Ophthalmic Devices Market Revenue To Attain USD 70.37 Bn By 2033

Ophthalmic Devices Revenue and Trends

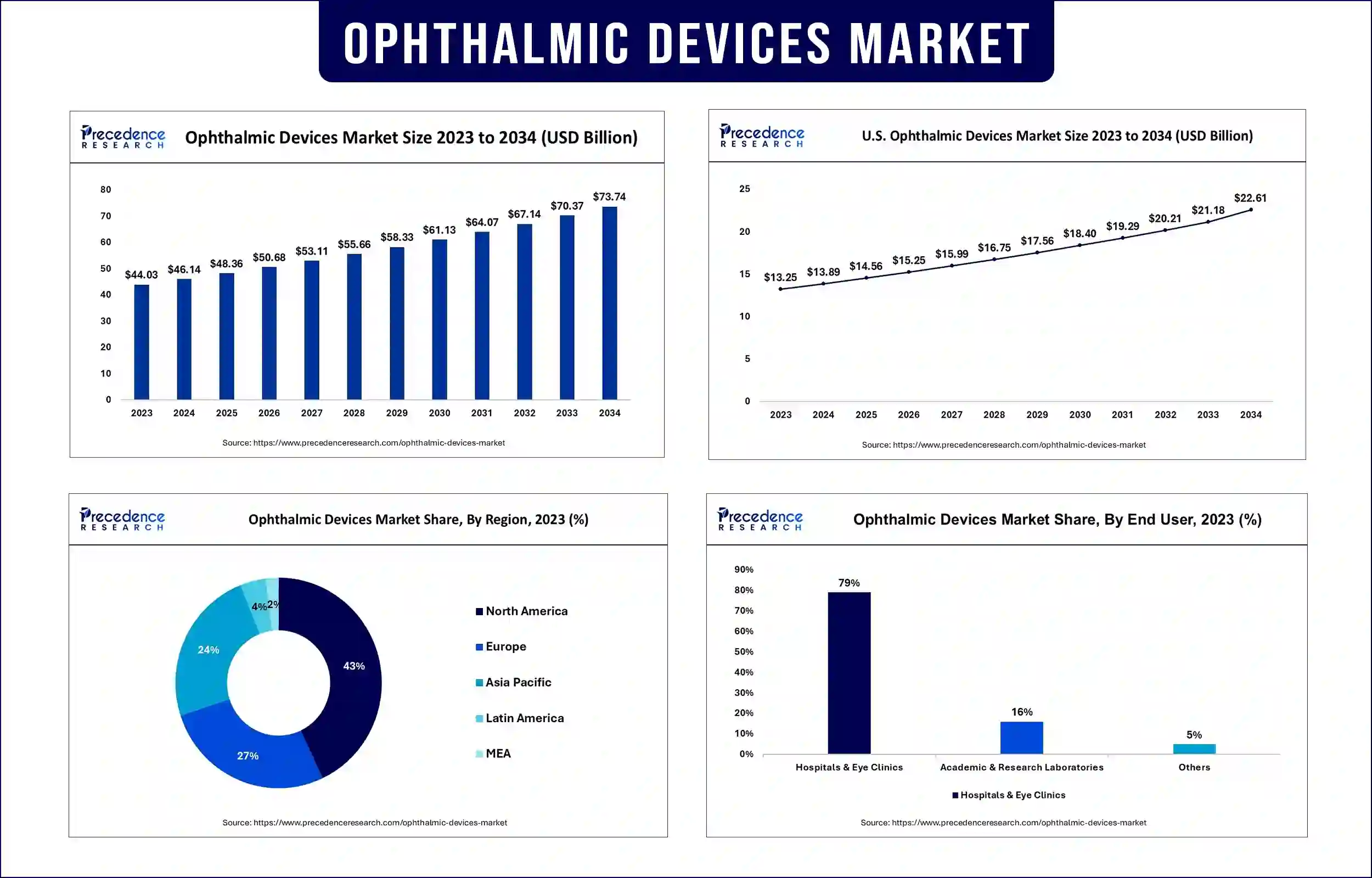

The global ophthalmic devices market revenue was USD 46.14 billion in 2023 and is predicted to be worth around USD 70.37 billion by 2033, expanding at a CAGR of 4.80% between 2024 and 2034. The demand for ophthalmic devices is increasing due to the rising prevalence of eye diseases. Rising advancements in ophthalmic devices and growing demand for vision correction procedures further contribute to market expansion.

Market Overview

Ophthalmic devices are used to treat eye defects and ocular abnormalities. The rising prevalence of eye diseases such as glaucoma, diabetic retinopathy, macular degeneration, and cataracts is fueling the market for ophthalmic devices. For quicker healing times and increased safety, ophthalmic devices are employed in various surgical procedures, including ultrasonic phacoemulsification. Ophthalmic devices include various diagnostic and surgical instruments, from high-end items like contact lenses, eyeglasses, and lens cleaning and disinfecting solutions to low-end products like phoropters, ophthalmoscopes, retinoscopes, and scanning laser polarimetry devices. The rising number of patients with vision impairments and the need for early diagnosis and effective treatment are expected to drive the market in the coming years.

Highlights of the Ophthalmic Devices Market Report

- On the basis of product, the cataract surgical devices segment dominated the market in 2023 due to the rising incidence of cataract blindness. According to a report published by the National Library of Medicine, the annual incidence of cataract blindness is about 3.8 million. On the other hand, the vision care products segment is expected to grow rapidly in the coming years. This is due to the rising demand for contact lenses. Many patients with eye illnesses who wear eyeglasses are switching to contact lenses due to their benefits, such as reduced distortion and enhanced comfort. According to a report published by CooperVision in May 2023, about 45 million individuals prefer contact lenses over eyeglasses, and this number is projected to increase rapidly.

- Based on end-user, the hospital & eye clinics segment held the largest share of the market in 2023. This is mainly due to the easy availability and accessibility of advanced ophthalmic devices in these settings. Moreover, people often prefer eye clinics for the treatment of eye ailments. With more mergers and acquisitions among major and small ophthalmic clinics and hospitals, the usage of ophthalmic devices in the clinic is also rising.

Ophthalmic Devices Market Trends

- Rising demand for eye procedures: The market is anticipated to expand at a rapid pace due to the rising demand for eye procedures. There is a growing need for contact lenses and cutting-edge equipment in surgical procedures of the eye. With the rising prevalence of numerous ophthalmic ailments, including diabetic retinopathy and age-related macular degeneration, the demand for advanced ophthalmic surgical devices is increasing.

- Increasing awareness about early diagnosis and technological advancements: Accurate diagnosis and better treatment of ocular problems are now possible due to technological advancements. Improved management of eye ailments, such as macular degeneration, cataracts, glaucoma, and dry eye diseases, has been made possible due to advancements in laser technology, diagnostic tools, and surgical techniques. The use of ophthalmic equipment is anticipated to rise because of a rising preference for minimally invasive procedures, including LASIK, multi-wavelength diabetic retinopathy treatment, ultrasonic phacoemulsification, and femtosecond laser surgery. In addition, rising awareness about early diagnosis boosts the demand for diagnostic equipment.

- Need for quality eye care: The global ophthalmic devices market is projected to expand due to the rising need for high-quality eye care and the rising need for advanced procedures to treat visual issues. For the development of products to treat visual problems, many market companies are concentrating on bolstering their research and development efforts, giving them a great chance to attract expensive customers.

Regional Stance

North America dominated the ophthalmic devices market with the largest share in 2023 due to the rising elderly population and the prevalence of eye disorders. The need for ophthalmic gadgets is rising in the region because of unhealthy lifestyles that cause stress-related illnesses, including diabetic retinopathy. Moreover, the well-established healthcare industry and the easy availability of advanced surgical equipment contributed to the region’s dominance. On the other hand, Asia Pacific is projected to witness rapid growth in the market in the near future. This is mainly due to the increasing demand for quality eye care. The rising awareness of early diagnosis and prevention and the increasing government initiatives to advance healthcare infrastructure contribute to regional market growth.

Ophthalmic Devices Market Market Coverage

| Report Attribute | Key Statistics |

| Market Revenue in 2024 | USD 46.14 Billion |

| Market Revenue by 2033 | USD 70.37 Billion |

| CAGR | 5.82% from 2024 to 2033 |

| Quantitative Units | Revenue in USD million/billion, Volume in units |

| Largest Market | North America |

| Base Year | 2023 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market News

- In May 2024, Bausch + Lomb Corporation, a leading eye health company, introduced Zenlens ECHO in the U.S. Zenlens Echo is a non-prosthetic, custom scleral contact lens technology designed to fit a wide variety of corneal shapes and sizes.

- In February 2024, Iridex Corporation, a worldwide leader in advancing laser-based medical systems, delivery devices, and procedure probes to treat glaucoma and retinal diseases, announced the European Patent EP 3009093 Number. The patent was awarded for the invention entitled Laser System with Short Pulse Characteristics and its Method of Use. This patent greatly enhances the company’s intellectual property in the European marketplace, including laser systems in ophthalmology and related fields.

Segments Covered in the Report

By Product

- Vision Care Products

- Spectacles

- Contact lenses

- Soft contact lenses

- Rigid gas permeable lenses

- Hybrid contact lenses

- Surgical devices

- Cataract surgical devices

- Intraocular lenses

- Ophthalmic Viscoelastic devices

- Phacoemulsification devices

- Cataract surgical lasers

- IOL Injectors

- Cataract surgical devices

- Vitreoretinal surgical devices

- Vitrectomy machines

- Vitreoretinal packs

- Photocoagulation lasers

- Illumination devices

- Vitrectomy probes

- Refractive surgical devices

- Femtosecond lasers

- Excimer lasers

- Others

- Glaucoma surgical devices

- Glaucoma drainage devices

- Microinvasive glaucoma surgery devices

- Glaucoma laser systems

- Ophthalmic microscopes

- Ophthalmic surgical accessories

- Surgical instruments & kits

- Ophthalmic forceps

- Ophthalmic spatulas

- Ophthalmic tips & handles

- Ophthalmic scissors

- Macular lenses

- Ophthalmic cannulas

- Others

- Diagnostic and monitoring devices

- Optical Coherence Tomography Scanners

- Fundus Cameras

- Perimeters/Visual Field Analyzers

- Autorefractors & Keratometers

- Ophthalmic Ultrasound Imaging Systems

- A-scan ultrasound imaging systems

- B-scan ultrasound imaging systems

- Ultrasound microscopes

- Pachymeters

- Tonometers

- Slit Lamps

- Phoropters

- Wavefront Abberometers

- Optical Biometry Systems

- Ophthalmoscopes

- Lensmeters

- Corneal Topography Systems

- Chart Projectors

- Specular Microscopes

- Retinoscopes

By End User

- Hospitals & Eye Clinics

- Academic & Research Laboratories

- Others

Get this report to explore global market size, share, CAGR and trends, featuring detailed segmental analysis and an insightful competitive landscape overview@ https://www.precedenceresearch.com/checkout/2241

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 804 441 9344