What is the Meat Substitutes Market Size?

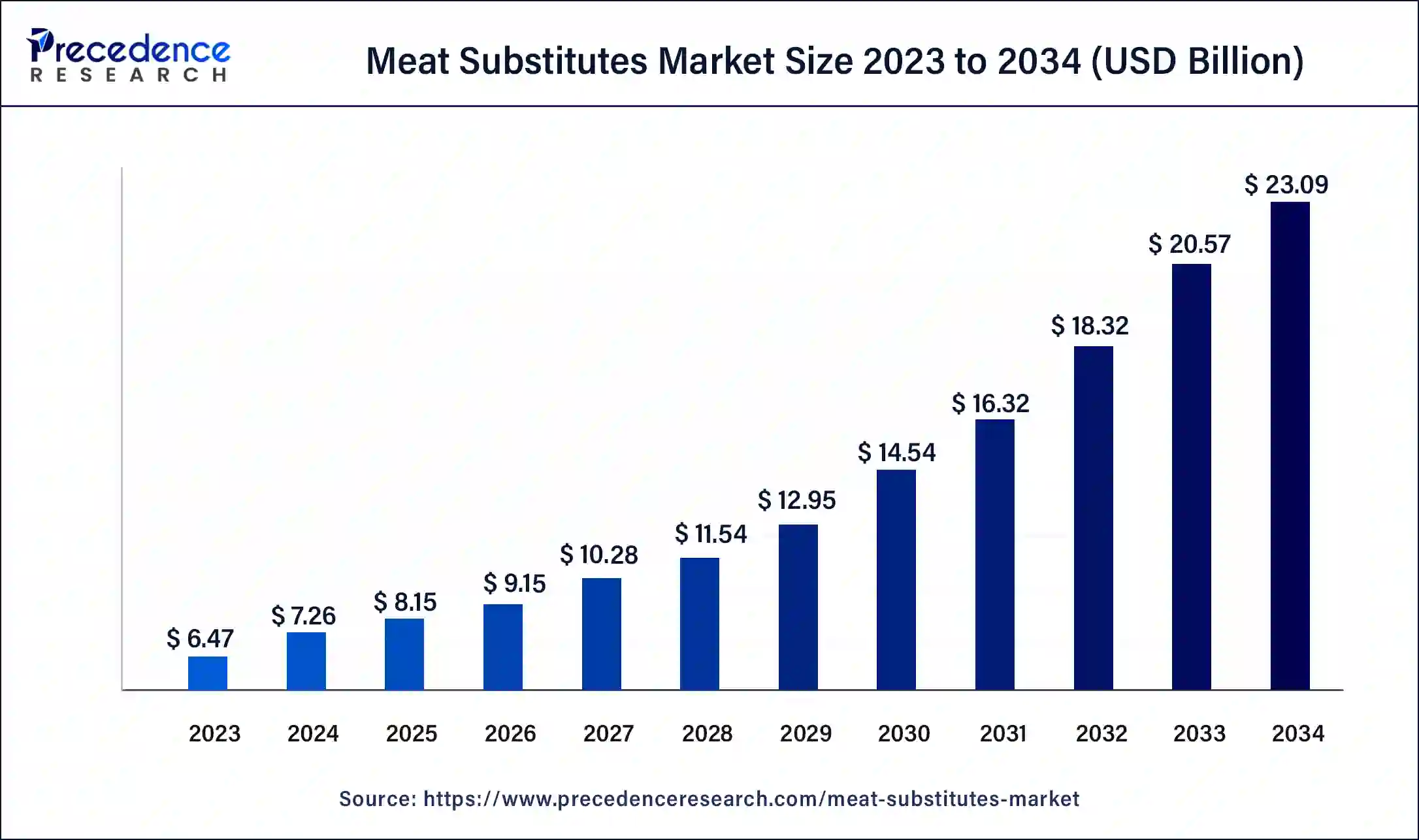

The global meat substitutes market size is valued at USD 8.15 billion in 2025 and is predicted to increase from USD 9.15 billion in 2026 to approximately USD 23.09 billion by 2034, expanding at a CAGR of 12.26% from 2025 to 2034. The ongoing criticisms regarding animal farming are increasing the demand for meat substitutes, fueling the market growth.

Meat Substitutes Market Key Takeaways

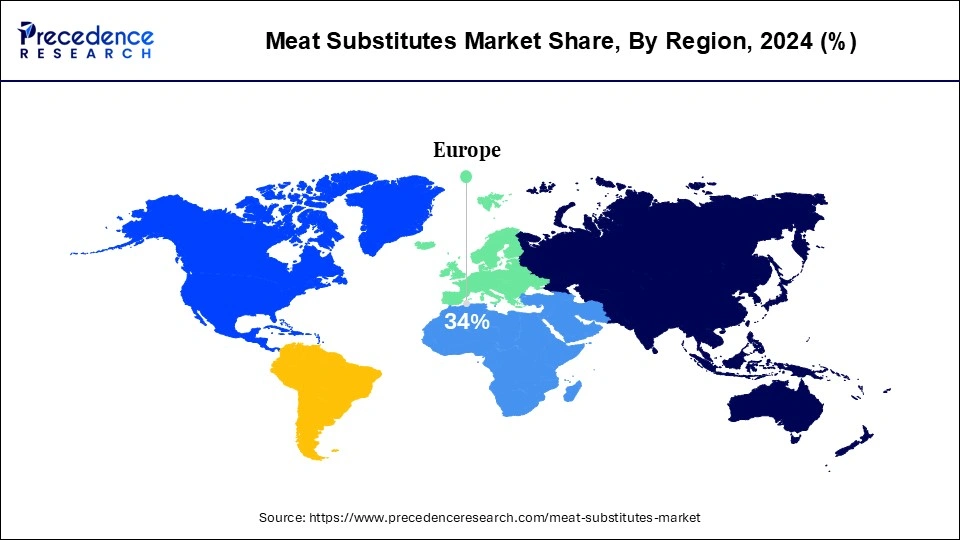

- Europe dominated the global meat substitutes market with the largest market share of 34% in 2024.

- North America holds a significant share of the global market.

- By region, Asia Pacific is expected to register the fastest growth in the market during the forecast period.

- By source, the plant-based protein segment held the largest share of the market in 2024.

- By source, the mycoprotein segment is expected to grow at the fastest CAGR in the market from 2025 to 2034.

- By distribution channel, the retail segment accounted for the largest share of the market in 2024.

- By distribution channel, the food service segment is expected to register the fastest growth in the market during the forecast period 2025 to 2034.

Market Overview

Meat substitutes, also known as plant-based meat, are an alternative to meat made using vegan or vegetarian ingredients. They are called replicas of meat because they use the same texture, taste, and appearance, providing the same nutritional value as meats. Some commonly used substitutes for meats are plant-based meats like tofu, which are normally added to meals with burgers and sausages.

There are meat substitutes made from white gluten, like seitan, which are used in vegetarian dishes. Mushroom-based meats like portobello and others are also known for their meat-like structure. The meat substitutes market is witnessing rapid growth due to multiple factors like increasing concerns regarding meat consumption, which is affecting the environment due to the release of greenhouse gases, which also leads to climate change.

- According to a report from The World Counts, global meat consumption is around 350 million tons per year. The United States has the highest per-person meat consumption, followed by Australia and Argentina.

What is the Role of AI in the Meat Substitutes Market?

The emergence of technologies like artificial intelligence (AI) is playing a vital role in the development of many sectors, including food technology. The main benefit of AI is that it can analyze multiple datasets, which helps enhance the overall production of meat alternatives. AI plays a vital role in optimizing plant-based ingredients, which can help maintain the supply of materials. It can also help formulate food products that maintain the balance between taste, texture, and nutritional values. Many companies, knowing its worth, are using AI to make significant progress in the meat substitutes market.

- In January 2024, Israeli AI expert Noa Weiss invented GreenProtein AI, which helps enhance the texture and reduce meat production costs.

Meat Substitutes Market Outlook

- Industry Growth Overview: The meat substitutes market is expected to experience robust growth from 2025 to 2034 as more people adopt non-vegetarian diets. Increasing rates of lifestyle diseases like obesity and heart conditions are encouraging consumers to choose plant-based options over red meat. Additionally, the expansion of fast-food and quick-service restaurants is boosting the demand for meat substitutes.

- Sustainability Trends:Sustainability is becoming the key pillar of market innovation, with manufacturers focusing on reducing carbon footprints, improving ingredient traceability, and adopting regenerative agriculture practices. Stricter climate policies are being implemented by governments in Europe and North America, which is pushing food companies toward low-emission production methods. Brands like Beyond Meat, Quorn Foods, and Meatless B.V. are increasing their R&D spending on processes that benefit the environment through precise fermentation and renewable energy-based production.

- Global Expansion:The market is expanding worldwide as manufacturers aim to strengthen regional supply chains and tap into emerging markets. Asia-Pacific is emerging as a high-opportunity region, driven by rising disposable incomes, rapid urbanization, and a growing shift toward plant-based proteins in countries such as China, India, Japan, and those in Southeast Asia. Adoption is also accelerating across Latin America, supported by government-backed sustainability programs and the rising popularity of health-focused retail chains.

- Major Investors:Major investors in the market include venture capital firms, food conglomerates, and sustainability-focused investment funds such as SoftBank, Temasek, BlackRock, Tyson Foods, and Nestlé. They contribute by injecting capital into R&D, scaling production technologies like precision fermentation, expanding global manufacturing capacity, and accelerating commercialization through strategic partnerships and distribution networks.

- Startup Ecosystem:The startup ecosystem in the market is evolving rapidly, propelled by breakthroughs in fermentation and novel protein-extraction technologies. Minimally processed, fiber-rich whole-cut alternatives from startups such as Meati Foods (U.S.), Next Gen Foods (Singapore), SunFed (New Zealand), and Black Sheep Foods (U.S.) are reshaping competitive dynamics. Innovation in precision fermentation is also accelerating, enabling startups to create animal-identical fats and proteins that substantially improve the taste, texture, and overall sensory experience of plant-based products.

Meat Substitutes Market Growth Factors

- The increasing trends like ‘Veganism' are changing the public perception towards meat, encouraging the consumption of meat substitutes and leading towards the growth of the meat substitutes market.

- The increasing government regulatory support stands out as a growth factor for the meat substitutes market.

- The increasing collaborations in agricultural sectors are creating many opportunities for farmers to develop more plant-based food options, which stand out as a growth factor for the meat substitutes market.

- The increasing focus on product innovation is enhancing the food quality and structure, which stands out as the growth factor of the meat substitutes market.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 23.09 Billion |

| Market Size in 2026 | USD 9.15 Billion |

| Market Size in 2025 | USD 8.15 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 12.26% |

| Largest Market | Europe |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Source, Distribution, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Rising environmental concerns

The rapid increase in overall lifestyles, especially in urbanization and industrialization, has raised many concerns related to the environment, which include animal farming. The increasing meat consumption can lead to many issues like climate change, deforestation, and many more, which tend to affect quality of life. Many reports also stated that the impact of meat production could also affect the water bodies due to the waste emitted from the production. The increasing awareness regarding these issues educates people, and they tend to prefer sustainable and environment-friendly options. As a result, many companies are trying to produce an alternative that won't affect the taste and nutritional value of the food.

Nutritional benefits of meat substitutes

The meat substitutes especially tend to offer more nutritional benefits while protecting the environment. The increasing market competition is leading towards the launching of premium food products that can provide additional benefits compared to meats like low saturated fat, rich in fiber, low in cholesterol, and many more. However, many people not only look towards the nutritional benefits, but some people also try to consider the environmental factor. Plant-based proteins are considered to help the growth of the meat substitutes market.

An article published by CBS News stated that Canadian researchers find that plant-based meat alternatives are healthier than traditional meat, which helps improve heart disease risk factors like cholesterol, blood pressure, and body weight.

Restraint

Higher costs of meat substitutes

The meat substitutes market has seen significant growth over the past few years, but there are still some concerns that tend to restrict the market growth. The production process of meat substitutes requires special ingredients, which are slightly higher in cost; this also affects the overall costs of the products. Many companies are using extra ingredients like flavors to enhance the overall taste of these food products; this also increases the overall prices. These products cannot be affordable for people with low incomes. Therefore, to tackle this issue, many companies are trying to increase production in many setups, which may help in tackling the issue and increase the growth rate of the meat substitutes market.

Opportunities

Increasing research and development (R&D)

The rapid shift towards the adoption of meat substitutes brings many challenges and opportunities for the market players due to the competitive business environment. These companies are primarily investing heavily in coming up with solutions like improving the texture and taste of the food product. These companies study consumer patterns and try to replicate the product to meats. Increasing the R&D enables the company to make innovations that could potentially benefit them. The increasing competition in the market also leads to R&D, which takes effort to minimize product costs so that it could be more significant in the meat substitutes market.

- In March 2024, Jeff Bezos' Earth Fund invested $60 million in alternative meat research. The investment aims to scale production and reduce climate impact.

Increasing emphasis on sustainability

The world is facing many environmental issues like climate change, global warming, and many more. This has forced many changes in multiple industries, including food and technology. Governments and organizations are constantly promoting sustainability, which includes the production of meat substitutes. These initiatives are leading towards the adoption of these products, which will help reduce the greenhouse gas effect and increase the quality of life. Governments are also promoting the use of meat alternatives that have sustainable production procedures and it also provides nutritional benefits. This is one of the hot trending topics that is attracting multiple investments and can boost the growth of the meat substitutes market.

Segment Insights

Source Insights

The plant-based protein segment held the largest share of the meat substitutes market in 2024. These are derived from sources like peas, soy, chickpeas, and many more, which are widely used in protein products and meat alternatives. The existence of these products in meals has been widely increasing in the past few years due to the global trend of ‘veganism.' This trend has been influencing many individuals to adopt a vegan lifestyle, which eliminates all the food sources derived from animals.

This trend has played a vital role in the development of multiple food options as meat alternatives. Plant-based proteins are known for their nutritional benefits. Although they are derived from plants, they also offer additional benefits like vitamins, essential amino acids, etc. Many reports also stated that women's use of plant-based proteins can help increase their life expectancy. The growth of this segment is attributed to these unique factors, which also help the market grow.

- In August 2024, Sujis Link secured an investment of $2.2M from Samyang Foods to develop and expand its high-moisture plant-based protein products globally.

The mycoprotein segment is expected to grow at the fastest CAGR in the meat substitutes market from 2025 to 2034. Theseproteins are derived from fungi, which are produced through a process called fermentation. The mycoprotein segment is gaining significant popularity due to its richness in providing nutritional benefits. It also has a meat-like texture, which is the reason it is getting popular among meat consumers. The production process of mycoprotein is highly sustainable, which drives more investments and initiatives to scale its production.

- In May 2023, Enifer, a Finnish biotechnology company, secured an investment of €36 million to build the world's first commercial mycoprotein factory, producing sustainable protein for aquafeed and pet food sectors.

Distribution Insights

The retail segment accounted for the largest share of the meat substitutes market in 2024. The growth of this segment is attributed to the established customer base of retail channels like hypermarkets, supermarkets, grocery stores, and others. These stores are well-known for selling homemade groceries, and they have also gained their attraction towards these products.

Additionally, the increasing shift towards sustainability leads to increasing promotion and advertisement of these products among consumers. As a result of increasing demand, many other companies are focusing on developing meat alternatives while reducing overall costs. Additionally, the emergence of online grocery platforms like Zepto, Blinkit, and many others is contributing to the growth of the market as they have tie-ups with local grocery stores, which leads to increasing sales of these products.

The European supermarkets are being urged to adopt targets for 60% plant-based protein. The region aims to reduce its environmental impact and align with global health recommendations.

The food service segment is expected to register the fastest growth in the meat substitutes market during the forecast period 2025 to 2034. It includes distribution through restaurants, cafes, and food chains that provide readymade food in offline and online formats. The increasing tourism, especially in North American and European countries, plays a key role in the growth of meat substitutes in the region.

The consumer preference for dine-out has increased, especially after 2021. Studying the market demand, food chains and restaurants are focusing on providing unique menus to the people, which include taste and nutrition in them. Additionally, the increasing partnerships between restaurants and online food delivery platforms increase the demand for meat alternative dishes in the market. These constant technological adoptions are driving the growth of the market.

Regional Insights

Europe Meat Substitutes Market Size and Growth 2025 to 2034

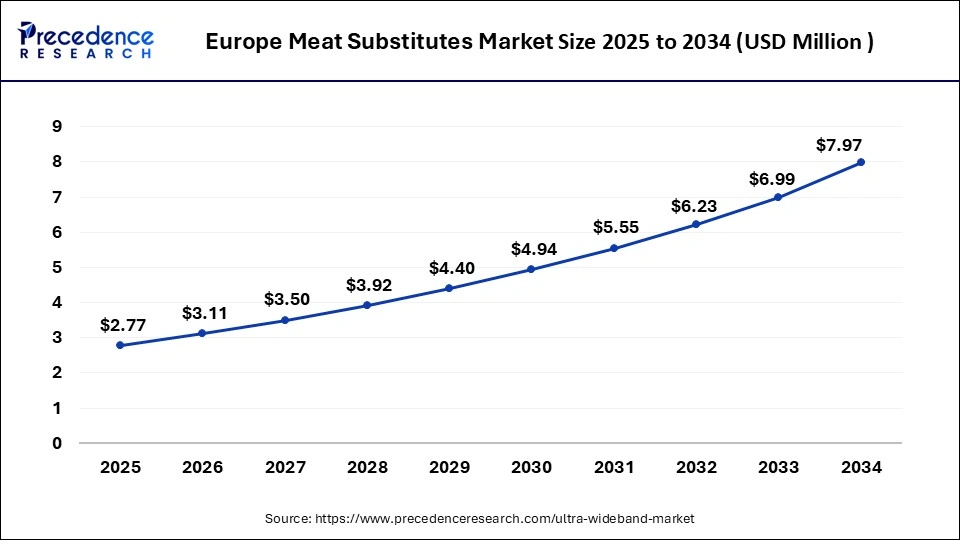

The Europe meat substitutes market size is exhibited at USD 2.77 billion in 2025 and is projected to be worth around USD 7.97 billion by 2034, poised to grow at a CAGR of 12.42% from 2025 to 2034.

Europe dominated the global meat substitutes market in 2024. The growth of the region is attributed to increasing consumer preferences, especially among the youth and adults. This population is widely adopting sustainable options due to increasing awareness through campaigns and educational programs. The governments are also encouraging the use of meat alternatives which can help in reducing the GHG effect. This opens many opportunities for companies to target countries like Germany to mark their significance in the market.

Germany Meat Substitutes Market Trends

The market in Germany is driven by its large vegan and flexitarian population, advanced retail infrastructure, and strong government-backed sustainability goals. Consumer interest continues to grow as Germans increasingly embrace protein diversification and adopt greener dietary practices. Retail chains are also expanding their own-label plant-based product lines, creating more competitive pricing and a broader selection for consumers.

Why is North America Considered the Second-Largest Market?

North America holds a significant share of the global meat substitutes market. The population in countries like the United States and Canada are becoming health conscious regarding the consumption of meat. The region has access to advanced technologies like machines, which help in the production of these products. This increases the availability of meat substitutes in the region, which also increases the trade opportunity for other regions. This increasing connectivity is driving the growth of the region's market.

U.S. Meat Substitutes Market Trends

In the U.S., the meat substitutes market is expanding rapidly as consumers increasingly prefer plant-based diets and enjoy wide product availability across mainstream retail chains. Demand is further strengthened by a growing focus on high-protein, low-cholesterol alternatives that align with preventive health trends. Continued product innovation from companies such as Beyond Meat, Impossible Foods, and MorningStar Farms further supports market growth in the country.

What Makes Asia Pacific the Fastest-Growing Region in the Market?

Asia Pacific is expected to register the fastest growth in the meat substitutes market during the forecast period. The increasing product diversification in countries like China and Japan is one of the major growth factors for the region. An increasing number of social media users are also adopting the vegan trend which can reduce the environmental impact and animal farming. The government in countries like India are also bound to promote sustainability which increases the opportunities in the region.

China Meat Substitutes Market Trends

China is expected to record the fastest growth in the Asia Pacific meat substitutes market, driven by rising urbanization, lifestyle changes, and growing consumer interest in sustainable, protein-rich food options. Expanding e-commerce platforms and new retail store formats are increasing product availability, while partnerships between international brands and Chinese foodservice operators are boosting visibility and consumer trial. With strong investment flows and high engagement from health-conscious millennials, China is projected to remain a long-term growth engine for the market.

What Potentiates the Growth of the Latin American Meat Substitutes Market?

The growth of the Latin American market is being driven by rising health awareness and a shift toward plant-forward diets among urban consumers. Expansion of multinational brands and local producers, combined with cost-competitive production, is increasing the availability and affordability of plant-based products. Additionally, partnerships with foodservice chains and rising interest in sustainable, protein-rich alternatives are further accelerating market growth across the region.

Brazil Meat Substitutes Market Trends

The market in Brazil is driven by growing consumer interest in healthier and environmentally conscious food choices. Market growth is further supported by localized formulations from domestic producers that incorporate soy, beans, and other local crops to match traditional flavor expectations. Additionally, modernization of retail infrastructure in major urban centers is expected to improve product availability and offer more affordable pricing.

What Factors are Contributing to the Growth of the Middle East & Africa Meat Substitutes Market?

The market in the Middle East & Africa (MEA) is being driven by rising demand for healthier protein options and increased adoption of Western dietary patterns. The market expansion is further supported by multinational brands collaborating with regional distributors to enhance distribution across the Gulf Cooperation Council (GCC) countries. Additionally, the growing focus on halal-compliant plant-based products presents a new market opportunity for manufacturers in the region.

UAE Meat Substitutes Market Trends

The UAE has seen rising adoption of meat substitutes in recent years, driven by its diverse expatriate population and openness to global food trends. High retail penetration, with hypermarkets and specialty stores offering international plant-based brands, is expected to further support market growth. Additionally, social programs aimed at diversifying food sources and reducing reliance on imported animal proteins are likely to promote greater uptake of alternative protein products.

Meat Substitutes Market – Value Chain Analysis

Raw Material Sourcing

The value chain begins with the procurement of essential plant-based ingredients such as soy protein, pea protein, wheat gluten, mycoprotein, legumes, and oil blends. These raw materials form the foundation for creating meat-like texture, protein density, and nutritional value.

- Key Players: Cargill, Archer Daniels Midland (ADM), Roquette Frères, Ingredion Incorporated.

Ingredient Processing & Formulation

Raw materials are processed into functional ingredients, textured vegetable proteins (TVP), isolates, concentrates, starches, fibers, and natural flavor compounds. Functionalization enables the creation of desired taste, texture, and binding characteristics required for meat analogs.

- Key Players: DuPont Nutrition & Biosciences, Givaudan, Kerry Group, DSM-Firmenich.

Product Manufacturing & Innovation

Processed ingredients are transformed into finished meat substitute products such as plant-based burgers, sausages, nuggets, mince, and seafood alternatives. This stage involves extrusion, fermentation, flavor enhancement, and advanced formulation technologies.

- Key Players: Beyond Meat, Impossible Foods, Quorn Foods, Amy's Kitchen, VBites Foods.

Packaging & Branding

Finished products are packaged using sustainable materials and designed to ensure shelf stability, consumer appeal, and regulatory compliance. Branding emphasizes health, sustainability, and clean-label claims to attract flexitarians, vegans, and health-conscious consumers.

- Key Players: Mondi Group, Amcor, Sealed Air Corporation.

Distribution & Retail Supply

Packaged meat substitutes are distributed through retail, online channels, foodservice networks, and quick-service restaurants (QSRs). Efficient cold-chain logistics and strategic retail partnerships ensure broad market reach and availability.

- Key Players: Walmart, Tesco, Amazon, Sysco Corporation, Carrefour.

End-Use Integration (Foodservice & Retail)

Products reach consumers through supermarkets, restaurants, fast-food chains, and meal-kit providers. Growing adoption by global QSR brands accelerates mainstream acceptance and market penetration.

- Key Players: McDonald's (McPlant), Burger King (Impossible Whopper), KFC, Starbucks.

Top Companies in the Meat Substitutes Market & Their Offerings

- Amy's Kitchen, Inc.: A leading organic food manufacturer offering plant-based ready meals and meatless entrées made from clean-label, minimally processed ingredients.

- Beyond Meat: A global innovator known for plant-based burgers, sausages, and beef alternatives designed to replicate the taste and texture of traditional meat.

- Impossible Foods Inc.:A biotechnology-driven company offering heme-based meat substitutes that closely mimic the flavor and sensory profile of animal meat.

- Quorn Foods:A pioneer in mycoprotein-based meat substitutes, providing a wide portfolio of sustainable, high-protein products like nuggets, fillets, and grounds.

- Kellogg Co.: Through its MorningStar Farms brand, Kellogg offers a broad range of plant-based patties, tenders, and vegan meal solutions.

- Tyson Foods, Inc.: A major protein giant expanding into the plant-based space with its Raised & Rooted line of meatless nuggets, patties, and blended protein products.

- Unilever: Via its Vegetarian Butcher brand, Unilever delivers plant-based meats that replicate beef, chicken, and pork for retail and foodservice markets.

- Meatless B.V.:A Dutch manufacturer specializing in textured plant-based ingredients used as functional meat substitutes in processed foods.

- VBites Foods Ltd.: A plant-based food producer offering an extensive range of vegan meats, seafood alternatives, and dairy-free products.

- SunFed:Known for innovative plant-protein products such as “Chicken Free Chicken,” made with clean and preservative-free ingredients.

Recent Developments

- In July 2024, UK plant-based meat startup ‘THIS' raised £20M in Series C funding to expand their product range in the market.

- In July 2024, Nestle launched Maggi Rindecarne which is a plant-based meat extender combining soy and spices. The product is currently available in Chile.

- In October 2023, French Foodtech firm Umiami raised €32.5M in Series A funding to expand its plant-based meat alternatives technology in Europe and the United States.

Segments Covered in the Report

By Source

- Plant-Based Protein

- Mycoprotein

- Soy-Based

- Others

By Distribution

- Retail

- Food Service

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting