Floating Power Plant Market Size and Forecast 2025 to 2034

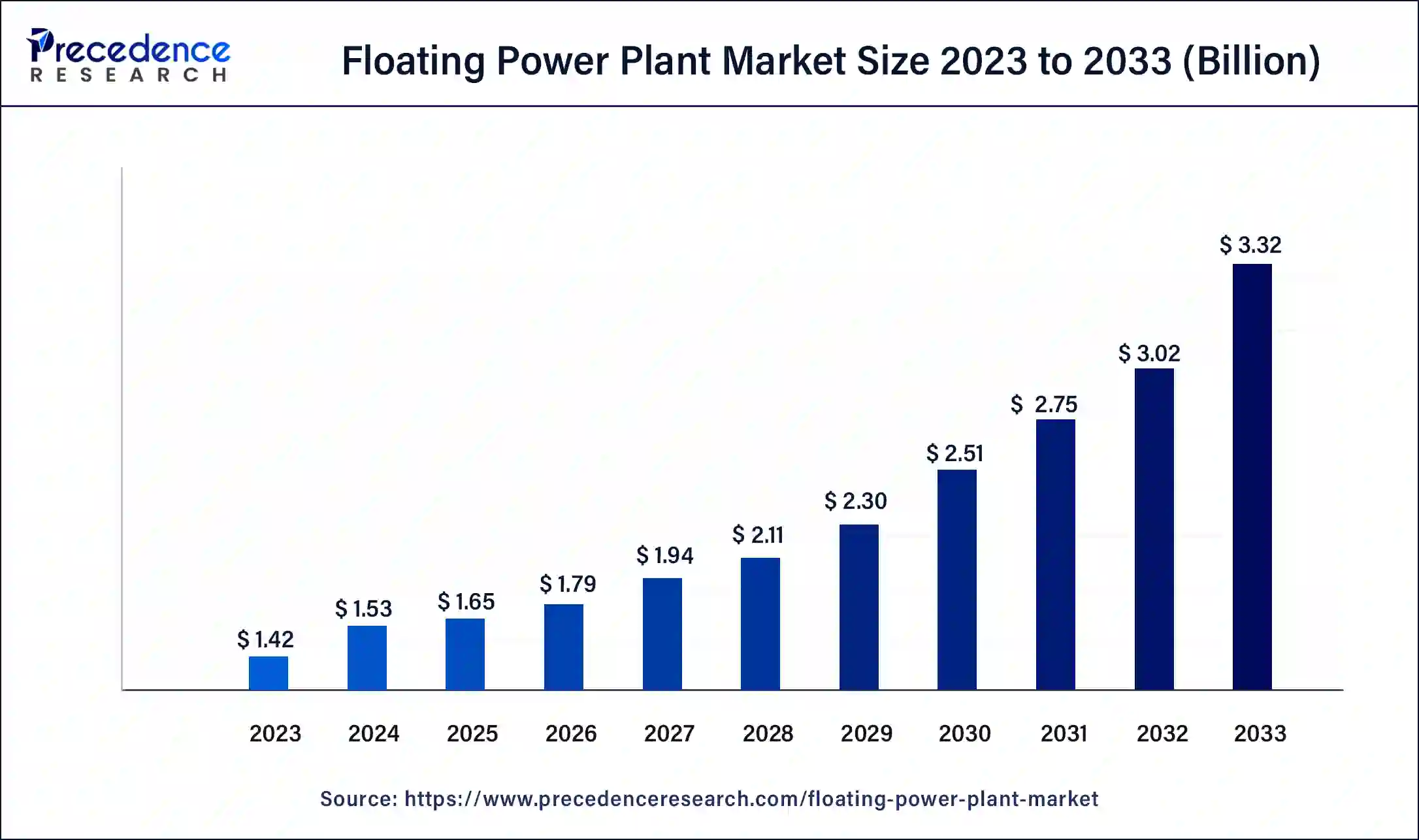

The global floating power plant market size accounted for USD 1.53 billion in 2024 and is expected to be worth around USD 3.51 billion by 2034, at a CAGR of 9.69% from 2025 to 2034. Floating power plants have many advantages, including land conservation, reduction of water evaporation, and cooler operating temperatures. They also support ecological balance by reducing algae growth in water bodies and permitting the coexistence of aquaculture.

Floating Power Plant Market Key Takeaways

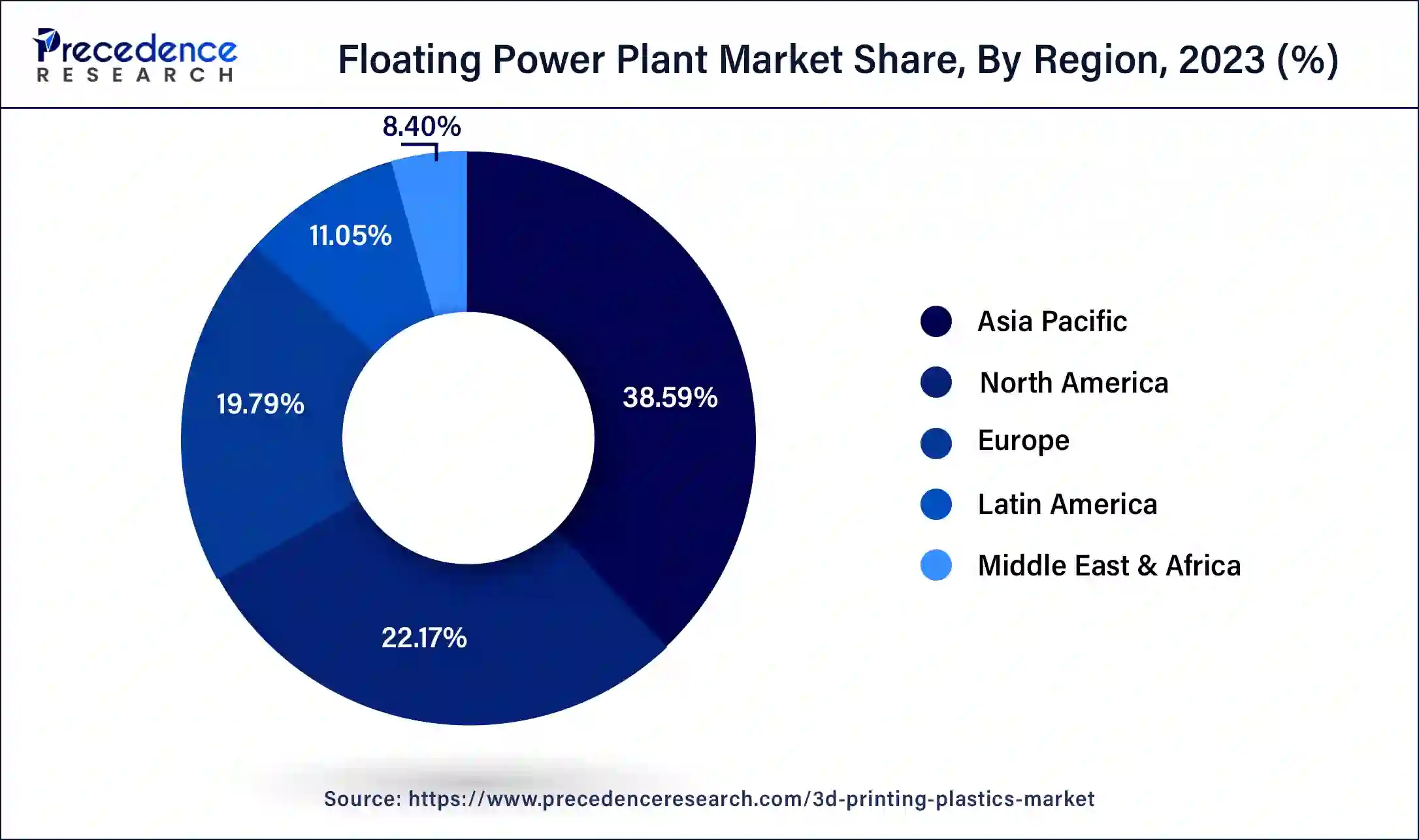

- Asia Pacific dominated the market with the largest revenue share of 38.59% in 2024.

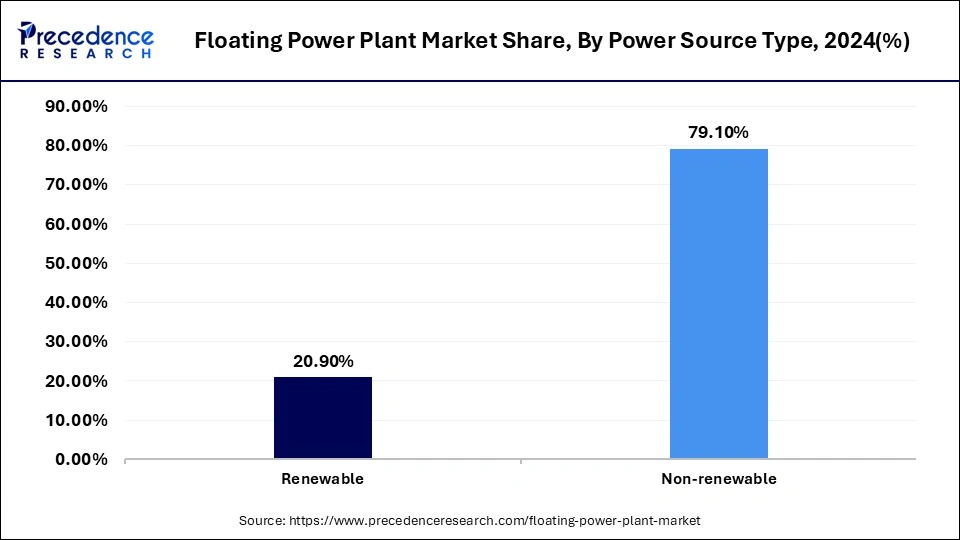

- By power source type, the non-renewable segment has held a major revenue share of 79.10% in 2024.

- By power rating type, the high-power segment has contributed more than 46.67% of revenue share in 2024.

- By power rating type, the medium-power segment is the fastest-growing during the forecast period.

What is the Role of AI in the Floating Power Plant Market?

Artificial intelligence (AI) makes this possible by turning chaotic environments into optimized, high-energy yield landscapes. From smarter anchoring and thermal modeling to ecological stewardship and predictive maintenance. AI is the silent engine keeping floating solar stable, efficient, and scalable. AI in power system can predict and identify system faults, improve real time monitoring, improve power flow, and stabilize the grid.

AI improves exploration processes in fossil fuel extraction while minimizing environmental impact. Grid management systems powered by AI improve energy distribution networks, adopting to fluctuating demand and integrating diverse energy sources without extra effort. AI benefits also include improved cybersecurity, easily handles big data, decision making, continuous learning and improvement, automate repetitive tasks, AI in risky situations, unbiased decisions, fraud detection, and minimizing errors.

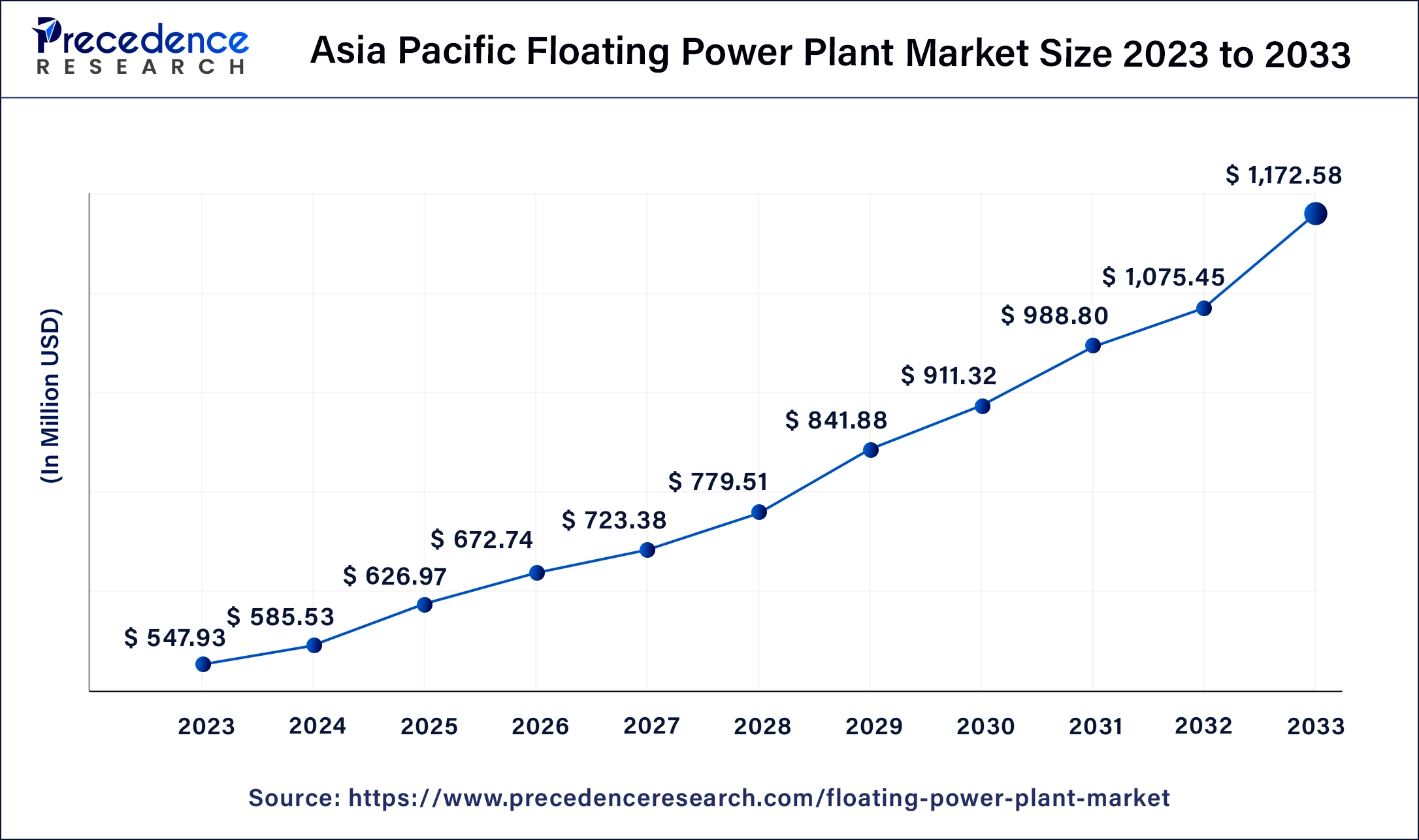

Asia Pacific Floating Power Plant Market Size and Growth 2024 to 2033

The Asia Pacific floating power plant market size was estimated at USD 585.53 million in 2024 and is predicted to be worth around USD 1,262.72 million by 2034, at a CAGR of 8.02% from 2025 to 2034.

Asia Pacific dominated the floating power plant market in 2024. Increasing adoption of renewable sources for energy generation and lack of power infrastructure helps the growth of the market in the Asia Pacific region. India and China are the leading countries for the growth of the market. In India, the Rihand Dam Floating Power Plant is a remarkable renewable energy project located in Uttar Pradesh on the Rihand reservoir.

Asia Pacific held a significant share of the floating power plant market in 2024.

- In February 2025, a new set of guidelines for the development of floating solar power plants, aimed at accelerating the state's renewable energy ambitions was approved by the Kerala Cabinet.

Kerala launches new guidelines to boost floating solar power projects - Elets eGov

- In August 2023, the two largest installations in India, Kayakulam in Kerala with 92MW, RamaGundam in Telangana with 100MW, and two smaller units at Auriya in Utter Pradesh with 20MW, and Kawas in Gujrat with 23MW capacity These four floating solar power plants were commissioned by CPSU (Central Public Sector Undertakings).

- In November 2023, Southeast Asia's largest floating solar power plant of 145MW was launched by Indonesian state utility Perusahaan Listrik Negara and Abu Dabi-based renewable energy company Masdar.

- In May 2024, two floating solar plants with 150MW capacity were established by the power transmission and distribution business of Larsen & Toubro in India.

Europe held the second-largest share of the floating power plant market in 2024. Increasing government investments, lack of power infrastructure, and demand for low-power energy led to the growth of the floating power plant market in the European region.

- In September 2023, Q Energy started work on Europe's largest floating PV plant with 74.3MW capacity in Northwestern France.

- In May 2024, for building and operating floating low-power nuclear generation projects, technology or floating nuclear power plant technology was offered by Russia to India.

Europe is projected to host the fastest growing market in the coming years.

- In June 2025, Europe's largest floating solar power plant was inaugurated by Q ENERGY. Les IIots Blandin plant, covering 12 7 hectares in Haute-Marne, has an installed capacity of 74.3 MWp, annually supplying electricity to the equivalent of 65% of the local urban community.

Q ENERGY inaugurates Europe's largest floating solar power plant - energynews

Market Overview

The floating power plant is a combination of marine technology and power generation, and it offers flexible and decentralized power generation. The floating power plant market is gaining momentum as a viable and sustainable solution for generating electricity. These floating power plants are available in remote locations where a traditional power plant may be problematic. These are surrounded by water that may be used for active cooling or passive cooling. These are easily transported for decommissioning, refurbishment, refueling, and relocation.

The floating power plants are earthquake-resistant, and almost no concrete or land is used. The floating power plants have many advantages, including a natural cooling effect, which improves efficiency and energy yield. These factors help to the growth of the market.

Floating Power Plant Market Growth Factors

- Surging deployment of advanced power quality monitoring & mitigation solutions

- Technological advancement

- Increasing integration of renewable energy

- Shifting focus toward grid modernization

- Renewable energy demand

Key Factors Influencing Future Market Trends

Renewable Energy Demand Increasing

The renewable energy policies will decarbonize power generation and bolster their energy supplies where there is abundant water. The increasing climate change concerns and decarbonization objectives bolster these trends, along with regions that are also land-limited and high in water, which have rising energy needs.

Hybrid Floating Power Systems

Hybrid Floating Power Systems could potentially achieve viable, scalable power systems, serve coastal and island geographies worldwide. Globally, coastal residents depend on their scalable, dependable hybrid floating power systems.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 1.65 Billion |

| Market Size in 2024 | USD 1.53 Billion |

| Market Size by 2034 | USD 3.51 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 9.69% |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Power Source Type, Power Rating Type, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Increasing electricity demand

For sustainable power generation, floating power plants are highly used. The network of photovoltaics/ photovoltaics or floating solar panels is mounted on a structure that is made to float on the surface of a water body, which may be a pond, irrigation canal, lake, or reservoir. Generally, floating power plants have a floating system, a mooring structure, or a pontoon to prevent panels from moving freely in the water. This floating power plant system generates electricity by using thermal energy and the underwater cable to transfer the generated power or electricity to the substation.

This type of floating power plant is gaining traction quickly because of its potential for efficiency and higher energy compared to traditional land-based power plant systems. A floating power plant may be helpful in fighting climate change. It can generate more capacity than land-based power plants. These factors help to the growth of the floating power plant market.

Restraint

Disadvantages of the floating power plant

The disadvantages of floating power plants include some negative impacts, such as ecosystem disruption. Large structures of the floating power plant in the water bodies may affect the aquatic ecosystem. The panel's shading may affect the aquatic plant's photosynthesis, which may have a negative effect on the aquatic life and water quality. Compared to land-based power plants, floating power plants are more expensive. The installation and material costs of the floating power plant are higher than those of the traditional ones. These factors can restrict the growth of the floating power plant market.

Opportunity

Rising innovation in floating technology

Increasing awareness and great potential for photovoltaic (PV) leads to rising innovation in floating technology. There is scope for the innovative search for flexible and sustainable energy sources from floating power plants. An improved range of energy efficiency can be obtained by the floating power plant. This floating power plant has a natural cooling effect from water, which improves energy efficiency and leads to a higher generation of energy than the traditional method. Minimum environmental impact and space utilization can be achieved with the help of a floating power plant. These opportunities help to the growth of the floating power plant market.

Power Source Type Insights

The non-renewable segment dominated the floating power plant market in 2024. Non-renewable power source types are highly used for floating power plants, including nuclear energy, thermal energy, liquified natural gas,gas turbines, IC (internal combustion) engines, diesel, etc. Nuclear energy is used in the floating power plant of the floating nuclear power plant type. Uranium fuel is highly used in nuclear reactors at the floating nuclear power plant. Floating power plants are helpful for converting mechanical energy or thermal energy into electrical energy by rotating turbines using energy sources such as nuclear power or natural gas, coal, oil, water, etc., and generating electricity by using a power generator that is connected to the turbines. IC engines-based floating power plants are highly used in the industry. Diesel engines are used in floating power plants to convert mechanical energy into electrical energy and have reliability, efficiency, and high energy density. Diesel fuel has various applications to provide electricity, such as primary power generation and backup power generation. These factors help the growth of the non-renewable power source type segment and contribute to the floating power plant market's growth.

The renewable segment is anticipated to grow at a remarkable CAGR of 8.76% between 2025 and 2034. Renewable power source types are used for floating power plants, including wind, solar, bioenergy, ocean, hydropower, and geothermal energy. A clean source of renewable power is solar energy. It has various benefits compared to traditional sources of power. This type of floating power plant uses solar energy, there is no requirement for raw materials, and also there are fewer operational costs. Renewable floating power plants are used to generate clean energy using natural resources like wind or the sun.

The sun's radiation is used in the floating power plant as a renewable power source to generate electricity. In wind farms, abundant wind resources are required to generate electricity. In the hydroelectric power plant, the potential energy of water is stored in dams to generate electrical energy. In marine power plants, the force of the sea is used to generate energy. These advantages of renewable power sources for energy generation have led to the growth of the renewable power source type segment and contributed to the growth of the floating power plant market.

- In March 2024, NMMC launched a 100 MW floating solar power plant (Navi Mumbai Municipal Corporation).

- In February 2024, a new solar plant, a 20MW floating solar power plant in Serendah, was developed by the Tan Chong Group to provide green energy.

The non-renewable segment underwent notable growth in the market during 2024.

- In March 2025, North India's largest floating solar power plant was launched by Chandigarh. Chandigarh's green energy drive is gaining momentum with a 4 MW floating solar power plant set to commissioned at Sector 39 water works in the coming financial year.

Chandigarh to Launch North India's Largest Floating Solar Power Plant - Elets eGov

The renewable segment is expected to grow at the fastest rate in the market during the forecast period of 2025 to 2034.

- In April 2025, West Africa's largest floating solar project, marking a significant step towards increasing its renewable energy capacity was launched by Ghana. The country aims to raise its share of renewable energy from the current 1% to 10% by 2030.

Ghana unveils West Africa's largest floating solar project, boosting renewable energy ambitions

Global Floating Power Plant Market Revenue, By Power Source Type, 2021-2023 (USD Million)

| Power Source Type | 2022 | 2023 | 2024 |

| Renewable | 276.88 | 296.73 | 319.24 |

| Non-renewable | 1,045.34 | 1,123.27 | 1,211.69 |

Power Rating Type Insights

The high-power segment dominated the floating power plant market in 2024. In the high-power rating type, it includes greater than 100 MW power. The floating power plant reduces the water's evaporation rate, and it also helps to maintain ambient temperature by improving electricity generation and efficiency. A 100MW capacity floating power plant may generate enough electricity to provide power to nearly 100000 homes for a day. These factors help the growth of the high-power rating type segment and contribute to the market's growth.

- In February 2022, a tender for the construction and operation of a 100 MW capacity floating power plant in eastern India's State of Jharkhand was launched by SECI (Solar Energy Corporation of India).

- In July 2022, NTPC (National Thermal Power Corporation Limited) at Ramagundam in the Peddapalli district of Telangana was developed as India's biggest floating power plant with 100MW capacity.

- In November 2023, a twin 100MW floating power plant tender was launched by the Shri Lankan government's Ministry of Power and Energy.

The medium-power segment is the fastest-growing during the forecast period. In medium-power floating power plants, power is 20MW to 100MW. It is used to prevent the evaporation of water and water cools. These help the growth of the medium-power power rating type segment and contribute to the growth of the floating power plant market.

- In February 2022, Ivory Coast launched a tender for a 20MW floating solar power plant in Kossou.

- In September 2023, a project management consultancy (PMC) service for a 20MW floating solar power plant project was issued by (APGCL) Assam Power Generation Corporation.

The high-power segment accounted for a considerable share of the market in 2024.

- In June 2025, international tender for floating power plant was launched by Mauritius. Mauritius seeks international investors to swiftly build a floating power plant of around 100 MW, aiming to secure the national energy supply by January 2026 and address current production shortfalls.

Mauritius launches international tender for floating power plant - energynews

The medium-power segment is predicted to witness significant growth in the market over the forecast period.

Global Floating Power Plant Market Revenue, By Power Rating Type, 2021-2023 (USD Million)

| Power Rating Type | 2022 | 2023 | 2024 |

| Low-power FPP | 241.35 | 259.22 | 279.49 |

| Medium-power FPP | 463.06 | 498.01 | 537.68 |

| High-power FPP | 617.82 | 662.77 | 713.76 |

Floating Power Plant Market Companies

- Ciel & Terre International

- Caterpillar Inc.

- Floating Power Plant A/S

- General Electric Company

- Ideol SA

- Kawasaki Heavy Industries, Ltd

- Kyocera Corporation

- MAN Disel & Turbo SE

- Seatwirl AB

- Siemens Gas and Power GmbH & Co.

- Wartsila

Recent Developments

- In February 2025, civil nuclear program focused on floating power plants was launched by CORE POWER. The program named Liberty, will include modular construction of advanced fission technology and create the regulatory and supply chain frameworks necessary to allow this technology to be rolled out worldwide.

CORE POWER launches civil nuclear program focused on floating power plants - Splash247 - In July 2025, operations of the world's first commercial scale floating photovoltaic (PV) power project located entirely offshore was officially commenced by China Petroleum & Chemical Corporation (Sinopec), in collaboration with the Shandong Provincial Government and Qingdao Municipality.

Sinopec Launches Its First Offshore Floating Solar Power Project, Pioneering Renewable Energy Innovation - SolarQuarter

Segments Covered in the Report

By Power Source Type

- Non-renewable

- Gas Turbines

- IC Engines

- Renewable

- Solar

- Wind

By Power Rating Type

- Low-power FPP

- Medium-power FPP

- High-power FPP

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting