especially for patients in underserved areas.

In 2024, the BCRF estimated that approximately 4 million breast cancer survivors undergoing monitoring significantly drive secondary lymphedema diagnostics. The U.S. Food and Drug Administration (FDA) continues to approve innovative projects, such as AI-driven NIRF imaging systems, thereby increasing their availability in medicine. Major academic medical providers, including the Mayo Clinic and Johns Hopkins Medicine, have supported the clinical adoption and research, further fueling the market in this region.

(Source: https://www.bcrf.org)

U.S. Lymphedema Diagnostics Trends

U.S. integration of advanced imaging modalities, focus on early detection and preventive care, and expansion of telehealth and remote diagnostics. A holistic approach to patient management is becoming more prevalent, with collaborations among oncologists, radiologists, and physical therapists to ensure comprehensive evaluation and integrated treatment planning.

Asia Pacific is expected to grow at the fastest rate in the market during the forecast period, driven by rising investments in advancing healthcare infrastructure and enhancing access to diagnostic services in major countries like China, India, Japan, and South Korea. With the increasing cancer incidence and growing clinician awareness, there is a high demand for imaging techniques, especially in clinics with oncology departments in major cities. Moreover, the growing aging population supports market expansion, as the aging population is more susceptible to chronic diseases, including those that can cause lymphedema.

A 2024 report by The Lancet Regional Health – Western Pacific highlights a significant rise in diagnostic imaging use for post-radiation confirmation in cancer patients. In India, the government's national cancer care programs aim to increase access to ultrasound and bioimpedance equipment. Increased access to localized diagnostic technology and positive regulatory changes are boosting regional market growth through enhanced accessibility and affordability.

(Source:https://www.thelancet.com)

China Lymphedema Diagnostics Market Trends

China's increasing incidence of cancer and a corresponding rise in secondary lymphedema cases. The market is adopting advanced diagnostic technologies like bioimpedance analysis and AI integration for more accurate and early detection. The expansion of the domestic medical device industry and the use of telemedicine are key to improving access to care across the country.

Europe is expected to experience notable growth in the coming years. The region's strong regulatory environment, established cancer care infrastructure, and focus on early treatment have all contributed to the increased use of advanced diagnostic tools. Germany, France, the UK, and the Netherlands prioritized early lymphedema detection through national health systems, particularly for breast and gynecological cancer survivors. The European Society of Lymphology (ESL) 2024 emphasizes the use of bioimpedance spectroscopy and near-infrared fluorescence (NIRF) imaging in clinical procedures to enhance the validity of prognosis. These changes solidified Europe's position as a key player in lymphedema management, thereby maintaining its market leadership.

Germany Lymphedema Diagnostics Trends

Germany's its robust healthcare system and a high incidence of cancer-related lymphedema. Key trends include the widespread adoption of advanced technologies like BIA and MRI, with strong contributions from domestic leaders like Siemens Healthineers. The market benefits from substantial healthcare expenditure and a national emphasis on comprehensive, guideline-based care.

Lymphedema Diagnostics Market Value Chain Analysis

Research & Development (R&D) and Technology Development

This initial stage focuses on innovating and developing new diagnostic technologies and refining existing ones for improved accuracy, patient comfort, and cost-effectiveness.

- Key Players: ImpediMed Ltd, Curadel LLC., and Fluoptics.

Manufacturing & Production

This stage involves the production, assembly, and rigorous quality control of lymphedema diagnostic equipment, including imaging systems (MRI, CT, ultrasound) and specialized tools like BIA devices.

- Key Players: GE Healthcare (US), Philips Healthcare (Netherlands), and Siemens Healthineers (Germany)

Distribution & Sales

This stage involves the marketing, sales, and logistics required to deliver diagnostic equipment to end-users like hospitals, diagnostic centers, and clinics.

- Key Players: Canon Medical Systems (Japan), Hitachi (Japan), and Stryker Corporation (U.S.)

Post-Sales Service & Clinical Application

This final stage focuses on the clinical use of the diagnostic equipment, supported by installation services, training, maintenance, and technical support.

- Key Players: Mindray Medical International (China), Neusoft Corporation (China), and Diagnostic Centers and Hospitals (End-users)

Top Companies in the Lymphedema Diagnostics Market & Their Offerings

- Ambra Health: Ambra Health provides a cloud-based medical image management suite, which facilitates the sharing and management of diagnostic imaging data for conditions like lymphedema across healthcare providers.

- Dr Scholl's: While a consumer foot care brand, their products do not directly contribute to the diagnostic lymphedema equipment market. They primarily offer insoles and foot relief products, not medical diagnostic tools.

- GE Healthcare:GE Healthcare is a major manufacturer of advanced medical imaging modalities, including ultrasound, MRI, and CT scanners, which are essential tools for diagnosing and assessing the severity of lymphedema.

- Hologic, Inc.: Hologic focuses primarily on improving women's health through diagnostics and medical imaging systems for breast and skeletal health. They do not have a direct presence in the dedicated lymphedema diagnostics equipment market.

- ImpediMed Limited:ImpediMed is a key player and innovator in the lymphedema diagnostics market, providing bioimpedance spectroscopy (BIS) devices like the L-Dex system for the early, non-invasive assessment and monitoring of lymphedema.

- LymphaTech: LymphaTech develops smartphone-based 3D limb measurement technology, offering a portable and accessible way for clinicians to monitor lymphedema patients.

- Medtronic: LINQ™: Medtronic's LINQ™ is an implantable cardiac monitor used for diagnosing heart conditions, not lymphedema. It is a cardiac diagnostic tool and does not contribute to the lymphedema diagnostics market.

- Medtronic plc: Medtronic is a global leader in medical technology, but primarily focuses on devices for chronic diseases like diabetes, cardiovascular issues, and neurological disorders.

- Micropos Medical: Micropos Medical is a Swedish company focused on improving precision in cancer treatment, specifically prostate cancer, not lymphedema diagnostics. Their products do not contribute to the lymphedema market.

- Natus Medical Incorporated:Natus Medical provides products for screening, diagnosis, and monitoring of disorders affecting the brain, nervous system, and sensory organs. They do not operate in the lymphedema diagnostics market.

- NIRx Medical Technologies:NIRx specializes in near-infrared spectroscopy (NIRS) systems for functional brain imaging research. While related to NIR technology, their focus is on neuroscience, not lymphedema diagnostics.

- Perometer (CardioMed Devices): The Perometer system provides a non-contact method to measure limb volume and shape precisely, offering objective data for the diagnosis and monitoring of lymphedema. This device is widely recognized as a standard tool for accurate lymphedema assessment.

- Philips Healthcare:Philips is a major provider of advanced medical imaging systems, including high-resolution ultrasound and MRI, used extensively in the evaluation and diagnosis of lymphedema.

- Qosina Corporation: Qosina is a global supplier of single-use components for the medical device and pharmaceutical industries, not a manufacturer of finished diagnostic equipment.

- Siemens Healthineers: Siemens Healthineers is a leading medical technology company offering a vast portfolio of imaging and diagnostic equipment, including MRI, CT, and ultrasound machines essential for complex lymphedema diagnostics. Their robust R&D drives innovation in medical imaging, crucial for accurate diagnosis.

- SonoSite (Fujifilm): SonoSite is a leader in portable ultrasound technology, providing compact, durable ultrasound machines that are useful for point-of-care lymphedema assessment. Their technology aids in differentiating lymphedema from other conditions and assessing tissue characteristics efficiently.

- Stryker Corporation:Stryker is a major medical technology company focused on orthopedics, surgical equipment, and neurotechnology, not dedicated to lymphedema diagnostics equipment. Their products do not contribute to this specific diagnostic market.

- Tactile Medical:Tactile Medical develops and markets products for the treatment of lymphedema and other chronic circulatory conditions, primarily therapeutic devices like the Flexitouch system, not diagnostic equipment.

- Venosafe (Pico Technology): Venosafe appears to be a name associated with DVT prevention or unrelated diagnostics; Pico Technology is an electronics company specializing in oscilloscopes and data loggers.

- Evalution Medical: Information for a company named "Evalution Medical" in the context of lymphedema diagnostics is unavailable in general knowledge. It does not appear to be a major or currently active contributor to this specific market segment.

Latest Announcement by Industry Leader

- In June 2025, Tactile Systems Technology, Inc., a medical technology company specializing in therapies for chronic conditions, presented promising new clinical data at the American Society of Clinical Oncology (ASCO) 2025 Annual Meeting. The findings highlight significant clinical and quality-of-life benefits associated with the Company's Flexitouch Plus system compared to standard care in patients suffering from head and neck cancer-related lymphedema. The study, led by Dr. Barbara Murphy, Professor of Medicine and Director of the Head and Neck Research Program at Vanderbilt-Ingram Cancer Center, revealed that patients using Flexitouch Plus experienced reduced swelling, faster initiation of therapy, and improved quality-of-life outcomes. Dr. Murphy noted that traditional care approaches—such as therapist-guided treatments and self-managed home care—often face accessibility challenges, delaying critical therapy for many patients. “These access limitations mean many patients either go untreated or start treatment too late,” said Dr. Murphy. “Our research supports the role of advanced pneumatic compression systems as a viable, scalable solution that enhances patient outcomes and streamlines care delivery.” The results further reinforce the clinical value of innovative, home-based lymphedema management technologies, particularly in oncology rehabilitation pathways where early intervention remains critical.

(Source: https://www.globenewswire.com)

Recent Developments

- In January 2024, Medicare introduced a new Medicare benefit category covering lymphedema compression therapy supplies. This category includes a range of items, such as daytime and nighttime garments, adjustable wraps, and bandages, intended to support patients with varying forms of lymphedema across different body regions.

(Source: https://www.vgm.com) - In April 2023, AIROS Medical, Inc., a U.S.-based medical technology company, announced that it received FDA 510(k) clearance to market its AIROS 8P Sequential Compression Therapy device and garment system for lymphedema treatment. The clearance includes approval for expanded garment options such as lower truncal devices used to treat abdominal swelling. The AIROS 8P system is designed to enhance patient care by delivering clinically effective, non-invasive compression therapy in both clinical and home settings.

(Source:https://www.businesswire.com)

Segments Covered in the Report

By Diagnostic Technology

- Imaging Techniques

- Lymphoscintigraphy

- Magnetic Resonance Lymphangiography (MRL)

- Computed Tomography (CT) Lymphangiography

- Ultrasound Imaging

- Near-Infrared Fluorescence (NIRF) Imaging

- Bioimpedance Spectroscopy (BIS)

- Circumferential Measurement Tools

- Tape Measures

- Perometers

- Other Diagnostic Tools

- Tissue Dielectric Constant (TDC) measurement devices

- Tonometry

By Application

- Primary Lymphedema Diagnosis

- Secondary Lymphedema Diagnosis

- Post-Surgical Monitoring

- Therapeutic Effectiveness Monitoring

By End-User

- Hospitals and Clinics

- Diagnostic Laboratories

- Specialized Lymphedema Treatment Centers

- Ambulatory Care Centers

- Home Healthcare Providers

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting