What is Pneumatic Tools and Accessories Market Size?

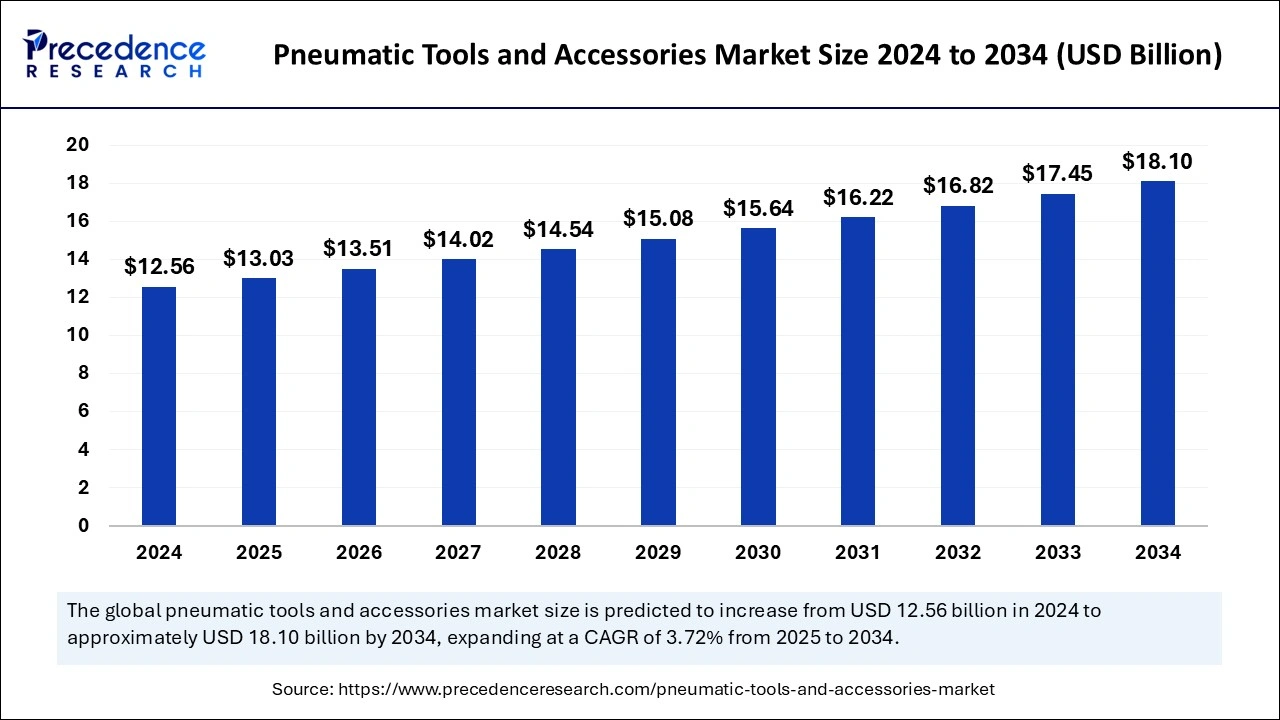

The global pneumatic tools and accessories market size accounted for USD 13.03 billion in 2025 and is expected to exceed around USD 18.10 billion by 2034, growing at a CAGR of 3.72% from 2025 to 2034. The increasing demand for sustainable options for electricity based industrial tools in a wide range of industries is driving the growth of the market.

Market Highlights

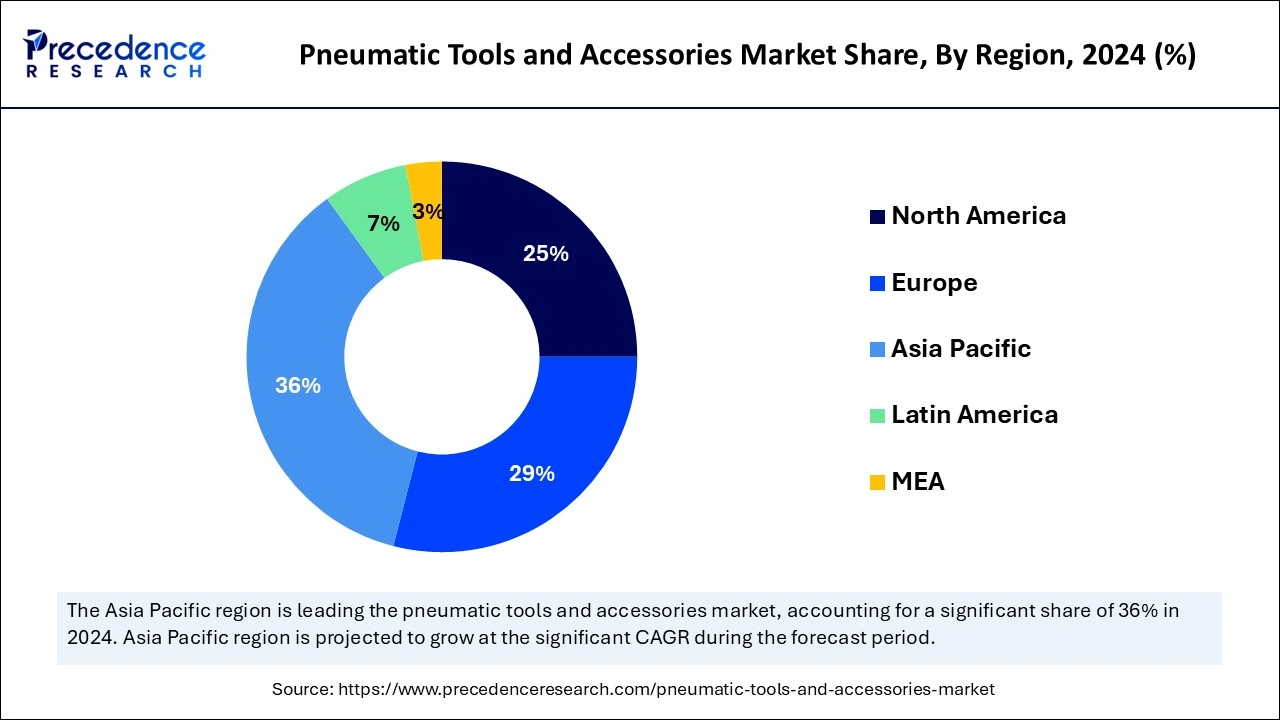

- Asia Pacific dominated the pneumatic tools and accessories market in 2024.

- North America is expecting substantial growth in the market during the predicted period.

- By type, the pneumatic tools segment dominated the market in 2024.

- By type, the pneumatic accessories segment will experience significant growth in the market during the predicted period.

- By end-use, the industries segment led the market in 2024.

- By end-use, the DIY segment will show notable growth in the market during the forecast period.

- By distribution channel, the direct sales segment dominated the global market in 2024.

- By distribution channel, the online retailer segment expects substantial growth in the market during the predicted period.

What arePneumatic Tools and Accessories?

Pneumatic tools are powerful tools that assist with compressed air rather than electricity. An air compressor is one of the important parts of the pneumatic tool, and it is used for efficient operation and helps provide a pressurized burst of air. The pneumatic tools and accessories market products and services have a wide range of industrial applications. These tools and accessories are called air tools. There are different types of pneumatic tools that are found in the market, and they are used to be driven by compressed carbon dioxide in small cylinders designed for portable applications.

How Can Artificial Intelligence (AI) Impact the Pneumatic Tools and Accessories Market?

The evaluation of the industrial infrastructure and integration of artificial intelligence and machine learning in the different industrial equipment such as in the pneumatic tools and accessories market. The advancement or integration of AI drives significant advancements in performance, sustainability, and eco-friendly manufacturing positioning. AI helps reduce energy consumption, making it a better alternative to traditional electric machines.

Pneumatic Tools and Accessories Market Growth Factors

- Increasing demand from industries: The rising demand for pneumatic tools and accessories from a wide range of industries, such as automotive, construction, electronics, mining, fabrication, aerospace, defense, and others, is driving the market's growth.

- Increasing demand for sustainable tools: The increasing demand for economical, eco-friendly, and sustainable equipment for construction, manufacturing, or mining operations boosts the demand for pneumatic tools and accessories.

- Rising government initiatives: The increasing investment by the different regional governments in infrastructural development across the countries accelerates the demand for the pneumatic tools and accessories market.

- Demand for efficient machinery: The increasing urbanization across countries and the growth of infrastructural development drive a higher demand for portable and lightweight industrial equipment.

Market Outlook

- Industry Growth Overview: The pneumatic tools and accessories market is growing, driven by advancements in industrial automation, development in the automotive and construction sectors, and an increasing DIY culture. Innovation in energy efficiency, IoT integration, and ergonomics drives the growth of the market.

- Global Expansion:The pneumatic tools and accessories market is growing worldwide, driven by increasing innovation in ergonomic and lightweight designs, the incorporation of Interntet of Things for advanced systems, and a growing focus on sustainability by energy-efficient knowledge. Asia Pacific is dominated in the market by a growing and large industrial base.

- Major investors:Major investors in the pneumatic tools and accessories market include established, large multinational corporations. Such as Atlas Copco AB, Makita Corporation, Stanley Black & Decker, Ingersoll Rand, Bosch Power Tools, and Emerson Electric Co.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 13.03 Billion |

| Market Size in 2026 | USD 13.51 Billion |

| Market Size by 2034 | USD 18.10 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 3.72% |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, End-Use, Distribution Channel, and Regions. |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa. |

Market Dynamics

Drivers

Benefits associated with pneumatic tools and accessories

The pneumatic tools or the air-powered tools offer several benefits in industrial operations. It is used in a wide range of industrial applications and offers benefits such as lightweight equipment. It can work in a harsh environment, it provides enhanced safety to the user, and it is totally safe to use on conductive material and inflammable situations or environments. The air-powered tools and accessories are fireproof and do not generate sparks or fires.

Restraint

Increased noise and demand for maintenance

The requirement of time-to-time maintenance and the high cost of equipment and parts of pneumatic tools and accessories limits the adoption of the pneumatic tools and accessories market.

Opportunity

Technological advancements in pneumatic tools

The continuous investment in technological advancements in pneumatic tools and accessories to improve performance and efficiency is driving the growth opportunity in the pneumatic tools and accessories market. Additionally, the integration of digital technologies, robotics, automation, and advancements in coating and materials are driving the demand for pneumatic tools and accessories. Furthermore, the rising urbanization and infrastructural development are accelerating market expansion.

Segment Insights

Type Insights

The pneumatic tools segment dominated the pneumatic tools and accessories market in 2024. The increasing demand for pneumatic tools from a wide range of industries for different tasks and applications drives the growth of the segment. The pneumatic tools are used in automotive shops, construction sites, fabrication, body shops, and industrial applications. Pneumatic tools are mainly used in applications such as nailing, sanding, and painting. Pneumatic tools are used in different applications such as nailing and stapling, sanding and grinding, painting, and spraying.

The pneumatic accessories segment will experience significant growth in the market during the predicted period. The pneumatic accessories include parts or products like fittings, gauges, tubing, flow controls, manifolds, check valves, and switches, which are used in a wide range of manufacturing applications. Pneumatic accessories are used in industries such as packaging equipment and robotics, medical tubing, agriculture, food and beverages, water purification, chemical transfer, automation, and automotive.

End-Use Insights

The industry segment led the pneumatic tools and accessories market in 2024. Pneumatic tools or systems are ideal solutions for different industries such as automotive, mining, construction, aerospace and defense, electronics, railroad, fabrication, and others. It provides several advantages in the field of industry that requires high speed, accuracy, and force. It is the most economical, eco-friendly, and cost-effective solution for industrial applications. Pneumatic tools in automotive manufacturing are used to fill the tires with compressed air, paint vehicles, operations of operate welding equipment, and perform plasma cutting. In the construction industry, different equipment and machinery depend on pneumatics, such as drills, jackhammers, air-powered tools, heavy-duty machinery, and others.

The DIY segment will show notable growth in the market during the forecast period. Pneumatic tools are one of the essential parts of DIY hobbyists, enthusiasts, and professionals. Pneumatic tools are used for personal, professional, and domestic purposes such as inflating tires and other items, cleaning and dusting places like workshop cleanup, electronic maintenance, automotive detailing, and yard equipment. It is used in sandblasting tasks like removing extreme dust removal, etching, and engraving. It is used for airbrushing, staple and nail gun applications, and others. The increasing enthusiasm of people for DIY and creating home aesthetics is accelerating the expansion of the industry.

Distribution Channel Insights

The direct sales segment dominated the global pneumatic tools and accessories market in 2024. X`The increasing sales of pneumatic tools and accessories through direct sales. The increasing availability of different types of pneumatic devices and equipment with different technologies and sizes is required for different applications. Direct sales are the simplest distribution process where producers, suppliers, and manufacturers go directly to the customer. Direct sales enhance customer experience. It increases accessibility, direct feedback, and control over sales, enhances profitability, provides optimal pricing, and strengthens brand loyalty.

The online retailer segment expects substantial growth in the market during the predicted period. The increasing inclination towards online retailing or the e-commerce industry due to the greater availability of pneumatic tools and accessories with different power, sizes, and brands is accelerating the sales of pneumatic tools by online retailing.

Regional Insights

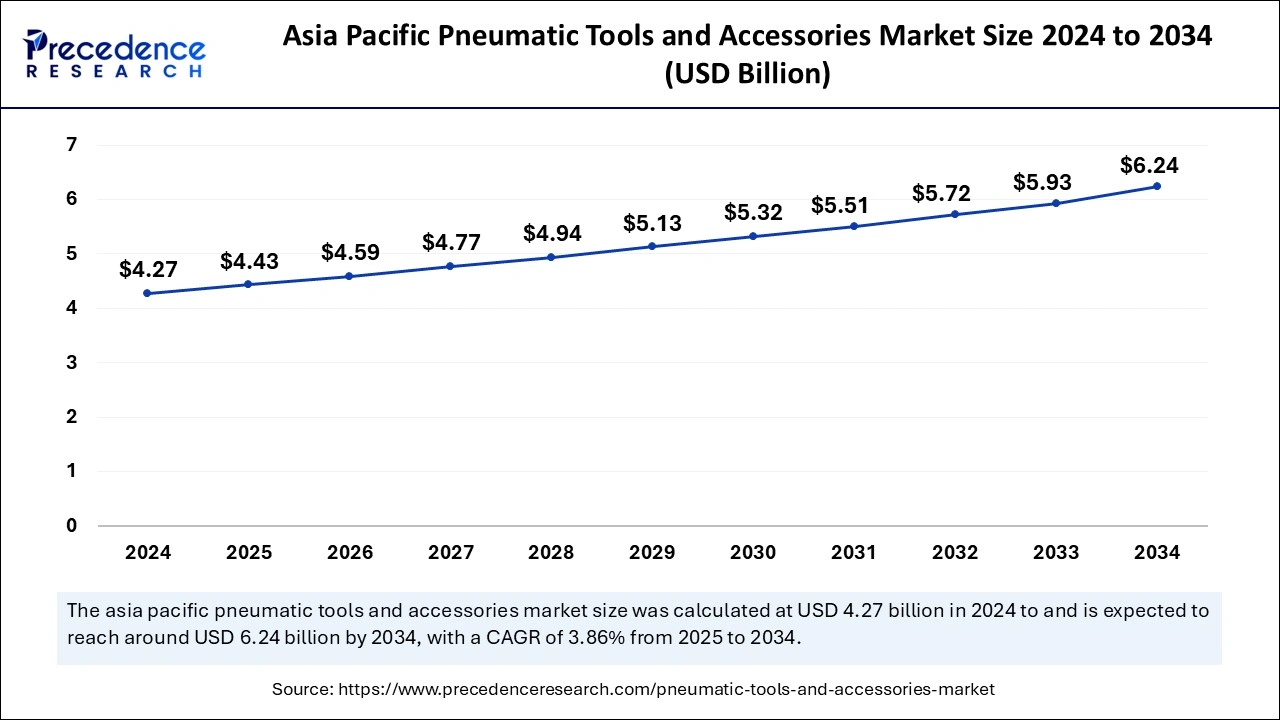

Asia Pacific Pneumatic Tools and Accessories Market Size and Growth 2025 to 2034

The Asia Pacific pneumatic tools and accessories market size is exhibited at USD 4.43 billion in 2025 and is projected to be worth around USD 6.25 billion by 2034, growing at a CAGR of 3.86% from 2025 to 2034.

Asia Pacific: Industrial expansion

Asia Pacific dominated the pneumatic tools and accessories market in 2024. This is attributed to the continuous rise in the population, and the infrastructural development in economically developing countries like China, India, and Japan is driving the demand for efficient equipment. The increasing industrialization, such as automotive, electronics, mining, construction, fabrication, shipbuilding, agriculture, manufacturing, and others, causes the demand for eco-friendly, sustainable, and efficient machinery.

- The Indices of Industrial Production in India for the month of December 2023 in mining stands at 139.4, for manufacturing, it stands at 150.6, and in the electricity sector stands at 181.6.

North America: Technological leadership and innovation

North America is expecting substantial growth in the market during the predicted period. The growth of the market is owing to the rising industrial development, the infrastructural development, and the construction industry that causes the demand for advanced and eco-friendly machinery or equipment that boosts the demand for the market. Additionally, the government's rising investment in infrastructural development and in the R&D of new machinery and equipment collectively drives the growth of the pneumatic tools and accessories market across the world.

India: Increasing infrastructure boom

India has a massive and affordable production base with a strong presence of MSMEs. Increasing demand for pneumatic devices in India due to infrastructure projects and industrial expansion, specifically in the manufacturing, automotive, and construction sectors. Large-scale government initiatives for infrastructure development, urbanization, and renewable energy projects increased the demand for pneumatic tools in maintenance.

Europe: Increasing government policies for energy saving

Europe is significantly growing in the market as this region has a massive concentration of modern automotive, manufacturing, and aerospace businesses that rely heavily on pneumatic devices for precision and power in assembly and manufacturing. EU directives and initiatives significantly focusing on energy efficiency, carbon footprint lowering, and sustainable manufacturing drive the advancement and application of eco-friendlier and energy-efficient pneumatic systems.

U.S.: Increasing government investment and initiatives

The U.S. has a well-established production and industrial base that needs high-performance and effective tools for different applications. High rate of acceptance of novel technologies and an increasing focus on research and development, which includes a shift towards more portable and energy-efficient devices. Increasing government funding for infrastructure advancement and guidelines that promote safety and efficiency encourage the use and novelty of pneumatic devices.

UK: Strong public health initiatives

The UK has a well-established and advanced engineering, construction, and automotive sector that is are major consumer of pneumatic devices. Industries are gradually adopting automated and semi-automated services, which increases the demand for pneumatic tools in applications such as assembly and fastening.

Pneumatic Tools and Accessories Market- Value Chain Analysis

- Raw Material Sourcing:

Raw material sourcing is the strategic process of evaluating, identifying, and procuring vital materials to manufacture products powered by compressed air.

Key Players: Bosch and Parker Hannifin Corporation - Package Design and Prototyping:

The process for pneumatic tools and accessories packaging includes a structured design phase followed by physical prototyping and severe testing to confirm safety, durability, and functionality.

Key Players: Stanley Black & Decker - Recycling and Waste Management:

The recycling and waste management of pneumatic tools and accessories predominantly involves disassembly to recover valuable materials, such as metals and plastics, and ensuring the proper disposal of components.

Key Players: Ingersoll Rand and Atlas Copco

Top Vendors in the Pneumatic Tools and Accessories Market & Their Offerings

|

Company |

Headquarters |

Key Strengths |

Latest Info (2025) |

|

AIRCAT Pneumatic Tools and Accessories |

Florida |

High-performance technologies |

The AIRCAT line shows the most significant development in the performance of pneumatic power devices in nearly 30 years. |

|

Atlas Copco |

Sweden |

Financial strength and stability |

Atlas Copco supplies a wide range of pneumatic assembly devices intended to give the highest possible productivity on the assembly line. |

|

Bosch Limited |

India |

Extensive research and development (R&D) focus |

The Bosch Professional catalog cover presents devices and accessories in various settings. |

|

Chicago Pneumatic (CP) |

France |

High durability and robustness |

Worldwide producer of high-performance power devices, light towers, generators, air compressors, and hydraulic equipment for professional use |

|

DeWalt |

Maryland |

Advanced battery systems |

DEWALT offers a full line of pneumatic/air devices, specifically designed with the professional in mind. |

Latest Announcement by Industry Leaders

- In November 2024, a German-based company, VisionTools Bildanalyse Systeme GmbH, which works on assembly line quality control, integrated with the Atlas Copco Group.

Recent Development

- In May 2024, Bobcat introduced a new air compressor with PA12.7v Portable Air Compressor with FlexAir Technology. The technology helps in operating between the range of 5.5 to 12.1 bars and enabling free air deliveries from 5.2 to 7 m3/min.

- In August 2024, Dynabrade, a leading player in pneumatic hand tools and surface treatment solutions, launched Autobrade, a product that leads innovative process improvements and robotic integration of automated surface conditioning solutions globally.

Segments Covered in the Report

By Type

- Pneumatic tools

- Wrenches

- Grills

- Grinders/sanders

- Hammers

- Screwdrivers

- Saws

- Others (buffers, riveting, guns, etc.)

- Pneumatic accessories

- Hose

- Hose reels

- Regulators

- Lubricators

- Fittings

- Couplers

- Others (Nailers, filters, etc.)

By End-Use

- DIY

- Professional

- Industrial

- Automotive

- Construction

- Mining

- Electronics

- Aerospace and defense

- Fabrication

- Shipbuilding

- Railroad

- Others (manufacturing, chemical, etc.)

By Distribution Channel

- Direct sales

- Distributors/wholesalers

- Online retailers

- Specialty stores

- Other retail stores

By Region

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting