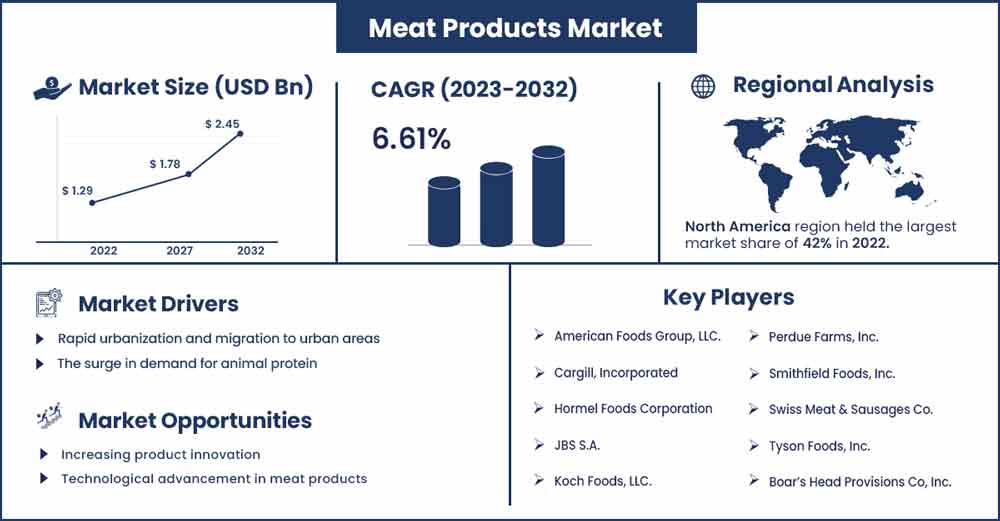

Meat Products Market To Attain Revenue USD 2.45 Bn By 2032

The global meat products market size was evaluated at USD 1.29 billion in 2022 and is expected to attain around USD 2.45 billion by 2032, growing at a CAGR of 6.61% from 2023 to 2032.

Meat products are fresh or cooked meat made completely or partially from the meat or other carcass of cattle, sheep, pigs, goats, or other animals. Meat is generally available in the form of processed meat or fresh meat. Other sorts of meat products include cultured meat and plant-based meat. Cultured meat, often known as clean meat, is cultivated under controlled conditions in a bioreactor. To match the sensory and nutritional properties of conventional meat, cultured meat is made from cells taken directly from animal tissues.

Processed meat is meat that has been cured by smoking, salting, fermenting, or adding chemicals to extend its shelf life and improve its flavor. Meats such as cattle, hog, turkey, chicken, and lamb are widely utilized in the production of processed meat. Processed meats include pepperoni, jerky, hot dogs, and sausages. Preservatives are used to preserve meat from spoiling due to bacteria and other organisms.

Report Highlights:

- On the basis of source, meat products are segmented into poultry, beef, pork, mutton, sheep, goats, birds, and others. The pork segment has gained a major share of the global market. Pork has a unique taste with a crisp texture and contains nutritional benefits.

- On the basis of product type, meat products are segmented into a processed meat, cultured meat, plant-based meat, chilled, frozen, and canned/preserved. The processed meat segment has gained a major share of the global market. Processed meat has a longer shelf life and is consumed on the move.

- On the basis of end-user, meat products are segmented into residential and commercial. The commercial segment has gained a major share of the global market due to increasing demand for food away from home.

- On the basis of distribution channel, it is divided into business-to-business and business-to-consumer. Business-to-consumer is the fastest growing segment as the popularity of specialty stores is increasing due to their unique offering to the consumer based on their need.

- On the basis of geography, the meat products market, North America is serving as the most dominating region among others. The dominance of the meat products market is largely due to the existence of meat production operations in North America

Regional Snapshots:

The Europe meat products market is one of the most promising regions that is expected to increase the sales of meat products in 2021. Due to the increase in the demand for simple and easy-to-eat food, the meat manufacturing sector is likely to develop in the next years. Over the projection period, the market will be propelled by rising consumer disposable income and an increase in the number of working professionals. Moreover, protein-rich processed foods have been in high demand as consumers in the country become more aware of the importance of getting enough protein. All these aspects are anticipated to drive the meat products demand in the region.

Meat Products Market Report Scope:

| Report Coverage | Details |

| Market Revenue in 2023 | USD 1.38 Billion |

| Projected Forecast Revenue in 2032 | USD 2.45 Billion |

| Growth Rate from 2023 to 2032 | CAGR of 6.61% |

| Largest Market | North America |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics:

Drivers:

Intense competition in the meat products market has encouraged market players to focus on strong branding and improved advertisements to attract consumers' interest. Branding and advertisement play a vital role in gaining consumer cognizance regarding the products. As a result, players are venturing into lucrative marketing campaigns to lure consumers. Furthermore, the trend of organic meat is increasing in the market. Consumers are capable of distinguishing between premium-quality meat and low-quality meat, which influences market sales of meat products. Market players are introducing grass-fed raised cattle meat without the use of artificial hormones and antibiotics.

For instance, in February 2020, Applegate Farms, LLC, a subsidiary of Hormel Foods Corporation, announced the launch of a creative advertisement campaign named "Go Applegatarian" to be advertised on television, YouTube, and other social media sites. The campaign's purpose is to create a new and passionate community of conscientious meat lovers who share the same passion for consuming the highest quality meat products. Applegate humanely raises its animals on farms that implement socially responsible environmental farming methods. The use of social media, strong branding, and advertisement is increasing the popularity and the sales of meat products, which, in turn, is likely to fuel the growth of the global market.

Restraints:

Processed meat has been designated as Group 1 carcinogenic by the World Health Organization, which indicates that there is convincing evidence that it can induce colorectal cancer. Red meat includes the molecule Haem. Haem is also accountable for the production of N-nitroso compounds, which cause bowel cancer by damaging the cell lining of the gut. Consuming more than 700 grams of processed meat every week raises the risk of cancer. A growth in consumer knowledge, a spike in health consciousness, and an increase in demand for healthy food items are just a few of the causes motivating the health-conscious populace to avoid eating processed meat. Therefore, the carcinogenic properties of red meat and processed meat hinder the growth of the global meat products market during the forecast period.

Opportunities:

The use of blockchain technology in the animal meat industry is in its early stages. The use of blockchain technology ensures transparency, traceability, efficiency, and sustainability in the animal meat industry. The awareness regarding meat quality and traceability is growing in the meat industry and the use of blockchain technology can provide assurance related to meat quality and enhance traceability. JBS S.A. announced the ‘Together for the Amazon’ program in 2020, under which JBS would progressively use blockchain technology to achieve sustainability and conserve the rainforests of Amazon. Moreover, blockchain technology will assure the prevention of animal laundering and leakage in the value chain, improving the effectiveness and efficiency of the supply chain of the animal meat industry. This will help to reduce the production cost of meat products and foster the revenue growth of the market players.

Recent Developments:

- In August 2021, Jennie-O Turkey a brand of Hormel Corporation launched turkey barbacoa a new product line in the turkey section. This move taken by brand is to extend the product portfolio and offer new product to the existing consumers.

Major Key Players:

- American Foods Group, LLC.

- Cargill, Incorporated

- Hormel Foods Corporation

- JBS S.A.

- Koch Foods, LLC.

- Perdue Farms, Inc.

- Smithfield Foods, Inc.

- Swiss Meat & Sausages Co.

- Tyson Foods, Inc.

- Boar’s Head Provisions Co, Inc.

- Conagra Foods, Inc.

- Maple Leaf Foods, Inc.

- Sigma Alimentos, S.A. de C.V.

- The Kraft Heinz Company

- WH Group Limited.

- Sysco Corporation

- OSI Group, LLC

- George’s Inc.

- Butterball LLC.

- Fresh Mark, Inc.

- Indiana Packer’s Corporation

- West Liberty Foods, Inc.

- Agri Beef Co.

- Clemens Food Group.

- Carl Buddig Co.

- Rastelli Foods Group.

- Dietz & Watson, Inc.

- Abby Land Foods, Inc.

- Dakota Provision LLC.

Market Segmentation:

By Source

- Poultry

- Beef

- Pork

- Mutton

- Sheep

- Goats

- Birds

- Others

By Product Type

- Processed Meat Products

- Fresh Processed Meat

- Raw Cooked Meat

- Pre Cooked meat

- Raw Fermented Sausages

- Cured meat

- Dried Meat

- Cultured Meat Products

- Plant-based meat

- Chilled

- Frozen

- Canned/Preserved

By End-User

- Residential

- Commercial

By Distribution Channel

- Business to Business

- Business to Consumer

- Hypermarket/supermarket

- Convenience stores

- Specialty stores

- Online retail

- Others

Buy this Research Report@ https://www.precedenceresearch.com/checkout/2534

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 9197 992 333