What is the Prosthetic Heart Valve Market Size?

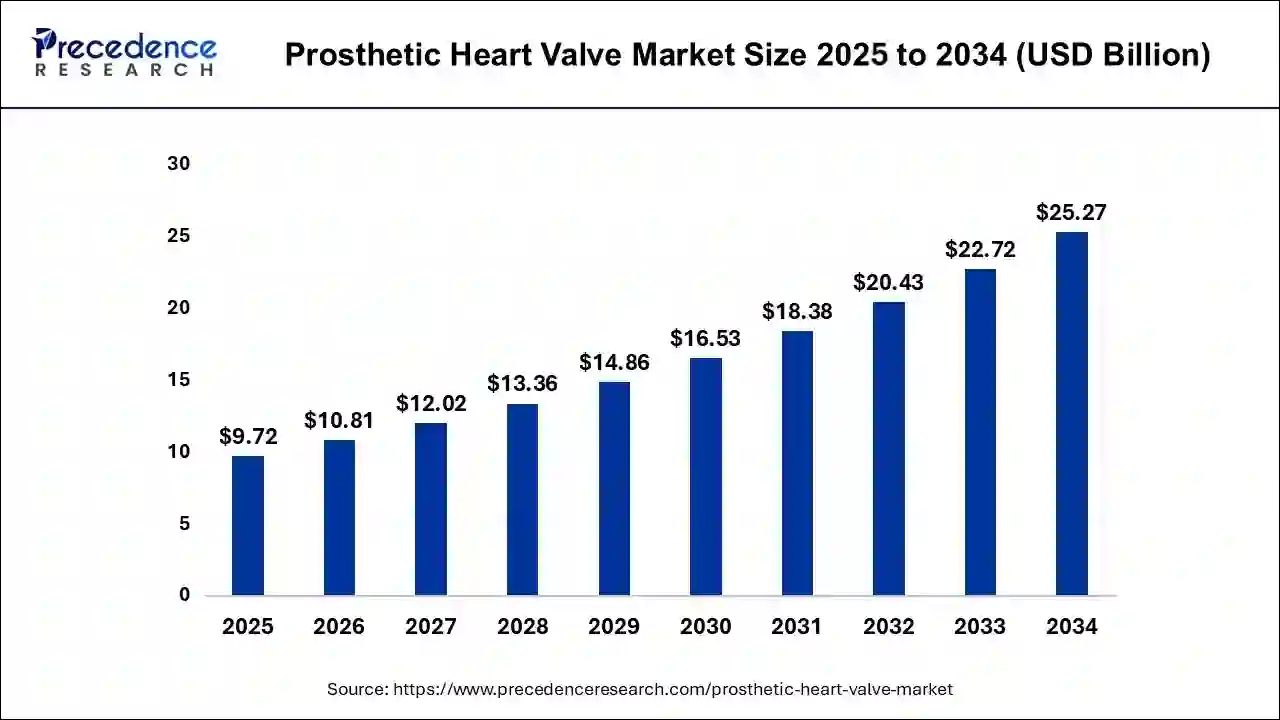

The global prosthetic heart valve market size is accounted at USD 9.72 billion in 2025 and predicted to increase from USD 10.81 billion in 2026 to approximately USD 25.27 billion by 2034, expanding at a CAGR of 11.20% between 2025 and 2034.

Prosthetic Heart Valve Market Key Takeaways

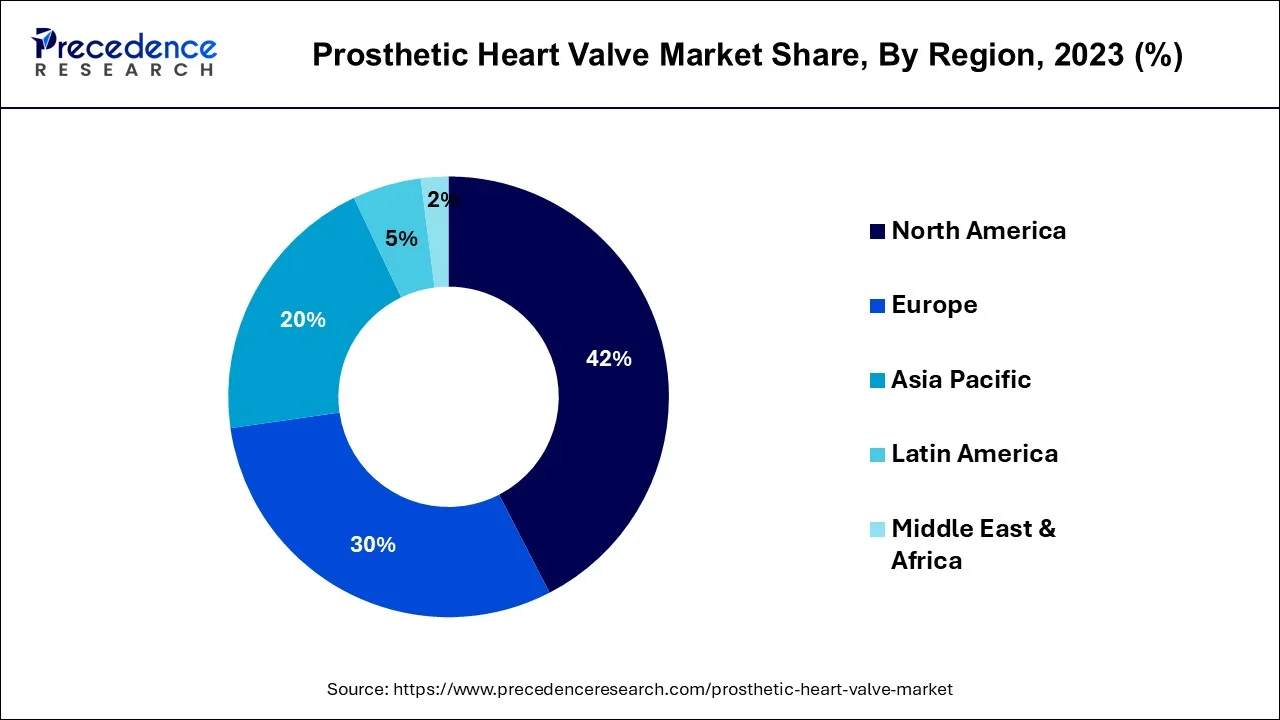

- North America contributed more than 41% of revenue share in 2024.

- Asia-Pacific is estimated to expand the fastest CAGR between 2025 and 2034.

- By product, the transcatheter heart valve segment has held the largest market share of 41% in 2024.

- By product, the mechanical heart valve segment is anticipated to grow at a remarkable CAGR of 12.4% between 2025 and 2034.

- By position, the mitral valve segment generated over 38% of revenue share in 2024.

- By position, the 3D printing segment is expected to expand at the fastest CAGR over the projected period.

What is a prosthetic heart valve?

A prosthetic heart valve is a sophisticated medical device crafted to replace a faulty natural heart valve, essential for maintaining proper blood flow through the heart. The heart comprises four valves—tricuspid, pulmonary, mitral, and aortic, each vital for regulating blood circulation in the chambers. Conditions such as valvular heart disease or congenital defects can impair these valves, necessitating the use of prosthetic alternatives.

Prosthetic heart valves come in two primary types: mechanical and biological. Mechanical valves, constructed from robust materials like titanium or carbon, demand ongoing blood-thinning medications to prevent clotting. Conversely, biological valves, often sourced from animal tissues or human donors, offer an option without the need for long-term blood thinners, though they may have a more limited lifespan.

The selection between these options depends on factors such as the patient's age, overall health, and lifestyle. In the realm of cardiac care, prosthetic heart valves stand as pivotal instruments, restoring cardiac function and enhancing the well-being of individuals grappling with valvular issues.

Prosthetic Heart Valve Market Growth Factors

- The increasing elderly demographic, prone to valvular issues, propels the demand for prosthetic heart valves.

- Ongoing innovations in valve design and materials drive market growth, enhancing durability and performance.

- The surge in heart-related ailments globally amplifies the need for prosthetic heart valve interventions.

- Growing preference for less invasive surgeries boosts the market, reducing patient recovery time and complications.

- Expansion of healthcare infrastructure in developing regions creates new avenues for prosthetic heart valve adoption.

- Unhealthy lifestyles contribute to cardiovascular issues, escalating the demand for heart valve replacements.

- Growing patient awareness about available treatment options fuels the prosthetic heart valve market.

- Increasing demand for personalized prosthetic solutions drives manufacturers to develop customizable heart valves.

- The trend of seeking cardiac care in foreign countries boosts prosthetic heart valve markets in medical tourism destinations.

- Industry collaborations enhance research capabilities, leading to the development of improved prosthetic heart valve technologies.

- Widening insurance coverage for cardiac procedures encourages more individuals to opt for prosthetic heart valve replacements.

- Advancements in post-surgery rehabilitation contribute to increased patient confidence in opting for prosthetic heart valves.

- Integration of wearable devices in cardiac care enhances monitoring post-prosthetic heart valve implantation.

- The growing use of telemedicine facilitates remote patient monitoring, benefiting those with prosthetic heart valves.

- Improvements in economic conditions enable greater access to advanced cardiac care, including prosthetic heart valve procedures.

- Increased funding in R&D accelerates the development of next-gen prosthetic heart valve technologies.

- Availability of positive patient outcomes data enhances the credibility and acceptance of prosthetic heart valves in the medical community.

Prosthetic Heart Valve Market Outlook

- Industry Growth Overview: From 2025 to 2030, the prosthetic heart valve market is set to grow robustly due to surging incidences of cardiovascular disease and the advancement of transcatheter valve technology. Demand increased in regions such as North America and Asia Pacific due to aging populations and expanded surgical applications for procedure-based medical-related surgery.

- Global Expansion: Key manufacturers expanded necessary cardiac care in new heart centers, ultimately in emerging markets of the world, such as America and Southeast Asia. Supply continuously improved the experience and access to cardiac care treatment in countries such as India and Latin America.

- Key Investors: The investment momentum continued a steady upward trajectory with private equity firms pursuing the medical device market segment that focuses on the development of devices designed to treat structural heart conditions. Important partnerships and collaborations between market leaders, such as Medtronic and Edwards Lifesciences, and local distributors accelerated R&D and commercialization efforts in developing markets.

- Startup Ecosystem: The startup ecosystem blossomed amidst innovations in next-generation polymer valve systems, as well as other electronic health innovations supported by AI, and the development of 3D-printed implant prototypes. Foldax (USA) and Tria Life Sciences (India) were among the startups performing well based on efforts to design affordable and durable valve systems, with a distribution model that supports global markets.

Market Scope

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 11.20% |

| Market Size in 2025 | USD 9.72 Billion |

| Market Size in 2026 | USD 10.81Billion |

| Market Size by 2034 | USD 25.27 Billion |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Position, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa |

Market Dynamics

Driver

Increasing incidence of cardiovascular diseases and minimally invasive procedures

The escalating incidence of cardiovascular diseases serves as a driving force behind the surging demand for prosthetic heart valves. As heart-related ailments become more prevalent globally, the need for effective interventions, such as prosthetic heart valves, intensifies. The market responds to this growing health concern by providing innovative and advanced solutions to address various valvular issues, contributing to an expanding patient pool seeking these life-saving interventions.

Furthermore, the increasing popularity of minimally invasive procedures significantly propels the market demand for prosthetic heart valves. Patients and healthcare providers alike are drawn to these procedures due to their reduced invasiveness, quicker recovery times, and lower postoperative complications. This trend aligns with a broader shift in medical practices towards less intrusive interventions, making prosthetic heart valves more accessible and appealing to a larger demographic, thereby fueling the market's growth.

Restraint

Prosthetic heart valve

The prosthetic heart valve market faces constraints in its growth trajectory due to a shortage of skilled healthcare professionals and the inherent risk of complications associated with the procedures. The intricate nature of prosthetic heart valve surgeries necessitates a high level of expertise among healthcare practitioners. However, a shortage of skilled professionals proficient in these specialized procedures poses a significant bottleneck, limiting the widespread adoption of prosthetic heart valves.

This scarcity not only hampers the accessibility of these life-saving interventions but also contributes to increased surgical risks. Moreover, the risk of complications, such as blood clots or infections, during and after prosthetic heart valve implantation procedures raises concerns among both healthcare providers and patients.

The potential for adverse events can deter individuals from opting for these interventions, impacting patient confidence and, consequently, impeding the overall growth of the prosthetic heart valve market. Addressing these challenges requires strategic efforts to enhance medical education and training programs, ensure a competent workforce, and continuous advancements in technologies to mitigate the risks associated with prosthetic heart valve procedures.

Opportunity

Expanding geriatric population and focus on bioengineered solutions

The expanding geriatric population worldwide presents a significant opportunity in the prosthetic heart valve market. With age being a prominent risk factor for valvular heart diseases, the rise in elderly individuals correlates with an increased demand for prosthetic heart valves. This demographic shift underscores the importance of developing and providing advanced cardiac solutions to cater to the specific needs of an aging population, thereby driving market growth.

Simultaneously, the focus on bioengineered solutions in prosthetic heart valve development opens new avenues. Bioengineered valves, designed to mimic natural tissue properties, hold the promise of improved durability and reduced complications. As the demand for biocompatible and long-lasting alternatives rises, the market can capitalize on bioengineering advancements to offer innovative prosthetic heart valve options. This emphasis on technological innovation aligns with the growing trend towards personalized and patient-centric healthcare, creating opportunities for manufacturers and researchers to contribute to the evolution of the prosthetic heart valve market.

Product Insights

The transcatheter heart valve segment has held a 41% revenue share in 2024. The transcatheter heart valve, a pivotal product in the prosthetic heart valve market, involves a minimally invasive approach to valve replacement. This innovative technology allows for the implantation of the prosthetic valve through catheter-based procedures, avoiding the need for traditional open-heart surgery.

As a trend, transcatheter heart valves are gaining prominence for their reduced recovery times, lower complications, and increasing applications across a spectrum of patients, including those considered high-risk or inoperable. The market is witnessing a shift towards these less invasive options, driving advancements and adoption of transcatheter heart valve technologies.

The mechanical heart valve segment is anticipated to expand at a significant CAGR of 12.4% during the projected period. A mechanical heart valve is a prosthetic device composed of durable materials such as titanium or carbon, designed to replace a malfunctioning natural heart valve. It operates through mechanical opening and closing mechanisms, regulating blood flow within the heart.

In the prosthetic heart valve market, the mechanical heart valve segment is witnessing trends towards enhanced durability and biocompatibility. Ongoing research focuses on developing innovative materials and refining design features to improve longevity and reduce the need for lifelong anticoagulant medications, addressing key concerns associated with mechanical heart valves.

Position Insights

The mitral valve segment had the highest market share of 38% in 2024. The mitral valve, a crucial component of the heart's anatomy, regulates blood flow between the left atrium and ventricle. In the prosthetic heart valve market, the mitral valve segment involves the development and deployment of artificial valves specifically designed for this cardiac position.

Trends in this segment include ongoing advancements in mitral valve replacement technologies, with a focus on improving durability, reducing complications, and enhancing overall patient outcomes. As innovations continue to address mitral valve-related issues, the market experiences a positive trajectory in meeting the specific needs of individuals with mitral valve disorders.

The aortic valve segment is anticipated to expand fastest over the projected period. The aortic valve, a crucial component of the heart, regulates blood flow from the left ventricle to the aorta. In the prosthetic heart valve market, aortic valve replacements address conditions like aortic stenosis or regurgitation. Emerging trends in aortic valve prosthetics focus on transcatheter aortic valve replacement (TAVR), a minimally invasive technique gaining prominence. TAVR offers reduced recovery times and is increasingly preferred, contributing to a notable shift in the market towards less invasive approaches for aortic valve interventions.

Regional Insights

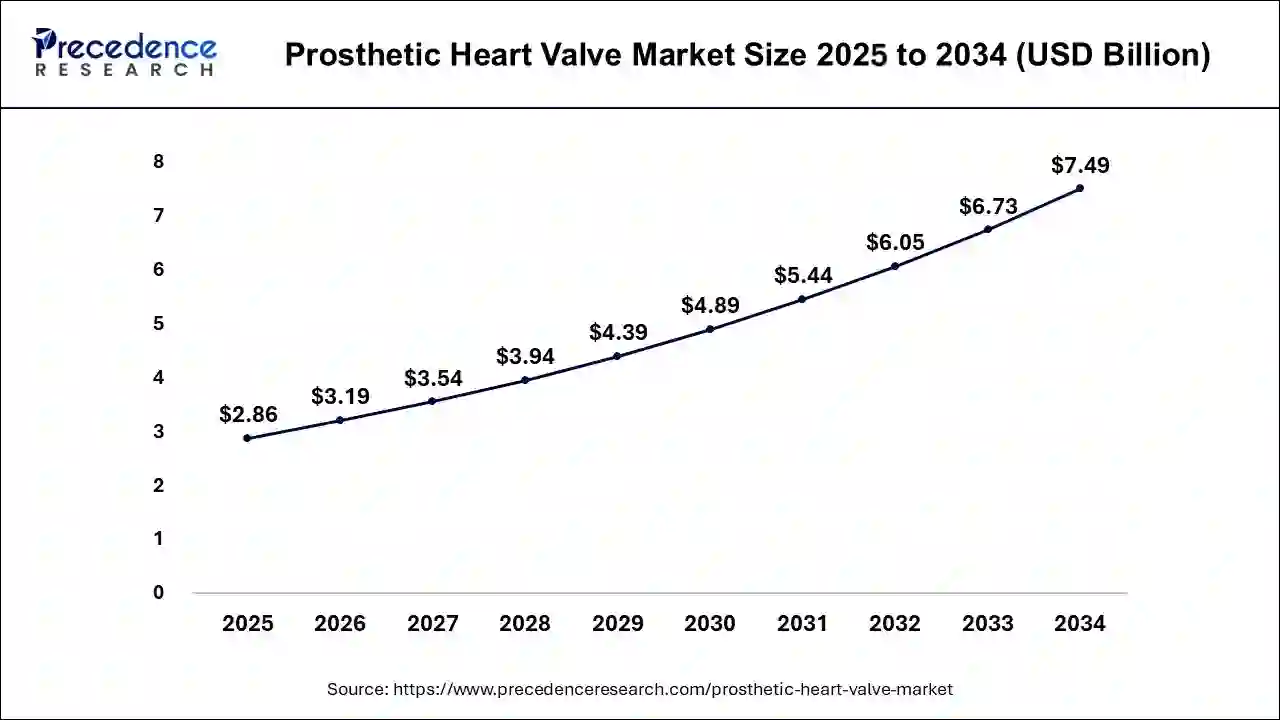

U.S. Prosthetic Heart Valve Market Size and Growth 2025 to 2034

The U.S. prosthetic heart valve market size accounted for USD 2.86 billion in 2025 and is expected to be worth around USD 7.49 billion by 2034, growing at a CAGR of 11.29% from 2025 to 2034.

North America has held the largest revenue share of 41% in 2024. North America dominates the prosthetic heart valve market due to factors like advanced healthcare infrastructure, high healthcare spending, and a significant prevalence of cardiovascular diseases. The region's well-established research and development capabilities contribute to continuous technological innovations in prosthetic heart valves.

Moreover, a growing aging population and increasing awareness about available cardiac interventions further drive the demand. Robust regulatory frameworks and reimbursement policies also play a crucial role in maintaining North America's major market share by fostering a favorable environment for the development and adoption of advanced prosthetic heart valve technologies.

U.S. Prosthetic Heart Valve Market Trends

The U.S. market is experiencing strong growth, driven by the increasing prevalence of valvular heart diseases such as aortic stenosis and mitral regurgitation, particularly among the aging population. Technological advancements and the growing adoption of minimally invasive procedures, including transcatheter aortic valve replacement (TAVR), are expanding treatment options and patient eligibility. The shift towards outpatient and ambulatory surgical centers, along with improvements in device durability, is further supporting market expansion.

Asia Pacific is estimated to observe the fastest expansion. Asia-Pacific commands a significant share in the prosthetic heart valve market due to a combination of factors. The rising geriatric population, increasing prevalence of cardiovascular diseases, and improving healthcare infrastructure contribute to the region's prominence.

Moreover, a surge in awareness, growing healthcare investments, and a shift towards advanced medical technologies fuel the demand for prosthetic heart valves. With a focus on innovation and expanding access to cardiac care, Asia Pacific stands as a key player in driving market growth for prosthetic heart valves.

China Prosthetic Heart Valve Market Trends

China's market is experiencing rapid growth, driven by an aging population, increasing prevalence of valvular heart diseases, and expanding access to advanced cardiovascular care. The transcatheter heart valve (TAVR) segment is emerging as the fastest-growing and most widely adopted valve type, offering minimally invasive treatment options to a broader patient base. Local manufacturers are gaining momentum, supported by government initiatives to enhance healthcare infrastructure, streamline regulatory

Why did Europe grow at a considerable rate in the prosthetic heart valve market?

Europe experienced considerable development within the prosthetic heart valve market owing to factors such as an aging population, improving cardiac awareness, and well-regulated medical device approval and reimbursement processes. Countries in the region, such as Germany and France, led the adoption of transcatheter heart valves. Ongoing research and development (R&D), favorable government funding, and favorable reimbursement systems foster market growth. Moreover, Europe's commitment to the advancement of sustainable healthcare technologies also led to opportunities for developing next-generation bio-based and polymeric heart valves throughout the continent.

Germany Prosthetic Heart Valve Market Trends

Germany led the European heart valve market because of its superior R&D capabilities and strong healthcare spending. Its sophisticated surgical expertise established medical research institutions, and collaboration with device manufacturers added to the rapid adoption of innovation in valve technology. Favorable reimbursement systems and the aging population also contributed to unprecedented demand for heart valves. Additionally, German companies continued to invest in sustainable, green materials to sustain the region's technological advancements in the manufacturing of heart valves.

What made Latin America grow consistently in the prosthetic heart valve market?

Latin America registered consistent development in its prosthetic heart valve market due to improvements in healthcare capacity and awareness of cardiovascular treatment. The market also benefited from increased investment aimed at modernizing hospitals, as well as importing medical devices. Furthermore, access to more advanced procedures was enhanced through partnerships with manufacturers and public healthcare programs. This development led to a market that was capable of introducing economically viable valve technologies for emerging economies throughout the region.

Brazil Prosthetic Heart Valve Market Trends

Brazil was the leading market for prosthetic heart valves in Latin America due to greater accessibility through a network of specialized cardiac centers and stronger government support demonstrated through healthcare reforms. In addition to the dynamics already described the continued expansion and investment in production from domestic manufacturing and partnerships involved in the international supply chain promoted greater access to regional residents for advanced, high-quality valve systems. Moreover, increased public awareness and improved health insurance coverage were both key contributors in facilitating the adoption of more advanced cardiac interventions throughout Brazil.

Why did the Middle East and Africa region experience significant growth in the prosthetic heart valves market?

The Middle East and Africa region experienced significant growth as a result of enhanced hospital facilities, medical tourism, and government healthcare investments. The increase in cardiovascular diseases also drove demand for next-generation cardiac implants. Furthermore, partnerships with global device manufacturers improved access to technology, while the broadening of health coverage and physician training created new opportunities for the use of prosthetic heart valves.

Saudi Arabia Prosthetic Heart Valve Market Trends

Saudi Arabia dominated the regional market due to its Vision 2030 health initiative and rapid hospital growth. Growth was the result of high incomes, government-sponsored cardiac centers, and growing acceptance of advanced prosthetic technologies. Moreover, collaborative partnerships with global companies were also developed to enhance clinical capabilities and eventually establish Saudi Arabia as a regional center of cardiovascular treatment and technology innovation.

Prosthetic Heart Valve Market Companies

- Edwards Lifesciences Corporation

- Medtronic plc

- Abbott Laboratories

- Boston Scientific Corporation

- CryoLife, Inc.

- LivaNova PLC

- St. Jude Medical, Inc.

- Braile Biomedica

- Micro Interventional Devices, Inc.

- JenaValve Technology, Inc.

- Colibri Heart Valve, LLC

- Meril Life Sciences Pvt. Ltd.

- Jenavalve Technology

- Labcor Laboratórios Ltda.

- TTK Healthcare Limited

Recent Developments

- In March 2022, Edwards Lifesciences achieved a significant milestone with FDA approval for the MITRIS RESILIA valve, a specialized tissue valve replacement designed for the mitral position in the heart. This approval marked a pivotal moment in providing advanced cardiac solutions.

- In parallel, JenaValve Technology, Inc. strategically partnered with Peijia Medical Limited in January 2022, securing a substantial cash and equity investment. This agreement granted Peijia exclusive rights to develop and market JenaValve's cutting-edge Trilogy TAVR systems in the Greater China area, addressing severe symptomatic aortic regurgitation or aortic stenosis. This collaboration showcased the global expansion of innovative transcatheter aortic valve replacement technologies, catering to the specific needs of patients in the rapidly advancing medical landscape of the Asia-Pacific region.

Segments Covered in the Report

By Product

- Mechanical Heart Valve

- Tissue Heart Valve

- Stented Tissue Heart Valve

- Stentless Tissue Heart Valve

- Transcatheter Heart Valve

By Position

- Mitral Valve

- Aortic Valve

- Other Positions

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting