What is the Machining Market Size?

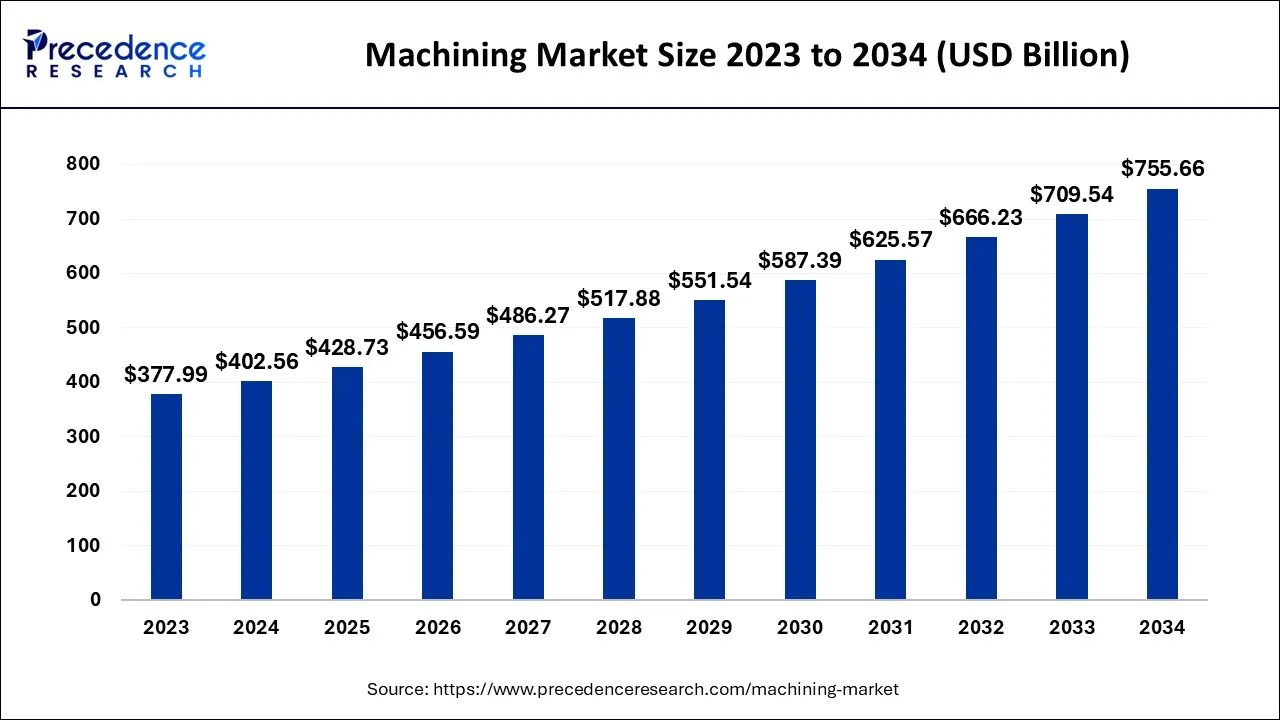

The global machining market size is calculated at USD 428.73 billion in 2025 and is predicted to increase from USD 456.49 billion in 2026 to approximately USD 799.90 billion by 2035, expanding at a CAGR of 6.44% from 2026 to 2035.

Machining Market Key Takeaways

- By region, the Asia Pacific region leads the market.

- By type, the segment for CNC lathe machines will likely grow substantially.

- By end-use, the industrial sector leads most of the machining market and will have the most significant growth over the following years.

Market Overview

The machining market refers to the industry that involves the manufacturing of various components and parts through the use of machine tools. Machining is a process that involves removing material from a workpiece to create the desired shape and size. It is commonly used in industries such as automotive, aerospace, electronics, and general manufacturing.

Machining is utilized to produce multiple products made of metal, it may also be used to process materials, including plastic, wood, ceramic, and composites. A specialist in machining is known as a machinist. "machine shop" describes a location, building, or establishment where machining is done. Modern machining is primarily done using computer numerical control, which employs computers to control the movement and usage of mills, lathes, and other cutting tools. As the CNC machine doesn't require a human operator to run it, efficiency improves, and labor costs for the machine are reduced.

Machining Market Growth Factors

The global machining market is accelerated by factors such as industrial expansion, rising demand for precise components, improving economies and technological advancements. The growing oil and gas sector needs will majorly propel the metal machining market's expansion. The requirement for oil and gas increased due to the quick industrialization and urbanization of developing nations like China and India and rising energy consumption. Major oil and gas firms are emphasizing expanding their exploration and production (E&P) activities to meet the growing energy demand. In the oil and gas business, metal machining is frequently utilized to construct pipelines, oil rigs, and other infrastructure. Additionally, it is used to set up compression stations and inspection gauges, which keep an eye on flow rate and pressure to guarantee that materials are transported without incident. The need for metal machining operations will increase along with the growth of E&P activities.

The automotive industry category was the primary source of market growth for metal machining. Given the extensive use of metal parts in the automobile industry, it is one of the most significant end-user segments of the worldwide metal machining market. The fastest-growing market for machining is in the Asia Pacific region, which will provide market vendors with several chances for expansion over the estimated time frame.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 428.73Billion |

| Market Size in 2026 | USD 456.49 Billion |

| Market Size by 2035 | USD 799.90Billion |

| Growth Rate from 2026 to 2035 | CAGR of 6.44% |

| Largest Market | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Type, End-Use, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Rising penetration of automation and integration

The use of automation and integration is another trend in the machining market. CNC machining is typically one stage of a multi-step, multi-machine, multi-operation process in manufacturing facilities. Many businesses are now integrating and connecting their CNC machining operations with other systems to speed up this procedure and increase efficiency.

The rise of Industry 4.0 technologies, like the Internet of Things (IoT) and big data analytics, is a wonderful illustration of the future of CNC machining. These technologies enable real-time communication between CNC machines and other systems, allowing them to share information and plan actions. This will assist in increasing the production process's effectiveness and speed while lowering the likelihood of mistakes and failures. For instance, a CNC machine can use IoT technology to alert a maintenance worker when a tool has to be replaced or when it has to be serviced. This might decrease downtime and raise the general dependability of the machining operation.

Restraint

Size Limitations

One of the benefits of hand production is the machinist's ability to manipulate a large part. The dimensions of the machined item may be restricted for some CNC machining tasks. The most significant amount a shop can manufacture depends on the enclosure's size and the tool's travel distance. The accuracy of the tools used to work on the part may be impacted by its size. The likelihood of distortion rises because the material is under more stress. The machine could need extra setup or operator training to ensure the machining tools are in the right starting positions in relation to the design and part size before the manufacturing process is finished. Extra-large or heavy pieces might not work well with CNC machining, depending on what needs to be made.

Opportunity

The use of alternative materials

Aluminum, steel, and brass have all traditionally been the metals on which machining has been utilized. But a significant trend in CNC machining over the past several years has been using alternative materials. This covers the utilization of composites, polymers, and other unusual materials. The rising demand for lightweight, high-strength materials in sectors like aerospace and automotive contributes to this trend. These materials can offer a variety of advantages, such as higher performance, decreased emissions, and improved fuel efficiency. For instance, using carbon fiber-reinforced polymers (CFRPs) in the aerospace sector can aid in lowering aircraft weight, which can enhance fuel economy and lower emissions.

For instance, using carbon fiber-reinforced polymers (CFRPs) in the aerospace sector can aid in lowering aircraft weight, which can enhance fuel economy and lower emissions. Similarly, using advanced composites in the automotive industry can help in lightening the load on vehicles, increase fuel efficiency, and lower pollutants. The growing desire for individualized and customized products contributes to the push toward alternative materials. For instance, the ability to create personalized products on demand due to 3D printing and other additive manufacturing processes has led to many businesses adopting CNC machining to complete and perfect these products. This includes using materials that, when used using typical machining techniques, might be challenging or impossible, such as resins, ceramics, and other unconventional materials.

Segment Insights

Type Insights

The segment for CNC lathes is expected to grow at a notable rate during the forecast period. CNC lathes are widely used to clamp the materials and to move them in multiple axes. The technological advancements in the CNC lathes operations are observed to offer a lucrative growth opportunity for the segment during the forecast period. One of the significant technological advancements in the market is the penetration of Computer Numerical Control to command exact design-related instructions.

The CNC laser machine market is also expected to expand significantly. The segment is anticipated to grow over the forecast period due to the rising demand for CNC laser-cutting machines from multiple manufacturing businesses to address the shortage of semiconductors in such industries.

End-Use Insights

The industrial segment holds the largest share of the machining market; the segment is expected to sustain its dominance during the forecast period. Industries such as electronics, packaging, and medicine have enormous demand for automated machines for manufacturing purposes. The massive demand for machines and tools in the industrial sector is to boost the productivity and capacity of manufacturing units by implementing cost-cutting strategies.

On the other hand, the automotive segment is expected to grow at a robust rate during the forecast period. The rising development of electric vehicles, along with the increasing demand for customized parts such as motor pumps and cylinder heads, will promote the growth of the segment.

Regional Insights

How is the Remarkable Dominating Position of the Asia Pacific in the Machining Market in 2025?

The Asia-Pacific region held the largest share of the marketshare and is expected to continue expanding throughout the projection period. During the anticipated time, sales of CNC machines are expected to treble, reaching 800 thousand units in 2022. Manufacturing outsourcing is becoming increasingly necessary due to the rise in industrial equipment sales, the accessibility of cheap raw materials, and the low cost of operations. As a result, CNC machine sales will increase over the coming years. With the presence of potential manufacturing industries in the countries of Asia Pacific, the demand for machine tools with increased productivity and reduced costs is expected to grow. Moreover, the booming automotive industry in countries such as China, Japan, and India will promote the growth of the market in the upcoming period.

India Machining Market Trends

India is rising through government initiatives and policy support, technological transformation, and global supply chain shifts. In November 2025, the IT Ministry approved seven private electronics component investments in Tamil Nadu, Madhya Pradesh, and Andhra Pradesh. Overall, strong industrial demand, technological modernisation, and policy support are positioning India's machining market for robust long-term growth.

In March 2025, the Production Linked Incentive (PLI) scheme supported ₹1.61 lakh crores in investment, ₹5.31 lakh crores in exports, and ₹14 lakh crores in production.

How is Europe Growing Significantly in the Machining Market?

The market in Europe will likewise experience significant growth in the upcoming years. Germany, Italy, France, and the nations of Central and Eastern Europe are the countries that are driving the growth. The rising industrialization and rapid adoption of advanced technologies are held as a significant factor for the growth of the market in Europe. Moreover, the rising emphasis on new-generation tools and machines in the region with the presence of potential key players in the industry plays a significant role in the market's development in Europe.

What Factors Drive North America's Fastest-Growing Lead in the Machining Market?

North America is expected to grow at the fastest rate in the market during the forecast period, owing to innovation in material processing, Industry 4.0, and automation integration. Workforce and skills are a persistent focus: the region continues to face a skills gap in areas like CNC programming, machine setup, automation integration, and data analytics. In October 2025, Stellantis planned to invest $13 billion to expand production in the U.S. with five new vehicle launches and 19 product actions over the next four years.

U.S. Machining Market Trends

The U.S. market is expanding due to federal policies and incentives, and a rapid shift towards domestic production. Digitalisation in machining extends to software-driven process planning and simulation, which improves programming efficiency and material utilization. In January 2025, GE Vernova, America's leading energy manufacturer, planned to invest almost $600 million in factories and facilities in the U.S. over the next two years.

What are the Major Factors Contributing to the Machining Market within South America?

South America is expected to experience notable growth during the forecast period due to infrastructure development, trade agreements, sustainability, and supply chain localization. Overall, steady demand for precision components, gradual uptake of CNC and automation technologies, and emphasis on workforce skills are shaping moderate but ongoing expansion of the South American machining market.

What Opportunities Exist in the Middle East and Africa in the Machining Market?

MEA is expected to grow at a lucrative rate in the market in the coming years, driven by smart manufacturing, economic plans, and supportive policies. There's growing emphasis on local manufacturing and supply chain resilience to reduce dependence on imports for precision parts and tooling. Incentives and industrial policies in countries like Saudi Arabia and the UAE encourage localization of machining operations, especially for defense, automotive, and infrastructure projects.

Machining Market - Value Chain Analysis

- Raw Material Sourcing (Metals, Electronics)

This stage is driven by a shift to sustainable materials, regional diversification, and AI-driven procurement.

Key Players: Tata Steel, Hindalco Industries, ArcelorMittal, Vedanta Ltd, Nucor Corporation. - Maintenance and After-Sales Service

In this stage, the rising trends are remote diagnostics and AR, additive manufacturing for parts, and maintenance-as-a-service

Key Players: DMG MORI, Haas Automation, ABB, Rockwell Automation. - Product Lifecycle Management

This stage includes concept, design, development, prototyping, production, launch, service, support, retirement, and disposal.

Key Players: Siemens Digital Industries Software, Dassault Systèmes, PTC, Autodesk, OpenBOM, Aras.

Machining MarketCompanies

- AMADA Co. Ltd.

- Bystronic Laser AG

- Atlas Copco AB

- DMG MORI Co Ltd

- Guangzhou Komaspec Mechanical and Electrical Products Manufacturing Co. Ltd.

- FANUC Corp.

- IPG Photonics Corp.

- Jet Edge Inc.

- Jenoptik AG

- JTEKT Corp.

- Mayville Engineering Co. Inc.

- Messer Cutting Systems Inc

- Matcor Matsu Group Inc.

- Okuma Corp.

- Otter Tail Corp.

- Shenyang Yiji Machine Tool Sales Co. Ltd.

- Sandvik AB

- Yamazaki Mazak Corp.

- TRUMPF GmbH Co. KG

- DN Solutions Co. Ltd.

Recent Developments

- In November 2025, AMADA Co., Ltd. announced that it had begun to accept the official order for the three-dimensional laser integrated system named ALCIS-1008e with blue laser and scanner head specifications. The system is developed to perform different laser processes like welding, cutting, and laminating on a single machine. (Source: amada.co.jp )

- In October 2025, Bystronic Laser AG signed an agreement to acquire the ‘tools for materials processing' business unit of Coherent Inc., attractive additional growth markets, like medical devices, semiconductors, and general manufacturing, and will be expanded through this agreement.

(Source: bystronic.com) - In January 2023,Teach-T, a teaching device to teach students CNC technology capabilities, was introduced as a prototype by Mitsubishi Electric India's Computerised Numerical Controllers (CNC) division. According to Masaya Takeda, General Manager of Mitsubishi Electric India's CNC Systems, the equipment designed and constructed in India will be released to the market in the upcoming fiscal year. To help customers with their machining needs, Mitsubishi Electric CNC offers an advanced CNC control system.

- b HireCNC, a website that was launched in February, connects job seekers and employers to streamline the hiring process for CNC-related positions. Candidates can now search for employment possibilities on a single platform, including CNC machinists. The website lists hiring companies and open vacancies. Additionally, employers (machine shops) now have access to a job board whose readership is exclusively focused on CNC machining. At the time of its introduction, the website featured about 8,700 jobs in Canada and the United States that were associated with CNC.

- In September 2022,the brand-new M800V and M80V series Computerised Numerical Controllers (CNCs) from Mitsubishi Electric India was introduced with cutting-edge technologies. The new M800V and M80V series will add a fresh perspective and develop current CNC technology while facilitating efficient manufacturing for the producers. The new series' cutting-edge control features enable machines to perform a variety of 'things' quickly and accurately. The new M80V and M800V offer multiple benefits such as increased number of control axes and increased fine segment processing capability, improved Screen Design and Multi-touch operation and 3D machining simulation.

- In August 2022,CNC expert NUM introduced a new CNC platform that raises the bar for machine control performance. The FlexiumPro CNC platform from NUM improves upon the Flexium+ CNC system, which was the company's first version, calculating power, speed, connectivity, and dependability. A Codesys V3 PLC and a CNC unit are included in FlexiumPro's real-time kernel (RTK). Advanced system-on-chip (SoC) technology is used to implement the RTK based on a multi-core ARM CPU. According to this technique, fewer components enhance system reliability and compactness.

Segment Covered in the Report

By Type

- Lathe Machines

- Laser Machines

- Milling Machines

- Grinding Machines

- Winding Machines

- Welding Machines

- Others

By End-Use

- Automotive

- Aerospace & Defense

- Construction Equipment

- Power & Energy

- Industrial

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting