Menstrual Hygiene Management Market Size and Forecast 2025 to 2034

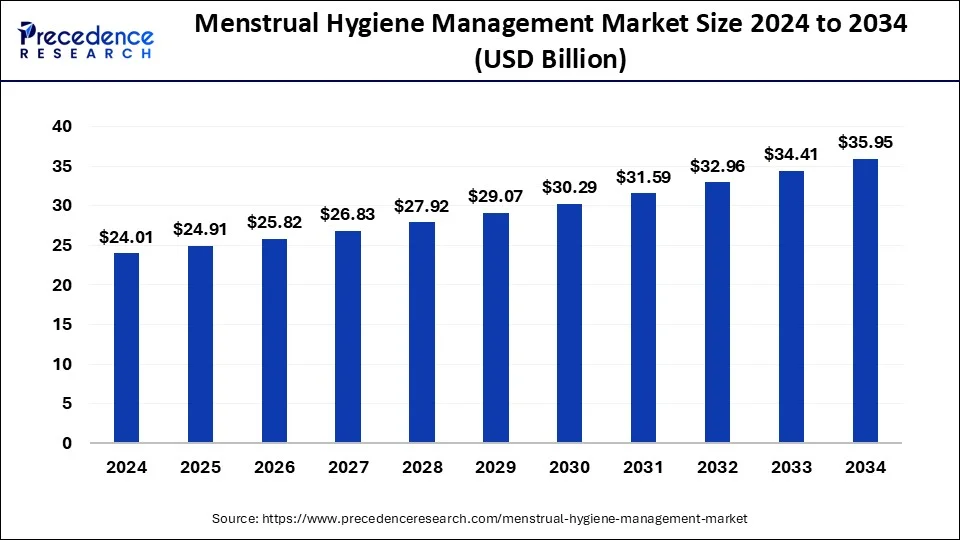

The global menstrual hygiene management market size was estimated at USD 24.01 billion in 2024 and is predicted to increase from USD 24.91 billion in 2025 to approximately USD 35.95 billion by 2034, expanding at a CAGR of 4.20% from 2025 to 2034. Educational programs and menstrual hygiene awareness campaigns, supported by the government and NGOs, are leading to exponential market growth.

Menstrual Hygiene Management Market Key Takeaways

- The global menstrual hygiene management market was valued at USD 24.01 billion in 2024.

- It is projected to reach USD 35.95 billion by 2034.

- The menstrual hygiene management market is expected to grow at a CAGR of 4.20% from 2025 to 2034.

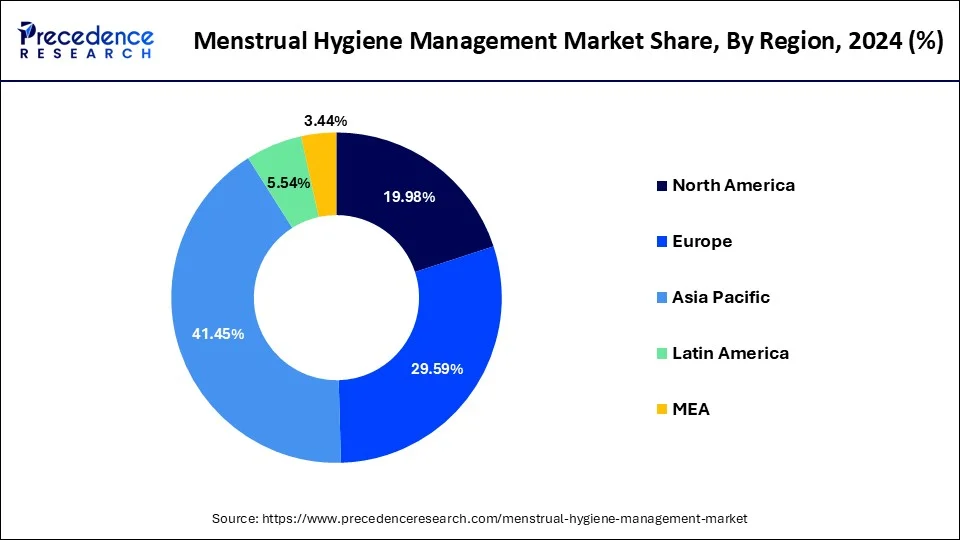

- Asia Pacific dominated the global market with the largest market share of 41.45% in 2024.

- North America is expected to expand significantly during the forecast period.

- By product type, the sanitary pads segment contributed the highest market share of 85% in 2024.

- By usability, the disposable segment captured the biggest market share of 80.4% in 2024.

- By distribution channel, the retail pharmacy segment generated a major market share of 35.6% in 2024.

Asia Pacific Menstrual Hygiene Management Market Size and Growth 2025 to 2034

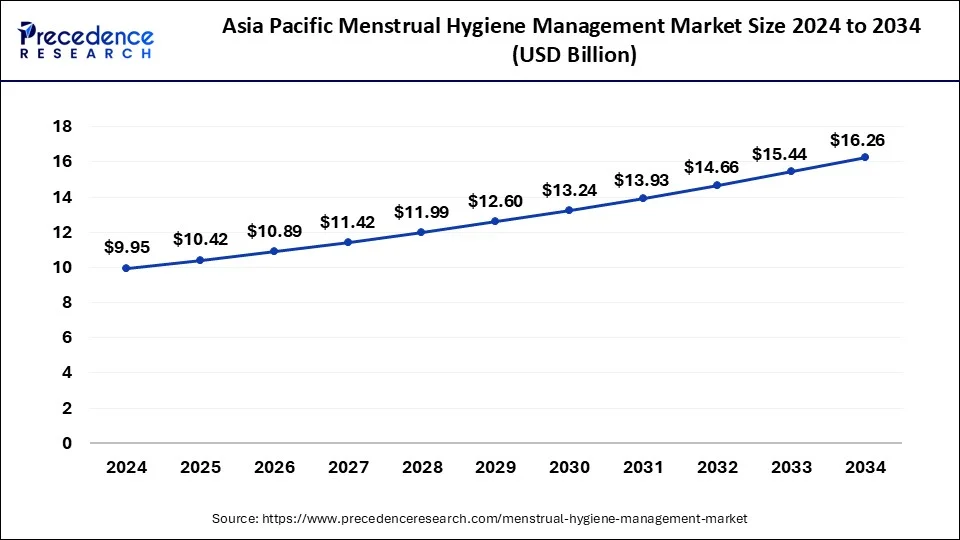

The Asia Pacific menstrual hygiene management market size was estimated at USD 9.95 billion in 2024 and is projected to surpass around USD 16.26 billion by 2034 at a CAGR of 5.10% from 2025 to 2034.

Asia Pacific has dominated the menstrual hygiene management market and is expected to grow substantially in the upcoming years. Many developing countries, such as India, which is most prominently emerging as robust economies, are supporting various public and private institutions or social workers that throw light on the importance of feminine hygiene and health.

Various government bodies across Asian Pacific are providing funds to educate teenage girls and women about menstruation and how to embrace it to be healthy as a person. They are making efforts to launch favorable policies and initiatives for girls and women in rural areas. So that they can access feminine hygiene products and take advantage of them at a reasonable rate. Such efforts are fueling the growth of the global market.

- The Ministry of Health and Family Welfare has implemented the Scheme for the Promotion of Menstrual Hygiene among adolescent girls in the age group of 10-19 years since 2011. The National Health Mission supports the scheme through the State Programme Implementation Plan (PIP) route, which is based on the proposals received from the States. Under the scheme, the Accredited Social Health Activist (ASHA) provides a pack of sanitary napkins to adolescent girls at a subsidized rate of Rs. 6 per pack.

- In the global market for menstrual hygiene management, North America is expected to expand significantly during the forecast period. The growth of the region can be due to the presence of developed countries like Canada, the U.S., and Mexico, where the standard of living is generally higher, and women are well-educated and aware of feminine hygiene and products related to it. Additionally, major players in the menstrual hygiene management market have come up with innovative and comfortable feminine hygiene products that raise the prevalence of use by many girls and women in the region.

Most women in North America opt for eco-friendly and sustainable hygiene products due to the increasing awareness of plastic hazards to the environment. As plastic is not easily degradable, it adversely affects the whole ecosystem of nature, including animals. Hence, the surge in cotton-based sanitary napkins and eco-friendly menstrual cups has increased, and thus, it is the major reason for the proliferation of the menstrual hygiene management market. Due to this, sanitation practices have improved for several women.

- In December 2022, Trace Femcare, based in North America, launched a cottony and regenerative hemp fiber tampon, which is beneficial to the environment as well. By acknowledging the adverse effects of non-disposable tampons, they provide an eco-friendly tampon. Hence, such innovative and collective efforts shape the growth of the market in North America.

- According to the data, nearly 20 billion tampons and sanitary pads are disposed of in North America annually.

Market Overview

The menstrual hygiene management market focuses on products and services tailored to help women manage their menstrual cycles comfortably and hygienically. This market includes a wide range of products, such as sanitary pads, tampons, menstrual cups, and panty liners, as well as related services like educational programs and menstrual hygiene awareness campaigns.

In recent years, there has been a growing awareness of the importance of menstrual hygiene, leading to increased demand for safer and more sustainable menstrual products. This trend has driven innovation in the market, with companies developing eco-friendly and reusable options to cater to environmentally conscious consumers. Overall, the menstrual hygiene management market is expected to continue growing as more women prioritize their health and environmental sustainability together.

Additionally, initiatives aimed at promoting menstrual health and hygiene in developing countries have further boosted market growth. Governments, NGOs, and international organizations are working together to improve access to menstrual products and education, particularly in rural and undeveloped areas. Innovations in product design and increased awareness about menstrual health are driving factors shaping the future of this menstrual hygiene management market.

Menstrual Hygiene Management Market Growth Factors

- Increasing awareness about menstrual hygiene's importance drives market growth.

- Rising adoption of eco-friendly menstrual products, like menstrual cups and reusable pads, due to environmental concerns.

- Government and nonprofit initiatives promote menstrual health education and access to affordable products, especially in developing countries.

- Improvements in distribution channels enhance accessibility of menstrual products in both urban and rural areas.

- Heightened awareness, environment-conscious consumer preferences, supportive initiatives, and improved accessibility collectively fuel market expansion.

- Continued growth is expected as these trends offer more options and opportunities for menstrual health and hygiene worldwide.

- Innovations in product design, such as leak-proof materials and comfortable shapes, enhance user satisfaction.

- Cultural shifts towards accepting menstruation as a natural process contribute to increased acceptance and demand for menstrual hygiene products.

- Technological advancements, like period tracking apps and online platforms for product purchases, provide convenience and personalized solutions for users.

- Collaborations between governments, NGOs, and private sector organizations facilitate a menstrual health program globally.

- Growing demand for organic and natural menstrual products reflects a broader consumer trend towards health-conscious and sustainable lifestyles.

- Expansion of education initiatives targeting schools and communities helps break taboos and empower individuals with knowledge about menstrual health and hygiene.

- Research and development efforts focus on creating innovative solutions, such as biodegradable materials and customizable menstrual products, to meet evolving consumer needs.

Market Scope

| Report Coverage | Details |

| Market Size in 2024 | USD 24.01 Billion |

| Market Size in 2025 | USD 24.91 Billion |

| Market Size by 2034 | USD 35.95 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 4.20% |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Usability, Distribution Channel, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Growing awareness about menstrual hygiene

The major driver fueling the growth of the menstrual hygiene management market is the increasing awareness about menstrual hygiene and its impact on overall health. In many parts of the world, there has been a significant shift in attitudes toward menstruation, with more open discussions and education about the importance of maintaining good menstrual hygiene practices.

As people become more informed about the risks associated with poor menstrual hygiene, such as infections and reproductive health issues, there is a growing demand for products and services that promote cleanliness and comfort during menstruation. This heightened awareness has led to a cultural shift towards menstruation and viewing it as a natural and normal part of women's lives. Moreover, with the rise of social media and digital platforms, information about menstrual health and hygiene is more accessible than ever before. Individuals are able to access resources, share experiences, and engage in conversations about menstrual hygiene, leading to increased awareness and empowerment of women.

As a result, consumers are actively seeking out products that not only provide effective stain protection but also prioritize their health and well-being. This has prompted companies to innovate and develop a wide range of menstrual products, from eco-friendly options to those tailored to specific needs and preferences. Overall, the growing awareness about menstrual hygiene is a driving force behind the expansion of the menstrual hygiene management market, shaping consumer preferences, product innovation, and initiatives aimed at promoting menstrual health worldwide.

Restraint

Cultural taboos and stigma

A significant restraint in the menstrual hygiene management market is the limited access to affordable and high-quality products for certain regions. Cultural taboos and stigma surrounding menstruation can impact the demand for menstrual hygiene products in some regions, leading to lower market penetration and slower growth.

In societies where menstruation is taboo, there may be reluctance among people to purchase or use menstrual products openly, leading to suppressed demand. Additionally, cultural norms and economic constraints may restrict the availability and affordability of menstrual products, particularly in rural or underserved areas. Addressing these barriers requires not only initiatives to challenge cultural taboos and stigma but also efforts to improve access to affordable menstrual products and comprehensive menstrual health education.

Furthermore, the lack of awareness about menstrual health and education and not enough campaigns can contribute to misconceptions and false information about menstrual hygiene, further impeding market growth. Without proper education and access to affordable products, individuals may be prompted to use an unhygienic alternative or wrong menstrual hygiene practices altogether, which can have serious health consequences. By addressing these challenges, the menstrual hygiene management market can better serve all individuals, regardless of cultural background or social status; it will unlock its full potential for growth on a global scale.

Opportunity

Adoption of innovative menstrual products

The future opportunity in the menstrual hygiene management market lies in the development and adoption of innovative menstrual products tailored to specific needs and preferences. As awareness about menstrual health continues to grow, there is a growing demand for products that offer enhanced comfort, convenience, and sustainability. Moreover, advancements in technology present opportunities for the integration of smart features into menstrual products. This could include the development of period-tracking apps, wearable devices, or connected sensors that provide personalized insights and recommendations for menstrual health management.

One such notable opportunity is the expansion of eco-friendly and sustainable menstrual products. With increasing concerns about environmental sustainability, there is a rising interest in alternatives to traditional disposable pads and tampons. This presents an opportunity for companies to develop and market eco-friendly options such as menstrual cups, reusable cloth pads, and biodegradable materials. These products not only reduce environmental impact but also offer cost savings and long-term benefits for users.

Furthermore, there is an opportunity to innovate in product design to address diverse user needs and preferences. This includes developing products that are suitable for individuals with sensitivities or allergies, as well as those with specific lifestyle or cultural requirements. For instance, there is potential for the development of customizable menstrual products that allow users to adjust absorbency levels or sizes to fit their unique preferences.

Product Insights

The sanitary pads segment held the dominant share of the market in 2024 and is expected to grow at the fastest rate during the projected period. This dominance of the segment is attributed to many factors, such as the wide availability of sanitary napkins in urban areas, disposable type of pads, heightened awareness of menstrual hygiene, etc.

The sanitary napkins segment includes various types of products ranging from age-wise and for heavy blood flow or less blood flow during menstrual days, such as ultra-thin napkins, overnight napkins, cotton napkins, or regular-size pads. Therefore, it has a prominent effect on the global market to drive exponentially. Also, major players in the market are bound to launch an innovative product for feminine hygiene, which is creating a buzz in the market.

- In November 2022, Billie Inc., a U.S.-based brand company, was acquired by Edgewell, a personal care company. This will help Edgewell expand its portfolio into a broader range of women's personal care products.

Menstrual Hygiene Management Market Revenue, By Product 2022-2024 (USD Billion)

| Product | 2022 | 2023 | 2024 |

| Sanitary Pads | 18,884.3 | 19,654.8 | 20,415.8 |

| Tampons | 1,179.2 | 1,230.8 | 1,282.1 |

| Menstrual Cups | 314.3 | 327.7 | 341.0 |

| Panty Liners | 632.1 | 657.3 | 682.2 |

| Menstrual Underwear | 241.6 | 249.9 | 257.9 |

| Others | 959.1 | 993.9 | 1,027.9 |

Usability Insights

The menstrual hygiene management market is mainly categorized into disposable and reusable types. The disposable segment dominated the market in 2024. The growth of the disposable segment is attributed to the increasing awareness about feminine hygiene and the importance of using disposable products to avoid further menstrual-related diseases. Many women have preferred to use disposable pads due to their convenience as they are highly absorbent for period blood flow, and they can be worn for a longer time than conventional cotton pads that need to change frequently as they are not as absorbent.

Despite these benefits, disposable pads are incorporated with chlorine compounds that contain small traces of dioxin. According to the Environmental Protection Agency in the US, dioxin is hazardous not only to the environment as it's hard to degenerate in the soil even after years, but it is the most potent ‘carcinogenic' compound which may be triggered to develop ovarian cancer in the females who used it for the long run. Hence, to avoid such a disaster, it must be disposed of in a way that it can be decomposed easily, or the product must be preferred, which is not incorporated with dioxin to save the ovarian health of females.

Menstrual Hygiene Management Market Revenue, By Usability2022-2024 (USD Billion)

| Usability | 2022 | 2023 | 2024 |

| Disposable | 17,778.7 | 18,546.8 | 19,309.3 |

| Reusable | 4,431.9 | 4,567.7 | 4,697.6 |

Distribution Channel Insights

The supermarket/hypermarket segment held a notable share of the menstrual hygiene management market in 2024. It is also projected to grow at the highest CAGR rate in the foreseen period. The growth of this segment can be considered due to various factors, such as supermarkets providing multiple ranges of feminine hygiene products, including a variety of sanitary pads and menstrual cups, with great offers.

The shopping experience in supermarkets is pleasant for consumers due to its aesthetic presence and organized products, as well as the availability of assistance for the customers in the supermarket. It gives a sense of understanding the consumer's need, and they are more vocal and open to which product a consumer is exactly searching for. Women are more comfortable purchasing feminine hygiene products, including sanitary pads, as supermarkets offer a wide range of products from multiple brands at discounted prices.

Moreover, some hypermarket systems are now working on IoT-based solutions to automate processes like billing, which is less time-consuming in the modern era. All these factors are boosting the supermarket segment in the menstrual hygiene management market on a global platform.

Menstrual Hygiene Management Market Revenue, By Distribution Channel 2022-2024 (USD Billion)

| Distribution Channel | 2022 | 2023 | 2024 |

| Retail Pharmacy | 7,872.9 | 8,211.8 | 8,548.0 |

| Hospital Pharmacy | 665.4 | 683.8 | 701.3 |

| E-commerce channels | 5,543.8 | 5,792.9 | 6,041.1 |

| Brick & Mortar | 3,311.2 | 3,427.8 | 3,541.4 |

| Supermarket/Hypermarket | 4,817.2 | 4,998.2 | 5,175.1 |

Menstrual Hygiene Management Market Companies

- Johnson & Johnson Private Limited. (U.S.)

- Procter & Gamble (U.S.)

- Kimberly-Clark (U.S.)

- Essity Aktiebolag (publ) (Sweden)

- Kao Corporation (Japan)

- Daio Paper Corporation (Japan)

- Unicharm Corporation (Japan)

- Premier FMCG (South Africa)

- Ontex (Belgium)

- Hengan International Group Company Ltd. (China)

- Drylock Technologies (Belgium)

- Natracare LLC (U.S.)

- First Quality Enterprises, Inc. (U.S.)

- Bingbing Paper Co., Ltd. (China)

- TZMO SA (Poland)

- Quanzhou Hengxue Women Sanitary Products Co., Ltd. (China)

- Rael (U.S.)

- Redcliffe Hygiene Private Limited (India)

- The Keeper, Inc. (U.S.)

- STERNE (India)

- MeLuna GmbH (Germany)

- Diva International Inc. (Canada)

- Hygienic Articles (Mexico)

Recent Developments

- In January 2022, a women-friendly project was launched by the government of Rajasthan, India. Known as,” I am Udaan”. This project cost INR 200 crore which is designed to provide free sanitary napkins to each girl and woman in the Rajasthan state regardless of their socio-economic status and their locality.

- In February 2022, Thinx, INC., was acquired by the Kimberly–Clark Corporation. Thinx, Inc. It is a leading provider of feminine care products, such as reusable menstrual products and underwear designed for menstrual days. This acquisition will help the enterprises strengthen their hold in the global menstruation hygiene management market while providing a broad range of personal care products to expand the company's portfolio.

Segments Covered in the Report

By Product

- Sanitary Pads

- Tampons

- Menstrual Cups

- Pantyliners

- Menstrual Underwear

- Others

By Usability

- Disposable

- Reusable

By Distribution Channel

- Retail Pharmacy

- Hospital Pharmacy

- E-Commerce Channels

- Brick & Mortar

- Supermarket/Hypermarket

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting