What is the Heart Pump Device Market Size?

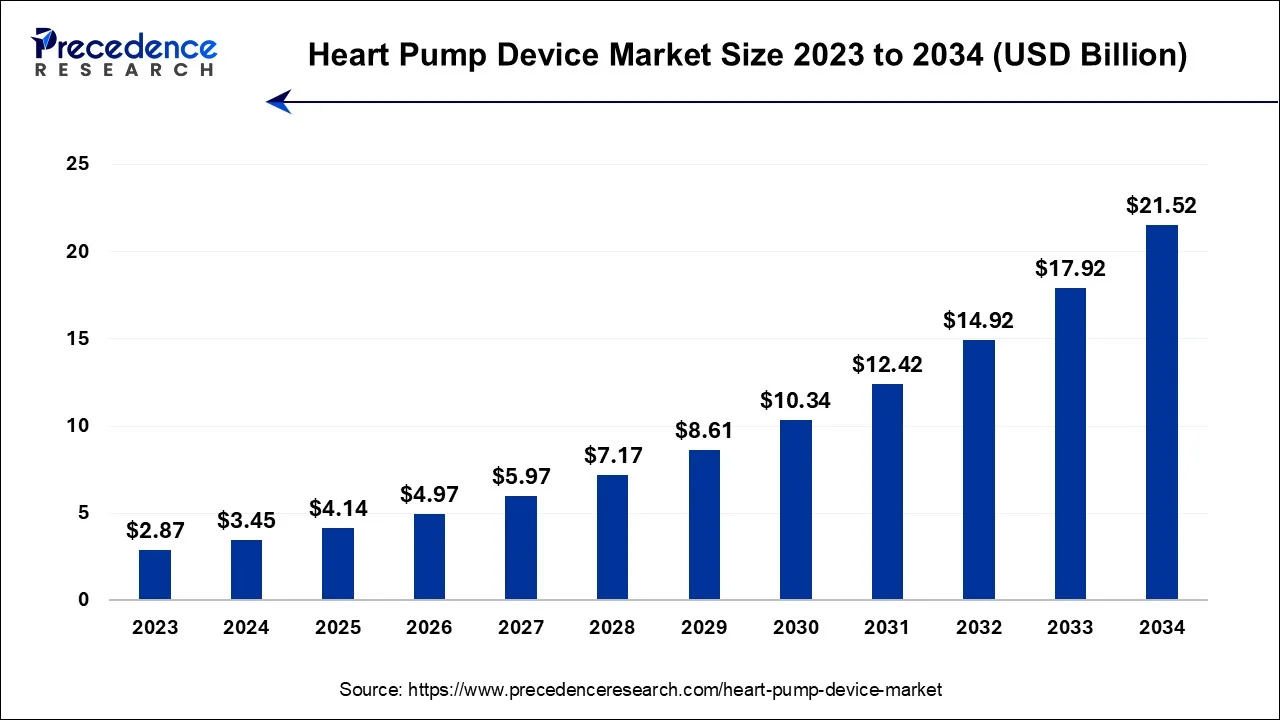

The global heart pump device market size is accounted for USD 4.14 billion in 2025 and is predicted to increase from USD 4.97 billion in 2026 to approximately USD 24.72 billion by 2035, growing at a CAGR of 19.57% from 2026 to 2035.

Heart Pump Device Market Key Takeaways

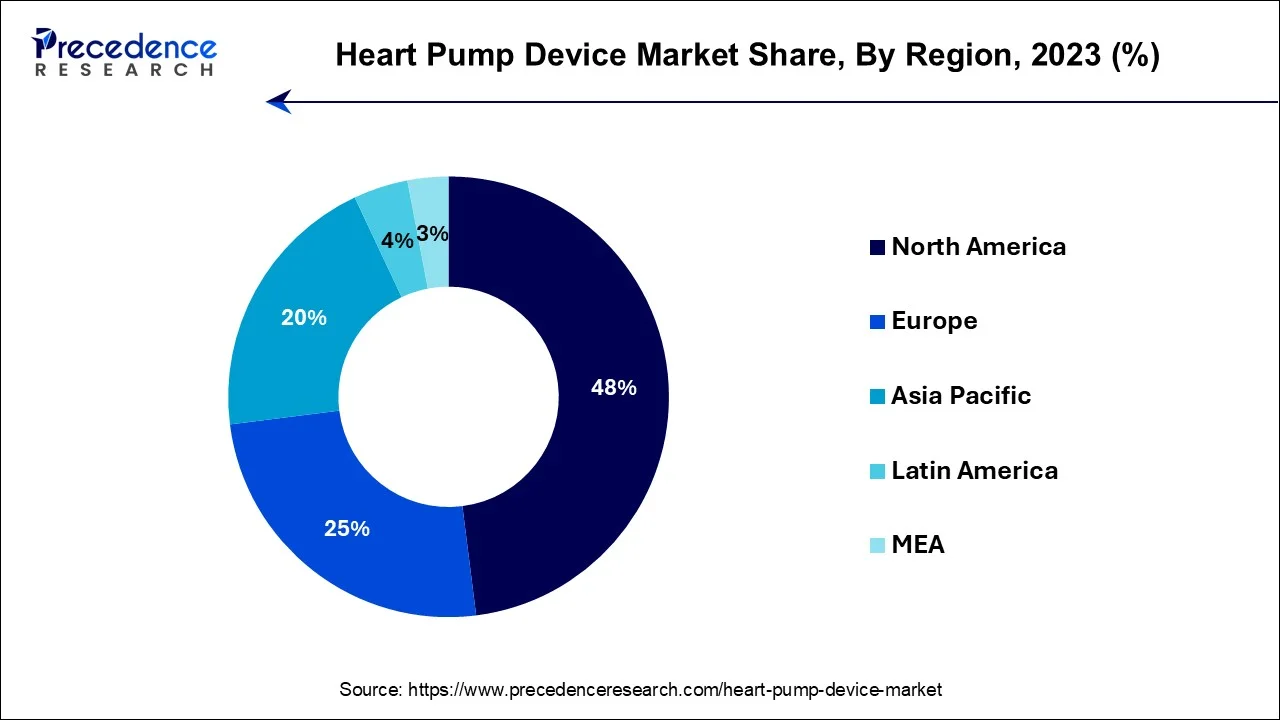

- By region, North America dominated the heart pump device market in 2025.

- By region, Europe is expected to witness the fastest rate of growth in the heart pump device market during the forecast period.

- By Type, the implanted heart pump devices segment held the largest share of the heart pump device market in 2025. On the other hand, the extracorporeal heart pump devices segment is expected to grow at a significant rate during the forecast period.

- By Product, the ventricular assist devices (VADs) segment accounted for a dominating share of the market.

- By Therapy, the bridge-to-transplant (BTT) segment held the largest share of the heart pump device market.

Market Overview

The global heart pump device market refers to the industry that designsmedical devicesto replace or assist the pumping function of the heart. These devices are typically used for patients with heart failure or other serious heart conditions. The global market for heart pump devices includes various manufacturers and models of heart pump devices and it is influenced by factors such as medical advancements, regulatory approvals and patient demand.

Heart Pump Device Market Growth Factors

With the growing count of individuals suffering from cardiovascular diseases (CVDs), an increasing number of product approvals, and a promising product pipeline, the heart pump devices market is expected to grow promisingly in the coming years.

- Owing to the scarcity of heart suppliers, heart pump devices are proving to be an optimal solution. In June 2023, Magenta Medical published a study for the world's smallest heart pump. To secure FDA approval, Magenta Medical commenced an early feasibility study with its Elevate Percutaneous Left Ventricular Assist Device (pLVAD) for high-risk percutaneous coronary intervention (HR-PCI). The increasing research and development (R&D) activities pertaining to heart pump devices are supporting the market growth positively.

- To enhance the development of heart pump devices, respective companies are considering collaborations, partnerships, and joint ventures. In November 2022, Johnson & Johnson announced that it completed a deal to buy heart pump maker Abiomed. To boost the growth of its medical devices unit, Johnson & Johnson acquired Abiomed for $16.6 billion.

Owing to the growing prevalence of heart attacks and other heart conditions, the requirement for heart pump devices is expected to grow notably. With the rising adoption of the latest medical technologies, competition among major players is anticipated to rise in the heart pump device market.

Market Scope

| Report Coverage | Details |

| Market Size by 2035 | USD 24.72 Billion |

| Market Size in 2026 | USD 4.97 Billion |

| Market Size in 2025 | USD 4.14 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 19.57% |

| Largest Market | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Type, Product, Therapy, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

High prevalence of heart failure

Heart pump devices have high utility in treating heart failures. The ventricular assist device can pull oxygen-rich blood in one side of the pump and propel it out of the other side, into the aorta. As per the Journal of Cardiac Failure, nearly 6.7 million Americans above 20 years of age have heart failure (HF), and the prevalence is estimated to increase to 8.5 million Americans by 2030.

As per the British Heart Foundation Fact Sheet 2023, it is found that over 900,000 people have heart failure in the United Kingdom. Also, about 200,000 new diagnoses of heart failure are observed each year in the UK. As per an article shared by the National Library of Medicine, over 8 million Americans will be living with heart failure by 2030. The growing prevalence of heart failure is driving the heart pump device market growth remarkably.

Restraint

High cost of heart pumps

As per a study result shared by Healthline Media UK Ltd., after the introduction of Impella heart pumps, the cost of treating heart patients with mechanical devices grew from $47,000 to $51,000 per patient. A total artificial heart (TAH) replaces the 2 lower chambers of the heart that may be not functioning due to end-stage heart failure. India Cardiac Surgery Site states that the average cost of artificial heart transplant in India ranges from about $54,000 (?45,00,000) to $98,000 (?80,00,000). Many patients are not able to afford such expensive heart pump devices. The higher costs associated with heart pump devices is restraining the market growth to a considerable extent.

Opportunity

Development of new heart pump devices

CorWave recently exhibited an unprecedented study on the performance of its implantable heart pump at the 41st Annual Meeting of the International Society for Heart and Lung Transplantation (ISHLT). CorWave unveiled the 1st study demonstrating sensorless synchronization of a pericardial pump with the native heart for over 30 days. In January 2022, The School of Medical Research and Technology (SMRT) of IIT Kanpur announced the launch of Hridyantra, a challenge-based program for developing an advanced artificial heart.

The new advanced artificial heart also known as the Left Ventricular Assist device (LVAD) is being developed for patients with end-stage heart failure. After receiving over $3 million from the National Heart, Lung, and Blood Institute in April 2022, Penn State College of Medicine started developing an implantable artificial heart that functions wirelessly and reliably for 10 years. The rising development of innovative heart pump devices is creating promising opportunities for market growth.

Segment Insights

Type Insights

The implanted heart pump devices segment held the dominating share of the heart pump device market in 2023. Implanted heart pump devices are becoming very popular among patients who suffer from heart failure (HF) and are not eligible for a heart transplant. Improved quality life offered by implanted heart pump devices has forced the adoption of such devices in the healthcare industry.

The extracorporeal heart pump devices segment is predicted to grow at a significant rate during the study period. These heart pump devices are temporarily support for the functioning of the heart by pumping blood out and returning it to the circulatory system. As per the American Heart Association, there are nearly 750,000 fatalities every year in the U.S. The rising prevalence of heart disease is contributing to the extracorporeal heart pump device segment growth.

Product Insights

The ventricular assist devices (VADs) segment dominated the global heart pump device market in 2023. Continuous advancements in ventricular assist devices technology have led to improved device reliability, reduced complications and enhanced patient outcomes. Heart failures is a prevalent cardiovascular condition, and its incidence is on the rise due to factors like aging population and lifestyle-related health issues. This factor has increased the demand for heart pump devices, with ventricular assist devices being a primary choice.

Therapy Insights

The bridge-to-transplant (BTT) segment accounted for the largest share of the heart pump device market. clinical studies and real-world evidence have demonstrated the positive impact of bridge-to-transplant therapy of patients, solidifying its role as the standard of care for many transplant candidates. This therapy usually involves the use of ventricular assist devices or other mechanical circulatory support the failing heart until a suitable donor becomes available.

Regional Insights

What is the U.S. Heart Pump Device Market Size?

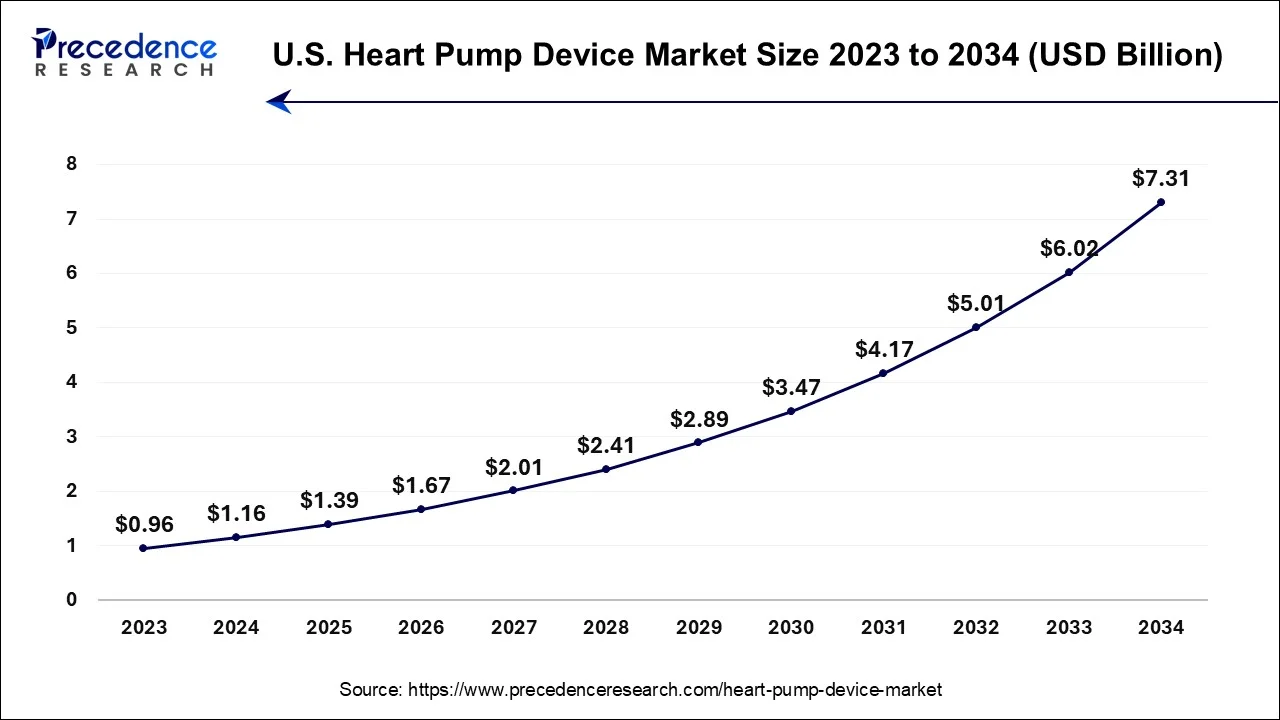

The U.S. heart pump device market size was exhibited at USD 1.39 billion in 2025 and is projected to be worth around USD 8.41 billion by 2035, poised to grow at a CAGR of 19.72% from 2026 to 2035.

How is the Revolutionary Growth of North America in the Heart Pump Device Market in 2025?

North America dominated the heart pump device market in 2023. The U.S. dominated the North American heart pump device market followed by Canada and Mexico. Cardiovascular disease (also known as heart disease) is the leading cause of death in the U.S. Considering the presence of nations with high spending capacity, early adoption of the latest medical technologies, and rising prevalence of heart disease, the heart pump device market is forecast to grow significantly in the North American region during the study period.

U.S. Heart Pump Device Market Analysis

There is a favorable reimbursement and robust coverage from Medicare, Medicaid, and private insurers. In December 2025, researchers at the National Heart, Lung, and Blood Institute received $3.2 million in federal funding to test a new heart pump for children.

How does Europe define the Fastest Rate of Growth in the Heart Pump Device Market?

Europe is observed to exhibit the fastest rate of growth in heart pump device market during the forecast period. The European heart pump device market is segmented into Germany, the United Kingdom (UK), Italy, Spain, France, and the Rest of Europe. Considering the well-developed healthcare infrastructure, Germany is expected to hold a higher share of the European heart pump device market during the forecast period.

Germany Heart Pump Device Market Analysis

Germany is growing due to strategic therapeutic applications of heart pump devices and a shift to minimally invasive procedures. The country's growth is driven by government programs and legislation, and industrial developments. The global product launches and innovations, major German companies, and investments drive the country.

Why is the Asia Pacific Witnessing a Notable Growth in the Heart Pump Device Market?

Whereas Asia Pacific is expected to witness a notable rate of growth throughout the forecast period. China is predicted to continue its dominance in the Asia Pacific (APAC) heart pump device market followed by Japan and India. As per the Indian College of Cardiology (ICC), 1st time heart attack-related mortality is around 15-20% in India (120,000 to 200,000 deaths). The high occurrence of heart attacks is expected to drive the adoption of Intra-Aortic Balloon Pumps (IABPs) in the APAC region.

How is the Pivotal Growth of the Heart Pump Device Market within South America?

South America is expected to experience significant growth during the forecast period, driven by the rising prevalence of cardiovascular diseases and the modernization of healthcare infrastructure.

- In July 2024, Magenta Medical, a leading developer of the world's smallest heart pump, closed a $105 million financing round that will support clinical programs.

How is the Middle East and Africa Gaining Momentum in the Heart Pump Device Market?

MEA is expected to grow at a lucrative rate in the market in the coming years, driven by clinical adoption, regulatory support, and the expansion of healthcare infrastructure. The various programs and initiatives are driven by regional countries like Saudi Arabia, the UAE, South Africa, and Ghana.

Value Chain Analysis

- R&D

This stage includes AI and ML integration, miniaturization, minimally invasive design, improved biocompatibility, and wireless power and remote monitoring.

Key Players: Abbott Laboratories, Johnson & Johnson, Medtronic, Terumo Corporation, Magenta Medical, BiVACOR. - Distribution to Hospitals, Pharmacies

This stage is driven by decentralized care, supply chain disruptions, and AI-enabled remote monitoring platforms.

Key Players: Abbott Laboratories, Cardinal Health, Medline Industries, Johnson & Johnson, Medtronic, Terumo Corporation, Magenta Medical, BiVACOR. - Patient Support & Services

This stage encompasses AI and remote monitoring services, clinical support and management, manufacturer support programs, and emerging global accessibility.

Key Players: SynCardia Systems, Berlin Heart, Abbott Laboratories, Johnson & Johnson, Medtronic, Terumo Corporation, Magenta Medical, BiVACOR.

Heart Pump Device Market Companies

- Abbott

- ABIOMED

- Berlin Heart

- BiVACOR Inc.

- CARMAT

- CorWave SA

- Evaheart, Inc.

- Fresenius SE & Co. KGaA

- Getinge AB.

- Jarvik Heart

- Leviticus Cardio

- LivaNova PLC

- SynCardia Systems, LLC

- Teleflex Incorporated

Recent Developments

- In August 2024, Abbott's HeartMate 3 left ventricular assist device (LVAD) received U.S. FDA approval for an aspirin-free regimen.

(Source: https://citoday.com/ ) - In April 2025, Teleflex Incorporated received FDA 510(k) clearance of the AC3 Range Intra-Aortic Balloon Pump (IABP). (Source:https://investors.teleflex.com/ )

- In September 2022, a team of IITians and investors from India started working on a made-in-India artificial heart or left ventricular assist device (LVAD). The device is planned to be made available for just ?20 lakh ($23,972), whereas the cost of an imported artificial heart in India is around ?1.20 crore ($143,832).

- In August 2022, new data exhibited that the Abbott HeartMate 3™ heart pump extends the survival of advanced heart failure patients by at least 5 years. The data are from the MOMENTUM 3 trial, the world's largest randomized clinical trial for assessing long-term results in advanced heart failure patients treated with a left ventricular assist device.

Segments Covered in the Report

By Type

- Extracorporeal Heart Pump Devices

- Implanted Heart Pump Devices

By Product

- Total Artificial Hearts (TAHs)

- Ventricular Assist Devices (VADs)

- Intra-Aortic Balloon Pumps (IABPs)

- Extracorporeal Membrane Oxygenation (ECMO)

By Therapy

- Bridge-to-Candidacy (BTC)

- Bridge-to-Transplant (BTT)

- Destination Therapy (DT)

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting