Pregnancy Medication Market Size and Forecast 2025 to 2034

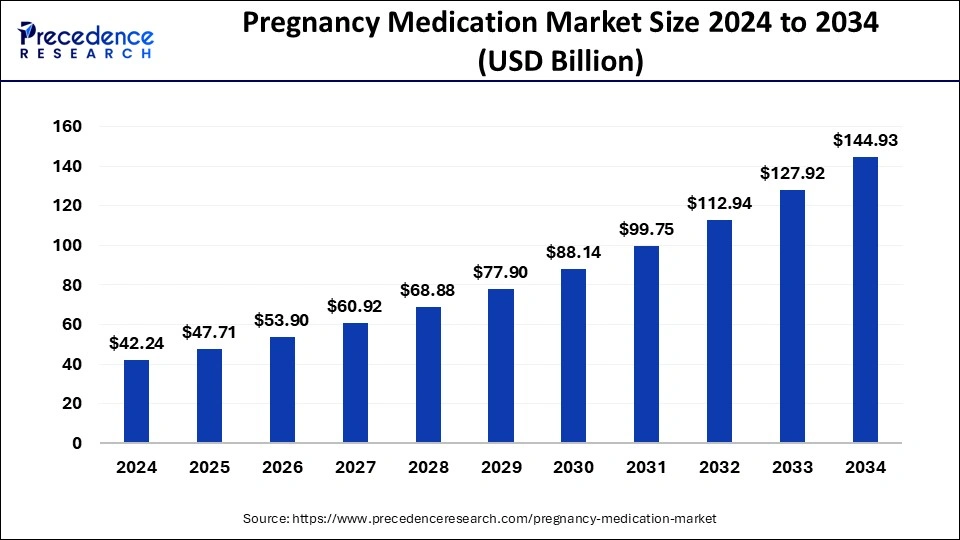

The global pregnancy medication market size accounted for USD 42.24 billion in 2024 and is predicted to increase from USD 47.71 billion in 2025 to approximately USD 144.93 billion by 2034, expanding at a CAGR of 14.70% from 2025 to 2034.

Pregnancy Medication MarketKey Takeaways

- In terms of revenue, the global pregnancy medication market was valued at USD 42.24 billion in 2024.

- It is projected to reach USD 144.93 billion by 2034.

- The market is expected to grow at a CAGR of 14.70% from 2025 to 2034.

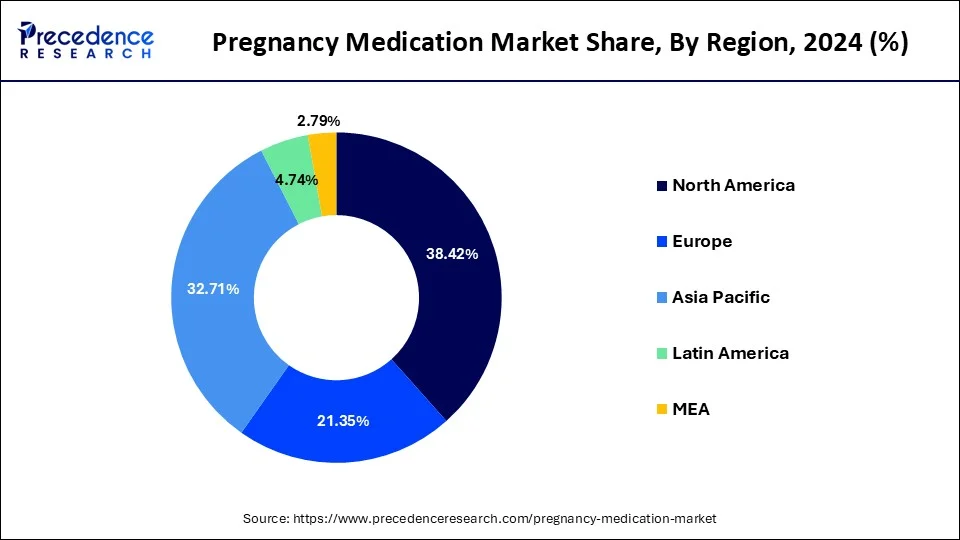

- North America dominated the market with the largest share of 38.42% in 2024.

- Asia Pacific is expected to witness the fastest rate of growth during the forecast period.

- By type, under the drug class segment, the antacids sub-segment accounted for the dominating share in the market in 2024.

- By type, under the drug class segment, the antianemia sub-segment is observed to witness a notable rate of growth during the forecast period.

- By distribution channel, the hospital pharmacy segment held the largest share of the market in 2024.

- By distribution channel, the online pharmacy segment is observed to experience a significant rate of growth during the forecast period.

- By pregnancy stage, the 3rd-trimester segment dominated the market in 2024.

U.S.Pregnancy MedicationMarket Size and Growth 2025 to 2034

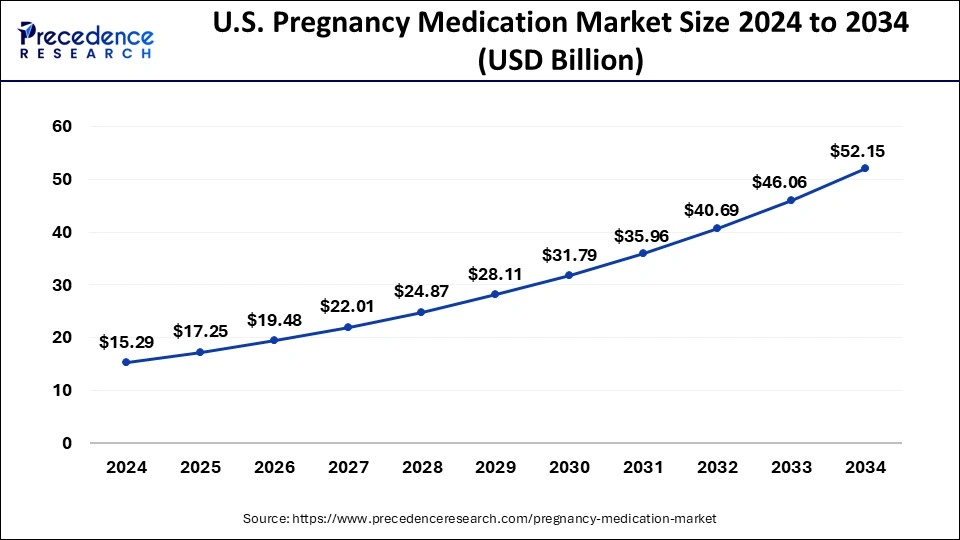

The U.S. pregnancy medication market size was exhibited at USD 15.29 billion in 2024 and is projected to be worth around USD 52.15 billion by 2034, growing at a CAGR of 14.61% from 2025 to 2034.

North America dominated the pregnancy medication market in 2024. The region is observed to witness a significant growth rate during the forecast period. The growth of the region is attributed to the presence of prominent pharmaceutical companies, rising healthcare spending and rising research and development activities, Moreover, the ongoing awareness campaigns regarding pregnancy care, and increasing incidences of pregnancy-related complications which results in increasing demand for pregnancy medication in the region.

The United States and Canada are the major contributors to the pregnancy medications market owing to the presence of sophisticated healthcare infrastructure, increasing product approvals by various regulatory bodies, rising disposable income, increasing women's inclination toward pregnancy medication for the treatment of chronic diseases, and rising cases of pregnancy.

- According to the data published by the CDC, the provisional general fertility rate for the United States in 2022 was 56.1 births per 1,000 women aged 15–44. The provisional number of births for the United States in 2022 was 3,661,220. Similarly, as per the data from the Government of Canada published there were 351,679 live births in Canada in 2022, excluding Yukon. Similar to previous years, the proportion of boys (51.4%) was slightly higher than the proportion of girls (48.6%).

- In July 2022, Glenmark Pharmaceuticals Inc., USA received final approval from the United States Food & Drug Administration (USFDA) for Norethindrone Acetate and Ethinyl Estradiol Capsules and Ferrous Fumarate Capsules, 1 mg/20 mcg. The approved drug is the generic version of Taytulla Capsules, of Allergan Pharmaceuticals International. The drug is a prescription birth control pill used for the prevention of pregnancy.

Asia Pacific is observed to witness the fastest rate of growth in the pregnancy medication market during the forecast period. The pharmaceutical industry in Asia Pacific is experiencing rapid growth and expansion, with many multinational pharmaceutical companies establishing a strong presence in the region. Local pharmaceutical manufacturers are also emerging as key players, producing a wide range of pregnancy medications to meet domestic and regional demand. Governments in the Asia Pacific are implementing various initiatives and policies to improve maternal and child health outcomes. This includes programs to increase access to prenatal care, maternal education, and essential medications for pregnant women. Government support and funding for maternal healthcare contribute to the expansion of the pregnancy medication market in the region.

Market Overview

The pregnancy medication market refers to the pharmaceutical sector focused on developing, manufacturing, and marketing medications specifically intended for use during pregnancy. These medications are designed to address various health conditions and concerns that may arise before, during, or after pregnancy, with the primary goal of ensuring the health and well-being of both the mother and the developing fetus. The pregnancy medication market includes medications used to manage various pregnancy-related conditions and complications, such as morning sickness, gestational diabetes, hypertension, preterm labor, and preeclampsia. These medications may include antiemetics, antidiabetic agents, antihypertensives, tocolytics, and corticosteroids, among others.

Pregnancy Medication MarketGrowth Factors

- The increasing prevalence of chronic diseases during pregnancy such as heartburn, diabetes, and low blood pressure is estimated to accelerate the growth of the pregnancy medication market.

- Rapid development in incidences of pregnancy-associated complications is anticipated to spur the demand for pregnancy medication during the forecast period.

- The growing awareness about pre-and post-natal health along with the technological advancements in the field of pregnancy medication solutions is projected to significant opportunities for the pregnancy medication market.

- The rising concerns about ensuring wholesome prenatal and postpartum care for expectant mothers and children are anticipated to boost market demand during the forecast period.

- The rise in disposable income increases the purchase of pregnancy medications and is estimated to accelerate the market's revenue during the forecast period.

Market Scope

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 14.70% |

| Market Size in 2025 | USD 47.71 Billion |

| Market Size by 2034 | USD 144.93 Billion |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Distribution Channel, and Pregnancy Stage |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Rising emphasis on treating nutritional deficiencies during pregnancy

The rising focus on treating nutritional deficiencies during the pregnancy phase to avoid major drawbacks after delivery is observed to act as a major driver for the pregnancy medication market. Increased awareness and education among pregnant women about the importance of nutrition and prenatal care contribute to the demand for pregnancy medications. Pregnant women are often proactive in seeking out information and resources to support their health and the health of their baby during pregnancy. Healthcare providers play a crucial role in educating pregnant women about the benefits of specific medications and supplements for addressing nutritional deficiencies and promoting a healthy pregnancy.

Pregnancy places increased nutritional demands on the mother's body to support the growth and development of the fetus. Inadequate nutrient intake during pregnancy can lead to maternal health issues such as anemia, gestational diabetes, preeclampsia, and postpartum complications. Medications and supplements designed to address specific nutritional deficiencies help support maternal nutrition and overall well-being during pregnancy, reducing the risk of maternal complications and improving pregnancy outcomes.

Restraint

High cost

The high cost associated with pregnancy medication is anticipated to hamper the pregnancy medication market's growth. Pregnancy medications are generally expensive and pregnant women need to go through ultrasound many times during the period of pregnancy. A significant amount is needed to purchase pregnancy drugs discourages women staying in the backward or underdeveloped areas. In addition, adverse side effects are associated with many pregnancy drugs which may lead to complications during the period of pregnancy, which may restrict the expansion of the global market.

Opportunity

Public health initiatives

Governments may allocate funding and grants to support research and development efforts in the field of pregnancy medication. Research funding from government agencies, such as the National Institutes of Health (NIH) or the European Commission, can accelerate the discovery and development of new medications for pregnancy-related conditions, such as gestational diabetes, preeclampsia, and preterm labor. Government-sponsored research initiatives can also facilitate collaborations between academia, industry, and healthcare providers to address unmet medical needs in maternal-fetal medicine.

Governments often collaborate with private sector stakeholders, including pharmaceutical companies, healthcare providers, and nonprofit organizations, to improve maternal and child health outcomes. Public-private partnerships may involve joint initiatives to develop and distribute pregnancy medications, provide educational resources and support services for pregnant women, and implement community-based interventions to address maternal health disparities. By leveraging the resources and expertise of both public and private sectors, governments can enhance the effectiveness and impact of interventions in the pregnancy medication market.

Type Insights

In 2024, the drug class segment dominated the pregnancy medication market. Under the segment, the antacids sub-segment accounted for the dominating share in the market. During pregnancy, the hormonal changes or the increasing baby pressing on the stomach may lead to indigestion, heartburn, or acid reflux in pregnant women. Antacids are recommended as first-line treatment for heartburn and acid reflux during pregnancy. Therefore, the use of Antacids coupled with the increasing availability of medicine over-the-counter platforms is expected to accelerate the segment's growth.

The antianemia sub-segment is observed to witness a considerable growth in the global pregnancy medications market over the forecast period. Antianemia medications prescribed during pregnancy are generally considered safe and effective when used as directed under the supervision of healthcare professionals. Iron supplements are available in various formulations, including oral tablets, capsules, and liquid preparations, making them convenient and easy to administer. Healthcare providers monitor maternal iron levels throughout pregnancy and adjust supplementation as needed to optimize iron stores and prevent anemia-related complications.

National and international health organizations, such as the World Health Organization (WHO) and the American College of Obstetricians and Gynecologists (ACOG), recommend routine iron supplementation for pregnant women to prevent and treat iron deficiency anemia. These guidelines are widely adopted by healthcare providers and form the basis for prenatal care protocols and antenatal screening programs. As a result, antianemia medications are routinely prescribed as part of standard prenatal care for pregnant women.

Distribution Channel Insights

The hospital pharmacy segment held the largest share of 2024 the pregnancy medication market in 2024. Hospitals often serve as primary points of care for pregnant women, particularly those with high-risk pregnancies or medical complications. Hospital pharmacies within these facilities are well-equipped to dispense a wide range of pregnancy medications prescribed by obstetricians, maternal-fetal medicine specialists, and other healthcare providers. This direct access to specialized care drives a significant portion of the demand for pregnancy medications within hospital settings.

Some pregnant women require hospitalization for the management of pregnancy-related complications, such as gestational diabetes, hypertension, or preterm labor. During hospital stays, patients may receive medications to control blood sugar levels, lower blood pressure, or prevent premature delivery. Hospital pharmacies are responsible for dispensing these medications and coordinating with healthcare teams to ensure appropriate medication management and monitoring.

The online pharmacy segment is observed to witness the fastest rate of expansion during the forecast period. The expansion of e-commerce sector, especially in urban areas promotes the segment's expansion in the market. Online pharmacies often offer a broader selection of pregnancy medications and related products compared to traditional pharmacies. Expectant mothers can choose from a variety of brands, formulations, and dosage forms to meet their specific needs and preferences. Additionally, online platforms may stock specialty or niche products that may not be readily available in local pharmacies.

Online pharmacies typically provide comprehensive information and educational resources about pregnancy medications, including dosage instructions, potential side effects, and safety precautions. Expectant mothers can access this information at their convenience, empowering them to make informed decisions about their healthcare and medication management during pregnancy.

Pregnancy Stage Insights

The 3rd-trimester segment held the largest share of the pregnancy medication market in 2024. period. The 3rd-trimester pregnancy involves the development and maturing of the brain, kidney, and lungs of the fetus in the mother's womb, which increases the nutritional requirements for the pregnant woman. Gynecologists prescribe a patient to increase their intake of protein and iron supplements to reduce the chances of anemia and boost the overall healthy development of the unborn child. Thus, the 3rd-trimester of pregnancy increases the demand for pregnancy medication such as antianemia, antacids, antiallergic, and other nutritional supplements. Thereby, the segment becomes the most prominent one in the market.

Recent Developments

- In March 2023, Pfizer unveiled its plans to launch RSV vaccines for older adults and pregnant women in the US and Europe. Pfizer opened a new tab and is ready to launch its respiratory syncytial virus (RSV) vaccine. Both Pfizer and British drugmaker GSK opened a new tab that has RSV vaccines which they are planning to launch in the United States and Europe.

- In November 2023, Wayne State launched a preterm birth awareness campaign. Wayne State University's Office of Women's Health serves as the coordinating center of the SOS MATERNITY Network in Michigan.

- In March 2023, BJ Government Medical College in Pune collaborated with Johns Hopkins

- University and Weill Cornell Medical College, USA launched a new study to assess Tuberculosis (TB), Human Immunodeficiency Viruses (HIV), and gestational diabetes among pregnant women.

Pregnancy Medication Market Companies

- Roche Holding AG

- Pfizer

- Glenmark Pharmaceuticals Ltd

- Alkem Laboratories Limited

- Lupin Limited

- Amgen Inc

- AbbVie

- Piramal Enterprises Limited

- Sanofi

- Janssen

- Sun Pharma

- Regeneron

- Dr. Reddy's Laboratories

- Alembic Pharmaceuticals Ltd

- Takeda

- Cipla Inc

- Viatris Inc(Mylan Inc.)

- GSK

Segments Covered in the Report

By Type

- Drug Class

- Antianemia

- Antacids

- Antiallergic

- Analgesics

- Antimicrobials

- Nutritional Supplements

- Others

By Distribution Channel

- Hospital Pharmacy

- Retail Pharmacy

- Online Pharmacy

By Pregnancy Stage

- 3rd-trimester

- 1st trimester

- 2nd trimester

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting