What is the Hydraulic Tools And Equipment Market Size?

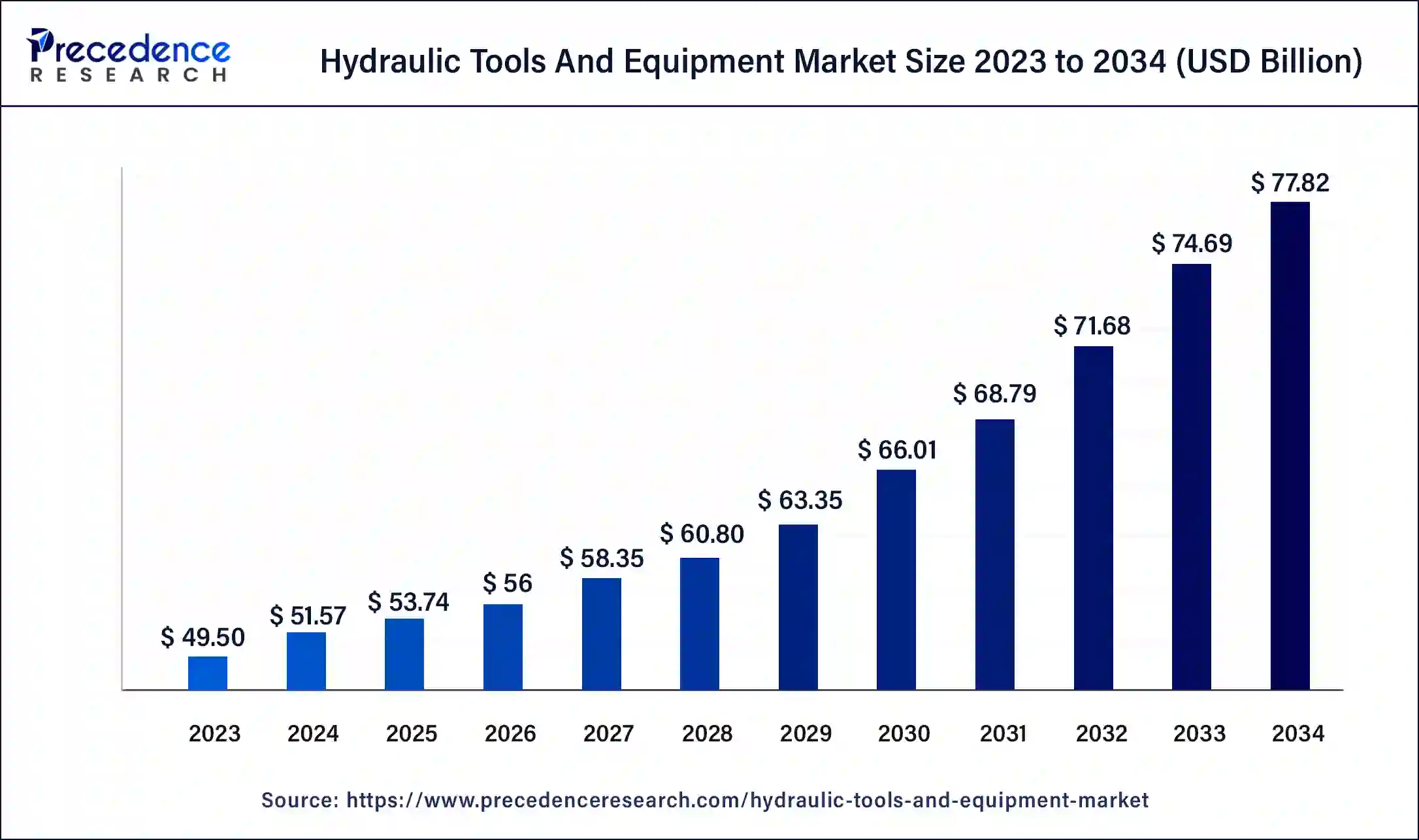

The global hydraulic tools and equipment market size is expected to be valued at USD 53.74 billion in 2025 and is anticipated to reach around USD 77.82 billion by 2034, expanding at a CAGR of 4.2% over the forecast period 2025 to 2034.

Hydraulic Tools And Equipment Market Key Takeaways

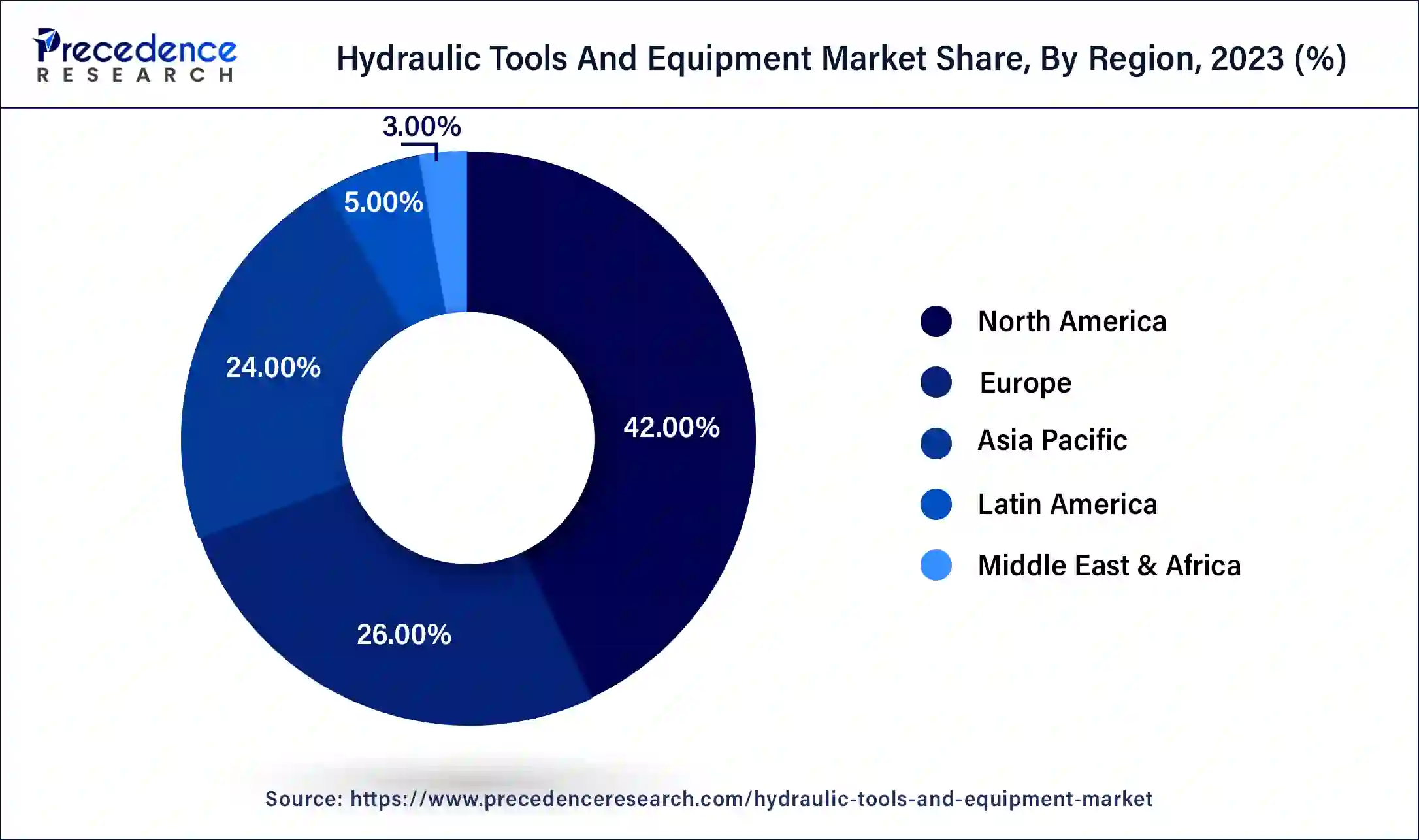

- The North America region contributed more than 42% of revenue share in 2024.

- Asia Pacific is estimated to expand the fastest CAGR between 2025 and 2034.

- By type, the hydraulic cylinder and jack segment has held the largest market share of 41% in 2024.

- By type, the tension and torque tools segment is anticipated to grow at a remarkable CAGR of 4.9% between 2025 and 2034.

- By component, the pumps segment generated over 26% of revenue share in 2024.

- By component, the transmission segment is expected to expand at the fastest CAGR over the projected period.

- By end user, the Industrial manufacturing segment generated over 31% of revenue share in 2024.

- By end user, the railway segment is expected to expand at the fastest CAGR over the projected period.

Hydraulic Tools and Equipment Market Overview: The Power in Motion

Hydraulic tools and equipment are mechanical devices that utilize the power of pressurized fluids, typically oil or water, to perform various tasks and operations. They are widely used in various industries for their ability to generate substantial force and precise control, making them essential in applications ranging from construction and manufacturing to automotive repair and aerospace engineering. Hydraulic equipment includes notable examples like hydraulic jacks for lifting hefty loads, hydraulic presses for shaping materials, and hydraulic cylinders for controlled linear movement. The versatility and might of hydraulic tools render them pivotal for a multitude of industries, facilitating the completion of tasks that would otherwise be arduous or unattainable through conventional mechanical means.

Hydraulic Tools And Equipment Market Growth Factors

- Growing investments in infrastructure projects worldwide drive the demand for hydraulic tools and equipment, used in construction and earthmoving applications.

- The trend towards automation in manufacturing and industrial sectors boosts the need for hydraulic systems in various machinery and robotics.

- Advancements in automotive technology, including electric vehicles and hybrid systems, require hydraulic equipment for powertrain and brake systems.

- The mining industry utilizes hydraulic machinery for excavation, drilling, and material handling, aligning with increased mineral demand.

- Modern farming equipment increasingly incorporates hydraulics for improved efficiency and precision in tasks like plowing and harvesting.

- Hydraulic tools are vital for drilling and extracting oil and gas resources in challenging environments, contributing to market growth.

- Stricter environmental regulations drive the adoption of hydraulic technology for more efficient waste management and recycling processes.

- The demand for precision engineering in industries like medical devices and semiconductor manufacturing necessitates hydraulic equipment.

- Hydraulic tools enhance safety in mining operations, driving their adoption as safety regulations become more stringent.

- Hydraulic systems play a crucial role in ship navigation, cargo handling, and offshore vessel operations, aligning with maritime industry expansion.

- Hydraulic energy storage systems help stabilize the grid, supporting the growth of renewable energy sources.

Hydraulic Tools and Equipment Market Outlook: Forecasting the Future Trends

- Industry Growth Overview: Growing automation in industries and infrastructure development are contributing to the industrial growth of the market.

- Major Investors: Large institutional asset management firms, strategic corporate investors, and investment companies are the major investors in the market.

- Startup Ecosystem: The startup ecosystem focuses on the integration of advanced technologies to enhance operational efficiency.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 53.74 Billion |

| Market Size in 2026 | USD 56 Billion |

| Market Size by 2034 | USD 77.82 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 4.2% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Type, By End User, and By Component |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa |

Market Dynamics

Driver

Industrial applications and essential oils extraction

Infrastructure development and industrial automation play pivotal roles in surging the market demand for hydraulic tools and equipment. Firstly, infrastructure development projects, such as the construction of roads, bridges, airports, and buildings, are major drivers of hydraulic equipment demand. These projects require heavy machinery for excavation, lifting, and material handling, all of which rely on hydraulic systems for their power and precision. The need for modern, efficient, and durable construction equipment is continuously on the rise, and hydraulic tools are integral to meeting these requirements.

As urbanization and economic growth continue worldwide, the demand for hydraulic equipment in infrastructure development is expected to increase. Secondly, industrial automation is transforming manufacturing and industrial processes. Automation technologies require highly precise and controlled movements, and hydraulic systems excel in providing the necessary force and accuracy. Whether it's in robotics, CNC machines, or assembly lines, hydraulic components contribute to increased efficiency, reduced downtime, and improved product quality. With the ongoing trend toward smart factories and Industry 4.0, the reliance on hydraulic tools and equipment for automation purposes is expected to grow significantly, further boosting market demand.

Restraint

Maintenance requirements and competition from alternative technologies

Maintenance requirements and competition from alternative technologies are significant restraints on the growth of the hydraulic tools and equipment market. Maintenance demands pose a substantial challenge as hydraulic systems require regular servicing and upkeep, which can be costly and time-consuming. The need for fluid changes, leak detection and repair, and component replacement can result in operational downtime, increased operational costs, and resource allocation. This can be particularly burdensome for industries aiming for uninterrupted production and cost-efficient operations.

Competition from alternative technologies, such as electric and pneumatic systems, is intensifying. These alternatives often offer cleaner and more energy-efficient operation, appealing to environmentally conscious industries and regions with stringent emissions regulations. Electric actuators and servo systems, for example, are gaining traction due to their precision, reduced maintenance needs, and energy savings. The hydraulic industry must address these competitive pressures by innovating and improving the energy efficiency and environmental performance of hydraulic tools to remain relevant and competitive in the market.

Opportunity

Smart manufacturing and hydraulic hybrid vehicles

Smart manufacturing, driven by Industry 4.0 principles, is revolutionizing the manufacturing landscape and creating significant opportunities in the hydraulic tools and equipment market. This transformation involves the integration of data, automation, and connectivity to optimize production processes. Hydraulic systems play a crucial role in smart manufacturing by providing precise and controllable motion, essential for automated machinery and robotics. Opportunities arise in the development of advanced hydraulic components, sensors, and control systems that align with the demands of smart factories, ensuring efficiency, quality, and adaptability.

Hydraulic hybrid vehicles represent another exciting opportunity for the industry. As the world strives for cleaner and more efficient transportation solutions, hydraulic hybrid technology offers the potential for significant fuel savings and emissions reduction. Hydraulic systems in these vehicles capture and store energy during braking and release it when needed for acceleration, enhancing overall efficiency. The adoption of hydraulic hybrid technology in commercial and heavy-duty vehicles, such as trucks and buses, presents a substantial growth avenue for hydraulic tools and equipment manufacturers looking to make a positive impact on the transportation sector's environmental footprint.

Type Insights

In 2024, the hydraulic cylinder and jack segment had the highest market share of 41% based on the type.In the hydraulic tools and equipment market, the hydraulic cylinder segment includes devices that convert hydraulic fluid power into linear mechanical force. These cylinders are widely used in various applications, from construction machinery to industrial automation, for controlled and precise linear motion.

The hydraulic jack segment encompasses tools designed for lifting heavy loads using hydraulic pressure. They are employed in automotive repair, construction, and material handling. The trend in these segments includes the development of compact and lightweight designs, enhanced safety features, and increased efficiency to meet the demand for more versatile and eco-friendly hydraulic solutions in diverse industries.

The tension and torque tools segment is anticipated to expand at a significant CAGR of 4.9% during the projected period. The tension and torque tools segment in the hydraulic tools and equipment market includes devices designed to measure and apply controlled force and rotational power. Tension tools are used to precisely measure and apply tension to fasteners, while torque tools ensure accurate torque application to achieve proper fastening and prevent over-tightening. Trends in this segment include the increasing demand for high-precision tension and torque tools to meet the stringent quality standards in industries like automotive and aerospace. Additionally, the integration of smart and digital features in these tools, such as real-time data monitoring and wireless connectivity, is gaining prominence, enabling enhanced control and traceability in industrial applications.

Component Insights

According to the component, the pumps segment held a 26% revenue share in2024. The pumps segment in the hydraulic tools and equipment market comprises the devices responsible for generating hydraulic fluid pressure. These components are essential for converting mechanical power into hydraulic power, driving various hydraulic systems. Key trends in this segment include a shift towards more energy-efficient and environmentally friendly pump designs, aligning with sustainability goals. Furthermore, the integration of advanced technologies, such as digital controls and condition monitoring, is on the rise, enhancing pump performance, reducing downtime, and enabling predictive maintenance strategies. These trends reflect the industry's commitment to innovation, efficiency, and sustainability in hydraulic pump technology.

The transmission segment is anticipated to expand fastest over the projected period. The transmission segment in the hydraulic tools and equipment market encompasses the components responsible for transmitting hydraulic power, typically through fluid, to various parts of the machinery. This includes pumps, valves, hoses, and connectors.

The transmission components play a critical role in controlling the flow and pressure of hydraulic fluid, enabling precise and efficient operation in hydraulic systems. Trends in the transmission segment involve advancements in component design for improved efficiency and reliability. These trends include the development of energy-efficient pumps, intelligent control systems for better fluid management, and the integration of digital technologies for real-time monitoring and predictive maintenance, ensuring the seamless and reliable operation of hydraulic equipment.

End User Insights

In2023, the industrial manufacturing segment had the highest market share of 31% on the basis of the end user. The industrial manufacturing segment in the hydraulic tools and equipment market comprises businesses involved in the production of goods across various industries. These end users rely on hydraulic tools for precision, control, and force in manufacturing processes. Trends in this segment include the increasing integration of hydraulic systems into automated manufacturing processes to enhance efficiency and productivity.

Additionally, the development of more energy-efficient and eco-friendly hydraulic solutions aligns with the growing emphasis on sustainability in industrial manufacturing, meeting both performance and environmental requirements.

The railway segment is anticipated to expand fastest over the projected period. In the hydraulic tools and equipment market, the railway segment refers to the use of hydraulic systems within the railway industry. These systems are essential for various applications in this sector, including train braking systems, track maintenance, and even the operation of hydraulic doors and ramps in passenger and freight trains.

A notable trend in the railway segment is the increasing adoption of hydraulic systems for high-speed trains and modern locomotives, as they offer precise control and reliable performance. Additionally, there is a growing focus on enhancing the safety and efficiency of railway operations through the integration of advanced hydraulic technology, promoting the continued growth of this market segment.

Regional Insights

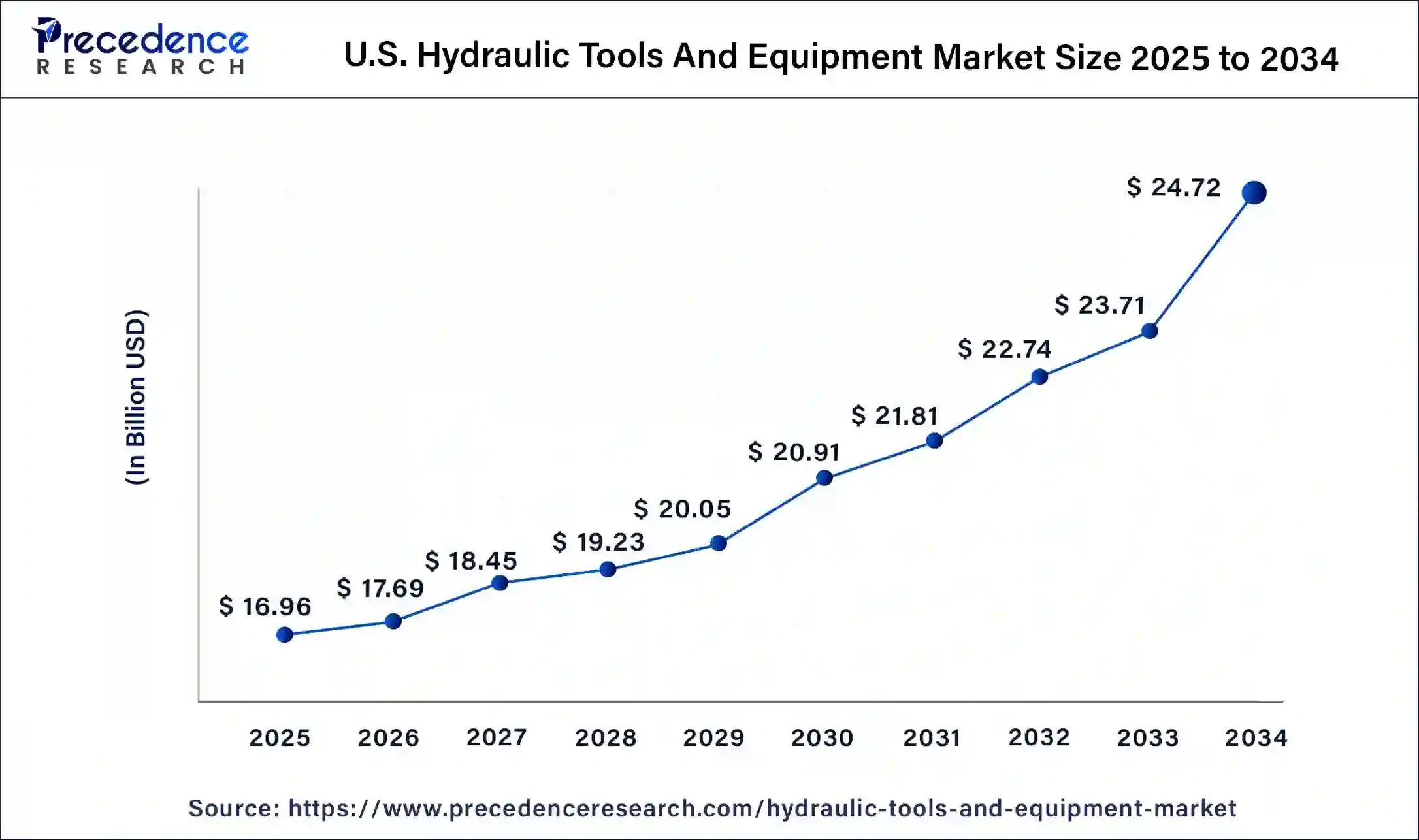

U.S. Hydraulic Tools And Equipment Market Size and Growth 2025 to 2034

The U.S. hydraulic tools and equipment market size is exhibited at USD 16.96 billion in 2025 and is projected to be worth around USD 24.72 billion by 2034, poised to grow at a CAGR of 4.3% from 2025 to 2034.

Strong Industrial Base Drives North America

North America has held the largest revenue share of 42% in 2024. North America holds a major share in thehydraulic tools and equipment market due to several factors. The region benefits from a strong industrial and manufacturing base, driving the demand for hydraulic systems in various applications. Moreover, the construction and infrastructure development sector remain robust, further boosting the market.

Additionally, the presence of well-established players in the hydraulic equipment industry, coupled with investments in research and development, contributes to technological advancements. Regulatory initiatives towards eco-friendly hydraulic solutions, along with the region's focus on safety and automation, also play a significant role in North America's dominant position in the hydraulic tools and equipment market.

Rapid Industrialization Boosts the Asia Pacific

Asia Pacific is estimated to observe the fastest expansion. Asia Pacific holds a major share in the hydraulic tools and equipment market due to several key factors. First, rapid industrialization and extensive infrastructure development projects across countries like China and India have spurred demand for hydraulic equipment in construction and manufacturing. Second, the burgeoning automotive and aerospace sectors in this region require hydraulic systems for various applications.

Additionally, the region's focus on renewable energy, agriculture, and mining contributes to the significant demand for hydraulic tools. Lastly, the presence of numerous manufacturing hubs and a skilled labor force makes Asia Pacific a prime market for hydraulic tool suppliers, driving its dominance.

Diverse Industries Enhance U.S.

The presence of diverse industries in the U.S. is increasing the demand for hydraulic tools and equipment for a wide range of applications. The growing advancements are also increasing the development of smart or automotive solutions. These advancements, along with government support, are increasing their use.

India Driven by Rapid Industrialization

India is experiencing rapid industrialization, which is increasing the demand for hydraulic tools and equipment. The growing manufacturing and automotive sector are also driving their demand, where the smart city development, along with metro and railway construction, is also increasing their adoption rates.

Robust Manufacturing Sector Propels Europe

Europe is expected to grow significantly in the hydraulic tools and equipment market during the forecast period, due to the robust manufacturing sector. This is increasing the use of hydraulic tools and equipment across the automotive, aerospace, and defence sectors. The industries are also actively developing smart and integrated systems to enhance their applications, promoting market growth.

Technological Advancements Shape the UK

The growing technological advancements are driving the demand for hydraulic tools and equipment in the UK. The advancing constructions and infrastructure are also increasing their use in various activities. Moreover, the stringent regulations are promoting their utilization and innovations to enhance workplace safety.

Value Chain Analysis

- Raw Material Sourcing

Procuring high-strength metals is involved in the raw material sourcing of the hydraulic tools and equipment.

Key players: Enerpac, Bosch Rexroth. - Installation and Commissioning

The installation and commissioning of the hydraulic tools and equipment focus on proper physical setup, verification of the pressure and flow settings, system purging to remove air, etc.

Key players: Enerpac, Bosch Rexroth. - Product Lifecycle Management

From initial product design to disposal are managed in the product lifecycle management of hydraulic tools and equipment is managed.

Key players: Siemens, PTC.

Hydraulic Tools and Equipment Market Innovators: Key Players' Offering

- Parker Hannifin Corporation: The company provides various hydraulic components.

- Bosch Rexroth AG: Axial piston pumps, compact hydraulics, etc, are provided by the company.

- Eaton Corporation: The company develops industrial and mobile hydraulic tools and equipment.

- Atlas Copco AB: The company provides handheld hydraulic equipment.

- Enerpac (Actuant Corporation): The company provides RC series, P series, W series, etc.

Hydraulic Tools and Equipment Market Companies

- Parker Hannifin Corporation

- Bosch Rexroth AG

- Eaton Corporation

- Danfoss A/S

- Emerson Electric Co.

- SMC Corporation

- KYB Corporation

- Toshiba Machine Co., Ltd.

- Atlas Copco AB

- Wipro Enterprises (P) Ltd.

- Stanley Black & Decker, Inc.

- Jiangsu Hengli Hydraulic Co., Ltd.

- Yuci Hydraulics Co., Ltd.

- Husqvarna AB

- Enerpac (Actuant Corporation)

Recent Developments

- In October 2022, Enerpac introduced the SBL600 gantry as an expansion of its SBL-Super Boom Lift hydraulic gantry range. This hydraulic gantry offers a remarkable top lifting height of 10.6 meters, achieved through a three-stage telescopic hydraulic cylinder. Notably, the gantry is designed with a foldable boom, enabling it to be transported on standard flatbed trucks without requiring special permitting or routing. The rectangular boom design enhances both its capacity and lifting height, with impressive weight capacities at each stage (674t, 562t, and 416t). Moreover, the gantry's structure is optimized for ease of transportation, resulting in cost savings during installation and setup.

- In August 2022, HAWE introduced the mini hydraulic power pack, known as type HICON, primarily designed for recreational boats. This hydraulic power pack offers a distinct advantage as it is waterproof, making it resistant to splash water or temporary immersion in water during operation. These developments in the hydraulic equipment market highlight the industry's continuous efforts to enhance functionality, safety, and versatility in various applications, including heavy lifting and marine operations.

Segments Covered in the Report

By Type

- Hydraulic Rescue Tool

- Tension and Torque Tools

- Hydraulic Cylinder and Jack

- Others

By End User

- Industrial Manufacturing

- Oil, Gas, and Petrochemical

- Electric Utility

- Railway

- Others

By Component

- Pumps

- Valves

- Cylinders

- Motors

- Filters and Accumulators

- Transmission

- Other Product Types

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting