What is the Power Tools Market Size?

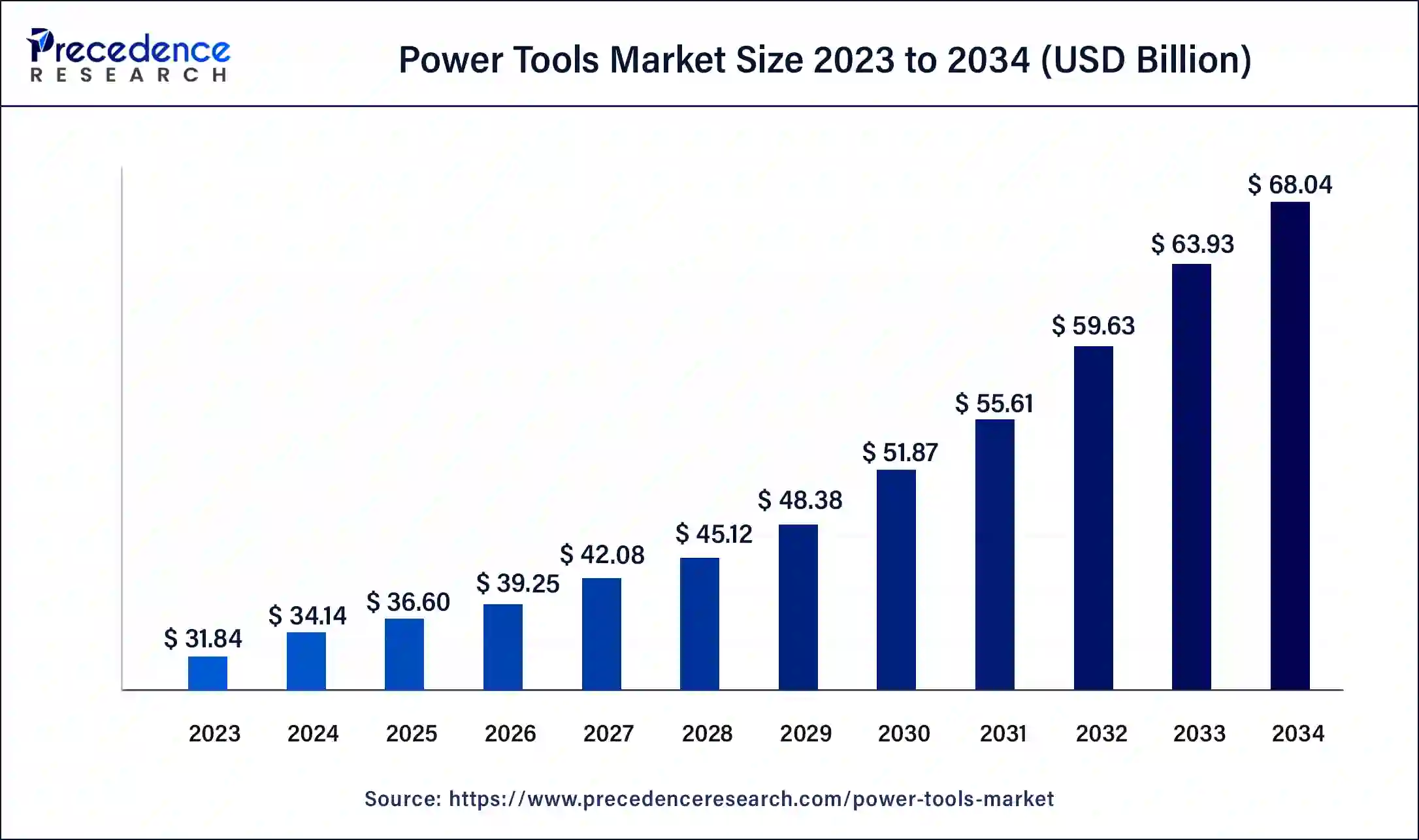

The global power tools market size accounted for USD 36.60 billion in 2025 and is predicted to reach around USD 68.04 billion by 2034, growing at a CAGR of 7.1% from 2025 to 2034. Rising construction activities in developing regions can boost the market.

Market Highlights

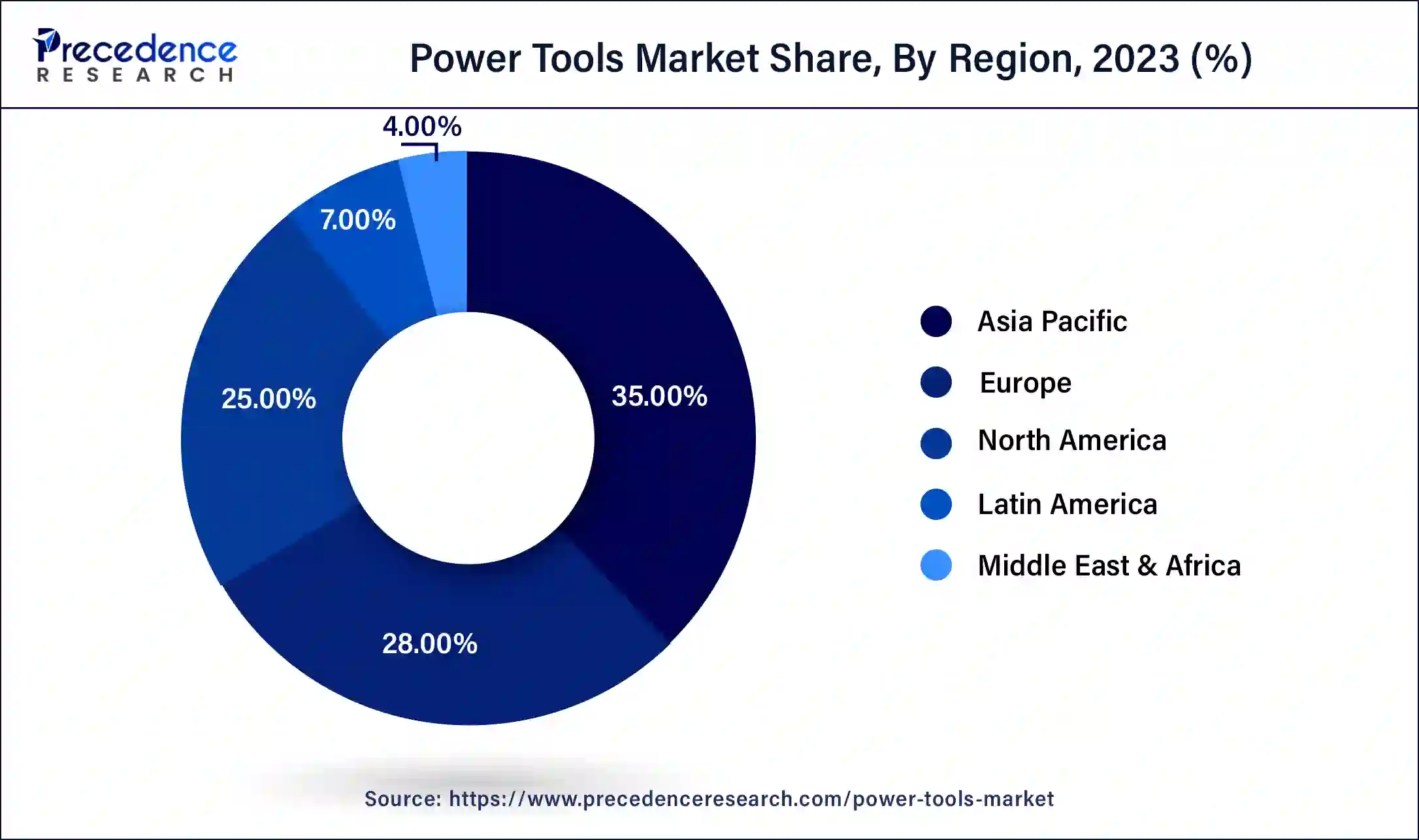

- Asia Pacific dominated market with the largest market share of 35% in 2024.

- The drills segment has contributed more than 33% of market share in 2024.

- The wrenches segment is expected to grow at the highest CAGR of 8.43% during the forecast period.

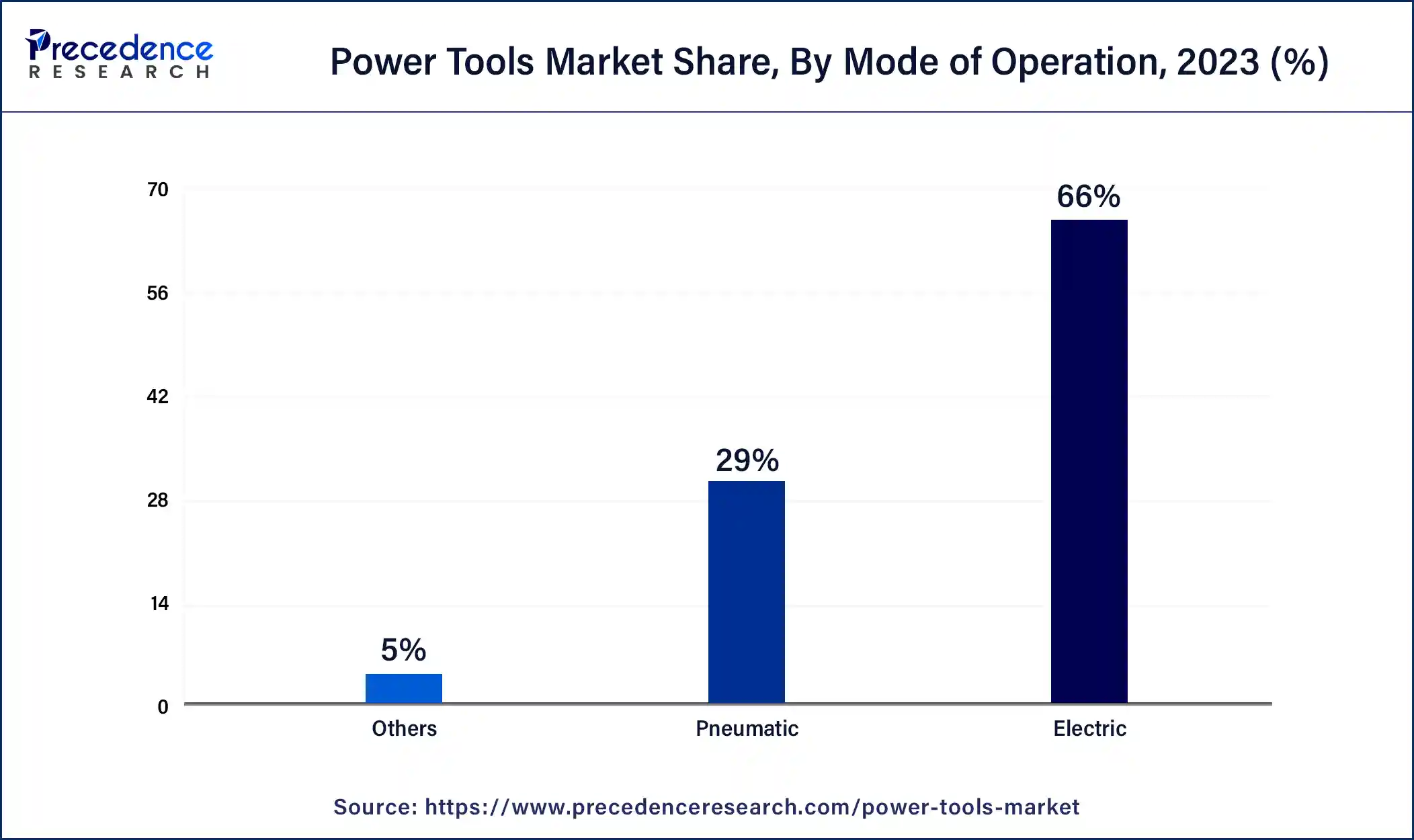

- By mode of operation, the electric segment has held the major market share of 66% in 2024.

- By mode of operation, the pneumatic segment is expected to expand at the fastest CAGR of 26.89% during the forecast period.

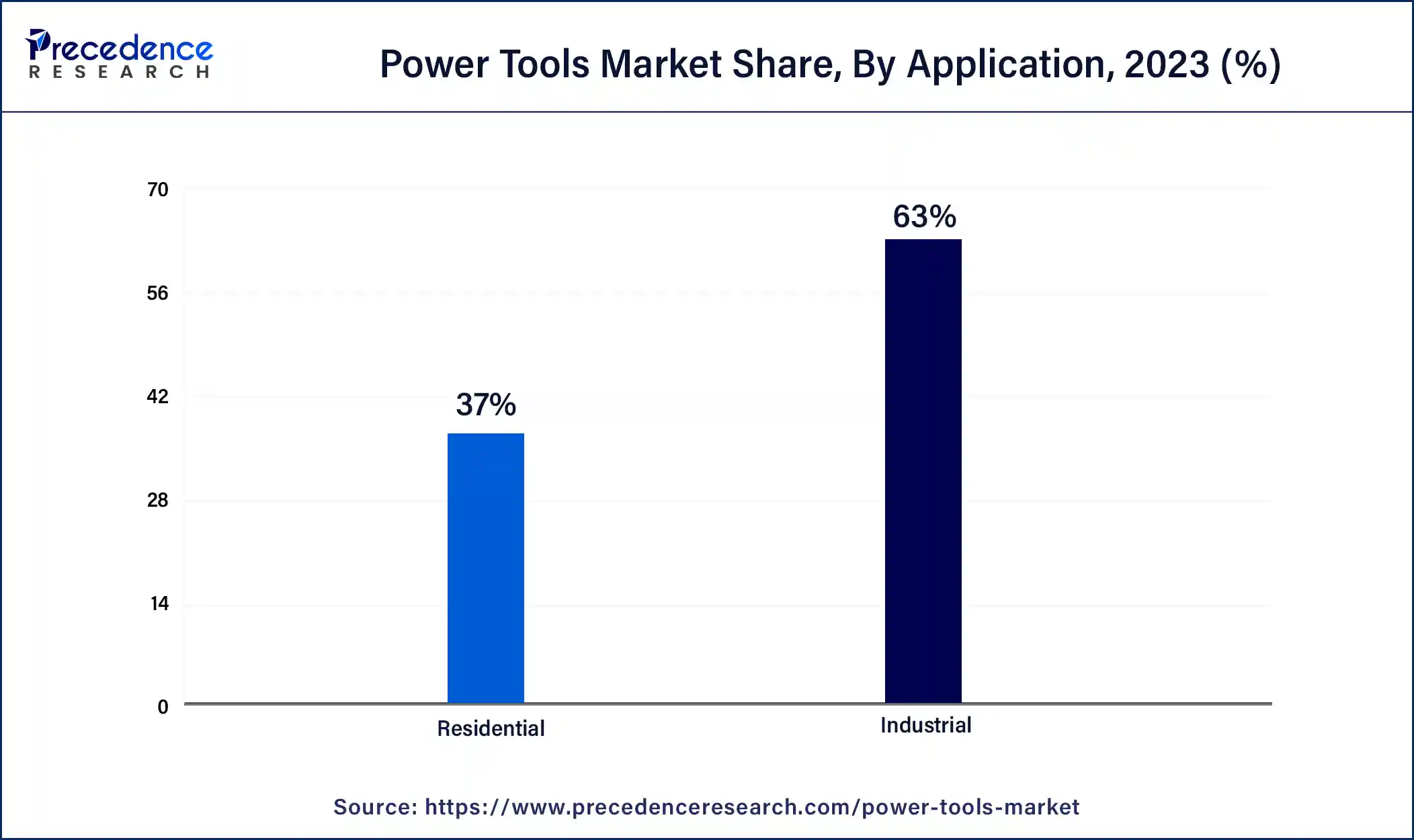

- By application, the industrial segment accounted for the major market share of 63% in 2024.

- By application, the residential segment is expected to expand at the highest CAGR of 8.32 during the forecast period.

Market Size and Forecast

- Market Size in 2025: USD 36.60 Billion

- Market Size in 2026: USD 39.25 Billion

- Forecasted Market Size by 2034: USD 68.04 Billion

- CAGR (2025-2034): 7.10%

- Largest Market in 2024: Asia Pacific

Market Overview

The power tools market refers to any equipment or gadget that runs on an external energy source, like compressed air or electricity and is referred to as a power tool. The power tools provide increased speed, strength, and efficiency over manual tools, which are entirely dependent on human labor. The advancements in technology, building and manufacturing activity, and customer demands for ease and efficiency all have an impact on the market.

The power tools market is extremely useful in a variety of industries. The power tools are essential in many different industries because they offer strength, accuracy, and efficiency. Additionally, the industry that produces and distributes portable or stationary tools for a variety of uses, including drilling, sanding, and cutting, that are driven by electricity, batteries, or compressed air is known as the market. It caters to both professional and do-it-yourself users and contains devices devices including drills, saws, grinders, and sanders.

Power Tools Market Growth Factors

- The increasing emphasis on urbanization and industrialization in developing regions can boost the power tools market.

- The improvement in the safety of power tools can be the opportunity to grow the power tools market.

Market Scope

| Report Coverage | Details |

| Power Tools Market Size in 2025 | USD 36.60 Billion |

| Power Tools Market Size in 2026 | USD 39.25 Billion |

| Power Tools Market Size by 2034 | USD 68.04 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 7.10% |

| Largest Market | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Mode of Operation, Application, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Expansion of modular construction in developing regions

The growing demand for power tools is driven by an emphasis on construction practices in developing nations, which can be attributed to expanded infrastructure projects, urbanization, and industrialization. The requirement for effective and potent equipment to speed up the construction of new buildings, roads, and facilities increases as a result, propelling the market's expansion of the power tools market.

Restraint

Need for ongoing maintenance and repair

The need for ongoing maintenance and repair may slow down the power tools market. Consumers might look at maintenance and repairs as an extra costly strain, particularly if they happen frequently or need expert help. The users may experience inconveniences as a result of routine maintenance and repairs that interfere with do-it-yourself projects or workflow.

Opportunity

Improved safety

The improvement in the safety of power tools can be the opportunity to grow the power tools market. The goal of power tool producers is to improve user safety, convenience, and comfort through ergonomic features such as anti-vibration technology, easily navigable controls, pleasant grips, and lightweight, compact designs. Active torque control (ATC) systems and onboard dust reduction (DR) systems assist in collecting dust that contains silica, which is dangerous. ATC also halts drill spinning when a bit jams, preventing injury. Additional safety measures on tools include the capacity to turn off instruments like grinders right away if the user abruptly shifts position in any direction.

Segments Insights

Product Insights

The drills segment dominated the power tools market by product in 2023. The drills are tools used for making holes in material like a drill bit or a drill machine. The drills are very adaptable instruments that may be utilized for a wide range of jobs, from minor home maintenance to building projects. For many customers, their extensive range of users makes them indispensable. The modern drills are engineered to be highly user-friendly, with lightweight construction, ergonomic handles, and simple controls. The professionals and do-it-yourself will find this accessible. In order to improve drill performance and usefulness, manufacturers are always coming up with new features and technologies.

In several industries, including manufacturing, automotive, aerospace, and woodworking, drills are indispensable tools. Their broad use in professional contexts can be attributed to their application in machining, fabrication, assembly, and maintenance operations, among other things.

The drills are becoming more and more popular as cordless power tools become the preferred option over corded ones. With cordless drills, users may work in places without power outlets since they are more mobile, convenient, and flexible. The performance and run-time of cordless drills have been enhanced by technological developments in battery technology, which has increased their popularity.

The saws segment is expected to grow to the highest CAGR in the power tools market by product during the forecast period. Globally, as urbanization and infrastructure building projects increase, saws are becoming more and more necessary for construction tasks like cutting metal, wood, and other materials. An increasing number of people are choosing to take on do-it-yourself (DIY) home renovation and improvement projects.

The need for this market is further fueled by the fact that saws are necessary equipment for do-it-yourself. Technological Developments: As a result of technological developments, saws have become more effective and adaptable, meeting a wide range of requirements and uses. Because of this, saws are becoming more widely available and have a greater range of applications, which has increased their market share. The saws are widely utilized in a variety of industries, including woodworking, automotive, aerospace, and manufacturing. As these sectors expand.

Mode of Operation Insights

The electric segment dominated the power tools market by mode of operation in 2023. In general, people believe that electric power tools are safer than instruments with pneumatic or gasoline power. They are favored in many job areas because they remove the dangers involved in handling combustible fuels or using high-pressure pneumatic systems. Due to their fewer pollutants and less environmental impact, electric power tools are becoming more and more popular over their gasoline-powered counterparts as people become more conscious of environmental issues.

This trend supports initiatives in a number of businesses to encourage sustainability and lower carbon emissions. Power tools are required for building, renovating, and maintaining projects because of the worldwide trend of urbanization and infrastructure development. These projects require electric tools because of their adaptability, dependability, and user-friendliness, which contribute to their market domination.

The pneumatic segment is expected to grow at a rapid pace in the power tools market by mode of operation during the forecast period. Many industrial industries, including manufacturing, automotive, aerospace, construction, and metallurgy, employ pneumatic power tools extensively. They are favored for heavy-duty drilling, grinding, riveting, and fastening tasks that call for high torque and continuous operation. The pneumatic tools are well-known for having an excellent power-to-weight ratio, which makes them appropriate for heavy-duty tasks requiring a high degree of mobility and maneuverability.

When compared to electric tools of the same size and weight, they provide more power, which makes them invaluable in industries that require high-performance tools. The pneumatic tools are renowned for their resilience to severe operating environments, high temperatures, and frequent use. Compared to electric tools, they have fewer moving parts, which lowers the possibility of mechanical problems and downtime.

Application Insights

The industrial segment dominated the power tools market by application in 2023. Industrial applications frequently need powerful power tools that can sustain demanding, ongoing use. To fulfill production demands, power tools used in the manufacturing, construction, automotive, aerospace, and metalworking industries must have excellent performance, dependability, and durability. Industries are increasingly dependent on automation and mechanization to increase production, efficiency, and accuracy. Power tools are vital in automated manufacturing processes because mass production and assembly activities depend on speed, accuracy, and consistency. Industrial applications frequently include specialized activities requiring particular power tool types designed to meet industry requirements. These might include industrial-grade saws for cutting massive materials in construction, precision grinders, or pneumatic drills for heavy-duty drilling in metal production.

The residential segment is expected to grow to the highest CAGR in the power tools market by application during the forecast period. The power tools that are more versatile, efficient, and perform better have been made possible by technological developments. The adoption of power tools is accelerated by features like digital controls, brushless motors, lithium-ion batteries, and cordless operation, which make them more appealing to domestic users. Power tool usage that integrates with smart technology is encouraged by the growing trend toward smart house solutions.

Tech-savvy households looking for convenience and automation will find smart power tools interesting because they provide features like app-based controls, remote monitoring, and connectivity with other smart equipment. The demand for power tools in residential applications is influenced by housing development projects and urbanization trends. Power is required when urban populations rise, and new housing developments are built. Globally, there has been a notable surge in home improvement and restoration projects, fueled by elements including evolving lifestyles, an aging housing stock, and rising disposable incomes.

Power tools are necessary for many jobs, including painting, gardening, plumbing, electrical, and carpentry, which supports the expansion of the home market. Among homeowners who would rather do home repair work themselves rather than employ professionals, the Do-It-Yourself (DIY) culture is becoming more and more popular. The market for home power tools is driven by the ability of do-it-yourself enthusiasts to complete a variety of chores successfully and economically with the help of power tools.

Regional Insights

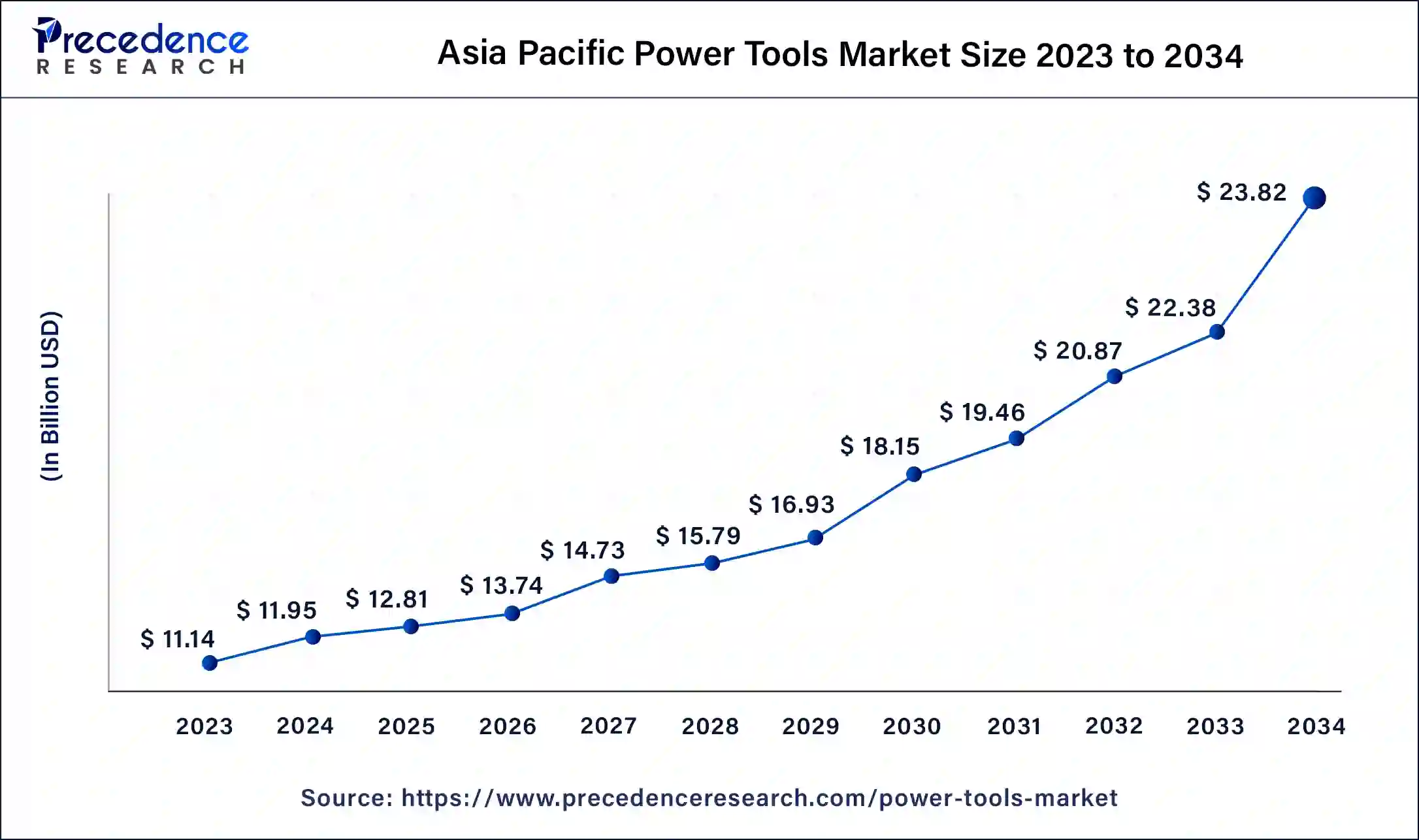

Asia Pacific Power Tools Market Size and Growth 2025 to 2034

The Asia Pacific power tools market size was estimated at USD 12.81 billion in 2025 and is expected to be worth around USD 23.82 billion by 2034, at a CAGR of 7.30% from 2025 to 2034.

Asia Pacific dominated the power tools market by region in 2024. Several reasons, including the region's population, rapid economic expansion, rising urbanization, technical innovations, and expanding middle class, contribute to its supremacy in the market. The economy of Asia Pacific is also greatly enhanced by the presence of some of the fastest-growing economies in the world, including those of China, India, and South Korea nations. The economic dominance of Asia Pacific has also been enhanced by smart infrastructure investments, advantageous government policies, and a move towards innovations and enterprises.

More than 85% of the world's power tools are produced in China. World-famous brands like DeWalt, Black-and-Decker, and Bosch use Chinese manufacturers to produce some of their power tools or components in China. In 2020, the scale of China's electric market is about 80.9 billion yuan, and the average compound annual growth rate of China's electric market from 2015 to 2020 is 6.9%. A list of Chinese suppliers of power tools is prepared for your perusal to learn more about China's power tool industry.

North America is expected to grow rapidly in the global market by region during the forecast period. The market is expected to grow for several reasons, including the consistent demand for power tools driven by ongoing construction activities, infrastructure, and the do-it-yourself culture. Additionally, positive economic trends and rising disposable income support the expansion of the power tools market in North America.

- In 2020, the size of the American market for power tools was estimated at around 13.57 billion U.S. dollars. In that same year, the U.S. power tool market size was estimated at 11.6 billion USD.

Power Tools Market Companies

- Techtronic Industries Co., Ltd.

- Snap-On, Inc.

- Robert Bosch GmbH

- Panasonic Corporation

- Emerson Electric Co.

- Atlas Copco AB

- Koki Holdings Co., Ltd.

- Makita Corporation

- Stanley Black & Decker, Inc.

- Apex Tool Group, LLC

Recent Developments

- In April 2024, Zoho Corporation once again made headlines with the announcement of its latest venture, Karuvi. With Karuvi, Vembu aims to disrupt traditional industries by providing innovative power tools that enhance efficiency and productivity. The launch of Karuvi marks a significant milestone in Vembu's entrepreneurial journey as he continues to push the boundaries of technological innovation.

- In February 2024, Alpha and Omega Semiconductor Limited (AOS) (Nasdaq: AOSL), a designer, developer, and global supplier of a broad range of discrete power devices, wide band gap power devices, power management ICs, and modules, announced the release of the AOZ32063MQV gate driver for BLDC motor applications. Available in a compact, 4mm x 4mm QFN-28L package, the highly integrated AOZ32063MQV is a 3-phase driver IC that offers superior driving ability, programmable dead, and sleep mode support.

- In December 2023, Dormer Pramet, a key player in metal cutting tools and a part of the Sandvik Group, announced the launch of its latest product line customized specifically for the Indian market. The comprehensive lineup includes advanced milling, turning, drilling, and tapping tool holders, along with a variety of collections and accessories designed to seamlessly integrate with machines ranging from traditional setups to cutting-edge CNC centers.

- In November 2023, Bosch became the world's first manufacturer to bring the benefits of tablet technology in battery cells to 18V batteries for cordless power tools. The ProCore18V+ with 8.0 Ah increases the runtime of Bosch's high-performance ProCore18V battery series even further, giving trade and industry professionals yet another efficiency boost. The new ProCore18V+ with 8.0 Ah increases runtime by up to 71 percent compared to the previous ProCore18V battery at the same capacity.

Segment Covered in the Report

By Product

- Drills

- Saws

- Wrenches

- Grinders

- Sanders

- Others

By Mode of Operation

- Electric

- Pneumatic

- Others

By Application

- Industrial

- Residential

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting