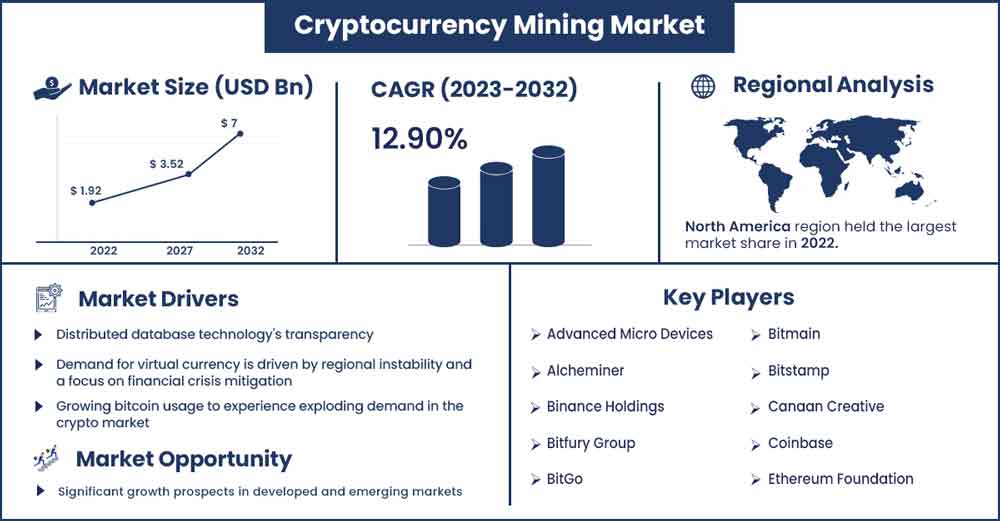

Cryptocurrency Mining Market Will Grow at CAGR of 12.90 % By 2032

The global cryptocurrency mining market size surpassed USD 1.92 billion in 2022 and it is projected to attain around USD 7 billion by 2032, poised to grow at a CAGR of 12.90% from 2023 to 2032.

Bitcoin and various other cryptocurrencies spawn additional coins and validate fresh payments through a process called cryptocurrencies to mine. It involves the use of massive, distributed computer systems throughout the globe to secure and validate blockchains, which are digital ledgers that store Bitcoin transaction data. For using their computing power, machines in the system are paid with fresh bitcoin. Miners protect and uphold the blockchain in a positive feedback loop.

The blockchain offers rewards in the form of currencies, and the coins give the miner motivation to keep the network up to date. By resolving puzzles, people create new bitcoins through the crypto mining procedure. And over the past few years, miners have advanced significantly, employing sophisticated technology to expedite mining activities. As a result, businesses are developing sophisticated mining equipment for their clients. Additionally, some businesses are working together to offer their clients a variety of services. As a result, as the market's need for mining pools grows, so does the need for cutting-edge mining equipment. Nevertheless, the high transaction costs associated with it can limit the market's expansion.

Report Highlights:

One of the main factors propelling the development of the crypto mining hardware market seems to be the steady rise of retailers accepting cryptocurrencies. The use of cryptocurrencies like Bitcoin and Ether by large shops for conducting financial transactions is growing significantly. Businesses and salesmen are progressively utilizing cryptocurrencies for everyday transactions, which has a positive impact on how customers view their use. Over the coming few years, the worldwide market for crypto mining gear is expected to rise as more developed nations adopt cryptocurrency mining solutions like cloud mine and distant hosting. Throughout 2022, the industry for cryptocurrency mining gear will grow as a result of investments made in mining-specific equipment by significant technology companies and an increase in the need for machinery made in China.

Regional Snapshots:

In terms of global cryptocurrency share of the market, North America is anticipated to have the greatest proportion. This is because of various developments in technology, the widespread presence of key players, and the growing demand for cryptocurrencies in this area. A quarter of American investors are investing in the cryptocurrencies and mining industries. The U.S. is a prominent player in the cryptocurrency mining sector, which has enormous potential. The industry for mining cryptocurrencies is expanding at the quickest rate in the Asia Pacific. Since mining cryptocurrencies is a significant industry in the region of the Asia-Pacific which accounts for over half of a global supply, The region is home to large data center computing companies that are mining cryptocurrencies.

Cryptocurrency Mining Market Report Scope:

| Report Coverage | Details |

| Market Revenue in 2023 | USD 2.17 Billion |

| Projected Forecast Revenue in 2032 | USD 7 Billion |

| Growth Rate from 2023 to 2032 | CAGR of 12.90% |

| Largest Market | North America |

| Base Year | 2022 |

| Forecast Period | 2023 To 2032 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics:

Drivers:

Especially in Asian countries where multiple instances of unlawful or fraudulent operations, such as the removal of scheduled charges, are frequently encountered, there are concerns with just a lack of accountability and when contact conditions without the knowledge of stakeholders. This could be the consequence of a mechanical malfunction, human error, or data manipulation even throughout the transaction process, costing customers a substantial sum of money. Financial institutions also frequently conceal their errors. Due to its insufficient transparency, the current monetary system is unpopular with the general people.

Restraints:

The market for cryptocurrencies is still unregulated. The acceptance of cryptocurrencies is now being held back by several important concerns, including a lack of laws and ambiguity surrounding them. Regulatory adoption is still one of the largest obstacles, even though finance regulatory authorities from all over the world are attempting to develop universal standards regarding cryptocurrencies. Authorities and policymakers at the national and global levels have a lot of questions regarding distributed ledger computing because it is still in its infancy.

Opportunities:

Emerging areas and developed countries (like the US, Germany, and Japan) are expected to offer significant development potential for enterprises operating in the cryptocurrency sector. For instance, in 2020, cryptocurrency companies in Brazil agreed to a rule of character with the goal of legitimizing and accelerating the adoption of digital currency in the country. Abcripto, the nation's association of cryptocurrency companies, signed the document on its behalf. The purpose of the Agreement is to establish operational procedures and compliance standards for all Participants. The code has been signed by several well-known bitcoin businesses from the country, including Cryptocurrency Market, Ripio, Foxbit, and Nolvadex.

Challenges:

Cryptocurrencies have the potential to reform and revolutionize peer-to-peer and conformity-free transfer transactions, but end users must get beyond some challenges related to security, secrecy, and control to use bitcoin. Because bitcoin, a shared distributed database, stores cryptocurrency transactions, hackers have a sizable attack surface to gather critical information. If the file is duplicated and used to store confidential information regarding contracts or credit card info, attackers will probably find it easier to reach the public ledger. if the key is compromised. The data can be retrieved using a hub-spoke design or a distributed system.

Recent Developments:

- In January 2022, Hut 8 Mining Corporation acquired the cloud hosting and founder network equipment businesses of TeraGo Inc. A wide range of customizable cloud services is also included in the arrangement, along with 5 data centers in Canada. As a consequence, this will help the business increase both its customer base and market share.

- In August 2021, iMining Tech disclosed that they have acquired the three validators defending the Ethereum Proof-of-Stake network. The three Eth 2.0 validators are online and operational. Due to the acquisition, the company will be able to cut costs and months of losing bets, which will help it grow.

- 650 banks and credit unions will be able to purchase cryptocurrencies starting in June 2021 as a result of a collaboration between NYDIG, a holding company for digital investments, and NCR Corporation. NCR Banking customers who already purchase virtual currency through third-party marketplaces have requested the project in response to customer demand.

- In March 2021, Visa Inc. accepted cryptocurrency direct payments exclusively on the Ethereum Blockchain and plans to make them a new type of service payment. With this significant project, the company intends to increase the usage of cryptocurrencies in the financial sector.

- Binance acquired Mumbai, India-based WazirX Bitcoin exchange in January 2020. Wiacquiredth this acquisition, Binance.com places a strong emphasis on expanding its business portfolio in India. To facilitate trading Binance virtual currency with purchases of Tether or USDT, WazirX's peer-to-peer (P2P) engines will be coupled with the Fiat Gateway platform, which Binance has licensed.

- Early in October 2018, the Singapore-based Qtum Network Foundation and AWS China collaborated to implement blockchain technologies on the AWS cloud. With the use of Amazon Elastic compute cloud images, this partnership intends to make it easier and more efficient for AWS users to design and distribute payment solutions (AMI).

- In March 2018, NVIDIA's potential inference market reached 30 million hyper-scale web servers, and the cost of offering services driven by deep learning was dramatically decreased.

- In February 2018, AMD released the Ryzen Embedding V1k and EPYC Embedding 3k series processors, which provide outstanding connection, on-chip security, and excellent quality.

Major Key Players:

- Advanced Micro Devices

- Alcheminer

- Binance Holdings

- Bitfury Group

- BitGo

- Bitmain

- Bitstamp

- Canaan Creative

- Coinbase

- Ethereum Foundation

- Ifinex

- Intel

- Ledger SAS

- NVIDIA

- Ripple Labs

- Xapo

- Xilinx

Market Segmentation:

By Offering

- Hardware

- Software

By Process

- Mining

- Transaction

By Type

- Bitcoin

- Ethereum

- Bitcoin Cash

- Ripple

- Litecoin

- Dash

- Others

By End-User

- Trading

- E-commerce and Retail

- Peer-to-Peer Payment

- Remittance

Buy this Research Report@ https://www.precedenceresearch.com/checkout/2524

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 9197 992 333