What is the Pre-Collision Technology Market Size?

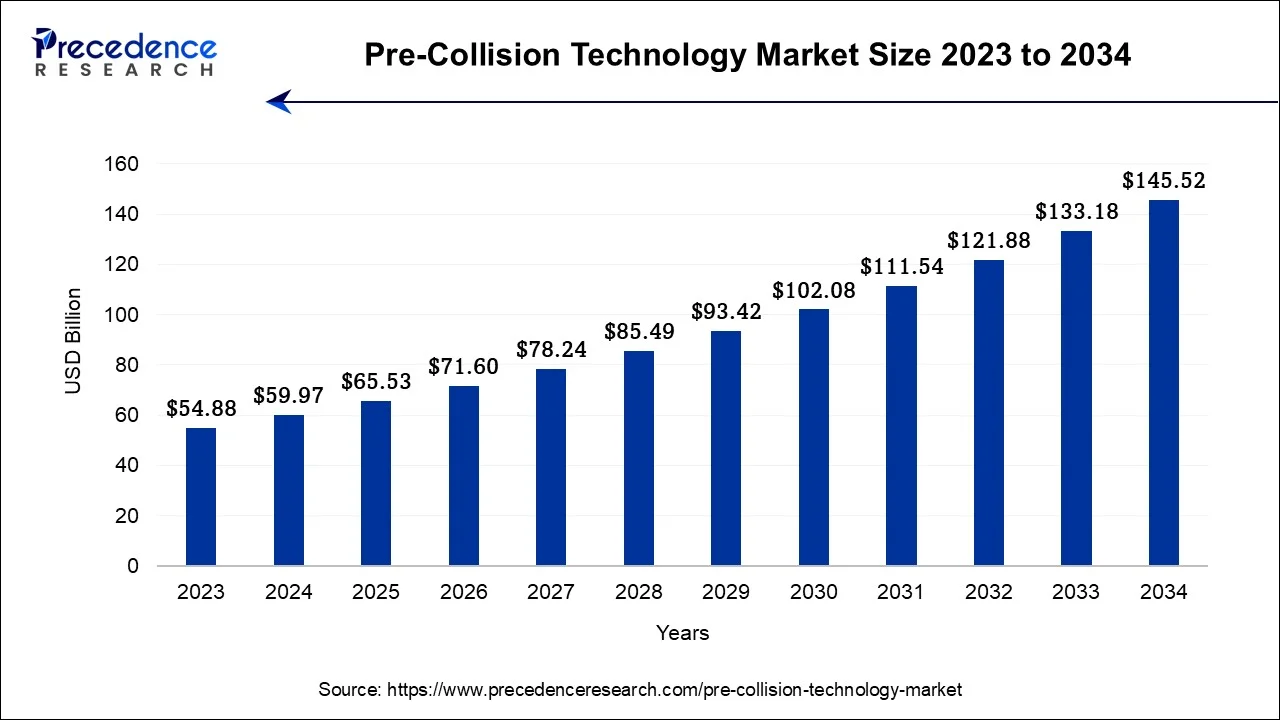

The global pre-collision technology market size is calculated at USD 65.53 billion in 2025 and is predicted to increase from USD 71.60 billion in 2026 to approximately USD 157.17 billion by 2035, expanding at a CAGR of 9.14% from 2026 to 2035.

Pre-Collision Technology Market Key Takeaways

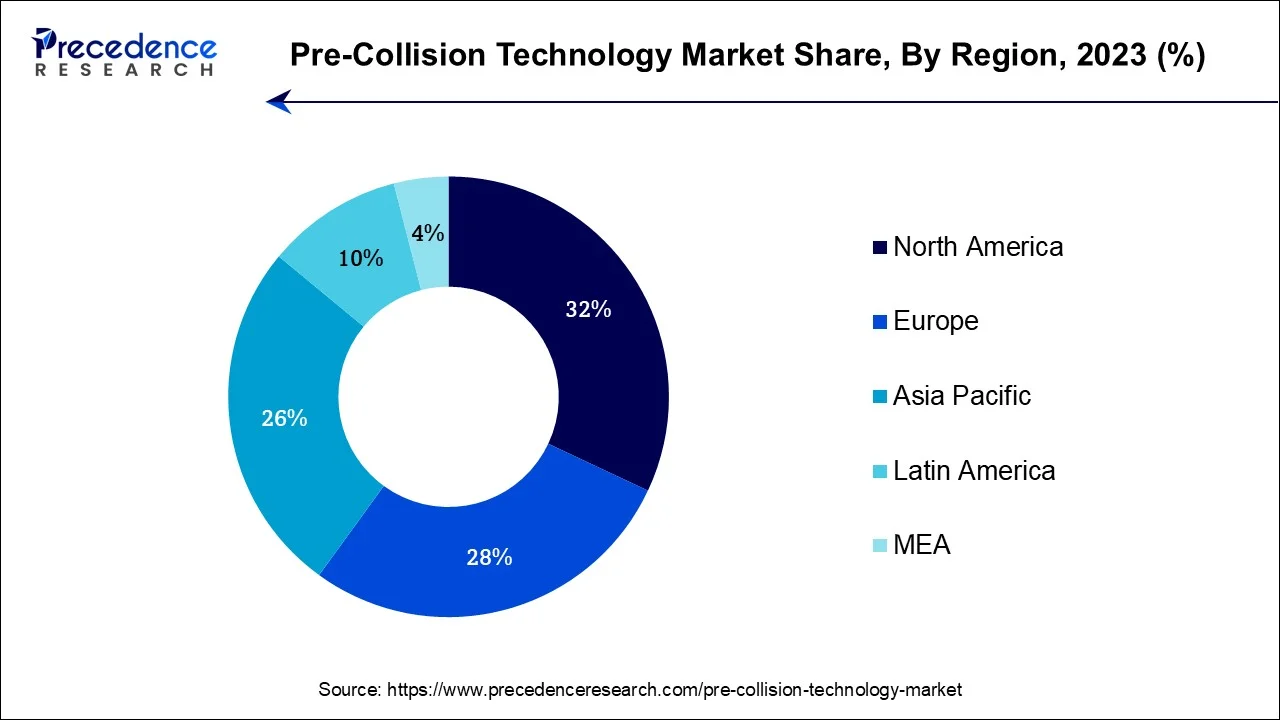

- North America contributed more than 32% of revenue share in 2025.

- By Product, the adaptive cruise control segment has held the largest revenue share in 2025.

- By Technology, the RADAR segment has held the highest market share in 2025.

Pre-Collision Technology Market Growth Factors

Governments and regulatory bodies worldwide are implementing stricter safety standards and guidelines for vehicles. This compels automakers to incorporate advanced driver-assistance systems (ADAS) into their vehicles, including pre-collision technology. The rise in road accidents causing injuries and fatalities necessitates leveraging technology to reduce these incidents. As a result, pre-collision systems have become a crucial component of future vehicles.

Furthermore, technology's rapid advancements greatly enhance the effectiveness and affordability of pre-collision systems. Collision detection systems have experienced remarkable advancements, greatly enhancing their accuracy and reliability. The seamless integration of advanced sensor technologies like radars, light intensity sensors, and high-resolution cameras has greatly heightened vehicular awareness.

In addition to that, machine learning algorithms and artificial intelligence actively analyze massive volumes of data in real-time. This enhanced processing power enables vehicles to have a deep understanding of their surroundings, empowering them with split-second decision-making. As these technological innovations continue to progress and mature, they become more accessible across a wider array of vehicles beyond just high-end or luxury models.

Market Scope

| Report Coverage | Details |

| Growth Rate from 2026 to 2035 | CAGR of 9.14% |

| Market Size in 2025 | USD 65.53 Billion |

| Market Size in 2026 | USD 71.60 Billion |

| Market Size by 2035 | USD 157.17 Billion |

| Largest Market | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | By Product and By Technology |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Rise in road safety concerns

Road safety has emerged as a crucial global concern, given the alarming rise in road accidents and casualties predominantly attributed to human error. Governments, organizations, and individuals have all been profoundly impacted by the devastating consequences of these incidents, prompting them to reevaluate their strategies extensively in combating this issue. The increasing awareness has generated a united call for innovative solutions capable of effectively reducing driving risks and minimizing the frequency and severity of accidents. Enter pre-collision technology, emerging as a proactive defense against road accidents.

By utilizing cutting-edge sensors, cameras, radar systems, and artificial intelligence algorithms, these advanced technological systems have the capability to instantly identify potential collision scenarios. They can promptly issue warnings or even autonomously take action to prevent disastrous outcomes.

The ability to anticipate and respond swiftly to imminent hazards like a potential frontal collision with another vehicle or an unexpected pedestrian crossing is truly revolutionary for enhancing road safety. Consequently, both consumers and governments are increasingly acknowledging the life-saving potential of pre-collision technology and its capacity to prevent innumerable accidents. This recognition further accelerates its widespread adoption.

Furthermore, road safety concerns go beyond the personal and emotional impact of accidents. Governments are actively seeking cost-effective strategies to address the significant economic implications of this issue. These implications include medical expenses, insurance costs, and damage to infrastructure. Pre-collision technology emerges as a compelling solution in this context. By reducing accidents and their associated expenses, it not only saves lives but also contributes to economic stability. Consequently, policymakers and legislators find it highly appealing.

Restraints

Limited infrastructure support

Integrated pre-collision systems primarily rely on onboard sensors and cameras for detecting potential hazards and obstacles. By establishing interconnected networks, vehicles can exchange essential data both among themselves and with roadside infrastructure. This seamless sharing enables a more comprehensive understanding of the traffic environment in real-time. However, despite their numerous benefits, the widespread implementation of V2V and V2I communication infrastructure faces significant challenges due to slow adoption.

Although certain regions and urban areas have started deploying elements of these systems, their coverage remains limited. Pre-collision systems may not reach their full potential in areas without necessary infrastructure support. In such cases, vehicles primarily rely on onboard sensors, which could compromise their ability to anticipate and respond to certain accidents or road hazards. For instance, collisions at blind intersections or obstacles hidden from a vehicle's sensors pose a challenge.

Additionally, hindered growth of pre-collision technology can be attributed to the lack of uniformity and standardization in infrastructure support. Diverse communication protocols or technologies are adopted by different regions and countries, posing challenges for effective communication between vehicles and infrastructure from separate areas. This fragmentation leads to compatibility issues and increased complexity for manufacturers and consumers alike.

Opportunities

Advancements in technology

Over the years, remarkable progress has been witnessed in sensor technology, artificial intelligence, and data processing capabilities. These advancements are crucial components of effective pre-collision systems. The advancements in technology have resulted in the development of more precise, reliable, and affordable sensors. Consequently, vehicles now possess an unprecedented ability to perceive their surroundings with utmost accuracy. This significant progress further strengthens the dependability of pre-collision systems.

Additionally, artificial intelligence and machine learning algorithms have evolved to swiftly analyze the abundance of sensor data available. Consequently, vehicles can make split-second decisions when faced with potential collision scenarios. These algorithms continuously enhance their performance by utilizing data-driven insights. This leads to improved adaptability and effectiveness of pre-collision technology. In addition, the progress in computing power empowers vehicles to efficiently process intricate data in real-time. This seamless integration merges pre-collision features with other advanced driver-assistance systems (ADAS). As technology advances, the cost of implementing pre-collision systems decreases. This allows more consumers to access these life-saving features.

Impact of COVID-19

The COVID-19 pandemic had a major impact on the pre-collision technology market. In the early stages of the crisis, various industries including automotive, experienced disruptions in their supply chains and manufacturing processes. Consequently, there were delays in producing and deploying vehicles that were equipped with pre-collision technology. Moreover, with reduced consumer spending and economic uncertainty, vehicle sales declined significantly, affecting the overall adoption rate of advanced safety features.

The pandemic, however, emphasized the significance of safety and hygiene. This led to a surge in interest for contactless and touchless technologies. In this context, pre-collision systems gained relevance as they operate without physical contact. Both consumers and fleet operators began prioritizing features that can enhance safety and minimize accident risks, potentially fueling future demand for pre-collision technology.

The pandemic has hastened the adoption of digitalization and automation, particularly in relation to autonomous and electric vehicles. These advancements closely align with the implementation of pre-collision technology. This advanced feature significantly boosts the safety and functionality of self-driving cars. As the automotive industry zeros in on electric and autonomous vehicles, there will be a growing focus on integrating advanced safety systems like pre-collision technology. This prioritization is expected to further propel market growth potential.

Segment Insights

Product Insights

According to the product, the adaptive cruise control sector has held the major revenue share in 2023. ACC represents sophisticated advancement in automotive safety and convenience, allowing vehicles to automatically adjust their speed and maintain safe following distance from the vehicle ahead. Unlike traditional cruise control systems, ACC uses sensors, typically radar or LiDAR, to detect the speed and distance of vehicles in same lane. This technology enables smooth and adaptive speed regulation, enhancing both safety and driving comfort.

Advanced driver-assistance systems (ADS), like Adaptive Cruise Control (ACC), offer numerous benefits. ACC will contribute to safety while at the same time making a considerable contribution towards reducing traffic congestion and improving fuel economy by reducing the risk for back-end accidents. With increasing consumer demand for such systems and ongoing advancements in autonomous vehicles, the ACC segment is projected for substantial growth. It is anticipated that ACC will play an integral role in shaping a safer and more efficient future for road transportation.

Technology Insights

Based on the technology, RADAR segment held the largest market share the market in 2023. The RADAR segment holds a crucial position in the pre-collision technology market. It is the foundation that enables vehicles to detect and respond to potential collision scenarios. Utilizing radio waves, RADAR (Radio Detection and Ranging) systems accurately measure the distance between a vehicle and objects in its surroundings. This real-time monitoring of the road environment proves especially effective in adverse weather conditions like rain and fog, surpassing other sensor technologies.

Responsible for various pre-collision features such as adaptive cruise control, blind-spot monitoring, and automatic emergency braking, RADAR plays a pivotal role. Continuous advancements further enhance this technology with higher resolution and increased range, enabling vehicles equipped with such systems to effectively detect obstacles and potential collisions. Consequently, road safety is improved while contributing to the growth and evolution of the pre-collision technology market.

Regional Insights

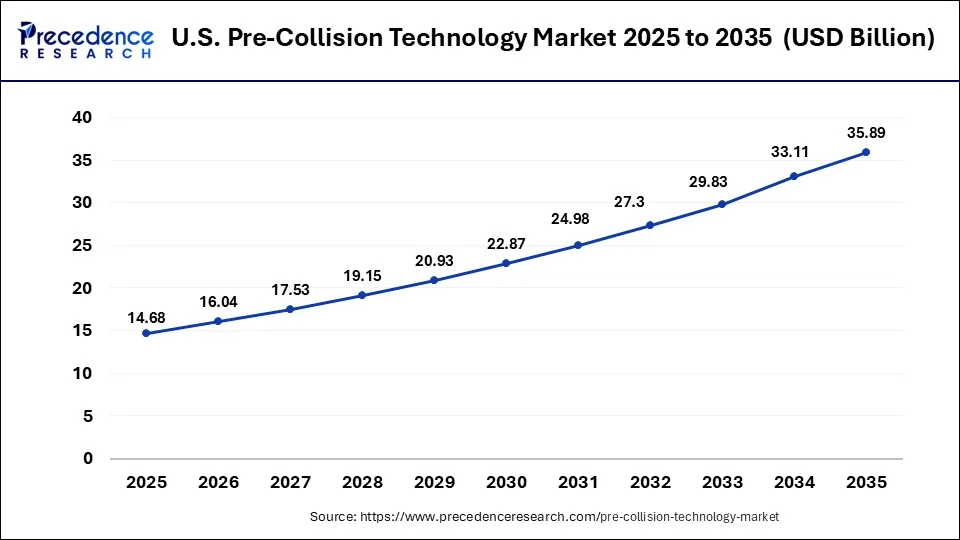

What is the U.S. Pre-Collision Technology Market Size?

The U.S. pre-collision technology market size was valued at USD 14.68 billion in 2025 and is estimated to reach around USD 35.89 billion by 2035, growing at a CAGR of 9.35% from 2026 to 2035.

Why Did North America Dominate the Pre-Collision Technology Market in 2024?

North America has held the largest revenue share in 2023. The North America pre-collision technology market holds a significant position in the global automotive industry. This region, encompassing the United States and Canada, has consistently been at the forefront of automotive innovation. Safety and driver assistance systems have been given utmost importance here. Several key factors have contributed to this trend.

Canada Market Analysis

Canada is considered a major contributor to the North American pre-collision technology market. The country has experienced significant shifts due to advancements in machine learning, data analytics, and artificial intelligence. These technologies enable predictive analysis and real-time insights about users, allowing organizations to make more accurate and informed decisions. As a result, businesses are able to optimize operations, enhance customer experiences, and drive better outcomes across industries.

The strict safety regulations and commitment to reducing road accidents have served as major driving forces for automakers. They are driven to incorporate more advanced driver assistance systems such as pre-collision assistance systems in their vehicles. In particular, the key role in shaping the current market landscape has been played by federal and state level regulations in the United States and similar initiatives in Canada.

Furthermore, the demand for safer vehicles in North America has significantly grown. Presently, buyers actively seek cutting-edge technologies like collision avoidance systems, adaptive cruise control, and lane keeping assistance. Safety features have become paramount in today's vehicle market. Consequently, automakers have responded by progressively incorporating these features as standard or optional across their vehicle lineups.

Why is Asia Pacific Considered the Fastest-Growing Region in the Market?

The Asia-Pacific market for pre-collision technology is seeing remarkable growth and transformation. The Asia-Pacific region is currently witnessing a rise in road accidents due to various factors. These nations have prioritized the implementation of advanced safety features in vehicles as their cities develop and car ownership rates increase. These features are essential to tackle challenges such as heavy traffic congestion and frequent road accidents efficiently.

India Market Analysis

The pre-collision technology market in India is influenced by the rising adoption of autonomous emergency braking and forward collision warning, which are exclusive to luxury vehicles. These features are now standard in popular mid-range models from manufacturers such as Tata Motors and Hyundai. Indian startups and established companies are also customizing pre-collision systems to local conditions, addressing challenges like unorganized traffic, pedestrians, and potholes in highly dynamic environments.

Moreover, the Asia-Pacific area has great potential as a marketplace for electric and driverless cars. With the rising acceptance of these advanced technologies, there is an escalating need for pre-collision systems that are essential to guarantee the security and performance of these cars. In particular, China has shown remarkable dedication in promoting the adoption of electric vehicles, creating a substantial opportunity for growth in pre-collision technology within the world's largest automotive market.

What Potentiates the Market in Europe?

The pre-collision technology market in Europe is growing steadily, driven by the region's strict vehicle safety regulations. The European Union mandates several advanced safety features, including Intelligent Speed Assistance, which alerts drivers when they exceed speed limits to help prevent accidents. Event Data Recorders capture detailed information before and after collisions, aiding in accident analysis and vehicle design improvements. Additionally, there is a high adoption of Automated Emergency Braking (AEB) systems that detect potential collisions and automatically apply brakes to prevent or mitigate accidents.

What Opportunities Exist in the Middle East & Africa for the Market?

The Middle East & Africa (MEA) presents significant opportunities in the pre-collision technology market due to rising demand for safer vehicles and increased adoption of advanced driver-assistance systems (ADAS). Growth is being driven by the availability of low-cost, high-performance sensors suitable for mass-market vehicles, along with expanding commercial vehicle fleets and consumer electronics integration. Additionally, the rollout of 5G networks and vehicle-to-everything (V2X) communication creates opportunities for innovative collision avoidance solutions and next-generation connected vehicle technologies in the region.

How is the Opportunistic Rise of Latin America in the Market?

Latin America is experiencing an opportunistic rise as commercial industries, particularly mining and logistics, adopt advanced safety systems to improve operational efficiency and reduce accidents. Early adoption of AI- and sensor-based solutions, such as multi-level collision avoidance and voice-based warning systems, is creating demand for innovative and localized technologies. This trend, combined with growing awareness of vehicle and workplace safety, presents significant growth opportunities for both global providers and local technology developers in the region.

Pre-Collision Technology Market Companies

- Wabtec Corporation

- Robert Bosch GmbH

- General Electric Company

- Alstom SA

- Denso Corporation

- Autoliv Inc.

- Collins Aerospace

- Delphi Automotive PLC

- Siemens AG

- Honeywell International Inc.

Recent Developments

- Toyota Motor Corporation, a Japanese multinational automaker, has teamed up with ZF and Mobileye to create advanced driver assistance systems (ADAS).

Segments Covered in the Report

By Product

- Parking assistance

- Lane Departure Warning System (LDWS)

- Autonomous Emergency Braking (AEB)

- Adaptive Cruise Control (ACC)

- Others

By Technology

- Camera

- Ultrasonic

- RADAR

- LiDAR

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting