What is the Tumor Ablation Market Size?

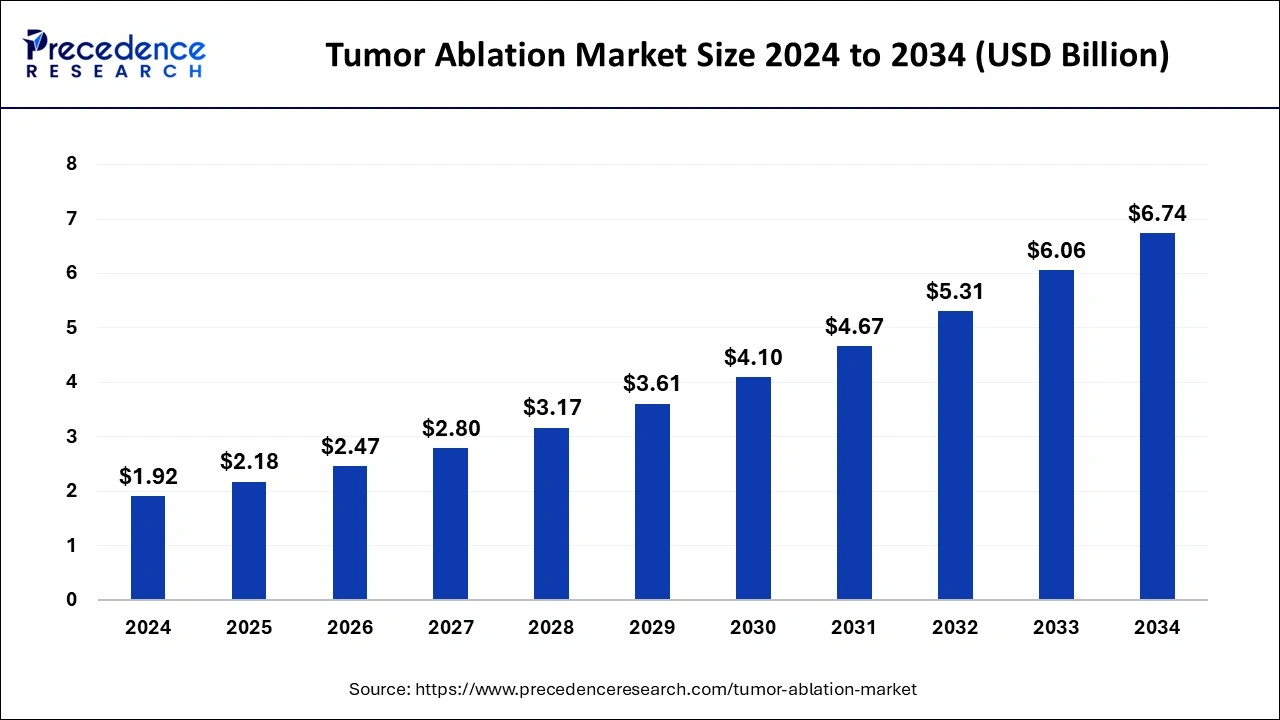

The global tumor ablation market size is calculated at USD 2.18 billion in 2025 and is predicted to increase from USD 2.47 billion in 2026 to approximately USD 7.47 billion by 2035, expanding at a CAGR of 13.11% from 2026 to 2035.

Tumor Ablation MarketKey Takeaways

- In terms of revenue, the global tumor ablation market was valued at USD 2.18billion in 2025.

- It is projected to reach USD 7.47billion by 2035.

- The market is expected to grow at a CAGR of 13.11% from 2026 to 2035.

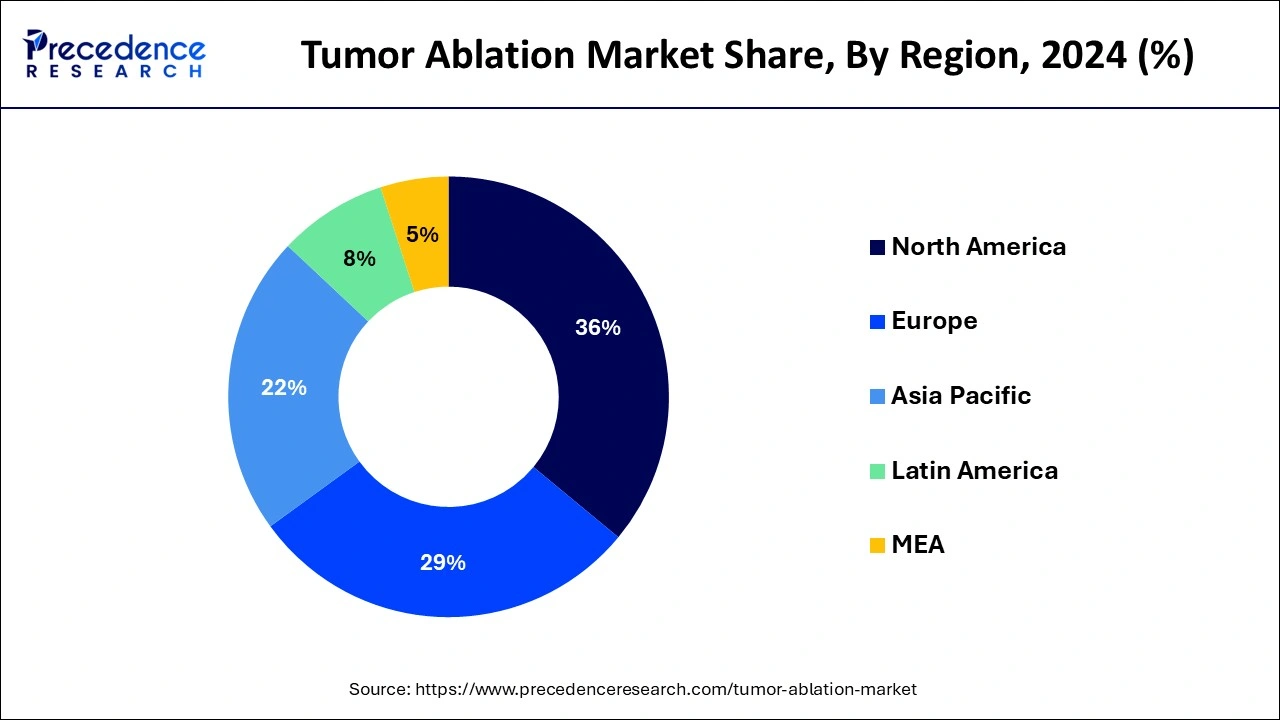

- North America dominated the market while carrying 36% of the market share in 2025.

- Asia Pacific is expected to witness the fastest rate of growth in the tumor ablation market during the forecast period.

- By technology, the radio frequency ablation technology segment held the largest share of the tumor ablation market, while carrying a of 34% share in 2025.

- By technology, the microwave ablation technology segment is expected to grow at the fastest rate during the forecast period.

- By treatment, the percutaneous ablation segment dominated the market with a 56% market share in 2025.

What is the Tumor Ablation?

The tumor ablation market comprises a diverse range of ablation techniques, such as radiofrequency ablation (RFA), microwave ablation (MWA), cryoablation, high-intensity focused ultrasound (HIFU), and laser ablation, among others. These techniques employ different energy sources to administer controlled heat, cold, or sound waves, resulting in the destruction of tumor cells. This process leads to the death of the targeted cells, which are subsequently eliminated by the body's immune system. Within the global tumor ablation market, various medical equipment is utilized for these procedures, including ablation probes, electrodes, needles, catheters, ultrasound systems, MRI systems, and monitoring systems.

These devices are intricately designed to precisely deliver ablation energy to the specific target tissue while minimizing damage to surrounding healthy tissues. Factors driving market growth include the increasing cancer burden, ongoing technological advancements in ablation devices, and a growing demand for minimally invasive surgeries. Additionally, the implementation of key strategies by major players, such as partnerships and collaborations aimed at enhancing the product portfolio, is expected to have a positive impact on the market.

How is AI contributing to the Tumor Ablation Industry?

The enhancement of tumor ablation by AI is facilitated by detailed analysis of images and the implementation of procedures. Algorithms are used to map the boundaries of the tumor, simulate energy delivery, and for real-time navigation. AI differentiates normal tissue from the malignancy, minimizes dependence on operators, personalizes treatment plans, and assesses the results following treatment to determine the presence of residual malignancy.

Tumor Ablation Market Data and Statistics

- Cancer is a highly prevalent global disease, impacting numerous individuals worldwide. For example, the Cancer Australia Statistics for 2022 reported 162,163 new cancer cases diagnosed in Australia, emphasizing the substantial burden it poses. Similarly, McMillan Cancer Support's October 2022 update revealed that 3 million people were living with cancer in the UK, with projections indicating a steady increase in this number over the coming years. This escalating cancer prevalence underscores the growing necessity for surgeries and effective ablation procedures, thereby contributing to the expansion of the tumor ablation market.

- In July 2021, Terumo Europe and University Medical Center Utrecht (UMC Utrecht) strengthened their collaboration in the field of oncology, focusing on tumor ablation and chemoembolization through technological innovations.

- In June 2022, IceCure Medical Ltd. submitted a regulatory filing to the Brazilian Health Regulatory Agency (ANVISA) for the approval of ProSense, an advanced cryoablation therapy utilizing liquid nitrogen. ProSense aims to treat various tumors, including those in the breast, kidney, bone, and lung, highlighting the continuous efforts to enhance cancer treatment options.

Tumor Ablation Market Growth Factors

The tumor ablation market is expected to witness lucrative growth due to the availability of advanced therapeutic options and a high demand for minimally and non-invasive therapies. Surgeons and patients alike are increasingly favoring minimally invasive surgical procedures, driven by the benefits of faster recovery, enhanced patient comfort, and reduced procedure time. This shift in preference is a significant factor contributing to the rising demand for advanced tumor ablation techniques.

Continuous technological advancements aimed at improving accuracy, portability, and cost-effectiveness are driving tumor ablation market players to enhance and introduce innovative tumor ablation devices. The integration of internally cooled radiofrequency probes in the cooled radiofrequency denervation technique is an emerging method with substantial growth potential. This technique facilitates the expansion of the lesion's size, enabling comprehensive denervation of the sacroiliac joint and contributing significantly to pain management.

Recent Trends

Rising Cancer Cases Boosting Market Growth

The market for tumor ablation is expanding quickly as cancer cases continue to rise globally. Nowadays, minimally invasive treatments that eliminate tumors without requiring extensive surgery are preferred by both patients and physicians. Because they provide quicker recovery, fewer complications, and shorter hospital stays than conventional cancer surgeries methods like radiofrequency microwave and cryoablation are becoming increasingly popular.

Radiofrequency Ablation Leading While Microwave Gains Speed

Radiofrequency ablation (RFA) remains the most widely used method due to its proven success in treating liver, lung, and kidney tumors. However, microwave ablation is emerging as the fastest-growing technique since it can treat larger tumors in less time with improved precision. The shift toward newer energy-based technologies reflects the industry's push for faster, safer, and more effective tumor destruction. Microwave technology offers the ability to reach higher temperatures faster and is less affected by surrounding tissue properties, such as blood flow (heat sink effect). This improvement allows for more predictable and consistent ablation zones, enhancing clinical confidence in treatment outcomes

Growing Preference for Percutaneous and Outpatient Procedures

Hospitals and clinics are increasingly performing ablation procedures using percutaneous, needle-based methods that do not require open surgery. These treatments can often be completed on an outpatient basis, reducing patient trauma and healthcare costs. The trend is supported by better imaging tools that guide doctors to accurately target tumors through small incisions. The shift minimizes hospital stays, leading to faster recovery times and lower infection risks for patients. This preference aligns with the broader healthcare goal of providing effective, less invasive treatments while optimizing resource allocation.

Market Outlook

- Industry Growth Overview: As minimally invasive treatments for solid tumors become more popular the market for tumor ablation is expanding. Both established and developing markets are adopting techniques like radiofrequency microwave and cryoablation because they provide quicker recovery and fewer complications.

- Sustainability Trends: Minimally invasive ablation reduces hospital stays and resource use, making treatment more efficient. Precision technologies minimize damage to healthy tissue, improve outcomes and help expand access to quality cancer care globally.

- Startups Ecosystem: Advanced abllation tools such as image guided and robotic assisted systems are being developed by startups and medical technology firms. Although there are still issues with adoption and regulations innovations concentrate on enabling outpatient procedures increasing indications and increasing precision.

Market Scope

| Report Coverage | Details |

| Growth Rate from 2026 to 2035 | CAGR of 13.11% |

| Market Size in 2025 | USD 2.18 Billion |

| Market Size in 2026 | USD 2.47 Billion |

| Market Size by 2035 | USD 7.47Billion |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | By Technology, By Treatment, and By Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Increasing preference among surgeons and patients for minimally invasive procedures

Minimally invasive procedures are characterized by smaller incisions or needle insertions, offering several advantages over traditional open surgeries. These procedures result in minimal tissue damage, reduced blood loss, and a lower risk of complications. Patients undergoing minimally invasive surgeries typically experience shorter hospital stays and faster recovery times, allowing them to resume normal activities sooner and enhancing their overall quality of life.

- In April 2023, AngioDynamics revealed an extended collaboration with Cardiva, a medical device company based in Spain. This extension builds upon the ongoing partnership between AngioDynamics and Cardiva, which has been effectively distributing AngioDynamics' vascular access portfolio in Spain and Portugal since 2012. The enhanced partnership will now encompass AngioDynamics' oncology portfolio, incorporating the Italian market into the distribution agreement.

The success of minimally invasive techniques is often attributed to advanced imaging technologies that enable surgeons to visualize and precisely target tumors. Thereby, the rising preferences for minimally invasive procedures acts as a driver for the tumor ablation market. This heightened accuracy ensures the preservation of healthy surrounding tissues. Additionally, the instruments used in minimally invasive procedures are designed for greater maneuverability and agility, providing surgeons with improved control and precision during complex surgeries. The use of smaller incisions further reduces the risk of post-operative infections when compared to open surgeries.

Restraint

Strict regulatory approval

The regulatory approval processes governing medical devices and procedures are typically protracted and meticulous. Evaluations focusing on safety, efficacy, and quality standards can significantly impede the introduction of new tumor ablation technologies to the tumor ablation market. These prolonged approval timelines pose a challenge to the timely availability and adoption of innovative tumor ablation solutions, consequently decelerating market growth.

Securing regulatory approvals and certifications entails substantial financial investments and specialized expertise. Companies are compelled to allocate resources to clinical studies, preclinical testing, and regulatory submissions, incurring considerable expenses. For small and medium-sized enterprises, meeting these requirements may pose financial challenges, limiting their capacity to introduce novel tumor ablation technologies to the market. The substantial cost and resource demands serve as entry barriers, constraining competition and innovation within the tumor ablation market.

Opportunity

Reimbursement policies

The existence of favorable reimbursement policies and comprehensive coverage for tumor ablation procedures plays a crucial role in ensuring broader accessibility to these treatments within the population. Reimbursement for tumor ablation procedures alleviates the financial burden on patients, facilitating increased accessibility across a wider patient demographic. This enhanced access, in turn, contributes to elevated procedure volumes, fostering the tumor ablation market's growth.

When healthcare providers benefit from favorable reimbursement rates and policies, they are incentivized to incorporate tumor ablation procedures into their service offerings. Adequate reimbursement serves as fair compensation for the resources, time, and expertise invested by healthcare providers in performing tumor ablation procedures. This favorable environment encourages more healthcare facilities and providers to embrace and provide these treatments, thereby propelling tumor ablation market's growth.

Segment Insights

Technology Insights

The radio frequency tumor ablation segment dominated the tumor ablation market while carrying 34% of the market share in 2025. This dominance is attributed to the specific and efficient nature of radiofrequency ablation in procedures targeting solid tumors in organs like the kidney and liver. The method allows for the treatment of multiple tumors simultaneously, enhancing procedural efficiency by utilizing multiple electrodes placed at different sites. This capability is anticipated to contribute to the increased adoption of advanced tumor ablation techniques. Radiofrequency/microwave ablation technology has demonstrated a high success rate, exceeding 85% in eliminating small liver tumors, according to the NCBI report. The advantages of radiofrequency techniques, particularly in successfully treating early-stage tumors, are expected to propel the growth of this segment.

Microwave ablation technology is projected to experience the fastest CAGR during the forecast period in the tumor ablation market. Unlike radiofrequency ablation devices that use electric current, microwave ablation devices propagate electromagnetic fields. This characteristic enhances the application of microwave ablation in tissues with low electrical conductance, such as bones and lungs. The technology offers benefits like a larger tumor ablation volume, consistent high-temperature performance, low ablation pain, and optimal heating of cystic masses. These advantages are anticipated to contribute to the growth of this segment. Moreover, the technology's minimal procedure time (5-10 minutes), improved efficacy with minimal complications, and reduced hospital stay are expected to further drive its growth.

Treatment Insights

The percutaneous ablation segment dominated the tumor ablation market with 56% of the market share in 2025. These procedures are favored for their attributes of faster recovery, minimal scarring, and heightened safety. Factors such as swift surgery time, patient comfort, and cost-efficiency are expected to further drive demand for this segment. However, challenges related to higher complications are anticipated to hinder its growth, particularly in hospitals where skilled professionals may be lacking. The recurrence rate of tumors is higher in percutaneous ablation due to inadequate ablation of tumors situated deep within the tissue.

Moreover, percutaneous ablation is contraindicated for treating lesions located very close to the gastrointestinal tract, gall bladder, bile duct, and heart due to the high risk of tumor recurrence. However, in such cases, laparoscopic ablation proves effective in delivering long-term outcomes while maintaining minimal invasiveness. This is expected to propel the growth of the laparoscopic ablation segment in the tumor ablation market during the forecast period.

Regional Insights

What is the U.S. Tumor Ablation Market Size?

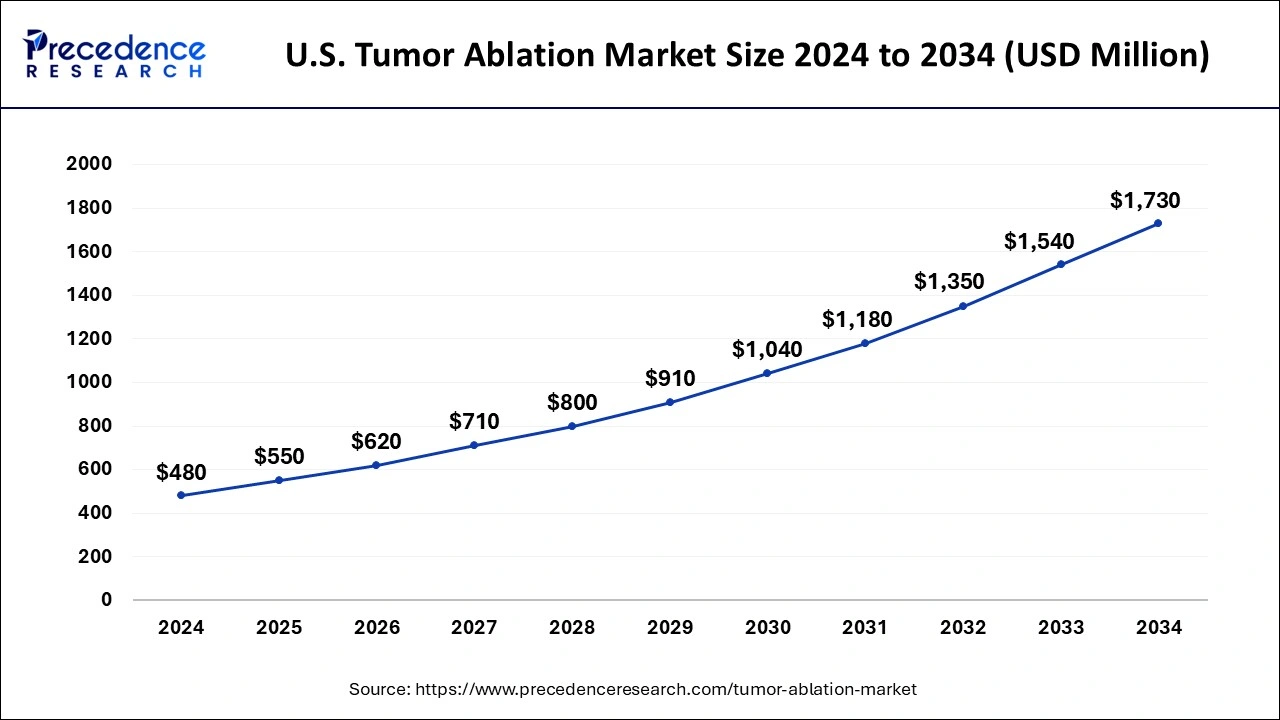

The U.S. tumor ablation market size is estimated at USD 550 million in 2025 and is anticipated to reach around USD 1,920 million by 2035, growing at a CAGR of 13.32% from 2026 to 2035.

North America held the largest share of 36% in the tumor ablation market. The region's growth is propelled by several factors, including government backing for quality healthcare, a high purchasing power parity, the availability of reimbursements, and a rising incidence of cancer. Initiatives such as the patient protection and affordable cre act (PPACA) in the U.S. aim to enhance healthcare quality and affordability through health coverage policies, reducing healthcare costs for individuals and the government. Additionally, precision medicine initiatives contribute to tailored strategies based on unique disease characteristics, further improving the healthcare system and fostering market growth.

- In April 2023, Johnson & Johnson Service Inc. revealed that the initial patient in North America underwent treatment in its clinical Investigational Device Exemption (IDE) trial. The trial aims to assess the safety and effectiveness of transbronchial microwave ablation utilizing the NEUWAVE FLEX microwave ablation system, with guidance provided by the MONARCH platform.

U.S. Tumor Ablation Market Trends

The U.S. is at the forefront in the adoption of tumor ablation due to the high presence of manufacturers. Image-guided percutaneous systems are preferred in hospitals. The strong consciousness of minimally invasive oncology procedures and favorable reimbursement systems promotes the large-scale clinical adoption of the procedures in cancer treatment facilities.

Europe holds a substantial market share, attributed to a higher degree of public funding in the region's healthcare system. The combination of a growing geriatric population and governmental support in cancer control initiatives is anticipated to bolster this growth.

- For instance, the European Cancer Observatory focuses on raising awareness about cancer, promoting early diagnostic techniques, and advocating advanced, minimally invasive therapeutic options.

Germany Tumor Ablation Market Trends

Germany is expected to witness remarkable growth. There is a good healthcare infrastructure that facilitates modern treatment of cancer. Through strict regulatory control, established technologies are the beneficiaries. Wide-ranging healthcare coverage of the general population guarantees access to non-surgical cancer treatment in hospitals and custom cancer care facilities.

Asia Pacific is expected to witness the fastest rate of growth in the tumor ablation market during the forecast period. Increasing patient numbers and the presence of prominent healthcare providers in developing economies such as India and China provide avenues for market expansion. Moreover, ongoing improvements in healthcare utilization, coupled with government support, contribute to this growth.

- The Indian government's Health Minister Cancer Patient Fund (HMCPF) scheme extends financial aid to indigent cancer patients, stimulating demand for tumor ablation devices and fostering the region's growth in the industry.

China Tumor Ablation Market Trends

The tumor ablation clinical research in China is predominant in the region. Increased cancer rates enhance the demands in therapies. The local production fortifies the availability of devices. There is a change in clinical preference to microwave ablation technology that facilitates the effective ablation of tumors and the broader application of interventional oncology.

Value Chain Analysis of the Tumor Ablation Market

- R&D: The detection of the targets of the tumor and creating ablation probes and supporting software platforms.

Key players: Medtronic, Boston Scientific, Johnson & Johnson (Ethicon/NeuWave), AngioDynamics - Clinical Trials/ Regulatory Approvals: Safety and tumor destruction efficacy are proven by human tests before regulatory approval.

Key Players: FDA (Regulatory Body), Medtronic, Boston Scientific, AngioDynamics - Formulation and Final Dosage Preparation: Adapting technical requirements or chemical ingredients into ready-to-use ablation systems.

Key players: Ethicon (NeuWave Medical), AngioDynamics, Galil Medical - Packaging and Serialization: Sterile closing with distinctive codes that guarantee traceability and anti-counterfeiting.

Key Players: Mermaid Medical, Canyon Medical, Olympus Corporation - Hospitals and Pharmacies Distribution: Secure logistics for the distribution of ablation systems to oncology centers and operating rooms.

Key Players: Medtronic, Boston Scientific, AngioDynamics, HealthTronics

Tumor Ablation Market Companies

- BSC Corporation: Offers cryoablation and radiofrequency technology that offers image-guided minimal invasive tumor ablation in oncology indications.

- Medtronic: Markets the OsteoCool bone tumor ablation system, which is used in the treatment of painful bone metastases.

- Olympus: Installs endoscopic image-controlled ablation instruments to allow the treatment of gastrointestinal cancer with high specificity.

Other Major Key Players

- Stryker (U.S.)

- Biotronik (Germany)

- Merit Medical Systems. (Utah)

- HealthTronics, Inc. (U.S.)

- Insightec. (Israel)

- AngioDynamics. (New York)

- Integra LifeSciences (U.S.)

- Bioventus LLC. (U.S.)

- Ethicon Inc. (A Subsidiary of Johnson & Johnson) (U.S.)

- EDAP TMS (Auvergne-Rhône-Alpes)

- Sonablate Corp. (U.S.)

- BVM Medical Limited (England)

- Terumo Europe NV (Belgium)

- IceCure Medical (Israel)

Recent Developments

- In April 2023, Compal Electronics, a Taiwanese electronics company, unveiled a novel radiofrequency ablation (RFA) system designed for the percutaneous and intraoperative coagulation and ablation of soft tissue. This includes the partial or complete ablation of non-resectable liver lesions. Additionally, Compal Electronics introduced a bi-level ventilator targeting chronic obstructive pulmonary disease (COPD) and respiratory insufficiency resulting from central and/or mixed apneas.

- In March 2022, Quantum Surgical, a company specializing in ablation devices and other medical technologies, obtained FDA approval for Epione, a ground-breaking interventional oncology robotics system designed specifically for minimally invasive liver cancer treatment. The Epione system from Quantum Surgical facilitates the planning and execution of minimally invasive ablation surgery, allowing it to be performed as an outpatient procedure. The system achieves this by deploying computer-guided needles through the skin to precisely target and eliminate tumors.

- In September 2020, Boston Scientific Corporation disclosed the signing of an investment agreement that included an exclusive option to acquire Farapulse, Inc., a privately-held company engaged in the development of a pulsed field ablation (PFA) system for treating atrial fibrillation (AF) and other cardiac arrhythmias. The PFA system comprises a sheath, generator, and catheters, aiming to ablate heart tissue by creating a therapeutic electric field, contrasting with conventional thermal energy sources such as radiofrequency ablation or cryoablation.

-

In October 2025, AngioDynamics announced its NanoKnife System was named one of TIME's 2025 Best Inventions for its use of Irreversible Electroporation (IRE) technology in treating prostate tumors. (Source: https://investors.angiodynamics.com)

-

In October 2025, IceCure announced it received FDA marketing authorization for its ProSense cryoablation system for the treatment of low-risk breast cancer in women aged 70 and above. (Source: https://www.prnewswire.com )

Segments Covered in the Report

By Technology

- Radiofrequency Ablation

- Microwave Ablation

- Cryoablation

- Irreversible Electroporation Ablation

- HIFU

- Other ablation technologies

By Treatment

- Surgical Ablation

- Laparoscopic Ablation

- Percutaneous Ablation

By Application

- Kidney Cancer

- Liver cancer

- Breast cancer

- Lung cancer

- Prostate cancer

- Other cancer

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting