What is the Nitrous Oxide Market Size?

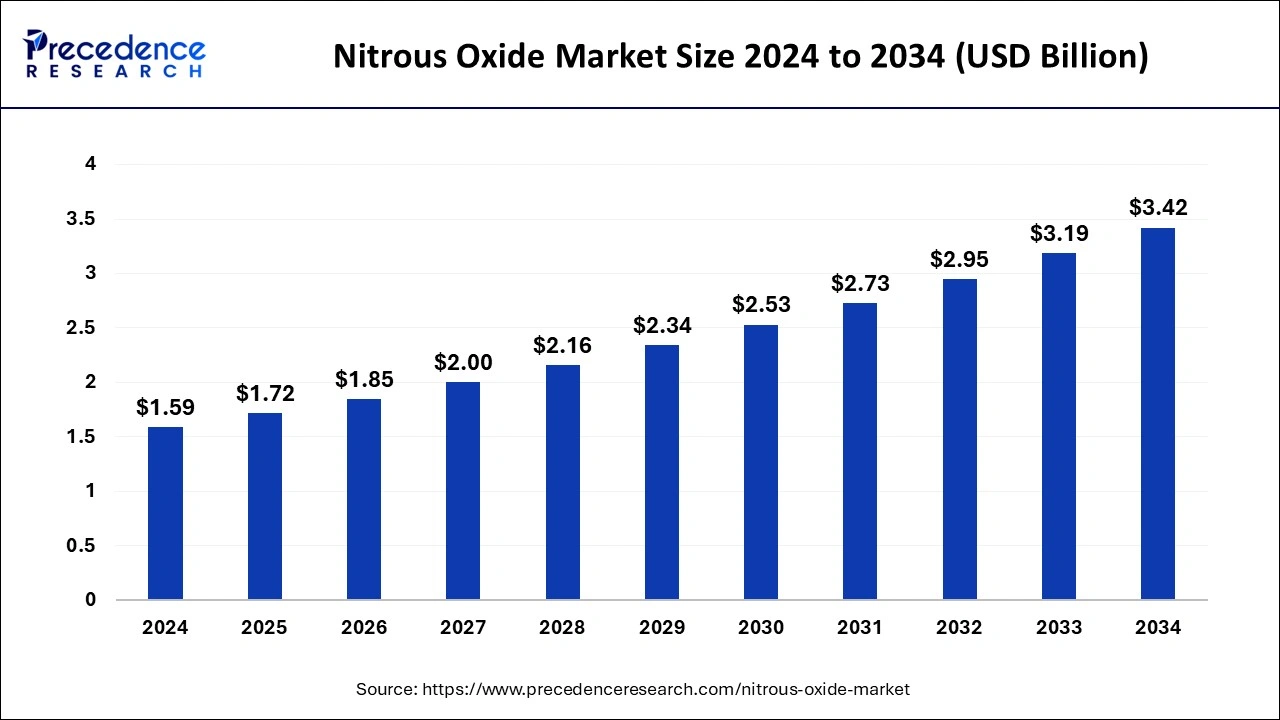

The global nitrous oxide market size is valued at USD 1.72 billion in 2025 and is predicted to increase from USD 1.85 billion in 2026 to approximately USD 3.42 billion by 2034, expanding at a CAGR of 7.96% from 2025 to 2034.

Nitrous Oxide Market Key Takeaways

- In terms of revenue, the global nitrous oxide market was valued at USD 1.59 billion in 2024.

- It is projected to reach USD 3.42 billion by 2034.

- The market is expected to grow at a CAGR of 7.96% from 2025 to 2034.

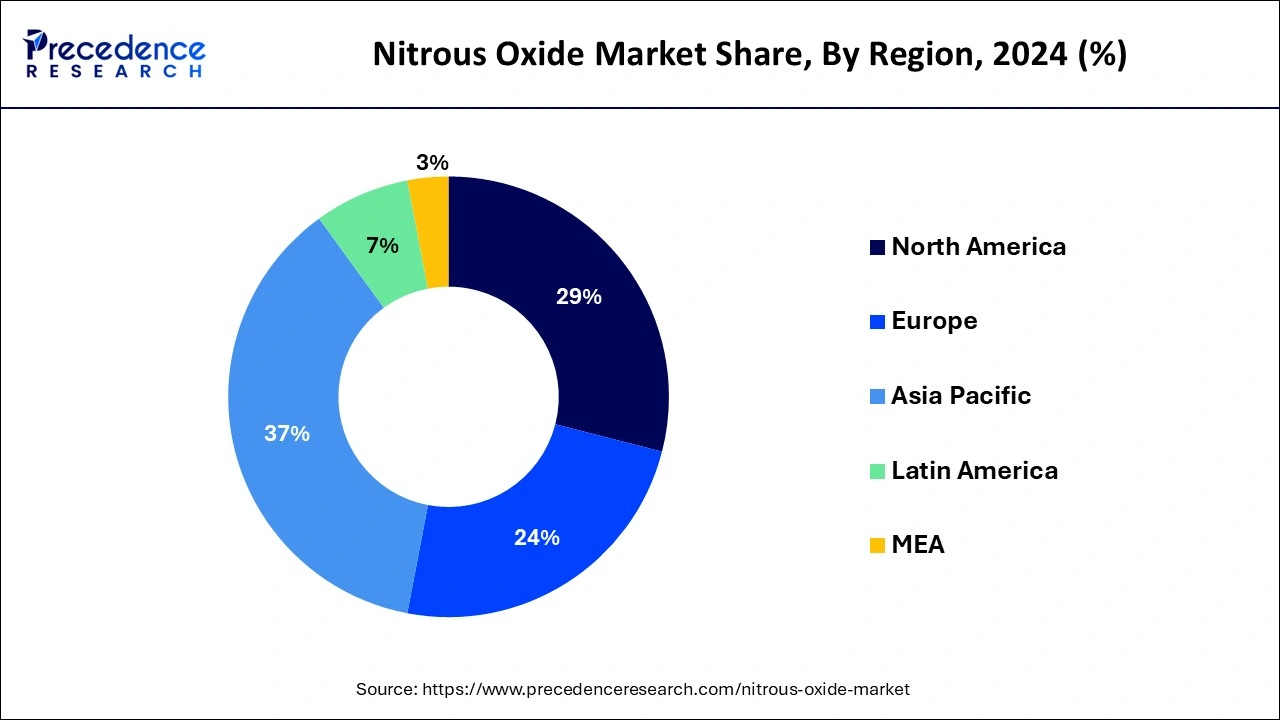

- Asia Pacific dominated the market with the largest share of 37% in 2024.

- North America is expected to witness the fastest CAGR of 5.49% during the forecast period.

- By application, the medical segment has contributed more than 88% market share in 2024.

- By application, the automotive segment is expected to grow at a notable CAGR of 7.39% from 2025 to 2034.

Market Overview

The nitrous oxide market consists of the production, distribution, and consumption of nitrous oxide, a colorless and odorless gas with the chemical formula N2O. Nitrous oxide is commonly known as laughing gas and is used for various purposes, including medical applications such as anesthesia, as a propellant in whipped cream dispensers, and in the automotive industry for enhancing engine performance. The production of nitrous oxide involves industrial processes, and companies or facilities may be engaged in manufacturing and refining it. These processes may include the synthesis of nitrous oxide as a byproduct of chemical manufacturing. The market consists various trends such as technological advancements in production methods, changes in demand due to evolving applications, and shifts in consumer preferences. Environmental concerns and regulations regarding the impact of nitrous oxide emissions on the atmosphere may also influence the market.

Nitrous Oxide Market Data and Statistics

- According to the U.S. Environmental Protection Agency, in 2021, N2O (nitrous oxide) accounted for 6% of whole U.S. greenhouse gas releases from human actions. Human activities such as fuel combustion, wastewater management, agriculture, and industrial processes are rising the quantity of nitrous oxide in the atmosphere.

Nitrous Oxide Market Growth Factors

- The use of nitrous oxide in the medical field as an anesthetic continues to drive market growth. The gas is employed during medical procedures and surgeries, especially in dentistry and minor surgical interventions. As healthcare infrastructure expands globally, the demand for medical-grade nitrous oxide is likely to increase.

- Nitrous oxide is utilized in the automotive industry for its ability to enhance engine performance. This is particularly popular in racing and high-performance vehicle communities. The interest in automotive sports and customization contributes to the demand for nitrous oxide in this sector.

- The food industry uses nitrous oxide as a propellant in whipped cream dispensers. As the demand for convenience and aesthetically pleasing food items rises, the use of whipped cream in various culinary applications is likely to increase, boosting the demand for nitrous oxide.

- Economic growth and rising disposable income in various regions can positively influence the demand for nitrous oxide. Higher disposable income often correlates with increased spending on recreational activities, which may involve the use of nitrous oxide, particularly in the automotive and entertainment sectors.

- Ongoing technological advancements in the production processes of nitrous oxide can contribute to increased efficiency, reduced costs, and improved safety standards. These advancements can make nitrous oxide more accessible and attractive to various industries.

- Growing concerns about environmental sustainability and emissions may drive innovation in nitrous oxide production and consumption. Companies may focus on developing environmentally friendly practices, and regulatory measures may influence the adoption of cleaner technologies within the industry.

- Ongoing research and development activities aimed at exploring new applications for nitrous oxide and improving its production processes can open up new market opportunities. Innovation in nitrous oxide-related technologies can lead to the discovery of novel applications and increased market penetration.

- Increased globalization facilitates the exchange of goods and services, including nitrous oxide. International trade agreements and collaborations can impact the market dynamics, allowing for the expansion of nitrous oxide production and distribution on a global scale.

Recent Trends

Rising Medical and Industrial Use:

Nitrous oxide is becoming more and more necessary for use in dentistry, medical anesthesia, and food processing applications like propellants for whipped cream. High-purity N2O is also used for specific manufacturing processes in the automotive and electronics industries. The global market for nitrous oxide is steadily expanding as a result of this broad application base.

Tightening Supply and Quality Requirements:

The market is confronted with obstacles like supply constraints and the requirement for ultra-high-purity gases despite rising demand. To comply with semiconductor and healthcare standards, manufacturers are concentrating on sophisticated purification systems and effective production methods. This pattern emphasizes how crucial quality control and dependability are throughout supply chains.

Increasing Environmental and Safety Regulations:

Stricter regulations on N2O production and handling are being prompted by growing concerns about emissions and climate impact. To remain compliant, businesses are investing in emission-control systems and implementing more environmentally friendly manufacturing techniques. This change in regulations is propelling technological advancements in gas storage and purification.

Market Outlook

- Industry Growth Overview: The market for nitrous oxide is expanding in the food and beverage industry, automotive, and medical sectors. Demand is driven by its extensive use in food propellants, anesthesia, and automotive boosting, with robust growth in the Asia Pacific. Market expansion is also being aided by growing adoption in new applications like electronics and the manufacturing of specialty chemicals.

- Sustainability Trends: Producers are focusing on efficient production, high purity standards, and safe handling to reduce environmental impact. Regulator compliance and better supply chain management are improving the market's sustainability and long-term viability. Companies are also exploring greener technologies and energy-efficient processes to further minimize emissions and waste.

- Startups Ecosystem: Innovation is concentrated on niche applications, enhanced delivery systems, and high-purity grades. Larger manufacturers work with startups and specialty gas companies, but scaling safety and regulatory obstacles continue to be major obstacles. The ongoing R&D sector is fueled by the growing interest in creating specialized solutions for end-use industries.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 3.42 Billion |

| Market Size in 2026 | USD 1.85 Billion |

| Market Size in 2025 | USD 1.72 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 7.96% |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Application and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa |

Market Dynamics

Driver

Ongoing advancements in medical technologies

- In February 2022, Glenmark Pharmaceuticals Limited (Glenmark) launched FabiSpray, a nitric oxide nasal spray, in India. It is used for the treatment of adult patients with COVID-19 who have high risk of evolution of the disease.

Ongoing advancements in medical technologies are significantly driving the demand for the nitrous oxide market. As medical practices continue to evolve, the versatile applications of nitrous oxide as an anesthetic agent in various medical procedures are becoming increasingly vital. The demand for minimally invasive surgeries and dental procedures, coupled with the emphasis on patient comfort, has led to a growing reliance on nitrous oxide for its sedative and analgesic properties. Advanced medical technologies, including improved delivery systems and precise monitoring equipment, enhance the safety and efficacy of nitrous oxide administration. The gas's quick onset and offset of action make it particularly valuable for procedures where rapid adjustments are crucial.

Furthermore, ongoing research and development initiatives focus on refining nitrous oxide formulations, optimizing dosage control, and exploring novel medical applications. The expansion of healthcare infrastructure, especially in emerging markets, further amplifies the demand for nitrous oxide. As medical facilities upgrade their capabilities, the need for reliable and efficient anesthetic options, such as nitrous oxide, continues to rise. This trend aligns with the broader objective of improving patient outcomes and overall healthcare experiences. Overall, the symbiotic relationship between ongoing medical advancements and the demand for nitrous oxide underscores its pivotal role in contemporary healthcare practices.

Restraint

Environmental concerns

- According to the U.S. EPA, 40% of total N2O emissions globally come from human activities. Nitrous oxide is released from land use, agriculture, industry, transportation, and other activities

Environmental concerns pose a significant restraint on the demand for the nitrous oxide market. Nitrous oxide, though widely used for its anesthetic and performance-enhancing properties, is also recognized as a potent greenhouse gas with a significant impact on climate change. The emission of nitrous oxide into the atmosphere contributes to global warming and depletion of the ozone layer, making it a focus of environmental scrutiny. Increasing awareness of the environmental implications of nitrous oxide use has led to calls for more sustainable alternatives in various industries. Stricter regulations and emission reduction targets set by governments and international bodies further intensify the pressure on industries to mitigate their carbon footprint, potentially impacting the acceptance of nitrous oxide in certain applications.

Efforts to address these environmental concerns include research into alternative propellants in the food industry and exploring eco-friendly anesthetic options in healthcare. Companies are also investing in technologies to capture and reduce nitrous oxide emissions during production processes. However, until these alternatives become widespread and cost-effective, the environmental impact of nitrous oxide may continue to restrain its demand, particularly in regions where environmental regulations are stringent and sustainability considerations play a central role in decision-making.

Opportunity

Innovations in nitrous oxide production

Innovations in nitrous oxide production are fostering promising opportunities within the market. Ongoing research and development initiatives are focused on enhancing production processes to make them more efficient, cost-effective, and environmentally sustainable. These innovations not only contribute to the overall quality of nitrous oxide but also open doors to new applications and market expansion. Technological advancements in production methods are aimed at optimizing resource utilization and minimizing environmental impact. Improved catalysts, novel reaction pathways, and advanced purification techniques are some of the key areas of innovation. These developments lead to increased production efficiency, ensuring a stable and reliable supply of nitrous oxide to meet growing demands across various industries.

Furthermore, innovations in production technologies often go hand-in-hand with sustainability efforts. Companies are exploring cleaner and greener manufacturing processes, aligning with the global push towards eco-friendly practices. Such initiatives not only address environmental concerns but also position nitrous oxide as a more socially responsible choice within the marketplace. As the industry continues to invest in cutting-edge production techniques, the opportunities for market growth are substantial.

Application Insights

The medical segment held the largest share of the nitrous oxide market in 2024. In the medical field, nitrous oxide serves as a valuable anesthetic during surgical and dental procedures. Known for its analgesic properties, it provides sedation to patients while allowing for quick recovery post-administration. The medical segment is a major consumer of high-purity nitrous oxide for its crucial role in pain management.

The automotive segment is expected to generate a notable revenue share in the market. Nitrous oxide is widely utilized in the automotive industry for its role as an oxidizer, enhancing engine performance. Commonly employed in racing and high-performance vehicles, nitrous oxide injection systems contribute to increased horsepower and torque, making it a popular choice among automotive enthusiasts.

Regional Insights

Asia Pacific Nitrous Oxide Market Size and Growth 2025 to 2034

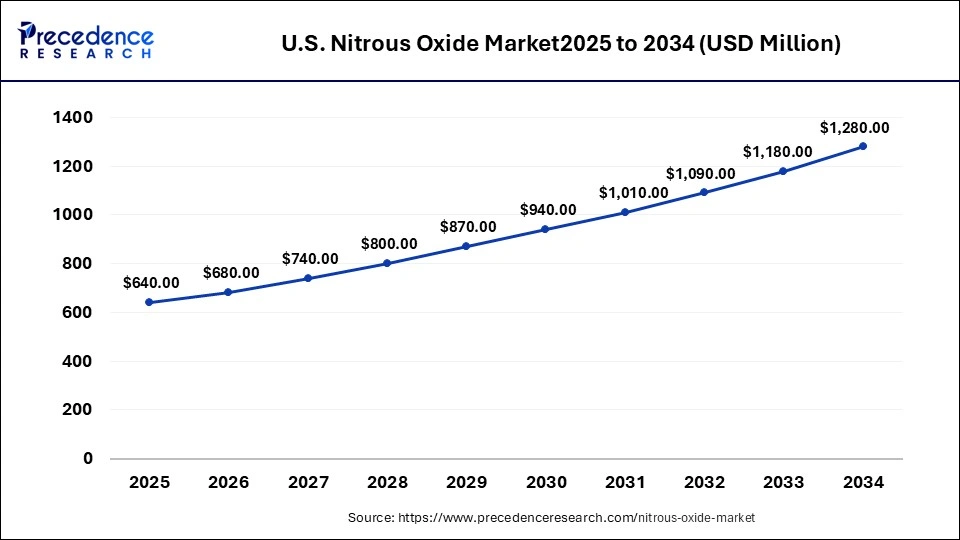

The Asia Pacific nitrous oxide market size is valued at USD 640 million in 2025 and is predicted to be worth around USD 1,280 million by 2034, rising at a CAGR of 8.05% from 2025 to 2034.

Asia-Pacific dominated the nitrous oxide market with the largest market share of 37% in 2024, driven by its extensive use in the medical sector. As healthcare infrastructure continues to develop, there is a growing need for anesthetics in medical procedures and surgeries. The automotive sector, particularly in countries with a strong motorsports culture, contributes to the demand for nitrous oxide. The use of nitrous oxide for performance enhancement in racing and recreational vehicles has gained popularity in certain markets within the Asia-Pacific region.

Additionally, economic growth in countries like China, India, Japan, and others has led to increased disposable income, influencing consumer behavior. This, in turn, may impact the demand for recreational activities, including those involving nitrous oxide. Howeover, growing environmental awareness may also impact the nitrous oxide market in the Asia-Pacific region, with increasing emphasis on sustainable practices and eco-friendly alternatives.

North America is poised for rapid growth in the nitrous oxide market due to diverse applications across various industries. Nitrous oxide is widely used in the medical field as an anesthetic during surgeries and dental procedures. The well-established healthcare infrastructure in North America contributes to the consistent demand for nitrous oxide in medical applications. Compliance with safety and environmental regulations is crucial in the nitrous oxide market. The regulatory landscape varies across North American countries, and market participants need to adhere to standards to ensure the safe production, distribution, and use of nitrous oxide.

- According to the U.S. EPA, U.S. Nitrous oxide emissions between 1990 and 2021 decreased by 3%. During this time, the emissions from mobile combustion reduced by 56% as a result of pollutant emission standards for on-road vehicles.

Europe is growing at a notable rate in the nitrous oxide market. Nitrous oxide is employed as a propellant in the food and beverage industry, especially in the production of whipped cream. The region's culinary traditions and the demand for high-quality food items contribute to the use of nitrous oxide. Nitrous oxide may find applications in various industrial processes, including manufacturing, electronics production, and research. Its unique properties make it suitable for specific applications within these sectors. Furthermore, ongoing research and innovation in nitrous oxide production processes and applications contribute to market growth and create opportunities for manufacturers and suppliers.

- In July 2022, BPR Medical partnered with Medclair, to establish a strategic agreement designed at attaining mutual objectives. The partnership will help BPR held exclusive distribution rights for Medclair's advanced mobile nitrous oxide conversion technology across Ireland and UK region.

Nitrous Oxide Market Companies

- Praxair Technology, Inc.

- Chart Industries, Inc.

- Linde plc

- MATHESON TRI-GAS, INC.

- SOL GROUP

- Merck KGaA

- Air Liquide

- Airgas, Inc.

- Ellenbarrie Industrial Gases

Recent Developments

- In June 2023, NNOXX Inc. launched its first new non-invasive and wearable device to display active nitric oxide levels, NNOXX One, the. The NNOXX One device can rapidly control people personal nitric oxide (PNO) level when it is positioned on any exercising muscle group, such as their arm or leg.

- In May 2023, GreatWhip launched its new 640G whip cream chargers, in which aluminum N2O tanks are packed with ultra-pure nitrous oxide, verified at 99.9%, and provide a 20% discount to all UK, US, and EU restaurant food enthusiasts and owners. According to the company, these GreatWhip whip chargers are aimed to increase the dessert capability and make whipped cream a breeze to yield.

- In January 2023, VERO Biotech Inc. announced FDA approval of the newest third generation tankless inhaled nitric oxide (iNO) GENOSYL Delivery System. The delivery system is developed by respiratory therapists to deliver key benefits for clinicians, patients, and providers.

-

In May 2025, Exactitude Consultancy announced that the global market for 99.999% purity nitrous oxide is expected to reach approximately $952 million in 2024, driven by increasing applications in pharmaceuticals, food processing, and medical sectors.

https://www.globenewswire.com -

In May 2025, Yara announced it is making its proven Nâ‚‚O abatement catalyst technology commercially available to other companies in the nitric acid production industry. This technology has already helped Yara cut its own emissions by over 45% and can remove up to 90% of Nâ‚‚O generated as a byproduct of fertilizer production globally.

https://beta.yara.com

Segments Covered in the Report

By Application

- Automotive

- Medical

- Electronics

- Food & Beverages

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting