What is the Wood Processing Machines Market Size?

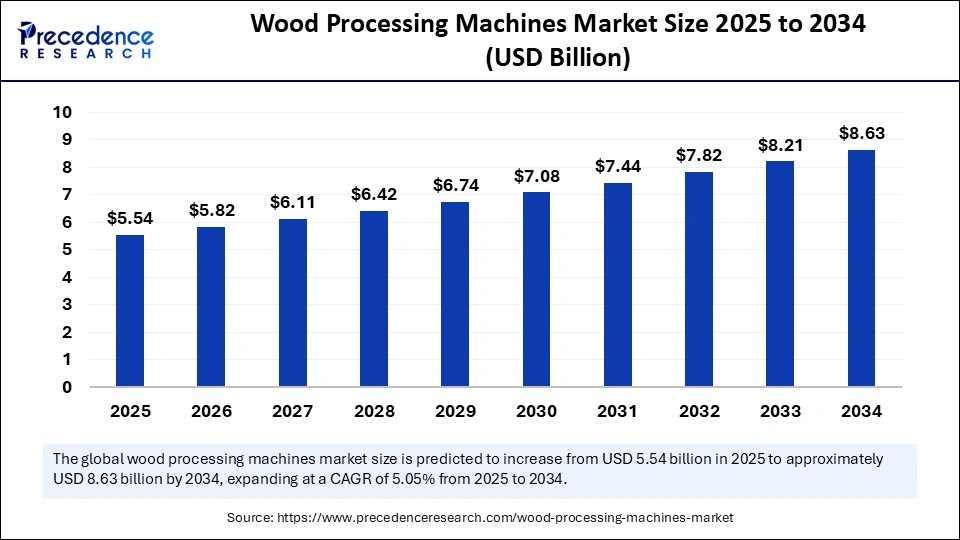

The global wood processing machines market size was calculated at USD 5.27 billion in 2024 and is predicted to increase from USD 5.54 billion in 2025 to approximately USD 8.63 billion by 2034, expanding at a CAGR of 5.05% from 2025 to 2034. The market is driven by the rising demand for efficient, automated solutions in furniture manufacturing, construction, and wood product industries to boost productivity and reduce labor costs.

Market Highlights

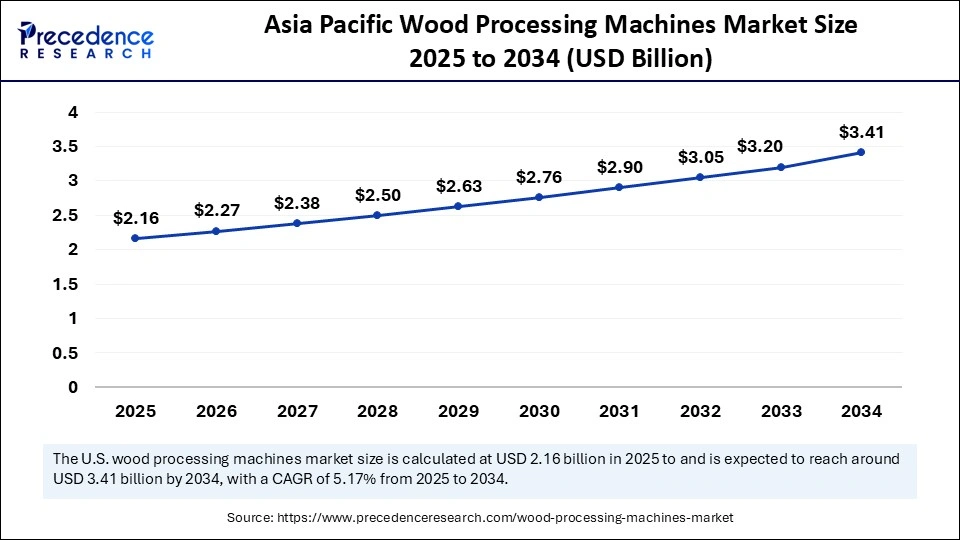

- Asia Pacific dominated the global wood processing machines market with the largest market share of 39% in 2024.

- North America is anticipated to witness the fastest growth during the forecasted years.

- By machine type, the primary conversion machines segment captured the biggest market share of 25% share in 2024.

- By machine type, the CNC and digital processing machines segment is anticipated to show considerable growth over the forecast period.

- By end-user industry, the furniture manufacturing segment contributed the highest market share of 30% in 2024.

- By end-user industry, the flooring manufacturing segment is anticipated to show considerable growth over the forecast period.

- By power source, the electric motor segment led the market, holding around a 78% share in 2024.

- By power source, the hydraulic-driven segment is anticipated to show considerable growth in the market over the forecast period.

- By installation mode, the stationary machines segment held the maximum market share of 87% in 2024.

- By installation mode, the portable machines segment is anticipated to show considerable growth over the forecast period.

- By material processed, the engineered wood segment accounted for the significant market share of 37% in 2024.

- By material processed, the recycled and reclaimed wood segment is anticipated to show considerable growth over the forecast period.

- By application/product output, the furniture components segment generated the major market share of 34% in 2024.

- By application/product output, the biomass fuel (pellets, briquettes) segment is anticipated to show considerable growth over the forecast period.

Market Size and Forecast

- Market Size in 2024: USD 5.27 Billion

- Market Size in 2025: USD 5.54 Billion

- Forecasted Market Size by 2034: USD 8.63 Billion

- CAGR (2025-2034): 5.05%

- Largest Market in 2024: Asia Pacific

- Fastest Growing Market: North America

Market Overview

The wood processing machines market is a broad category of machines that are utilized to convert raw timber and engineered wood into finished or semi-finished products that can be used in the manufacturing of furniture, construction, flooring, packaging, and biomass industries. Such machines comprise primary breakdown systems, secondary shaping equipment, panel and board production lines, finishing solutions, and waste-to-value processing tools. The enhanced performance of wood processing machinery due to the invention of technology, particularly in the aspect of automation and digital control systems, which are currently more reliable, energy-saving saving and cheaper.

The rapid urbanization and growth in the number of residential and commercial projects have added to the high demand for construction materials of wood, hence adding pressure on the use of effective processing machines. Wood is gaining progressive favor in terms of sustainability, cost-efficiency, and design, leading to a high desire for refined machines that could produce high-quality products in large quantities. Also, the increased attention to sustainable energy in the world has increased the demand to produce biomass, and wood waste-to-value machines are critical to this.

How is AI Integration Transforming the Wood Processing Machines Market?

The introduction of Artificial Intelligenceintegration is transforming the wood processing machines market because it allows smarter, faster, and more efficient processing of wood. AI-driven predictive analytics enable manufacturers to optimize machine operation, anticipate when and why machines require maintenance, and minimize downtime, leading to improved productivity and a lower cost of operation. Also, AI improves automation through the adaptive control mechanism by responding to the variety of wood using its moisture content and processing needs in real-time. With the industry moving towards smart factories and Industry 4.0 implementation, AI is likely to become an important factor in transforming competitiveness, efficiencies, and sustainability in the wood processing value chain.

What Factors Are Fueling the Rapid Expansion of the Wood Processing Machines Market?

- Gaining Construction Operations: The construction industry in the world has grown, and this has been driven by the high rate of urbanization, construction of infrastructure, and consequently, the demand for materials that are made of wood has risen. Wood processing machines are accurate, scalable, and effective in the manufacturing of beams, panels, and flooring products, being instrumental in the growth of requirements of the modern residential and commercial construction.

- Expansion in Furniture Production: The growth of the furniture business due to the increasing disposable income, urban housing, and the preference of people towards elegant and sustainable wooden furniture is facilitating the adoption of machines. High processing machines allow production of high volumes, personalization, and better finishing, which assists the manufacturers in keeping up with the growing world demand in residential as well as commercial furniture.

- Automation and Technological Advances: The application of automation, robotics, and the application of digital control systems in wood processing machines has increased efficiency, accuracy, and productivity. The inventions decrease labor reliance, waste is minimized, and sustainability is ensured, and high technical machinery has become very appealing to manufacturers who want to be more competitive in the world market, and at the same time cut down on the running costs.

Market Scope

| Report Coverage | Details |

| Market Size in 2024 | USD 5.27 Billion |

| Market Size in 2025 | USD 5.54 Billion |

| Market Size by 2034 | USD 8.63 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 5.05% |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Machine Type, End-User Industry, Power Source, Installation Mode, Material Processed, Application/Product Output, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Growing Demand from Construction and Furniture Industries

As cities are rapidly becoming urbanized, and infrastructure is increasingly developed, the trend in the use of wood has become a sustainable and cost-effective, and aesthetically pleasing material. Wood is being extensively used in construction as flooring, paneling, and as a structural material, and in the furniture industry, the increasing disposable income and shifts in consumer lifestyle are increasing the demand for modern and customizable wooden furniture. Such an increase in demand requires sophisticated wood processing machines that meet high levels of accuracy, efficiency, and scalability in production.

Expansion of the Packaging and Logistics Industry

The rapid growth of the world logistics and packaging industry is the one that is putting the wood processing machines in demand. With the increase in e-commerce, global trade, and supply chain activities, the demand to possess durable, standard, and ecological wooden pallets, crates, and shipping containers is high. To manufacture these products, wood processing machines would be significant to ensure that quality is equivalent to structural integrity and to ensure safe transportation. Automation of production and high-quality cutting tools help the manufacturing companies to reduce wastage and the cost of production.

Restraint

High Cost of Machinery and Maintenance

Although the a need to meet the increasing demand, the wood processing machines market is limited by the high start-up costs and additional costs of continuing upkeep of sophisticated equipment. The modern world is typically associated with wood processing machines, which are typically linked to automation, robotics, and digital monitoring, which are expensive to acquire and are not available to small and medium-scale producers. Such costs might be a burden on low-budget businesses; they might not be able to access such machines.

The routine maintenance, presence of a skilled workforce, and possible downtimes increase the operational costs, and this further influences cost-sensitive businesses. In less developed markets where there is less infrastructure and fewer financing options available, manufacturers might postpone on such technologies, which slows down the market penetration. Also, the changes in the price of raw materials and other supply chain issues may affect profitability, and therefore, investing in a costly machine will be less interesting.

Opportunity

Rising Focus on Sustainable Wood and Biomass Utilization

The environmental friendliness of the operations by the governments and the industries, the high ability of the machines to properly process the wood residues and waste into value-added products such as biomass fuel, pellets, and engineered wood, are in high demand. In addition to contributing to the creation of renewable energy sources, such a change contributes to the reduction of the negative impact on the environment by reducing the volume of waste in wood.

The increased use of green building materials and eco-certified furniture has provided an opportunity for more advanced processing machines that could provide precision, efficiency, and sustainability. The firms that embrace innovation in the energy-efficient machinery, waste-to-value equipment, and eco-design solutions are in a good position to exploit such trends, and sustainability is a significant source of future opportunities in the wood processing machines market.

Segments Insights

Machine Type Insights

How did the Primary Conversion Machines segment lead the Wood Processing Machines Market?

The primary conversion machines segment led the market while holding a 25% share in 2024, since it is part of the first process of the transformation of the raw timber into products. Examples of such machines are circular saws (single and multi-blade), band saws (horizontal and vertical), gang saws, and resaws, and they are the staple of any wood processing business. Their services are required in the transformation of logs into planks, boards, and panels in a very accurate and efficient way. The dominance of the segment is supported by the fact that the construction and furniture industry, and the packaging industry, are relatively stable about the high demand for timber in large volumes that are uniformly processed. Also, improved technology of saw blades, automatic feed technology, and safety measures have improved productivity and helped minimize the workforce.

The CNC and digital processing machines segment is expected to grow at a significant CAGR over the forecast period due to the growing need to be more precise, customized, and automated in wood manufacturing. Owing to the increased need to be more accurate, specialized, and automated in wood making. The machining centers, drilling/boring centers, panel processing centers, and CNC router allow the manufacturers to cut complicated shapes, designs, as well as create highly precise cuts with minimal waste. Digital integration provides automated production processes, real-time control, and predictive maintenance, which are much more efficient in operations and minimize downtime. The integration of CNC and digital solutions also facilitates mass customization and flexible production runs in line with the changing consumer preferences.

End-User Industry Insights

Why has the Furniture Manufacturing segment led the Wood Processing Machines Market?

The furniture manufacturing segment held a 30% share in the market in 2024. The dominance of the segment is through the increasing global demand for residential, commercial, and office furniture that is produced using wood and engineered wood products. Manufacturers must have high-precision machines such as CNC routers, panel saws, and resaws to create custom designs, intricate carvings, and complex assemblies easily. Increasing disposable income levels, urbanization, and the changing consumer tastes and preferences towards aesthetically valuable, durable, and environmentally friendly furniture continue to boost this demand. Also, the growing popularity of mass customization and pre-assembled furniture has been a catalyst for the use of automated and computerized wood processing equipment.

The flooring manufacturing segment is expected to grow substantially in the market. Both hardwood and laminate flooring products are now being preferred by residents and commercial spaces as a result of their longevity, beauty, and sustainability. The use of high-precision machines, including the planers, sanders, panel saws, CNC routers, etc., is needed to manufacture uniform planks, complex designs, and finished products with very tight tolerances. Moreover, the automated systems and digital monitoring tools enable manufacturers to attain greater throughput and reduce waste, energy, and production costs. Urbanization and infrastructure development are also increasing the construction industry and, hence, the demand for wooden flooring solutions all over the world. This segment is also growing very fast due to the increased consumer demand for eco-friendly and sustainable building materials.

Power Source Insights

How did the Electric Motor Segment Lead the Wood Processing Machines Market?

The electric motor segment led the market while holding a 78% share in 2024. The electric motors are reliable, predictable, and provide the power supply to a wide range of products in the line of Wood processing equipment, i.e., saws, Computer Numerically Controlled machines, planers, and sanders. They apply well in high-volume production environments of the furniture and flooring sectors, construction industries, due to their high efficiency, low maintenance, and the fact that they can manage their pace. Also, the electric-powered machines can be connected to automated and digital control systems, which assist in the advanced manufacturing processes, mass customization, and efficiency of operation. Their capability to manage continuous processes, high precision, and easy integration with modern smart factory systems makes this segment the dominant source of power in the international market of wood processing machines.

The hydraulic segment is expected to grow at a significant CAGR over the forecast period, owing to its benefits in heavy-duty applications and high-precision operations. Hydraulic systems offer strong, smooth, and constant force and motion control, which is suitable in industrial saws, presses, and panel cutting machines that demand a lot of torque. There is also increased flexibility of the machine, higher safety features, and more reliable operation by hydraulic systems. Due to the need of industries to acquire high-performance equipment in both traditional and sophisticated wood processing activities, hydraulic-powered machinery is likely to gain more acceptance, especially in large-scale manufacturing plants, sawmills, and intensive industrial supply.

Installation Mode Insights

Why did the Stationary Machines Segment Dominate the Wood Processing Machines Market?

The stationary machines segment held an 87% share in the market in 2024, due to their suitability in large-scale operation within the furniture manufacturing, construction, flooring, and panel production enterprises. Semi-portable machines like the fixed saws, CNC machining centres, planers, and sanders are stable, more precise, and can machine large logs or panels efficiently. They are constructed to have a continuous and high-volume production, and thus they best suit an industrial sawmill and manufacturing plant. They are essential to the current wood processing companies with their solid design, endurance, and ability to produce the same quality of output. Increased needs of processed wood products in urbanization, development of infrastructure, and furniture industries ensure that stationary machines are the installation mode of choice among the large manufacturers around the world.

The portable machines healthcare segment is expected to grow substantially in the market. The compact saws, planers, as well as routers are portable machines, which possess mobility, flexibility, and ease of use, and can be used in on-site operations, small workshops, and maintenance operations. The growing popularity of small furniture manufacturing, as well as DIY woodworking and on-site wooden construction projects, is also increasing the need to find portable solutions. Also, there have been technological advancements such as lightweight motors, battery-powered motors, and modular designs, which have contributed to the efficiency and usability of the portable wood processing machines. The portable segment will continue to increase fast as companies and artisans are getting the convenience and flexibility of processing as they pursue cost-effective solutions to their current processes, as a supplement to the traditional stationary machines in the worldwide market.

Material Processed Insights

How did the Engineered Wood Segment Lead the Wood Processing Machines Market?

The engineered wood (MDF, particleboard) segment held a 37% share in the market in 2024, due to the growing global need in the furniture, flooring, and building industries in standard, strong, and cheap wood products. To process engineered wood, special machines are required, CNC router, panel saw, sanding machine, and presses, to shape and finish the wood to any precision. There has been an increasing pressure towards the need to have machines that can be applied in the engineering of wood, such as the increased use of mass production processes and automated manufacturing processes. The appearance of modular furniture, inner paneling, and construction applications also contributed to the fact that there are high-performance machines, which could process large volumes of engineered wood efficiently and offer high accuracy with minor volumes of waste products.

The recycled and reclaimed wood segment is expected to grow substantially in the market. Reclaimed timber is finding use in the furniture industry, flooring industry and construction industry because of the increased environmental consciousness, sustainability, and reclaimed timber being used in the construction industry. The use of wood processing machines that can handle reclaimed wood enables the manufacturer to cut, shape, and finish the irregular or used wood without compromising its structure. Increased adaptability of machinery, digital monitoring, and accuracy of cutting contribute to the reduction of material waste and maximization of output quality. The emphasis on deforestation regulation and sustainable sourcing also encourages the use of recycled wood, which opens up the possibilities of special equipment.

Application Output Insights

Why did the Furniture Components Segment Lead the Wood Processing Machines Market?

The furniture components segment led the market while holding a 34% share in 2024. The force behind this dominance is the increase in the world's need for high-quality, durable, and aesthetically appealing furniture pieces in residential, commercial, and office settings. Machines used in processing wood, such as CNC routers, panel saws, and planers, can help manufacturers produce parts of high precision, intricate design, and high-quality uniform panels with a high degree of efficiency. Increasing use of mass customization, pre-made furniture, and building on modular designs is also contributing to the rapid uptake of automated and computer-based processing tools for wood. Moreover, the rising disposable income, urbanization, and the shift in lifestyle choices have resulted in the attainment and growth of the demand for furniture components that demand accuracy in production and uniformity.

The biomass fuel (pellets, briquettes) segment is expected to grow at a significant CAGR over the forecast period. Demand for renewable and sustainable sources of energy in the world is driving the use of wood residues, sawdust, and offcuts to produce biomass fuel. The equipment that can successfully convert waste products into pellets or briquettes is gaining popularity in regions where carbon emissions decrease and the spread of green energy becomes the main priority. High-tech devices guarantee standardization of size, density, and quality of biomass products, which enhances efficiency in combustion and the generation of power. The development of biomass energy plants, governmental support of renewable energy, and the growth of the use of the principle of the cyclical economy are the major factors in favor of the development of this segment.

Regional Insights

Asia Pacific Wood Processing Machines Market Size and Growth 2025 to 2034

The Asia Pacific wood processing machines market size is evaluated at USD 2.16 billion in 2025 and is projected to be worth around USD 3.41 billion by 2034, growing at a CAGR of 5.17% from 2025 to 2034.

Why did Asia Pacific Dominate the Wood Processing Machines Market?

Asia Pacific led the global market with the highest market share of 39% in 2024, mainly caused by the fast industrialization, urbanization, and development of infrastructure in countries like China, India, Japan, and the Southeast Asian countries. The increase in construction operations, together with the increased demand for wooden furniture and flooring, has made the high-performance wood processing machine highly in demand. Moreover, the region has high raw materials availability based on the form of forests and plantations that both provide the local manufacturing and export-focused industries. The market in the region has been reinforced by government efforts to encourage sustainable forestry management and investments in new manufacturing plants.

Being the most influential player in the region of the Asia Pacific, China is very relevant in the development of the wood processing machines market. Residential and commercial building activities have significantly grown in the country and contributed to the growth of processed wood products, engineered boards, and furniture components. Wooden furniture and flooring are also significant Chinese exports that bring about a constant demand for modern processing machines that can produce high volumes through precise and efficient output. Also, increased environmental awareness and policies that favor the sustainable use of wood have been furthered.

What Are the Key Trends Driving the North America Wood Processing Machines Market?

The North America wood processing machines market is expected to account for a substantial market share in 2024, owing to the highly established construction, furniture, and packaging sectors in the region. The growing demand for the wood products of high quality such as engineered boards, furniture parts, and other such materials used in flooring, has made it necessary to have advanced processing machinery. Also, sustainability projects, recycled wood, and waste-to-value biomass solutions are impacting investment in machinery that minimizes material waste and the usage of energy. The high-quality and precision of operations and high regulatory standards of the region have also boosted the adoption of advanced wood processing machinery, making North America one of the target markets in the world.

In the North American region, the U.S. leads the market in supplying wood processing machines. With a well-developed residential and commercial construction market, the high demand for custom-made and mass-produced furniture in the country leads to the necessity of specific and high-performance equipment. Modern manufacturing is based on advanced automation, robotics, and AI, which guarantee efficiency, consistency, and reduction of waste. The presence of good industrial infrastructure, availability of skilled labor, and availability of advanced technology also contribute to the development of the U.S. market.

Wood Processing Machines Market Companies

- HOMAG Group

- Biesse Group

- SCM Group

- Weinig Group

- Felder Group

- Altendorf GmbH

- Holz-Her

- Morbidelli

- Casadei Busellato

- Brandt

- Powermatic

- Laguna Tools

- Barberán

- Cefla Finishing

- OMGA S.r.l.

- MINIMAX

- Stiles Machinery

- Leadermac

- Griggio S.p.A.

- Holzma

Recent Developments

- In August 2025, the Wood-Mizer launched the MR250 Double Arbor Multirip - a high-performance, precision-cutting, gangsaw designed to perform at a high level in the industrial sawmilling operations. The MR250 is a powerful solution designed to comply with the requirements of the contemporary production environment, which is fast, flexible, and provides a high level of recovery. (Source: https://woodmizer.co.uk)

- In May 2025, MINDA Group then purchased HOWIAL GmbH and Co KG in order to expand its capacity in finger joint technology as well as increase its industrial wood processing. It is a strategic move as the integration is an integration of the conveyor and press systems of MINDA and the use of specialized finger jointing skills of HOWIAL. (Source: https://www.minda.com)

- In June 2024, Wehrmann GmbH and Co. KG was acquired by GINDUMAC, which is a portfolio company of The Platform Group AG, a company with long experience in wood machinery and special service solutions. The acquisition will enable GINDUMAC to expand its B2B machinery-trading to wood processing and other related after-sales services.(Source: https://com.wehrmann-maschinen.de)

Segment Covered in the Report

By Machine Type

- Primary Conversion Machines

- Circular saws (single and multi-blade)

- Band saws (horizontal and vertical)

- Gang saws

- Resaws

- Secondary Conversion Machines

- Edgers and trimmers

- Cross-cut saws

- Planers and thicknessers

- Four-sided planers and moulders

- Tenoners and mortisers

- Profiling machines

- Panel and Board Processing Machines

- Panel saws (beam saws)

- Laminating presses (hot and cold)

- Plywood presses and layup systems

- Veneer lathes and slicers

- Veneer dryers

- CNC and Digital Processing Machines

- CNC routers/machining centers

- CNC drilling/boring centers

- CNC panel processing centers

- Surface Finishing Machines

- Wide-belt sanders

- Edge/profile sanders

- Spray coating lines

- UV curing lines

- Edge and Decorative Processing Machines

- Edge banders

- Profile wrapping machines

- Assembly and Joining Machines

- Glue spreaders and adhesive applicators

- Dowelling and insertion machines

- Automated assembly lines

- Waste and Biomass Machines

- Wood chippers

- Shredders and granulators

- Debarkers

- Pelletizers and briquetting machines

- Biomass dryers

- Ancillary and Support Equipment

- Conveyors and handling systems

- Automatic stackers/destackers

- Dust extraction and filtration units

- Grading and scanning systems

- Portable Machines

- Portable saws

- Portable planers

- Portable routers

By End-User Industry

- Furniture manufacturing

- Construction and building products

- Flooring manufacturing

- Cabinetry and joinery

- Panel and board producers

- Packaging and pallets

- Doors and windows manufacturing

- Biomass and energy sector

- DIY and small workshops

By Power Source

- Electric motor-driven

- Hydraulic-driven

- Pneumatic-assisted

By Installation Mode

- Stationary (plant-based)

- Portable (on-site use)

By Material Processed

- Solid hardwood

- Softwood

- Engineered wood (MDF, particleboard, HDF)

- Plywood and veneer

- Composite wood (OSB, WPC)

- Recycled and reclaimed wood

By Application/Product Output

- Lumber and beams

- Furniture components

- Flooring panels

- Decorative mouldings and profiles

- Doors and window frames

- Packaging (pallets, crates)

- Biomass fuel (pellets, briquettes)

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting