Prosthetics and Orthotics Market Revenue to Attain USD 13.36 Bn by 2033

Prosthetics and Orthotics Market Revenue and Trends

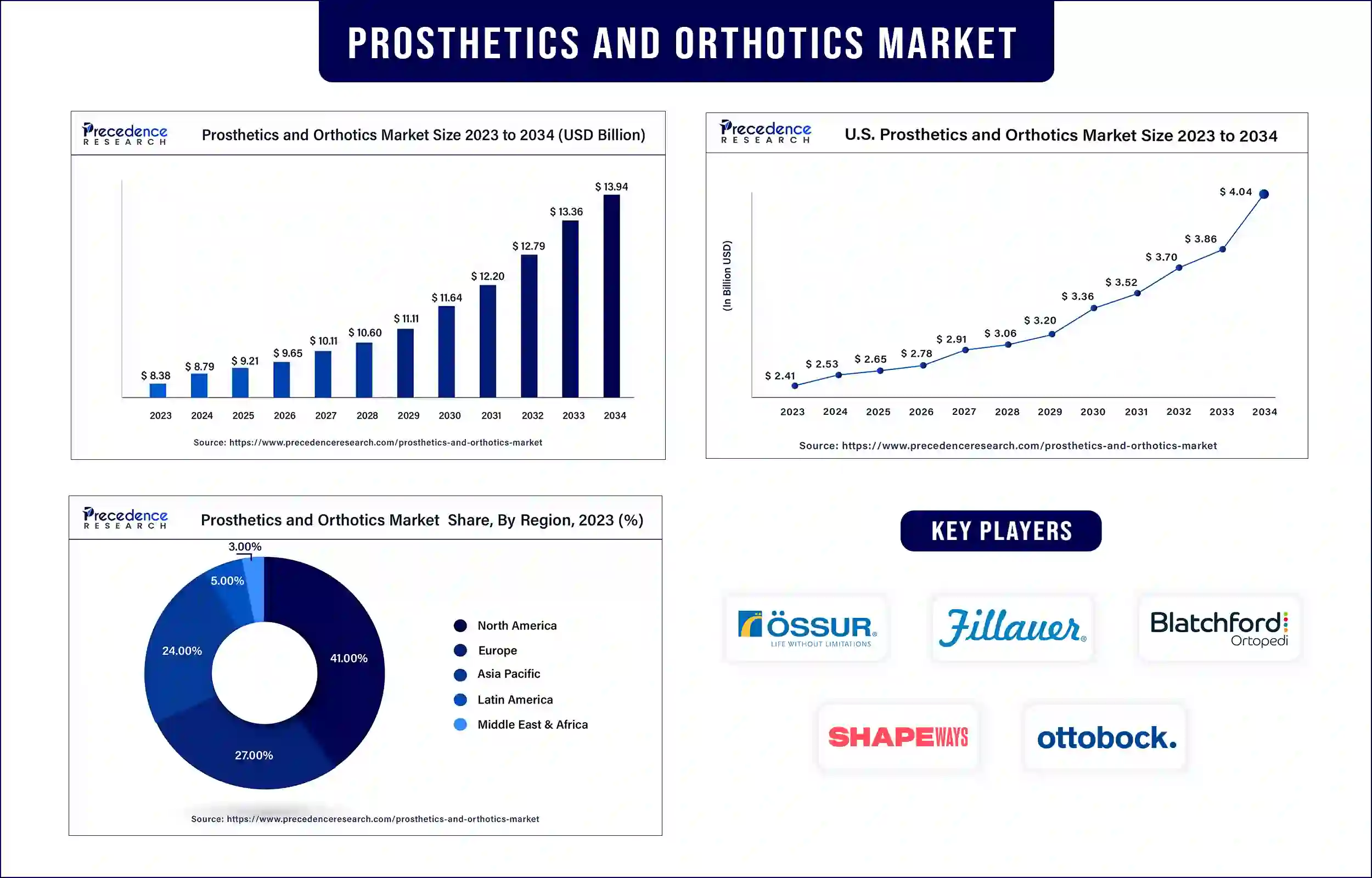

The global prosthetics and orthotics market revenue was valued at USD 8.79 billion in 2024 and is expected to attain around USD 13.36 billion by 2033, growing at a CAGR of 4.72% during forecast period. The demand for prosthetics and orthotics is rising due to the increasing burden of sports injuries, accidental injuries, osteosarcoma, diabetes-related amputations and the growing elderly population.

Market Overview

The field of prosthetics and orthotics has reached the technological peak for available artificial limbs and brain-controlled prosthetics. Large-scale investments made in the development of functional and adaptable artificial limbs and aids led to an increase in demand within the global prosthetics and orthotics market. A major 0contributor to the alarming increase in amputation surgeries performed worldwide is the scary increase in the incidence of traffic accidents. Prosthesis is the artificial limbs that allow persons who have lost limbs to move normally again. Contrarily, orthotics is the study and production of orthoses to give artificial parts accuracy and precision.

The fusion of these two specialties has the potential to significantly improve patient rehabilitation. As amputations occur increasingly frequently, orthopedic prosthetic devices are being used more frequently. Due to the rise in demand, the global orthopedic prosthetics market is expanding. Technology innovations and improvements in the design of prosthetic devices are driving growth in the orthopedic prosthetics sector. Sports injuries, auto accidents, and disability rates are on the rise, which is fueling lower limb amputation surgeries.

Report Highlights of the Prosthetics and Orthotics Market

- Based on type, the orthotics segment dominated the market with the largest share in 2023, due to an increase in the frequency of sports injuries, osteoarthritis, and the penetration of orthopedic technology. On the other hand, the prosthetics segment is anticipated to expand at the fastest growth rate throughout the forecast period. The subcategories of prosthetics are the lower extremity, upper extremity, liners, and modular components. Orthotics are advised for a variety of reasons, including preventing, treating, or adapting foot abnormalities as well as aligning and supporting the ankle or foot. Sales of orthotics are also increasing because of the rising incidence of osteoarthritis and spinal injuries. Furthermore, these remedies can greatly reduce discomfort and take care of other physical or postural issues.

- On the basis of technology, the conventional segment led the market in 2023 due to its low costs. In addition, advantages such as safety, energy efficiency, stability, and affordability of conventional technology for prosthetics and orthotics also accelerated the segment's expansion in the market.

Prosthetics and Orthotics Market Trends:

- Increasing instances of accidental injuries and musculoskeletal ailments: According to the data published by the WHO in 2021, about 222 million individuals experience neck pain worldwide, while an estimated 305 million people experience musculoskeletal ailments. The number of fatalities from traffic accidents has increased in recent years, which could boost the market's growth.

- Increasing disability rates and the frequency of Osteosarcoma: It is projected that the rising prevalence of osteosarcoma and the rising rate of disability will fuel the expansion of the global prosthetics and orthotics market. Next-generation technologies like microprocessors, automation, artificial intelligence (AI), and others are projected to support the growth of the market. These technologies are being heavily used to produce prosthetic devices, which are being adopted since they are affordable and easy to use.

- Aging Population: The demand for orthotic devices is being driven by the aging population, which is more susceptible to osteoporosis, osteoarthritis, and other physical diseases, increasing prevalence of bone injury and sport-related injuries. The usage of orthotic devices will increase globally as people look for alternatives to surgical deformity treatment and pain management. Additionally, orthotic devices are becoming more widely available and affordable thanks to developments in the prosthetics and orthotics business. As a result, the market for prosthetics and orthotics is expected to develop due to increased demand for orthotic devices.

Regional Stance:

In 2023, North America dominated the prosthetics and orthotics market. The region has established prosthetics suppliers in countries like the U.S., and the demand for orthotics and prosthetics in the North American region has been growing at an unprecedented rate. Also, rising sports injuries are bolstering the market expansion in North America. The region's favorable reimbursement policies, greater investments in R&D, and accessibility to well-established healthcare infrastructure further augmented the market.

Osteoporosis is so widely prevalent in Asia Pacific, which is the major factor boosting the regional market growth during the forecast period of 2024 to 2034. A significant rise in the number of traffic accidents, an increase in the number of diabetes-related amputations, and supportive government initiatives further contributes to market expansion in Asia Pacific.

Prosthetics and Orthotics Market Coverage

| Report Attribute | Key Statistics |

| Market Revenue in 2024 | USD 8.79 Billion |

| Market Revenue by 2033 | USD 13.36 Billion |

| CAGR | 4.72% from 2023 to 2033 |

| Quantitative Units | Revenue in USD million/billion, Volume in units |

| Largest Market | North America |

| Base Year | 2023 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market News

- In May 2024, Ottobock, a leading medical technology firm, launched its groundbreaking mechanical prosthetic foot, Evanto, on a global scale. Evanto harmoniously balances dynamics, flexibility, and stability, marking a pivotal advancement in prosthetics. Evanto caters to mobility grades 2 to 4 (from moderate to very active), making it ideal for daily tasks, quick sprints, and extended hiking adventures.

- February 2024, Fillauer entered into an agreement with Hanger, Inc., a top-tier provider of orthotic and prosthetic (O&P) patient care services and solutions. Fillauer will join Hanger's Products & Services business segment, expanding its brand, leadership, and team.

Market Segmentation

By Type

- Orthotics

- Upper Limb

- Lower Limb

- Spinal Orthotics

- Prosthetics

- Upper Extremity

- Lower Extremity

- Liners

- Sockets

- Modular Components

By Technology

- Conventional

- Electric-powered

- Hybrid Orthopedic Prosthetics

By End Users

- Hospitals

- Prosthetics Clinics

- Rehabilitation Centre

- Others

Get this report to explore global market size, share, CAGR and trends, featuring detailed segmental analysis and an insightful competitive landscape overview@ https://www.precedenceresearch.com/checkout/1110

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 804 441 9344