What is the Non-surgical Skin Tightening Market Size?

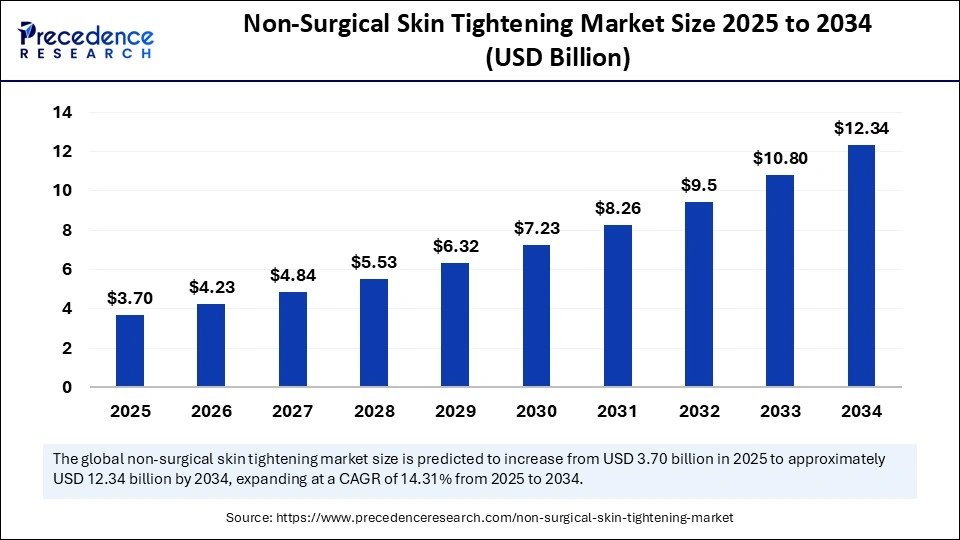

The global non-surgical skin tightening market size accounted for USD 3.24 billion in 2024 and is predicted to increase from USD 3.70 billion in 2025 to approximately USD 12.34 billion by 2034, expanding at a CAGR of 14.31% from 2025 to 2034.

Market Highlights

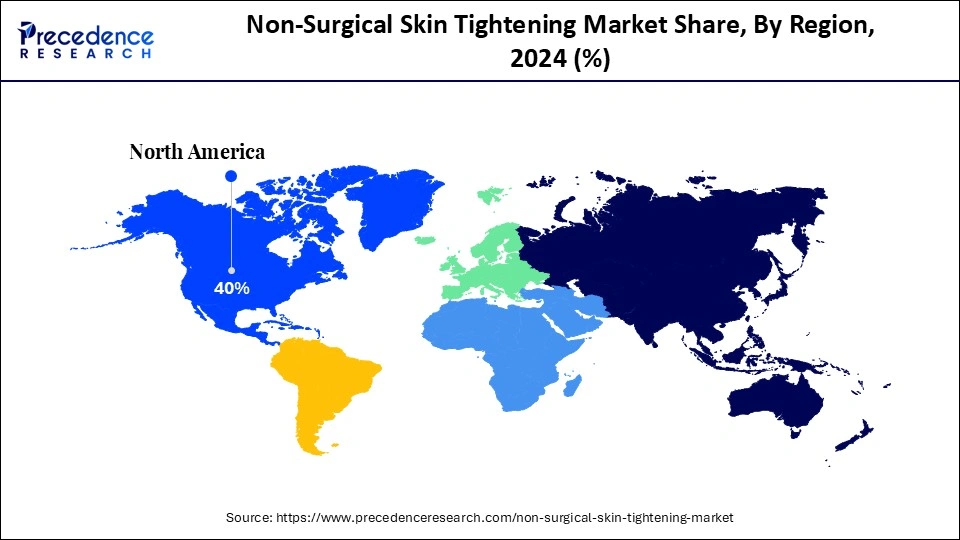

- North America dominated the market 40% market share in 2024.

- Asia Pacific is observed to be the fastest growing region in the market.

- By type of treatment, radiofrequency therapy segment led the market while holding 35% share in 2024.

- By type of treatment, microneedling segment is seen to grow at the fastest rate during the forecast period.

- By technology, the radiofrequency technology segment led the market with 30% share in 2024.

- By technology, the high-intensity focused ultrasound segment segment is observed to grow at the fastest rate during the forecast period.

- By end-user, the beauty clinics segment held the largest share of 40% in 2024.

- By end-user, dermatology clinics segment is expected to experience rapid growth rate during the forecast period.

- By age group, the Gen X (35-54) segment led the market with 30% share in 2024.

- By age group, the millenials segment is expected to grow at the fastest rate during the forecast period.

- By gender, the female segment dominated the market with 75% share in 2024.

- By gender, the male segment is expected to grow at the fastest rate during the forecast period.

Market Size and Forecast

- Market Size in 2024: USD 3.24 Billion

- Market Size in 2025: USD 3.70 Billion

- Forecasted Market Size by 2034: USD 12.34 Billion

- CAGR (2025-2034): 14.31%

- Largest Market in 2024: North America

- Fastest Growing Market: Asia Pacific

Market Overview

The non-surgical skin tightening market refers to the global industry focused on devices, technologies, and treatments designed to tighten and rejuvenate the skin without invasive surgery. These procedures utilize energy-based technologies such as radiofrequency (RF), ultrasound, laser, and infrared to stimulate collagen production, improve skin elasticity, and reduce wrinkles and sagging. Common treatment areas include the face, neck, abdomen, arms, and thighs.

This market includes equipment manufacturers, aesthetic clinics, dermatology service providers, and med-spas, as well as technology developers offering innovative solutions in non-invasive aesthetics.

Impact of AI on Non-surgical Skin Tightening Market

Artificial Intelligence (AI) is playing a transformative role in the non-surgical skin tightening market, enhancing both clinical outcomes and operational efficiency. AI-powered technologies are enabling personalized treatment planning by analyzing patient-specific data such as skin type, elasticity, and age to optimize device settings for safer and more effective results. Real-time skin analysis tools powered by AI help clinicians accurately assess skin conditions and target problem areas with greater precision. Additionally, smart devices now feature adaptive energy delivery systems that automatically adjust treatment parameters based on live feedback from the skin, improving safety and comfort.

Top Applications of Non-surgical Skin Tightening Products

| Application Area | Description | Significance |

| Facial Skin Tightening | Lifting and firming of cheeks, jawline, and forehead | High demand for non-invasive facelifts; most visible aging signs appear on the face |

| Neck & Chin Tightening | Reduces sagging and loose skin under the chin (“double chin”) and along the neck | Common concern with aging; popular among both men and women |

| Periorbital (Eye Area) Firming | Tightening around the eyes to reduce crow's feet, puffiness, and under-eye sagging | Sensitive area treated safely with RF and ultrasound; high patient satisfaction |

| Abdominal Skin Tightening | Firms loose skin on the stomach, often post-pregnancy or weight loss | Increasing demand for body contouring without surgery |

| Thigh & Buttocks Firming | Lifts and tightens sagging skin or cellulite-prone areas on thighs and buttocks | Popular for aesthetic body sculpting, especially among women |

| Arm Skin Tightening | Treats “bat wings” or loose upper arms, particularly in aging or post-weight-loss individuals | Non-surgical alternative to arm lift surgery; growing interest in full-body rejuvenation |

| Décolletage (Chest) Rejuvenation | Smooths and firms skin on the upper chest, where fine lines and wrinkles often develop | Frequently treated area for women; visible in open-neck clothing |

| Post-Liposuction Skin Tightening | Helps improve skin texture and firmness after fat removal treatments | Often used to enhance results of other body contouring procedures |

Latest Trends in the Non-Surgical Skin Tightening Market

- Increased use of combination therapies

Clinics are combining skin tightening with microneedling, fillers, or PRP for enhanced results and overall skin rejuvenation. - Rise of at-home skin tightening devices

Portable, consumer-grade RF and LED-based devices are gaining popularity for maintenance treatments between clinic visits. - AI and smart technology integration

Devices are being equipped with smart sensors and AI to provide real-time skin analysis, personalized settings, and improved safety. - Shift toward non-invasive body contouring

Beyond facial tightening, more patients are seeking non-surgical options for the abdomen, thighs, and arms, boosting demand for full-body treatment devices. - Growing popularity among men

Male consumers are increasingly adopting non-invasive aesthetic procedures, including skin tightening, driven by changing beauty standards and social acceptance. - Regenerative skin tightening solutions

Emerging treatments focus on cell regeneration and bio-stimulation, using growth factors or stem cell-enhancing serums alongside energy devices. - Increased availability in med-spas and dermatology chains

Treatments are becoming mainstream, offered at more accessible venues beyond plastic surgery centers, leading to greater adoption. - Geographic market expansion

The market is rapidly growing in Asia-Pacific, Latin America, and the Middle East, driven by urbanization, rising disposable income, and aesthetic awareness.

Market Scope

| Report Coverage | Details |

| Market Size in 2024 | USD 3.24 Billion |

| Market Size in 2025 | USD 3.70 Billion |

| Market Size by 2034 | USD 12.34 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 14.31% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type of Treatment, Technology, End-User, Age Group, Gender, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa |

Market Dynamics

Driver

Rising Demand for Minimally Invasive Aesthetic Procedures

The growing global preference for non-invasive or minimally invasive cosmetic treatments is a primary driver of the non-surgical skin tightening market. Consumers today are seeking effective aesthetic solutions with minimal downtime, lower risk, and no surgical intervention—factors that non-surgical skin tightening procedures meet perfectly.

These treatments, often using radiofrequency (RF), ultrasound, or laser technology, offer visible results for skin lifting and collagen stimulation without the need for incisions or anesthesia.

For instance, devices like Thermage FLX and Ultherapy are widely used for tightening facial and neck skin, and they've gained strong traction due to high satisfaction rates and quick recovery.

This trend is particularly prominent among the 30–60 age group, who are looking for preventive or maintenance anti-aging treatments without undergoing a facelift. The growth of med-spas and increasing male participation in aesthetics further amplify this demand.

Restraint

High Cost of Advanced Devices and Treatments

Despite growing popularity, one of the key restraints in the market is the high cost associated with advanced non-surgical skin tightening devices and procedures. Treatments often range from $500 to over $5,000 per session, depending on the area treated and the technology used.

In addition, high-end technologies such as HIFU (High-Intensity Focused Ultrasound) and fractional lasers require significant capital investment by clinics, which limits adoption among small or mid-sized aesthetic centers, particularly in price-sensitive regions like parts of Asia and Latin America.

Moreover, these treatments are usually considered elective cosmetic procedures and are not covered by insurance, making them less accessible for a large segment of the population.

Opportunity

Expansion into Emerging Markets

Emerging economies present a major growth opportunity for the non-surgical skin tightening market, driven by rising disposable incomes, urbanization, and increasing aesthetic awareness. Countries such as India, Brazil, China, and Indonesia are witnessing a surge in demand for non-invasive cosmetic treatments as beauty standards evolve and younger populations become more image-conscious.

For instance, the Indian aesthetic market is projected to grow significantly, with non-surgical treatments being a preferred choice due to cultural sensitivities around surgery and faster lifestyle demands. Global device manufacturers are responding by entering partnerships with local clinics or launching cost-effective, portable devices tailored for emerging markets.

Furthermore, social media influence and medical tourism are boosting cross-border demand, making these regions attractive for global players seeking to expand beyond saturated markets like North America and Western Europe.

Segmental Analysis:

Type of Treatment Insights

The radiofrequency therapy segment led the market, holding a 35% share in 2024. RF therapy is highly preferred due to its safety, efficacy, and minimal recovery time. It works by delivering controlled heat to stimulate collagen and elastin production, making it effective for skin tightening, wrinkle reduction, and contouring. Its widespread use for both facial and body applications, along with FDA approvals for various RF-based devices, has propelled its dominance in the treatment landscape.

The microneedling segment is projected to grow at the fastest rate during the forecast period. Microneedling, especially when combined with radiofrequency (RF microneedling), is gaining popularity for improving skin texture, firmness, and reducing fine lines. It appeals to a wide demographic due to its relatively lower cost, minimal downtime, and compatibility with other skin treatments like PRP (platelet-rich plasma). Increasing availability in med-spas and consumer trust in collagen-induction therapy are fueling its rapid growth.

Technology Insights

The radiofrequency technology segment led the market with a 30% share in 2024. RF technology has become a cornerstone in non-invasive aesthetic procedures due to its proven ability to stimulate deep dermal collagen without damaging the skin surface. Leading brands such as Thermage and Venus Concept have helped expand its reach across different regions and consumer demographics. Its versatility in treating the face, neck, and body gives it a technological edge over other modalities.

The high-intensity focused ultrasound (HIFU) segment is observed to grow at the fastest rate during the forecast period. HIFU is gaining traction as a non-invasive alternative to surgical facelifts. It works by delivering focused ultrasound energy to deeper layers of the skin, promoting long-lasting lifting and tightening effects. With increased FDA and CE approvals, and rising awareness of its non-surgical benefits, HIFU is expected to see widespread adoption, especially among consumers aged 30–60 seeking natural-looking results without surgery.

End-User Insights

Beauty clinics held the largest share of 40% in 2024, dominating the non-surgical skin tightening market. These clinics are often the first point of contact for consumers seeking affordable and accessible aesthetic treatments. With a broad range of service offerings and flexible pricing models, beauty clinics attract a wide consumer base, especially in urban areas. Their high footfall, skilled practitioners, and increasing use of advanced devices contribute to their market leadership.

Dermatology clinics are expected to experience the fastest growth rate during the forecast period. The shift toward medically supervised aesthetic treatments is leading more patients to choose certified dermatologists for procedures like RF therapy and microneedling. Dermatology clinics also appeal to clients looking for tailored, skin-safe solutions, especially for sensitive skin types or complex conditions. As consumer education improves, the preference for medical-grade, clinic-administered treatments is rising significantly.

Age Group Insights

The Gen X (35–54) segment led the market with a 30% share in 2024. This age group is typically more concerned about early signs of aging, such as fine lines, skin laxity, and volume loss. They represent a key consumer base for non-surgical skin tightening treatments that offer natural-looking results without extended recovery periods. This demographic often has greater disposable income and a strong interest in preventive aging solutions.

The millennials segment is expected to grow at the fastest rate during the forecast period. Increasing aesthetic awareness among millennials (aged 25–34), along with their digital exposure and social media influence, is driving early adoption of non-invasive cosmetic treatments. This generation prioritizes preventive care and is more likely to explore non-surgical options for subtle enhancement and skin maintenance. Demand from millennials is also reshaping marketing strategies and treatment packaging in the industry.

Gender Insights

The female segment dominated the market with a 75% share in 2024. Women have historically been the primary consumers of aesthetic treatments, driven by cultural beauty standards, aging concerns, and a higher degree of engagement with wellness and skincare routines. Non-surgical skin tightening solutions are especially appealing to women seeking facial rejuvenation without invasive procedures, making them the largest user segment by far.

The male segment is expected to grow at the fastest rate during the forecast period. Growing social acceptance of male grooming and aesthetic care is contributing to increased demand for skin-tightening treatments among men. Targeted marketing, male-focused treatment plans, and a rising desire for subtle enhancements—especially among professionals and middle-aged men—are fueling this growth. Clinics are also expanding service offerings tailored specifically to male clients, including jawline contouring and non-surgical facial lifting.

Regional Insights

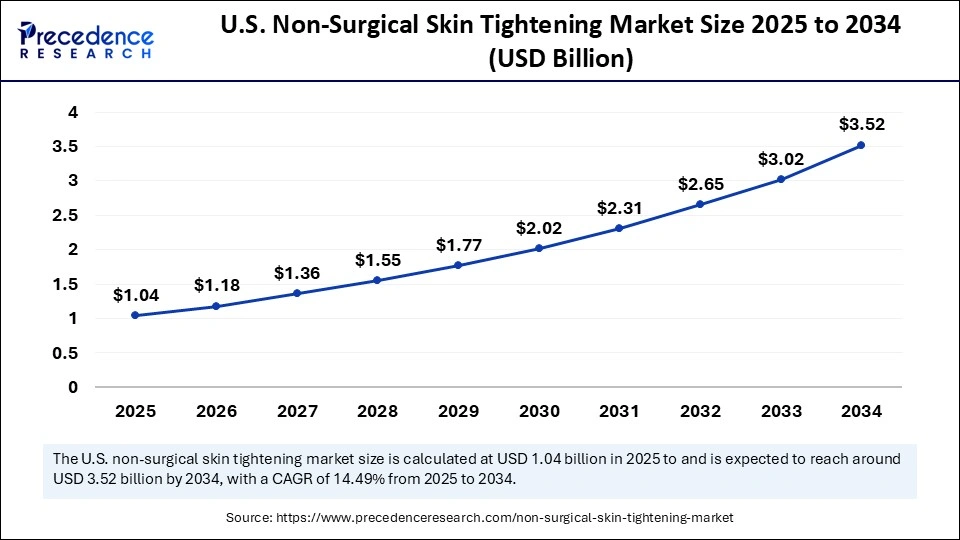

U.S. Non-surgical Skin Tightening Market Size and Growth 2025 to 2034

The global non-surgical skin tightening market size was exhibited at USD 0.91 billion in 2024 and is projected to be worth around USD 3.52 billion by 2034, growing at a CAGR of 14.49% from 2025 to 2034.

North America dominated the market with a 40% share in 2024, making it the leading region in the non-surgical skin tightening industry. The region's strong performance can be attributed to high awareness of aesthetic procedures, advanced healthcare infrastructure, and a well-established network of med-spas and dermatology clinics.

Additionally, a strong presence of major players and early adoption of innovative skin-tightening technologies such as radiofrequency (RF) and HIFU (High-Intensity Focused Ultrasound) devices contribute to sustained market dominance. The U.S. continues to be a key growth engine within the region due to rising disposable income and consumer willingness to invest in cosmetic enhancements.

Asia Pacific is observed to be the fastest-growing region in the market, driven by rising aesthetic consciousness, increasing disposable incomes, and expanding access to dermatological care. Rapid urbanization, a younger demographic base, and the influence of social media are fueling demand for non-invasive aesthetic procedures. Countries like China, India, South Korea, and Japan are seeing a surge in beauty clinics and medical tourism, making Asia Pacific a hotbed for market expansion during the forecast period.

Non-Surgical Skin Tightening Market Companies

- Allergan (AbbVie)

- Cutera

- Lumenis

- Syneron Candela

- BTL Industries

- Venus Concept

- Sciton

- Hologic

- Fotona

- Alma Lasers

- Cynosure (Hologic)

- Lutronic

- Sofwave

- Cynosure

- InMode

- Merz Pharmaceuticals

- Ulthera (AbbVie)

- ZELTIQ Aesthetics (Allergan)

- Solta Medical (Valeant Pharmaceuticals)

- RevitaLash Cosmetics

Recent Developments

- April 2025 —

Bausch Health's aesthetic unit (Solta Medical) received medical device license clearance from Health Canada for Thermage FLX, the latest generation of its Thermage line. This device is used for non‑invasive skin tightening and contouring, offering faster treatments, a larger treatment tip, better patient comfort (vibration & cooling), and smart impedance technology. - May 2025 —

InMode introduced IgniteRF, a doctor‑only, minimally invasive soft tissue contraction platform, in Australia. IgniteRF uses a “QuantumRF” technology; it's meant to provide efficient, safer skin tightening and body contouring without aspiration or strict core temperature requirements.

Segments Covered in the Report

By Type of Treatment

- Ultrasound Therapy

- Focused Ultrasound

- Micro-focused Ultrasound

- Radiofrequency Therapy

- Monopolar Radiofrequency

- Bipolar Radiofrequency

- Tripolar Radiofrequency

- Laser Therapy

- Fractional Laser

- Non-ablative Laser

- Microneedling

- Microneedling with RF

- Microneedling without RF

- Infrared Therapy

- Cryolipolysis

By Technology

- HIFU (High-Intensity Focused Ultrasound)

- Laser Technology

- Radiofrequency Technology

- Microneedling Technology

By End-User

- Beauty Clinics

- Dermatology Clinics

- Cosmetic Surgeons

- Spas & Wellness Centers

By Age Group

- Millennials (18–34 years)

- Gen X (35–54 years)

- Baby Boomers (55 years and above)

By Gender

- Male

- Female

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content