Cardiovascular Health Supplements Market Size and Forecast 2025 to 2034

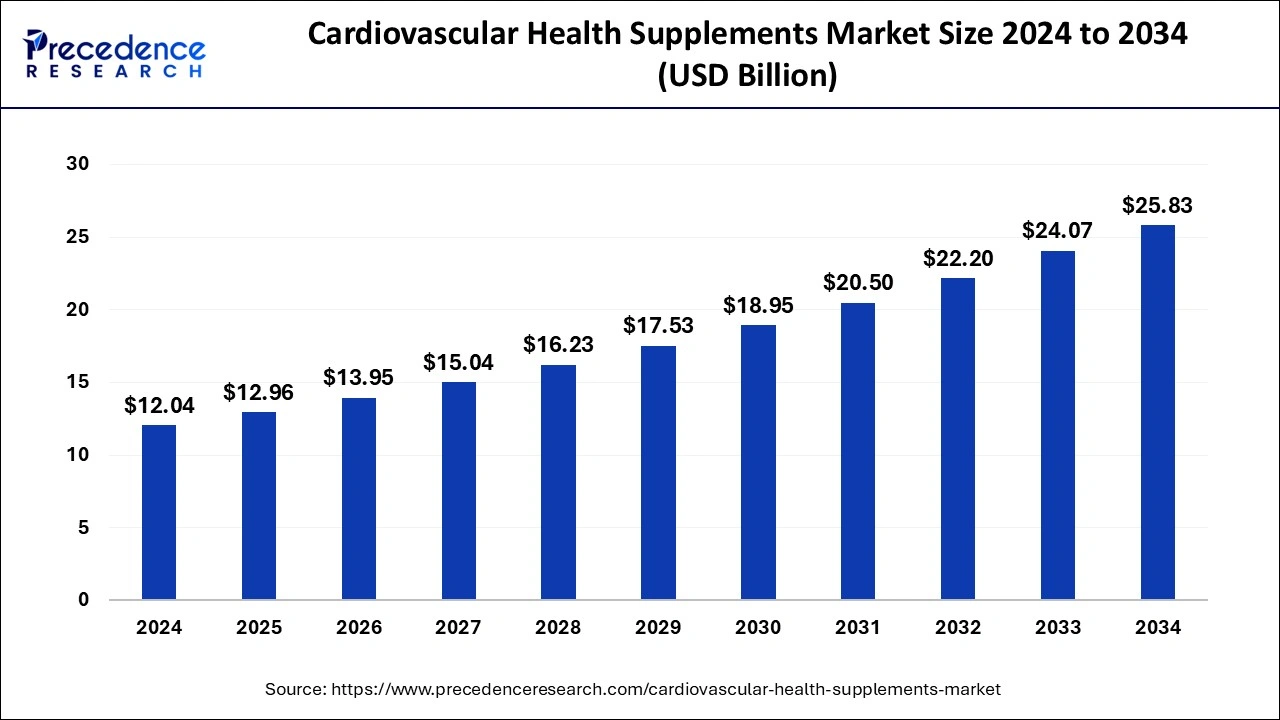

The global cardiovascular health supplements market size was estimated at USD 12.04 billion in 2024 and is predicted to increase from USD 12.96 billion in 2025 to approximately USD 25.83 billion by 2034, expanding at a CAGR of 7.93% from 2025 to 2034.People are becoming more aware of the significance of heart health, mainly due to a growing number of elderly individuals and an increase in heart-related diseases. This has led to significant growth in the market.

Cardiovascular Health Supplements Market Key Takeaways

- In terms of revenue, the global cardiovascular health supplements market was valued at USD 12.04billion in 2024.

- It is projected to reach USD 25.83 billion by 2034.

- The market is expected to grow at a CAGR of 7.93% from 2025 to 2034.

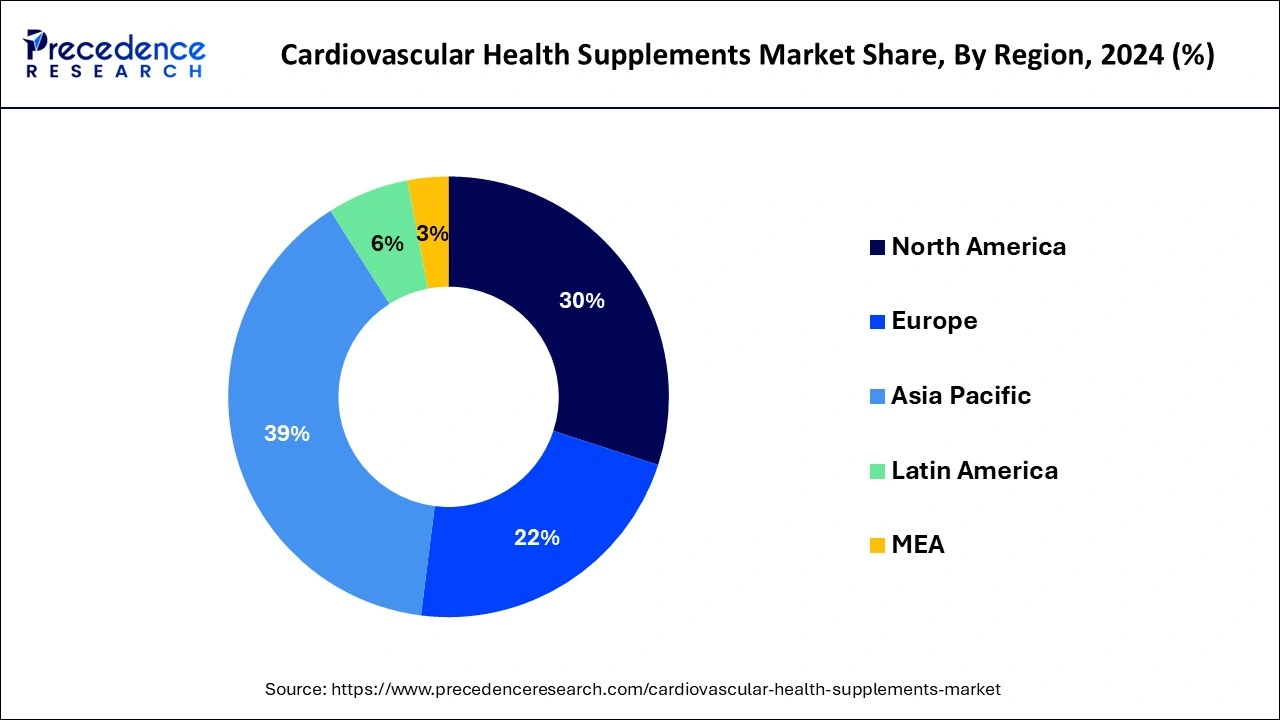

- Asia Pacific dominated the market while contributing 39% market share in 2024.

- By type, in 2024, the natural supplements segment dominated the market with a 70% market share.

- By type, the synthetic supplements segment is expected to experience substantial growth at a CAGR of 8.13% during the forecast period.

- By ingredient, in 2024, the omega fatty acids segment dominated the market with a 31% market share.

- By ingredient, the herbs & botanicals segment is expected to grow at a CAGR of 10.34% during the forecast period.

- By form, the softgel segment dominated the market holding the largest share, 37%, in 2024.

- By form, the capsules segment is expected to grow at a CAGR of 9.95% during the forecast period.

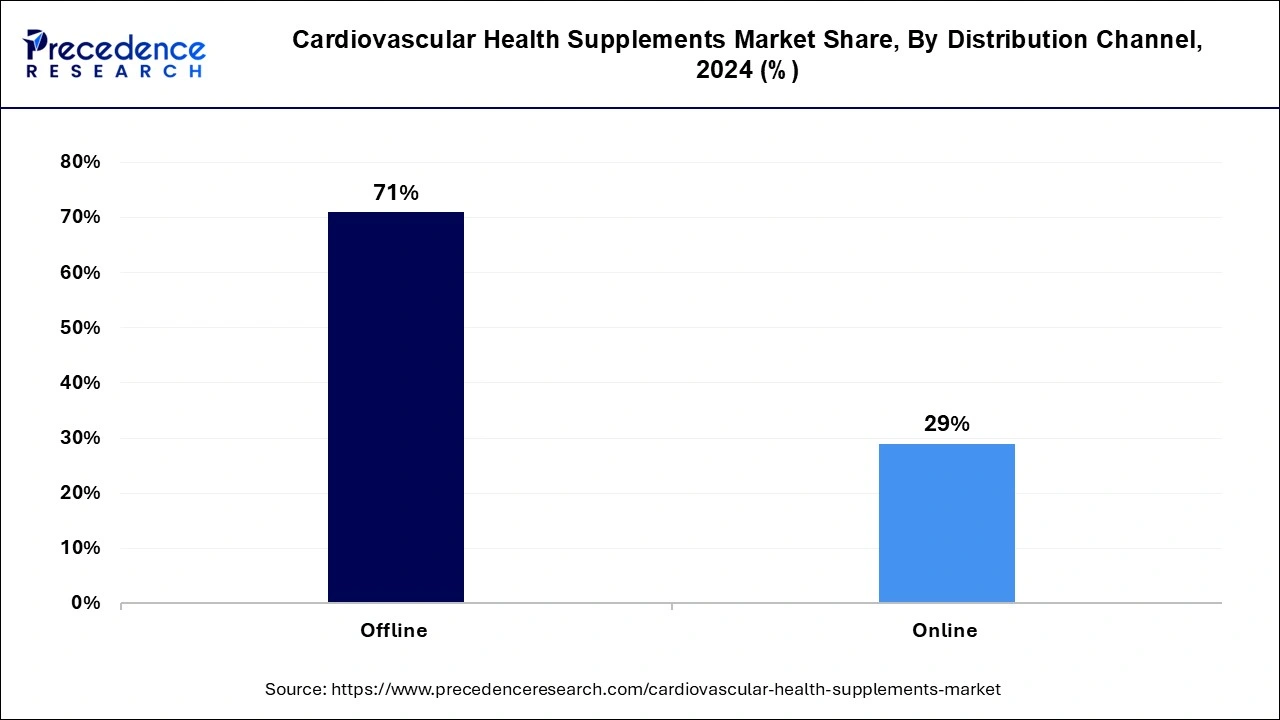

- By distribution channel, the offline segment held the largest market share of 71% in 2024.

- By distribution channel, the online segment is observed to grow at a CAGR of 10.42% during the forecast period.

Asia PacificCardiovascular Health Supplements Market Size and Forecast 2025 to 2034

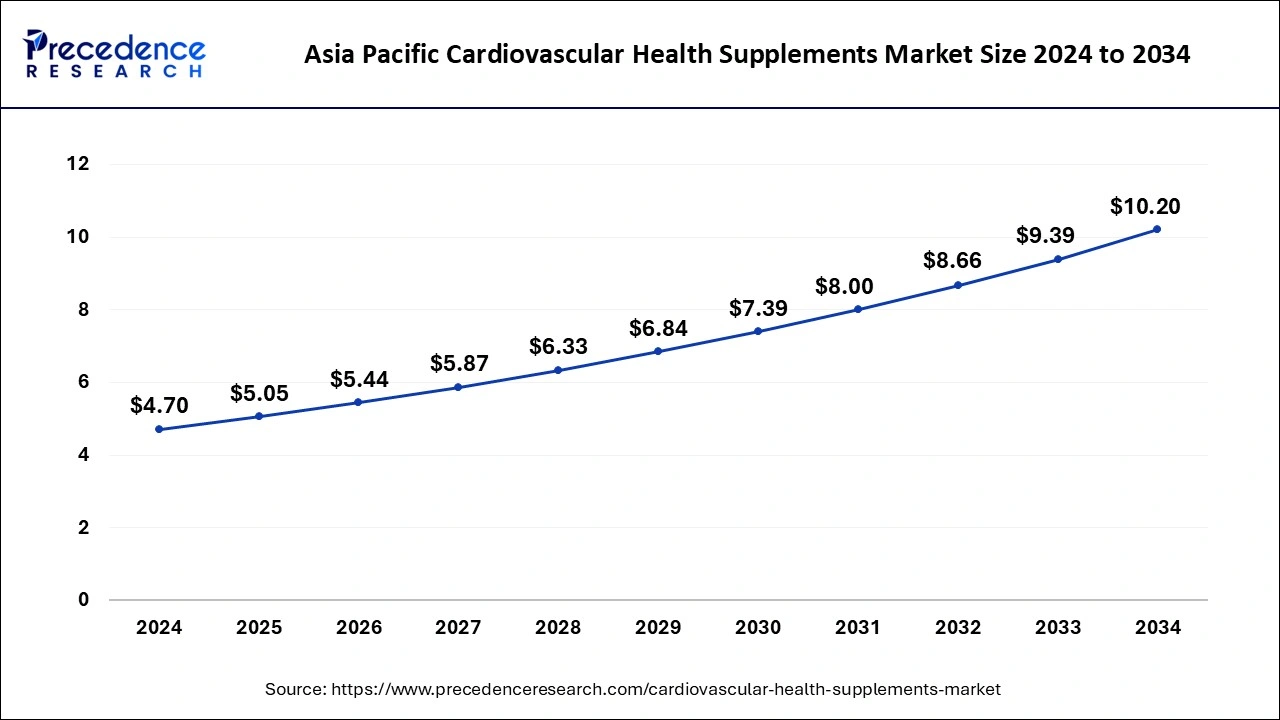

The Asia Pacific cardiovascular health supplements market size was estimated at USD 4.70 billion in 2024 and is anticipated to reach around USD 10.20 billion by 2034, growing at a CAGR of 8.06% from 2025 to 2034.

Asia Pacific dominated the cardiovascular health supplements market while contributing to 39% market share in 2024. This can be credited to the growing awareness of heart health and the region's increasing prevalence of cardiovascular diseases. A health-conscious population in Asia Pacific drives the rising demand for supplements to enhance cardiovascular well-being. People are actively taking steps to manage their heart health, leading to a notable increase in the consumption of dietary supplements. Market players focusing on developing nations such as India and China are expected to contribute to regional growth in the coming years.

Countries like India, China, and Japan have ample agricultural resources, enabling them to produce essential herbal ingredients used in supplements domestically. This gives the supplement industry a cost advantage and lessens reliance on imports. Brands are capitalizing on the popularity of traditional medicines to create herbal or Ayurveda-based products that align with local health beliefs and practices.

Europe is anticipated to expand at a significant CAGR during the forecast period of 2025-2034. This growth is linked to the rising occurrence of cardiovascular disease in the region. Additionally, regulatory agencies in several European nations have endorsed nutritional supplements and functional foods, contributing to the industry's growth. Reforms and adjustments to the regulatory process have simplified the approval process for these supplements.

Market Overview

People are increasingly focused on adopting healthy diets and lifestyle changes, recognizing the value of nutritious foods for overall well-being. The rising issue of obesity is a significant worry, primarily attributed to inactive lifestyles and unhealthy eating. Consequently, there is a growing demand for supplements that offer substantial health advantages, particularly in preventing heart disease.

The cardiovascular health supplements market addresses this demand by supporting heart health and essential nutrients for overall well-being. Furthermore, the increasing awareness of healthcare, along with a rising population affected by issues like cholesterol, obesity, and cardiovascular diseases, is leading to a higher demand for cardiovascular supplements in the foreseeable future.

According to the World Heart Federation reports that about 4.4 million people worldwide succumb to high cholesterol annually. Supplements such as plant sterols or stanols play a role in reducing LDL (bad) cholesterol by disrupting its absorption in the intestines, potentially lowering the risk of atherosclerosis.

Cardiovascular Health Supplements MarketGrowth Factors

- The global cardiovascular health supplements market benefits from increasing consumer awareness of preventive healthcare. The market's growth is driven by innovative products tailored to specific health needs and their easy accessibility.

- More and more consumers are choosing high-quality foods that support health and provide consistent nutritional value. This shift towards healthier dietary habits and lifestyle changes has become prominent, especially with the increasing cases of cardiovascular diseases. As a result, prioritizing heart health has become a top concern for many.

- The world's population is aging swiftly. Advances in medicine have prolonged life and increased overall life expectancy. Nonetheless, aging is accompanied by declining health and a higher likelihood of cardiovascular issues.

- Through virtual health programs, doctors and nutritionists are advising patients to use dietary supplements for heart-related concerns, contributing to an increased demand.

- The dietary supplement choices of older individuals are influenced by their family members. As children become more health-conscious, they encourage their parents and grandparents to focus on preventive healthcare through dietary changes and supplements.

- Many manufacturers are adding new products to their lineup due to the growing demand for cardiovascular health supplements.

Market Scope

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 8% |

| Market Size in 2025 | USD 11.2 Billion |

| Market Size by 2034 | USD 24.07 Billion |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Type, By Form, and By Distribution Channel |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Focus on plant-based supplements

Many cardiovascular health supplement brands are adapting to the increasing demand for plant-based solutions by conducting extensive research and introducing blends and formulas derived from plants. A leading brand has launched a supplement incorporating turmeric, garlic, ginger, and green tea extracts to support circulation and maintain healthy cholesterol levels.

Clinical trials have demonstrated the heart health benefits of garlic, while research suggests that curcumin in turmeric may positively impact blood pressure and inflammation levels with regular consumption. This trend leads consumers to opt for multi-ingredient plant-focused supplements for cardiovascular protection, moving away from single-ingredient options. As the understanding of herb-drug interactions and plant benefits expands, adopting plant-based supplement blends is expected to boost the cardiovascular health supplements market's growth in the coming years.

Investment by startups and key players

A significant trend in the cardiovascular health supplements market is the increasing preference for natural and plant-based ingredients among consumers. People are seeking products that do not contain artificial additives or chemicals, and this has led to a rise in the popularity of supplements incorporating plant sterols and phytosterols.

Omega-3 fatty acids, commonly found in fish oil supplements, remain a popular choice for addressing heart-related issues, supported by consistent research demonstrating their benefits in reducing the risk of heart disease. Furthermore, the cardiovascular health supplements market is expected to experience growth due to the increasing involvement of startups and investments by key players aiming to expand their nutritional platforms.

- In December 2022, HealthKart secured USD 135 million in funding led by Temasek. This funding allows the company to broaden its online and offline presence globally.

Restraint

Presence of alternative treatment options

The availability of alternative treatment options hinders the growth of the global cardiovascular health supplements market. As people become more health-conscious and prioritize overall well-being, they increasingly turn to non-invasive and natural therapies for various aesthetic and medical needs. This shift in preference has led potential customers away from cardiovascular health supplements.

Alternative treatments such as herbal remedies, essential oils, ayurveda, acupuncture, yoga, and other mind-body practices are gaining popularity due to their perceived minimal side effects and natural qualities, posing a challenge to the cardiovascular health supplements industry.

Opportunities

Product launches by market players

Various manufacturers are expanding their product offerings in response to the growing demand for cardiovascular health supplements. These additions aim to enhance the nutritional value of the supplements, making them more valuable to consumers. These factors will contribute to the market's growth in the coming years.

- In September 2023, Nutrartis introduced a new natural plant sterol supplement called Cardiosmile. This supplement, presented in a convenient liquid sachet form, utilizes water-dispersible phytosterols. A critical trial conducted at the University of Manitoba in Canada demonstrated that regular use of Cardiosmile could reduce LDL cholesterol by 12% and triglycerides by 14% within 28 days.

Growing consumer focus on preventive healthcare

Consumers increasingly focus on preventive healthcare and proactively managing their well-being. Rather than waiting for diseases to manifest, people are taking precautions and making lifestyle and dietary changes to prevent health issues. The awareness of the benefits of prevention and concerns about rising healthcare costs drives this shift.

Cardiovascular health supplements play a role in preventive care, offering ingredients that support heart health when consumed regularly. These supplements, easily incorporated into daily routines, are gaining acceptance, especially with the growing affordability and accessibility through e-commerce platforms. As a result, supplements are becoming a crucial aspect of the preventive healthcare approach for mindful individuals, expected to drive demand in the foreseeable future.

Type Insights

The natural supplements segment dominated the cardiovascular health supplements market, with a 70% market share in 2024 and it is anticipated to experience the fastest growth in the upcoming period. This is due to a rising awareness of the significance of health and wellness, leading consumers to prefer natural alternatives over traditional pharmaceuticals. It can be easily incorporated into any wellness routine and complements efforts to maintain a healthy body weight, engage in regular cardio exercise, reduce stress, and consume heart-healthy foods.

- In April 2023, Nutrishop introduced a cardiovascular health-supporting supplement called Heart Formula by Nu-Tek Nutrition. This supplement is crafted with heart-healthy ingredients, such as garlic extract, hawthorn berry, turmeric root, organic beetroot, olive leaf extract, coenzymeq10, grape seed extract, and vitamin K2.

The synthetic supplements segment is expected to experience substantial growth at a CAGR of 8.13% during the forecast period. Perceived health benefits, individual lifestyle choices, and more influence the increasing demand for synthetic supplements. Requirement of rapid treatments promote the adoption of synthetic supplements.

Ingredients Insights

The omega fatty acids segment dominated the cardiovascular health supplements market with a 31% market share in 2024. Scientific research consistently highlights the considerable cardiovascular advantages of omega-3 fatty acids, specifically EPA (eicosatetraenoic acid) and docosahexaenoic acid. These essential fatty acids are recognized for lowering triglyceride levels, reducing blood pressure, and enhancing heart health.

The herbs & botanicals segment of the cardiovascular health supplements market is expected to experience the fastest growth at a CAGR of 10.34% during the forecast period. Supplements derived from herbs and botanicals, like garlic, hawthorn, and green tea extracts, are becoming increasingly popular for their positive effects on heart health. The demand for these natural ingredients is rising, fueled by their traditional use and scientific validation.

Form Insights

The softgels segment dominated the cardiovascular health supplements market while contributing a 37% market share in 2024. Softgels are famous for their easy consumption and digestibility, making them a favored option for individuals looking for cardiovascular health support. This user-friendly format appeals to a broad audience, including those struggling to swallow pills or capsules. Softgel formulations offer higher bioavailability and nutrient absorption rates than other supplement forms.

- In December 2023, ZYUS Life Sciences Corporation, a Canadian life sciences company, revealed that it has chosen to move forward with a Phase 2 Clinical Trial in Canada. This trial aims to evaluate the initial effectiveness, safety, and tolerance of Trichomylin soft gel capsules in patients dealing with advanced cancer and experiencing moderate to severe cancer-related pain.

The capsules segment is expected to grow at a CAGR of 9.95% over the forecast period. Capsules can contain well-researched combinations of ingredients known for their positive impact on heart health. This offers a comprehensive approach to supplementation, aligning with the increasing demand for holistic and preventive healthcare solutions.

Distribution Channel Insights

The offline segment led the cardiovascular health supplements market in 2024 while holding 71% of the market share, which comprises physical stores like brick-and-mortar shops, pharmacies, and health food stores. These establishments provide consumers with a physical space to discover and buy health supplements, making them a favored option among customers. Furthermore, numerous companies are making substantial investments in establishing physical stores to reach a broader customer audience.

- In April 2023, Nordic Naturals, a health and wellness company, revealed a partnership with a multinational retail corporation to make its omega-3 supplement available in over 2,500 Walmart stores. This strategy aims to broaden the range of available products and create awareness.

The online segment is projected to grow at a CAGR of 10.42% during the forecast period. The online distribution channel has been on the top during the pandemic to improve the reach of products; companies are actively collaborating with different e-commerce platforms to sell their products. The emergence of online medical stores, especially in urbanized areas promotes the segment's growth.

Cardiovascular Health Supplements Market Companies

- NOW Health Group, Inc.

- Bright Lifecare Pvt Ltd (Truebasics.com)

- Natural Organics, Inc.

- DaVinci Laboratories of Vermont

- Nordic Naturals

- Thorne HealthTech, Inc.

- Nestle (Pure Encapsulations, LLC.)

- Amway

- InVite Health

- GNC Holdings, LLC

Recent Developments

- In September 2023, Nutrartis, a health solutions provider, introduced Cardiosmile, a supplement containing natural plant sterols, in the U.S. The liquid format offers a convenient way to support daily heart health and manage cholesterol.

- In March 2023, Life Extension, a neutraceuticals company, launched new omega-3 fish oil-based gummy bites. These sugar-free, tropical fruit-flavored chews provide potent omega-3 acids, with a high concentration of eicosapentaenoic acid (EPA) and docosahexaenoic acid (DHA) fatty acids in each serving.

Segments Covered in the Report

By Type

- Natural Supplements

- Synthetic Supplements

- Ingredient

- Vitamins & Minerals

- Herbs & Botanicals

- Omega Fatty Acids

- Coenzyme Q10 (CoQ10)

- Others

By Form

- Liquid

- Tablet

- Capsules

- Softgels

- Powder

- Others

By Distribution Channel

- Offline

- Online

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting