What is the Nutricosmetics Market Size?

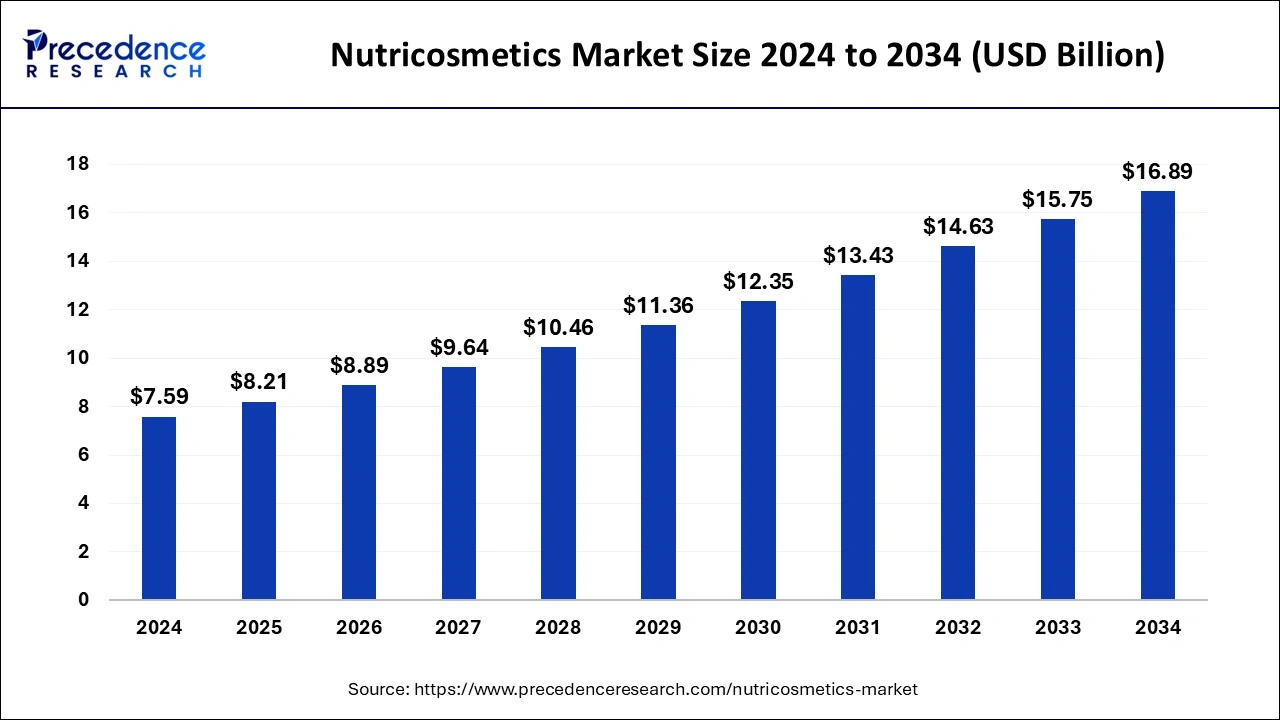

The global nutricosmetics market size was calculated at USD 8.21billion in 2025 and is predicted to increase from USD 8.89 billion in 2026 to approximately USD 18.02 billion by 2035, expanding at a CAGR of 8.18% from 2026 to 2035. The nutricosmetics market is growing as nutricosmetics formulations optimize nutrients to meet the needs of the skin, improve skin conditions, and delay aging.

Nutricosmetics Market Key Takeaways

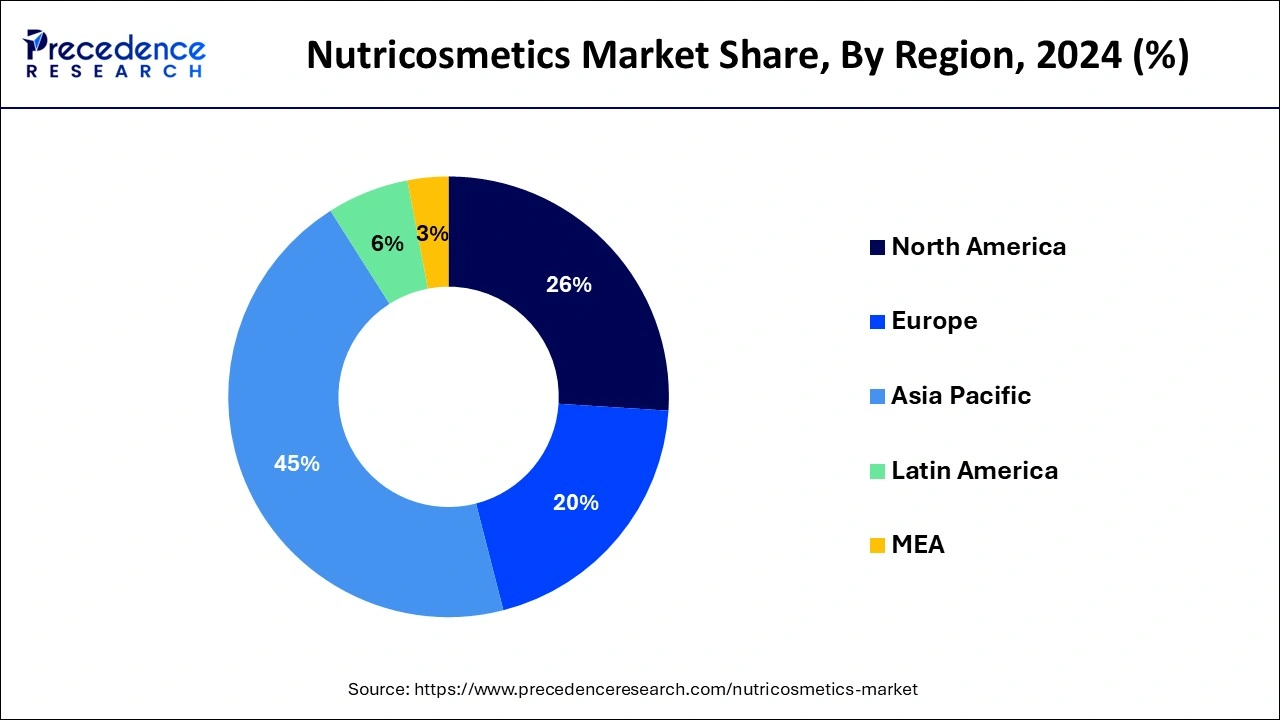

- Asia Pacific dominated the global market with the largest market share of 45% in 2025.

- North America is projected to expand at the notable CAGR during the forecast period.

- By ingredient, the carotenoids segment contributed the highest market share in 2025.

- By ingredient, the vitamins segments is estimated to be the fastest-growing segment during the forecast period.

- By application , the skin care segment captured the biggest market share in 2025.

- By application, the hair care segment is expected to grow at a significant CAGR from 2026 to 2035.

- By distribution channel, the onshore segment has held the largest market share in 2025.

Impact of Artificial Intelligence (AI) on the Biogas Market

Advanced technology has revolutionized nutricosmetics, particularly nanotechnology and artificial intelligence. These solutions help tailor supplements to specific needs, improving product efficacy and user experience. New and upcoming ingredients and supporting technologies in the nutricosmetics market and the factors driving their development and adoption are explored. The integration of artificial intelligence (AI) and automation in the nutraceutical industry is driving innovation and efficiency in manufacturing and marketing strategies. AI technology is used to analyze customer behavior, allowing companies to create designs and marketing that are specific to their needs and trends. Automation in the manufacturing process also increases production capacity and reduces costs, making it easier to maintain quality while meeting high demand. Data-driven insights from AI applications not only improve the performance of nutricosmetics products but also help identify market gaps, ultimately providing consumers with more personalized and effective products, and supporting the growth of the nutricosmetics market.

Nutricosmetics Market Growth Factors

- Nutricosmetics help improve nail health, making nails strong and healthy. Nutraceuticals contribute to vital aspects of life, mind, and body, which has led to the growth of the nutricosmetics market.

- Nutricosmetics contain important antioxidants and elements, including vitamins, plant extracts, curcumin, prebiotics, and probiotics, which has led to the growth of the nutricosmetics market.

- The increasing awareness of consumers about taking beauty supplements and their willingness to spend more money on quality nutricosmetics products has led to the growth of the nutricosmetics market.

- Consumers' awareness of ingestible beauty solutions is increasing, and they are prepared to spend good money on high-quality nutricosmetics, this causes growth of the nutricosmetics market.

- Instead of relying on medical treatment, consumers are increasingly looking for nutritional products that provide beauty benefits, which is driving the growth of the nutricosmetics market.

Market Outlook

- Industry Growth Overview: The rapid development of the nutricosmetics market is driven by the growth of beauty-from-within, anti-aging, and functional ingestible skincare.

- Sustainability Trends: Brands are moving to vegan collagen, ethical sourcing, clean labels, and sustainable packaging.

- Key Investors: L'Oreal, Amway, Herbalife Nutrition, Nestle Health Science, BASF SE, improving innovation and portfolio development.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 8.21 Billion |

| Market Size by 2035 | USD 18.02Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 8.18% |

| Largest Market | Asia-Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Ingredient, Application, Intake Type, Form, Distribution Channel, Geography |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Segment Insights

Ingredient Insights

The carotenoids segment dominated the nutricosmetics market in 2022. Many vegetables and fruits include carotenoids, which are plant pigments that give them their vivid yellow, red, and orange colors. Plant health depends on these pigments. The carotenoids are also beneficial to people's health when they eat foods containing them. In the human body, carotenoids also function as antioxidants. As per the Physicians Committee for Responsible Medicine, they contain powerful cancer fighting qualities. The body converts certain carotenoids into vitamin A, which is necessary for vision as well as normal development and expansion. The carotenoids are also anti-inflammatory and immune system boosters, and they are linked to a lower risk of heart disease.

The vitamins segment is fastest growing segment of the nutricosmetics market in 2020. Vitamins are organic molecules that are necessary micronutrients that an organism requires in little amounts for appropriate metabolism. The essential nutrients cannot be manufactured in the body, either completely or in sufficient amounts, and must therefore be received through food. Vitamin C is considered as essential ingredient in cosmetics ingredients.

Application Insights

The skin care segment dominated the nutricosmetics market in 2022. The powders, creams, and lotions are examples of skin care products that enhance the quality and health of the skin while also providing nutrition. Many men and women use these products on a regular basis for a variety of reasons, including cleansing, moisturizing, and hydrating. The herbal and organic skin care has been increasingly popular in recent years. This is due to the people are aware of synthetic chemicals' negative impact on the skin. Ingredients originating from natural items such as root and leaf extracts, are safe to utilize on the skin because they have no negative effects.

- The skin care segment in nutricosmetics market was valued at USD 3,947.39 million in 2020 registering a CAGR of 8.11% during the forecast period.

- The hair care segment in nutricosmetics market was valued at USD 2,273.68 million in 2020 registering a CAGR of 8.06% during the forecast period.

- The nail care segment in nutricosmetics market was valued at USD 704.42 million in 2020 registering a CAGR of 7.67% during the forecast period.

The hair care segment is fastest growing segment of the nutricosmetics market in 2022. The hair care products assist women and men in maintaining the cleanliness and health of their hair while also protecting it from injury. The oil, shampoo, serum, conditioner, and other hair products are available in a variety of formats including gel, liquid, lotion, and cream. The shampoos for greasy and dry hair, shampoos for colored and curly hair, and conditioners for damaged hair and scalp healing are all available.

By Distribution Channel

The supermarkets/hypermarkets segment held the largest share of the nutricosmetics market in 2025. Supermarkets offer a range of nutricosmetic products of various brands under a single roof, allowing consumers to compare different products. This convenience factor further enhances customer experience. Moreover, supermarkets/hypermarkets often engage in effective marketing strategies, attracting more consumers, thus contributing to segmental growth.

The online retail segment is expected to expand at the highest CAGR in the coming years due to the rising trend of online shopping. Online retailers often have various nutricosmetic products than offline stores, allowing consumers to access different brands from the convenience of their homes. Online stores also provide doorstep delivery services and exciting offers, attracting more consumers.

Regional Insights

What is the Asia Pacific Nutricosmetics Market Size?

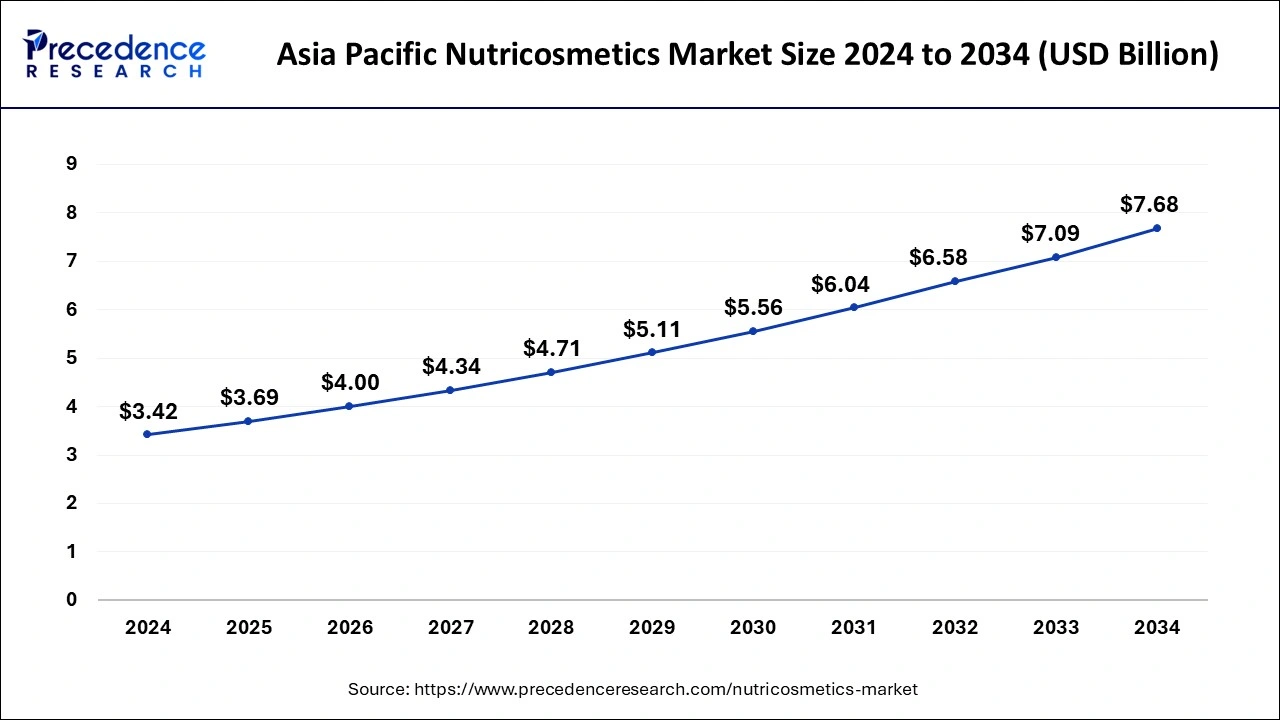

The Asia Pacific nutricosmetics market size was exhibited at USD 3.69 billion in 2025 and is projected to be worth around USD 8.22 billion by 2035, growing at a CAGR of 8.34% from 2026 to 2035.

Asia-Pacific dominated the nutricosmetics market in 2025. India dominated the nutricosmetics market in Asia-Pacific region. In Asia-Pacific region, several professional make up lines can accommodate the wide range of make up artists and salons. The rapid rise of the beauty industry in the region has attracted many foreign companies, making the region a significant market and boosting commerce for nutricosmetic goods in the region. Changing lifestyles as a result of increased income allow customers to choose healthier options themselves and the atmosphere that were previously unavailable; these elements are propelling the nutricosmetics market to significant growth in the region.

Japan Nutricosmetics Market Trends

The deep-seated beauty and nutritional heritage of Japan establish the country as the main center of regional innovation. The nutricosmetics industry offers anti-aging solutions that contain high collagen content, premium marine materials, and sophisticated delivery systems. The market maintains a strong demand for functional nutricosmetics because customers trust the products that pharmacies distribute and that contain scientifically proven formulas.

Europe, on the other hand, is expected to develop at the fastest rate during the forecast period. The UKand Italy dominates the nutricosmetics market in Europe region. Italians like skincare products with active substances and natural components, and this trend is expected to continue; another quality that is greatly sought after is the product's simplicity of absorption and utilization. Italian cosmetics are known throughout the globe for their formula invention and production company service features, which have helped the Italian cosmetics industry establish itself in both emerging and traditional markets. These elements have helped Europe establish itself as a key market for nutricosmetic products in Europe.

Germany Nutricosmetics Market Trends

Germany focuses on developing preventive wellness programs that establish their scientific backing. Customers show a preference for products that contain clean-label ingredients and organic-certified and vegan-certified components. The market displays strong demand for products that connect beauty with immune resilience.

What Are the Driving Factors of the Nutricosmetics Industry in North America?

North America is expected to grow at a significant rate during the forecast period. The beauty food trend, together with advanced research ecosystems and consumer interest in targeted nutricosmetics, has created strong growth momentum for North America. The market demands products that deliver anti-aging benefits and skin protection because customers are becoming aware of preventive beauty nutrition, which is offered through high-quality products that include innovative features.

U.S. Nutricosmetics Market Trends

The U.S. market operates through digital channels while customers seek convenient services. The market prefers gummies and flavored powders because these products match their daily routines. Direct-to-consumer brands use personalization tools and subscription services together with microbiome positioning to create beauty products that connect gut health awareness with consumers.

Value Chain Analysis of the Nutricosmetics Market

- Raw Material Procurement: Sourcing of high-quality ingredients that are nutritionally sound, traceable, and have high standards of safety.

Key players: Nexira, DSM-Firmenich, Gelita AG, Evonik Industries - Processing and Preservation: Processing converts the ingredients into the final products, whereas preservation increases shelf life and maintains bioavailability.

Key Players: Suntory Holdings, Shiseido Co. Ltd., Amway, ActivInside - Quality Testing and Certification: Strict tests and certifications will guarantee compliance with regulations, safety of the products, validation of their effectiveness, and confidence in the consumers of the products.

Key players: SGS, Eurofins Scientific, Intertek Group plc, Merieux NutriSciences - Packaging and Branding: Different and protective packaging convey the benefits, stability of the products, and prime positioning.

Key players: Amorepacific, Nutrawise Health & Beauty, Shiseido, Herbalife Nutrition - Cold Chain Logistics and Storage of Nutricosmetics: The efficacy of sensitive formulations is maintained by storage and distribution at controlled temperatures until delivery to the consumers.

Key players: DB Schenker, DHL, Kuehne + Nagel, FedEx, UPS

Nutricosmetics Market Companies

- Dermatologique ACM Laboratoire.: Offers the dermatologist-prescribed nutricosmetics, which address the skin pigmentation, acne, hair, and nails, and are backed by clinical effectiveness and dermatological knowledge.

- Forza Industries Ltd.: Creates nutricosmetics and wellness supplements produced in the United Kingdom with a combination of research-based formulation, quality production, and positioning as beauty-from-within products.

- Vitabiotics Ltd.: Markets science-based beauty supplements that feed the skin, hair, and nails with balanced mixes of micronutrients and consumer-trusted brands.

Other Major Key Players

- D-LAB Nutricosmetics (France)

- Skinade (England)

- Amway (U.K.)

- Natrol, LLC (U.S.)

- SOS Hair Care (U.K.)

- WR Group (U.S.)

- Pfizer, Inc. (U.S.)

Recent Developments

- In January 2026, In-cosmetics global 2026 introduces the Inner Beauty Zone, merging personal care with nutricosmetics, to promote "beauty-from-within." Scheduled for April 14-16 at Paris Expo Porte de Versailles, the zone, sponsored by KSM-66 and partnered with The Good Pill Co, highlights innovative developments. (Source: https://www.happi.com )

- In August 2025, TOSLA Nutricosmetics launches VELIOUS™ 3.0 Flavor Technology, enhancing taste in liquid nutricosmetics without sugar. This evolution of their patented flavor-masking system raises standards for formulation sophistication, consumer enjoyment, and product safety in beauty and wellness. (Source: https://cosmeticsbusiness.com )

- In February 2024, Tosla Nutricosmetics partnered with Triije Architects to create its headquarters. Tesla 3 will serve as the company's R&D, marketing, and business center. According to the company, it will be equipped with facilities and technologies that will enable the team to be productive and efficient. "TOSLA 3 is a huge milestone for the company. This project symbolizes the realization of our long-term goals and signifies our dedication to providing our team with an inspiring and efficient workspace," said the founder and CEO at Tosla Nutricosmetics, Primož ArtaÄÂ.

- In January 2023, Neutrogena partnered with Nourished to create 3D-printed, customized treatments based on skin tests. The cosmetics brand uses AI and precision 3D printing to create food products using its Skin360 mobile app. The technology is used to scan the face for analysis, collecting data with more than 100,000 skin pixels and scan for 2,000 facial attributes. It uses this data to then identify dermatological requirements and design a topical skincare routine to fulfill specific therapeutic goals.

- In May 2023, Ritual entered the beauty category with its first supplement focused on skincare, HyaCera, priced at $54.  The new product comes as the supplement market continues to grow, alongside interest in beauty ingestibles. The product incorporates “moisture-control bottle technology” to increase product longevity and help protect the stability of the ingredients, despite being gluten-free, non-GMO, sugar free, and with no artificial colors.

Segments Covered in the Report

By Ingredient

- Carotenoids

- Vitamins

- Omega 3 Fatty Acids

- Others

By Application

- Personal Care

- Skin Care

- Sun Care

- Anti-Ageing

- Radiance and Glow

- Anti Acne/Pimple

- Hair Care

- Nail Care

- Health Care

- Digestive Health

- Heart Health

- Weight Management

- Others

By Intake Type

- Pill Type Nutricosmetics

- Drinkable Nutricosmetics

By Form

- Tablets and Capsules

- Powder and Liquid

- Gummies and Soft Chews

By Distribution Channel

- Supermarkets/Hypermarkets

- Drug Stores/Pharmacies

- Specialist Stores

- Online Retail

- Other Distribution Channels

By Geography

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia-Pacific

- China

- India

- Japan

- South Korea

- Malaysia

- Philippines

- Latin America

- Brazil

- Rest of Latin America

- Middle East & Africa (MEA)

- GCC

- North Africa

- South Africa

- Rest of the Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting