Sustainable Finance Companies | Forecast by 2033

Sustainable Finance Market Growth and Trends

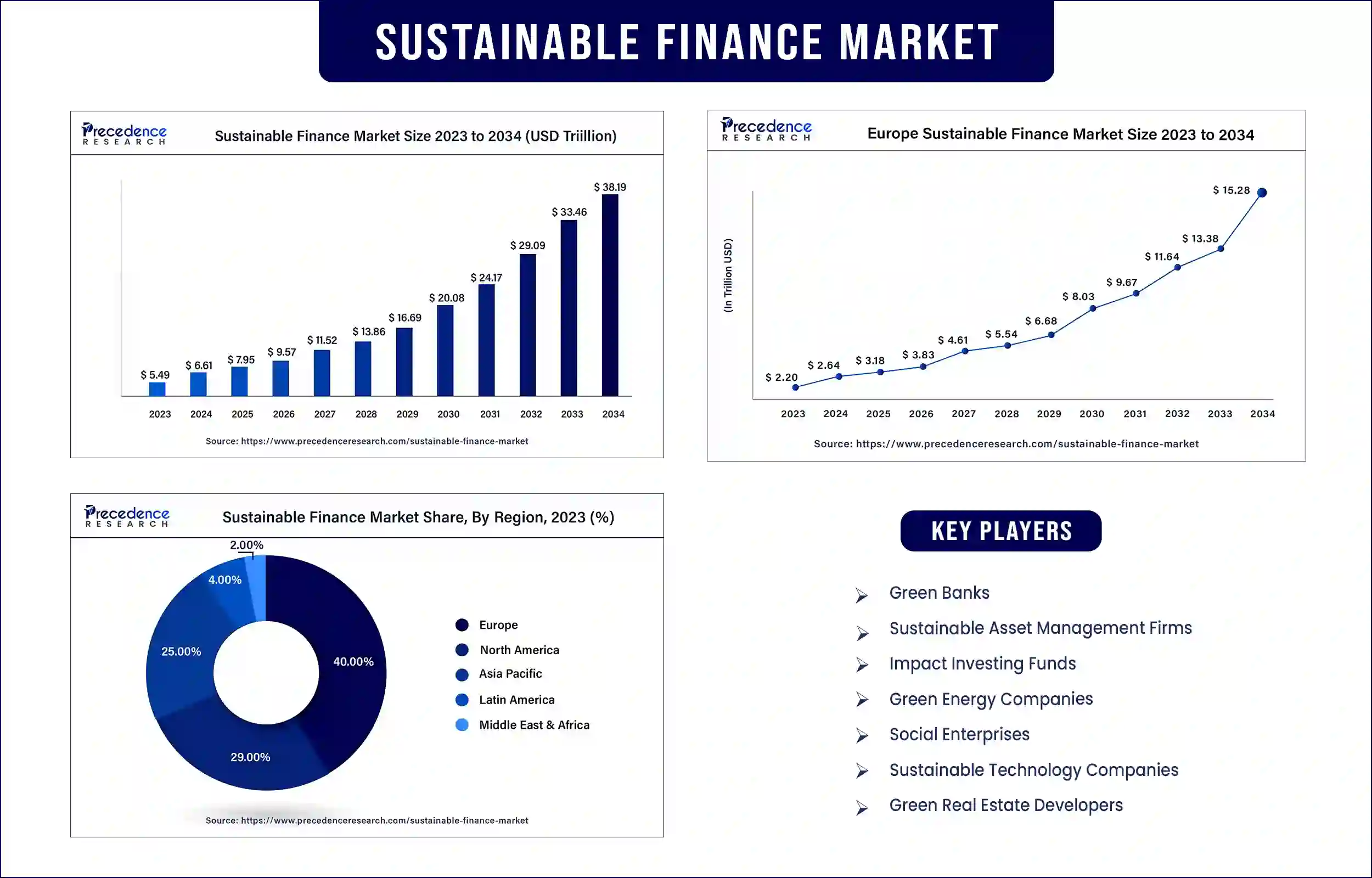

The global sustainable finance market was exhibited at USD 5.49 trillion in 2023 and is estimated to expand around USD 33.46 trillion by 2033, growing at a CAGR of 19.2% during the forecast period. The market is developing rapidly due to government initiatives towards sustainable finance that help people learn more about it. These initiatives are ultimately responsible for the growth of the sustainable finance market.

The Full Study is Readily Available | Download the Sample Pages of this Report@ https://www.precedenceresearch.com/sample/3198

Market Overview

The finance field has enormous power to capitalize on and deliver awareness regarding sustainability in various ways, such as by promoting research and development work for different energy sources or by providing support to businesses that use trial skills and sustainable labor practices. Sustainable finance term refers to the investment process and promotion of social and environmental factors. Sustainable finance is a developing field formed by features in the environment, such as climate change. This method emphasizes the necessity to sustain economic development while dropping the pressure on the environment and confirming long-term sustainability by addressing social differences.

Several industries and sectors already implemented various effective and practical strategies towards sustainable finance. For example, green bonds can be included in different financial investment projects associated with environmental benefits. Such bonds are growing rapidly as corporations, governments, and financial institutions issue them to fund energy competence enhancements, renewable energy plans, and various other ecologically friendly initiatives.

- For instance, in March 2024, the Green Central Bank conducted boot camps in Brazil to build the capacity for sustainable finance across the world. It is fortified by various core concepts such as environmental, social, and governance integration, impact investing, green financing, and social responsibilities.

Sustainable Finance Market Emerging Trends

- Net Zero: Several countries are now concerned about the mid-century zero emission goal. For this ambition to be achieved, it is important to channel the system with proper planning.

- Impact investing: Impact investing has a significant role in sustainable finance, as researchers have found that impact investing surged in the past few years and is expected to grow more.

- Strategies to impact climate change: Businesses across the world, importantly countries such as Europe and the US, are administrating new laws to incentivise decarbonisation plans.

Growing awareness of social and environmental concerns drives the sustainable finance market

The impact of sustainable finance is crucial for the finance service industry due to the primary roles and responsibilities associated with it. The major preference of stakeholders, managers, clients, investors, and society shifted in the direction of the United Nations’ Sustainable Development Goals. For instance, in October 2023, Deloitte, which is a leading company for global provider of audit and assurance, financial advisory, tax, consulting, risk advisory, and various related services, launched its Green & Sustainable Finance (GSF) Certificate to narrow Hong Kong’s GSF talent gap. By considering ESG factors, businesses, and investors can classify and alleviate risks associated with social matters and environmental, leading to more even and robust investments. The social measurement of sustainable finance is around confirming that economic development is comprehensive and assists all sections of society.

Beginning inclusive financial processes is essential to a firm’s expansion. Strong financial mechanisms aid an initiative function proficiently, as they support normalized charges and reinforce efficacy. The developing operating atmosphere focuses on the necessity of influencing numerous commercial explanations so workers can emphasize the errands that add worth. This could comprise a broad-based reconsideration of individual services and the overview of individual advancement programs to let work spread its full possibility. Inventiveness, such as board gateways and computer-generated AGMs or board assemblies, can improve business recital and optimize core processes, involvements, and transparency. Businesses are required to be advanced in the search for competence and obey the best governance performs to guard their characters and balance sheets.

- For instance, in October 2023, DBS Bank, a leading financial services group in Asia, launched the DBS Eco Renovate Loan, a new sustainable finance tool targeting small and medium enterprises (SMEs). This tool enables small companies to access a wider pool of funds for green projects.

However, due to high initial costs, the sustainable finance market faces challenges. The initiatives in the field have long-term benefits and advantages, but they require a large financial base to start, and many investors find it difficult to commit to the plans.

Top Companies in the Sustainable Finance Market

- BlackRock, Inc.

- Goldman Sachs

- State Street Corporation

- Deutsche Bank AG

- Morgan Stanley

- The Bank of New York Mellon Corporation

- USB

- Euronext N.V.

- Bloomberg L.P.

- Amundi US

- JPMorgan Chase & Co.

- Corporate Green Bond Issuers

- Franklin Templeton Investments

A Recent Development Bloomberg L.P.

- In November 2023, Bloomberg L.P., which is a global leader in business and financial information, delivers trusted data, news, and insights that bring efficiency, fairness, and transparency to markets, launched a new data mapping and materiality assessment tool. This is launched to enable investors to assess the potential impact of a company’s business.

A Recent Development by Euronext N.V.

- In September 2023, a pan-European bourse that provides trading and post-trade services for a range of financial instruments announced the launch of a series of ESG tools and sustainable finance-focused inventiveness.

Regional Insights

Asia-Pacific is estimated to grow at the fastest rate during the forecast period. This is mainly due to the contributions of developing countries such as Japan, India, China, and several others. For instance, in May 2022, Mizuho Bank, Ltd, which is a retail and corporate banking unit of Mizuho Financial Group, the third largest financial company in Japan, announced the launch of Sustainable Supply Chain Finance (SSCF) for the first time in Japan. It is designed to assist clients with working capital requirements and sustainability goals. Such developments are boosting the market by providing support in several ways.

North America dominated the sustainable finance market in 2023 due to rising concern among people about climatic changes. Because of that, many countries are also facing issues with their food systems. For instance, the National Library Medicines of the US released that the increased use of mineral fertilizers in the food system has increased productivity but has also impacted the environment through deterioration of water quality and GHG emission. Awareness of financial sustainability by collaborating with companies boosts the market to grow rapidly.

- For instance, in September 2023, MSCI Inc., an American finance company that globally provides real estate indices, equity, multi-asset portfolio, ESG, and fixed income, launched the MSCI Sustainability Institute, a new initiative aimed at collaborating across the capital market ecosystem to create sustainable value and address global challenges.

Market Potential and Growth Opportunity

Rising climatic initiatives by governmental and non-governmental organizations increase market opportunities

Continuous efforts by all sectors and customers help the sustainable finance market expand rapidly. Different organizations have taken various initiatives to bring development to this field. For instance, in April 2024, RWE, which is a trusted company for electricity generation, energy trading, and building storage systems, introduced its first green US dollar bond to expand sustainable finance. This is launched to use the net proceeds for its growing green investment and growth program and to mark a significant contribution to the success of the decarbonization of the energy system and energy transition. With such innovative ideas, sustainable financing is growing rapidly, along with the competition in the market.

Sustainable Finance Market Highlights

| Report Attribute | Key Statistics |

| Market Revenue in 2024 | USD 6.61 Trillion |

| Market Revenue by 2033 | USD 38.19 Trillion |

| CAGR | 19.2% |

| Quantitative Units | Revenue in USD million/billion, Volume in units |

| Largest Market | Europe |

| Base Year | 2023 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Sustainable Finance Market News

- In April 2024, Ernst & Young Global Limited launched a new Sustainable Finance Innovation Hub in Dublin to support financial institutions across the globe with the goal of fast-tracking their efforts to encounter environmental, social, and governance (ESG) regulatory and reporting necessities.

- In January 2024, Barclays plc, a British multinational universal bank, announced the establishment of a new Sustainable Banking Group within its Capital Markets commercial and organized the Sustainable Capital Markets and ESG Advisory teams of the bank in a change intended to address the sustainability requirements of clients across the market.

Market Segmentation

By Investment Type

- Equity, Fixed Income

- Mixed Allocation

By Transaction Type

- Green Bond

- Social Bond

- Mixed- sustainability Bond

By Industry Verticals

- Utilities

- Transport and Logistics

- Chemicals

- Food and Beverage

- Government

Buy this Research Report@ https://www.precedenceresearch.com/checkout/3198

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 650 460 3308