Tumor Ablation Market Will Grow at CAGR of 13.60% By 2033

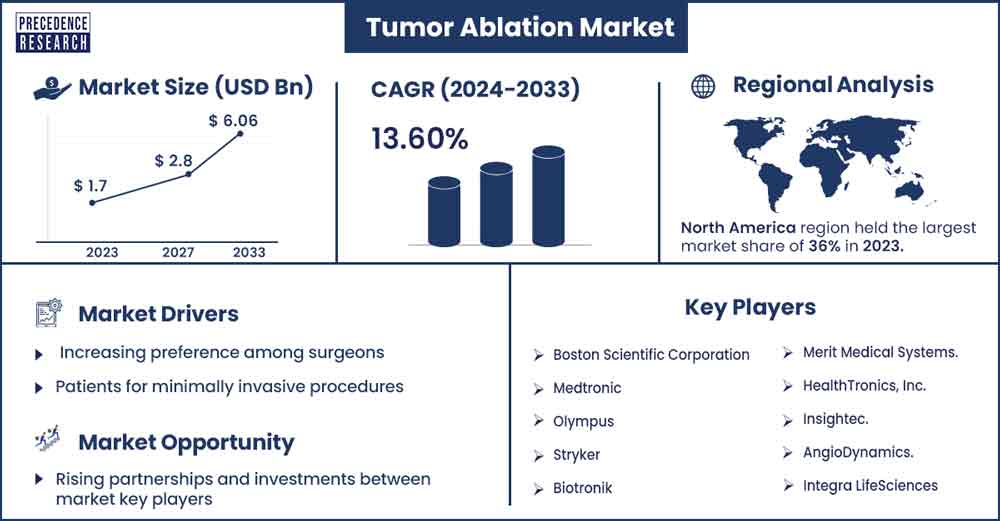

The global tumor ablation market size was exhibited at USD 1.7 billion in 2023 and is anticipated to touch around USD 6.06 billion by 2033, expanding at a CAGR of 13.60% from 2024 to 2033.

The procedure of ablation is a non-surgical technique that involves the use of a needle-tipped catheter to enter directly into invasive tumors and then rapidly shrink or eliminate them using high temperatures, extreme heat, or cold without surgery. The imaging guidance is used to localize the tumor precisely without affecting surrounding tissues through heat or cold. This process is currently the standard treatment for liver tumors and is increasingly used for other cancers such as lung, kidney, and certain benign and malignant bone tumors.

Tumor ablation is the most captivating and significant procedure, which is considered an induction therapy for patients with small hepatocellular carcinomas or benign liver tumors by incorporating high temperature for removal and relief of blockages or tumors. This treatment can be performed using various techniques such as microwave ablation, radiofrequency ablation, image-guided therapy, cryoablation, etc.

Tumor ablation is a crucial treatment for individuals who have not responded well to chemotherapy or radiation therapy and are not currently undergoing surgery. This therapy is primarily used to treat various conditions, including esophageal squamous dysplasia, gastric antral vascular ectasia, radiation proctopathy, cholangiocarcinoma, and pancreatic neoplasia. It works by using alternating electrodes to produce radiofrequency energy that heats the lining of the digestive tract, ultimately destroying cancerous or infected tissue.

The rising prevalence of cancer worldwide and the aging population are the major factors driving the market growth. Furthermore, technological advancements in ablation devices and increasing demand for minimally invasive surgeries boosted the overall demand for tumor ablation in the market. Government and health authorities are very concerned about the use of radio and microtechnology because of its side effects. Therefore, it may hinder the growth of the tumor ablation market.

Regional Analysis

North America dominates and has the largest market share due to government support for quality healthcare, high purchasing power parity, reimbursement availability, and increasing cancer prevalence in the region. The United States owns a significant portion of the tumor ablation market. Furthermore, the rising aging population and rising weight issues have increased the risk of cancer, which is expected to drive the adoption of cancer therapy and diagnosis.

According to the American Cancer Society, there were 1,958,310 new cases of cancer in the U.S. in 2023. This reflects the need for tumor ablation. In the future, cancer cases will increase, especially due to exposure to a lot of carcinogens, which suggests that the tumor ablation market has a huge scope of growth in the U.S.

The tumor ablation market in the Asia-Pacific region is anticipated to experience rapid growth. This is mainly due to the improved healthcare infrastructure and government initiatives in the region. Economic advancements in India and China are expected to stimulate market growth further. Therefore, there are opportunities for growth by forming collaborative partnerships and bilateral agreements with companies in this region. The markets in Japan and China are gradually expanding.

Europe is the second largest market for tumor ablation, driven by increasing cancer incidence and a rising preference for minimally invasive procedures. Leading countries like Germany, France, and the UK are at the forefront due to advanced healthcare systems and significant investments in medical technology. The market growth is further supported by favorable reimbursement policies and ongoing clinical research in the region.

Tumor Ablation Marke Report Scope

| Report Coverage | Details |

| Market Revenue in 2023 | USD 1.7 Billion |

| Projected Forecast Revenue by 2033 | USD 6.06 Billion |

| Growth Rate from 2024 to 2033 | CAGR of 13.60% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Advanced prevalence of cancer

Patients with a few small tumors without an option for surgery are more likely to benefit from the tumor ablation market. Furthermore, patients receiving such treatment are less likely to require hospitalization, resulting in a higher probability of ablation system adoption among individuals. An increasing prevalence of different types of cancers, such as breast cancer, colon cancer, prostate cancer, and lung cancer, are the reasons for expecting an increase in demand for ablation technologies to treat kidney, soft tissue, liver, and bone tumors.

According to the Pan American Health Organization, there will be around 10 million deaths due to cancer, and 20 million new cases will be registered. It will create a huge burden on the healthcare system but will open new doors for the growth of the tumor ablation market.

Modern techniques in tumor ablation

Recent developments in the tumor ablation market have led to improvements in precision, portability, and affordability, prompting companies to introduce new devices and regularly update them. The significant technological advancements in this area include irreversible electroporation, high-intensity focused ultrasound (HIFU), cryoablation, and image-guided devices. With current technological and innovative ablation methods, even larger and more complex cancers in various organs can be treated. Additionally, advances in intraprocedural imaging aim to improve the quality of care, reduce complications, and provide a more accurate assessment of the ablation zone.

Restraint

Complications with tumor ablation remedy

Ablation therapy is a new treatment option for various cancers that affect solid organs. However, as the number of procedures performed increases, complications can become more common. The two most frequent issues that arise during ablation therapy are bleeding and damage to the target organ. These complications are ranked in terms of their level of risk. The surgical procedures can lead to complications that may slow down the expansion of the tumor ablation market.

Opportunity

Rising partnerships and investments between market key players

Investment from both the private and public sectors plays a critical role in shaping the tumor ablation market. Grants and funding from the government support research and development in the medical sector. Medical researchers can explore innovative techniques and technologies in tumor ablation with the help of these fundings without the immediate pressure of market development. Combining academic rigor and market-oriented approaches through the alignment of private and public financial interests often leads to breakthrough innovations. Private investment accelerates the commercialization process of these new technologies.

Public funding also supports the early-stage research to develop a new and genuine tumor ablation method. At the same time, private investment can facilitate the clinical trials and marketing required to make it available to market. Combining all these techniques accelerates the pace of innovation and boosts market dynamics, driving growth and competence in the tumor ablation market.

Recent Developments

- In February 2024, Butterfly Network launched a tumor ablation device. A new handheld ultrasound system has been developed using artificial intelligence and 3D imaging. The system is called iQ3TM, which is a point-of-care device that conducts optimal organ scanning. It provides 46 ultrasound slices simultaneously with a wide angle.

- In September 2022, Stryker, one of the world's leading medical technology companies, introduced a new bone tumor ablation system. This technology is a reliable approach for individuals with metastatic tumors that are very painful. According to Stryker, the U.S. Food and Drug Administration has authorized its OptaBlate bone tumor ablation system. With the addition of the OptaBlate technology to Stryker's spinal Interventional procedures, the company's expertise in spine augmentation and radiofrequency ablation has expanded. This new technology was added to Stryker's portfolio for the treatment of metastatic vertebral body fractures.

Key Player in the Market

- Boston Scientific Corporation (U.S.)

- Medtronic (U.S.)

- Olympus (Germany)

- Stryker (U.S.)

- Biotronik (Germany)

- Merit Medical Systems. (Utah)

- HealthTronics, Inc. (U.S.)

- Insightec. (Israel)

- AngioDynamics. (New York)

- Integra LifeSciences (U.S.)

- Bioventus LLC. (U.S.)

- Ethicon Inc. (A Subsidiary of Johnson & Johnson) (U.S.)

- EDAP TMS (Auvergne-Rhône-Alpes)

- Sonablate Corp. (U.S.)

- BVM Medical Limited (England)

- Terumo Europe NV (Belgium)

- IceCure Medical (Israel)

Market Segmentation

By Technology

- Radiofrequency Ablation

- Microwave Ablation

- Cryoablation

- Irreversible Electroporation Ablation

- HIFU

- Other ablation technologies

By Treatment

- Surgical Ablation

- Laparoscopic Ablation

- Percutaneous Ablation

By Application

- Kidney Cancer

- Liver cancer

- Breast cancer

- Lung cancer

- Prostate cancer

- Other cancer

Buy this Research Report@ https://www.precedenceresearch.com/checkout/3758

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 650 460 3308