What is Cardiovascular Drugs Market Size?

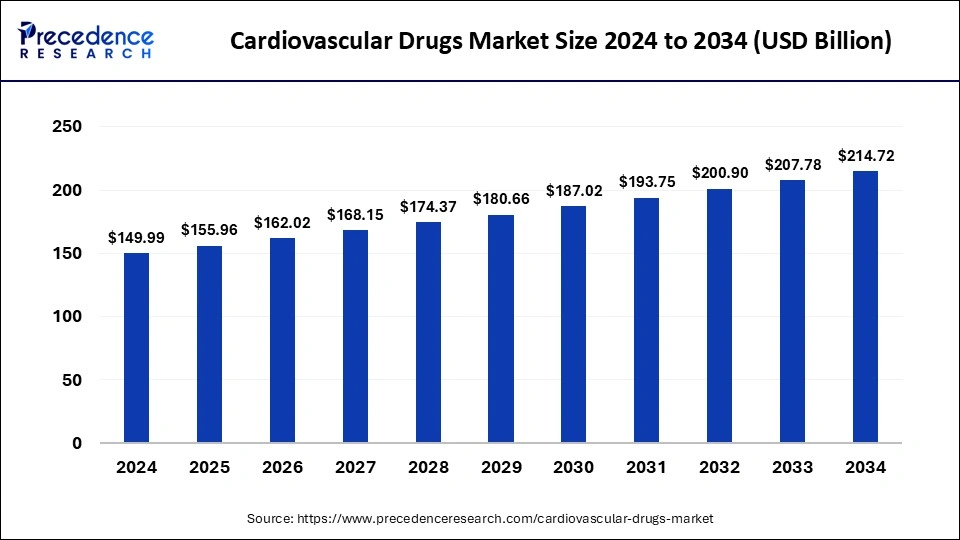

The global cardiovascular drugs market size is calculated at USD 155.96 billion in 2025 and is predicted to increase from USD 162.02 billion in 2026 to approximately USD 214.72 billion by 2034, expanding at a CAGR of 3.62% from 2025 to 2034.

Market Highlights

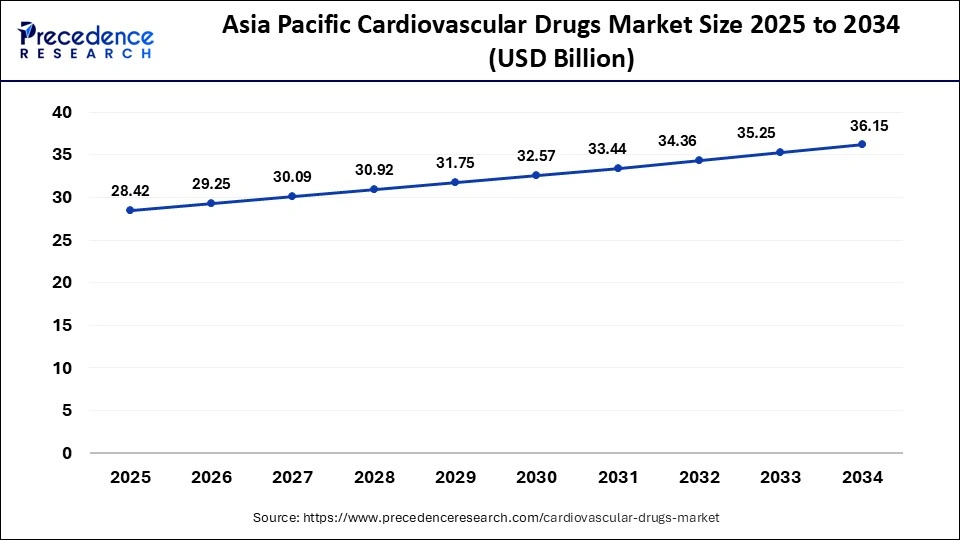

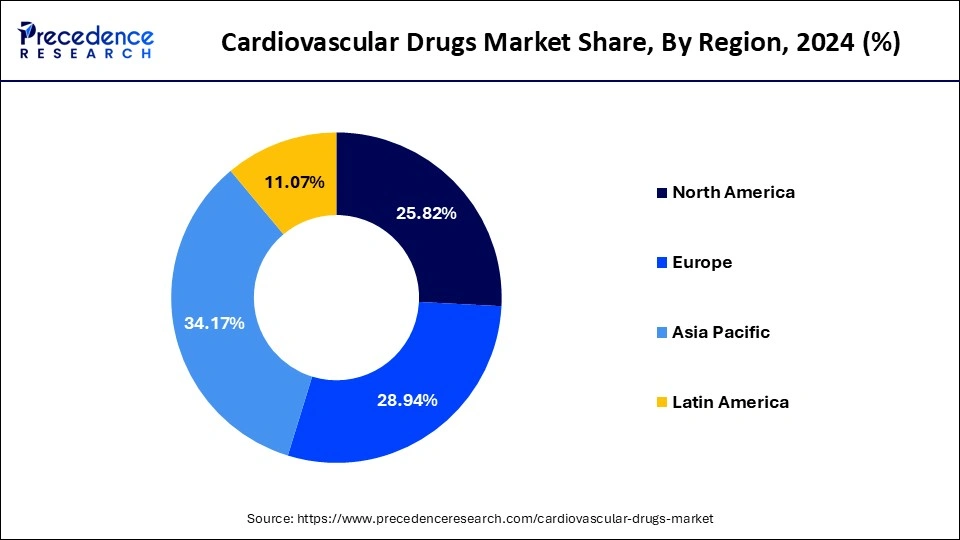

- Asia Pacific led the global market with the highest market share of 34.17% in 2024.

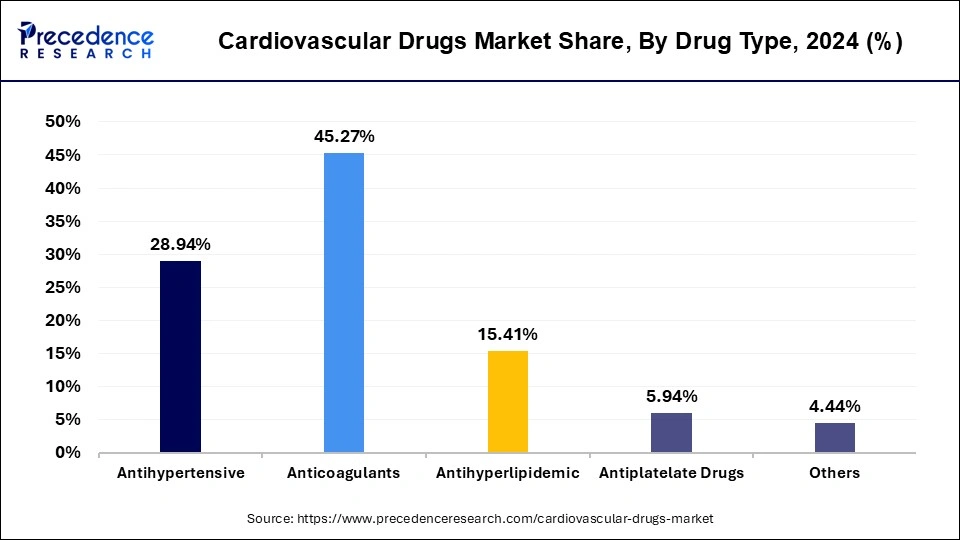

- By Drug Type, the anticoagulants segment accounted the biggest market share of 45.27% in 2024.

- By Route of Administration, the oral segment contributed more than 54.67% of revenue share in 2024.

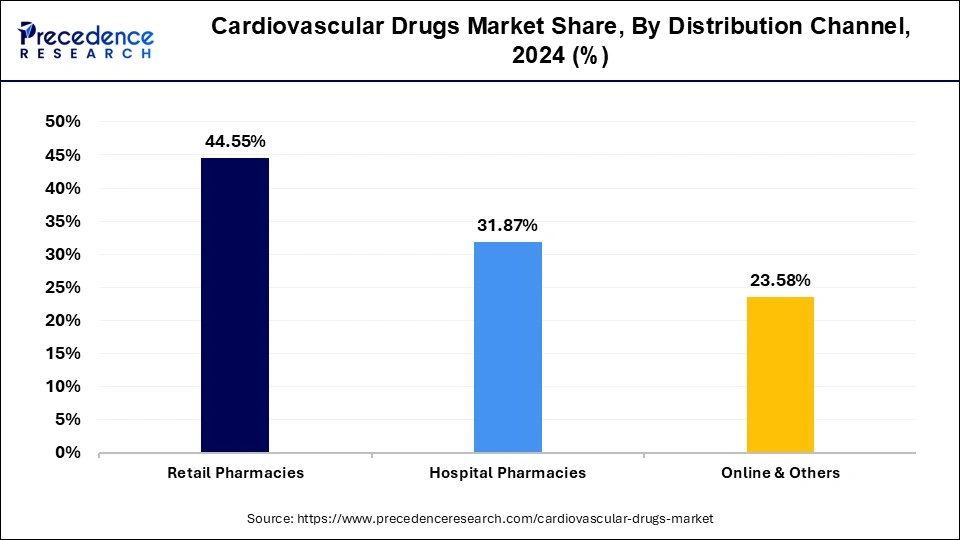

- By Distribution Channel, the retail pharmacies segment accounted the largest market share of 44.55% in 2024.

- By disease indication, the hypertension segment accounted the largest market share of 28.94% in 2024.

Market Size and Forecast

- Market Size in 2025: USD 155.96 Billion

- Market Size in 2026: USD 162.02 Billion

- Forecasted Market Size by 2034: USD 214.72 Billion

- CAGR (2025-2034): 3.62%

- Largest Market in 2024: Asia Pacific

Market Overview

With the increasing prevalence of cardiovascular diseases among the people a rapid growth has been seen in the cardiovascular drugs market. The number of people suffering with cardiovascular diseases has tremendously increased as a result of the faulty lifestyle practices and sedentary habits of the people. The alterations in the food and drinking habits of the people too has shown a significant impact on the cardiovascular system.

The problems of cardiovascular diseases has also increased due to the rise in work pressure and stress among the people belonging to the younger generation. The people belonging to the geriatric age group already present a number of cardiovascular disorders which helps to boost the market of the cardiovascular drugs tremendously. Even minor alterations in the rhythm or rate of the cardiovascular system helps the cardiovascular drugs market to grow considerately. Not only the elderly people but also the younger generation present a number of cardiovascular complaints as a result of their lifestyle practices. With the prevalence of cardiac arrest among the people, the market for the cardiovascular drugs has boosted tremendously.

The high court associated with the use of advanced technology and medicines in the market for the cardiovascular drugs has seen or drop in the developing nations, where the disposable income of the people is very low. The developed nations possess a high disposable income which helps the market to record a higher revenue return from them. Lack of awareness among the people regarding healthcare facilities that are available for the common people lead to delay in the treatment of life-threatening conditions of the patients with cardiovascular disorders.

The Global Lifeline Industry Powering a Potential Future

Therapeutics that manage hypertension, arrhythmias, lipid disorders, thrombotic events, heart failure, and ischemic heart disease remains consistently strong. The market spans a diverse therapeutic spectrum from generics that support mass accessibility to advanced biologics and next-generation oral therapies designed to modulate complex cardiometabolic pathways. Increasing patient awareness, improved diagnosis rates, and the rise of preventive cardiology continue to redefine the demand landscape. This is no longer just a pharmaceutical category it is a systemic enabler of longevity and health-span.

Cardiovascular Drugs Market Growth Factors

- The huge number of patients suffering with cardiovascular diseases has helped the market to record a considerable growth during the forecast period.

- The increasing prevalence of cardiac arrest and cardiac arrhythmias has boosted the demand for cardiovascular drugs in the society.

- The sedentary lifestyle practices have increased the prevalence of obesity among the people which directly hampers the heart health of the individual. Thus, the demand for cardiovascular drugs keeps increasing with the growing number of cardiovascular disorders.

- The faulty food habits of the people as a result of rapid modernization have also proved to be a major factor for the number of patients suffering with cardiovascular blockages and irregularities.

The occurrence of the pandemic has also helped the market to record a considerable growth as a result of increasing cardiovascular disorders among the people. With the increasing prevalence of restricted moments in the world, the cardiovascular health of the people has deteriorated to a great extent. Lack of moment and physical activity among the people belonging to the walking class has proved to be a growing factor for the cardiovascular drugs market.

Another factor that helps the market to show a significant growth is the habit-forming nature of the drugs, which does not allow the consumer to discontinue the medications for a considerably long period of time. This keeps the revenue generation system running without interruptions. Rapid increase in the amount of stress and frustration among the people as a result of working from home has also created a number of cardiovascular diseases.

The prevalence of hypertension among the people has put an additional chance of cardiovascular disorders which helps to boost the market for the cardiovascular drugs. The long working hours which are followed by the youngsters belonging to the developing countries has increased the risk of cardiovascular disorders among them. A huge number of people are seen to be suffering with cardiovascular irregularities which increases the sales and supply of the related drugs. A drawback for the patient is that these cardiovascular in drugs cannot be easily discontinued which in turn proves to be a growing factor for the cardiovascular drugs market.

The various complications and side effects that are associated with these cardiovascular drugs help to increase the sales and demand of the other accessory drugs that are required to manage and balance these side effects. The cardiovascular drugs being an essential necessity for the people, finds its place in the disposable income of an individual which keeps the revenue return running under all circumstances. The minimum age for a cardiovascular disorder has reduced tremendously which makes it a very profitable situation for the growth of the market.

Blood thinning drugs to find a special place among all this as it goes hand in hand with the cardiovascular drugs. Lack of awareness among the people regarding their health conditions also proves to be a risk factor for the patient which creates severe pathological changes in the cardiovascular system. This leads to various cardiovascular disorders that facilitates the consumption of these drugs. These multiple reasons prove to be the growth factors for the cardiovascular drugs market.

Market Outlook

- Industry Outlook: The cardiovascular pharmaceutical industry is undergoing a strategic recalibration from traditional blockbuster models to diversified portfolios built around precision targets, biologics, and cardio-renal-metabolic integration. Companies are intensifying investments in gene regulators, RNA-based therapies, and anti-inflammatory cardiovascular agents.

- Sustainability Trend: Sustainability in cardiovascular pharmaceuticals is gaining strategic importance. Companies are embracing low-waste manufacturing, solvent recovery, renewable energy integration, and biodegradable packaging. The shift toward plant-derived intermediates, fermentation-based APIs, and enzymatic synthesis methods is reducing environmental impact.

- Major Investors: Major investors in the cardiovascular pharmaceutical industry include leading venture capital firms and biotech-focused investment groups committed to advancing innovative therapies. These investors are increasingly supporting companies that prioritize precision medicine, gene therapies, and sustainable practices, reflecting a growing confidence in the sector's potential for significant returns and positive health outcomes.

- Startups: Startups in the cardiovascular pharmaceutical sector are pioneering innovations that focus on niche therapeutic areas and personalized medicine, often leveraging cutting-edge technologies such as genomics and artificial intelligence. These companies are not only driving breakthroughs in treatment but also contributing to a more sustainable and efficient healthcare industry by developing eco-friendly production methods and digital health solutions.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 214.72 Billion |

| Market Size in 2025 | USD 155.96 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 3.62% |

| Dominated Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Drug Type, Disease Indication, Route of Administration, Distribution Channel, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segment Insights

Drug Type Insights

Based on drug type, the anticoagulants segment dominated the cardiovascular drugs market in 2024, due to the rising frequency of cardiovascular disorders, particularly in the geriatric?population. A greater number of individuals are being diagnosed and treated with anticoagulants to prevent and manage blood clots related to cardiovascular disorders as awareness of these conditions and their potential implications rises. The need for anticoagulants is further increased by ongoing developments in medication formulations and therapies that aim to improve efficacy and safety. This market segment has significantly expanded, emphasizing its vital position in current cardiovascular care. Additional factors contributing to this growth include initiatives to decrease thromboembolic complications and expanded applications of anticoagulants in various medical conditions.

Moreover, the antihypertensive drugs segment is the fastest growing, as it is the most common disorder people suffer from due to the high amount of salt intake and age-related disorders. The increasing stress among people due to work and frustration has also increased its prevalence in society. These drugs form a habit among the consumers which makes them purchase these drugs again and again, thus boosting the market size over the period.

Global Cardiovascular Drugs Market, By Drug Type 2022-2024 (USDBillion)

| Drug Type | 2022 | 2023 | 2024 |

| Antihypertensive | 40.12 | 41.75 | 43.41 |

| Anticoagulants | 62.25 | 65.04 | 67.90 |

| Antihyperlipidemic | 21.44 | 22.27 | 23.11 |

| Antiplatelet Drugs | 8.30 | 8.60 | 8.91 |

| Others | 6.22 | 6.44 | 6.66 |

Disease Indication Insights

On the basis of disease indication, hypertension has dominated the segment as it is the most common disease that people are seen suffering with as a result of the high work pressure among the youngsters and the age-related disorders which are caused in the geriatric population. Lack of physical activity also gives rise to a number of diseases. Higher intake of fast foods and salt has increased the prevalence of hypertension.

Heavy consumption of alcohol too leads to the causation of this cardiovascular disorder which is commonly seen among the people. Arrhythmias and hyperlipidemia form the next segment as a result of the sedentary lifestyle practices of the people and faulty lifestyle practices. CAD forms the next segment which also contributes considerably to the growth of the market.

Distribution Channel Insights

Based on distribution channels, the retail stores segment dominated the market in 2024 due to their widespread accessibility and convenience for purchasing medications. Rising awareness of cardiovascular health, an aging population needing ongoing management, expanded services like health screenings, and the incorporation of e-commerce for online medication procurement contribute to this growth. Moreover, evolving healthcare policies and initiatives promoting preventive care drive individuals to seek cardiovascular medications and advice from retail pharmacies, making them a leading and rapidly expanding distribution channel.

The hospital pharmacies record significant growth due to the rapid demand and supply of cardiovascular drugs seen due to the easy availability of rare and commonly used drugs. They distribute prescribed cardiovascular medications to inpatient and outpatient populations, ensuring timely access to acute and chronic cardiovascular drugs. Additionally, they play a role in clinical trials and research, contributing to advancements in cardiovascular medicine. Moreover, Online stores also show considerable growth with the increasing trend of online shopping. The demand for contactless delivery services of drugs has boosted the demand for cardiovascular drugs through online stores, which also provide a wide range of lucrative discounts and offers to consumers to attract them. The availability of a ready comparison between the other available drugs also helps the consumer to make a suitable choice of drugs.

Global Cardiovascular Drugs Market, By Distribution Channel 2022-2024 (USD Billion)

| Distribution Channel | 2022 | 2023 | 2024 |

| Retail Pharmacies | 62.25 | 64.53 | 66.82 |

| Hospital Pharmacies | 44.27 | 46.02 | 47.80 |

| Online & Others | 31.82 | 33.56 | 35.36 |

Regional Insights

Asia Pacific Cardiovascular Drugs Market Size and Growth 2025 to 2034

The Asia Pacific cardiovascular drugs market size is exhibited at USD 28.42 billion in 2025 and is projected to be worth around USD 36.15 billion by 2034, growing at a CAGR of 2.71% from 2025 to 2034.

The Asia Pacific region has dominated the cardiovascular drugs market due to the increasing incidence of cardiovascular diseases, lifestyle changes, rising healthcare expenditure, and improving access to healthcare. Governments in countries such as China and India are investing in healthcare infrastructure, boosting the market further.

The North America region is a growing segment as a result of the high prevalence of cardiovascular diseases among the people. With the growing modernization and increased trend of fast food the prevalence of hypertension and other cardiac diseases have increased. The sedentary lifestyle practices followed by the people which is clubbed with faulty food habits has increased the chances of cardiovascular diseases which boosts the demand for these drugs.

What are the Key Drivers of Growth in the Cardiovascular Pharmaceutical Market in Latin America?

The cardiovascular pharmaceutical market in Latin America is experiencing significant growth, driven by rising rates of cardiovascular diseases and increasing access to healthcare. Governments and private stakeholders are investing in healthcare infrastructure and preventive cardiology initiatives, creating a more favorable environment for pharmaceutical development. Additionally, population awareness of heart health is on the rise, resulting in greater demand for both preventive measures and therapeutic interventions. As a result, the region is becoming an attractive landscape for cardiovascular drug manufacturers and innovative startups focusing on localized solutions.

The Europe region has been witnessing significant growth in the cardiovascular drugs market driven by a well-developed healthcare system, a significant patient population with cardiovascular diseases, and a high adoption rate of advanced treatment options. Additionally, a focus on research and development in cardiovascular medicine contributes to the growth of this market.

Brazil in Cardiovascular Drugs

As the largest market in Latin America, Brazil is witnessing increased investment in cardiovascular research and development. The government's strong focus on public health initiatives aimed at reducing hypertension and other cardiovascular conditions is propelling growth in this sector. The expansion of health insurance coverage is also facilitating access to new therapies.

Market Value Chain Analysis

- Raw Material Sourcing: Raw material sourcing for cardiovascular drugs prioritizes purity, stability, and regulatory compliance. Synthetic intermediates derived from fine chemicals for APIs such as statins, beta-blockers, ACE inhibitors, and anticoagulants. Biological materials, including cell lines and fermentation substrates for biologics and RNA therapeutics.

- Technological Advancements: Technological frontiers are rapidly reshaping cardiovascular drug development and commercialization. RNA-based therapeutics for precise cholesterol and triglyceride modulation. Long-acting formulations reducing pill burden and improving adherence. AI-driven target discovery, accelerating understanding of cardiometabolic pathways. Advanced drug-delivery systems, including nanoparticles, microneedles, and biodegradable implants.

Key Players in Cardiovascular Drugs Market & Their Offerings

- Bristol-Myers Squibb (BMS): A biopharmaceutical company known for its research in areas like oncology and immunology.

- Bayer AG:A multinational life science company with a strong presence in pharmaceuticals, but also in consumer health and crop science.

- Pfizer Inc.: A large pharmaceutical company with a wide range of products, including numerous medicines and vaccines.

- Janssen Pharmaceuticals, Inc.: The pharmaceutical arm of Johnson & Johnson, it develops and markets a variety of treatments for different diseases.

- Novartis AG:A global pharmaceutical company that focuses on research-based innovation, including advanced therapies and medicines.

- Merck & Co.: A global pharmaceutical company that develops and produces a wide array of medicines, vaccines, and animal health products.

Recent Developments

- In March 2025, Lupin Ltd, launched rivaroxaban tablets USP, 2.5 mg, in the US market after its abbreviated new drug application finally was approved by the FDA. The drug is the generic equivalent of Xarelto 2.5 mg developed by Janssen Pharmaceuticals. It is utilized for the reduction of major cardiovascular events in patients with coronary artery disease and peripheral artery disease.

- In January 2025, the heart health company, Kardigan, was established to develop several coordinated treatments for cardiovascular disease. Combining a research platform with strategic licensing and acquisitions allows the advancement of treatments specific to individual patients. The R&D platform matches disease drivers with treatment responders.

- In January 2025, Ncardia launched Ncyte Heart in a Box, a 3D cardiac microtissue model derived from human induced pluripotent stem cells. This model recreates the human heart's complexity and functionality and serves as a strong platform for researchers to study heart development, disease progression, and cellular interaction.

- In November 2024, Medera Inc., a biotechnology company, will launch Asia's first cardiac gene therapy clinical trial for heart failure in Singapore. It is the first and only site outside the U.S. to employ next-generation gene-and-cell-based modalities to treat cardiovascular conditions that fall in that limbo between treatable and incurable.

Segments Covered in the Report

By Drug Type

- Antihypertensive

- Anticoagulants

- Antihyperlipidemic

- Antiplatelet Drugs

- Others

By Disease Indication

- Hypertension

- Coronary Artery Disease

- Hyperlipidaemia

- Arrhythmia

- Others

By Route of Administration

- Oral

- Parenteral

- Others

By Distribution Channel

- Hospital Pharmacies

- Online Pharmacies

- Retail Pharmacies

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting