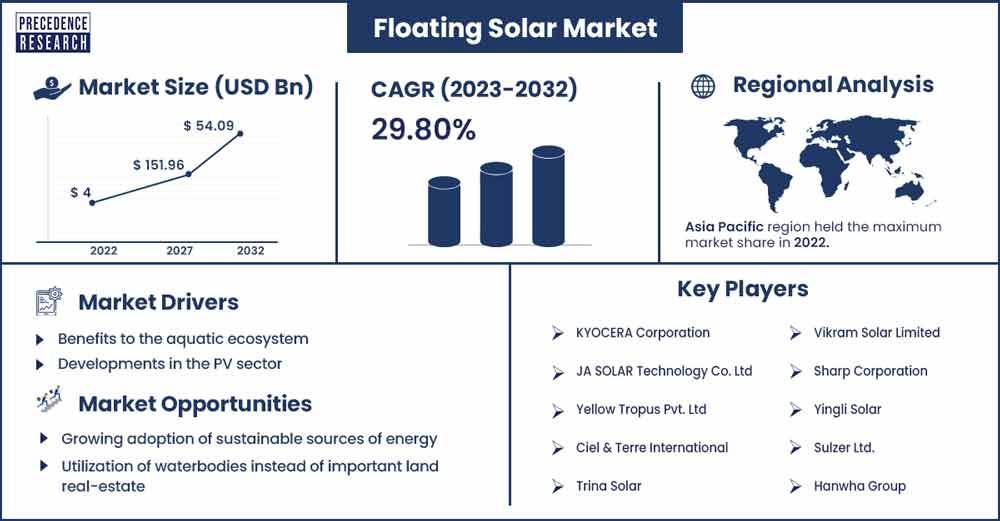

Floating Solar Market Will Grow at CAGR of 29.80% By 2032

The global floating solar market size was exhibited at USD 4 billion in 2022 and is anticipated to reach around USD 54.09 billion by 2032, growing at a CAGR of 29.80% from 2023 to 2032.

Market Overview

Floating solar panels, also known as floating photovoltaic (FPV) systems, represent an innovative method of harnessing solar energy by installing solar panels on the surface of bodies of water such as oceans, lakes, reservoirs, canals, and irrigation ponds. With an increasing number of countries pledging to achieve competitive solar and broader renewable energy targets, adopting FPV becomes pivotal in achieving these ambitious goals. A notable trend in the global market is the rise of solar-tracking floating panels, which are expected to grow in value.

Floating solar panels are gaining traction as a cost-effective alternative to land-based photovoltaic systems, as the presence of water in the systems enhances the efficiency of solar modules, which is particularly valuable in hot climates and presents opportunities globally. They play a crucial role in the ongoing energy transition by offering a viable solution for solar markets encountering challenges with traditional photovoltaic (PV) applications.

Also, installing floating solar panels in a reservoir can decrease annual water evaporation losses. A recent study in the International Journal for Innovative Research in Science and Technology highlighted the effectiveness of floating solar photovoltaics in large reservoirs. The system has the potential to significantly decrease evaporation losses by up to 70%, simultaneously providing shade to shield the water from direct sunlight.

Companies in the floating solar industry express optimism regarding the global expansion of large-scale projects. They are mainly focused on utility-scale floating solar plants, anticipating a significant impact on reducing fossil fuel imports worldwide and saving countries money in foreign currencies. However, the success of floating solar plants hinges on meticulous site selection. Businesses should thoroughly understand the geography of the waterbed to ensure suitability for anchoring floats. Anchoring is essential to mitigate the risk of solar islands colliding with banks or being displaced during storms by evenly distributing the loads caused by wind and waves.

Regional Snapshot

Asia Pacific (APAC) is expected to experience a surge in the adoption of floating solar technology due to its substantial market potential. The region has approved numerous designs and structures for these panels due to limited available land and a finite supply of fossil fuels. Governments in the region have facilitated the proliferation of floating solar panels to meet the growing demand for electricity while minimizing ecological impact. The regional dominance of floating solar panels in India, China, and Japan can be attributed to heightened government support, consistently rising energy costs, and an increasing awareness of the benefits of solar energy use.

In Japan, the widespread adoption of floating solar panels is driven by limited land availability and a restricted supply of fossil fuels. Consequently, the government has approved various initiatives for deploying floating panels to address the increasing demand for electricity while minimizing the environmental impact. Furthermore, the anticipated reduction in solar panel costs in the region and growing awareness of floating solar technology are poised to propel market growth in the coming years.

Floating Solar Market Report Scope

| Report Coverage | Details |

| Market Revenue in 2023 | USD 5.17 Billion |

| Projected Forecast Revenue by 2032 | USD 54.09 Billion |

| Growth Rate from 2023 to 2032 | CAGR of 29.80% |

| Largest Market | North America |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Benefits to the aquatic ecosystem

The FVP systems can cut evaporation losses by 70% and offer shade to shield water from direct sunlight. A recent study in an international science and technology journal explored the potential of floating solar panels in large reservoirs. By installing these panels, we can reduce yearly water evaporation by an average of 1250 million liters per square km, equivalent to about 4 million gallons per acre. The panels also block sunlight, essential for photosynthesis and algae growth, improving water quality. This, in turn, slows algae growth, reducing labor and medical care costs and boosting demand for floating solar panels.

Developments in the PV sector

Driven primarily by the expansion of the stationary floating solar panel sector, the market for floating solar panels is predicted to grow. Stationary floating solar PV systems, consisting of cables, aluminum solar panel frames, and inverters, are installed on the water's surface. Generally, more cost-effective than mobile or tracking solar panels, stationary panels are gaining increased demand, supported by the promising future of the market and numerous large-scale projects. The distinct capital and operating costs of solar tracking floating panels versus stationary panels contribute to this growing demand, benefiting manufacturers.

Restraint

Complex installation

Special floaters anchored to the bottom of the reservoir are required to prevent the panels from moving in the wind. The tracking technology for these panels is still in its early stages. One significant challenge facing the global market for floating solar panels is the high installation cost associated with the panels or systems. The elevated investment costs jeopardize the system's profitability and create uncertainty about project investment, hindering market expansion. Additionally, a lack of awareness about sustainable products has limited the market's growth. Generally, this technology is more expensive than stationary systems, influencing overall project costs.

Opportunities

Growing adoption of sustainable sources of energy

As natural resources deplete and concerns about fossil fuels rise, there's a growing demand for renewable energy. Solar energy, a readily available source, is gaining popularity. Floating solar panels, offering advantages over land-based ones, are expected to increase demand, especially in water-rich regions. Supportive government policies and a skilled labor pool are boosting investor confidence. Floating solar panels provide an efficient solution in regions facing energy crises, and developing tracking systems enhances their overall effectiveness.

Utilization of waterbodies instead of important land real-estate

Using floating solar panels reduces the need for expensive land and precious farmland. This opens up land for other purposes and decreases the pressure on solar energy production. This creates profitable opportunities in the market. Installing solar panels on water bodies avoids conflicts over land use and eliminates the need for extensive site preparations, like levelling or foundation laying, required for land-based solar installations. Floating solar represents a new frontier in the global expansion of renewable energy and is poised to increase as technologies mature.

Recent Developments

- In July 2023, the solar developer Noria Energy, based in California, introduced a 1.5-megawatt floating solar power system on the reservoir at Colombia's Urrá Dam. This marks the largest project of its kind in South America.

- In September 2023, the Philippines plans to launch a pioneering 100-megawatt floating solar farm in Cadiz City, northern Negros Occidental. Developed through a partnership between Zonal Renewables Corp. (ZRC) and property owner A.M. Hijos Inc. (AMHI), this project, the first of its kind in Visayas and Mindanao, will be located on a 90-hectare fishpond in Barangay Tinampaan.

- In August 2023, Kyocera Corporation announced plans for a new Center for Development at its Shiga Yasu Campus in Japan. The center will consolidate production engineering and development functions, fostering collaboration among Kyocera's business divisions. It also aims to serve as a training ground for the development of future engineering leaders.

- In September 2023, JA Solar achieved a significant milestone by becoming the inaugural Chinese private-sector company and the world's foremost solar PV company to join the World Business Council for Sustainable Development (WBCSD). This historic membership was announced during the New York United Nations Sustainable Development Goals Summit.

- In June 2023, Vikram Solar Ltd-backed venture VSK Energy LLC will invest up to $1.5 billion in the U.S. solar energy supply chain, starting with a Colorado factory next year. The company aims to leverage India's solar manufacturing expertise to contribute to the U.S. clean energy manufacturing sector, positioning itself in competition with China.

Key Market Players

- KYOCERA Corporation

- JA SOLAR Technology Co. Ltd

- Yellow Tropus Pvt. Ltd

- Ciel & Terre International

- Trina Solar

- Vikram Solar Limited

- Sharp Corporation

- Yingli Solar

- Sulzer Ltd.

- Hanwha Group

Segments Covered in the Report

By Capacity

- Below 5MW

- 5MW – 50MW

- Above 50MW

By Type

- Stationary Floating Solar Panels

- Tracking Floating Solar Panels

By Connectivity

- On grid

- Off grid

Buy this Research Report@ https://www.precedenceresearch.com/checkout/1587

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 9197 992 333