What is the Cardiovascular Devices Market Size?

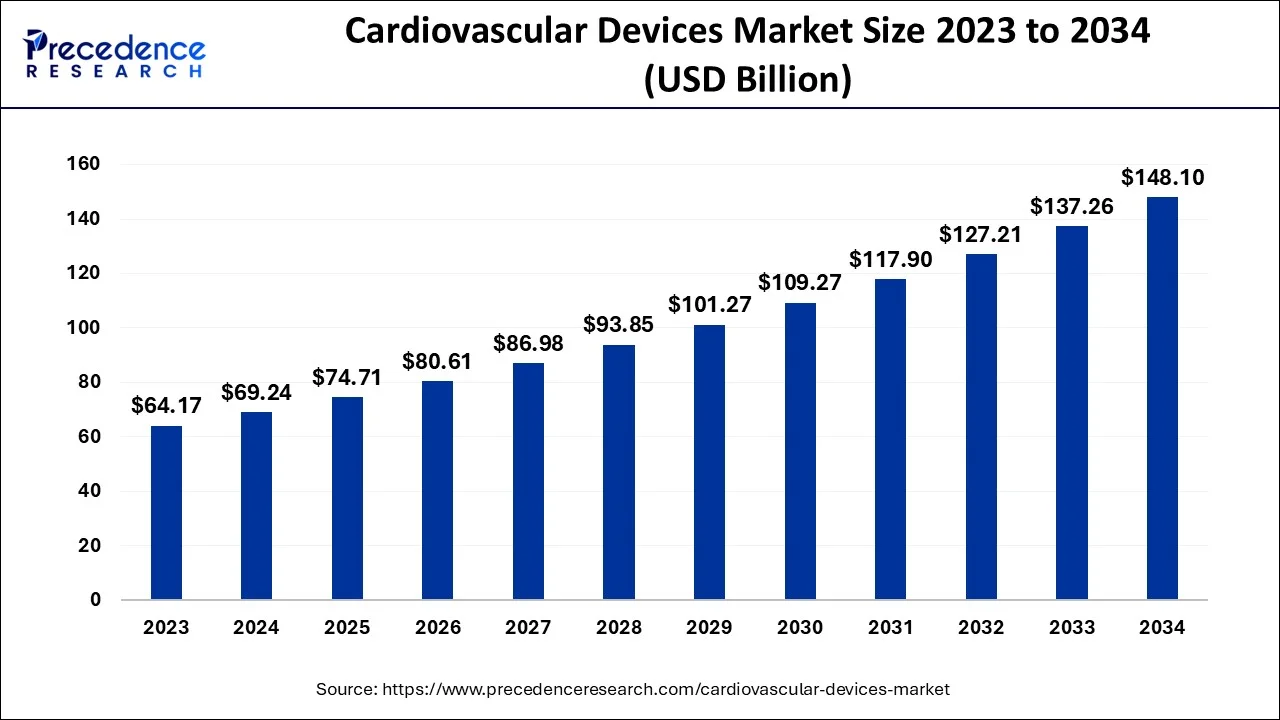

The global cardiovascular devices market size is exhibited at USD 74.71 billion in 2025 and is anticipated to reach around USD 158.41 billion by 2035, expanding at a CAGR of 7.81% from 2026 to 2035.

Market Highlights

- The cardiac ablation devices segment has captured 73% of the revenue share in 2025.

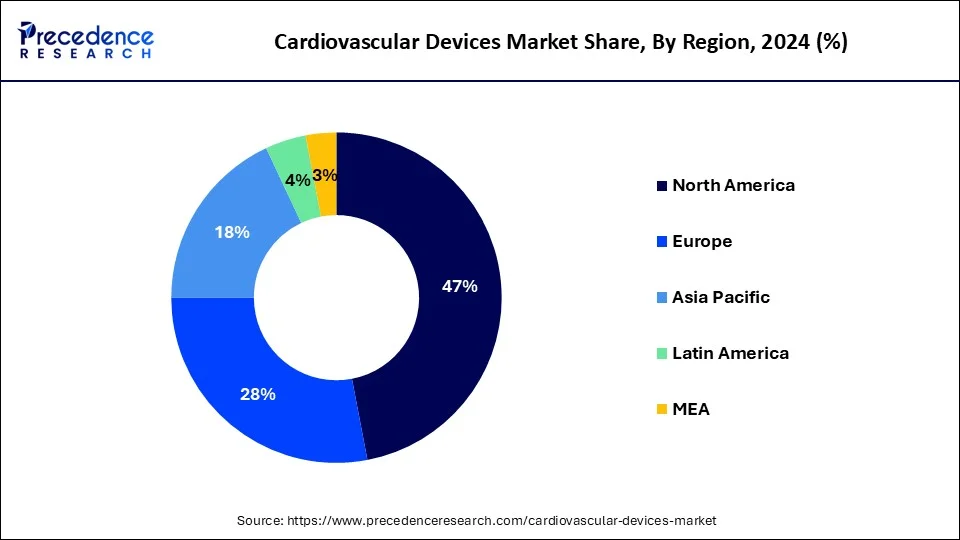

- The North America region has captured 47% of the revenue share in 2025.

- Europe region has held for 28% of the total revenue share in 2025.

- The left atrial appendage closure devices segment is expected to reach at a CAGR of 28.2% from 2026 to 2035

AI in the Market

Artificial intelligence is transforming the cardiovascular devices market for early recognition, precise treatment, and better device efficiency. From the accumulation of patient data, AI-based algorithms assess risk factors for the patient, decide individualized treatment, and accordingly establish a precise diagnosis. AI-enabled wearables and connected devices support continuous monitoring, thus enabling proactive identification of complications and management of diseases. Furthermore, AI enables efficiency in workflows by automating documentation and integration of data with clinics dedicated to patient care. Virtual clinical trials supported by AI and device simulations help to speed up innovation levels and cut down costs. Portable AI-led diagnostics and guiding tools help to increase access to expertise in underserved regions.

Cardiovascular Devices Market Growth Factors

The global cardiovascular devices market is significantly driven by the growing prevalence of chronic cardiovascular diseases across the globe. According to the World Health Organization, cardiovascular diseases are the leading cause of death across the globe. Cardiovascular diseases results in around 17.9 million deaths each year, globally. The major causes of the cardiovascular diseases include high consumption of salt in diet, increased consumption of tobacco, rising prevalence of smoking, and higher alcohol consumption. The cardiovascular diseases can be treated effectively by detecting it early. Therefore, the rising demand for the early diagnosis of the cardiovascular diseases is expected to drive the growth of the global cardiovascular devices market. Moreover, an alarming rise in obese population and physical inactivity is increasing the risks of cardiovascular diseases, which is expected to augment the demand for the cardiovascular devices across the globe. Growing geriatric population across the globe is another major factor behind the market growth. The old age people have higher chances of developing cardiovascular related diseases. According to the United Nations, the global geriatric population is estimated to reach at around 2 billion by 2050.

The new product launches with innovative and new features is expected to boost the demand for the cardiovascular devices. For instance, in February 2021, Remo Care Solutions introduced a new AI based remote monitoring device for the cardiac patients that analyzes the cardiovascular conditions of the patients in real-time. The growing demand for the efficient and innovative cardiovascular devices to reduce the deaths related to the cardiovascular diseases is significantly driving the growth of the global cardiovascular devices market. Moreover, the integration of the latest technologies like artificial intelligence (AI) in the cardiovascular devices is improving the patient care services and reducing the mortality of the cardiac patients. The rising investments by the top market players in the development and clinical trials of advanced cardiovascular devices is opening new growth avenues that will foster the market growth in the forthcoming years.

- Increased incidence of cardiovascular diseases is demanding early detection and advanced treatment.

- With increasing numbers of old people and risk factors that can be attributed to the lifestyle of obesity, smoking, and very little exercise, market growth is triggered.

- Innovations in technology and product launches with value additions are playing an important role in the acceptance.

- Fostering advancement in cardiovascular devices due to increasing investments in research, clinical trials, and integration of digital technologies.

- Remote monitoring and minimally invasive solutions go a long way in improving patient outcomes and ensuring the sustained growth of the market.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 74.71 Billion |

| Market Size in 2026 | USD 80.61 billion |

| Market Size by 2035 | USD 158.41 Billion |

| Growth Rate from 2026 to 2035 | 7.81% |

| Largest Market | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Device, Application,Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Segment Insights

Device Type Insights

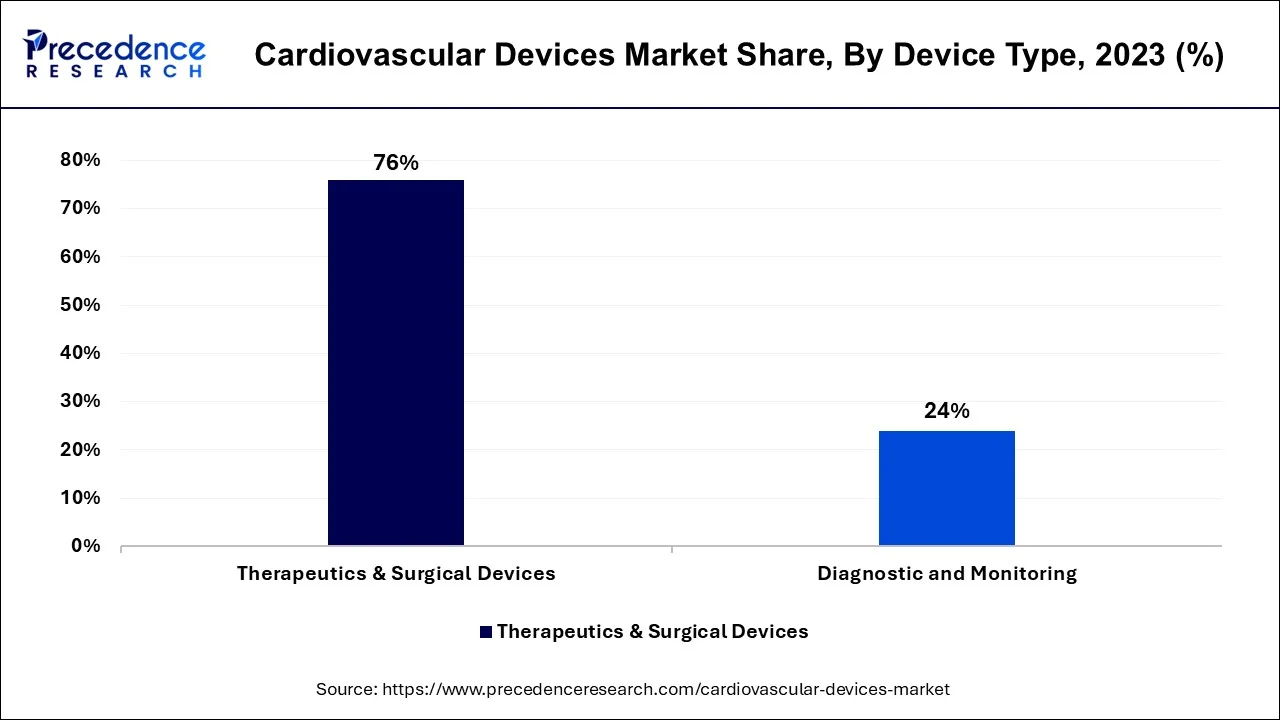

The therapeutics & surgical devices segment dominated the market with a 76% revenue share in 2025. This is attributed to the increased number of bypass surgeries across the globe. The increased demand for cardiac rhythm management devices, stents, and catheters has pumped the revenue generation of this segment. The increased awareness regarding the cardiovascular diseases and easy availability of the devices has fostered the segments growth.

The diagnostic and monitoring is estimated to be the most opportunistic segment during the forecast period. The rising demand for the early diagnosis of the cardiovascular diseases is fueling the growth of this segment. The rising awareness among the population regarding the benefits of the early detection of CVDs and effective treatment availability are the major factors behind the growth of the diagnosis and monitoring segment.

Application Insights

The coronary artery disease segment dominated the global cardiovascular devices segment in 2025. The increased prevalence of the coronary artery diseases has fueled the sales of the coronary stents in the market. The rising popularity of the stents in the treatment of coronary artery disease is expected to sustain the dominance of this segment throughout the forecast period.

The cardiac arrhythmia is estimated to be the most opportunistic segment during the forecast period. This is attributable to the rising demand for the pacemakers. The growing investments in the development of innovative pacemakers with innovative features are expected to drive the market growth in the upcoming years. For instance, Medtronic launched a pacemaker that has BlueSync technology, in India.

Regional Insights

What is the U.S. Cardiovascular Devices Market Size?

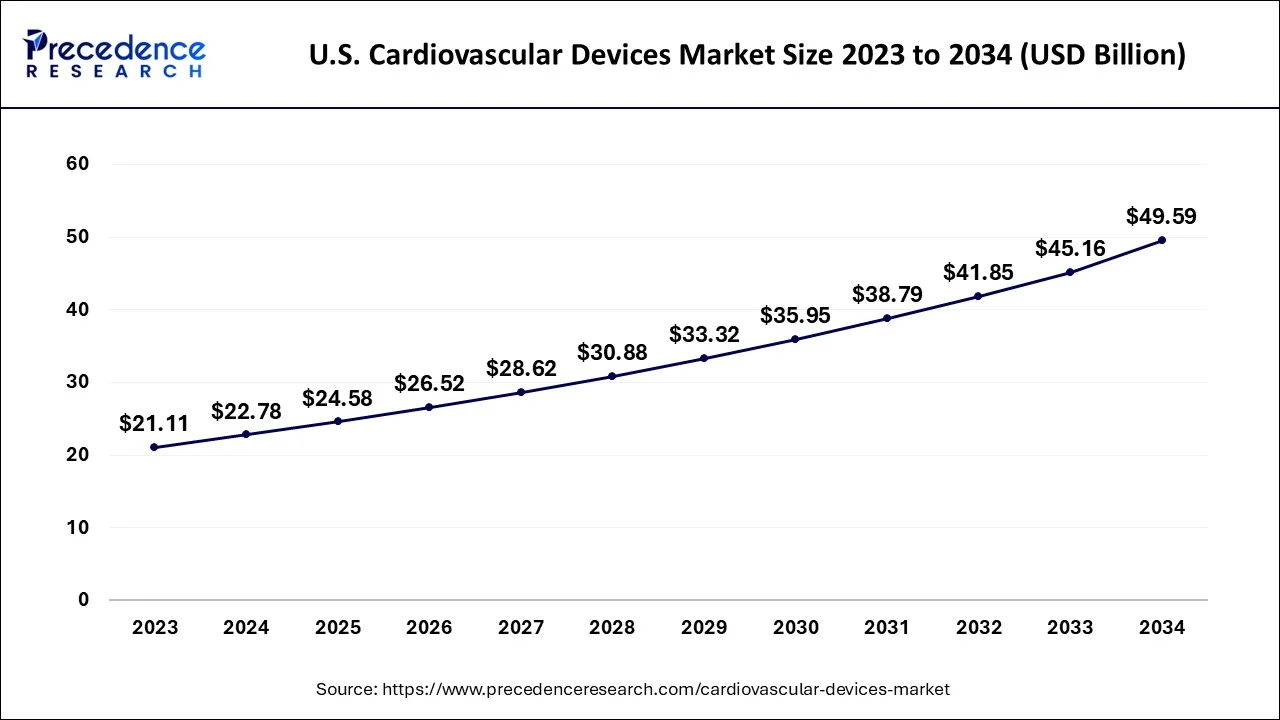

The U.S. cardiovascular devices market size accounted for USD 24.58 billion in 2025 and is predicted to be worth around USD 53.27 billion by 2035, growing at a CAGR of 8.04% from 2026 to 2035

How did North America dominate the Cardiovascular Devices Market in 2025?

North America dominated the global cardiovascular devices market in 2025. The presence of several top manufacturers in the region along with the growing burden of cardiovascular diseases in US is augmenting the demand for the cardiovascular devices in the region. According to the American Heart Association, around 18.6 million deaths were associated with the cardiovascular diseases in US in 2019. The increased healthcare expenditure and improved access to the healthcare facilities has significant contributions in the market growth. Moreover, the higher adoption rate of the innovativemedical devicesamong the population has driven the demand for various cardiovascular devices. The presence of developed and advanced healthcare infrastructure in North America coupled with the favorable reimbursement policies has fostered the demand for the various diagnostic devices and surgeries in North America.

North America dominated the cardiovascular devices market due to technological advancements in healthcare infrastructure and awareness regarding the optimization of government and digital healthcare solutions. Early detection assists in identifying and prescribing medication for chronic diseases, and monitoring devices significantly improve the prevention of diseases, as they provide real-time tracking of patient data and continuously measure oxygen saturation, blood glucose levels, and heart rate. In addition,

Canada plays a crucial role as it provides patients with government initiatives and promotes awareness regarding the adoption of digital monitoring devices. The advanced infrastructure provides individuals with the topmost clinical facility that helps prevent chronic diseases that require long-term medical attention.

United States Cardiovascular Devices Market Trends

The United States is a major contributor to the cardiovascular devices market. The high prevalence of cardiovascular diseases increases demand for therapeutic, diagnostic, and monitoring cardiovascular devices. The well-established healthcare system and advancements in healthcare infrastructure help in the market growth.

The growing research and development in cardiovascular devices and the strong presence of medical device manufacturing drive the market growth. The growing spending on healthcare increases demand for cardiovascular devices. The aging population in the United States and strong government support for the adoption of cardiovascular devices drive the overall growth of the market.

Canada Cardiovascular Devices Market Trends

Canada is growing in the cardiovascular devices market. The aging population and growing demand for the treatment of cardiovascular devices increase the adoption of cardiovascular devices. The growing prevalence of cardiovascular diseases helps in the market growth. The high prevalence of hypertension & diabetes and a favorable healthcare system drive the overall growth of the market.

How did Asia Pacific Grow at the Fastest Rate in the Cardiovascular Devices Market?

Asia Pacific is estimated to be the fastest-growing market during the forecast period. Asia Pacific is characterized by the presence of huge population, rising prevalence of cardiovascular diseases, rising healthcare expenditure, and rising investments by the government towards the development of sophisticated healthcare infrastructure in the region that are expected to drive the growth of the cardiovascular devices market in the region. According to the World Health Organization, around 75% of the cardiovascular diseases related deaths occur in low and middle income countries. The rising accessibility to healthcare services and rising affordability are fueling the adoption of the cardiovascular devices in Asia Pacific region. Moreover, the rapidly growing geriatric population in the region is further expected to influence the demand for the cardiovascular devices. According to the United Nations, around 80% of the global geriatric population is expected to live in low and middle income countries by 2050.

In Asia Pacific, the cardiovascular devices market is also experiencing rapid growth, fueled by a combination of factors, including a diverse and growing patient population base of chronic patients. Moreover, India is home to a robust healthcare system that includes digital health apps and government initiatives, which reinforce a strong presence in the market for telemedicine platforms. These dynamics contribute to the region's elevated demand for monitoring devices, particularly among patients with cardiovascular diseases. The presence of strong healthcare infrastructure, smart handheld devices, and an increasing emphasis on the adoption of digital health technologies like telemedicine systems. Individuals exhibit a wide range of preferences, from those seeking affordable digital devices to those desiring personalized smart devices that provide 24/7 monitoring devices that enhance patient engagement.

China Cardiovascular Devices Market Trends

China is a key contributor to the cardiovascular devices market. The large population and growing cardiovascular disease patient pool increase demand for cardiovascular devices. The growing prevalence of cardiovascular disease due to factors like unhealthy diets and lifestyle changes helps in the market growth. The strong government support for healthcare development and enhanced access to healthcare services increases the adoption of cardiovascular devices. The growing advancements in medical technology and the focus on local manufacturing of medical devices support the overall growth of the market.

India Cardiovascular Devices Market Trends

India is significantly growing in the cardiovascular devices market. The rapid growth in the cardiovascular incidence, like hypertension & heart disease, due to factors like increased stress, unhealthy diets, and lack of physical activity, increases demand for cardiovascular devices. The growing conditions like obesity, high cholesterol, and diabetes fuel demand for cardiovascular devices. The growing elderly population and growing cardiovascular ailments in older individuals help in the market growth. The strong government support through various initiatives like Ayushman Bharat and Make in India encourages the domestic development of cardiovascular devices. The rising cardiovascular health awareness and the growing domestic production of cardiovascular devices drive the overall growth of the market.

What Makes Europe a Notably Growing Region in the Cardiovascular Devices Market?

Europe is expected to witness notable growth during the forecast period. This growth is driven by the region's strong and well-established healthcare systems, high healthcare spending levels, and a supportive regulatory framework that promotes the widespread adoption of advanced cardiovascular devices. The rapidly aging population across the region also increases demand for cardiovascular devices, as older adults are more prone to heart diseases.

Additionally, the region is increasingly focused on preventive healthcare and emphasizes early detection and treatment, which further fuels market growth. Countries such as Germany, France, and the UK are leading players in the region due to their advanced market landscapes and high rates of adopting new, innovative technologies.

What Potentiates the Market in Latin America?

The cardiovascular devices market in Latin America is expanding significantly due to increasing CVD rates and technological progress. Brazil and Mexico are the main players in the region and are expected to grow further during the forecast period. Rising healthcare spending and government initiatives also aim to enhance cardiac care infrastructure. Additionally, collaborations and partnerships among key companies, healthcare providers, and research institutions are gaining momentum, further advancing the market.

What Opportunities Exist in the Middle East & Africa?

The Middle East & Africa (MEA) presents significant market opportunities due to the high prevalence of cardiovascular issues, including cardiac arrhythmias like AFib and VT. Increasing sedentary lifestyles, poor diets, and a rapidly aging population all contribute to the rising demand for cardiovascular devices for effective diagnosis and treatment. Several countries in the region are also increasing their healthcare spending to enhance access and quality of healthcare. Governments are investing heavily in healthcare infrastructure, including hospitals, clinics, and medical equipment, further driving market growth.

Latin America: Brazil Cardiovascular Devices Market Trends

The Brazilian market is expanding steadily due to the rising prevalence of cardiovascular diseases and an aging population. Increasing adoption of minimally invasive procedures is driving demand for advanced devices such as stents, catheters, and implantable cardiac devices. Government initiatives to improve healthcare access and infrastructure are supporting wider use of cardiovascular technologies across public and private hospitals.

Technological advancements, including drug-eluting stents and remote cardiac monitoring devices, are enhancing treatment outcomes and patient care.

MEA: South Africa Cardiovascular Devices Market Trends

The South African market is growing as the burden of cardiovascular diseases increases due to aging demographics and lifestyle-related risk factors. Rising adoption of minimally invasive cardiac procedures is driving demand for stents, catheters, and cardiac monitoring devices. Improvements in healthcare infrastructure and expanding access to private healthcare are supporting greater utilization of advanced cardiovascular technologies.

Value Chain Analysis

- Research and Development: New cardiovascular devices are developed, and current products are improved based on scientific investigation and technological advancements.

Key Players: Medtronic, Abbott Laboratories - Clinical Trials and Regulatory Approvals: Clinical trials evaluate the safety and efficacy of new devices in humans, while regulatory approvals, such as FDA and EMA, are obtained for market access.

Key Players: IQVIA, Parexel - Formula and Final Dosage Preparation: In terms of devices, such a procedure refers to the precise design of manufacturing series and final assembly of the device to ensure its performance and safety, rather than dose preparation.

Key Players: Edwards Lifesciences, Boston Scientific - Packaging and Serialization: This includes packaging design to protect the device and assigning unique serial numbers to each device and its packaging to track them through the supply chain.

Key Players: DuPont, MM Group - Distribution to Hospitals and Pharmacies: These activities include the transport and handling of cardiovascular devices from the manufacturer to customers such as hospitals, clinics, and pharmacies.

Key Players: Cardinal Health, McKesson - Patient Support and Services: Having included its after-sales activities, training of healthcare professionals was conducted, followed by technical support and maintenance

Key Players: Medtronic, Philips Healthcare

Cardiovascular Devices Market Companies

- B. Braun Melsungen AG: Provides a broad range of interventional vascular products and surgical tools, including drug-eluting stents, balloon catheters, and specialized cardiothoracic surgical instruments.

- Abbott: Offers a comprehensive portfolio of life-saving technologies such as the MitraClip for valve repair, AVEIR leadless pacemakers, and HeartMate 3™ heart pumps for advanced heart failure.

- Johnson & Johnson Services, Inc.: Operates primarily through its MedTech division, focusing on electrophysiology mapping and Impella heart pumps for heart recovery and circulatory restoration.

- Medtronic: Supplies an extensive array of cardiovascular therapies, including implantable pacemakers and ICDs, transcatheter heart valves, and extracorporeal life support systems.

- Boston Scientific Corporation: Focuses on interventional cardiology and rhythm management with key products like the WATCHMAN™ stroke prevention implant and SYNERGY™ drug-eluting stents.

- LivaNova Plc: Specializes in cardiopulmonary equipment such as heart-lung machines and oxygenators, as well as advanced circulatory support systems.

- Edwards Lifesciences Corporation: Leading provider of structural heart disease solutions, specifically known for its SAPIEN transcatheter heart valves and surgical valve replacement technologies.

- GE Healthcare: Delivers advanced diagnostic cardiology solutions, including Vivid™ cardiovascular ultrasound systems and interventional image-guided systems for cardiac procedures.

- Siemens Healthcare GmbH: Offers high-precision cardiovascular imaging systems like CT and MRI scanners optimized for heart health and interventional radiology tools for minimally invasive treatments.

- Terumo Cardiovascular Systems Corporation: Manufactures critical perfusion and surgical products for cardiac surgery, including oxygenators, heart-lung machines, and endoscopic vessel harvesting systems.

Recent Developments

-

In August 2025, BDC Laboratories partnered with the newly established Dilawri Cardiovascular Institute to improve the development and clinical validation of cardiovascular medical devices. (Source: https://www.prnewswire.com)

-

In February 2025, Johnson & Johnson MedTech introduced the Cereglide 92 Catheter System, a next-generation catheter designed for acute ischemic stroke treatment, offering a larger lumen and full catheter visibility under fluoroscopy. (Source:https://cardiovascularbusiness.com)

Segments Covered in the Report

By Device Type

- Diagnostic & Monitoring

- ECG

- Holter Monitors

- Event Monitors

- Implantable Loop Recorders

- Echocardiogram

- Pet Scan

- MRI

- Cardiac CT

- Doppler Fetal Monitors

- Therapeutic & Surgical Devices

- Pacemakers

- Stents

- Catheters and accessories

- Guidewires

- Cannulae

- Electrosurgical Procedures

- Valves

- Occlusion Devices

- Others

By Application

- Cardiac Arrhythmia

- Coronary Artery Disease

- Heart Failure

- Others

By End User

- Hospitals

- Specialty Clinics

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content