Port Cranes Market Size and Forecast 2025 to 2034

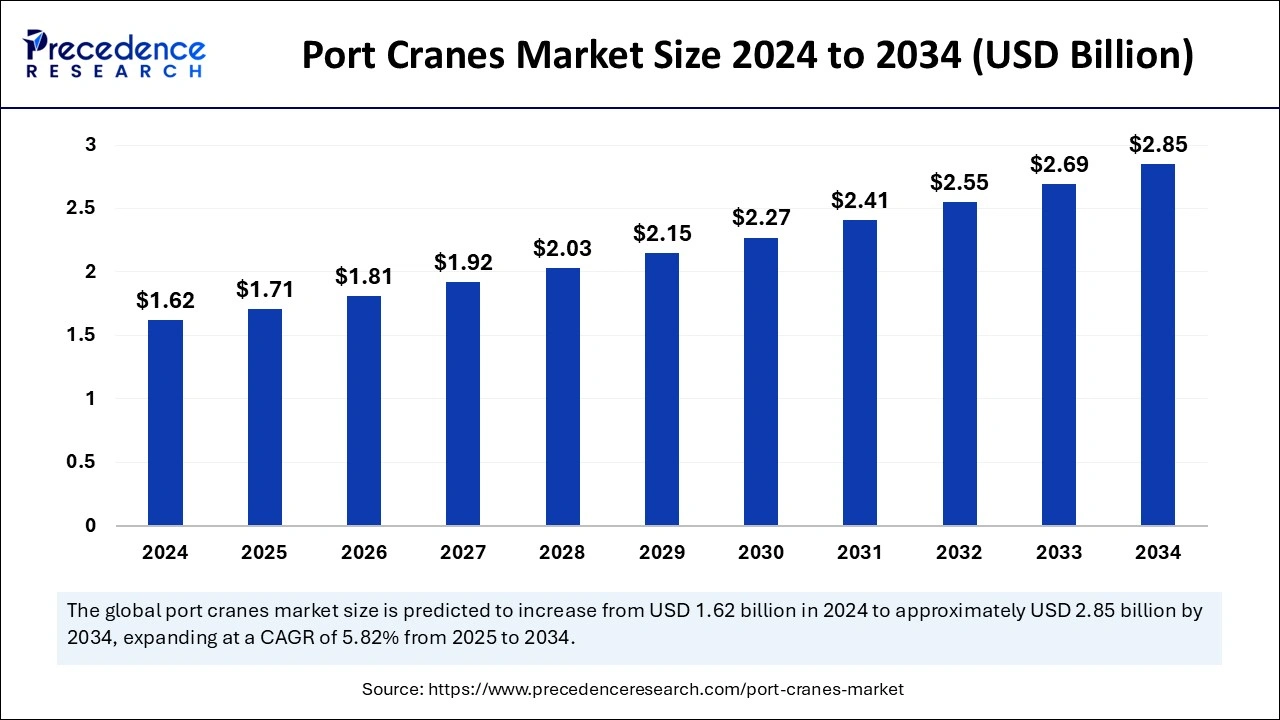

The global port cranes market size was estimated at USD 1.62 billion in 2024 and is predicted to increase from USD 1.71 billion in 2025 to approximately USD 2.85 billion by 2034, expanding at a CAGR of 5.82% from 2025 to 2034. The increasing demand for technologically advanced and automated cargo shipment machinery to and from ships is driving the growth of the market.

Port Cranes Market Key Takeaways

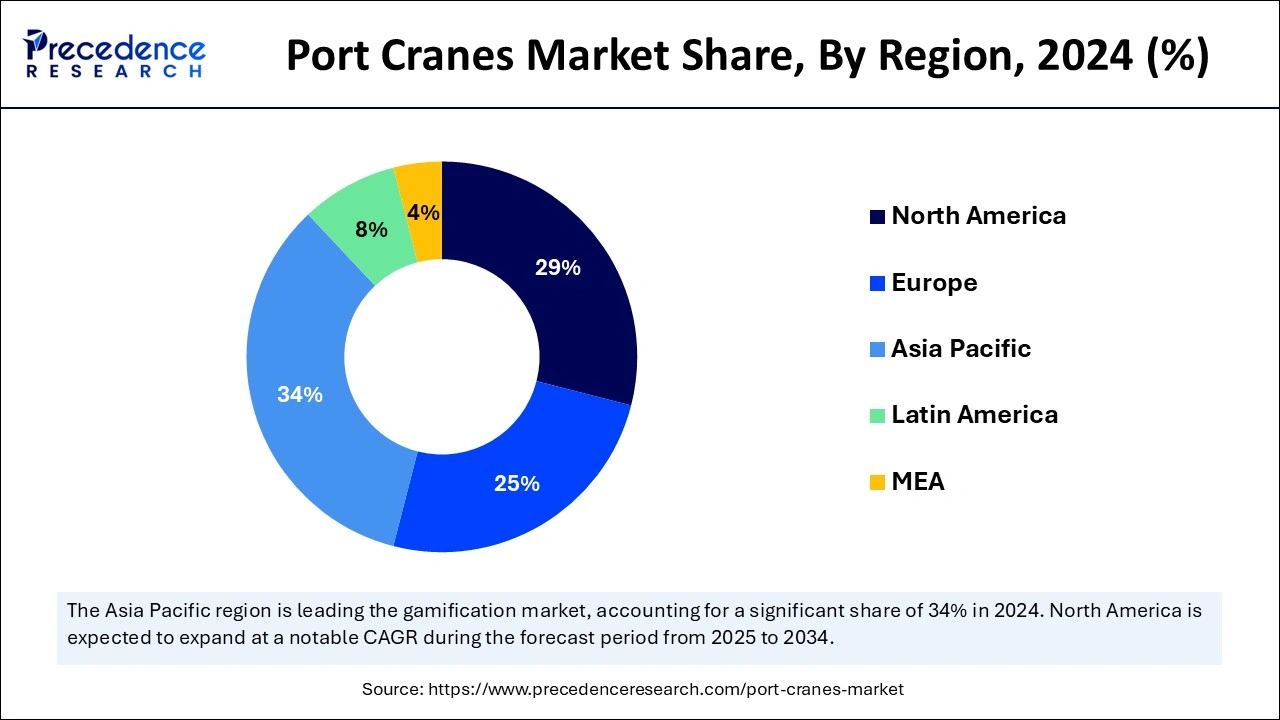

- Asia Pacific dominated the global port cranes market with the biggest market share of 34% in 2024.

- North America is expecting substantial growth in the market during the forecast period.

- By type, the gantry cranes segment led the global market in 2024.

- By type, the overhead cranes segment will experience notable growth in the forecast period.

- By crane capacity, the medium capacity segment accounted for a significant share of the market in 2024.

- By crane capacity, the small capacity segment expects substantial growth during the predicted period.

- By power source, the diesel power source segment led the global market in 2024.

- By power source, the hybrid power source segment will show substantial growth during the predicted period.

- By control method, the manual segment dominated the market in 2024.

- By the control method, the automated segment expects substantial growth during the predicted period.

- By application, the shipbuilding industry segment dominated the global market in 2024.

- By application, the construction industry segment will witness significant growth during the predicted period.

Market Overview

The port cranes market is one of the important parts of any type of shipment facility. The port cranes usually help load and offload cargo to and from ships and within port terminals. These are the heavy-duty machinery built on the gantry frame. There are some types of port cranes used in the shipment or port facilities, such as rubber-tired gantry cranes, rail-mounted gantry cranes, automatic stacking cranes, ship-to-shore cranes, deck cranes, crane barges, tower cranes, reach stackers, and level luffing cranes which are used in the different port facilities.

How Can Artificial Intelligence (AI) Impact the Port Cranes Market?

The integration of artificial intelligence into the advancements of the port cranes market has led to improved operational efficiency. AI is the major technological advancement in smart ports and port automation; it helps in providing enhancements in security improvements, vessel turnaround time, vessel route, and container dwell time optimization. AI also enables real-time performance. AI can handle the increase in traffic and cargo, minimize human error, optimize employee working hours, and more productive supply chain management.

- In October 2024, the Kerala-based Vizhinjam International Port, operated by Adani Ports, introduced AI-driven vessel traffic management. It is the transformative step in maritime operations with associated AI technologies.

Asia Pacific Port Cranes Market Size and Growth 2025 to 2034

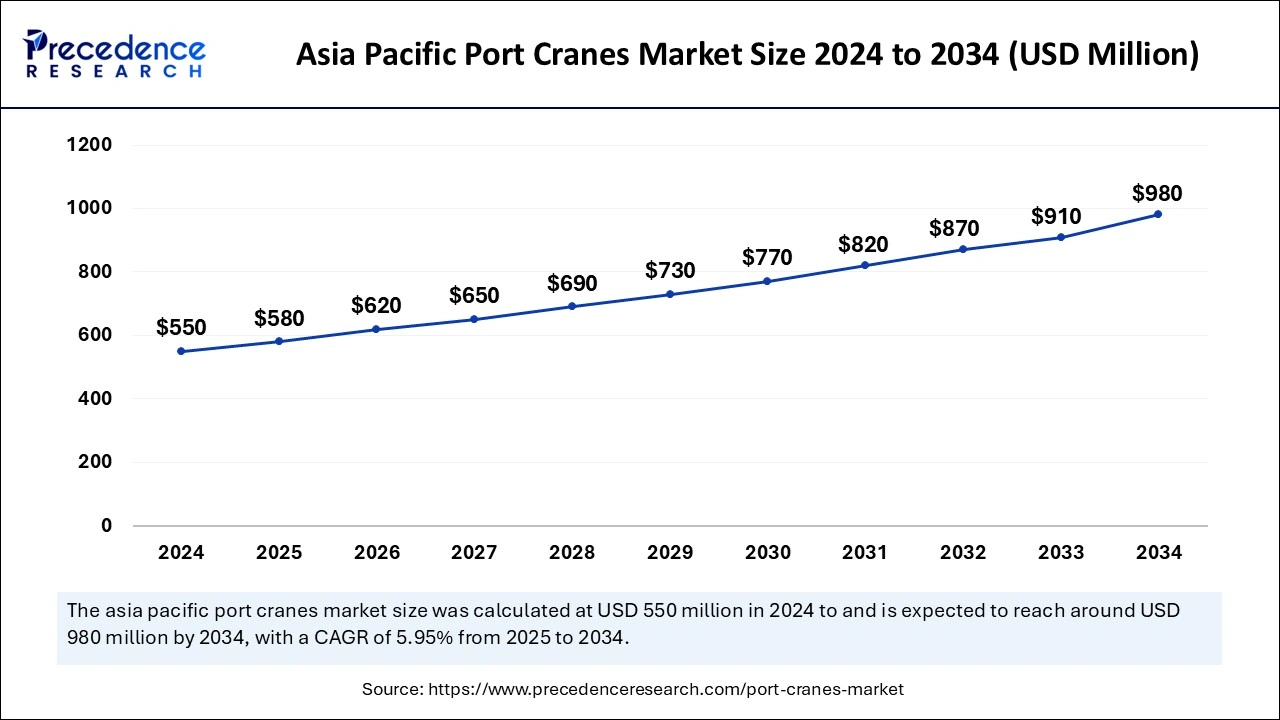

The Asia Pacific port cranes market size was exhibited at USD 550 million in 2024 and is projected to be worth around USD 980 million by 2034, growing at a CAGR of 5.95% from 2025 to 2034.

Asia Pacific dominated the global port cranes market in 2024. The growth of the market is attributed to the rising economic development in regional countries like China, India, Japan, and South Korea, which drives the infrastructural development and trade activities in the countries are driving the growth of the shipping industry, which led to the increasing development of technologically advanced and machinery in the ports are contributing to the expansion of the market. Additionally, the rising government investments in the development of trade activities and international imports and exports are accelerating the growth of the port crane market in the region.

- MoPSW organized GMIS 2023, the largest Global Maritime India Summit ever conducted in Mumbai. The summit was launched by the Honorable Prime Minister and launched the 'Maritime Amrit Kaal Vision 2047'.

North America is expecting substantial growth in the port cranes market during the predicted period. The rise in the market is owing to the presence of well-established infrastructure and the international import and export activities driving the demand for advanced ports with the availability of technologically advanced machinery and cranes driving the demand for the port cranes. The increasing availability of the leading manufacturing unit for advanced machinery and heavy-duty vehicles across the region.

- The Overhead Crane Manufacturing size in the United States was USD 1.4 billion in 2023.

Port Cranes Market Growth Factors

- Increasing urbanization: Rising urbanization and per capita income drive living standards and lifestyle spending, which contribute to the expansion of the e-commerce industry, which drives the demand for the shipping industry and drives the growth of the market.

- Economic development: Rising economic development in countries owing to rising infrastructural development, supportive government policies, and international trade drives the demand for efficient shipping ports for the international transport of goods and drives the demand for port cranes.

- Government support: The rise in government support for the expansion of national and international business and the rise in the e-commerce industry is driving the demand for shipment facilities over the countries to enhance the growth of the market.

Market Scope

| Report Coverage | Details |

| Market Size by 2024 | USD 1.62 Billion |

| Market Size in 2025 | USD 1.71 Billion |

| Market Size in 2034 | USD 2.85 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 5.82% |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Crane Capacity, Power Source, Control Method, Application, and Regions. |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa. |

Market Dynamics

Drivers

Rise in import and export activities

The increasing adoption of trade activities for economic development across several countries for economic stability, enhanced revenue, reduced competition, longer product lifespan, risk management, easier cash-flow management, advantages in currency exchange, export financing, enhanced reputation, and others. The increasing government intervention in international trade activities is causing the demand for efficient operational locations or product shipping ports, leading to the increased demand for heavy-duty machinery for loading and offloading operations that boosts the growth of the market.

Restraint

High cost

The increased cost of port cranes due to their high cost of machinery, components, energy consumption rate, and maintenance cost is collectively limiting the growth of the port cranes market.

Opportunity

Technological advancements in port cranes

Technological advancements in the port cranes and advanced machinery with the integration of the Internet of Things(IoT), automation, digitization, and remote operations drive the growth of the port cranes market. Advancements such as automation in the port cranes for enhancing performance, efficiency, safer and more precise shipping of cargo, optimizing resource utilization, and reducing operational time and cost boost profitability with less cost consumption that collectively drives the growth of the port cranes market.

Type Insights

The ship-to-shore (STS) cranes segment accounted for the dominating share of 28.40% in 2024. The growth of the segment is primarily driven by a surge in global trade, the increasing adoption of larger container ships, and the rising need for faster turnaround times at ports. Governments and private companies are increasingly investing in port infrastructure development, intending to support the increasing volume of container traffic. These investments generally include building new ones, expanding existing terminals, and upgrading equipment like STS cranes. STS cranes are becoming automated to enhance efficiency, reduce human error, and speed up operations, with features like AI-driven scheduling, automated container handling, and remote operation.

Application Insights

The container handling segment held the major market share of 53.10% in 2024. The rise in international trade, especially of containerized goods, increases the need for efficient port operations for unloading and loading. The market is witnessing increasing reliance on container shipping for transporting goods, which spurs the demand for port cranes such as ship-to-shore (STS) cranes during the forecast period.

Lifting capacity Insights

The 40–80 tons segment registered its dominance with 36.50% over the global port cranes market in 2024. The port crane, particularly those in the 40-80 tons lifting capacity range, is experiencing significant growth owing to the increasing global trade activities, increasing investment in port infrastructure development, growing demand for containerized trade, and rapid technological innovation. The demand for cranes in the 40-80 tons range is widely utilized for handling containers and other cargo efficiently.

Operation Insights

The manual contributed the biggest market share of 44.70% in 2024. Manual cranes are extensively used, particularly in regions with reduced labor costs. Manual port cranes find various applications in ports that rely on human power, typically through chains rather than electricity for their operation. Manual cranes are simpler to operate and maintain in comparison with the electric ones, which makes them highly preferable for locations with limited or unreliable power environments.

End User Insights

The commercial ports segment accounted for the highest port crane market growth rate of 57.40%. Port cranes are crucial for the efficient operation of commercial ports, facilitating the faster movement of goods between ships and the land transportation network. Port cranes play an integral role in safe handling and transporting cargo in commercial ports. As technology continues to advance, port cranes are becoming increasingly automated and efficient, contributing to an innovative and more sustainable maritime industry. There are different types of cranes, including gantry cranes, ship-to-shore cranes, and floating cranes, that are designed to meet the specific needs of different commercial port operations.

Port Cranes Market Companies

- Kito Corporation

- Anupam Industries

- RAM Spreaders

- Mi-Jack Products

- Sumitomo Heavy Industries

- Konecranes

- Liebherr Group

- Cargotec (Kalmar)

- Shanghai Zhenhua Heavy Industries (ZPMC)

- Terex Corporation

- Hyundai Heavy Industries

- Tadano

- SANY Group

- Mitsubishi Heavy Industries

- Conductix-Wampfler

- Künz

- Paceco

- Doosan Heavy Industries & Construction

- Weihua Group

- Eilbeck Cranes

Latest Announcement by Industry Leaders

- In March 2024, Shanghai Zhenhua Heavy Industries (ZPMC) rejected the pose of a cybersecurity threat to ports of the United States after questions were raised on the Chinese state-owned company's work on cranes bound for the U.S. by U.S. congressional committees.

Recent Developments

- In December 2024, Adani Gangavaram Port introduced two Economic Grab Ship Cranes, making a significant advancement in India's first Economic Grab Ship Cranes. The electric cranes are made to handle the different operations in the port and manage the loading and offloading processes.

- In October 2024, The Port of Greenock officially launched the new £25m cranes, with continuous investment in the expansion of productivity at the facility.

Segments Covered in the Report

By Type

- Ship-to-Shore (STS) Cranes

- Rubber-Tyred Gantry (RTG) Cranes

- Rail-Mounted Gantry (RMG) Cranes

- Mobile Harbor Cranes

- Level Luffing Cranes

- Floating Cranes

- Portal Cranes

- Others

By Operation

- Manual

- Semi-Automated

- Fully Automated

By Lifting Capacity

- Below 40 Tons

- 40–80 Tons

- 80–100 Tons

- Above 100 Tons

By Application

- Container Handling

- Bulk Material Handling

- Ship Loading/Unloading

- Others (e.g., heavy project cargo)

By Port Type

- Sea Ports

- Inland Ports

- Dry Ports

By End User

- Commercial Ports

- Industrial Ports

- Naval Ports

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting