Dental Hygiene Devices Market Size and Forecast 2025 to 2034

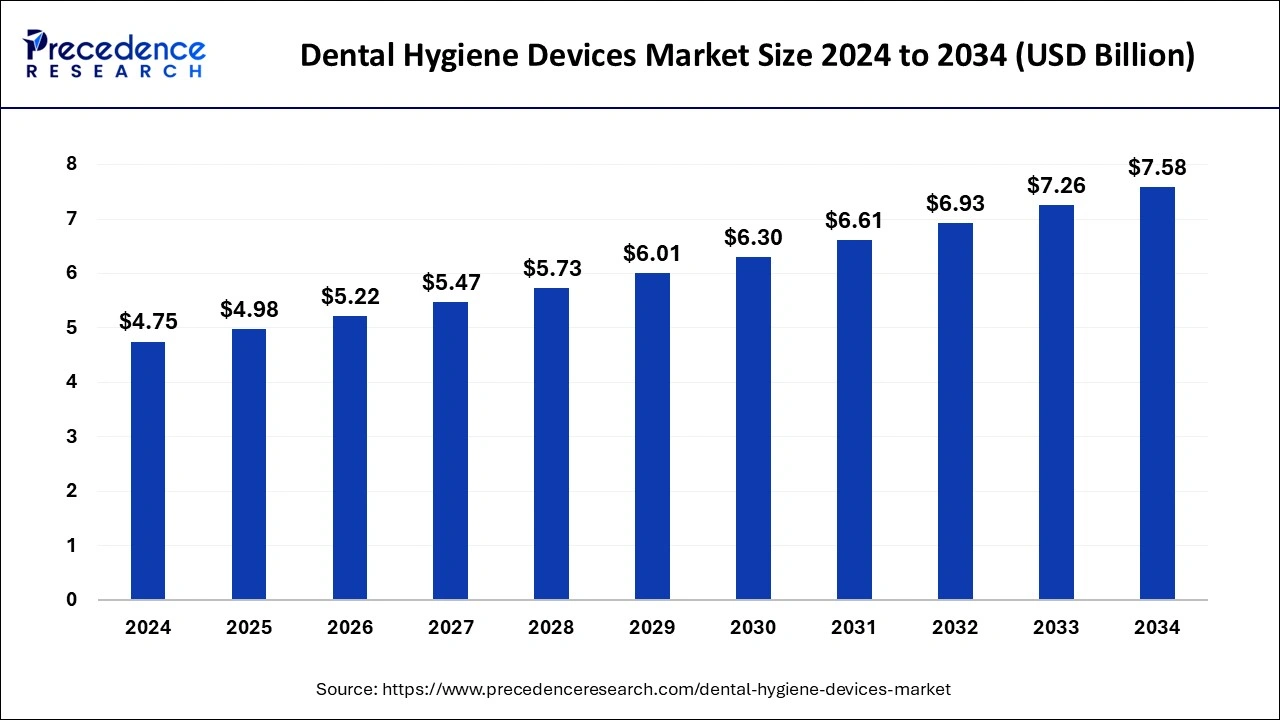

The global dental hygiene devices market size accounted for USD 4.75 billion in 2024 and is predicted to increase from USD 4.98 billion in 2025 to approximately USD 7.58 billion by 2034, expanding at a CAGR of 4.78% from 2025 to 2034. People worldwide are becoming more conscious of the need for good dental hygiene, driving the desire for dental hygiene products.

Dental Hygiene Devices Market Key Takeaways

- The global dental hygiene devices market was valued at USD 4.75 billion in 2024.

- It is projected to reach USD 7.58 billion by 2034.

- The market is expected to grow at a CAGR of 4.78% from 2025 to 2034.

- North America held the largest share of the market in 2024.

- Asia Pacific is expected to grow rapidly during the forecast period.

- By type, the toothbrush segment held the largest share of the market in 2024.

- By type, the dental polishing devices segment is expected to expand significantly during the forecast period.

- By application, the hospital pharmacies segment dominated the market in 2024.

- By application, the online pharmacies segment is expected to gain a significant share of the market during the forecast period.

Market Overview

The value of good dental health for general well-being as well as appearance has come to light more and more. The need for dental hygiene products has increased as a result of this awareness. Significant technical improvements in the dental hygiene sector have resulted in the creation of more effective and user-friendly gadgets. This covers developments in oral care devices such as water flossers and electric toothbrushes.

A greater population needs dental care as a result of global population aging. The need for specialist dental hygiene products among the elderly to preserve oral health is driving the dental hygiene devices market expansion. People are more inclined to spend money on oral hygiene products and other personal care items when their disposable incomes improve.

People are becoming more and more focused on preventing dental problems rather than treating them after they arise, which is a shift toward preventive dentistry. This mentality change increases the need for dental hygiene products that guard against oral health issues. Dental tourism, the practice of people traveling abroad for dental work because the cost is cheaper or the care is of higher quality, has been increasing. People are becoming more aware of the need to maintain their oral health both before and after dental operations, which in turn is driving up demand for dental hygiene products. Although the pandemic first caused problems for the dental sector, it also raised public awareness of good hygiene, particularly oral hygiene.

Dental Hygiene Devices Market Growth Factors

- The need for dental hygiene products is being driven by the rise in dental issues such as cavities, gum disease, and oral cancer. The dental hygiene devices market is growing as people become more conscious of oral health issues and seek out treatments and preventative measures.

- As the world's population ages, age-related dental conditions such as tooth decay, gum disease, and tooth loss are becoming more common. It is anticipated that this generational trend will increase demand for oral irrigators, electric toothbrushes, and flossing tools. This drives the growth of the dental hygiene devices market.

- Growing disposable income in emerging economies enables people to spend more on dental treatment as well as other forms of healthcare. Advanced dental hygiene gadget adoption is being driven by this trend, particularly in areas where dental healthcare infrastructure is increasing.

- Governments and healthcare organizations worldwide are strongly emphasizing preventative dental care to lessen the burden of oral disorders and related healthcare expenses. Mouthwashes, toothbrushes, and interdental cleaners are among the home dental hygiene products in high demand due to this emphasis. This drives the growth of the dental hygiene devices market.

- The dental hygiene devices market is becoming more and more in demand due to the growing trend of dental tourism, particularly in nations that provide excellent dental care at affordable prices. For maintenance and post-treatment care, patients who visit overseas for dental procedures frequently buy oral hygiene products.

Market Scope

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 4.78% |

| Market Size in 2025 | USD 4.98 Billion |

| Market Size in 2024 | USD 4.75 Billion |

| Market Size by 2034 | USD 7.58 Billion |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type and Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Increasing disposable income

Consumers who have more disposable income would be more inclined to spend more on high-end dental hygiene products with improved functionality, cutting-edge features, and increased convenience. More education and better health awareness are frequently correlated with higher levels of disposable income. Customers might, therefore, place a higher priority on dental health and be more prepared to spend money on preventive dental care items.

Increased disposable income can support the dental hygiene industry's R&D initiatives, resulting in advancements in technology, materials, and product design. Expanding disposable income leads to an overall expansion of the consumer market. As a result, oral hygiene gadget producers may be able to reach out to hitherto untapped markets and demographics, expanding the dental hygiene devices market as a whole.

Restraint

Supply chain disruptions

In the dental hygiene devices market, medical-grade metals and polymers are among the specialty materials used to make several dental hygiene products. Production delays and shortages may result from disruptions in the availability of these resources brought on by pandemics, natural disasters, or geopolitical unrest. Most dental hygiene products are produced in a single location and sold all over the world. Product delivery to clients may be delayed by delays in transportation, which can be brought on by traffic jams at ports, a shortage of cargo capacity, or geopolitical events that impact trade routes. Supply chains can be disrupted by shifts in customer demand, particularly during recessions or public health emergencies. Production levels may be difficult for manufacturers to change appropriately, which could result in shortages or overstock.

Opportunity

Rising oral health awareness

People are actively looking for ways to maintain their oral health in order to avoid dental issues like cavities, gum disease, and bad breath as the emphasis on preventative healthcare grows. The dental hygiene devices market products that enhance preventive oral care include electric toothbrushes, water flossers, and tongue cleaners. These tools provide more effective cleaning than conventional methods. In order to preserve their general well-being, people in metropolitan regions and the middle and upper-middle-income groups emphasize using high-quality dental care items. As a result, there is a rising need for oral hygiene products designed specifically for older persons. Examples of these products include ergonomically designed electric toothbrushes, simple-to-use water flossers, and mouthwashes.

Type Insights

The toothbrush segment held the largest share of the dental hygiene devices market in 2024. In the market, which includes a broad range of items intended to preserve oral health, the toothbrush is a mainstay. There are several types of toothbrushes available in this market, such as powered and manual models. These are manual toothbrushes, which require the user to move the brush in order to clean the teeth and gums. To accommodate individual tastes and dental demands, they are available in a variety of forms, sizes, and bristle arrangements. When compared to manual toothbrushes, electric toothbrushes can deliver more effective and consistent brushing, which has led to their increasing popularity. Typically, they use acoustic, oscillating, or rotating movements to efficiently remove dirt and plaque. As a result of technological advancements, data-tracking and connection features have been integrated into smart toothbrushes.

The dental polishing devices segment is expected to expand significantly during the forecast period. Dental polishing tools are essential for preserving dental health since they clean the surfaces of teeth of stains, plaque, and tartar. These gadgets are vital instruments that dental practitioners employ during regular cleanings and operations, according to the dental hygiene equipment market. In order to ensure user-friendliness and reduce fatigue for dental professionals during lengthy procedures, ergonomics is a major consideration in the design of dental equipment. In order to ensure patient safety and hygiene, dental polishing tools are frequently used in conjunction with disposable prophy angles. Cross-contamination between patients is avoided by using these single-use attachments. Dental polishing tools should work with a variety of prophy pastes to meet the demands and preferences of different patients.

Application Insights

The hospital pharmacies segment dominated the dental hygiene devices market in 2024. Hospital pharmacies are essential to the dental hygiene devices industry because they supply patients receiving dental treatments or operations in hospital settings with dental care goods and equipment. Toothbrushes, dental floss, mouthwashes, dental irrigators, and more specialized equipment, including dental chairs, X-ray machines, and sterilizing devices, are all considered dental hygiene gadgets. Hospital pharmacies provide a range of dental hygiene products to meet the requirements of patients who are being admitted for oral surgery or other treatments. When procuring dental hygiene devices, hospital pharmacists give precedence to quality assurance and adherence to regulatory guidelines. To manage the provision of dental hygiene supplies, hospital pharmacies frequently work closely with the hospital's dental departments or clinics.

The online pharmacies segment is expected to gain a significant share of the dental hygiene devices market during the forecast period. The distribution channel where dental hygiene goods are offered through online platforms run by pharmacies is known as the "online pharmacies" segment in the dental hygiene equipment industry. Due to customer convenience and the growing trend of online purchasing, this area has experienced tremendous development in recent years.

A large selection of dental hygiene supplies, including toothbrushes, toothpaste, mouthwash, dental floss, and other oral care items, are available from online pharmacies. From the comfort of their homes, customers may peruse a variety of products, evaluate costs, read customer reviews, and make purchases. The increasing popularity of online pharmacies for oral hygiene products can be attributed to this convenience feature.

Regional Insights

North America held the largest share of the dental hygiene devices market. In order to preserve oral health and cleanliness, a broad range of goods and technologies are included in the North American market. This market comprises a range of products, including mouthwashes, oral irrigators, toothbrushes, dental floss, and other accessories for oral hygiene.

The dental hygiene devices market is being driven by an increasing understanding of the significance of oral cleanliness and its influence on general health. North America's aging population increases the risk of dental problems, which drives up demand for dental hygiene supplies and equipment. North American consumers can now afford to spend more on high-end dental hygiene products, which is driving the market's rise.

Asia Pacific is expected to grow rapidly during the forecast period. A number of factors have contributed to the regions dental hygiene devices market steady growth. Key drivers include an aging population, rising disposable incomes, and increased knowledge of oral health. Furthermore, technological developments that have resulted in the creation of novel oral hygiene products have also fueled market expansion.

Threats to the dental hygiene devices market expansion, however, come from issues like pricing pressure, especially in emerging economies, and the existence of counterfeit goods. Different countries have different regulatory needs and standards. Thus, businesses operating in the region must navigate these differences carefully. Government campaigns to raise awareness of oral health issues and to increase access to dental treatment in rural regions have also spurred market expansion.

Recent Developments

- In November 2023, with an aim to meet the demand for high-quality oral healthcare products, ICPA Health, a Mumbai-based pharmaceutical company in the oral healthcare sector, unveiled its latest innovation- Plakoff, a premium electric water flosser. The instrument, designed as a handheld oral care device, Plakoff utilizes a powerful jet of water to effectively cleanse the interdental space between teeth and gums. ICPA Health has a 14% market share in the Rs 1,050 crore prescription-based Indian dental market, covering approximately 70% of India's dental surgeons through its extensive franchise network.

- In February 2023, On Monday, Frimline Private Limited made the Dente91 She launch announcement. As per the company's statement, this toothpaste is the first of its kind in India, designed specifically to enhance and promote dental health in women. Women have hormonal changes throughout their lives, from puberty to menopause, which makes them more prone to dental conditions like gingivitis, caries, and hypersensitivity. In light of this, Frimline claimed to have created toothpaste specially meant to treat oral health problems in women.

Dental Hygiene Devices Market Companies

- 3M

- Danaher

- Colgate Palmolive Co

- Dentsply Sirona

- Straumann

- GC corporation

- Carestream health

- BIOLASE inc

- Ivoclar Vivadent

Segment Covered in the Market

By Type

- Toothbrush

- Dental Polishing Device

- Dental Scalers

- Others

By Application

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting