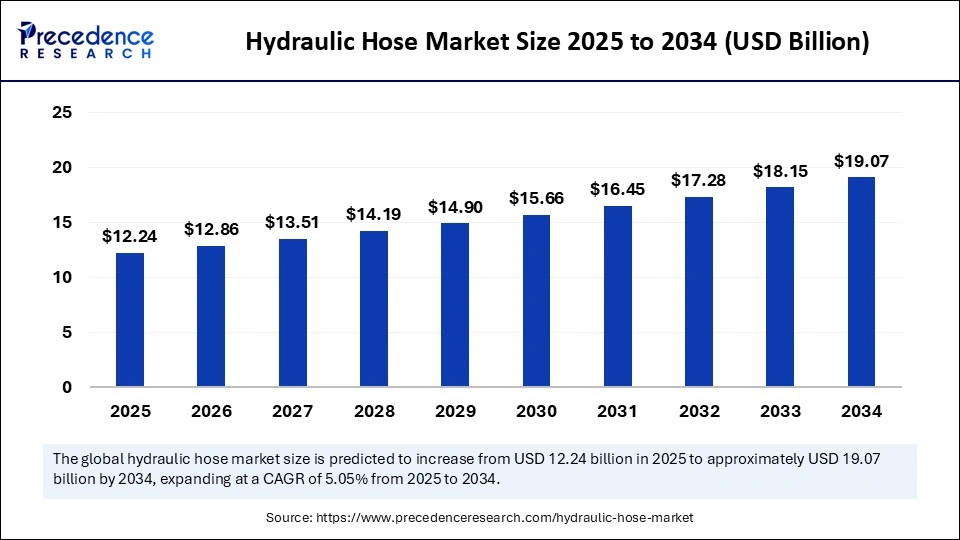

What is the Hydraulic Hose Market Size?

The global hydralic hose market size is calculated at USD 12.24 billion in 2025 and is predicted to increase from USD 12.86 billion in 2026 to approximately USD 19.07 billion by 2034, expanding at a CAGR of 5.05% from 2025 to 2034.

Market Highlights

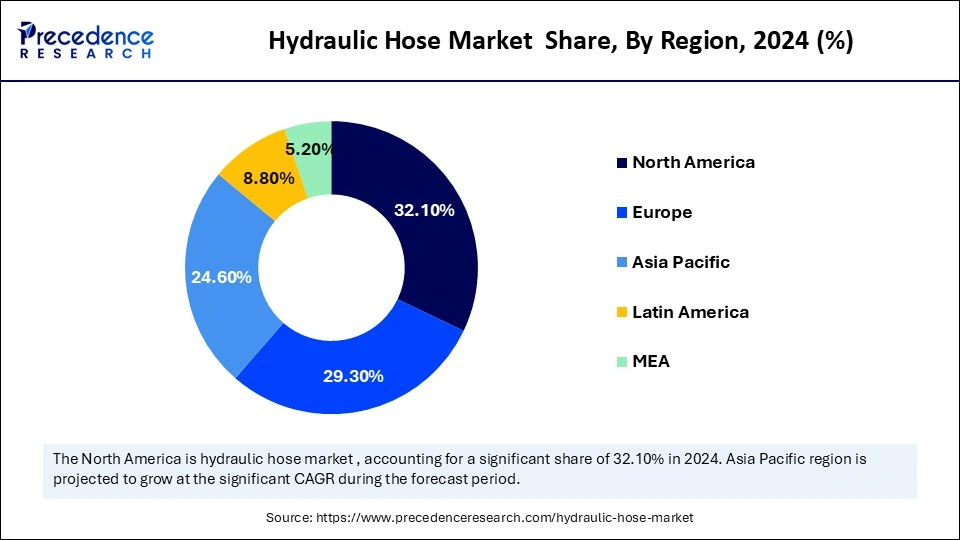

- North America dominated the hydraulic hose market with the largest market share of 32.1% in 2024.

- Asia Pacific is expected to grow at the fastest CAGR during the forecast period.

- By product, the reinforced hydraulic hoses segment held the biggest market share of at 41.5% in 2024.

- By product, the coiled hydraulic hoses segment is expected to grow at the fastest CAGR during the forecast period.

- By pressure rating, the high-pressure segment captured the highest market share of 38.2% in 2024

- By pressure rating, the ultra-high pressure segment is projected to grow at the fastest CAGR in the coming years.

- By material, the rubber segment contributed the maximum market share of 55.6% in 2024.

- By material, the thermoplastics segment is emerging as the fastest-growing during the forecast period.

- By hose reinforcement type, the wire braided hose (single/double) segment accounted for the significant market share of 44.3% in 2024.

- By reinforcement type, the spiral wire hose (4/6 layers) segment will grow rapidly during the forecast period.

- By end-use industry, the construction and infrastructure segment generated the major market share of 29.6% in 2024.

- By end-use industry, the mining segment is expected to grow at the fastest CAGR during the forecast period.

Strategic Overview of the Global Hydraulic Hose Industry

The global hydraulic hose market is witnessing steady growth, driven by the need for high-pressure fluid transfer systems is growing in sectors like manufacturing, mining, construction, and agriculture. Expanding fleets of heavy-duty equipment, modernizing agricultural machinery, and increasing investments in infrastructure development are all contributing to the market growth. Technological developments are improving performance and prolonging service life, such as the creation of hose materials that are more resilient, flexible, and environmentally friendly. Additionally, new opportunities are being created by the increasing trend toward automation and high-efficiency hydraulic systems, which makes hydraulic hoses an essential part of both developed and emerging economies.

Artificial Intelligence: The Next Growth Catalyst in Hydraulic Hose

Improving efficiency, dependability, and sustainability throughout the value chain, artificial intelligence is drastically changing the global hydraulic hose market. Predictive maintenance driven by AI uses sensors and algorithms to track hose performance in real time, predicting wear and averting failures to cut down on downtime and operating expenses. Through automated defect detection, machine learning models enhance quality control, streamline procedures, and reduce material waste in manufacturing.

AI improves supply chain management by predicting demand, regulating the purchase of raw materials, and guaranteeing quicker delivery. Additionally, it fosters creativity by making it possible to run virtual simulations for novel, environmentally friendly hose designs, speeding up R&D while supporting sustainability objectives. Globally, the integration of AI is promoting hydraulic hose operations that are safer, more intelligent, and more economical.

Hydraulic Hose Market Growth Factors

- Rising construction and infrastructure projects are boosting heavy machinery demand.

- Expanding agricultural mechanization is increasing the use of hydraulic systems.

- Growing mining and industrial activities require durable high-pressure hoses.

- Technological advancements in lightweight, eco-friendly, and abrasion-resistant hoses.

- Higher focus on safety, efficiency, and compliance with standards.

- Rising adoption of automation across industries.

Market Outlook:

- Market Growth Overview: The Hydraulic Hose market is expected to grow significantly between 2025 and 2034, driven by innovations in technology, industrial expansion and rapid urbanization, particularly in emerging economies, and agricultural mechanization.

- Sustainability Trends: Sustainability trends involve the deployment of eco-friendly materials, compatibility with biodegradable fluids, and extended product lifespans and durability.

- Major Investors: Major investors in the market include Vontier Corporation, Dover Corporation, Danfoss, Caterpillar Inc., Continental AG, Blackstone, and Parker Hannifin Corporation plc.

- Startup Economy: The startup economy is focused on smart technology and IoT integration, bio-based and sustainable materials, additive manufacturing for niche components, and on-demand services and aftermarket solutions.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 12.24 Billion |

| Market Size in 2026 | USD 12.86 Billion |

| Market Size by 2034 | USD 19.07 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 5.05% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product Type, Pressure Rating, Material, Reinforcement Type, End-Use Industry, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Infrastructure Boom

The need for heavy equipment is being driven by government-led infrastructure projects, smart city initiatives, and rapid urbanization. Excavator's loaders and cranes all depend on hydraulic hoses to ensure that their hydraulic systems run smoothly. Usage is further increased by rising investments in metro rail projects, roads, and bridges. Demand is anticipated to increase gradually as a result of extensive construction in emerging economies. Infrastructure development is therefore one of the most reliable market drivers.

Industrial Expansion

As heavy industries like manufacturing, oil and gas, and mining grow, they need long-lasting hydraulic hose solutions. Hydraulic hoses are essential for handling high-pressure fluids in industrial presses, drilling rigs, and mining trucks. This need is being further reinforced by the rising demand for energy and raw materials worldwide. Adoption is further increased by the application of hydraulic systems in industrial automation and material handling. Together, these sectors account for a sizable portion of market demand.

Restraints

Raw Material Dependency and Cost Fluctuations

Due to its reliance on raw materials like steel reinforcements, thermoplastics, and synthetic rubber, the hydraulic hose market is severely constrained. Supply chains become unstable because production costs are directly impacted by fluctuations in the price of metals and crude oil. Manufacturers' margins are impacted by this reliance since it leaves them open to disruptions in international trade, exchange rate swings, and local shortages.

High Maintenance and Shorter Service Life

Hydraulic hoses need to be replaced often due to wear, pressure fatigue, and exposure to the environment, even with advancements in technology. The total cost of ownership for end users is raised by routine inspection, preventive maintenance, and replacement downtime. Adoption may be deterred in cost-sensitive sectors like construction and agriculture by this high replacement frequency.

Opportunities

Rising Mechanization in Agriculture

As farming becomes more mechanized, hydraulic systems are becoming increasingly necessary for tractors, harvesters, and irrigation equipment. The use of sophisticated hydraulic hoses will increase as a result of the drive for increased productivity and efficiency in developing nations. String growth potential exists in the market, especially for hose designs that are inexpensive, flexible, and lightweight.

Replacement and Aftermarket Opportunities

The aftermarket provides manufacturers with steady revenue streams because hydraulic hose needs to be replaced regularly. Digital investor platforms, expedited delivery networks, and preventive maintenance contracts are all opportunities for distributors and service providers to take advantage of by improving aftermarket services, businesses can increase recurring sales and create enduring relationships with their customers.

Segments Insights

Product Type Insights

Why did the Reinforced Hydraulic Hoses Segment Dominate the Market in 2024?

The reinforced hydraulic hoses segment dominates the hydraulic hose market as they are widely used in heavy-duty applications such as construction machinery, agricultural equipment, and industrial systems. Their durability, flexibility, and ability to handle high pressures make them the preferred choice for large-scale operations across multiple sectors. In addition, reinforced hoses are cost-efficient compared to advanced variants, making them a practical solution for operators.

The coiled hydraulic hoses segment is the fastest growing due to their small size and portability in tight areas. Their ability to retract makes them more aesthetically pleasing in portable machinery and mobile equipment while also reducing clutter and enhancing safety. Coiled hoses are becoming increasingly popular as industries search for solutions that save space and require less maintenance. Light construction and logistics equipment, where flexibility is a crucial necessity, is also seeing an increase in demand.

Pressure Rating Insights

Why did the High-Pressure Hydraulic Hoses Segment Dominate the Hydraulic Hose Market?

The high-pressure segment held the dominant share as they are necessary for machinery used in construction, agriculture, and industry, where dependability and constant pressure are crucial. Their widespread use across industries is guaranteed by their resistance to demanding working conditions. Because they balance price performance and durability, end users still favor high-pressure hoses. Their broad acceptance is also aided by industry standardization.

The ultra-high pressure segment is the fastest-growing segment, driven by growing demand for heavy industrial applications, mining, and oil and gas. These hoses have longer lifespans and greater safety margins because they are designed for extremely demanding environments. Improvements in hose reinforcement technology are making it possible to handle pressure with greater efficiency. The need for safe and effective operations under challenging working conditions is increasing, which speeds up adoption even more.

Material Insights

Why did the Rubber-Based Hydraulic Hoses Segment Dominate the Hydraulic Hose Market?

The rubber segment dominated the hydraulic hose market owing to its affordability, adaptability, and resilience to harsh working conditions and abrasion. Their broad industry acceptance guarantees their sustained dominance in material types. Rubber hoses are favored in a variety of operating environments due to their demonstrated dependability. They are a strong market standard due to their longstanding user trust and accessibility across geographical boundaries.

The thermoplastics segment is the fastest growing, as they offer lighter weight. Chemical resistance and better performance in extreme temperatures. They are appealing to contemporary industries due to their eco-friendly qualities and compatibility with automation trends. These hoses are becoming increasingly popular in applications where low weight and flexibility are crucial. Their market share is growing as a result of their increasing use in material handling robotics and environmentally sensitive projects.

Hose Reinforcement Type Insights

Why did the Wire Braided Hoses Segment Dominate the Hydraulic Hose Market?

The wire braided hose (single/double) segment dominates the hydraulic hose market because standard equipment in the industrial, agricultural, and construction sectors uses them extensively and adaptably. They are a popular option due to their harmony of flexibility and pressure capacity. These sizes are suitable for medium-duty equipment, making them highly demanded in maintenance and replacement markets. Additionally, standardization within this size range aids producers in maximizing output levels.

The spiral wire hose (4/6 layers) segment is the fastest growing due to the growing need in heavy industries like mining, oil, and gas, and others, where large machinery and high-volume fluid transfer are essential. In specialized applications, their capacity to manage heavy loads makes them indispensable. Adoption is being pushed further by the global trend toward bigger more potent toward bigger more potent equipment. In high-demand situations, manufacturers are concentrating on innovations to improve durability and avoid failures.

End Use Industry Insights

Why did the Construction and Infrastructure Sector Dominate the Hydraulic Hose Market in 2025?

The construction and infrastructure segment dominates hydraulic hose usage, supported by urbanization, smart city development, and ongoing international projects. Strong hoses are necessary for heavy equipment like cranes, loaders, and excavators, which creates steady demand. Growth is sustained by government spending on housing, bridges, and roads in both developed and developing countries. Large fleets' constant replacement requirements serve to further solidify construction's hegemony.

The mining segment is the fastest growing segment, since mining machinery such as loaders, trucks, and drills need strong high high-pressure hydraulic systems. This quick adoption is fueled by rising exploration and higher capital expenditures for mining operations. Demand increases when projects are expanded throughout areas with abundant resources. There are more opportunities for high-performance hoses because of the requirement for safety and operational effectiveness in harsh mining environments.

Regional Insights

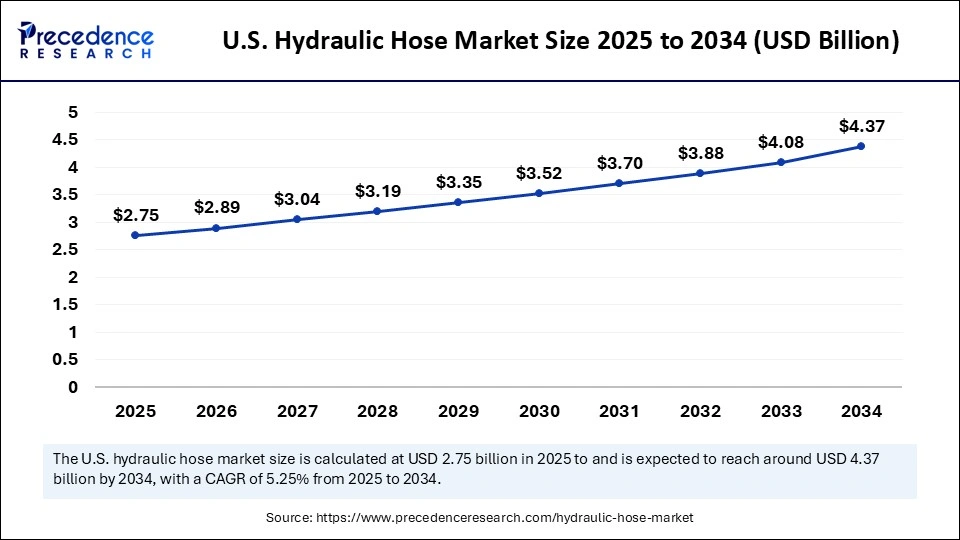

U.S. Hydraulic Hose Market Size and Growth 2025 to 2034

The U.S. hydraulic hose market size is exhibited at USD 2.75 billion in 2025 and is projected to be worth around USD 4.37 billion by 2034, growing at a CAGR of 5.25% from 2025 to 2034.

Why did North America Dominate the Hydraulic Hose Market in 2024?

North America dominates the hydraulic hose market share of 32.1% in 2024, due to its highly developed oil and gas construction and agricultural sectors. Strong demand for replacements, strict safety regulations, and dependable infrastructure all contribute to maintaining regional leadership. The region's standing is further enhanced by the presence of top international manufacturers. The use of hoses in industrial applications is still increasing as a result of investments in automation and energy projects.

North America: U.S. Hydraulic Hose Market Trends

The U.S. hydraulic Hose market is experiencing steady growth, driven by construction and agriculture, and a strong emphasis on technology and regulatory compliance. The integration of smart sensors for predictive maintenance, the use of high-performance material for enhanced durability, and a robust aftermarket demand for replacements.

Asia Pacific is the fastest-growing market, fueled by growing agricultural mechanization, infrastructure development, and fast industrialization. Adoption is being fueled by massive mining and construction projects as well as growing demand from a variety of end-use industries. Asia Pacific is the most dynamic growth hub due to its cost competitiveness and growing domestic production capacity.

Asia Pacific: China Hydraulic Hose Market Trends

China's dominant and growing demand from heavy industries, rapid industrial automation and smart manufacturing, and investment in R&D to produce hoses with superior resistance to chemicals, abrasions, and extreme temperatures using advanced materials like thermoplastic elastomers and reinforced rubber. Strong domestic manufacturing base and export focus, and environmental regulations and sustainability push.

Value Chain Analysis of the Hydraulic Hose Market

- Raw Material Sourcing and Preparation

This foundational stage involves sourcing critical raw materials such as synthetic rubber, thermoplastic elastomers, steel wire for reinforcement, and various chemicals.

Key Players: ExxonMobil, DuPont, and Parker Hannifin - Manufacturing and Assembly

This core stage involves the extrusion, braiding, spiraling (reinforcement), and outer layer application to produce a functional hydraulic hose.

Key Players: Parker Hannifin, Eaton Corporation, Danfoss (formerly Eaton Hydraulics), Gates IndustriaCorporation, and Manuli Hydraulics. - Outbound Logistics and Distribution

This stage focuses on storing and transporting a wide range of hose assemblies and components through a global network of warehouses and distribution centers to end-users and maintenance providers.

Key Players: DHL and FedEx - Marketing and Sales

This stage involves promoting product quality, specific technical specifications, safety certifications (e.g., SAE, ISO, DIN), and value-added services like predictive maintenance and technical support to diverse industrial clients.

Key Players: Gates Industrial Corporation and Eaton - Service, Support, and Aftermarket

The final stage is vital for the hydraulic hose market, focusing on installation, maintenance, troubleshooting, and replacement of hoses in the field.

Key Players: Caterpillar or John Deere, and Parker Hannifin. - End-user Application

This is where the value of the hydraulic hose is realized in heavy machinery across various industries.

Key Customers (End Users): Caterpillar Inc., Deere & Company (John Deere), and Komatsu Ltd.

Hydraulic Hose Market Companies

- AB Volvo: While primarily known as a heavy equipment manufacturer, AB Volvo is a significant end-user of hydraulic hoses for its construction equipment and trucks, driving demand and influencing quality standards.

- Bailey International LLC: Bailey International is a manufacturer and distributor of hydraulic components, including hoses and fittings, serving the aftermarket and OEM sectors.

- Bridgestone Corp.: As a global leader in rubber and tire manufacturing, Bridgestone leverages its expertise in materials science to produce high-performance rubber hydraulic hoses.

- Caterpillar Inc.: A major end-user and OEM of construction and mining equipment, Caterpillar drives demand for high-quality hydraulic hose assemblies. The company also manufactures its own brand of hydraulic hoses, which are used as original equipment and for aftermarket replacement.

- Continental AG: Known for its automotive products, Continental also produces a wide range of industrial hydraulic hoses for various applications. The company utilizes its rubber and plastics expertise to create durable and reliable hose solutions.

- Dyna Flex Inc: Dyna Flex is a manufacturer and supplier of hydraulic hose assemblies and fittings, catering to industrial and mobile equipment markets. The company provides a range of standard and custom solutions to meet specific customer requirements.

- Eaton Corp.: Eaton is a significant player in the hydraulic hoses market, offering a comprehensive portfolio of hose, fittings, and connectors. The company's hydraulic business, now integrated into Danfoss, provided a wide range of fluid conveyance solutions.

- Emerson Electric Co.: While a diverse industrial company, Emerson produces fluid conveyance products, including hoses and connectors, used in hydraulic applications. Its focus on reliability and performance contributes to the quality standards of the market.

- Enerpac Tool Group Corp.: Enerpac provides high-pressure hydraulic tools and equipment and relies on robust, high-pressure hydraulic hoses to power its products. This drives demand for specialized hoses and related components.

- Gates Industrial Corp. Plc: Gates is a leading global manufacturer of fluid power products, including a vast array of hydraulic hoses and couplings. The company is known for its high-performance and innovative solutions for industrial and automotive applications.

- Komatsu Ltd.: A major manufacturer of construction, mining, and military equipment, Komatsu is a significant end-user of hydraulic hoses. The company's demand for durable and reliable products influences hose quality standards and development.

- Kurt Manufacturing Co: Kurt Manufacturing produces precision-engineered hydraulic components, including specialized fittings and couplings used in hydraulic systems. Its products contribute to the reliability and performance of hydraulic hose assemblies.

- Manuli Hydraulics Group: A global manufacturer of hydraulic hoses and fittings, Manuli Hydraulics specializes in high-pressure and high-performance products. The company focuses on developing integrated systems for industrial machinery.

- Nitta Industries Europe GmbH: Nitta produces a wide range of industrial components, including thermoplastic hydraulic hoses, which offer lightweight and flexible alternatives for various applications. Its focus is on meeting specialized industry needs.

- NRP Jones: NRP Jones is a manufacturer of hydraulic hoses, serving a variety of industries, including construction, agriculture, and oil and gas. The company is known for its custom solutions and wide range of products.

- Parker Hannifin Corp.: A global leader in motion and control technologies, Parker Hannifin offers one of the most comprehensive ranges of hydraulic hoses, fittings, and systems.

- RYCO Hydraulics Pty Ltd.: RYCO Hydraulics is a global manufacturer of hydraulic hose and fittings, specializing in high-performance and high-pressure fluid transfer. The company caters to heavy-duty applications in construction, mining, and agriculture.

- Transfer Oil Spa: Transfer Oil is an Italian manufacturer specializing in thermoplastic and PTFE high-pressure hoses for hydraulic and fluid transfer applications. Its products are known for their quality and performance in demanding environments.

- Wipro Ltd.: As a technology and IT services company, Wipro's contribution is less direct, but its focus on intelligent systems and automation may extend to providing software or analytics that support predictive maintenance and operational efficiency in hydraulic systems for clients.

- Yokohama Rubber Co., Ltd.: Similar to Bridgestone, Yokohama leverages its rubber manufacturing expertise to produce high-quality hydraulic hoses for industrial applications.

Recent Developments

- In January 2024, Continental, USD 90 million investment in new manufacturing facility Continental announced a major expansion by investing approximately USD 90 million to build a new hydraulic hose production facility in Aguascalientes, Mexico. (Source: https://www.einpresswire.com)

Segments Covered in the Report

By Product Type

- Reinforced Hydraulic Hoses

- Coiled Hydraulic Hoses

- Corrugated Hydraulic Hoses

- Articulated?Hydraulic Hoses

- Others

By Pressure Rating

- Low Pressure

- Medium Pressure

- High Pressure

- Ultra-High Pressure

By Material

- Rubber

- Thermoplastics

- Metal

- Composite/Hybrid

- Bio-based or Eco-materials

By Reinforcement Type

- Wire Braided Hose

- Spiral Wire Hose

- Textile Reinforced Hose

- Thermoplastic Reinforced Hose

By End-Use Industry

- Construction and Infrastructure

- Agriculture

- Mining

- Industrial Manufacturing

- Oil and Gas

- Automotive and Transportatio

- Marine

- Aerospace

- Defense and Military

- Waste Management and Utilities

By Region

- North America

- Europe

- Asia Pacific

- South America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting