What is the Pet Care Market Size?

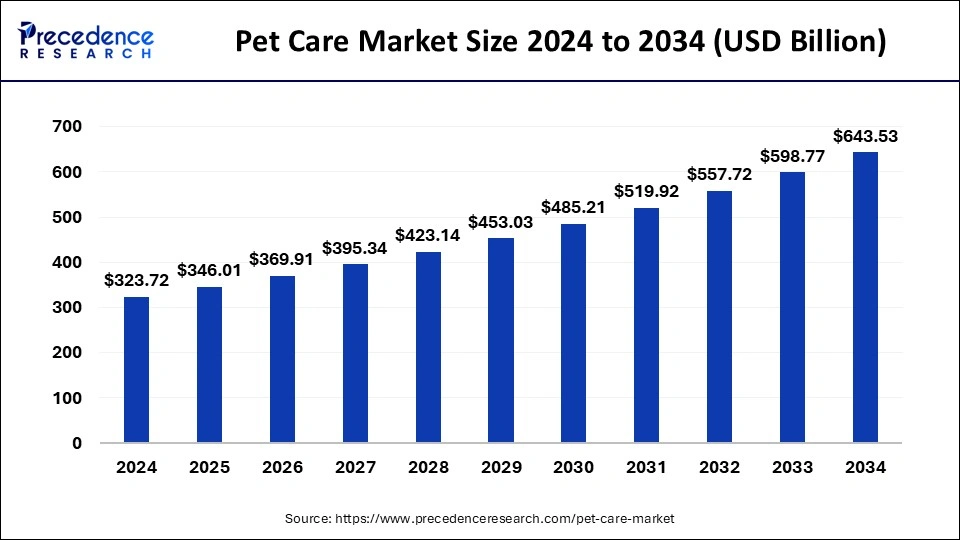

The global pet care market size is calculated at USD 346.01 billion in 2025 and is predicted to increase from USD 369.91 billion in 2026 to approximately USD 643.53 billion by 2034, expanding at a CAGR of 7.10%.

Market Highlights

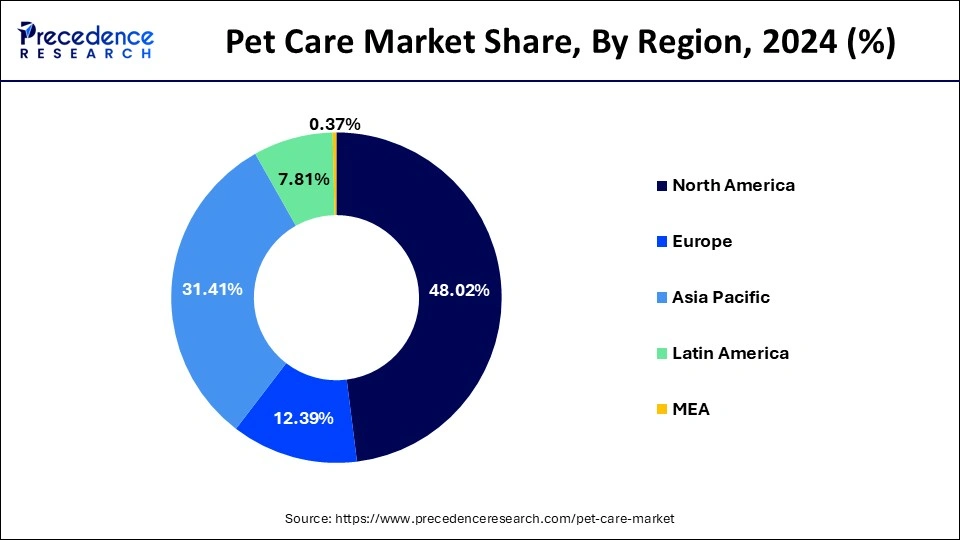

- North America has contributed more than 48.03% of the market share in 2024.

- Asia Pacific is observed to be the fastest growing during the forecast period.

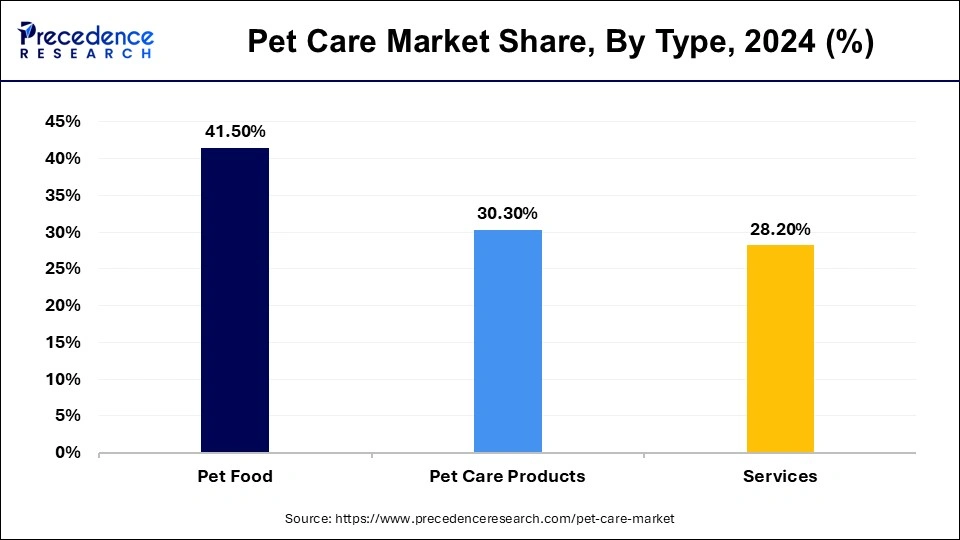

- By type, the pet food products segment has held a major market share of 41.50% in 2024.

- By animal, the dog segment held the largest share of the market in 2024.

- By distribution channel, the stores segment led the market with the largest market share of 64.24% in 2024.

Market Size and Forecast

- Market Size in 2025: USD 346.01 Billion

- Market Size in 2026: USD 346.01 Billion

- Forecasted Market Size by 2034: USD 643.53 Billion

- CAGR (2025-2034): 7.10%

- Largest Market in 2024: North America

- Fastest Growing Market: Asia Pacific

Market Overview

The global trend of embracing companion animals such as cats, dogs, fish, and birds is experiencing a rapid upsurge. Pet ownership offers a myriad of benefits including enhanced confidence, stress reduction, improved cardiovascular health, and better blood pressure management, supported by scientific evidence. This growing awareness of the positive impact of pets is fueling a surge in pet adoption rates, particularly among millennials and Generation Z, amplified by the pervasive influence of social media. The burgeoning e-commerce landscape is also playing a pivotal role in propelling the expansion of the pet care market worldwide.

The burgeoning demand for luxury pet care items and services, coupled with the growing phenomenon of pet humanization, is catalyzing the proliferation of pet care products and services. Notably, the surge in pet adoption rates and per-capita pet expenditure across various regions is generating a burgeoning market for high-end pet care offerings. Moreover, in developing nations, the pet care industry is experiencing rapid growth, propelled by urbanization dynamics. Smaller pets like cats and dogs are particularly favored due to their ease of care and propensity for human-like companionship.

Market trends

- In July 2025, a collaboration between the Domestic Violence Service Center and the SPCA of Luzerne County was announced to be formed for the safety of the pets. Moreover, to celebrate the launch of Purple Paws, which will be their new initiative, a ribbon-cutting program was conducted at Wilkes-Barre City Hall, where the officials from both organizations gathered together. The essential resources for the pets from the domestic abuse families will be provided by this initiative. Thus, services such as feeding, vaccination, boarding, along with 30 days of care for the pets with free of cost to the victims will be offered.(Source: https://www.citizensvoice.com)

- In June 2025, the second round of the Next Generation Pet Food Program will soon be launched by the collaboration between Big Idea Ventures and Mars Petcare with Bühler, Givaudan, and AAK. The startups will be supported with advanced processing, novel ingredients, and sustainable fats and proteins to enhance the pet food sector's innovations, which will be the ultimate goal of this initiative. (Source: Program offers free pet care for families experiencing domestic abuse – Wilkes-Barre Citizens' Voice Big Idea Ventures and Mars Petcare Launch 2025 Global Pet Food Innovation Program in Collaboration with AAK, Bühler, and Givaudan) (Source: https://www.thehansindia.com)

Pet Care Market Growth Factors

- Growth in spending on pet products, such as food, healthcare, insurance, and grooming, is expected to drive market expansion by boosting consumption rates.

- Increased pet ownership and consumption rates and growing infrastructure facilities are expected to drive growth in pet care market.

- The pace of integrating technology into pet care is increasing, which presents a wide range of unexplored opportunities. Wearables that track vital signs and Artificial Intelligence (AI)- powered pet language translation are some examples of tech-driven innovations that can transform how we comprehend and care for our pets.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 346.01 Billion |

| Market Size in 2026 | USD 369.91 Billion |

| Market Size by 2034 | USD 643.53 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 7.10% |

| Dominated Region | North Aemrica |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Animal, Distribution Channel, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

The playful evolution of pet comforts

In pet care market, pet dogs are increasingly affected by obesity in many parts of the world. As a result, the demand for pet dog dietary food products is expected to rise to maintain their health. A recent study has shown that pets suffer from weight issues due to unhealthy feeding habits. The need for vegan animal nutrition is growing due to the changing preferences of pet owners. They are more inclined to provide their pets with healthy and plant-based meals. Additionally, the popularity of premium toys for both dogs and cats is expected to increase the demand for pet toys. Furthermore, the market growth is likely driven by the growing need for high-quality animal hygiene products in the upcoming years.

The worldwide obsession with luxurious pet care

There is a growing global trend of indulging our beloved pets with luxuries and pampering. Pet care market is expanding rapidly, offering a variety of products and services ranging from premium food and designer clothing to luxurious grooming and spa treatments. This phenomenon of pet pampering is gaining momentum, and pet owners worldwide are willing to splurge on their furry companions. The demand for high-end pet care services is increasing, and it is fascinating to see how pet owners will go to keep their pets happy and healthy.

The surge in the grooming and accessory industry

As pet humanization continues to grow, more and more people treat their pets as family members. This trend has had a positive impact on the pet market as a whole. However, as urbanization continues to drive people into smaller living spaces, many choose smaller pets that are easier to care for. Because these smaller pets require less maintenance, they are often pampered and treated like humans. Today, a wide range of natural, high-quality, and safe pet care products are available to meet the growing demand for luxurious pet grooming worldwide.

Moreover, the increasing popularity of pet fashion among pet enthusiasts has led to significant market growth in the pet grooming industry. As a result, many manufacturers are investing heavily in research and development to create new and unique products that meet the needs of pet owners. Overall, the growing trend of pet humanization is driving the growth of pet care market.

Restraint

Accessibility to high-quality pet care services

Rising prices of high-quality pet care products are expected to limit demand among lower-income pet owners. Additionally, animal-borne illnesses such as abdominal pain, diarrhea, and others due to unsanitary living conditions of pets, which remain unknown to their owners, are also expected to restrict market growth to some extent. Furthermore, the vague regulations around labeling and promoting pet care products will likely hinder companies' profit margins in the pet care market.

Opportunities

Growing demand for sustainable and ethical products

In pet care market, the increasing demand for sustainable and ethical pet care products is opening up new avenues for innovation. Consumers are showing a preference for products that are environmentally friendly and sourced from ethical suppliers. This trend impacts the traditional pet food and supplies market and extends to pet care services, where businesses focus on reducing their environmental impact and ensuring ethical practices. By capitalizing on this trend, companies can differentiate themselves in the market and attract a segment of consumers who are conscious about the products and services they purchase for their pets.

Diversification of services and products

The pet care market is witnessing a shift towards offering various services and products to cater to pet owners' needs. From high-end nutrition to specialized pet care services like grooming, training, and boarding, the market is expanding to meet pet owners' diverse needs. This diversification allows businesses to tap into different market segments, from luxury pet owners to those seeking affordable and convenient services. Moreover, it will enable enterprises to cross-sell and upsell services, thereby increasing revenue streams.

Franchise opportunities and job creation

Multiple franchise opportunities exist across the sector for those interested in pet care market but prefer to join a recognized brand rather than starting from scratch. Franchising allows entrepreneurs to leverage established brands to boost customer awareness and accelerate growth. This model provides a structured approach to business and offers support and resources for entrepreneurs. Additionally, the pet industry offers many job opportunities that do not require a post-secondary degree, catering to individuals at various career stages. This creates a vibrant ecosystem of employment opportunities, from daycare providers to veterinary professionals, making it an attractive sector for job seekers.

Self-employment and entrepreneurship

Pet care market provides excellent opportunities for self-employment and entrepreneurship. If you want to be your boss, you can find various ways to establish a pet-centered business, such as pet sitting, dog walking, selling pet supplies, or providing specialized pet care services. The flexibility of this market enables entrepreneurs to customize their business to their skills and interests, which can lead to a satisfying and fulfilling career path.

Segments Insights

Type Insights

The pet food products segment accounted for the largest share in pet care market in 2024, with a growing focus on sustainability and eco-friendly options. The demand for pet food is driven by increasing consumer awareness about the health and well-being of pets. The segment includes various products such as meat, meat byproducts, grains, cereals, vitamins, and minerals. The emphasis on home delivery services by online stores and the trend toward clean labeling is expected to boost the growth of this segment.

The pet care products segment is observed to grow at a notable rate. The segment offers veterinary services Veterinary care services including essential healthcare and wellness services for pets. This segment includes various services, from routine check-ups and vaccinations to specialized treatments and surgeries. The demand for these services is influenced by the increasing pet population, rising disposable incomes, and a growing awareness of pet health and wellness.

Global Pet Care Market Revenue, By Type, 2022-2024 (USD Million)

| Type | 2022 | 2023 | 2024 |

| Pet Food | 1,17,278.6 | 1,25,509.7 | 1,34,302.3 |

| Pet Care Products | 88,669.4 | 93,276.2 | 98,148.6 |

| Services | 77,617.2 | 84,151.7 | 91,269.5 |

Animal Insights

The dogs segment held the largest share of the pet care market in 2024. Many homeowners keep a well-trained dog as a security measure to prevent break-ins. This trend is expected to continue and result in a higher number of households owning dogs, which will consequently drive the growth of this market segment.

With the rise of wearable technology, there's a growing trend in apps that allow dog owners to monitor their pets' health remotely. This includes tracking heart rate, activity levels, and other vital signs through wearable devices. Such applications provide peace of mind for owners and help in the early detection of health issues.

The cat segment is expected to grow considerably because of rising online sales of cat products from prominent e-commerce sites like Walmart, Amazon, and others. Like dog care, cat owners also benefit from apps focusing on pet care and health. This includes apps that offer advice on grooming, nutrition, and health monitoring. The focus here is on addressing the unique needs of cats, such as their specific dietary requirements and health concerns.

- In January 2023, Cargill announced its entry into the pet care sector by launching a pet-care app called Zoonivet. Zoonivet is a Telehealth platform that was launched years ago. It's an app that enables pet owners to connect with qualified veterinarians through video calls to provide primary healthcare services to their pets.

Global Pet Care Market Revenue, By Animal, 2022-2024 (USD Million)

| Animal | 2022 | 2023 | 2024 |

| Dogs | 1,75,020.5 | 1,85,841.1 | 1,97,294.9 |

| Cats | 68,388.1 | 74,137.6 | 80,449.6 |

| Birds | 5,876.8 | 6,233.0 | 6,607.9 |

| Fishes | 7,269.4 | 7,742.9 | 8,241.0 |

| Horses | 16,051.2 | 17,411.6 | 18,915.5 |

| Others | 10,959.3 | 11,571.2 | 12,211.5 |

Distribution Channel Insights

The stores segment dominated the global pet care market in 2024. Stores frequently run promotional activities, discounts, loyalty programs, and in-store events to attract customers and encourage repeat purchases, driving sales and market share in the pet care industry. Physical stores serve as hubs for community engagement, bringing together pet owners, enthusiasts, and experts through events, workshops, and social gatherings, fostering a sense of belonging and loyalty among customers.

Global Pet Care Market Revenue, By Distribution Channel, 2022-2024 (USD Million)

| Distribution Channel | 2022 | 2023 | 2024 |

| Stores |

1,86,655.2 | 1,97,008.4 | 2,07,967.9 |

| E-commerce |

51,233.9 | 56,861.8 | 63,040.5 |

| Others |

45,676.1 | 49,067.3 | 52,712.0 |

Regional Insights

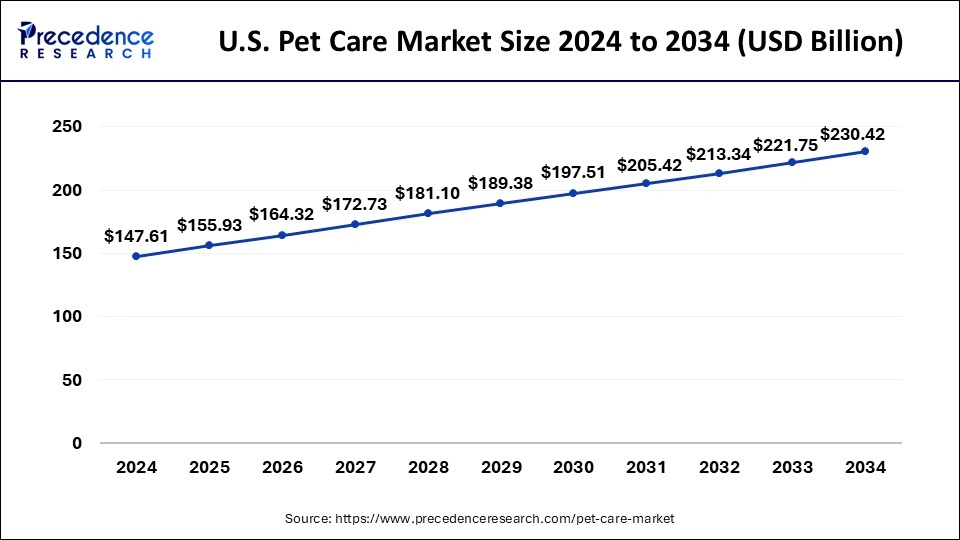

U.S.Pet Care Market Size and Growth 2025 to 2034

The U.S. pet care market size was exhibited at USD 155.93 billion in 2025 and is projected to be worth around USD 230.42 billion by 2034, growing at a CAGR of 4.43%.

North America dominated the global pet care market share of 48.02% in 2024. North America boasts one of the highest pet ownership rates globally, with many households owning pets. This high adoption rate of pets translates into a substantial market for pet care products and services. The demand for pet food, toys, grooming supplies, and veterinary services is consistently high, reflecting the region's vibrant pet care market. The economic stability and high disposable income in North America contribute to the region's strong demand for premium pet care products.

Consumers in North America often have the financial means to invest in high-quality pet food, toys, and accessories, which further drives the market. The ability to afford these products not only caters to the needs of pets but also reflects the pet owners' willingness to spend on their pets' well-being.

- In October 2023, a new booking platform was launched in Chicago that connects pet owners with local pet care providers. The platform is called Pawcare and it was co-founded by Mike Monteiro, the creator of the restaurant-booking app Resy, and CEO Kunal Chopra, a former director of products at Groupon. The aim of Pawcare is to make pet care more convenient for pet owners.

The region's extensive infrastructure, including pet stores, veterinary clinics, and online pet care platforms, facilitates the availability of a wide range of pet care products. This infrastructure ensures pet owners can access various options, from food and toys to healthcare and grooming services. The availability of products and services in convenient locations and online platforms supports the market's growth. Consumer spending patterns in North America favor the pet care market, with a growing trend towards premium products.

Pet owners in North America are increasingly willing to pay more for high-quality pet food, toys, and accessories that cater to their pet's specific needs and preferences. This trend towards premiumization is a significant driver of the market's growth. Government policies and regulations in North America also support pet care market. The region has implemented policies to improve pet care and promote responsible pet ownership. These policies and the region's vigorous enforcement of animal welfare laws create a favorable environment for the pet care industry.

Asia Pacific is the fastest-growing region in the pet care market. Asia-Pacific is home to various countries, including mature markets and emerging markets like India and China. These countries have different buying patterns and social cultures. Pet care market in Asia-Pacific is mainly driven by rapid urbanization and connectivity programs. Many people in these countries consider owning a pet a symbol of social status and sensitivity. Still, they feed their pets human food like white rice, dairy products, fish, chicken, and peanut butter instead of proper pet food. This could hinder the growth of the market.

Europe is expected to grow significantly in the pet care market during the forecast period. There is a rise in the ownership of pets in Europe. This, in turn, is increasing the awareness about pet health, increasing the demand for pet care services. The use of natural, as well as organic, pet food is also increasing. The industries in the UK are developing various lab-grown meats, as well as natural and organic probiotics, which are also being launched. While in Germany, the demand for healthcare services, as well as the development of smart devices, is increasing. Thus, all these factors are promoting the market growth.

Pet Care Market Companies

- Spectrum Brands Inc

- Zooplus AG

- Hill's Pet Nutrition(Colgate Palmolive company)

- Freshpet

- Zetis

- J.M. Smucker

- PetSmart Inc

- Nestle Purina PetCare(Nestle SA)

- Mars Inc

- Champion Petfoods

- Petmate Holdings Co

- Ancol Pet Products Limited

- Blue Buffalo Pet Products Inc.

- Chewy Inc

Recent Developments

- In May 2025, TelmyVet and PetPace jointly announced the launch of a pioneering Quality-of-Life Consultation, a virtual care service designed to support pets and their families during the most vulnerable stage of life. The Quality-of-Life Consultation provides a safe, virtual space for pet parents to connect with veterinary professionals, receive guidance, and make informed decisions, reducing the stress of in-clinic visits for pets with limited mobility or chronic illness. (Source: https://www.businesswire.com)

- In April 2025, Godrej Pet Care, a subsidiary of Godrej Consumer Products, launched its pet food brand, Godrej Ninja, in Tamil Nadu. The brand offers scientifically formulated dog food aimed at improving gut health and immunity. The brand offers scientifically formulated dog food aimed at improving gut health and immunity. (Source: https://www.afaqs.com)

- In April 2024, HDFC ERGO General Insurance introduced Paws n Claws, an extensive insurance policy designed for pet dogs and cats. This policy offers a financial safety net for pet owners against the expenses of their pets' illnesses, injuries, and surgeries; this policy allows coverage for up to five pets under a single policy. (Source: https://www.livemint.com)

- In March 2024, PetPace 2.0 redefined pet health with a revolutionary vet-grade AI-driven collar that improves the health and quality of life of pets through remote monitoring, to bring peace of mind to pet owners and help prevent unnecessary pain and suffering for dogs. Only PetPace AI-powered smart dog collar provides immediate health alerts, continuous vital sign monitoring, proprietary wellness scores, and health comparisons based on their exclusive database. (Source: https://www.businesswire.com)

- In Oct 2023, Scientific Remedies is a company that specializes in companion animal health. They have recently launched Affinity Advance. In collaboration with Scientific Remedies, Affinity Petcare has launched its flagship pet food brand in India. The primary aim of this launch is to offer high-quality pet food to pet parents across India.

- In December 2023, The company has recently introduced its new pet health services, which they have named "Chewy Vet Care". The inaugural Chewy Vet Care practice was launched in South Florida in 2024. Chewy's custom-built open platform will power all the practices, and it can be seamlessly applied to both Chewy Vet Care and third-party partner practices.

- In April 2023, SKU, an accelerator program for consumer-packaged goods (CPG) industries, announced a new track dedicated to pet care brands. The program provides customized mentorship to help pet industry brands grow their businesses.

- In October 2023, actress and animal advocate Kaley Cuoco announced her new pet care brand, Oh Norman! Cuoco's love for her late dog, Norman, inspired her to launch this brand. The brand is dedicated to manufacturing eco-friendly, durable, and safe pet products.

- In Apr 2023, Leading pet lifestyle brand Heads Up for Tails in India launched Dash Dog, which offers Innovative products that cater to the needs of active pets and their parents based on extensive research and consumer insights.

Segments Covered in the Report

By Type

- Pet Food Products

- Pet Care Products

- Services

By Animal

- Dogs

- Cats

- Birds

- Fishes

- Horses

- Others

By Distribution Channel

- Stores

- E-commerce

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting