Tumor Necrosis Factor Inhibitor Drugs Market Size and Growth 2025 to 2034

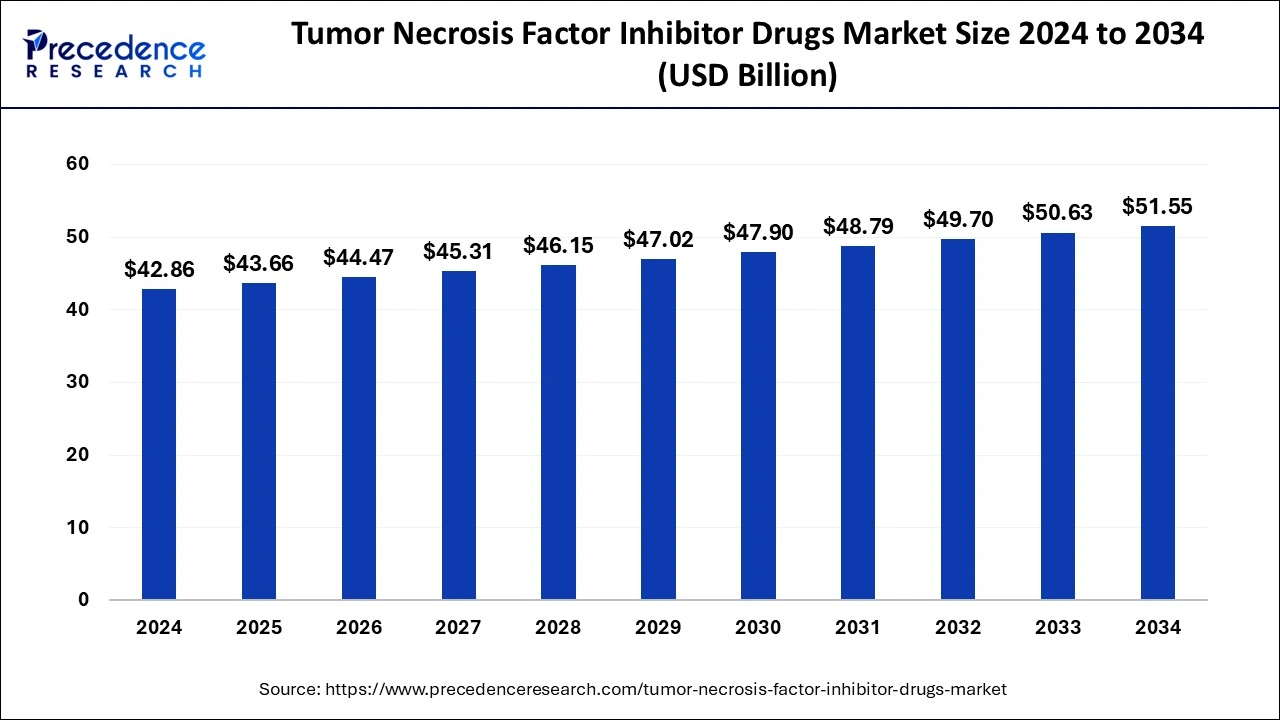

The global tumor necrosis factor inhibitor drugs market size was estimated at USD 42.86 billion in 2024 and is predicted to increase from USD 43.66 billion in 2025 to approximately USD 51.55 billion by 2034, expanding at a CAGR of 1.86% from 2025 to 2034. The need for tumor necrosis factor (TNF) inhibitor medications is being driven by the rising incidence of autoimmune illnesses around the globe.

Tumor Necrosis Factor Inhibitor Drugs Market Key Takeaways

- The global tumor necrosis factor inhibitor drugs market was valued at USD 42.86 billion in 2024.

- It is projected to reach USD 51.55 billion by 2034.

- The market is expected to grow at a CAGR of 1.86% from 2025 to 2034.

- North America held the largest share of the tumor necrosis factor inhibitor drugs market in 2024 and is expected to grow further during the forecast period.

- Asia Pacific is also expected to gain a significant share in the upcoming years.

- By product, the Humira segment led the market in 2024 and is projected to maintain its position during the forecast period.

- By product, the Enbrel segment is also expected to grow at the fastest CAGR in the upcoming years.

- By application, the autoimmune disease segment led the global market in 2024.

- By application, the psoriasis and psoriatic arthritis segment is expected to expand notably during the forecast period.

- By sales channel, the hospital pharmacies segment dominated the market in 2024.

- By sales channel, the specialty pharmacies segment is expected to obtain a substantial market share during the forecast period.

Market Overview

TNF inhibitors, with yearly sales in the billions, have been a significant source of income for pharmaceutical corporations. For a number of years, Humira (adalimumab) was the best-selling medication in the world, bringing in billions of dollars in sales every year. The introduction of biosimilars, which are comparable copies of licensed biologic medications, has boosted competition in the tumor necrosis factor inhibitor drugs market.

Biosimilars may result in financial benefits for patients and healthcare systems, which would boost their uptake. TNF inhibitors have demonstrated promise in treating inflammatory bowel illness, including Crohn's disease and ulcerative colitis, psoriasis, psoriatic arthritis, and ankylosing spondylitis, in addition to their well-established usage in rheumatic disorders. Prospective combination treatments and novel indications are still being investigated in ongoing research. These include injection site responses, greater susceptibility to infections, and, in certain situations, an increased chance of developing certain cancers.

Although TNF inhibitors have completely changed the way autoimmune disorders are treated, they are not without dangers and drawbacks. The approval and marketing of TNF inhibitors and biosimilars are strictly regulated by regulatory agencies such as the European Medicines Agency (EMA) and the U.S. Food and Drug Administration (FDA). Changes in labeling and other regulatory actions can have a big effect on how the market works. Concerns have also been expressed about availability and cost, specifically in relation to how affordable these biological medicines are for individuals and healthcare systems.

Tumor Necrosis Factor Inhibitor Drugs Market Growth Factors

- Worldwide, the prevalence of diseases like psoriasis, ankylosing spondylitis, rheumatoid arthritis, and Crohn's disease has increased. TNF inhibitor prescriptions are frequently given to treat these autoimmune disorders, which propels the market's expansion.

- The incidence of autoimmune disorders and related problems seems to rise with the global aging population. The aging population aids in the growth of the tumor necrosis factor inhibitor drugs market because TNF inhibitor medications are frequently used to treat these conditions.

- The ongoing progress in biotechnology has resulted in the creation of more efficient and less adverse-effect TNF inhibitor medications. These developments drive more doctors and patients to these drugs, which accelerates the expansion of the tumor necrosis factor inhibitor drugs market.

- More people are diagnosed and treated as a result of increased knowledge about autoimmune disorders and advancements in diagnostic methods. TNF inhibitor medication demand rises as a result, driving the expansion of the tumor necrosis factor inhibitor drugs market.

- Beyond autoimmune illnesses, the tumor necrosis factor inhibitor drugs market is being investigated for the treatment of other inflammatory ailments, including Alzheimer's disease and several forms of cancer. These medications' growing range of uses broadens the market and spurs expansion.

- Pharmaceutical businesses frequently form alliances and partnerships in order to diversify their product lines and increase their market share. These partnerships promote the growth of the tumor necrosis factor inhibitor drugs market by easing the development and commercialization of these medications.

Market Scope

| Report Coverage | Details |

| Global Market Size in 2025 | USD 43.66 Billion |

| Global Market Size by 2034 | USD 51.55 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 1.86% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| 2024 to 2034 | By Product, By Product, and By Sales Channel |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Efficiency in treating chronic diseases

An essential component of healthcare management is the effectiveness of treatment for chronic illnesses in the market for tumor necrosis factor (TNF) inhibitor drugs. TNF inhibitors are drugs that are frequently used to treat autoimmune conditions such as ulcerative colitis, ankylosing spondylitis, psoriasis, rheumatoid arthritis, and Crohn's disease. TNF inhibitors function by reducing the inflammatory cytokine tumor necrosis factor-alpha's activity. Effective therapy should significantly reduce symptoms of autoimmune illnesses, including skin lesions, stiffness, inflammation, and gastrointestinal problems, in addition to joint pain and stiffness. The patient's quality of life gains should be taken into consideration when assessing the effectiveness of a treatment plan. This covers elements including overall treatment satisfaction, psychological well-being, physical function, and capacity to carry out everyday tasks.

Restraint

Development of antibodies

A key component of biopharmaceutical innovation in the market for tumor necrosis factor (TNF) inhibitor medications has been the creation of antibodies. A class of drugs known as TNF inhibitors work by inhibiting the function of a cytokine called tumor necrosis factor-alpha (TNF-α), which is involved in systemic inflammation. They are mostly used to treat autoimmune conditions such as ankylosing spondylitis, psoriasis, rheumatoid arthritis, and Crohn's disease. The initial class of TNF inhibitors comprised monoclonal antibodies (mAbs) that selectively targeted TNF-α. These antibodies are designed to attach to TNF-α and stop it from doing its job, which lowers inflammation and the signs and symptoms of illness. Other TNF inhibitors, such as TNF receptor fusion proteins like etanercept, have been developed in addition to monoclonal antibodies.

Opportunity

Personalized medicine

Tumor necrosis factor (TNF) inhibitor medications are essential in the treatment of conditions like psoriasis, Crohn's disease, and rheumatoid arthritis (RA), and personalized medicine has revolutionized many facets of healthcare. Biologic drugs called TNF inhibitors can help control inflammation and treat symptoms of diseases including Crohn's disease and RA. Genetic variants that may affect a patient's reaction to TNF inhibitor medications can be found through genetic testing. By using this information, doctors can choose the right drug and dosage for each patient, increasing effectiveness and reducing side effects. Healthcare professionals can evaluate each patient's unique risks—such as infections or infusion reactions—related to TNF inhibitor medication thanks to personalized medicine.

Product Insights

The Humira segment led the tumor necrosis factor inhibitor drugs market in 2024 and is projected to maintain its position during the forecast period. Historically, Humira (adalimumab) has been one of the top medications in the market for TNF inhibitors. Many autoimmune illnesses, including rheumatoid arthritis, psoriatic arthritis, ankylosing spondylitis, Crohn's disease, ulcerative colitis, and plaque psoriasis, are treated with TNF inhibitors like Humira. Humira has been one of the top-selling medications in the world for a number of years, thanks to AbbVie, the pharmaceutical firm that created it. But with the advent of biosimilars—similar but distinct versions of biologic medications like Humira—the market for TNF inhibitors has grown more competitive. Compared to original branded medications, biosimilars are more reasonably priced.

In the tumor necrosis factor inhibitor drugs market, the Enbrel segment is also expected to grow at the fastest CAGR in the upcoming years. Enbrel, also known as etanercept, is a well-known medication within the tumor necrosis factor inhibitor family. This particular class of medications is used to treat autoimmune illnesses, including juvenile idiopathic arthritis, rheumatoid arthritis, psoriasis, and psoriatic arthritis. It functions by preventing the body's production of TNF, a chemical that causes inflammation. Along with other TNF inhibitors such as Humira (adalimumab), Remicade (infliximab), Simponi (golimumab), and Cimzia (certolizumab pegol), Enbrel has historically been one of the most popular drugs. These medications are often used and have made a substantial difference in the management of autoimmune disorders. The market for TNF inhibitor medications continues to be dominated by Enbrel, in part because of its well-established safety and effectiveness profiles.

Application Insights

The autoimmune disease segment led the tumor necrosis factor inhibitor drugs market globally in 2024. A class of drugs known as tumor necrosis factor inhibitors is frequently prescribed to treat autoimmune conditions such as Crohn's disease, ulcerative colitis, psoriasis, rheumatoid arthritis, ankylosing spondylitis, and psoriatic arthritis. These medications function by preventing the body's natural production of TNF, which is an inflammatory agent. The ironic side effect of TNF inhibitor medication, the emergence of autoimmune illnesses, is another crucial factor to take into account. While these drugs are intended to treat autoimmune disorders, there is a chance that they will aggravate pre-existing autoimmune diseases or cause new ones to arise. Ultimately, even though TNF inhibitors have transformed the way autoimmune disorders are treated and have greatly benefited a large number of people, healthcare professionals still need to carefully consider the advantages and disadvantages of the prescription of these drugs.

In the tumor necrosis factor inhibitor drugs market, the psoriasis segment is expected to expand notably during the forecast period. Inflammation is a hallmark of both psoriasis and psoriatic arthritis, two chronic autoimmune illnesses that can cause issues with the skin and joints. The need for efficient treatment alternatives has increased due to the expanding global prevalence of psoriasis and psoriatic arthritis. TNF inhibitors belong to the larger class of biological treatments, which have made great strides in the last several years. Patients now have more therapy options thanks to the introduction of newer TNF inhibitors that have better safety and efficacy characteristics on the market. Increased accessibility to healthcare, particularly in developing nations, has further fueled the market for TNF inhibitor medications. The market keeps growing as more people have access to these drugs.

Sales Channel Insights

The hospital pharmacies segment dominated the tumor necrosis factor inhibitor drugs market in 2024. Since tumor necrosis factor inhibitor medications are mostly used to treat autoimmune disorders such as rheumatoid arthritis, psoriasis, Crohn's disease, and ankylosing spondylitis, hospital pharmacies are important players in the market for these medications. Hospital pharmacies are in charge of obtaining, storing, preparing, and giving patients TNF inhibitors, which are frequently given as injections or infusions. Purchasing TNF inhibitor medications from manufacturers or pharmaceutical suppliers is the responsibility of hospital pharmacists. Hospital pharmacy ensures that inventory is managed properly and that pharmaceuticals are not allowed to spoil or run out. TNF inhibitor medications are given to patients by hospital pharmacy in accordance with doctor's orders.

In the tumor necrosis factor inhibitor drugs market, the specialty pharmacies segment is expected to obtain a substantial market share during the forecast period. Tumor necrosis factor inhibitor medications, which are frequently used to treat autoimmune disorders such as rheumatoid arthritis, psoriasis, Crohn's disease, and ankylosing spondylitis, are distributed and managed largely by specialty pharmacies. Patients who participate in these programs receive information and support in order to understand better their prescription regimen, possible adverse effects, and the significance of adherence. To ensure that patients receive TNF Inhibitor medications on time and to handle any concerns related to insurance or coverage, specialty pharmacies frequently collaborate closely with medical professionals and insurance providers. Clinical monitoring services, such as laboratory testing and assistance with disease management, may be provided by specialty pharmacies.

Regional Analysis

North America held the largest share of the global tumor necrosis factor inhibitor drugs market in 2024 and is expected to grow further during the forecast period. This is mostly due to the rise in autoimmune illnesses such as psoriasis, ulcerative colitis, rheumatoid arthritis, and Crohn's disease. TNF is a chemical that can produce inflammation and contribute to autoimmune illnesses; as such, TNF inhibitors suppress the immune system by preventing TNF from doing its job. The market for TNF inhibitor medications is anticipated to expand in North America as a result of aging populations, an increase in autoimmune disease incidence, and escalating healthcare costs. Furthermore, the market is anticipated to continue growing due to developments in biotechnology and the creation of innovative treatments.

In the tumor necrosis factor inhibitor drugs market, Asia Pacific is also expected to gain a significant share in the upcoming years. Over the past few years, the area has seen steady growth in the market for medications that block the tumor necrosis factor (TNF). A class of drugs known as TNF inhibitors inhibits the function of a cell signaling protein called tumor necrosis factor-alpha (TNF-α), which is involved in inflammation. In Asia Pacific, autoimmune illnesses like psoriasis, rheumatoid arthritis, and inflammatory bowel disorders are becoming more common. The demand for these medications is fueled by the widespread use of TNF inhibitors in the treatment of various illnesses. Spending on healthcare has increased as a result of economic expansion in several Asia Pacific nations. As a result, more patients may now afford pricey biologic medications like TNF inhibitors.

Tumor Necrosis Factor Inhibitor Drugs Market Companies

- UCB Inc.

- Pfizer Inc.

- Johnson & Johnson

- Amgen Inc.

- Abbvie

Recent Developments

- In August 2023, CVS Health (NYSE: CVS) announced the establishment of Cordavis, a wholly-owned subsidiary that will collaborate directly with manufacturers to commercialize and/or co-produce biosimilar products for the U.S. pharmaceutical market. Biosimilars are FDA-approved biologic medications that are highly similar to one another and differ not significantly from one another clinically. The FDA-approved Cordavis products will be of excellent quality, simple to use for patients, and contribute to a steady, long-term supply of reasonably priced biosimilars.

Segment Covered in the Report

By Product

- Humira

- Enbrel

- Remicade

- Simponi

- Cimzia

By Application

- Autoimmune disease

- Psoriasis

- Psoriatic arthritis

- Crohn's disease

- Ulcerative colitis

- Ankylosing spondylitis

- Juvenile idiopathic arthritis

- Hidradenitis suppurativa

- Others

By Sales Channel

- Hospital pharmacies

- Specialty pharmacies

- Online pharmacies

By Geography

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting