What is the Microsurgical Robotic System Market Size?

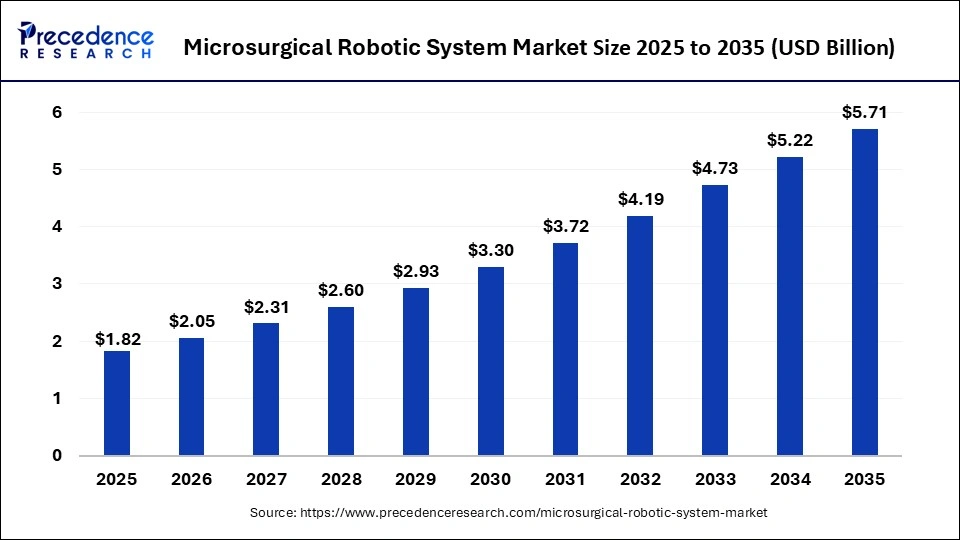

The global microsurgical robotic system market size is accounted at USD 1.82 billion in 2025 and predicted to increase from USD 2.05 billion in 2026 to approximately USD 5.71 billion by 2035, representing a CAGR of 12.11% from 2026 to 2035.

Microsurgical Robotic System Market Key Takeaways

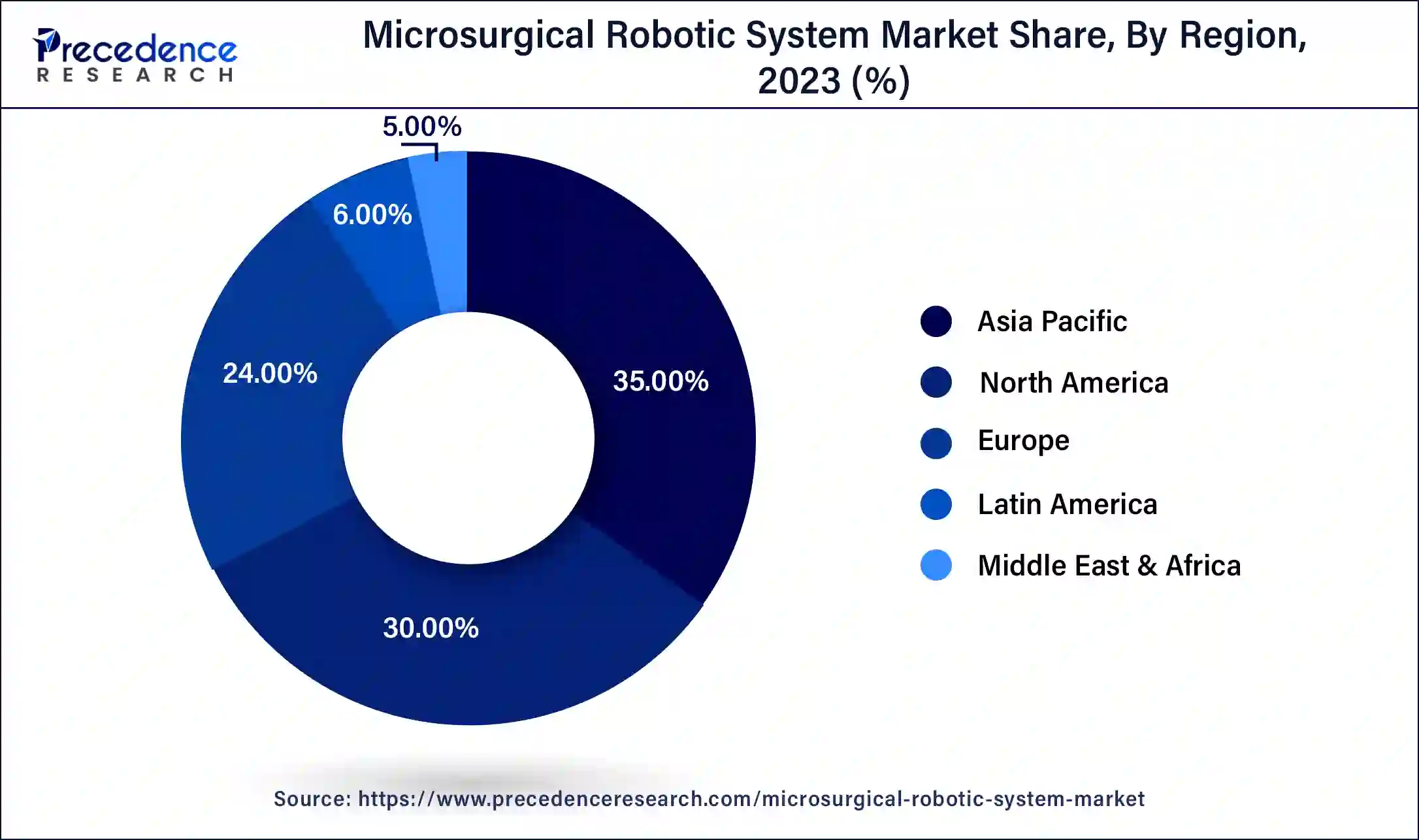

- Asia-Pacific contributed more than 35% of revenue share in 2025.

- North America is estimated to expand the fastest CAGR between 2026 and 2035.

- By application, the obstetrics and gynecology surgery segment has held the largest market share of 32% in 2025.

- By application, the ophthalmology surgery segment is anticipated to grow at a remarkable CAGR of 14.2% between 2026 and 2035.

- By end-use, the hospitals and clinics segment generated over 41% of revenue share in 2025.

- By end-use, the research institutes segment is expected to expand at the fastest CAGR over the projected period.

Market Overview

A microsurgical robotic system is an advanced medical technology that combines the precision of robotics with the intricacy of microsurgery. This system utilizes robotic arms, often equipped with miniaturized instruments and cameras, to perform delicate surgical procedures with high precision. The surgeon controls the robotic system through a console, translating their hand movements into precise actions by the robotic arms. This allows for greater dexterity and accuracy, particularly in procedures that involve intricate movements or operate on small structures within the body.

The advantages of a microsurgical robotic system include reduced invasiveness, minimized tissue damage, and enhanced visualization, making it particularly beneficial for procedures such as neurosurgery, ophthalmic surgery, and vascular surgery. The system's ability to scale down the surgeon's movements and filter out hand tremors contributes to improved patient outcomes and faster recovery times. While these systems are continually evolving, their integration into medical practice represents a significant leap in the field of surgery, offering new possibilities for complex and precise interventions.

Microsurgical Robotic System Market Growth Factors

- Technological Advancements: Ongoing innovations and advancements in robotic technology are driving the growth of the microsurgical robotic system market, enabling more sophisticated and precise surgical interventions.

- Increasing Surgical Applications: The expanding range of surgical applications, including neurosurgery, ophthalmic surgery, and vascular surgery, is fueling the demand for microsurgical robotic systems, as they offer enhanced precision in delicate procedures.

- Rising Aging Population: The growing aging population globally is contributing to increased demand for minimally invasive surgeries, where microsurgical robotic systems play a pivotal role, driving market growth.

- Improved Patient Outcomes: Microsurgical robotic systems are associated with improved patient outcomes, such as reduced recovery times and minimized tissue damage, which is encouraging their adoption and driving market expansion.

- Investments in Research and Development: Significant investments in research and development by healthcare companies and institutions are leading to the introduction of more advanced and efficient microsurgical robotic systems.

- Surge in Chronic Diseases: The rise in chronic diseases, such as neurological disorders and eye conditions, is creating a higher demand for microsurgical robotic systems to address complex surgical challenges associated with these conditions.

- Increasing Awareness among Surgeons: Growing awareness among surgeons about the benefits of microsurgical robotic systems, including improved precision and control, is boosting their adoption in various medical specialties.

- Global Acceptance of Robotic-Assisted Surgery: The increasing acceptance of robotic-assisted surgery as a standard practice in healthcare is driving the demand for microsurgical robotic systems worldwide.

- Government Initiatives and Support: Supportive government initiatives and funding for the adoption of advanced medical technologies, including microsurgical robotic systems, are propelling market growth.

- Surge in Ambulatory Surgical Centers: The increasing number of ambulatory surgical centers opting for microsurgical robotic systems due to their efficiency and effectiveness in minimally invasive surgeries is contributing to market expansion.

- Advancements in Imaging Technologies: Integration with advanced imaging technologies, such as augmented reality and 3D visualization, is enhancing the capabilities of microsurgical robotic systems, attracting surgeons and driving market growth.

- Expanding Healthcare Infrastructure: Growth in healthcare infrastructure, particularly in emerging markets, is creating new opportunities for the adoption of microsurgical robotic systems.

- Patient Preference for Robotic Surgery: Growing patient preference for robotic-assisted surgeries, considering the associated benefits like reduced scarring and faster recovery, is stimulating the demand for microsurgical robotic systems.

- Increasing Disposable Income: Rising disposable income levels in developing countries are facilitating greater affordability of advanced medical procedures, contributing to the growth of the microsurgical robotic system market.

- Regulatory Approvals: Stringent regulatory standards and approvals for robotic surgical systems are instilling confidence in healthcare professionals, driving adoption and market expansion.

- Growing Medical Tourism: The rise in medical tourism, particularly for specialized surgeries, is boosting the demand for microsurgical robotic systems in regions known for their advanced healthcare facilities.

- Training and Education Programs: Increasing availability of training and education programs for surgeons to enhance their skills in using microsurgical robotic systems is fostering greater adoption in the medical community.

- Integration with Artificial Intelligence: The integration of microsurgical robotic systems with artificial intelligence for real-time decision support is emerging as a key growth factor, improving surgical outcomesb and attracting healthcare providers to invest in these technologies.

- In 2022, Stryker generated 18.4 billion U.S. dollars in sales revenue, up from 17.1 billion in the previous year.

Market Scope

| Report Coverage | Details |

| Growth Rate from 2026 to 2035 | CAGR of 12.11% |

| Market Size in 2025 | USD 1.82 Billion |

| Market Size in 2026 | USD 2.05 Billion |

| Market Size by 2035 | USD 5.71 Billion |

| Largest Market | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Application, End-use, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Minimally invasive surgeries and improved patient outcomes

Minimally Invasive Surgeries (MIS) and the consequential improvement in patient outcomes are key drivers surging the demand for microsurgical robotic system. The adoption of these systems enables surgeons to perform intricate procedures through small incisions, reducing trauma to surrounding tissues. This results in minimized scarring, faster recovery times, and shorter hospital stays, meeting the growing patient preference for less invasive interventions.

Improved patient outcomes associated with microsurgical robotic system, such as reduced postoperative complications and enhanced precision, instill confidence among both healthcare providers and patients. These systems offer a level of accuracy and control that is challenging to achieve through traditional surgical methods, leading to better overall results. As the healthcare industry increasingly prioritizes patient-centered care and efficient recovery processes, the demand for microsurgical robotic systems continues to surge, driven by the tangible benefits of minimizing invasiveness and optimizing patient outcomes.

Restraint

Microsurgical robotic system

Maintenance expenses serve as a significant restraint on the growth of the microsurgical robotic system market. While the initial investment in acquiring these advanced systems is substantial, ongoing maintenance costs add a layer of financial burden for healthcare institutions.

Regular updates, software upgrades, and technical support contribute to the overall cost of ownership, making it challenging for some facilities to sustain the long-term use of microsurgical robotic systems. The need for specialized technicians and engineers to perform maintenance tasks further escalates expenses.

These maintenance-related financial pressures can deter healthcare providers, especially those with limited budgets, from adopting or expanding the use of microsurgical robotic systems. To overcome this restraint, there is a growing need for innovative business models, such as service agreements and cost-effective maintenance plans that address the financial concerns associated with the continual upkeep of these sophisticated medical technologies.

Opportunity

Wider application spectrum

The expansion of the application spectrum is a pivotal factor creating significant opportunities in the microsurgical robotic system market. Beyond its current applications in neurosurgery and ophthalmology, the versatility of microsurgical robotic systems opens doors to a broader range of medical specialties. Emerging opportunities lie in fields like microvascular surgery, plastic surgery, and other intricate procedures where the precision and dexterity of robotic assistance are beneficial.

As technology evolves to accommodate diverse surgical needs, healthcare providers can explore new avenues for adopting microsurgical robotic systems, thereby driving market growth. This wider application spectrum not only enhances the market's overall attractiveness but also positions these systems as versatile tools across various medical disciplines, contributing to their acceptance and utilization in an expanding array of surgical interventions.

Application Insights

In 2025, the obstetrics and gynecology surgery segment had the highest market share of 32% on the basis of the application. In the realm of microsurgical robotic system, the obstetrics and gynecology surgery segment specifically focus on utilizing robotic assistance in surgeries pertaining to women's reproductive health. Current trends reveal a growing inclination towards incorporating microsurgical robotic systems in various gynecological procedures, including but not limited to hysterectomies and myomectomies.

This inclination is primarily attributed to the technology's heightened precision and capacity to minimize invasiveness. The adaptability of these systems to execute intricate maneuvers in delicate anatomical areas is also fostering their integration into obstetric procedures, showcasing a promising pathway for advancing minimally invasive surgical approaches within the domain of women's healthcare.

The ophthalmology surgery segment is anticipated to expand at a significant CAGR of 14.2% during the projected period. Ophthalmology surgery within the microsurgical robotic system market involves the use of robotic technology for precise and intricate eye surgeries. This segment encompasses procedures such as retinal surgery, cataract surgery, and corneal surgery. The trend in ophthalmology surgery with microsurgical robotic systems is marked by advancements in image-guided procedures, enhanced visualization, and improved control during delicate eye surgeries. Surgeons benefit from the technology's ability to execute minute maneuvers, contributing to better outcomes and reduced postoperative complications in ophthalmic interventions.

End-use Insights

According to the end-use, the hospitals and clinics segment has held a 41% revenue share in 2025. The hospitals and clinics segment in the microsurgical robotic system market refers to the utilization of these advanced systems in medical facilities for various surgical procedures. Trends indicate a growing adoption of microsurgical robotic systems in hospitals and clinics, driven by the demand for precision in surgeries, reduced recovery times, and minimal invasiveness.

As these systems become more integrated into the surgical workflow of healthcare institutions, there is a trend toward enhancing surgeon training programs and optimizing the operational efficiency of microsurgical robotic technology within hospital and clinic settings.

The research institutes segment is anticipated to expand fastest over the projected period. The research institutes segment in the microsurgical robotic system market refers to academic and research institutions utilizing these systems for experimental surgeries, training programs, and innovative medical studies.

A notable trend in this segment is the increasing collaboration between technology developers and research institutes, fostering advancements in microsurgical robotic technology. Research institutions serve as crucial hubs for testing and refining these systems, contributing to their continuous improvement and playing a pivotal role in shaping the future landscape of microsurgical robotic applications.

Regional Insights

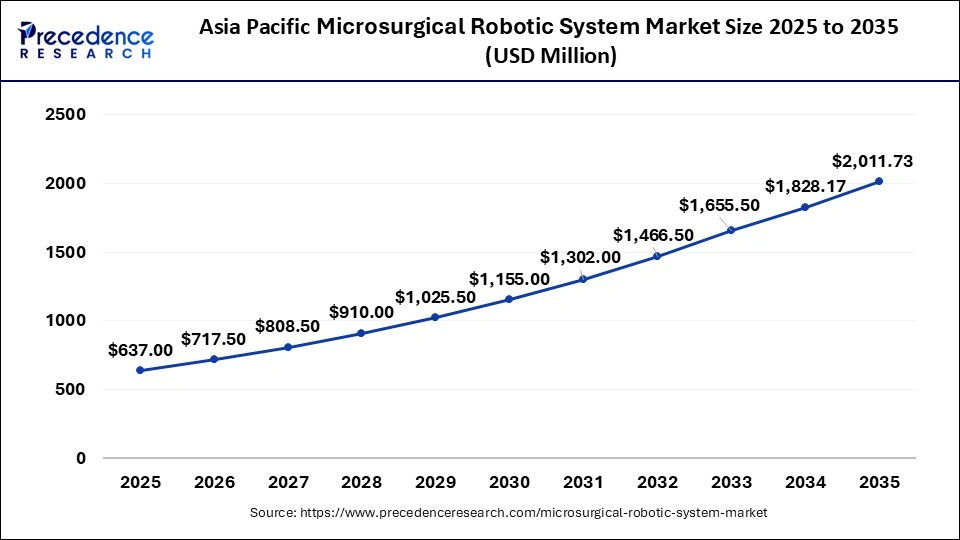

Asia Pacific Microsurgical Robotic System Market Size and Growth 2026 To 2035

The Asia Pacific microsurgical robotic system market size is valued at USD 637.00 million in 2025 and is expected to be worth around USD 2,011.73 million by 2035, at a CAGR of 12.19% from 2026 to 2035.

North America has held the largest revenue share 35% in 2025. North America dominates the microsurgical robotic system market due to factors such as advanced healthcare infrastructure, high healthcare expenditure, and early adoption of innovative medical technologies. The region's robust research ecosystem and collaborations between technology developers and healthcare institutions contribute to continuous advancements.

U.S. Market Trends

The U.S. microsurgical robotic system market is growing due to the increasing demand for minimally invasive procedures, which reduce patient recovery time, lower complication risks, and improve overall surgical outcomes. Additionally, technological advancements such as AI-assisted guidance, AR/VR integration, and high-definition visualization are enhancing the precision and efficiency of surgeries, making robotic systems more attractive to hospitals and surgeons.

Additionally, favorable reimbursement policies and a well-established regulatory framework facilitate market growth. The region's inclination toward minimally invasive surgeries and a strong presence of key market players further solidifies North America's major share in the microsurgical robotic system market.

What Makes Asia Pacific the Fastest-Growing Region in the Market?

Asia-Pacific is estimated to observe the fastest expansion. Asia-Pacific dominates the microsurgical robotic system market due to a combination of factors. The region's large population base, rising healthcare infrastructure, and increasing prevalence of chronic diseases drive the demand for advanced surgical technologies. Additionally, supportive government initiatives, escalating healthcare investments, and growing awareness among healthcare professionals contribute to the region's significant market share. The evolving economic landscape and the surge in minimally invasive procedures further fuel the adoption of microsurgical robotic systems, making Asia-Pacific a key player in shaping the global market.

India Market Trends

The market in India is growing due to a strong government push to bridge technological gaps, with institutions like AIIMS adopting advanced robotic systems. Increased MedTech funding is supporting R&D, AI integration, and expansion of healthcare infrastructure, enabling wider access to these systems. Additionally, greater acceptance in ambulatory surgery centers, driven by the cost-effectiveness of robotic procedures, is boosting adoption and overall market growth in the country.

What Potentiates the Market in Europe?

The microsurgical robotic system market in Europe is potentiated by a rising demand for minimally invasive surgeries (MIS), which improve patient outcomes, reduce recovery times, and lower complication risks. Technological advancements such as enhanced imaging, haptic feedback, and improved surgical precision are making robotic systems increasingly attractive to hospitals. Additionally, government initiatives, strong healthcare infrastructure, increased surgical volumes, favorable reimbursement policies, and a skilled medical workforce, particularly in countries like the Netherlands, further drive adoption across specialties like neurosurgery, ENT, and cardiovascular surgery.

How is the Opportunistic Rise of Latin America in the Market?

Latin America is expected to grow at a lucrative rate in the upcoming period due to the growing adoption of minimally invasive surgeries and the increasing prevalence of chronic diseases, which drive demand for advanced surgical solutions. In countries like Argentina, robotic systems are expanding beyond traditional urology and gynecology into neurology, orthopedics, and general surgery, offering patients quicker recovery, smaller incisions, and better outcomes. Additionally, integration with telemedicine and the development of new robotic systems for delicate procedures is further boosting market growth and creating new opportunities for manufacturers in the region.

What Opportunities Exist in the Middle East & Africa for the Market?

The Middle East & Africa (MEA) presents immense opportunities in the market due to rapidly growing healthcare infrastructure and investments in advanced medical technologies, which increase access to robotic surgery. Rising demand for minimally invasive procedures and improved patient outcomes is encouraging hospitals to adopt robotic systems across specialties such as urology, orthopedics, and cardiovascular surgery. Additionally, government initiatives, private hospital expansions, and partnerships with global MedTech companies are supporting technology transfer, training, and the introduction of innovative robotic platforms, further driving market growth in the region.

Value Chain Analysis

- R&D

This upstream stage focuses on developing core technologies, including advanced robotics, surgical precision software, imaging systems, and micro‑instrumentation that form the technological foundation of microsurgical robotic systems.

Key Players: Intuitive Surgical, Inc., Medtronic plc, Stryker Corporation, Johnson & Johnson - Clinical Trials and Regulatory Approvals

It follows a structured, multi-stage process to guarantee device safety and effectiveness. This pathway includes extensive testing along with data submission to regulatory bodies such as the FDA in the U.S. or for a CE mark in Europe.

Key Players: Medical Microinstruments, Microbot Medical, Johnson & Johnson - Distribution & Sales

Once systems are manufactured, they must be distributed and sold to healthcare facilities, including hospitals, specialty surgical centers, and research institutions.

Key Players: Intuitive Surgical, Medtronic, Stryker

Microsurgical Robotic System Market Companies

- Intuitive Surgical, Inc.

- Medtronic plc.

- Stryker Corporation

- Zimmer Biomet Holdings, Inc.

- Accuray Incorporated

- Smith & Nephew plc.

- TransEnterix Surgical, Inc.

- Renishaw plc.

- Medrobotics Corporation

- Titan Medical Inc.

- Auris Health, Inc.

- Verb Surgical Inc. (a joint venture between Alphabet Inc.'s Verily and Johnson & Johnson)

- Microsure

- MST Medical Surgery Technologies Ltd.

- Synaptive Medical Inc.

Recent Developments

- In 2022, BGS Beta-Gamma-Service GmbH & Co. KG responded to the growing demand for sterilization services in biotechnology, medicine, and diagnostics by expanding its laboratory in Wiehl. This expansion aimed to cater to the specific needs of sectors relying on radiation cross-linking processes.

- Similarly, Sterigenics expanded its electron beam facility in Columbia City, Indiana, in 2022. This facility plays a crucial role in providing E-beam sterilization services, particularly for medical devices and drug products, emphasizing its commitment to ensuring the safety and integrity of these critical healthcare items.

- In May 2025, Smith+Nephew announced a Central Europe roadshow to promote its CORI Surgical System, an advanced robotics-assisted platform for total knee and hip replacements.

https://orthospinenews.com

Segments Covered in the Report

By Application

- Ophthalmology Surgery

- Cardiovascular Surgery

- Neurovascular Surgery

- Gastrointestinal Surgery

- Obstetrics and Gynecology Surgery

- Urology Surgery

- Oncology Surgery

- ENT Surgery

By End-use

- Hospitals and Clinics

- Ambulatory Surgical Centers

- Research Institutes

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting