Pet Calming Products Market Size and Forecast 2025 to 2034

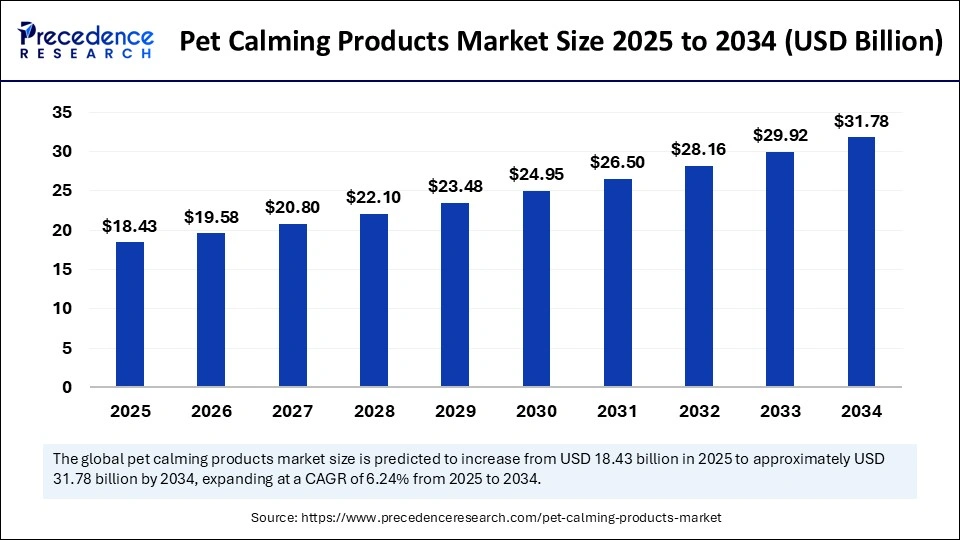

The global pet calming products market size accounted for USD 17.35 billion in 2024 and is predicted to increase from USD 18.43 billion in 2025 to approximately USD 31.78 billion by 2034, expanding at a CAGR of 6.24% from 2025 to 2034. The rising awareness among pet owners about their pet mental health is expected to boost the growth of the market during the forecast period. Increased spending on pet healthcare products further supports market expansion.

Pet Calming Products MarketKey Takeaways

- In terms of revenue, the pet calming products market is valued at $18.43 billion in 2025.

- It is projected to reach $ 31.78 billion by 2034.

- The market is expected to grow at a CAGR of 6.24% from 2025 to 2034.

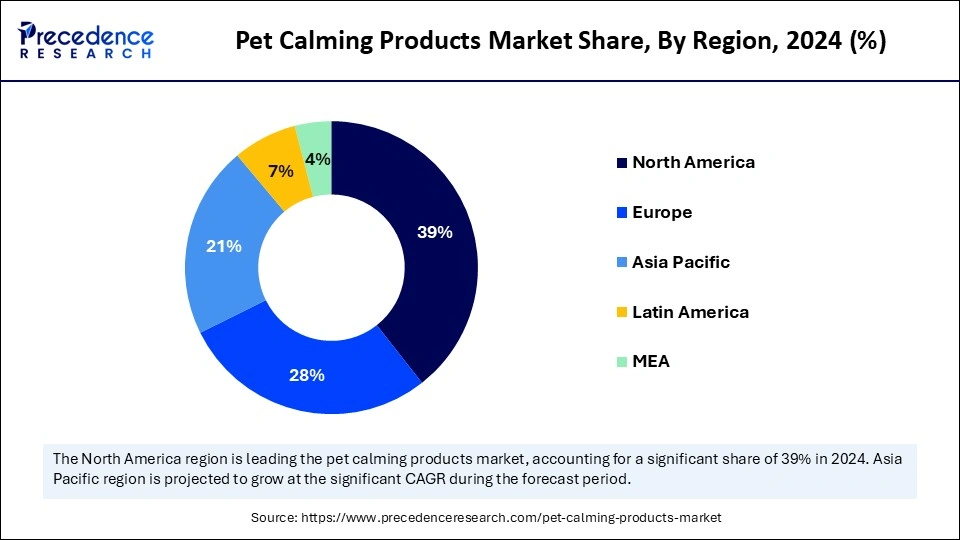

- North America accounted for the major revenue share of 39% in 2024.

- Asia Pacific is expected to grow at the fastest CAGR of 7.2% from 2025 to 2034.

- By pet, the dog segment held the major revenue share of 53% in 2024.

- By pet, the cat segment is expected to grow at the fastest CAGR of 6.9% between 2025 and 2034.

- By product, the snacks and treats segment contributed the highest revenue share of 39% in 2024.

- By product, the gel and ointment segment is expected grow at a significant CAGR of 8.2% between 2025 and 2034.

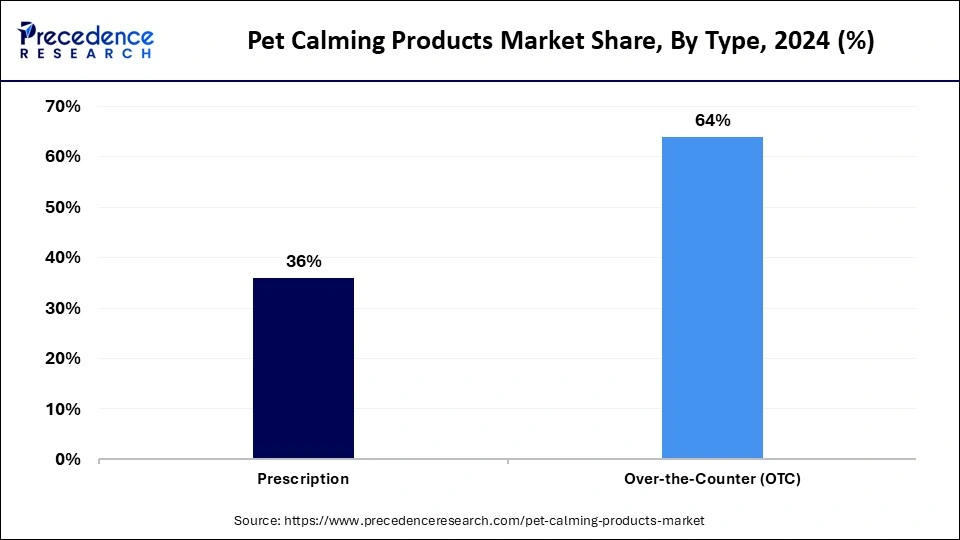

- By type, the over-the-counter (OTC) segment captured the biggest revenue share of 64% in 2024.

- By type, the prescription segment is expanding at a CAGR of 6.9% from 2025 to 2034.

- By ingredient, the melatonin segment contributed the biggest revenue share of 27% in 2024.

- By ingredient, the herbal segment is expected to grow at the highest CAGR of 6.8% from 2025 to 2034.

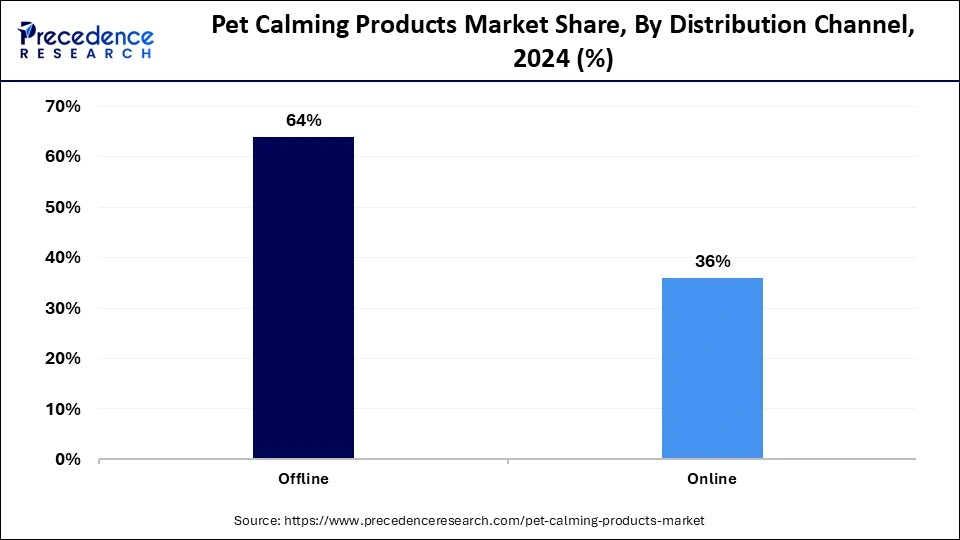

- By distribution channel, the offline segment accounted for the major revenue share of 64% in 2024.

- By distribution channel, the online segment is growing at a CAGR of 6.6% from 2025 to 2034.

How is AI Influencing the Pet Calming Products Market?

Artificial Intelligence is a transformative leap forward in the future of pet care technology. AI is enabling better understanding and parenting for pets. AI-enabled apps or devices enable monitoring of pet health and behavior. This helps pet owners tailor calming products to their pets' specific needs. Several AI-enabled apps provide tips and suggestions according to pets' emotional data, enabling pet owners to anticipate and address anxiety-related issues. For instance, Traini's smart dog collar is gaining popularity. This collar is designed to provide better pre-parenting, where AI algorithms help to provide pet care by understanding and complying emotional needs of pets.

U.S. Pet Calming Products Market Size and Growth 2025 to 2034

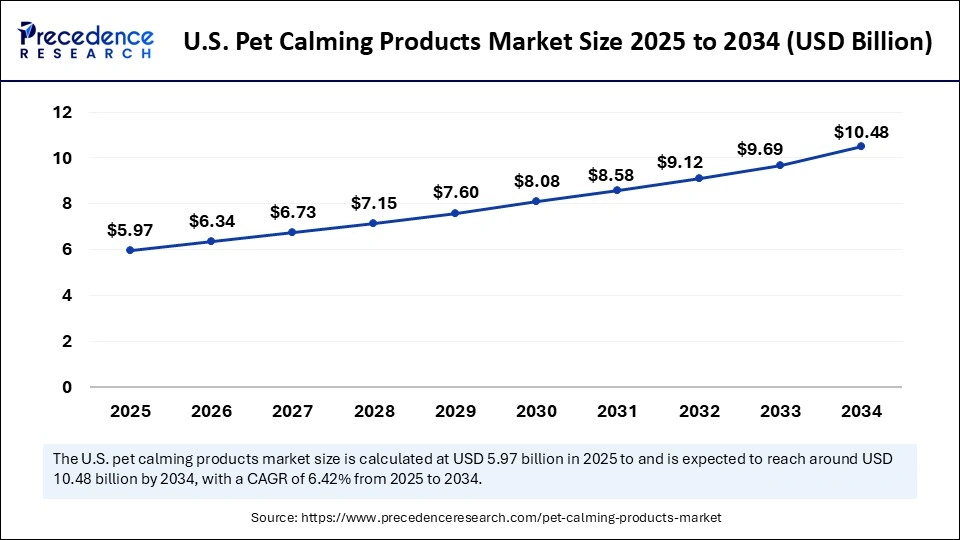

The U.S. pet calming products market size was exhibited at USD 5.62 billion in 2024 and is projected to be worth around USD 10.48 billion by 2034, growing at a CAGR of 6.42% from 2025 to 2034.

How Does North America Dominate the Pet Calming Products Market?

North America registered dominance in the market by capturing the maximum revenue share of 39 in 2024. This is mainly due to the increased number of pet owners, heightened awareness about pet health, and the trend of pet humanization. North America has a high number of dog and cat owners. Pet owners in the region have become increasingly aware of their pets' mental and behavioral health, driving the demand for premium and natural pet products. The rising sustainability trend is fostering novel innovations in pet calming products. Additionally, wide product availability in online stores supports regional market growth.

The U.S. Pet Calming Products Market Trends

The U.S. is a major player in North America. The growth of the market in the U.S. is driven by increased demand for natural and holistic products. There is increasing demand for over-the-counter calming products. Supplements, gels, and ointments are highly preferred products for pet calming in the country. The increasing demand for veterinarian-formulated products for pet health is fostering market growth. Elanco Animal Health Inc. is the major manufacturer of pet healthcare products in the U.S., providing science-backed and veterinarian supplements to improve pet health.

What Opportunities Exist in the Pet Calming Products Market Within Asia Pacific?

Asia Pacific is poised to grow at a notable CAGR of 7.2% during the forecast period. The growth of the market in the region is driven by rising pet ownership and awareness of pet anxiety. Increased disposable income is enabling pet owners to spend on premium pet calming products. Domestic manufacturers are developing innovative calming treats, supplements, and pheromone diffusers to meet the increased demand for pet calming products. Additionally, the rise of e-commerce contributes to market growth by improving access to a range of products. China is a major player in the regional market, with a high number of pet owners in the country. There is heightened awareness among pet owners about pets' mental health, increasing spending on premium products

Market Overview

The global pet calming products market has been witnessing transformative growth due to the increased number of pet owners and the trend of treating pets as family members. There is a trend on social media, “Dogs and cats are new babies and plants are new pets!” Pet owners have increased their spending on their pet care. The rising awareness about mental & behavioral health, availability of customized products on online distribution channels, demand for premium calming products, and focus on manufacturers to provide innovative and technologically advanced calming products are taking the market toward growth. Various pet behavioral studies have demonstrated pet anxiety and stress disorders, making a significant impact on owner care perspectives for their pets. The ongoing trend of veterinarian and organic products has contributed to increased demand for natural and veterinarian-formulated pet calming products, driving innovative approaches in the industry.

- In November 2024, a new product range of pet calming products for improving pet wellness at both home and on the go, Mellow, was launched by PetFriendly. The Mellow product line provides diffusers and sprays to help cats and dogs reduce their stress and anxiety.

(Source: https://finance.yahoo.com)

What are the Growth Factors of the Pet Calming Products Market?

- Urbanization & Lifestyle Changes: Rapid lifestyle changes, urbanization, noise issues, separation, and environmental issues are major reasons causing stress and anxiety disorders among pets, driving the need for pet calming products.

- E-commerce Platform: expanding e-commerce platform enabling easy access to customized and premium solutions, including pet calming products, contributing to the market growth.

- Customized and Premium Products: Pet owners are seeking specialized, customized, and premium pet care products for their specific pet breeds and their anxiety types.

- Innovative Products: Key vendors are focusing on developing innovative products like calming supplements, pheromone diffusers, sprays, and treats to comply with the increased demand for more effective and user-friendly pet calming solutions.

- Natural Vegetarian-formulated Products: The demand for natural and vegetarian-formulated calming products, including chamomile, valerian root, and CBD, has increased, fostering innovative approaches in the market competition.

Marker Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 31.78 Billion |

| Market Size in 2025 | USD 18.43 Billion |

| Market Size in 2024 | USD 17.35 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 6.24% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Pet, Product, Type, Ingredient, Distribution Channel, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Rising Awareness of Pet Anxiety and Stress

The rising awareness among pet owners about pet anxiety and stress is the major driver of the global pet calming products market. Pet owners are becoming increasingly aware of their pets' health & well-being, driving demand for innovative calming products. Changing lifestyle, urbanization, and changing family environments cause stressful situations for pets. Additionally, the trend for treating pets as family members has drawn significant focus on the emotional, mental, and behavioral well-being of pets. Various studies have unveiled anxiety and stress disorders in pets, making calming products more appealing.

Restraint

Concern about Ingredient Safety and Efficacy

Pet owners are highly concerned about the ingredients' safety, efficacy, and side effects used in pet calming products. Concern over the side effects of ingredients, including CBD, hinders the owner's confidence in product brands. Additionally, regulatory compliance about ingredient safety and efficacy, with inaccurately labeled ingredients or those containing harmful substances, can hamper market expansion. However, the rising focus on transparency, quality control, compliance, and scientific backing can bring consumer trust in certain products.

Opportunity

Growing Preference for Natural and Non-Invasive Solutions

The preference for natural and non-invasive solutions has increased among pet owners. Natural calming products, including essential oils, pheromones, and herbal extracts, are being preferred in pet calming products. Additionally, the use of non-invasive solutions like diffusers, trets, and sprays has increased. The market growth has been shaped mainly due to increased preference for organic food, tech-enabled care, and health supplements among millennials and Gen Z pet owners. Herbal remedies, pheromone-based products, and CBD-infused products are trending in the market.

Pet Insights

Why Did the Dog Segment Dominate in 2024?

The dog segment dominated the pet calming products market by holding more than 53% of revenue share in 2024 due to increased purchases of pet calming products for dogs, along with increased dog ownership worldwide. Dogs have close bonds with their owners, making them slightly high prone to anxiety-related problems. Dogs experience major anxiety and stress issues due to separation from their owners, noise phobias, and social anxiety, making pet calming products appealing. Various innovative products like supplements, treats, collars, and tracking apps are fostering segment growth.

The cat segment is expected to expand at the fastest CAGR of 6.9% during the forecast period, driven by increasing cat ownership. The demand for premium and specialized cat products is rising, contributing to the segment's growth. Kittens are more likely to suffer from anxiety and stress disorders. Ongoing innovations in cat calming products, like treats, chews, supplements, pheromone products, and natural scents, are transforming the cat calming products industry. For instance, the kitten calming products pack is gaining popularity in the market. This pack includes 1 x 15ml Calming Spray, 1 x 60 Day Plug-in Diffuser, and 3 x Calming Wipes. Additionally, the sale of Petroyale Calming Chews for Cats is also rising.

Product Insights

How Snacks & Treats Segment Dominated the Pet Calming Products Market in 2024?

The snacks & treats segment dominated the market with largest revenue share of 39% in 2024 due to the high preference for effective and convenient pet calming products. Snacks and treats are palatable to relax the pets. Pet owners are increasingly preferring snacks and treats with calming ingredients like CBD to handle pet anxiety. Demand for customized calming treats and snacks for specific pet needs is trending in the market. Additionally, the demand for natural ingredient-based calming snacks and treats is fostering market growth.

On the other hand, the gel & ointment segment is expected to grow at a CAGR of 8.2% over the forecast period. The segment growth is attributed to the increasing preference for pet calming products to be applied directly on the skin. CBD, natural extracts, and pheromone ingredient-based gel & ointments are highly adaptable. The increased awareness of pet anxiety and stress has increased owners' spending. Changing lifestyles and frequent traveling are the major concerns that have increased demand for gel and ointment calming products.

Type Insights

What Made Over-the-Counter (OTC) the Dominant Segment in 2024?

The over-the-counter (OTC) segment dominated the pet calming products market with the major revenue share of 64% in 2024. This is mainly due the wide availability of over-the-counter (OTC) pet calming products. Easy access to this product, convenience prescriptions, and a variety of options encourage owners to prefer to purchase OTC products. Additionally, OTC products are cost-effective, making them appealing to pet owners. The increased awareness among pet owners and product innovations are fostering segment growth.

Meanwhile, the prescription segment is expanding at a CAGR of 6.9% in the coming years due to the rising demand for more effective pet calming products. Prescribed products offer veterinary guidance and product suggestions. Pets with severe anxiety, stress, and behavioral issues need to receive specific products with targeted relief and support. The growing demand for veterinarian-recommended products is furtherfueling segment growth.

Ingredient Insights

Why did the Melatonin Segment Dominate the Pet Calming Products in 2024?

The melatonin segment dominated the market by holding more than 27% of revenue share in 2024. This is mainly due to the increased pet owners' preference for natural and non-addictive calming products. Melatonin is a natural hormone that helps to regulate the sleep cycle and helps to relax animals. Lemon Balm has been the most popular product for dog health in the past few years. However, the market has witnessed significant growth in demand for melatonin-based chews and sprays, due to their gentle nature for reducing the stress and anxiety of pets.

Meanwhile, the herbal segment is expected to grow at a CAGR of 6.8% during the forecast period. The popularity of natural and holistic products is increasing as pet owners are seeking organic, safe, and effective calming products. Herbal ingredients like chamomile, lavender, and valerian roots are mainly being used in pet calming products due to their safe and effective nature. The rising preference for natural and holistic solutions for pets' stress and anxiety is shaping segment growth.

Distribution Channel Insights

What Made Offline the Dominant Distribution Channel in 2024?

The offline segment dominated the pet calming products market in 2024 by holding more than 64% of revenue share. This is mainly due to increased consumer preference for in-store experiences or traditional shopping habits. Offline stores provide tactile engagements with immediate access, personalized services, and products. Pet owners' preference for physical verification of product quality and after-sales services. Immediate access to products makes offline stores appealing for urgent calming assistance to the pet's needs, making the offline segment crucial.

The online segment is expected to grow at a significant CAGR of 6.6% over the projection period. The expanding e-commerce platforms and wide accessibility to customized and specific products are driving the growth of the segment. Consumers can widely select their customized products and compare prices, product details, and reviews on online platforms. The ability to purchase products from home and competitive prices make online platforms convenient and affordable for consumers. Easy doorstep delivery offered by online stores further attracts more consumers.

Pet Calming Products Market Companies

- Zesty Paws

- Nestlé Purina Petcare

- Virbac

- THUNDERWORKS

- NOWFoods

- Zoetis Inc.

- CEVA (ADAPTIL)

- GARMON CORP.

- PetHonesty

- PetIQ, LLC.

Recent Developments

- In May 2025, SecureCat, SecureDog, and SecureBunny were launched by the worldwide leader in pheromone research and pet well-being, SIGNS. These products are a scientifically advanced line of pheromone products for use by pet owners and veterinary professionals. These products help pets understand communication to let them know that "everything is OK".

- In February 2025, Pet Protect, a veterinarian-formulated supplements line for dogs and cats, was launched by Elanco Animal Health Incorporated. The product is designed to support the various health needs of pets. (Source: https://www.feedbusinessmea.com)

- In April 2024, Cymbiotika launched its first pet nutrition range of supplements, including Hip & Joint, Probiotic+, Calm, and Allergy & Immune Health for gut health, calm, joint health, allergies, and immunity.

(Source: https://www.petfoodindustry.com)

Segments Covered in the Report

By Pet

- Dog

- Cat

- Others

By Product

- Food & Supplements

- Snack & Treats

- Gel & Ointment

- Spray & Mist

- Others

By Type

- Prescription

- Over-the-Counter (OTC)

By Ingredient

- Melatonin

- L-theanine

- Vitamin B1

- Herbal Ingredients

- Others

By Distribution Channel

- Offline

- Online

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content