PentaneMarket Size and Forecast 2025 to 2034

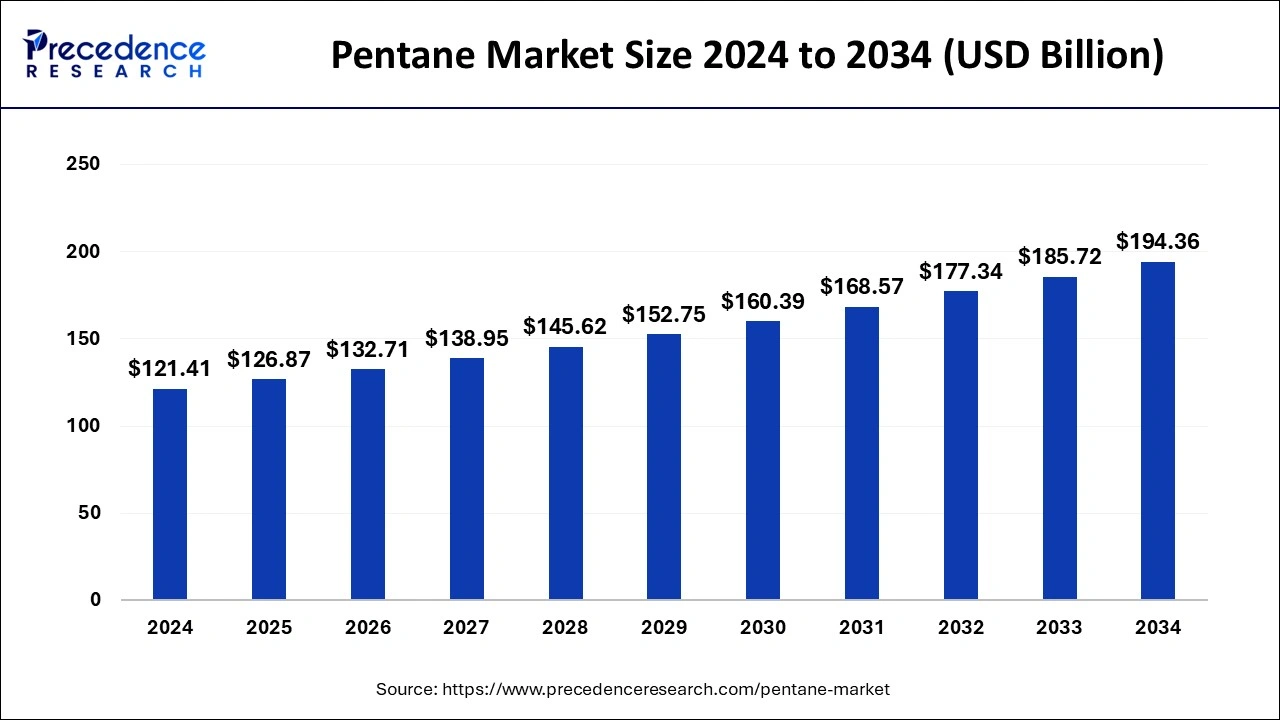

The global pentane market size was calculated at USD 121.41 billion in 2024 and is predicted to increase from USD 126.87 billion in 2025 to approximately USD 194.36 billion by 2034, expanding at a CAGR of 4.82% from 2025 to 2034.

Pentane Market Key Takeaways

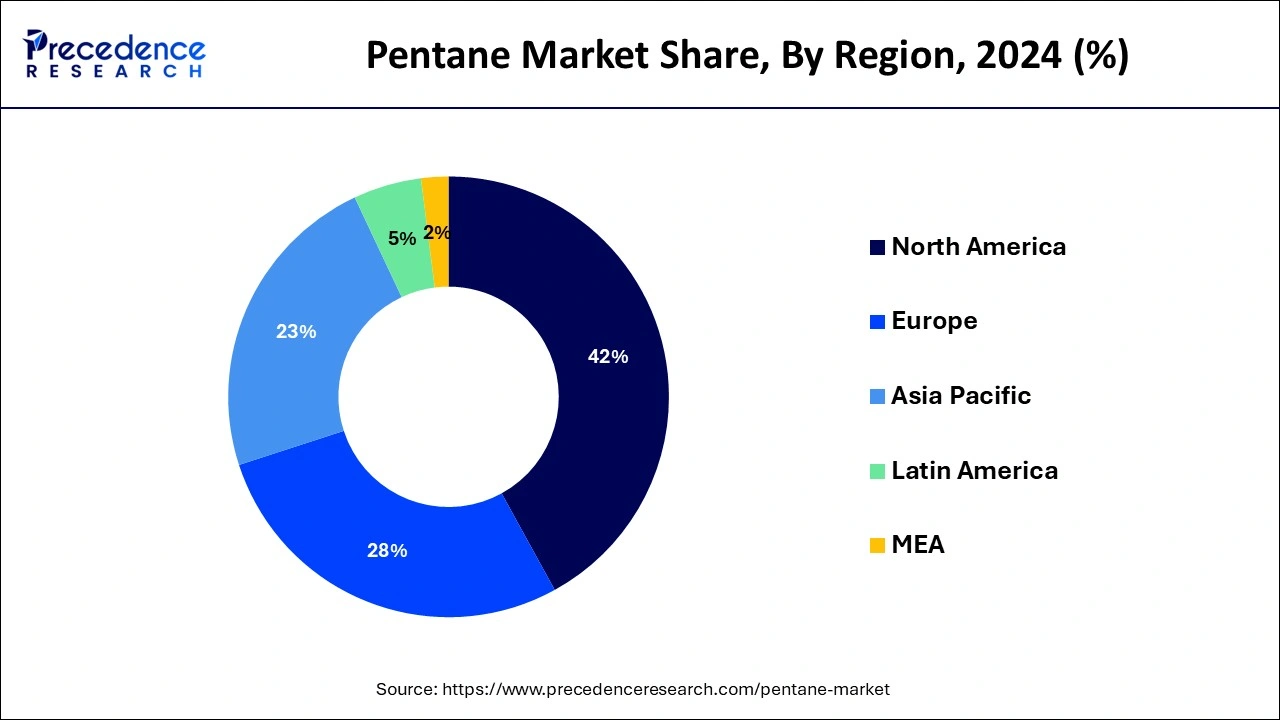

- North America contributed more than 42% of revenue share in 2024.

- Europe is estimated to expand the fastest CAGR between 2025 and 2034.

- By type, the n-Pentane segment has held the largest market share of 43% in 2024.

- By type, the neopentane segment is anticipated to grow at a remarkable CAGR of 5.4% between 2025 and 2034.

- By application, the blowing agent segment generated over 32% of revenue share in 2024.

- By application, the electric cleansing segment is expected to expand at the fastest CAGR over the projected period.

U.S. Pentane Market Size and Growth 2025 to 2034

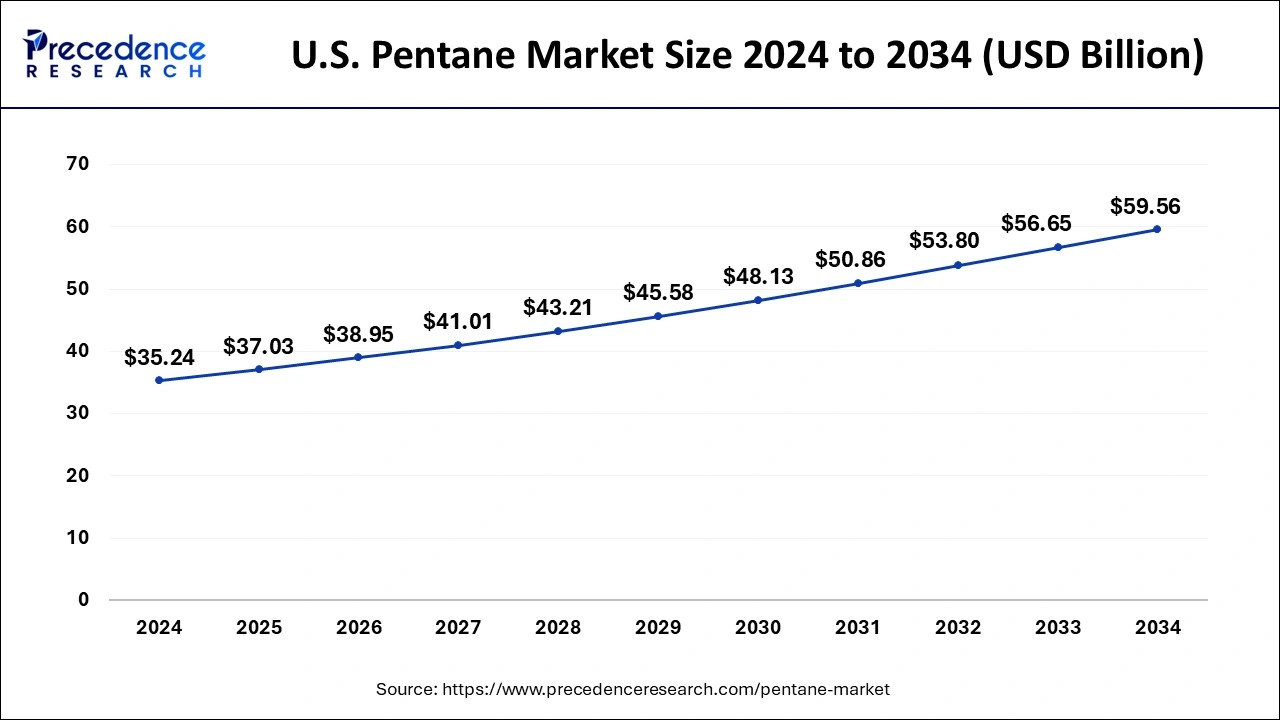

The U.S. pentane market size was evaluated at USD 35.24 billion in 2024 and is projected to be worth around USD 59.56 billion by 2034, growing at a CAGR of 5.39%.

North America has held the largest revenue share of 42% in 2024. In North America, the pentane market is characterized by a robust demand for cleansing agents. Pentane, due to its excellent solvent properties, is a key ingredient in the formulation of cleansing products. This includes its use in various industrial and household cleaning solutions. The trend in the North American market is shifting towards eco-friendly and sustainable cleansing agents, with pentane-based products aligning with these preferences. Additionally, the region is witnessing an increasing focus on innovative, low-VOC (volatile organic compound) formulations, ensuring safety and environmental compliance in the cleansing industry.

Moreover, North America's pentane market is observing a growing inclination towards customized cleansing solutions to cater to specific industry needs. This trend is driven by a greater awareness of the importance of tailored cleansing agents in diverse applications, from electronics manufacturing to automotive cleaning. Overall, the North American pentane market's cleansing segment is evolving to meet stringent environmental standards while offering versatility and efficiency in addressing diverse cleansing requirements.

Europe is estimated to observe the fastest expansion. In Europe, the pentane market is marked by a strong emphasis on environmental cleansing. The region is witnessing a growing trend towards the adoption of eco-friendly, low-global-warming-potential pentane formulations, especially in refrigeration and insulation applications. Stringent environmental regulations are pushing companies to develop and utilize cleaner, sustainable pentane-based products. Additionally, there is a rising interest in recycling and recovery processes to minimize waste and improve sustainability, aligning with the European commitment to greener practices and a cleaner environment within the pentane market.

Market Overview

Pentane is a highly flammable hydrocarbon compound with the molecular formula C5H12. It belongs to the alkane family of organic compounds and is one of the simplest and straight-chain isomers of this class. Pentane exists in three structural isomers: n-pentane, isopentane (or 2-methylbutane), and neopentane (or 2,2-dimethylpropane), each with distinct molecular arrangements. N-pentane represents the most prevalent version of pentane, characterized by its straight, saturated hydrocarbon structure. This colorless and odorless liquid maintains its form in standard room conditions and serves a valuable role as a laboratory reagent, as well as a constituent in the formulation of fuels and solvents.

Meanwhile, isopentane and neopentane exhibit more intricate, branched structures, and their applications extend to diverse industrial sectors, such as refrigeration and inclusion in gasoline blends. All three isomeric forms of pentane find significance in the realms of petrochemical and chemical industries due to their distinct properties and versatile uses. Nonetheless, it is imperative to exercise caution when handling pentane due to its pronounced flammability, necessitating careful storage and controlled usage to mitigate potential hazards.

Pentane Market Growth Factors

- Growing global transportation needs result in increased demand for pentane as a fuel additive.

- Pentane plays a pivotal role in the petrochemical industry, which is poised for substantial growth.

- The chemical industry uses pentane for various processes, and its growth contributes to pentane demand.

- Pentane is used as a refrigerant, and the growing demand for cooling solutions drives market growth.

- Pentane is used in insulation materials, and increased construction projects boost its demand.

- Pentane is used in the manufacturing of automotive parts, and the expanding automotive sector drives demand.

- Growing economies demand more chemical products, benefiting the pentane market.

- Urbanization leads to increased use of refrigeration and air conditioning systems, boosting pentane demand. Stringent environmental regulations may drive the adoption of eco-friendly refrigerants, including pentane.

- Pentane is used in the production of foam products in the consumer goods industry.

- Pentane can be used to enhance energy efficiency in various applications, aligning with sustainability goals.

- Ongoing R&D efforts can lead to the discovery of new applications for pentane, expanding its market.

- Growth in emerging markets can significantly increase pentane consumption.

- Pentane is used in pharmaceutical and medical applications, and the healthcare industry's growth contributes to the market.

- As industries expand, the need for pentane-based chemicals and solvents increases. Large-scale infrastructure projects drive pentane demand for insulation and construction materials.

- The development of alternative energy sources can influence pentane usage in energy storage systems. Streamlining the supply chain and logistics can reduce costs and promote market growth.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 126.87 Billion |

| Market Size by 2034 | USD 194.36 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 4.82% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type and Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Growing energy demand and petrochemical industry growth

The pentane market experiences a substantial boost in demand due to two influential factors, the escalating global need for energy and the robust growth of the petrochemical sector. Firstly, the surging global energy consumption, prompted by factors like population growth and industrial expansion, leads to an increased requirement for energy sources such as fuels and electricity. Since pentane is a key component in fuel blends and essential to various petrochemical processes, this heightened energy demand directly translates into a greater need for pentane.

Furthermore, the expansion of the petrochemical industry is a result of its capacity to meet the increasing need for everyday commodities, encompassing items like packaging materials, consumer products, and automobile components. Pentane assumes a critical function in the manufacturing of numerous such items, rendering it an indispensable component in the petrochemical supply chain.

Restraint

Flammability and price volatility

Flammability and price volatility are significant restraints on the pentane market. The highly flammable nature of pentane necessitates stringent safety measures during storage, transportation, and application, adding to operational costs and concerns. This safety risk can limit its use in various industries.

Additionally, price volatility, influenced by factors such as fluctuations in crude oil prices and supply disruptions, can disrupt the cost-effectiveness of pentane utilization. Unpredictable pricing can make long-term planning and budgeting challenging for businesses. These dual constraints not only affect safety and affordability but also encourage industries to explore alternative, less volatile, and more environmentally friendly options, thereby hindering the overall growth and stability of the pentane market.

Opportunity

Growing demand for sustainable refrigerants

The growing demand for sustainable refrigerants represents a significant opportunity in the pentane market. As environmental consciousness increases, there is a pronounced shift towards eco-friendly refrigerants that have a lower impact on global warming and ozone depletion. Pentane, when used as a refrigerant, aligns with these sustainability objectives. Its natural properties make it a viable alternative to synthetic refrigerants with high global warming potential.

This demand for sustainable refrigerants creates an avenue for pentane's market growth, particularly in the refrigeration and air conditioning sector. Manufacturers and consumers are increasingly seeking greener alternatives, and pentane's compatibility with this trend positions it as a valuable player in the market, offering both energy-efficient cooling solutions and reduced environmental impact, thereby driving its utilization in this important application.

Type Insights

According to the type, the n-Pentane segment held a 43% revenue share in 2024. n-Pentane is a straight-chain, saturated hydrocarbon and one of the three isomeric variants of pentane. It exists as a clear, odorless liquid under standard conditions and is prominently utilized in the petrochemical and chemical sectors, where it finds roles as a laboratory reagent and as an ingredient in fuels and solvents. In the pentane market, the demand for n-pentane is shaped by dynamics such as the expansion of the petrochemical industry, the growth of chemical manufacturing, and its incorporation into solvents and gasoline mixtures. However, its high flammability necessitates rigorous safety precautions and controlled handling procedures to prevent accidents.

The neopentane segment is anticipated to expand at a significant CAGR of 5.4% during the projected period. Neopentane, recognized as 2,2-dimethylpropane, stands as a distinct isomer of pentane, characterized by its intricately branched molecular arrangement. Within the pentane market, neopentane plays a crucial role, mainly serving as a foundational element for crafting specialty chemicals. Its applications encompass the production of pharmaceuticals and high-performance fuels, signifying its significance in diverse industrial and research sectors. Recent trends in the pentane market indicate a growing demand for neopentane due to its applications in advanced industrial processes, research, and development. Its unique properties make it valuable in niche sectors, contributing to its steady presence in the market and further exploration of potential uses.

Application Insights

In 2024, the blowing agent segment had the highest market share of 32% based on the application. Blowing agents, a key application in the pentane market, are chemicals used in the production of foams, particularly in the insulation and packaging industries. Pentane is employed as a blowing agent to create foam materials with excellent insulating properties. Recent trends indicate a growing focus on environmentally friendly blowing agents to reduce the carbon footprint. This has led to increased interest in pentane's potential as a more sustainable choice, aligning with the broader trend of adopting greener alternatives in foam production for improved energy efficiency and reduced environmental impact.

The electronic cleansing segment is anticipated to expand fastest over the projected period. Electronic cleansing within the pentane market pertains to the utilization of pentane solvents for the meticulous cleaning and decontamination of electronic components, including semiconductors and printed circuit boards. This process ensures the optimal functionality and reliability of these components by eliminating impurities and residues.

A noteworthy trend in this realm is the escalating demand for ultra-pure pentane solvents to meet the exacting cleanliness standards of advanced electronics manufacturing. As electronic devices continue to become more compact and intricate, the necessity for precise cleaning solutions involving pentane is experiencing a notable upswing. Moreover, there is a growing emphasis on adopting environmentally friendly and low-VOC (volatile organic compound) pentane solvents to align with sustainability objectives within the electronics industry.

Recent Developments

- In July 2021, Haltermann Carless, a trailblazing global provider of premium hydrocarbon solutions for various sectors including mobility, life sciences, industry, and energy, successfully concluded the construction of its state-of-the-art hydrogenation facility located at the Speyer site. This achievement is poised to significantly bolster the cyclopentane and cyclopentane blends industry in Germany.

Pentane Market Companies

- ExxonMobil

- Royal Dutch Shell

- Chevron Phillips Chemical Company

- Phillips 66

- LyondellBasell

- Maruzen Petrochemical Co., Ltd.

- Bharat Petroleum Corporation Limited

- LG Chem

- INEOS Group

- JX Nippon Oil & Energy Corporation

- SK Innovation

- Haltermann Carless

- HCS Group

- TOP Solvent Co., Ltd.

- Ganga Rasayanie (P) Ltd.

Segments Covered in the Report

By Type

- n-Pentane

- Isopentane

- Neopentane

By Application

- Blowing agent

- Chemical solvent

- Electronic cleansing

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content