Floating Solar Market Size and Forecast 2025 to 2034

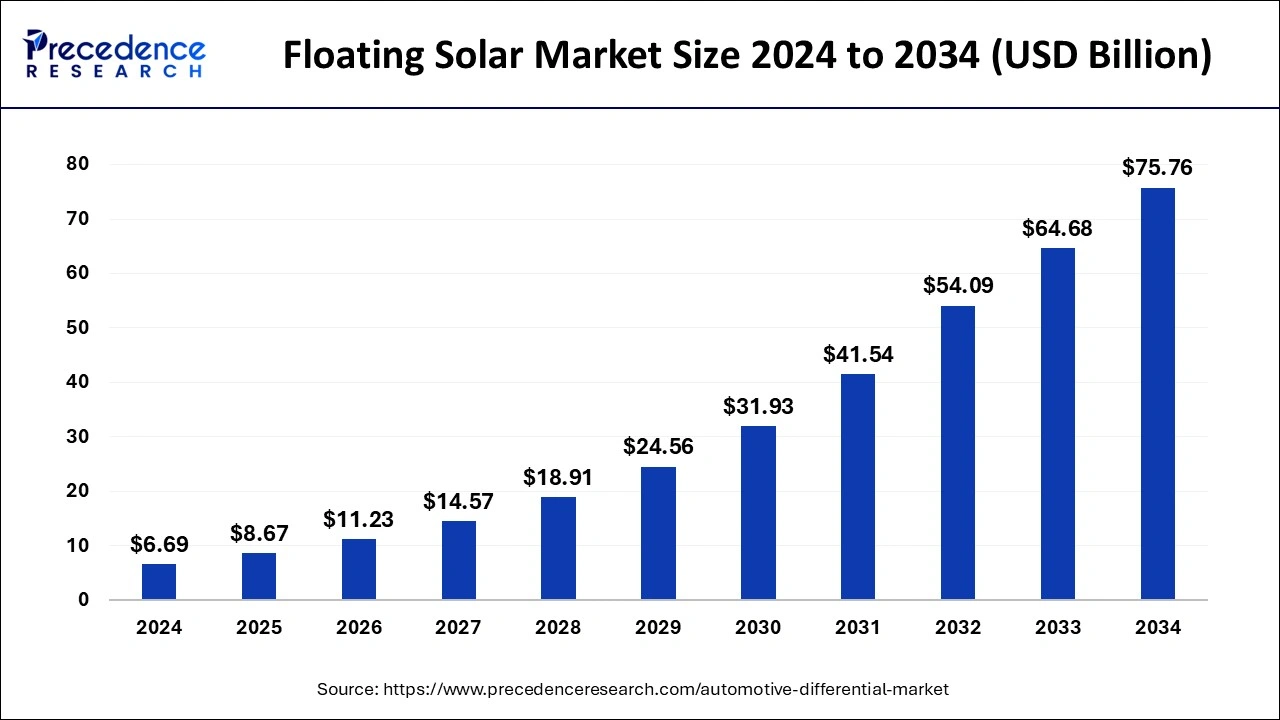

The global floating solar market size was accounted for USD 6.69 billion in 2024 and is anticipated to reach around USD 75.76 billion by 2034, growing at a CAGR of 27.47% from 2025 to 2034.

Floating Solar Market Key Takeaways

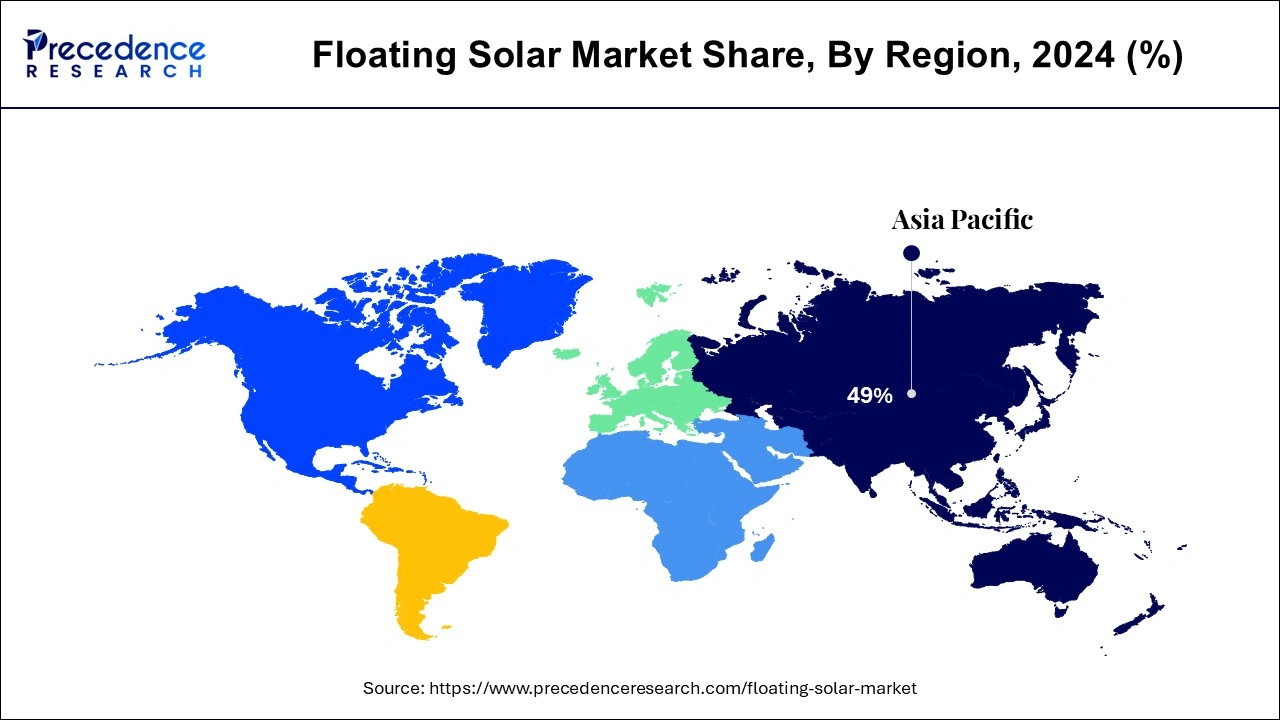

- Asia Pacific dominated the globalfloating solar market with the largest market share of 49% in 2024.

- North America is projected to expand at the notable CAGR during the forecast period.

- By type, the stationary floating panels segment has held the largest market share in 2024.

- By capacity, the 5 MW-50 MW segment captured the biggest market share in 2024.

- By connectivity, the on-grid segment contributed the highest market share in 2024.

Impact of Artificial Intelligence (AI) on the Floating Solar Market

Artificial Intelligence (AI) has proven to be a game changer for the better in solar floating projects. Beyond pure efficiency, AI is changing the way use solar energy, making solar panels smarter, more flexible, and more environmentally friendly. AI in floating solar is falling into the realm of predictive analytics. Advanced algorithms analyze historical and real-time data, including weather patterns, sunlight exposure, and water. AI-powered monitoring systems increase the overall efficiency of floating solar projects. These systems continuously analyze data from sensors placed on the floating platform to identify potential problems or inefficiencies. AI also plays a key role in planning. By predicting equipment failure or wear and tear based on data patterns, AI can improve maintenance, reduce downtime, and increase operational efficiency, thereby spurring the development of the floating solar market.

Asia Pacific Floating Solar Market Size and Growth 2025 to 2034

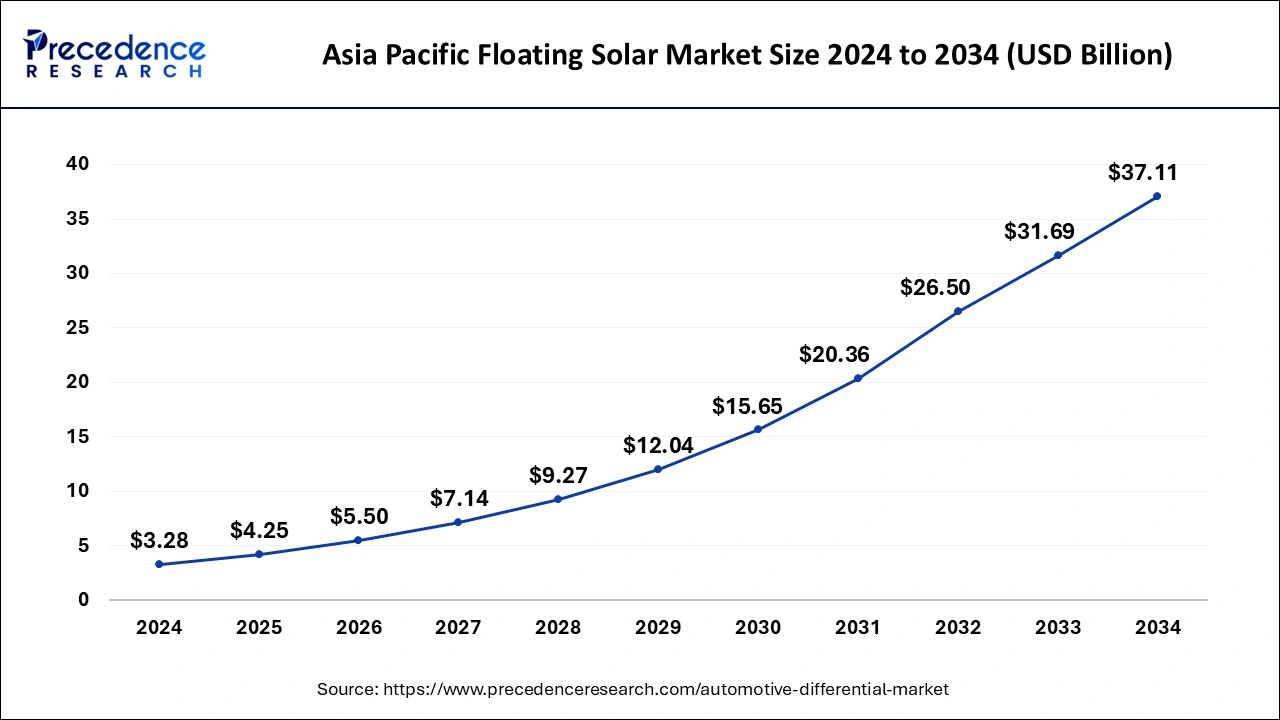

The Asia Pacific floating solar market size was evaluated at USD 3.28 billion in 2024 and is predicted to be worth around USD 37.11 billion by 2034, rising at a CAGR of 27.49% from 2025 to 2034.

The Asia Pacific region experiences high levels of solar irradiance, making it conducive to solar energy generation. Floating solar panels on water bodies benefit from increased sunlight exposure, leading to higher energy yields compared to land-based solar installations. Several countries in the Asia Pacific have implemented supportive government initiatives and policies to promote renewable energy, including floating solar. Incentives, subsidies, and favorable regulations have encouraged the adoption of floating solar technologies.

Countries such as India, China, and Japan have embraced technological advancements in floating solar technology. Ongoing research and development initiatives, along with collaborations with international innovators, have led to improved efficiency and cost-effectiveness of floating solar installations.

- In August 2023, Madhya Pradesh state in India launched its first module of floating solar system in Omkareshwar. This new floating solar project aims to achieve the state's renewable purchase obligation (RPO) target.

China is observed to be one of the largest contributors to the market's development in the upcoming period. China has embraced large-scale deployment of floating solar projects, leveraging its expansive water surfaces, including lakes, reservoirs, and ponds. This commitment to scale has propelled the country to the forefront of the global floating solar market. In April 2023, Chinese yard CIMC Raffles delivered China's first ever semi-submersible photovoltaic power generation platform to CIMC Offshore Solar Technology.

North America is observed to witness the fastest rate of growth in the floating solar market during the forecast period. North America has witnessed a growing commitment to renewable energy sources, including solar power. Governments, businesses, and communities are increasingly recognizing the environmental and economic benefits of transitioning to cleaner energy alternatives. The region has seen innovative deployments of floating solar projects on various water bodies, including reservoirs, ponds, and lakes. These projects often involve collaborations between government entities, utilities, and private companies to maximize energy generation and address specific energy needs.

Market Overview:

The solar panels attached to a structure that floats on a body of water, usually a reservoir or lake, are known as floating solar or floating photovoltaics. The fundamental benefit of floating photovoltaic plants is that they do not require any land, with the exception of the small areas required for the electric cabinet and grid connections. Their cost is equivalent to that of land-based plants, but they offer a smart option to avoid using up the land.

The use of floating solar panels has been highlighted as a viable and cost-effective alternative to land-based photovoltaic systems. It's a novel way to generate solar energy by utilizing the available water surface on dams, reservoirs, and other bodies of water. Solar panels that float on water, such as irrigation ponds, reservoirs, lakes, canals, and the ocean, are known as floating solar panels.

The companies in the floating solar industry are optimistic about the expansion of large-scale projects all around the world. They're putting more emphasis on utility-scale floating solar plants, which will help to reduce fossil fuel imports in various parts of the world while saving countries money in foreign currencies.

Growth Factors of the Floating Solar Market

- Floating solar power plants reduce the need to reclaim agricultural land or land for solar farms by using non-polluting water sources such as rivers, lakes, and ponds, which leads to the growth of the floating solar market.

- The water body has inherent reflective properties, thus increasing the value of floating solar panels and leading to the development of the floating solar market.

- Floating solar panels contribute to water conservation by reducing the evaporation of the water body they occupy. Especially in arid and semiarid regions where water resources are insufficient, the shading effect of floating solar panels can prevent water evaporation and save important water resources, thus leading to the development of the floating solar market.

- Floating solar power plants can have lower financial requirements compared to land-based solar power plants. They bypass the need for land acquisition and general site planning, which often involves significant expenses, that have led to the growth of the floating solar market.

ReportScope of theFloating Solar Market

| Report Coverage | Details |

| Market Size by 2034 | USD 75.76 Billion |

| Market Size in 2025 | USD 8.67 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 27.47% |

| Largest Market | Asia Pacific |

| Bae Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Capacity, Type, Geography |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Type Insights

The stationary floating panels segment held the dominating share of the market in 2024. Stationary floating solar panels are often considered more cost-effective to install and maintain compared to other floating solar technologies. Their simpler design and fixed structure can result in lower upfront costs and reduced maintenance requirements. Stationary floating panels are relatively easier to install and require less complex engineering compared to some other floating solar solutions, such as tracking systems. This ease of installation can make them a preferred choice for project developers seeking efficient deployment.

CapacityInsights

The 5 MW-50 MW segment held the significant share of the floating solar market in 2024; the segment is observed to sustain the position throughout the forecast period. Floating solar projects within the 5 MW to 50 MW range are often considered optimal in terms of size. They strike a balance between being large enough to benefit from economies of scale and small enough to efficiently manage and deploy. This size range allows for substantial electricity generation without facing some of the challenges associated with extremely large projects.

Moreover, the feasibility, grid integration and cost-effectiveness of the solar projects that hold the capacity of 5 MW to 50 MW propel the overall growth of the segment. Floating solar projects in the 5 MW to 50 MW range can be designed to have a positive environmental impact without causing significant disruption to aquatic ecosystems.

Connectivity Insights

The on-grid segment held the largest share of the floating solar market in 2024. On-grid floating solar systems are directly connected to the existing electricity grid. This integration allows for a seamless supply of solar-generated electricity to the grid, contributing to the overall energy supply. Utilities and energy providers find on-grid connectivity more convenient for managing and distributing solar power efficiently.

Floating Solar Market Companies

- KYOCERA Corporation

- JA SOLAR Technology Co. Ltd

- Yellow Tropus Pvt. Ltd

- Ciel & Terre International

- Trina Solar

- Vikram Solar Limited

- Sharp Corporation

- Yingli Solar

- Sulzer Ltd.

- Hanwha Group

Recent Developments

- In September 2024, Ameresco, Inc., a leading clean utility focused on energy and renewables, celebrated the completion of the first solar farm in Utah's Mountain River Development Coordination, which has a dedicated site. The floating solar project is located on the lake at the Power Mountain Water Treatment Plant and was celebrated with a ribbon-cutting ceremony attended by representatives from Ameresco, Mountain Water, and Rocky Mountain Power. Lou Maltezos, Executive Vice President of Ameresco, said, “The notion that solar panels must be installed on land is an unnecessary limitation. By reconsidering their placement, we unlock new opportunities for sustainability. The District isn't just implementing solar energy for its own sake – they are deeply invested in the economic aspects of this project. This first-ever floating solar array in Utah is both innovative and economically feasible, making it a prime example of sustainable development.”

- In June 2024, Technique Solaire Group, an independent renewable energy producer dedicated to transforming agriculture, will expand its global presence through the acquisition of new jobs to be “Ready-to-Build” in the Netherlands and Spain. The group is adding 58 MWp to its development pipeline.

- In December 2023, Abu Dhabi Future Energy Company PJSC Masdar, one of the world's leading renewable energy companies, signed a cooperation agreement with Indonesian state-owned enterprise PLN to develop the largest project for the construction of the largest solar power plant in the southeast Asia and the green hydrogen opportunity. Masdar and PLN's partnership builds on The COP28 climate change conference in the UAE. The floating plant stands in the Cirata reservoir in West Java, Indonesia The plant generates enough renewable energy to power 50,000 homes, while displacing 214,000 tonnes of carbon emissions per year.

Segments Covered in the Report

By Capacity

- Below 5MW

- 5MW – 50MW

- Above 50MW

By Type

- Stationary Floating Solar Panels

- Tracking Floating Solar Panels

By Connectivity

- On grid

- Off grid

By Geography

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia-Pacific

- China

- India

- Japan

- South Korea

- Malaysia

- Philippines

- Latin America

- Brazil

- Rest of Latin America

- Middle East & Africa (MEA)

- GCC

- North Africa

- South Africa

- Rest of the Middle East & Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content