What is the Pallets Market Size?

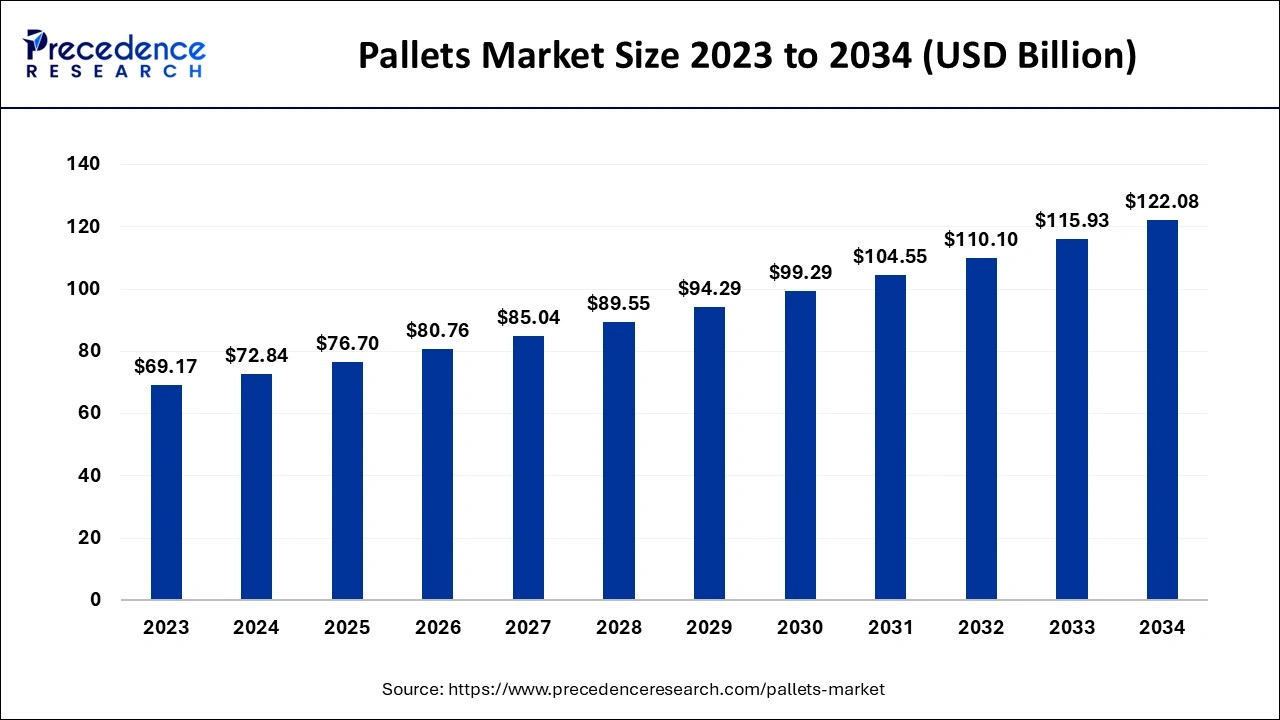

The global pallets market size is calculated at USD 76.70 billion in 2025 and is predicted to increase from USD 80.76 billion in 2026 to approximately USD 122.08 billion by 2034, expanding at a CAGR of 5.30% from 2025 to 2034.

Pallets Market Key Takeaways

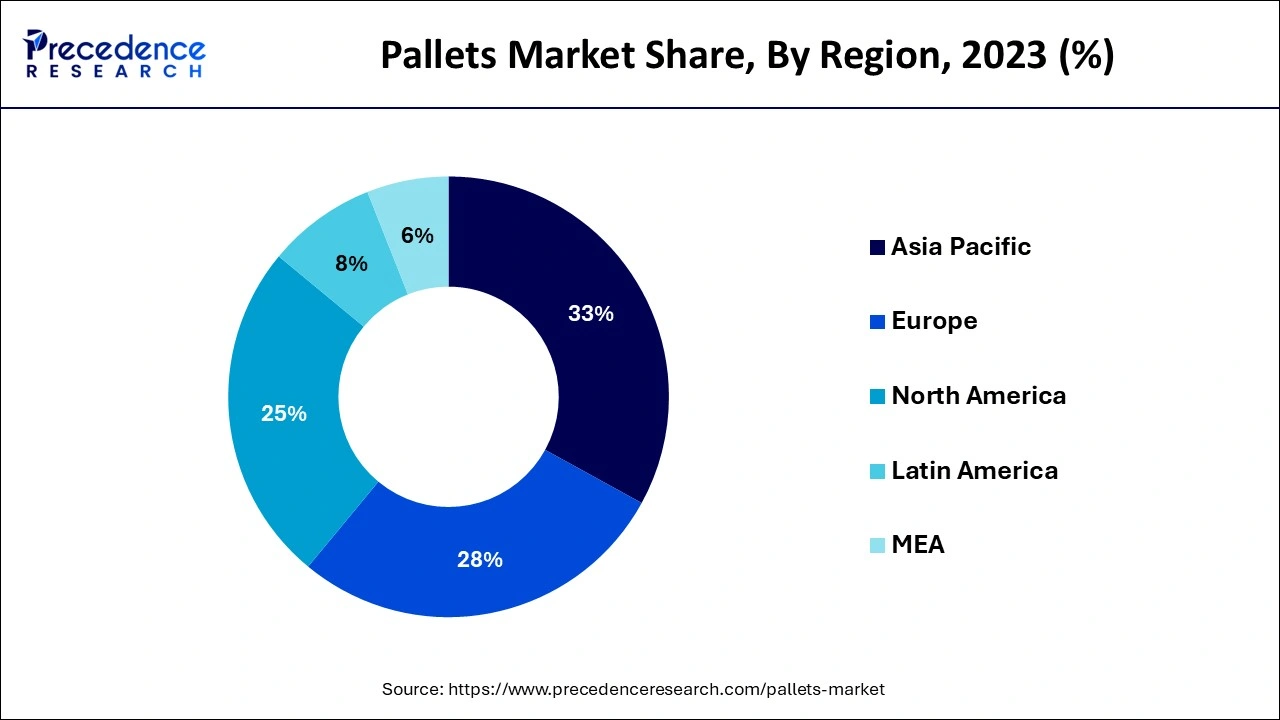

- Asia Pacific dominated the global market with the largest market share of 33% in 2024.

- By material, the high-density polyethylene (HDPE) segment dominated the market in 2024.

- By type, the nestable pallets segment led the market in 2024.

- By end user, the food and beverage segment led the market in 2024.

Market Overview

Pallets are horizontal support platforms that help move products from one location to another with a forklift or a front loader. They are one of the most often used substrates for stacking products, and they are typically stabilized using stretch wrap, pallet collars, glue, or other techniques. Depending on the intended use, they can be produced using a variety of materials, including wood, plastics, metal, etc. Workers may stack larger items on a single pallet without risk of damage since they are considerably tougher than some other containers like plastic wraps and cardboard boxes. Many manufacturers and shippers of business items utilize them widely because of these qualities all over the world.

The need for logistics services is being greatly boosted by the rising smartphone sales, expanding internet usage, and expanding e-commerce sector, which in turn is bolstering the growth of the pallet market globally. In addition, rising consumer spending on housing and infrastructure due to consumers' rising income levels, in conjunction with the fast industrialization and urbanization, is raising the need for pallets globally. Additionally, manufacturers are spending money on research and development (R&D) projects to incorporate technical advancements into the pallet manufacturing process. For instance, they have made multiple-trip pallets available, which help to lower trip costs, eliminate solid waste, and boost operational effectiveness. Due to its capacity to be recycled and reused, plastic pallets have also seen tremendous growth in appeal across a variety of industries.

Pallets Market Outlook

- Industry Growth Overview: The market is poised for steady growth from 2025 to 2034, driven by e-commerce expansion, warehouse automation, and rising international trade volumes. High-growth segments include plastic pallets due to their durability and hygiene benefits, and block pallets designed for compatibility with automated handling systems.

- Transition to A Circular Economy:The most dominant trend in the pallet market is the transition to a circular economy. This shift emphasizes reuse, repair, and recycling, driving increased demand for durable, reusable plastic and composite pallets over traditional wood, and encouraging the adoption of bio-based materials and eco-friendly designs.

- Global Expansion: The market is expanding worldwide due to rapid industrialization, urbanization, and growing e-commerce activity in countries such as China and India. North America continues to hold a significant market share due to its established logistics infrastructure and high levels of automation.

- Major Investors: Investment is flowing from major logistics and manufacturing companies, as well as private equity firms like KKR and Carlyle Group, attracted by strong margins, high technical barriers, and alignment with ESG goals. Key players like Brambles (CHEP), UFP Industries, and ORBIS Corporation are major investors in R&D, market consolidation through acquisitions, and new manufacturing facilities.

- Startup Ecosystem:The startup ecosystem is dynamic, focusing on specialized innovations in smart pallets, automation, and sustainable materials. Innovators are developing solutions such as AI-driven sorting systems, robotics for disassembly, and novel materials, such as coconut-husk pallets (CocoPallet). These emerging firms are attracting significant funding by offering scalable, certified, and sustainable alternatives that improve supply chain visibility and efficiency through IoT and RFID integration.

Pallets Market Growth Factors

Growing use of plastic pallets in the pharmaceutical, chemical, food, and beverage industries due to their superior qualities such as lightweight, easy handling, and shock absorption among others; expanding e-commerce activities in the world; and an increase in demand for wooden pallets due to low cost, lightweight, and high strength when compared to other kinds of materials used as pallet decks or surfaces are just a few of the key factors driving this growth in the pallets market.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 76.70 Billion |

| Market Size in 2026 | USD 80.76 Billion |

| Market Size by 2034 | USD 122.08 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 5.30% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Materials, Type, Application, Structural Design, End Use and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Drivers

- Rise in awareness regarding benefits of plastic pallet - The expansion of the pallets market is being driven by an increase in demand for plastic pallets as a result of increased consumer awareness of the advantages of plastic pallets. Pallets made of plastic are easier to handle during shipment. Additionally, they come highly suggested in sectors like food and beverage, pharmaceuticals, chemicals, and others where there is a greater chance of chemical contamination. Plastic pallets can also be utilized in clean room applications since they are simple to disinfect and clean. Such elements are influencing the pallets industry's need for plastic pallets.

- Liberalization of Economies and Growing World Trade - The global economy has grown rapidly in recent decades. Unexpectedly rapid expansion in global commerce has contributed to some of this development. Technological advancements and deliberate initiatives to remove trade obstacles both contribute to trade growth. While the majority of developing countries have not, others have opened their economies to fully take advantage of trade possibilities. Countries' integration into the global economy has been demonstrated to be a key instrument for fostering economic growth, development, and the eradication of poverty. Over the past 20 years, global commerce has increased at an average pace of 6% annually, which is twice as quickly as world output.

Challenges

- Volatility of Raw Material Prices - The fluctuation of raw material prices is one of the reasons limiting the expansion of the pallet business. Plastic, which is composed of polyethylene (PE) and polypropylene, is one of the most often used raw materials in the construction of pallets (PP). Over the years, they have seen a huge price increase as a result of supply-chain instability. As a result, the cost of producing plastic pallets has gone up, which has undoubtedly increased the cost to end users and decreased the market for these pallets. The margins of all different stakeholders in the global pallet market value chain, including vendors, are impacted by any change in the price of these raw materials, which worries both pallet manufacturers and end-users.

Opportunities

- Increasing Freight Volumes: Pallets are used for transportation, which drives the market. The freight industry consists of businesses that transport bulk goods as a part of an integrated, multimodal logistics network. By 2050, the amount of maritime freight transported globally will have more than tripled, and more than one-third of all logistical expenditures will be made on road freight. Pallets are frequently utilized in both circumstances. Pallets are required for the transportation of some items. A motorbike, for instance, is a product that requires the use of pallets. Its two-wheel base prevents it from standing on its own, and depending on a motorbike stand won't prevent it from tumbling, particularly inside a moving freight vehicle.

- Adoption of pallets for transportation purposes- The market is driven by the use of pallets for transportation. In the multimodal, integrated logistics network that makes up the freight sector, there are companies that transport bulk products. The Organization for Economic Cooperation and Development (OECD) predicts that by 2025, the volume of freight moving across the world will have increased by more than four times, with road freight accounting for about one-third of all logistics expenditures worldwide. One product where the usage of pallets is crucial is the motorbike, as an example. Because its base is made up of two wheels, it is unable to stand solidly on its own, and depending on a motorbike stand would not guarantee that it would not topple, particularly when inside a moving cargo vehicle. Putting the product on a pallet and securing it firmly prevents it from dropping or colliding with other priceless goods. Therefore, the need for pallets will continue to rise in the future as a result of rising freight volumes.

Segmental Insights

Materials Insights

In terms of value in 2024, high-density polyethylene (HDPE) held the highest share with 73% of the market for materials. HDPE pallets are popular among end-user organizations because they are simple to maintain, provide great impact resistance, as well as good solvent and corrosion resistance. Furthermore, when handled roughly by forklifts and other material handling equipment, HDPE pallets sustain little to no damage. Additionally, HDPE pallets have strong chemical and weather resistance, which makes them appropriate for use in food and pharmaceutical industries.

Polypropylene (PP) materials are anticipated to see the largest increase between 2025 and 2034 because to their exceptional durability and suitability for heavy-duty applications in a small supply chain. PP pallets are more expensive than HDPE pallets, but because of their superior longevity, PP pallets may make more return trips than HDPE and ultimately end up being more cost-effective. Due to their high cost, PP pallets can only be used in closed-loop applications and cannot be used as export or one-way pallets. However, businesses are choosing returnable pallets more frequently in order to cut down on plastic waste and solve sustainability issues brought on by disposable or one-way pallets, which is anticipated to increase demand for PP pallets.

Type Insights

In 2024, nestable pallets held a commanding 44.6% revenue share in the type segment of the plastic pallets market. Because they may nest inside of one another, they take up less room during return freight and are more economical than other types of pallets. Additionally, they are less costly than their rackable and stackable equivalents, which makes them perfect for use in open-loop supply chains or export.Rackable pallets are made to be stored on racks; because they may be arranged evenly apart in vertical order on the racks, these pallets enable end-use businesses to utilize their floor space. In order to handle big loads, racking pallets typically contain a picture frame or runner frame at the bottom.

In contrast to a nestable pallet, a stackable pallet features a sturdy platform as its basis. When being delivered back to the source, these pallets are often piled on top of one another. Due to its construction, stackable pallets offer the most stability to the loaded products, making them a popular pallet option for shipping goods over extended distances. Because of its more durable architecture than rackable pallets, stackable pallets are frequently utilized in heavy-duty applications.Due to the frequent handling and shipping of heavier components from suppliers' facilities to vehicle assembly plants, larger pallets are favored in the automotive sector. Over the course of the projection period, the demand for stackable pallets is anticipated to benefit from the constant growth of the heavy metal and automotive manufacturing industries.

End Use Insights

With more than 23.9% of the worldwide sales in 2024, the market's leading end-use category was food and beverage. Farmers and agricultural businesses that handle fresh produce as well as businesses that store, handle, and transport meat, dairy, baked goods, and other processed foods were the main drivers of demand.

Plastic pallets are frequently used in the chemical industry to handle a variety of powder, granule, and liquid form goods. Pallets are used for loading, unloading, and transportation of chemicals, minerals, metals, and plastic polymers including PET, PP, ABS, and others. Due to their inexpensive cost and widespread availability, wooden pallets are frequently used in the chemical industry for export applications. However, because to their durability, sustainability, and hygienic qualities, chemical firms have started to choose plastic pallets more and more in recent years.

In the pharmaceutical sector, product hygiene for material handling and packaging is crucial. Due to their difficulty in cleaning and ability to house germs and fungi, wooden pallets provide a danger of contamination. However, plastic pallets are a great option for material handling in the pharmaceutical business because of their excellent chemical resistance and lack of contamination.

Regional Insights

Asia Pacific Pallets Market Size and Growth 2025 to 2034

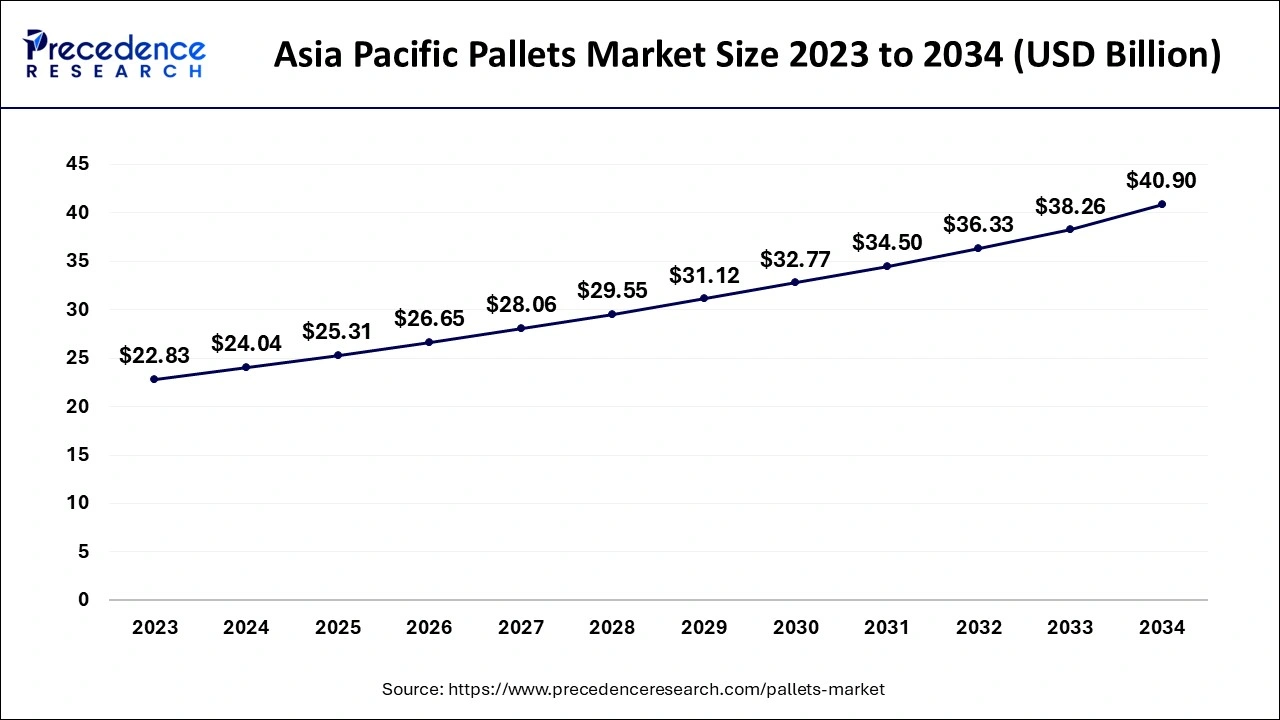

The Asia Pacific pallets market size is exhibited at USD 25.31 billion in 2025 and is predicted to be worth around USD 40.90 billion by 2034, rising at a CAGR of 5.46% from 2025 to 2034.

With approximately 33% of the worldwide revenue share in 2024, the Asia Pacific was in the lead and is expected to continue to grow at the quickest CAGR from 2025 to 2034. The market in the area will develop at the greatest rate from 2025 to 2034 due to a number of important factors, including the region's rapid industrialization and the exponential rise of e-commerce.

Between 2025 and 2034, North America, which was the second-largest market in 2024, is predicted to see a significant CAGR. Favorable trade agreements, like as the T-MEC between the United States, Canada, and Mexico, are expected to boost regional industrial activity and thereby the North American market.

The U.S. is the major contributor to the North America pallets market due to its large logistics, warehousing, and manufacturing sectors requiring efficient material handling solutions. High demand from e-commerce, retail, and industrial distribution further drives the adoption of pallets across the country.

Innovative Logistics Solutions Benefiting the Pallet Market of India

The pallet market in India has experienced substantial change in recent days, specifically because of the growing need for efficient and economical logistics solutions. A primary factor is the rising need for pallets, which are essential in streamlining loading and unloading procedures while guaranteeing the secure transport of products. The rapid growth of the e-commerce and logistics sectors in India is further driving this demand, as they depend significantly on effective and sturdy packaging solutions.

Wooden pallets, specifically, are gaining popularity since they can be reused several times and match the growing focus on sustainable business practices. As the market keeps changing, the sector expects additional growth, fueled by industrial development, increased focus on supply chain efficiency, and the rising demand for eco-friendly packaging options. Modernization trends in material handling systems, such as the integration of robotics and compression or rotational molding, further boost market expansion.

How Crucial is the Role of Europe in the Pallets Market?

Europe has a mature and highly regulated pallet market, driven by the need for efficient, standardized, and sustainable supply chains. The market is dominated by wooden pallets, especially the widely used EUR-pallet standard set by the European Pallet Association. Strict environmental regulations and a strong focus on the circular economy are increasing the adoption of pallet pooling systems (CHEP, LPR) and shifting toward more durable, reusable, and sometimes plastic or composite alternatives to reduce waste and carbon footprint.

Germany Pallets Market Trends

Germany is a epicenter of the European pallets market, acting as a major manufacturing and logistics center. The country has a high demand for standardized wooden pallets to ensure efficient storage and transport, especially in the food and beverage sector. The market benefits from advanced automation in warehouses and the strong presence of leading pallet producers and pooling service providers, focusing on quality, compliance, and sustainability, with ongoing research into recyclable materials and new technologies.

What Potentiates the Growth of the Latin America Pallets Market?

The Latin American pallets market is experiencing consistent growth, driven by increasing industrialization, expanding logistics networks, and a rising e-commerce sector. The region's abundant timber resources and relatively lower labor costs make wooden pallets a dominant and cost-effective choice. Key uses include the food and beverage industry, which requires hygienic transport, as well as general warehousing. There is also growing interest in plastic and reusable pallets, aimed at improving operational efficiency and addressing sustainability concerns.

Brazil Pallets Market Trends

Brazil is a leading contributor to the Latin American market, with demand for pallets mainly driven by its large logistics and transportation sector, which relies heavily on road freight to move goods like agricultural products and manufactured items. The market is dominated by the PBR standard wooden pallet, designed to be compatible with the national supply chain. The growth of e-commerce and the need to improve warehouse efficiency are further increasing demand, particularly for four-way block pallets.

How do the Middle East and Africa contribute to the Pallets Market?

The Middle East and Africa (MEA) offer significant market opportunities, mainly driven by infrastructure investments, expansion of the logistics sector, and rising international trade volumes. Wooden pallets are currently the most commonly used type in the region due to their cost-effectiveness, with standardized EUR and ISO pallets widely adopted. However, there is a growing shift toward durable plastic pallets, especially in hygiene-sensitive industries such as food and beverage and pharmaceuticals. The region is also adopting smart technologies like RFID for improved tracking and supply chain management.

Saudi Arabia Pallets Market Trends

Saudi Arabia plays a distinctive role in the global market, focusing on economic diversification, the development of logistics zones, and the expansion of e-commerce. The government promotes sustainable practices and has mandated the use of pallets for container shipments at its ports to improve efficiency and ensure compliance with international standards. While wood pallets are still widely used, plastic and composite pallets are gaining popularity due to their durability and hygiene benefits, especially in the food and pharmaceutical industries.

Value Chain Analysis

- Raw Material Sourcing and Supply

This stage involves procuring wood, plastic resins, and metals for manufacturing.

Key Players: Timber companies, HDPE/polypropylene suppliers, UFP Industries Inc. - Design and Manufacturing

This stage involves designing and producing pallets (e.g., nestable, stackable) often with automation and IoT integration.

Key Players: PalletOne, Kamps Inc., Schoeller Allibert, CHEP. - Distribution, Sales, and Pallet Pooling

This stage involves distributing pallets via direct sales or leasing through pooling services.

Key Players: Brambles (CHEP), PECO Pallet, iGPS Logistics. - Usage in End-User Industries

This stage involves integrating pallets into supply chains for storage and transport across various sectors.

Key Players: Amazon, Food & Beverage companies, Pharmaceutical, and Automotive industries. - Maintenance, Repair, and Lifecycle Management

This stage involves inspecting, cleaning, and repairing reusable pallets to extend their lifespan and ensure compliance with safety standards.

Key Players: Pallet pooling companies, Organizations providing R2, e-Stewards, or ISPM-15 certification. - Final Disposal and Recycling

This final stage is responsible for the disposal or recycling of end-of-life pallets.

Key Players: Waste management companies (WM), specializing in recycling plants.

Top Companies in the Pallets Market

- Smurfit Kappa Group: A leading producer of paper-based packaging offering lightweight, sustainable, and fully recyclable corrugated pallets designed to optimize supply chain logistics.

- DS Smith Plc:Specializes in sustainable packaging and provides customizable corrugated pallets engineered to reduce freight costs and enhance supply chain efficiency.

- Oji Holdings Corporation:A major global paper products manufacturer with extensive offerings in industrial packaging, including heavy-duty corrugated board used for packaging systems and potentially pallet applications.

- Conitex Sonoco:Provides a range of industrial paper-based solutions, and as part of Sonoco, offers various packaging products, including pallet systems and protective components for shipping goods.

- Tri-Wall Holdings Limited:Focuses on heavy-duty corrugated board and packaging, offering high-strength corrugated pallets (like the Tri-Wall Pak) as durable, lightweight alternatives for industrial shipping.

Other Key Players

- Multi-wall Packaging

- KraftPal Technologies Ltd.

- Europal Packaging

- Tat Seng Packaging Group Ltd.

- Dopack

- Interpal Industries Pte Ltd.

- Pheng Hoon Honeycomb Paper Products Pte. Ltd.

- Mabuchi Singapore Pte Ltd.

- The Alternative Pallet Company Ltd.

- Kimmo (Pty) Ltd.

- GreenLabel Packaging

- Palletkraft Europe Ltd.

- Packprofil Sp. z.o.o.

- The Corrugated Pallet Company

- Elsons International.

Recent Developments

- In July 2024, CSafe, a supplier of both active and passive temperature-controlled shipping solutions for the pharmaceutical sector, revealed the introduction of a new reusable pallet shipper, the Silverpod MAX RE, equipped with several enhanced features. The enhanced product will assist pharmaceutical clients globally in reducing disposal expenses, achieving sustainability goals, and enhancing logistical transparency throughout the shipping process.

- In January 2025, VLS Environmental Solutions, a green waste management firm, introduced the Pallet Recycling Program, a project aimed at converting unusable pallets into clean, renewable energy. This initiative provides environmental and financial advantages for manufacturers and industrial companies in various industries.

- In March 2025, at ProMat 2025, Photoneo and Jacobi Robotics collaborated to demonstrate an innovative method for automating mixed palletizing. Their system integrates Photoneo's 3D vision technology with Jacobi's AI-driven robots, providing warehouses with a quicker, more intelligent method to manage pallets containing various product types. The live demonstration was scheduled for Booth E11505 from March 17-20 at McCormick Place in Chicago.

- In May 2022, Cabka signed a contract with Target, a significant US-based general merchandise retailer with close to 2,000 locations. For Cabka, the arrangement had significant value in terms of potential future earnings. The contract between Cabka and Target demonstrated Cabka's expansion strategy in the US, namely using the prospects in the big container and bespoke solutions area.

- In September 2021, Menasha's subsidiary ORBIS Europe partnered with pooling firm RECALO. With the help of the cooperation, ORBIS hoped to provide its clients with extra advantages, regardless of whether they chose to hire the load carriers or make use of the full range of RECALO pooling services.

Segments Covered In the Report

By Materials

- Wood

- Plastic via Injection Molding

- Plastic via Other Methods

- Corrugated Paper

- Metal

By Type

- Rackable

- Nestable

- Stackable

- Display

By Application

- Rental

- Non-rental

By Structural Design

- Block

- Stringer

- Others

By End Use

- Food & Beverage

- Pharmaceuticals

- Cosmetics & Personal Care

- Consumer Electronics

- Engineering Products

- Chemicals

- Textile and Handcraft

- Agriculture and Allied Industry

- Building & Construction

- Automotive

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)

Get a Sample

Get a Sample

Table Of Content

Table Of Content