What is Medical Tubing Market Size?

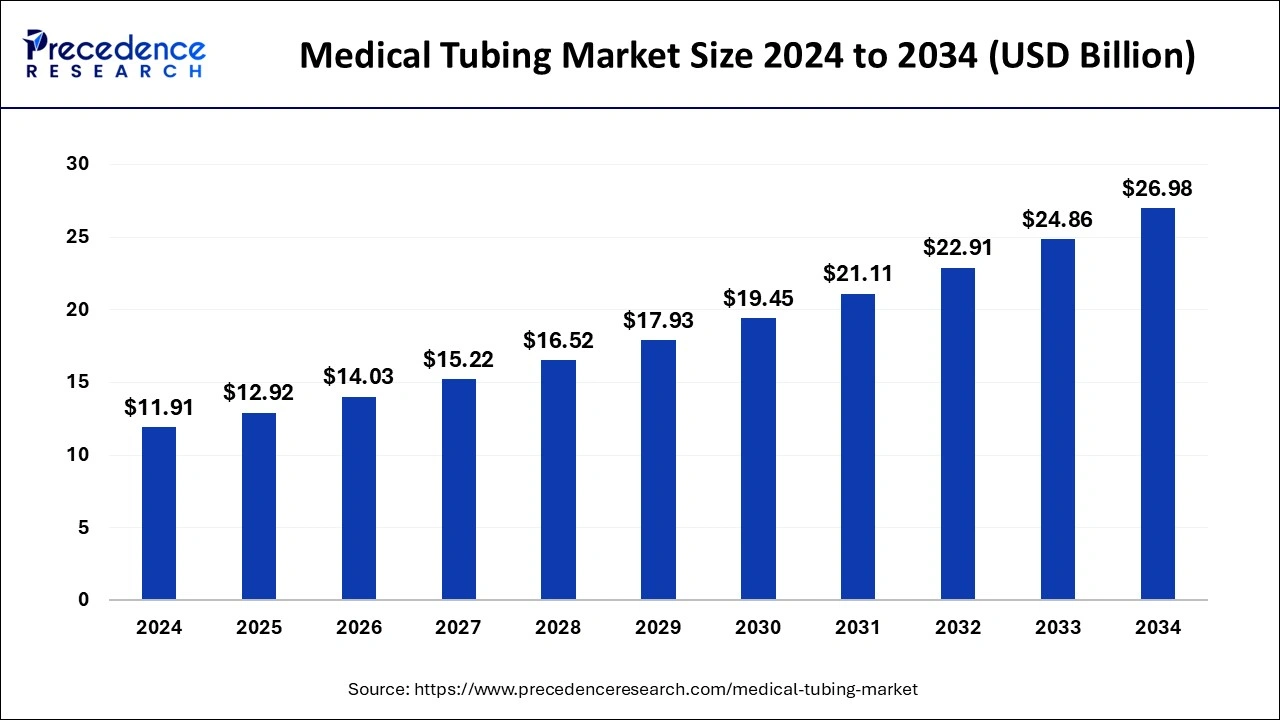

The global medical tubing market size is accounted for USD 12.92 billion in 2025 and is anticipated to reach around USD 26.98 billion by 2034, growing at a CAGR of 8.52% from 2025 to 2034.

Market Highlights

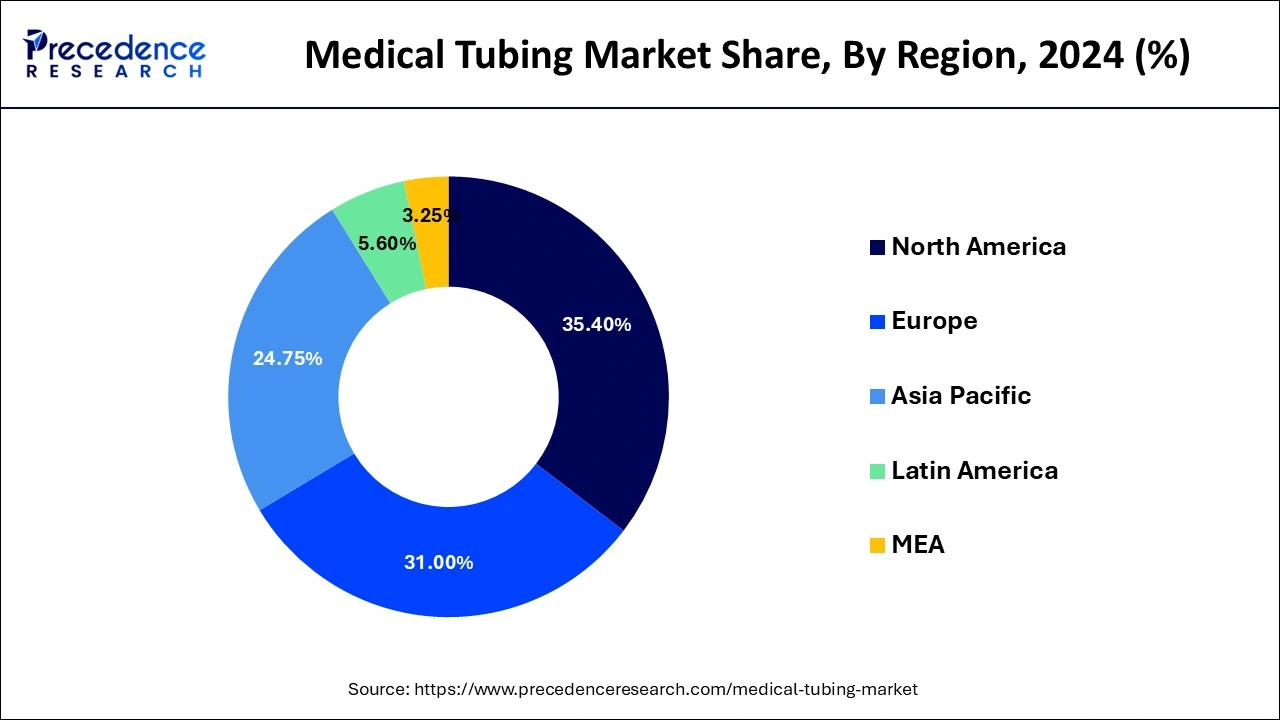

- North America dominated the medical tubing market with the largest market share of 35.40% in 2024.

- Asia Pacific region is expected to grow rapidly in the medical tubing market over the forecast period.

- By medical application, the cardiovascular segment dominated the market.

- By medical application, the urology segment is expected to grow rapidly over the forecast period.

- By application, the bulk disposable tubing contributed the highest market share of 35% in 2024.

- By material type, the polyvinyl chloride (PVC) segment dominated the market.

- By material type, the polyolefin segment is expected to show the fastest growth during the predicted timeframe.

- By end-user, the hospitals segment dominated the market.

How is Innovation Impacting the Market?

Developments in manufacturing practices have led to the integration of bioactive constituents into extruded materials, together as a way to distribute drugs and to encourage healing. For instance, pharmaceutical elements can be blended with silicone to provide multiple benefits. Silicone has highly constant absorption characteristics. Ultraviolet light treatable silicones allow extruders to blend drugs into silicone and extrude drug entrenched tubing without affecting the efficiency of the medication. Such medications are predominantly antimicrobials or antibiotics that can be discharged at regulated rates. Medicinal tubing usage is used in multiple therapeutic procedures; therefore, the manufacturing of medical tubing requires some certifications and a standard technique.

Distinct materials with chosen specifications are employed to produce medical tubing. Constant innovation in drug transfer systems is increasing the mandate for customizable medical tubes, which is expected to drive the need for medical tubes in medication delivery structures. Also, the preference for less invasive medicinal procedures over conservative surgical procedures is growing, as they offer benefits such as quick recovery period, low cost, and reduced length of hospital stays. Moreover, increasing modernizations in drug transfer systems such as photo-thermally triggered medication delivery, intra-cochlear medication delivery which employ nano-medical tubing, is likely to further propel industry growth over estimate period.

How Can AI Revolutionize the Medical Tubing Market?

Medical tubing where Artificial Intelligence can be implemented includes central venous catheters, nasogastric tubes, urinary catheters and endotracheal tubes. AI can be applied for various purposes in medical tubing such as for monitoring vital signs, detecting abnormalities in blood flow, predicting potential complications, early detection of infection and for optimizing fluid administration by analysing real-time data from the tubes which helps healthcare professionals to make informed decisions and responsive interventions.

Medical Tubing Market Growth Factors

- Increasing demand for medical devices

- Growing popularity of minimally invasive surgical procedures

- Increasing healthcare expenditure

- Growing geriatric population

- Increasing prevalence of chronic ailments such as cardiovascular and urological disorders

- Rapidly increasing awareness regarding hospital-attained infections

- Increased focus on the improvement of healthcare infrastructure in developing regions

- Growing investment by major market players on research and development

Market Outlook

- Growth overview during 2025-2034: The market will expand steadily, driven by rising chronic diseases and demand for advanced therapies like biologics and gene therapies. Technological integration, especially AI and continuous manufacturing, is streamlining R&D and production processes, boosting efficiency and speed to market.

- Global expansion and major investors: North America dominates the market, while the Asia-Pacific region is the fastest-growing due to expanding capacity and favorable government policies in India and China. Major investors include industry giants such as AstraZeneca, Eli Lilly, Johnson & Johnson, Novartis, and Roche, all committing tens of billions to new facilities and R&D globally.

- Major investors: These corporations are strategically investing in domestic manufacturing to improve supply chain resilience and meet global demand. Contract Development and Manufacturing Organizations (CDMOs) are also seeing significant investment as companies outsource complex manufacturing, especially for biologics.

Market Scope

| Report Highlights | Details |

| Market Size in 2025 | USD 12.92 billion |

| Market Size in 2026 | USD 14.03 billion |

| Market Size by 2034 | USD 26.98 billion |

| Growth Rate From 2025 to 2034 | CAGR of 8.52% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Medical Condition, Application, Material Type, End-User and Region |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, Middle East & Africa (MEA) |

Market Dynamics

Drivers

Rising Importance on Use of Sustainable Chemical Manufacturing

With the rising investments by industries in research and development as well as the integration of economic principles for transforming chemical manufacturing, reducing waste and for enhancing resource planning is promoting the utilization of sustainable manufacturing methods which will help in reducing environmental impact by reducing product carbon footprint.

Restraint

Limited compatibility and discomfort

Materials used in medical tubing and medical devices for medical purposes can cause discomfort in patients leading to skin irritations, infections and allergic reactions. Certain considerations about availability and usage of suitable materials with specific properties such as biocompatibility, chemical resistance, flexibility, strength and lightweight in nature can limit the development of tubing in various applications.

Opportunity

Technological Innovations for Developing Minimally Invasive Procedures

The rising demand by patients for minimally invasive procedures for diagnosis, monitoring and treatment purposes is accelerating the development process of innovative methods for enhancing patient compliance and comfort.

Segment Insights

Medical Condition Insights

The cardiovascular segment dominated the market with the largest share in 2024. Cardiovascular disease burden is rising in the world with the changing lifestyle habits, due to other medical conditions, environmental factors, psychological factors and biological factors which creates the demand for suitable and sustainable medical tubing and devices used for diagnosis, monitoring and treatment purposes. Furthermore, the application of medical tubing in various cardiovascular procedures such as cardiac catheterization, atherectomy and coronary angioplasty are driving the market growth of this segment.

The urological medical conditions segment in expected to grow rapidly over the forecast period. Medical tubes are widely used in urology for various purposes such as urinary catheters, urinary incontinence, urinary retention, for surgical purposes, during childbirth and in chemotherapy for bladder cancer in patients. Moreover, the rising innovations for advancing the applications of these medical tubes with increased efficacy and patient convenience are expected to fuel the market growth of this segment during the forecast period.

Application Insights

The bulk disposable tubing contributed the highest market share of 35% in 2024. Disposable tubing is applied for variety of medical applications such as blood transfusions, IV infusions, drug delivery, laboratory testing among other. Furthermore, they are widely used in hospital and clinical settings for medical diagnosis and treatment purposes which drives the market growth of this segment.

Material Type Insights

The polyvinyl chloride (PVC) segment dominated the market with the largest share in 2024. PVC is widely utilized in medical tubing applications including intravenous (IV) tubing, blood bags, catheters among others owing to its various advantages such as durability, flexibility, ease of sterilization and ability to be moulded in different shapes and sizes. Moreover, the biocompatibility and reduced manufacturing costs using PVC are fuelling the market growth of this segment.

The polyolefins segment is expected to grow rapidly over the forecast period. Polyolefins are easy to sterilize, highly flexible, chemically resistant and biocompatible making them a suitable material for various applications in medical field. Moreover, they can be easily customized as per their specific application and durable for fluid delivery which makes them a sustainable and convenient option for manufacturing of medical tubing thereby fuelling the market growth of this segment in the predicted timeframe.

End-User Insights

Based on end-user, the hospitals segment dominated the market with the largest share in 2024. The market growth of this segment can be attributed to the medical procedures such as colonoscopy, endoscopy, myringotomy and ureteral catheterization among others which use medical tubes for diagnostic and treatment purposes in patients.

Regional Insights

U.S. Medical Tubing Market Size and Growth 2025 to 2034

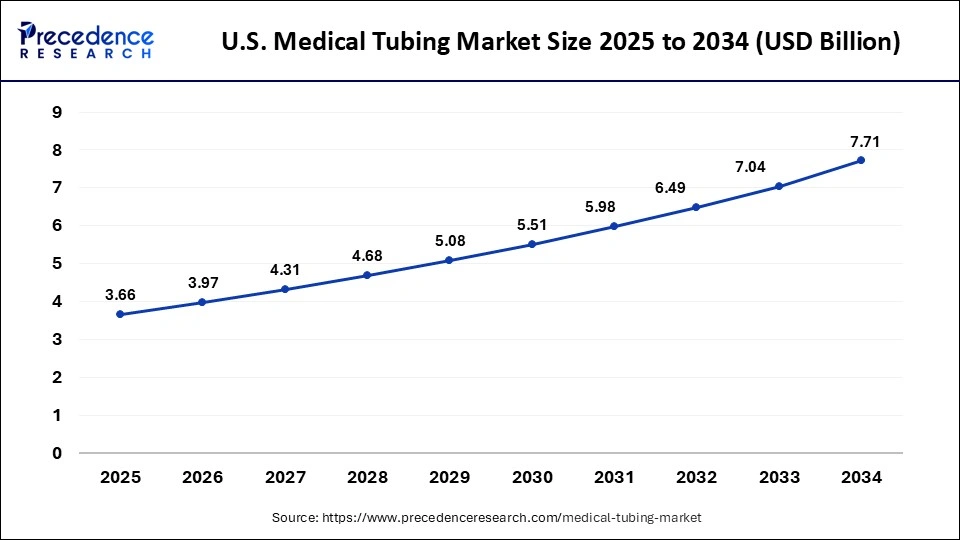

The U.S. medical tubing market size is evaluated at USD 3.66 billion in 2025 and is predicted to be worth around USD 7.71 billion by 2034, rising at a CAGR of 8.63% from 2025 to 2034.

U.S.: Grows with Healthcare Demand and Advanced Materials

The U.S. market is expanding due to rising demand from hospitals, clinics, and diagnostic centers for applications in IV systems, catheters, and respiratory devices. Increasing healthcare expenditure, growing minimally invasive procedures, and advancements in flexible, biocompatible tubing materials are driving adoption. Additionally, the need for improved patient safety, infection control, and regulatory compliance is further boosting the market's growth across the country.

North America dominated the medical tubing market with the largest market share of 35.40% in 2024. The growth can be attributed to the rising innovations in developing minimally invasive procedures used for medical applications mitigating the risk of infection and decreasing discomfort in patients. Furthermore, the surging demand for medical tubing and medical devices in various medical fields for research and clinical study purposes, support from government authorities and use of sustainable manufacturing materials lessening the environmental impact are promoting the market growth of this region.

Asia Pacific region is expected to grow rapidly in the medical tubing market over the forecast period. The increased healthcare expenditure, rise in clinical trials, growing awareness among people about advanced medical procedures and support from government bodies in providing advanced medical devices as well as for setting up health centres is driving the market growth of this region. Moreover, the increased outsourcing of international companies for developing medical tubing manufacturing facilities in this region to increase access with regional partners and reducing import costs is expected to fuel the market growth of this region in the upcoming years.

China Surges with Healthcare Expansion and Innovation

China's medical tubing market is expanding due to rapid growth in healthcare infrastructure, increasing hospital and clinic capacity, and rising demand for minimally invasive procedures. The adoption of advanced, biocompatible, and flexible tubing for applications like catheters, IV systems, and respiratory devices is increasing. Additionally, government initiatives to improve healthcare access, coupled with growing medical device manufacturing and technological advancements, are driving market growth in the country.

Advanced Technology and Healthcare Needs Drive Europe

Europe's medical tubing market is growing due to increasing demand for minimally invasive surgeries, rising healthcare spending, and expanding hospital infrastructure. The adoption of advanced, biocompatible, and flexible tubing for applications such as catheters, IV systems, and respiratory devices is driving growth. Additionally, stringent regulatory standards, focus on patient safety, and technological innovations in medical tubing materials are further boosting market expansion across the region.

UK: Innovation and Patient Safety Focus

The UK market is growing due to increasing demand for medical devices in hospitals, clinics, and diagnostic centers. Rising adoption of minimally invasive procedures, advanced biocompatible tubing materials, and strict regulatory standards are driving market growth. Additionally, government healthcare initiatives focus on patient safety, and technological innovations in tubing design for applications such as catheters, IV systems, and respiratory devices are further supporting market expansion.

Value Chain Analysis

Clinical Trials

- Clinical trials for medical tubing begin with preclinical and pilot studies to evaluate initial safety and performance.

- Larger pivotal studies are conducted to provide definitive evidence for regulatory approval.

- After approval, post-market studies monitor long-term performance and safety in the broader patient population.

- This phased approach ensures both effectiveness and compliance with regulatory standards.

Regulatory Approvals

- Regulatory approval for medical tubing varies by country and device risk classification.

- Compliance with authorities such as the U.S. FDA or India's CDSCO is required.

- Key steps include obtaining manufacturing licenses and ensuring materials meet standards like USP Class VI.

- Adherence to quality system regulations, such as FDA 21 CFR Part 820, is mandatory for approval.

Patient Support and Services

- Patient support for medical tubing includes in-home care and access to specialized equipment.

- Educational resources guide patients and caregivers on safe usage and maintenance of tubing devices.

- Emotional and practical support is provided to help manage conditions requiring feeding tubes, catheters, or respiratory equipment.

- These services aim to improve patient safety, adherence, and overall quality of care.

Top Vendors and their Offerings

- Teleflex Incorporated: Provides a wide range of medical tubing products for cardiovascular, respiratory, and minimally invasive procedures, including catheters and specialized tubing for surgical applications.

- W. L. Gore & Associates: Offers advanced polymer-based medical tubing solutions, including ePTFE and fluoropolymer tubing, for applications in vascular, catheter-based, and minimally invasive medical devices.

- The Lubrizol Corporation: Supplies high-performance polymeric tubing and coatings for medical devices, focusing on biocompatibility, flexibility, and chemical resistance.

- Tekni-Plex: Manufactures medical-grade tubing and extrusion products for IV systems, catheters, and other medical devices, emphasizing precision and safety.

- Raumedic AG:Provides silicone and thermoplastic medical tubing for applications in infusion therapy, catheters, and respiratory devices, designed for biocompatibility and reliability

The companies focusing on research and development are expected to lead the global medical tubing market. Leading competitors contending in global medical tubing market are as follows

- Teleflex Incorporated

- L. Gore & Associates

- The Lubrizol Corporation

- Saint-Gobain Performance Plastics

- Zeus Industrial Products, Inc.

- Freudenberg Medical

- Tekni-Plex

- Raumedic AG

- The Dow Chemical Company

- Nordson Corporation

Latest Announcements by Industry Leaders

- In November 2024, Lubrizol, a global leader in specialty chemicals signed a MoU with Polyhose, a global leader in fluid conveyance system for development of new medical tubing manufacturing facility in Chennai which will boost new level innovations in the Indian medical sector. Bhavana Bindra, Lubrizol's Managing Director India, Middle East and Africa said that, “This agreement brings precision manufacturing technology into India – a new business opportunity for the country to serve critical care markets in India and across the globe. Lubrizol is proud to enable high-quality solutions and local access with in-region partners, ensuring the region expands into new categories while reducing reliance on imports to service medical device needs.”

Recent Developments

- In December 2024, Teleflex Incorporated, a leading global provider of medical technologies declared the launch of its new Pressure Injectable Arrog+ard Blue Plus MSB Procedure Kit in Europe, the Middle East and Africa regions. The kit expands Teleflex's market-leading portfolio of centrally-inserted central catheters.

- In October 2024, Zephyrus Innovations, a privately-owned medical device company designing and manufacturing safety syringes and Closed System Transfer Devices (CSTDs) announced the launch of its innovative products, VaporShield which is world's first injectable CSTD, at the Partnership Opportunities in Drug Delivery (PODD) conference in Boston, Massachusetts.

Segments Covered in the Report

By Medical Condition

- Gastrointestinal

- Cardiovascular

- Ophthalmic

- Urological

- Neurovascular

- Others

By Application

- Drug Delivery Systems

- Catheters

- Special Applications

- Disposable Tubing

- Cannulas

- Others

By Material Type

- Polyethylene (PE)

- Silicone

- Engineering Plastics

- Polyvinyl Chloride (PVC)

- Polypropylene (PP)

- Polyolefin

- Others

By End-User

- Ambulatory Surgical Centers

- Hospitals

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa (MEA)

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting