What is the Pork Meat Market Size?

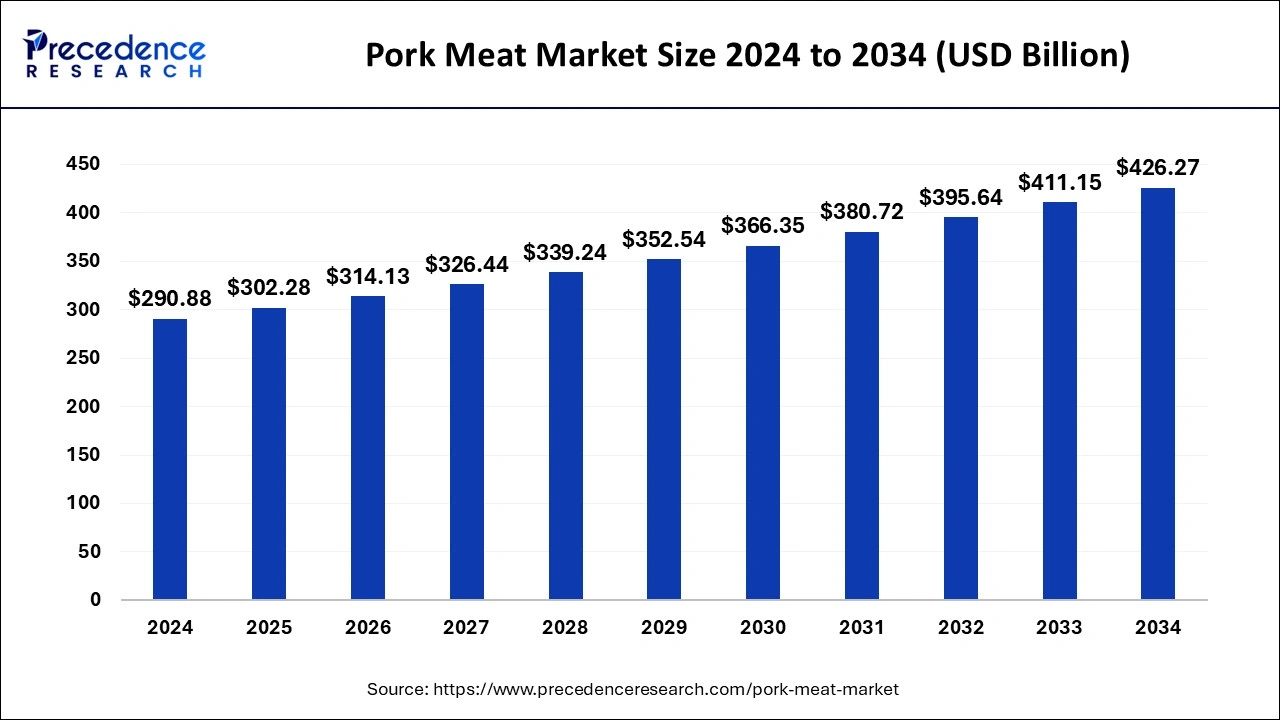

The global pork meat market size is calculated at USD 302.28 billion in 2025 and is predicted to increase from USD 314.13 billion in 2026 to approximately USD 441.65 billion by 2035, expanding at a CAGR of 3.86% from 2026 to 2035.

Pork Meat Market Key Takeaways

- The global pork meat market was valued at USD 302.28billion in 2025.

- It is projected to reach USD 441.65billion by 2035.

- The market is expected to grow at a CAGR of 3.90% from 2026 to 2035.

- Asia Pacific was a prominent player in the pork meat market in 2025.

- North America has been witnessing steady growth in the global market.

- By type, the frozen segment emerged as the dominant player in the market in 2025.

- By packaging, the shrink bags segment emerged as the dominant presence in the market in 20245 and is expected to maintain this dominance in the future.

- By application, the commercial segment asserted dominance in the global market in 2025.

Market Overview

The pork meat market continues to show resilience and growth, driven by increasing global demand for protein-rich diets. Despite challenges such as disease outbreaks and fluctuating feed costs, the pork industry remains robust, buoyed by technological advancements in production and processing. Consumer preferences for healthier, sustainable, and ethically sourced meat options have influenced the market dynamics, prompting producers to adopt more transparent and environmentally friendly practices.

The rise of alternative protein sources has led to innovation in pork products, with companies exploring plant-based and lab-grown alternatives to meet evolving consumer demands. International trade agreements and geopolitical factors play a significant role in shaping pork meat market landscape. Changes in tariffs, import/export regulations, and disease outbreaks in major pork-producing countries can impact global supply and demand dynamics, influencing prices and market trends.

Overall, while the pork meat market faces various challenges and uncertainties, it remains a vital component of the global food industry, with emerging opportunities for growth and innovation driven by shifting consumer preferences and technological advancements.

Artificial Intelligence: The Next Growth Catalyst in Pork Meat

AI is transforming the pork meat industry by integrating advanced technologies across the entire supply chain, from farming to processing and distribution. In pig farming, AI-powered systems use sensors, cameras, and microphones for real-time monitoring of animal behavior, health, and environmental conditions (e.g., temperature, humidity), enabling early disease detection, optimizing feed consumption, and improving animal welfare.

In processing plants, computer vision and robotics with machine learning algorithms enhance efficiency and precision in tasks, such as carcass grading, cutting, and quality control, which helps minimize human error, reduce labor costs, and ensure consistent product quality.

Pork Meat Market Growth Factors

- As the global population continues to grow, so does the demand for protein-rich diets, including pork.

- Economic development in emerging markets has led to higher discretionary earnings, allowing more people to afford pork products.

- Urbanization trends are driving changes in dietary habits, with more people opting for convenient and ready-to-cook pork products.

- Advancements in breeding techniques, genetics, and production methods have increased efficiency and productivity in pork farming, leading to higher yields and lower production costs.

- Despite some controversies, pork is still perceived as a valuable protein source, and efforts to promote leaner cuts and healthier production methods have contributed to sustained demand.

- Growing demand for the pork meat market internationally, coupled with trade agreements and market access, presents significant export opportunities for pork-producing countries.

- Innovation in pork processing, packaging, and product development, including value-added products and convenience foods, attracts new consumers and drives the growth of the pork meat market.

- Efforts to improve environmental sustainability in pork production, such as waste management and reduced carbon emissions, appeal to environmentally conscious consumers and open up new markets.

- Government policies and subsidies in some regions support pork production, fostering investment and growth in the industry.

Market Outlook

- Market Growth Overview: The pork meat market is expected to grow significantly between 2025 and 2034, driven by the rising global population and disposable income, growing demand for processed, ready-to-eat, and value-added pork products, and rising online platforms.

- Sustainability Trends: Sustainability trends involve animal welfare and health, rising consumer demand and niche markets, and integration of the technology.

- Major Investors: Major investors in the market include WH Group Limited, JBS S.A., Tyson Foods, Inc., Hormel Foods Corporation, and Danish Crown.

Market Scope

| Report Coverage | Details |

| Growth Rate from 2026 to 2035 | CAGR of 3.86% |

| Market Size in 2025 | USD 302.28 Billion |

| Market Size in 2026 | USD 314.13 Billion |

| Market Size by 2035 | USD 441.65 Billion |

| Largest Market | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Type, Packaging, and Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Demand for a protein-rich diet

One major growth driver of the pork meat market is the increasing global population coupled with rising savings. As the world's population continues to grow, particularly in emerging economies, the demand for protein-rich diets, including pork, is on the rise. With higher incomes, more people can afford to include pork in their diets, leading to increased consumption levels. This trend is particularly pronounced in urban areas, where convenience and ready-to-cook products are in high demand. Moreover, economic development in emerging markets has led to shifts in dietary habits, with pork becoming more accessible and affordable to a larger segment of the population. As people become more urbanized and adopt modern lifestyles, the demand for protein sources like pork is expected to escalate further.

Additionally, advancements in technology and production methods have boosted efficiency and productivity in pork farming, ensuring a steady supply to meet growing demand. These factors combined create a favorable environment for the sustained growth of the pork meat market, presenting opportunities for producers, processors, and retailers to capitalize on the increasing appetite for pork products worldwide.

Restraint

Disease outbreaks

A significant restraint facing the pork meat market is the threat of disease outbreaks, particularly those affecting livestock. Diseases such as African Swine Fever (ASF) pose a significant risk to pork production, as they can lead to mass culling of infected animals, disruptions in supply chains, and significant economic losses for producers and the industry as a whole. ASF, in particular, has been a major concern in recent years, spreading across various regions and causing significant disruptions in pork markets worldwide. The highly contagious nature of ASF, combined with the lack of a vaccine or effective treatment, makes it challenging to control and prevent outbreaks.

Moreover, disease outbreaks not only impact the supply of pork but also erode consumer confidence in the safety and reliability of pork products. This can lead to decreased consumption of pork production practices. Further exacerbating the challenges faced by the industry. Addressing the threat of disease outbreaks through improved biosecurity measures, surveillance, and international cooperation is crucial to mitigating this restraint and ensuring the long-term sustainability of the pork meat market.

- In March 2024, Tons of African Swine fever-infected pork was recalled and stored in cold storage. During random testing of the pork sample, the pork imported by Bhai Bhai and Mendayla Enterprises tested positive for the African Swine Fever virus, whereas the pork from RKS Enterprise tested negative twice.

Opportunity

Innovative pork products

One significant opportunity for the pork meat market lies in the growing demand for alternative protein sources and the development of innovative pork products to meet evolving consumer preferences. As consumer awareness of health, environmental sustainability, and animal welfare issues continues to rise, there is a growing interest in plant-based and lab-grown meat alternatives.

Pork producers have the opportunity to tap into this trend by investing in research and development to create plant-based pork substitutes or hybrid products that combine pork with plant-based ingredients. By offering consumers more diverse and sustainable options, pork producers can expand their market reach and appeal to a broader audience.

Additionally, there is an opportunity to capitalize on the growing market for premium and specialty pork products. Consumers are increasingly willing to pay a premium for high-quality, ethically sourced pork products. Producers who focus on quality, traceability, and sustainable production methods can differentiate themselves in the market and capture a premium price.

Furthermore, the rise of e-commerce and direct-to-consumer sales channels presents an opportunity for pork producers to bypass traditional retail channels and engage directly with consumers. It aids in offering customized products and personalized shopping experiences to consumers. By embracing digital technologies and online platforms, pork producers can strengthen their brand presence and increase sales in an increasingly competitive market landscape.

Segment Insights

Type Insights

The frozen segment emerged as the dominant one in the pork meat market in 2025. This dominance can be attributed to several factors, such as the fact that frozen pork products offer convenience to consumers, allowing for longer storage periods and easy meal preparation. Freezing pork meat helps preserve its freshness and nutritional value for an extended period, reducing food waste and ensuring product quality.

Frozen pork products facilitate international trade, as they can be stored and transported over long distances without compromising quality. Freezing is an effective method for controlling and reducing the risk of foodborne illnesses, ensuring that pork products remain safe for consumption. The availability of a wide range of frozen pork cuts and products makes them accessible to a diverse range of consumers, including those in remote areas or regions with limited access to fresh pork.

Packaging Insights

The shrink bags segment emerged as the dominant presence in the pork meat market in 2025 and is expected to maintain this dominance in the future. Shrink bags are easy to use and handle, allowing for efficient packaging and labeling processes in both manufacturing facilities and retail outlets. Shrink bags provide a secure barrier against bacteria and other pathogens, ensuring the safety and quality of pork products throughout the supply chain.

A number of factors contribute to the dominance of this segment, as Shrink bags provide excellent protection against external contaminants and moisture, extending the shelf life of pork products and preserving their freshness. Shrink bags offer a visually appealing presentation, enhancing the attractiveness of pork products on store shelves and enticing consumers to make purchases. The tight seal created by shrink bags helps prevent leakage and product loss during storage and transportation, reducing waste and maximizing profitability for producers.

Application Insights

The commercial segment asserted dominance in the global pork meat market in 2025. This supremacy is attributed to the fact that Commercial establishments, such as restaurants, hotels, and catering services, are significant consumers of pork meat for preparing a variety of dishes to cater to diverse consumer preferences. Commercial food processors utilize pork meat as a primary ingredient in a wide range of processed foods, including sausages, bacon, deli meats, and ready-to-eat meals, catering to the convenience-seeking consumer demographic.

Schools, hospitals, and other institutions procure pork meat in bulk quantities for meal preparation, contributing significantly to the commercial segment's market share. The demand for pork meat in catering services for events, parties, and social gatherings further bolsters the commercial segment's dominance. Furthermore, the proliferation of fast-food chains worldwide has increased the demand for pork meat as a key ingredient in popular items like burgers, sandwiches, and pizzas.

Regional Insights

Asia Pacific was a prominent player in the pork meat market in 2025. Several factors contributed to the region's prominence. With a large and rapidly growing population, particularly in countries such as China and India, the region represents a substantial consumer base for pork meat products. Also, Rapid urbanization and changing lifestyles have fueled demand for convenient and processed pork products in urban centers across Asia Pacific.

Pork is a staple food in many Asian cuisines, including Chinese, Korean, Japanese, and Southeast Asian cuisines, contributing to the consistently high demand for pork meat across the region. Economic growth and rising disposable incomes in these countries have led to increased consumption of protein-rich foods, including pork meat. The region also serves as a major hub for pork meat exports, with countries like China, Vietnam, and Thailand being significant exporters to international markets.

China Pork Meat Market Trends

China's increased domestic supply and downward price pressure. A structural shift is underway as consumers, with rising incomes and health awareness, seek higher-quality, safer, and traceable pork products. The industry is consolidating into larger, more modernized operations, leveraging e-commerce for sales and distribution

North America has been witnessing steady growth in the global pork meat market. North America has established pork consumption patterns, with pork being a popular protein choice among consumers in these regions for various dishes. Both regions have seen advancements in pork production technologies, including breeding techniques, feed efficiency, and processing methods, leading to improved productivity and cost-effectiveness. Stringent health and safety regulations in North America and Europe ensure the quality and safety of pork meat products, instilling consumer confidence and driving demand.

The pork meat market in North America offers a wide range of products, including fresh cuts, processed meats, and value-added products, catering to diverse consumer preferences and lifestyles. The region is a major exporter of pork meat, benefiting from strong demand in international markets and contributing to overall market growth. Therefore, the steady growth in the region reflects the resilience and maturity of these markets, with continued expansion opportunities driven by innovation, consumer demand, and export opportunities.

U.S. Pork Meat Market Trends

U.S. demand for a variety of ready-to-eat and easy-to-prepare processed pork products. Simultaneously, health-conscious consumers are pushing for lean cuts and "clean-label" options that align with high-protein diets and personal wellness goals.

How Did Europe Experience A Notable Growth in the Pork Meats Market?

Europe's significant surge in demand for high-protein, ready-to-eat products and a robust recovery in the foodservice sector. Major producers like Spain and Germany have increased self-sufficiency through advanced farming and vacuum-sealing technologies that extend shelf life and appeal.

Germany Pork Meat Market Trends

In Germany, the number of pig farms has dropped significantly, improving portability of farmers, and strong demand for processed pork. Consumers' demand is for higher animal welfare and sustainable practices, innovation in precision farming, and AI is growing to boost efficiency and meet regulations.

Value Chain Analysis of the Pork Meat Market

- Production (Farrowing and Finishing): This initial stage involves breeding and raising pigs to market weight, which requires significant investment in feed, housing, and animal health management.

Key Players: Muyuan Foods, Wens Group, and Smithfield Foods. - Processing & Distribution: This stage involves the logistical steps of transporting live pigs to slaughterhouses, processing the meat into various cuts (e.g., ham, ribs, bacon), packaging, and distributing the products to wholesalers and retailers.

Key Players: JBS S.A., Tyson Foods Inc., Danish Crown A/S, Vion Food Group, and WH Group Ltd. - Marketing & Sales: Marketing activities build brand recognition and drive demand through various channels, including supermarkets, restaurants, and other food services.

Key Players: Walmart, Tesco, and Carrefour.

Pork Meat Market Companies

- Danish Crown contributes significantly to the European pork market as a leading global pork exporter, particularly to China, leveraging its cooperative structure to maintain large production volumes and high-quality standards.

- Triumph Foods is a major supplier of pork products in the United States, utilizing large-scale processing facilities to provide fresh pork and bacon to both retail and foodservice sectors.

- Yurun Group contributes to the Chinese pork market through its integrated supply chain, specializing in the production of chilled and processed meat products such as hams and sausages.

- Vion Food Group Ltd. operates across Europe to supply pork to retail and foodservice clients, focusing on sustainable practices and integrated production chains from farm to processing.

- WH Group, the world's largest pork company and owner of Smithfield Foods, impacts the global market through its extensive international footprint in both packaged meats and fresh pork.

- Smithfield Foods, as a subsidiary of WH Group and a leading U.S. pork producer, contributes to the market through large-scale operations providing fresh pork, bacon, and various packaged meat products domestically and internationally.

Other Major Key Players

- JBS S.A.

- Tonnies

- Tyson Foods Inc.

- Shuanghui Development

Recent Developments

- In March 2025, Creta Farms introduced a "super-meat" pork product from pigs fed solely on olive oil and extracts, resulting in meat with high Omega-3 and low Omega-6 levels. Creta Farms states this is the first pork globally to officially claim enhanced Omega-3 status.

(Source: https://www.euromeatnews.com ) - In May 2024,German food tech startup MyriaMeat unveiled a cultivated pork fillet made from 100% pork cells without any scaffolds or plant proteins. Months after emerging from stealth, German startup MyriaMeat has announced the successful development of a cultivated pork fillet made entirely from pig cells.

Segments Covered in the Report

By Type

- Chilled

- Frozen

By Packaging

- Store Wrap

- Modified Atmosphere Packaging

- Vacuum Packaging

- Shrink Bags

- Others

By Application

- Household

- Commercial

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting